AUGUST 2023 • Vol.10 • No.08 (ISSN 2564-1980) OPEN ENROLLMENT: AVOIDING ANOTHER MISSED OPPORTUNITY - Jean Roque, Founder & President, Trüpp 19 10 24 32 Maximizing Elective Benefits’ Value During Open Enrollment Exclusive interview with Barrett Scruggs, SoFi at Work Payers Pony Up For Hybrid Collaborative Care - Sam Holliday, Oshi Health Empowering Self-Insured Employers: Upgrading Technology For Increased Cost Savings - Scott Speranza, HealthLock Financial Wellness Programs Should Have Partnership At The Core - Rochelle Gorey, SpringFour, and Assad Lazarus, Purchasing Power

Articles Open Enrollment: Avoiding Another Missed Opportunity Four steps to improving your company’s open enrollment – Jean Roque, Founder & President, Trüpp 07 On the Cover INDEX Employee Benefits & Wellness Excellence AUGUST 2023 Vol.10 No.08 35 Shaping Employee Benefits In A Transformative Era A new study reveals 14% surge in lifestyle spending account adoption – Jaclyn Chen, Co-Founder & CEO, Benepass (ISSN 2564-1980) 13 The Top Five Strategies for Improving Digital Wellness – The HR Research Institute, powered by HR.com 22 Supporting Employees With Invisible Disabilities Inclusivity beyond appearance – Laura Neuffer, Wellness Content Development Coordinator, Carebook Technologies 27 Employee Well-Being: A Critical Imperative For HR Leveraging technology for enhanced employee experience and wellness – Alison Borland, Chief Well-Being Officer, Alight Solutions Sponsored Article

Straight Talk with HR.com

Maximizing Elective Benefits’ Value During Open Enrollment

Exclusive interview with Barrett Scruggs, Vice President, SoFi at Work

Payers Pony Up For Hybrid Collaborative Care

Navigating open enrollment in 2024 with integrated collaborative care in health plans

- Sam Holliday, CEO, Oshi Health

Empowering Self-Insured Employers: Upgrading Technology For Increased Cost Savings

As healthcare costs rise, claims monitoring solutions offer efficiencies for employers and employees

- Scott Speranza, Founder & CEO, HealthLock

Top Picks 10 19 24 32

Financial

Wellness Programs Should Have Partnership At The Core Addressing immediate financial needs alongside long-term planning

- Rochelle Gorey, Co-Founder & CEO, SpringFour, and Assad Lazarus, Chief Client & Development Officer, Purchasing Power

INDEX

How are our Employee Benefits & Wellness Products and Services helping

Benefits & Wellness Excellence - Monthly Interactive Learning Journal

This monthly interactive learning experience captures key metrics and actionable items and keeps you focused on your Benefits and Wellness planning goals and solutions.

Benefits and Wellness Virtual Events

Employee Benefits and Wellness Virtual Events ensure attendees stay compliant and up-to-date with the latest changes to employee benefits and wellness regulations. Each event varies on topics such as healthcare legislation and compliance related to employee benefits and workplace wellness programs including COBRA, FMLA, Medical Benefits, the Affordable Care Act (ACA), Outsourcing Benefits, Retirement Benefits, Voluntary Benefits and Work-Life Programs. Wellness topics encompass injury prevention, battling obesity, disease prevention, how technology is affecting wellness. Each Virtual Event consists of up to 10 credit webcasts.

Benefits and Wellness Webcasts for Credit

HR.com webcasts deliver the latest Benefits and Wellness industry news, research trends, best practices and case studies directly to your desktop. Webcasts are available live online with a downloadable podcast and a copy of the slides (PDF) available before and after each webcast. Earn all of the required recertification credits for aPHR, PHR, SPHR, GPHR, and SHRM Certifications. HR.com’s onehour webcasts, in every HR specialty including Benefits and Wellness, are pre-approved for HRCI and SHRM credit (excluding Demo webcasts).

Benefits and Wellness Community

Join more than 100,000 HR.com members with a similar interest and focus on Benefits or Wellness. Share content and download research reports, blogs, and articles, network, and “follow” peers and have them “follow” you in a social network platform to communicate regularly and stay on top of the latest updates. This well established Benefits and Wellness Communities are an invaluable resource for any HR professional or manager.

to make you smarter?

For more information phone: 1.877.472.6648 | email: sales@hr.com | www.hr.com

Use these invaluable Employee Benefits & Wellness resources today!

Editorial Purpose

Our mission is to promote personal and professional development based on constructive values, sound ethics, and timeless principles.

Excellence Publications

Debbie McGrath CEO, HR.com - Publisher

Sue Kelley Director (Product, Marketing, and Research)

Babitha Balakrishnan and Deepa Damodaran Excellence Publications Managers and Editors

Employee Benefits & Wellness

Excellence Team

Babitha Balakrishnan Editor

Koushik Bharadhwaj Jr. Editor

Arun Kumar R Design and Layout (Digital Magazine)

Chandra Shekar A K Magazine (Online Version)

Submissions & Correspondence

Please send any correspondence, articles, letters to the editor, and requests to reprint, republish, or excerpt articles to ePubEditors@hr.com

For customer service, or information on products and services, call 1-877-472-6648

