3 minute read

The Buyer Education Meeting

Once you make the decision to work with our Team, we’ll set up a time to meet with you to discuss in more detail about your home search, explain to you more about the buying process, and go over the buyer contract and other paperwork (including what we can do and any limitations) We’ll work around your schedule, and what’s convenient for you to be able to meet.

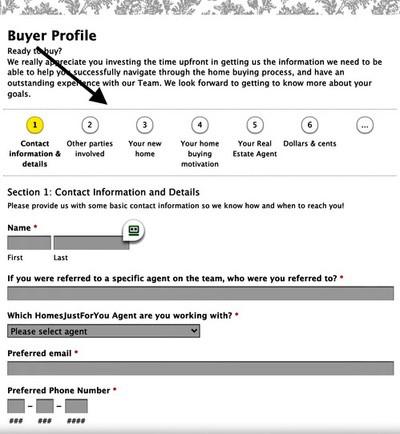

Before the Buyer Meeting, we’ll be sending you out our Bu y er Survey (you can scan the QR code to fill it out on your phone!). This will allow us to better prepare for our meeting and maximize the benefit of the time we spend together. It should only take 10 -15 minutes to complete but is invaluable to us! Also in the same email, we’ll give you more info on our Team and send you our 200+ page Consumer Guides with topics such as lead p aint , radon, Title 5 and more!

Please bring any and all questions you have to the meeting, as well as your pre -approval letter from your lender. This is the true start to our journey, and we can’t wait to take the trip with you!

Choosing your lender (and getting pre-approved)

Buyers will often ask us “Do I need to be pre -approved before I can start looking at houses?” Although technically the answer is no, you will want to get pre -approved because you will need to have that pre -approval to submit an offer. Some sellers also request that their properties only be shown to pre-approved buyers.

You shouldn’t wait until you find the home that you are interested in first, and here's why :

Imagine you go out looking at homes and see 4 or 5 or even 10 homes before you finally find “THE ONE”. You need to get your pre-approval for your offer. You call the lender, and it takes 24 -48 hours for them to check what you’ve provided and generate the letter! Or worse, it’s a weeken d and you can’t even start the process until Monday.

You will likely lose out on being able to compete for the house you love simply because other buyers had a pre -approval letter ready to go and you didn’t. Going back to our analogy of going on a long trip but starting out with the gas tank on Empty - you’re not going to get far and will have to stop for gas soon!

Meet with a mortgage lender you trust; someone you know who has an excellent reputation for completing loans quickly and competently. With this person you’ll determine the best loan program for your current situation, how much of a mortgage you can qualify for and what the estimated monthly payment will be (principal, interest, taxes, and insurance). This is the maximum you could afford at this time. They will also help to determine if you will need to request any closing cost be paid by the seller, and if so, what that amount should be. Now determine a monthly payment you are COMFORTABLE with, one that may be lower than what you may qualify for. This gives you the price range of homes you should be looking for.

Your preapproval should be updated at least every 30 days.

As you are going through the pre -approval and financing process, be aware (and prepared) for the upfront costs of buying a home:

Deposit money:

Typically, $1000-2000 when making an offer + between 1-5% of the purchase price at Purchase & Sale

Down Payment:

The amount required by your mortgage lender for the mortgage program you will be using (typically 3%, 3.5%, 5%, 10% or 20% down) unless you are using a 100% financing program such as VA or USDA

Will the lender be requiring you to keep a certain amount of money in reserves for your purchase?

Home Inspection:

Typically, $450-700 for the base inspection. Some additional tests that are available at an added cost include Radon, Pest (insects, etc.), Well/water test (if applicable), and Lead Paint. In NH you may need to schedule your own septic system test.

Up -front appraisal: $500-700

Closin g costs and pre -paids: Varies by property and loan type

Typically, $6000 - 12,000 including:

Mortgage acquisition cost

Required Escrows (monies held in advance from you) for taxes & ins.

Title insurance

Owners’ Title insurance

PMI (Private Mortgage Insurance)

Massachusetts Homestead

Real Estate taxes escrows

Homeowners insurance (Typically $800-1200)

Your lender can help you get a fairly accurate estimate of what your particular closing costs will be.

Moving costs - cost of boxes, to rent a truck or hire a moving company

Even with 100% financing you will need money up front to purchase your new home.

Other Costs to Consider

Closing costs are the first step to consider when you are purchasing your home. Make sure to factor in your ongoing living expenses when preparing your budget, and trying to figure out how much of a mortgage payment you can afford...

• Known Home Repairs and Maintenance

• Water, Heat, Electricity (you can get a good sense for this by having your a gent request current seller’s costs)

• Food

• Car (payment, gas, maintenance, insurance)

• Clothing

• Entertainment

• Phone, Internet, Cable or Dish TV

• Health Insurance or a health savings account

• Loan payments - school, personal

Consider a contingency fund for unplanned repairs (money in the bank that you replace if used)