Debbie Mcgrath Publisher, HR.com

Babitha Balakrishnan Editor, Employee Benefits & Wellness Excellence

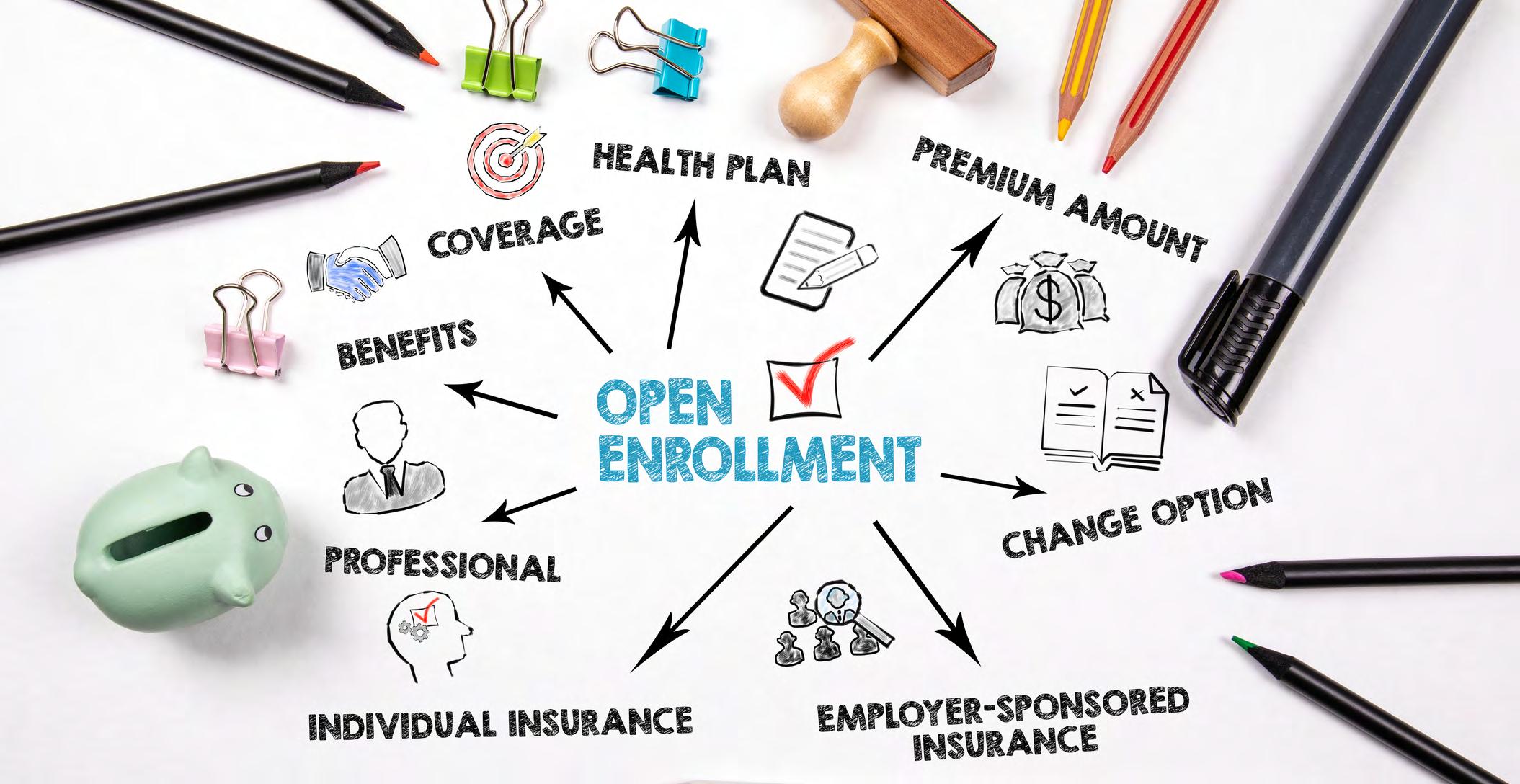

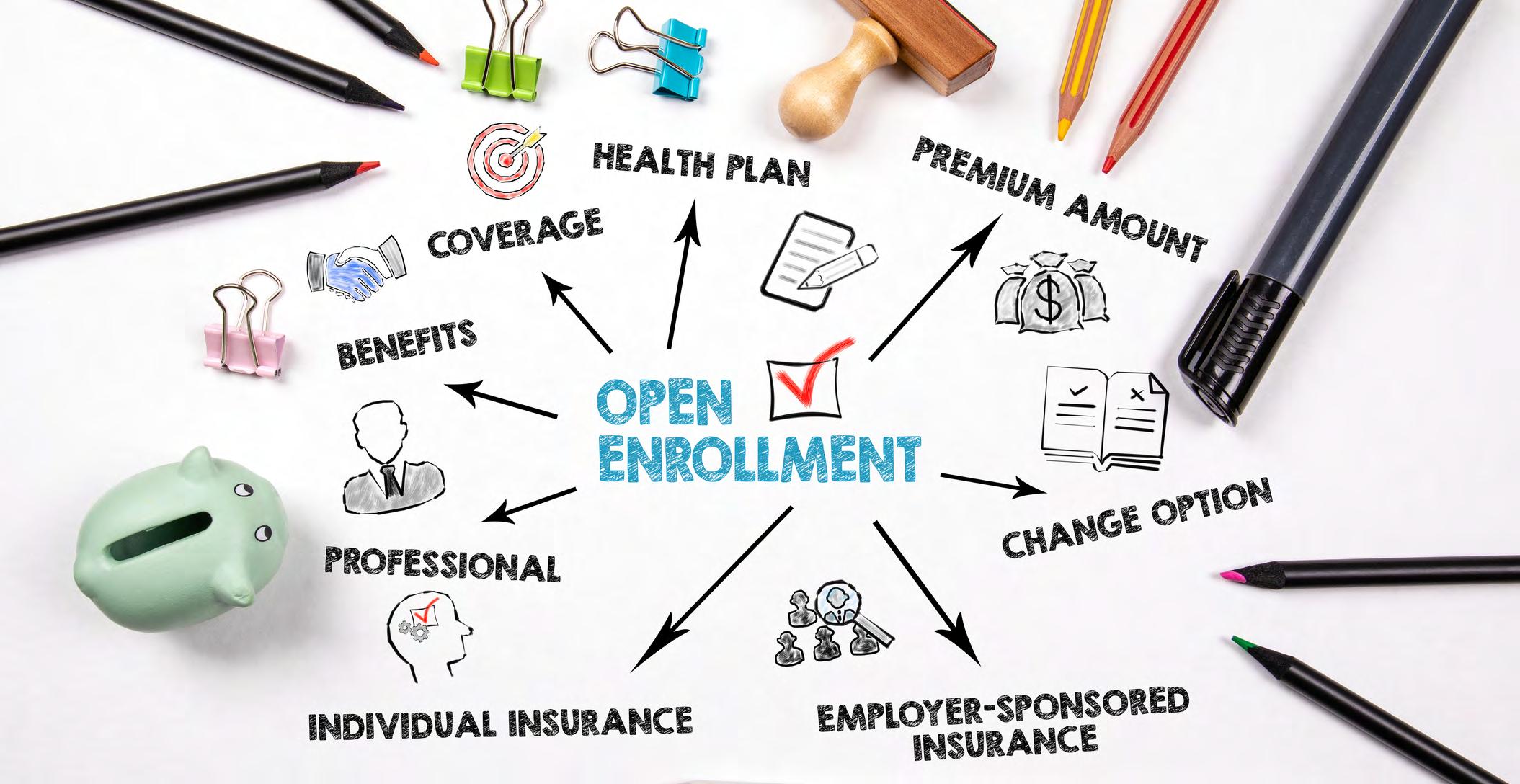

Open Enrollment Transformation: Aligning Benefits with Dynamic Workplace Changes

Asthe work landscape continues to undergo constant shifts, the strategies related to employee benefits during the Open Enrollment season are also experiencing changes. This process has grown beyond a mere checklist of insurance plans; it now revolves around aligning offerings with the shifting needs of employees, employers, and the organization as a whole. As these changes occur rapidly, grasping what factors to consider during open enrollment has gained unprecedented significance.

For employees, this means meticulously evaluating their individual circumstances. The repercussions of remote work, evolving family dynamics, and personal health concerns have introduced an extra layer of intricacy to the realm of benefit choices. Conversely, employers are striving to find equilibrium between attracting and retaining top-tier talent while prudently managing costs. This equation has expanded to encompass not just physical health coverage, but also holistic well-being, work-life equilibrium, and an emphasis on promoting financial wellness.

Furthermore, the digital revolution has lent a transformative dimension to open enrollment. User-friendly online platforms are streamlining the process, providing employees with intuitive tools to explore, understand, and select benefits.

Read the August edition of Employee Benefits & Wellness Excellence for informative articles on open enrollment, financial wellness, employee well-being and much more.

Employee Benefits & Wellness

Excellence (ISSN 2564-1980)

is published monthly by HR.com Limited, 56 Malone Road, Jacksons Point, Ontario L0E 1L0

Internet Address: www.hr.com

In the article, Maximizing Open Enrollment: Seizing the Opportunity, Jean Roque (Founder & President, Trüpp) provides insights into enhancing the open enrollment experience within organizations. This involves delineating benefit objectives that align with both employee needs and the broader organizational objectives. Additionally, Roque emphasizes the

utilization of technology to streamline the process of data collection for a more efficient experience.

Barrett Scruggs (Vice President at SoFi at Work,) in an exclusive interaction with HR.com, explores the integration of financial well-being programs (encompassing personalized financial advisory services and assistance with student loan commitments) and their alignment with the open enrollment procedure.

Healthcare remains a paramount concern for both employees and employers. In his article, Payers Pony Up For Hybrid Collaborative Care, Sam Holliday, (CEO, Oshi Health) explores the emerging concept of hybrid collaborative care within health plans

Scott Speranza’s (Founder & CEO of HealthLock) article, Empowering Self-Insured Employers: Upgrading Technology For Increased Cost Savings, weighs in on the importance of claims monitoring solutions in maximizing cost savings during open enrollment.

In brief, showing your unwavering dedication to your employees' health and well-being holds greater significance than ever. Equipping your employees with resources, initiating timely communication, and simplifying the enrollment process emerge as potent strategies to guide them through the intricacies of their health insurance options.

We hope you find the articles in this edition useful. Please share your thoughts on these topics, and let us know how we can continue to provide content that empowers you and your organization.

Happy Reading!

Disclaimer: The views, information, or opinions expressed in the Excellence ePublications are solely those of the authors and do not necessarily represent those of HR.com and its employees. Under no circumstances shall HR.com or its partners or affiliates be responsible or liable for any indirect or incidental damages arising out of these opinions and content.

EDITOR’S NOTE

For Advertising Opportunities,

©

part

publication may be reproduced or transmitted in any form without written permission from the publisher.

must be credited.

email: sales@hr.com Copyright

2023 HR.com. No

of this

Quotations

Write to the Editor at ePubEditors@hr.com

In a world of unparalleled challenges (global pandemic, racial injustice, political rivalry, digital 4.0, emotional malaise), uncertainty reigns. Finding opportunity in this context requires harnessing uncertainty and harnessing starts with reliable, valid, timely, and useful information. The Excellence publications are a superb source of such information. The authors provide insights with impact that will guide thought and action.

Excellence publications are my ‘go-to’ resource for contemporary and actionable information to improve leadership, engagement, results, and retention. Each edition offers rich and diverse perspectives for improving the employee experience and the workplace in general.

Winkle

Winkle

I regularly read and contribute to Leadership Excellence and Talent Management Excellence. I use many of the articles I read to augment my own presentations and I often share the articles with my clients. They are always quick, right on target for the latest issues in my field, and appreciated by my clients. If you want to stay up to date on the latest HR trends, choose a few of the different issues from the Excellence series of publications.

We’re eager to hear your feedback on our magazines. Let us know your thoughts at ePubEditors@hr.com

Dave Ulrich

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

Dave Ulrich

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

WHY EXCELLENCE PUBLICATIONS?

Julie

Giulioni Author, Virtual /Live Keynote Presenter, Inc.’s Top 100 Leadership Speakers

Dr. Beverly Kaye CEO, BevKaye&Co.

Open Enrollment: Avoiding Another Missed Opportunity

Four steps to improving your company’s open enrollment

By Jean Roque, Trüpp

Let’sface it. For most organizations, open enrollment is a daunting project. And the effort quickly becomes consumed with a plethora of time-constrained administrative activities. Proactively approaching open enrollment from a strategic perspective, however, can improve your experience by:

● Increasing efficiencies and quality of information;

● Creating an agreed-upon framework upon which leadership can make informed benefit plan decisions;

● Providing employees with the tools to make informed benefit plan choices; and

● Expanding your workforce’s understanding of the value of the benefits your company is providing.

Four Steps to Improving Your Company’s Open Enrollment

1. Define Your Objectives

Before making choices for the coming plan year and communicating those choices to your workforce, take time to define the objectives of the benefits you offer and the open enrollment process. Leadership should consider questions such as:

Why do we offer benefits? Is our current benefit offering accomplishing what we want? How well does our benefits offering align with our current employee population? What could we do to increase employee utilization and the perceived value of our benefits offering? The answers to these questions will provide a framework for making effective benefit plan choices and defining how employee benefits will be managed.

2. Establish a Timeline

Open enrollment season can easily sneak up on us. Ideally, planning should begin three to four months before open enrollment. More time may be needed for companies that are making significant changes to their benefits offering or creating new processes and tools to improve the open enrollment experience. When creating your timeline, consider activities that may need to occur before making plan choices, such as defining your objectives, conducting a benefits survey with employees, and researching new benefit options.

3. Create a Communication Plan

Today, open enrollment communications must be much more than requiring your employees to attend the obligatory open enrollment meeting.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 7 Submit Your Articles

COVER ARTICLE

Open enrollment essentially should be an internal marketing campaign, which requires defining and using a consistent message, determining the communication channels (e.g., email, internet, texting, print materials, one-on-one/group meetings, video, and social media) that will be used to reach your target audience, determining key content components that will be communicated, and defining the timing, method, and content for each communication.

4. Streamline Data Collection

Fortunately, many options are now available that enable employee benefits data to be captured and submitted electronically. Although this process may not eliminate the need to remind employees and validate information, it can transition accountability to the employee and ease the administrative burden.

If you are not already leveraging technology in your open enrollment process, check with your payroll/ HRIS (human resources information system) provider or benefits providers about electronic systems you can leverage.

Recommended Resources

● Employer open enrollment checklist

● Five tips for efficient employee communication during open enrollment

● Five ways to highlight the value of employee benefits year-round

● How can your business improve benefits administration?

● Maximize your benefits investment with effective employee support during open enrollment

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com August 2023 8 Submit Your Articles

Open Enrollment: Avoiding Another Missed Opportunity

Jean Roque is the Founder & President of Trüpp HR, Inc. , which provides comprehensive HR services, including HR consulting services, HR outsourcing, recruiting, compensation, HR audits, employee handbooks, benefits administration, payroll administration, supervisor training, and leadership development for organizations.

Align your brand with this year’s State of the Industry hot HR topics and showcase your expertise

Sponsor any of this year’s state of the industry research topics and come away with your very own affordable and branded research report and infographic, establish yourself as an industry thought leader by presenting at a one-day Virtual Event, and bolster sales through the generation of qualified leads.

The Future of Talent Acquisition

Virtual Event

Sept 6-7, 2023

Learn more at: hr.com/FutureTalentAcquisition

The State of People Analytics

Virtual Event

Sept 20, 2023

Learn more at: hr.com/PeopleAnalytics

The State of Employee Retention

Virtual Event

Oct 18, 2023

Learn more at: hr.com/EmployeeRetention

HR Skills and Education Virtual Event

Nov 01, 2023

Learn more at: hr.com/hr-skills-and-education

The Future of AI Recruiting Technology Virtual Event

Nov 15-16, 2023

Learn more at: hr.com/RecruitmentTechnologies Research

Successful Talent Management Strategies From Hire to Retire

Nov 30, 2023

Learn more at: hr.com/TalentManagement

Employee Benefits & Wellness Excellence presented by HR.com July 2022 9 Submit Your Articles

list of hot industry research topics below and give us a call to get started. A State of the Industry Research & Virtual Event Sponsorship Opportunity Contact us today to get started at sales@hr.com

1.877.472.6648

hr.com/industryresearch

See

|

|

Maximizing Elective Benefits’ Value During Open Enrollment

“More than half of employees say finances are the main source of stress in their lives, but many may not realize how it affects their mental and physical health, job satisfaction, and productivity. Employees want to stay with companies that prioritize their well-being, and two out of three workers (68%) would sacrifice at least one other key benefit to keep their financial benefits,” says Barrett Scruggs, Vice President, SoFi at Work.

In his role at SoFi, he oversees a team of consultative employee financial well-being professionals who design and deliver SoFi at Work’s solutions through on-demand, digital interventions for employers across the United States.

In an exclusive interaction with HR.com, Barrett talks about how human resources (HR) leaders can encourage engagement with their benefits programs year-round.

Q.Withthe tight labor market and the high importance employees place on benefits, what specific communication strategies do you recommend to effectively convey the value of elective benefits such as student loan repayment programs and emergency savings funds during open enrollment?

Barrett: Clear communication is vital during open enrollment to ensure elective benefits don’t get overlooked. Consider that 38% of Americans put off medical care last year due to rising costs. While health care is top of mind during open enrollment, take the opportunity to connect the dots between how financial benefits can help employees budget for and prioritize mental and physical care.

Beyond open enrollment, regular and open feedback between HR and employees is a strong starting point for understanding a workforce’s needs. HR managers should conduct internal surveys and ask employees at least twice a year what their financial pain points are and personalize benefits messaging accordingly. For example, if you find a large percentage of your workforce is focused on paying off student loan debt in 2023, you know to highlight specific financial well-being benefits like student loan contribution programs. Avoiding jargon and incorporating data and real-life examples helps demonstrate the impact of your company’s benefit offerings in a more personalized way.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 10 Submit Your Articles

Straight Talk with HR.com

Excerpts from the interview: Top Pick

Q&A with Barrett Scruggs, Vice President, SoFi at Work

Q.ManyHR leaders struggle to engage employees year-round in benefits programs. Could you share some practical tips on how HR leaders can maintain consistent engagement with these programs beyond the open enrollment period?

Barrett: Repetition is key; don’t rely on the open enrollment period to drive adoption for elective benefits. Busy employees require consistent touchpoints year-round as a reminder to maximize their benefits. Try scheduling communications around a moment in time, such as National Wellness Month in August or back to school in the fall, to make your message especially relevant. You can also connect your benefits to timely themes or pressing concerns, such as rising inflation or changes to student loan policies, to show you’re paying attention to what’s impacting their life outside of work. Tracking spikes or drops in engagement throughout the year

can help indicate when your employees are most dialed in so you can adjust your communications strategy accordingly.

Q.As the landscape of employee benefits evolves, what innovative communication approaches have you seen that successfully capture employees’

attention and drive the adoption of elective benefits?

Barrett: We’re seeing HR leaders implement new, effective communication styles regularly – especially with the evolution of hybrid work. Many companies are bringing in external experts for webinars and Q+As to dive into benefit offerings more in-depth. By holding an interactive session, employees can ask questions and learn how benefits can help them meet personal goals. Holding wellness challenges can also get employees excited about using their benefits and help drive adoption.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 11 Submit Your Articles

Straight Talk with HR.com

Q.Employeewell-being is a critical factor in retaining talent. How can HR leaders effectively integrate well-being initiatives into their communication strategy to emphasize the overall financial well-being aspect of elective benefits?

Barrett: More than half of employees say finances are the main source of stress in their lives, but many may not realize how it affects their mental and physical health, job satisfaction, and productivity. Employees want to stay with companies that prioritize their well-being, and two out of three workers (68%) would sacrifice at least one other key benefit to keep their financial benefits. To retain talent, HR leaders need to show they’re listening and care about what their employees want from their benefits

programs. They can start by educating employees on the far-reaching impacts of financial well-being and connect the dots between financial benefits and personal wellness goals, like being able to afford more nutritious food or sleeping easier knowing you have an emergency savings fund in place.

Q.Given the diversity of the modern workforce, how do you recommend tailoring the communication strategy to effectively reach and engage all employees, including remote workers or those from different age groups and backgrounds, during open enrollment?

Barrett: Addressing the needs of a diverse workforce will require an understanding of your employees’ varying financial needs and goals. Younger employees focused on paying off student loan debt may not resonate with retirement planning, for example, while communicating that information is going to be essential for older employers. I recommend using a variety of communication channels to reach employees from different age groups and backgrounds during open enrollment as well as year-round.

Some employees might engage more with webinars, virtual information sessions, and email updates, while others may actually prefer snail mail or 1:1 meetings with their HR manager to get a break from the digital noise. Ensure digital content is accessible to all employees by adding descriptive alt-text to any images and subtitles to videos. When in doubt, send out an employee poll to see what kind of communication style each group prefers.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com August 2023 12 Submit Your Articles

Straight Talk with HR.com

The Top Five Strategies for Improving Digital Wellness

About the Research

In this article, we allude to data from the HR Research Institute’s survey on Digital Wellness that was fielded in 2023 in partnership with McAfee, the global computer security software company. The survey had 204 respondents from a wide range of industry verticals, all of them being HR professionals from large organizations (at least 1,000 employees) in the United States.

Today’s organizations prioritize employee well-being as never before. Because so many people spend most of their workdays on computing devices, digital wellness has become especially critical to employee well-being. We believe organizations can adopt five key strategies to boost digital wellness in their workforces.

First, Leverage the Right Technologies and Support

It’s no surprise that technology plays a role in digital wellness, but how can it be used most effectively? First, consider which technologies are best suited to your employees’ needs. Do existing work

technologies enable digital wellness or are they so inefficient, insecure, and stress-inducing that they diminish it?

Potential problems are made more complicated by remote and hybrid work arrangements, which have become standard in so many organizations. For example, many companies now need to consider the security risks of more employees using personal devices for work purposes. Our study found that 99% of organizations have employees who use personal devices for work at least some of the time. Understandably, 80% of responding firms are “concerned or very concerned” about employees exposing confidential information.

13 ARTICLE

The HR Research Institute, powered by HR.com

So, what should one look for when considering an employee digital wellness solution? To ensure the well-being of employees, organizations should consider software that allows proactive and comprehensive protection. Specifically, those that prioritize online privacy, preferably with the inclusion of a reliable VPN (that is, a virtual private network) and robust protection against identity theft. Further, such user-friendliness and ease of integration across all devices must be ensured.

Beyond technical features, it can be crucial to consider customer support. Does the digital wellness solution offering provide easily accessible customer support? An ideal digital wellness solution ensures that users can receive prompt assistance whenever needed.

Of course, organizations also need to educate and inform employees about digital wellness and the necessity of it. If an employee finds a virus checker, VPN, or any other tool troublesome, that can engender a negative attitude and inhibit learning. Worse, employees can start to assume that other similar tools aren’t worth using.

Second, Formulate the Right Policies and Guidelines

While digital technologies tend to be essential at work, they can also create more significant personal and professional vulnerabilities. In 2022, the U.S. Internet Crime Complaint Center reported 2,385 complaints identified as ransomware with adjusted losses of more than $34.3 million. That same report stated there were $2.7 billion in losses due to business email compromises.

● Create and maintain strong passwords: Implement passwords that combine different letter cases and symbols. Consider changing these passwords every few months to account for employees who have left the organization but still have access.

● Audit and update technology as needed: Conducting thorough audits helps identify potentially vulnerable weak links that could pose security risks. By keeping technology up-to-date, organizations can not only enhance security but also foster an environment that boosts employee productivity. Security patches released in updates block hackers from exploiting previously identified weaknesses within a system.

● Limit access to sensitive information: Give employees access to sensitive information only on a need-to-know basis. This will help enhance data privacy and security.

● Establish a plan in case of incidents: While most organizations do their best to protect from security breaches, incidents can still happen. So, it’s important to have a plan in place if something were to happen. For example, assign a team to deal with security issues and encourage employees to report incidents to that team.

● Encourage employees’ personal digital wellness: By acknowledging the impact of digital habits on mental and physical health, companies can demonstrate a commitment to a balanced work environment.

Policies and guidelines play a vital role in reducing such threats and enhancing digital wellness. For example, the following practices could ensure better cybersecurity.

Incorporating guidelines for mindful and safe technology use can contribute to enhanced security. It can also improve productivity and overall job satisfaction, ensuring a healthier and happier workforce.

14 ARTICLE

For such guidelines to work, make sure employees understand why the policy exists. Policies work best when employees accept them as being in everyone’s best interest. Be sure to listen to any concerns they have and address those concerns.

For example, if they feel that strong passwords are troublesome, show them how today’s tools can make managing such passwords relatively easy.

In terms of employees’ general digital well-being, also consider a right-to-disconnect policy. This policy would allow employees to enjoy their time away from work-related digital devices. Ultimately, this tends to create a more productive and engaged workforce.

Third, Engage in the Right Communications

Communication is vital for organizational success in various ways. But how does it specifically pertain to digital wellness?

For one, communication channels such as messaging applications and email allow employees to escalate any security issues to leadership in

real-time. Through these means, security breaches can be dealt with quickly, thereby reducing the amount of damage caused to the organization.

Further, our research found that 61% of organizations have suffered from security breaches due to human error. Communication plays a large role in reducing these breaches. For example, HR can collaborate with the IT department to determine the top sources of human error. From there, organizations can act by communicating the issues to employees and offering training and education to reduce the risk of human error in the future.

In some cases, organizations can make employees aware of issues related to identity theft. Our study revealed that 91% of organizations believe employees are at least moderately concerned about identity theft, highlighting the significance of this issue. Additionally, approximately half of responding organizations view reduced work performance, financial loss, and mental health issues as potential outcomes of identity theft.

15 ARTICLE

Survey Question: What do you view as the potential outcomes of identity theft for employees? (select all that apply)

Fourth, Implement the Right Training and Education

Empower employees with the knowledge to improve digital wellness. There are many ways in which organizations can train employees on how to get the most use out of their digital wellness solutions protect themselves and enhance their organization’s well-being too.

For example, employers can provide resources such as articles and bring in experts to speak on these issues. They can also incorporate related

training and videos into their e-learning systems. And, they can offer incentives or rewards for employees who actively participate in cybersecurity training and demonstrate good digital wellness practices in their personal lives.

Consider tailoring the training content based on the role of every employee. Address the important elements of employee digital well-being solutions such as real-time protection, personal data clean-up, virtual private networks, and identity monitoring/identity theft coverage.

16 ARTICLE 0 10 20 30 40 50 60 58% 54% 48% 46% 40% 37% 32% 34% Fear about financial safety Reduced work performance (e.g., distractions at work) Financial loss More mental health issues (e.g., stress, depression) Difficulties re-establishing credit Diminished overall wellbeing Higher rates of absenteeism

Send Positive Messages

Communication and training on cyber security risks can feel ponderous and threatening, but it doesn’t always need to be. Communication messages often work best when they incorporate humor. A series of cartoons may do more to help employees remember best practices than simply relying on text.

Training can be made more fun by using games and quizzes. Getting teams to compete in a game about their cyber security knowledge or practices will often positively grab the attention of employees.

Finally, you may find entertaining guest speakers who can share memorable stories that will bring home the value of following the organization’s security guidelines.

Fifth, Offer the Right Set of Benefits

Our study showed that 71% view digital wellness benefits as important for employees. So, what do these benefits look like? They can be anything from device protection from suspicious attacks to identity theft protection and recovery coverage. Here we discuss four elements of digital benefits that were most widely cited in our study.

● Real-time protection: As an example of real-time protection, we cited “anti-virus software” in our survey, but this can allude to a variety of protections such as password managers so employees know when it is time to update their passwords.

● Personal data clean-up: Personal data clean-up involves reviewing social media and other accounts to ensure the employee’s information is accurate, ensuring personal

information is secure, and removing any unused or unwanted profiles.

● Virtual Private Networks: Through encryption, a VPN creates a secure connection between a digital device and a computer network, or between two networks, even while using insecure communication mediums such as the public Internet. A VPN can also protect employees from various online threats and risks that they might encounter while working remotely.

● Identity monitoring and Identity theft coverage: Identity monitoring, which is an element of identity theft protection, gives employees access to a service that checks the dark web to see if their personal information has been subject to a security breach. Other features related to identity theft protection could include ID restoration. In a related area, sometimes there is insurance to cover some of the expenses incurred in the case of identity theft.

Conclusion

There are, of course, various ways of boosting the digital wellness of employees, but we think that leveraging the right technologies, policies, communications, training, and benefits is especially important. Of course, each of them must be managed well to be effective, but if they are, then they tend to reinforce one another in a virtuous cycle of employee well-being. Would you like to comment?

17 ARTICLE

Complete Digital Peace of Mind. For Employees. For You.

All-in-One Digital Wellness Benefits from McAfee

Identity, privacy and award-winning device protection during work time and play-around time.

Keeping your employees safe online is our full-time job.

Learn more

Learn more

Payers Pony Up For Hybrid Collaborative Care

Navigating open enrollment in 2024 with integrated collaborative care in health plans

By Sam Holliday, Oshi Health

Thenext few weeks and months are the final stretch of employer health plan construction for many benefits leaders before Open Enrollment begins. But this year represents the first in which some of the more forward-leaning plan sponsors are covering virtual or hybrid care for a majority of the most expensive healthcare cost centers for employers.

While the lived reality for many managers is already one of point-solution fatigue, negotiating one-off benefits and support for their individual workplace needs, this is a meaningful inflection point whereby payer coverage as an in-network provider removes the burden from benefits teams and allows them to simply market available benefits that can bring both access and relief to their workers and potentially save them thousands of dollars per employee for a wide range of high cost conditions.

To fully capitalize on this opening, managers should either already be working with insurance partners to close gaps in their networks

and plans or begin asking hard questions about how to add these new benefits.

Emerging, Effective Treatments for Expensive Conditions

Excluding cancer, the most common top health cost drivers for most businesses are diabetes, cardiovascular, musculoskeletal, and gastrointestinal conditions. The ranking might vary depending on each business and its location and workforce demographics, but most big-ticket healthcare expenses will likely involve some combination of the above.

Historically, these conditions were treated with a traditional approach that included brick-and-mortar physicians, a litany of tests, and medication. However, emerging research and treatment plans are demonstrating the power of integrated care and hybrid care delivery models combining virtual and brick-and-mortar care to produce faster, lasting, and more cost-effective treatments for these complex conditions.

This is because our bodies are complicated systems with interconnected parts that impact one another. Treating conditions and disease does not happen in isolation and we can often produce faster, more efficient positive outcomes through an integrative approach that involves wider care teams that bring expertise in diet, movement, psychological support, and more.

Certain specialties are ideally suited for this hybrid approach due to their reliance on iterative approaches from diagnosis to treatment. Consider neurological and psychiatric disorders, which require 4-5 visits in the first month of care, alongside daily app messages. Or digestive disorders, where visits every 2-3 weeks are needed to iterate quickly through root cause identification followed by treatment iteration until symptom control is achieved.

Data shows that frequent, high-touch patient interactions are crucial to best manage these multifaceted health challenges.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 19 Submit Your Articles

Top Pick

This approach has enormous appeal for employers that are seeking cost-effective relief for workers across a wide range of conditions so they remain engaged, happy, and productive on the job. Offering mental health support, nutritionists, and others as a covered benefit before jumping to more expensive testing and procedures that take workers away from the job is often a no-brainer.

But achieving this level of care requires a level of coordination and collaboration among many sub-specialties that traditional providers are not built to support. And - until recently - most insurers were not set up to reimburse this type of care. Even physicians supporting integrated approaches were hamstrung by reimbursement requirements, and

could not make money offering these more effective treatments.

Innovative Insurers Reimburse Hybrid Collaborative Care

The pandemic and its resulting embrace of telehealth and digital health offerings began to loosen this grip. It enabled the emergence of virtual providers that specialized in integrated approaches to care. It also set the table for virtual providers to begin partnering with their brick-and-mortar counterparts to provide a continuum of care spanning both the digital and physical worlds, an approach known as hybrid collaborative care (HCC).

Well-known examples are virtual musculoskeletal companies like Sword, Hinge and Vori Health,

which treat patients for joint and back pain. These virtual care companies work with orthopedic specialists and surgeons to provide physical therapy and supporting services for patients who also may need in-person care. These local providers also like working with virtual care companies because it can help streamline their work, produce referrals, and avoid more severe interventions.

Employers and insurers embrace these virtual MSK companies because this hybrid approach can help produce relief before escalating to more painful and expensive treatments like surgeries. In fact, Hinge says it saves employers an average of $2,387 per worker in medical claims each year while also driving a 68% pain reduction in participants.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 20 Submit Your Articles

Payers Pony Up For Hybrid Collaborative Care

Importantly, HCC models can best serve both employees and employers when it comes to whole-person medical care because they enable frequent, iterative touch points that produce quicker, lasting relief to many chronic conditions, which are responsible for 90% of healthcare spending according to estimates from the Centers for Disease Control.

The power of integrated HCC models was again made clear in a recently completed study by one nationally known health insurer. This study found that integrated virtual support for digestive health patients - including diet

and psychological specialistsavoids $10,292 in total healthcare costs per patient per year by avoiding unnecessary testing and emergency room visits.

That same study documented the ability of virtual care to deliver 98% patient satisfaction and 92% symptom improvement for those suffering from digestive health conditions. Meaning there is a viable, cost-effective solution that actually works for employees.

The key takeaway though isn’t the $10,000 in potential savings…it’s that the study was sponsored by a major health insurer. Insurers are beginning to compensate

providers for integrated collaborative care in digestive, musculoskeletal, diabetes and other major cost centers for employers.

Next Steps to a Healthier Workforce and Reduced Costs

This growing support for integrated care by national health payers provides a path for benefits managers and companies to more effectively mitigate risk, boost productivity, improve morale, and cut costs.

To take advantage before next year’s plans are locked in, HR teams and benefits managers should contact their insurance partners today to understand if virtual specialty care is a covered benefit of their plan. If not, it’s time to start asking some hard questions of your insurance partners.

Prescient benefits teams should be planning now for how to stay ahead of the trend and deliver a comprehensive benefits plan for 2024 and beyond that ensures workers remain healthy, happy, and on the job.

Sam Holliday is the CEO of Oshi Health , where he combines his passion for redesigning healthcare around the needs of patients with a mission to increase access to the high-quality, whole-person care that two of his family members have needed to manage their gastrointestinal conditions. Would

Employee Benefits & Wellness Excellence presented by HR.com August 2023 21 Submit Your Articles

Payers Pony Up For Hybrid Collaborative Care

you like to comment?

Supporting Employees With Invisible Disabilities

Inclusivity beyond appearance

By Laura Neuffer, Carebook Technologies

Theunseen is often overlooked, and disabilities that are not visually apparent can directly affect the overall health and well-being of a workplace. The Invisible Disabilities Association defines them as “a physical, mental or neurological condition that is not visible from the outside, yet can limit or challenge a person’s movements, senses or activities. Unfortunately, the very fact that these symptoms are invisible can lead to misunderstanding, false perceptions, and judgments.”

These disabilities include a number of mental health conditions, such as autism, depression, and attentiondeficit/hyperactivity disorder and physical conditions affecting neurological functioning, such as chronic pain, chronic fatigue, and dyslexia. The lack of visible impairment and the stigma that accompanies many of these conditions results in their being infrequently discussed and targeted in workplace diversity, equity, and inclusion efforts.

Even the most supportive employers, and their human resources (HR) practitioners, find their attempts to address invisible disabilities are often compromised by individuals who, for various reasons, have chosen not to disclose their condition. Making that important step easier for those employees who feel they have to hide a part of themselves in their work environment is made much easier in an open, accepting, and inclusive environment.

Creating a Culture of Inclusivity

Employees with invisible disabilities need and deserve inclusiveness, starting with how they are described by the employer and their peers. They often don’t see

themselves as a “disabled person” and would rather be identified as “people with impairments.”

Keep in mind that they should be seen first as a person, not a condition. Saying “John has depression” as opposed to “John is depressed.” Rick Hansen said, “My disability is that I cannot use my legs. My handicap is your negative perception of that disability and thus of me.”

Always assume their proficiency, meaning that person will produce high-quality work if given reasonable accommodations.

Partner with therapists, nurses, and health coaches with the knowledge and experience to train HR, leaders, and stakeholders regarding invisible disabilities. They will be the backbone of informal and accessible support networks.

Physical accommodations such as disabled parking or parking passes are a sign of inclusivity.

Understanding Invisible Disabilities

Simply understanding invisible disabilities will help reduce the stigma that often accompanies these conditions. Demonstrate the organization’s awareness of and willingness to help employees with disabilities. A good first step is a commitment to inclusivity in your company’s policy statements. Be transparent about offering resources to support specific needs. Open lines of communication will boost employee morale and culture.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 22 Submit Your Articles

Flex time, remote, or hybrid work can be offered to accommodate special needs. Minimizing or eliminating a commute may well remove a barrier for those with disabilities.

Make sure that employees know about the resources available to them. Environmental Protection Agencies, wellness programming, access to telehealth, and therapists are just a few of the ways to help employees manage their own health.

For many invisible disabilities, self-care can go a long way. For example, daily walks can be as effective as antidepressants and are a helpful addition to medication. Simple programming, like walking challenges, can be a contributor to the organization’s overall health and well-being.

Health Assessments

Some employees may not recognize or fully understand their own disabilities or health conditions. Customized, interactive health risk assessments can help employees better identify, understand, and manage their health. They can also help HR determine specific employer-sponsored resources that demonstrate the company’s supportive and accommodating stance on invisible disabilities.

All employees reflect the benefits of working in a supportive, inclusive workplace. But when an individual’s self-esteem and contribution are compromised by an invisible disability, a healthy, happy, and inclusive culture can help that person and the company achieve happiness and success.

Laura Neuffer , M.S., has more than 10 years of experience in corporate wellness. After earning a bachelor’s degree in Public Health and Health Education at Oregon State University, she began working with a corporate wellness company as an account manager, working directly with on-site staff to plan, deliver, and analyze worksite health programs. Laura now works at Carebook Technologies as Wellness Content Development Coordinator to help create technology and programming that is used in worksite wellness programs around the world. Laura is also a registered yoga instructor and a former university adjunct professor of communications.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com August 2023 23 Submit Your Articles

Supporting Employees With Invisible Disabilities

Empowering Self-Insured Employers: Upgrading Technology For Increased Cost Savings

By Scott Speranza, HealthLock

By Scott Speranza, HealthLock

Inthe ever-evolving landscape of health insurance management, self-insured employers face a multitude of challenges not faced by the average employer within a complex industry. Escalating healthcare costs, along with increasing incidents of data breaches and overbilling, have created a pressing demand for solutions that can safeguard finances and sensitive data. The primary goal is crystal clear: Employers’ need to control rising healthcare costs aligns seamlessly with employees’ desire for enhanced control over their healthcare.

Employer & Employee Healthcare Spending Landscape

The self-insured employer model has gained substantial traction as organizations seek heightened control over healthcare costs and outcomes. In contrast to traditional insurance plans, self-insured employers shoulder the financial risk associated with their employees’ medical expenses. This involves paying for each out-of-pocket claim as they are incurred rather than adhering to a fixed premium

paid to an insurance carrier. While this model offers potential cost savings and increased customization, it also introduces challenges in efficiently managing claims and ensuring fair billing practices.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 24 Submit Your Articles

As healthcare costs rise, claims monitoring solutions offer efficiencies for employers and employees

Top Pick

As healthcare costs continue their relentless ascent, self-insured employers are proactively exploring avenues to alleviate financial burdens on their employees. Kaiser Family Foundation’s 2022 Employer Health Benefits Survey reveals that employer-sponsored insurance covers nearly 159 million non-elderly individuals, and family coverage annual premiums have surged by a staggering 43% over the past decade. This substantial escalation in costs is a burden borne by both employers and employees alike. While premium increases from 2021 to 2022 weren’t drastic, this upward trajectory is expected to persist in 2023’s prevailing inflationary climate.

Key Challenges & Role of Technology in Medical Claims Management

Critical cost factors for self-insured employers span beyond medical treatments, encompassing administrative overhead, fraud detection, and preemptive overbilling prevention. Conventional

medical claims management approaches often rely on labor-intensive manual processes, elevating the risk of errors and exposing organizations to financial losses.

Enter data-driven technologies – a beacon of hope in addressing the intricacies self-insured employers face. Advanced medical claims monitoring platforms leverage cutting-edge analytics and real-time data tracking to revolutionize the claims management process and preemptively shield against potential issues.

Digital solutions empower the employees of self-insured employers with real-time insights into their healthcare expenditures. Armed with this data, members are equipped to proactively identify cost-saving opportunities and make informed decisions that optimize their benefits plans. This, in turn, significantly benefits their respective self-insured employers.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 25 Submit Your Articles

Empowering Self-Insured Employers: Upgrading Technology For Increased Cost Savings

Advanced analytics serve as vigilant sentinels capable of detecting anomalous patterns in medical claims, thereby flagging potential instances of fraud or overbilling before they spiral out of control. By nipping these issues in the bud, early detection not only thwarts financial losses but also upholds the integrity of the benefits system. It also empowers users to catch errors that otherwise would have gone completely undetected, financially harming employees and employers alike.

Enhanced Transparency, Communication & Employee Satisfaction

Technology bridges the communication gap that often exists among self-insured employers, employees, and healthcare providers. Transparent billing and claims information foster trust, enable more effective negotiations, and invariably enhance overall satisfaction among all stakeholders.

Empowering employees with user-friendly tools to effectively manage their medical claims and bills instills a profound sense of control over their healthcare journey. This newfound empowerment translates into heightened employee satisfaction and an overall sense of well-being.

Overcoming Implementation Challenges & Future Considerations

Acknowledging the inevitable challenges associated with technological integration, self-insured employers must navigate the path of successful medical claims

monitoring platform adoption. Addressing data security and privacy concerns, seamlessly integrating new systems with existing processes, and diligently ensuring employee education and buy-in are pivotal steps in this journey.

As we peer into the future, a complex and cost-intensive healthcare landscape underscores a unique opportunity for self-insured employers. Leveraging technology for efficient medical claims management through advanced analytics and real-time tracking can usher in enhanced transparency, fraud prevention, and employee empowerment. The potential for substantial cost savings and heightened employee satisfaction firmly establish the adoption of medical claims monitoring platforms as a strategic advantage for self-insured employers.

Recommended Resources

● Kaiser Family Foundation’s 2022 Employer Health Benefits Survey: https://www.kff.org/report-section/ ehbs-2022-summary-of-findings/

● Healthlock Employee Care information: https://healthlock. com/employeecare/

Scott Speranza is the Founder & CEO of HealthLock – a digital solution platform that monitors its members’ healthcare claims and keeps them apprised of possible red flags putting their medical identity and finances at risk. Under Scott’s leadership, HealthLock has become a cutting-edge disrupter in healthcare billing and fraud protection, forging partnerships with large, multinational financial institutions, employer groups, and benefits providers to offer unique health data privacy solutions. Scott is passionate about combining his deep knowledge of health insurance with technical know-how to make healthcare simpler and more effortless for all.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com August 2023 26 Submit Your Articles

Empowering Self-Insured Employers: Upgrading Technology For Increased Cost Savings

Employee Well-Being: A Critical Imperative For HR

Leveraging technology for enhanced employee experience and wellness

By Alison Borland, Alight Solutions

Widespread business disruption. Supply chain issues. Inflation. Economic uncertainty. A once-in-a-century global pandemic. Racial injustice. Mass shootings. Geopolitical conflict. Technological innovation

seems to be coming at an ever-increasingly dizzying pace. It’s no wonder the workforce is incredibly stressed out.

Left unchecked, soaring stress levels can be incredibly

detrimental to employee well-being, affecting sleep, nutrition, concentration, frequency of illness/injury, and consumption of alcohol and tobacco products. Further, high-stress levels may lead to a lack of motivation, reduction in productivity, poor performance, increased absenteeism, and even “presenteeism,” where staff physically come to work but are not fully functioning.

Three-quarters (75%) of employees categorize their stress levels as moderate to high, and nearly half (46%) experience symptoms of burnout, according to the 2023 International Workforce and Wellbeing Mindset Study. Considering this alarming finding, it’s not surprising that just half of employees (51%) feel like they have the resources to improve their health and happiness.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 27 Submit Your Articles

With concern mounting about workforce well-being, organizations are recognizing the need to provide well-being tools, programs, and resources to complement the work already taking place in company culture and work environments. Human resources (HR) teams are at the forefront of implementing and driving these well-being programs.

There are several factors they must consider in designing effective programs and ensuring their success. These include understanding the solutions available in the market, leveraging the right technology strategy to best fit their employees’ needs, proving the return on investment (ROI) of the organization’s

well-being programs, and more. First, however, they must seek to acquire a thorough understanding of the employee experience and the critical role it plays in driving employee well-being.

Understanding Employees’ Experience

Defining employee well-being involves recognizing the interplay between life at work and life at home and how it influences the employee experience. Organizations must acknowledge that employees’ personal lives significantly influence their work lives and vice versa, especially given today’s remote and hybrid work arrangements. This shift emphasizes the importance of expanding well-being program

access and capabilities to benefit both employees and their families.

Maximizing the effectiveness of well-being programs requires that organizations consider critical moments that matter in employees’ lives. These include moments of acute need, such as difficult diagnoses or unexpected financial hardships, moments of opportunity, like retirement or starting a family, and everyday opportunities for maintaining mental and physical health.

By addressing these critical moments through integrated well-being programs, organizations can make a significant positive impact on employee well-being and overall satisfaction with their employee experience.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 28 Submit Your Articles

Employee Well-Being: A Critical Imperative For HR

HR professionals must also consider the attraction and retention of talent, particularly in a tight labor market. Employees want to know their employers will support their physical, emotional, and financial health, especially during challenging times. By prioritizing employee well-being, organizations create a positive work environment, optimize productivity, improve health outcomes, reduce healthcare costs, and boost employee retention and satisfaction scores.

Understanding Technology Investments

Initially aimed solely at automating routine processes and reducing the administrative burden on HR professionals, HR technology has expanded to enhancing the employee experience, improving well-being outcomes, and solving for employees’ physical, mental, and financial health.

As organizations realize the benefits of investing in technology that directly impacts employee well-being, HR leaders are challenged by the increasing fragmentation of the HR tech ecosystem. The proliferation of point solutions has made it difficult for employees to navigate and effectively use available resources, which has led to employee fatigue and reduced utilization. To address these issues, HR leaders should prioritize investments in HR technology that improve integration and connectedness across solutions, leveraging artificial intelligence (AI), personalized guidance, and relevant content.

What employees look for are HR technology systems and solutions that provide one-stop-shops across both web and mobile. And most importantly, the technology must save time and offer timely and trusted insights, meet employees’ expectations, and drive organizational efficiency. Mobile sites and access, personalized messaging, and information based on individual employee data and technology that summarizes all an employee’s benefits information are necessary requirements today. This will empower employees and their families to achieve a healthier mind, body, wallet, and life, leading to improved productivity, engagement, and health.

Modern employee experience preferences emphasize convenience and relevance, with employees expecting technology to deliver what they need when they need it. To meet these expectations, HR professionals must create a unified and intuitive platform for well-being programs akin to the convenience of a streaming service like Netflix.

Proving ROI Across the Organization

The increasing focus on employee well-being extends beyond HR departments. Chief Well-Being Officers and other C-suite executives are recognizing the significance of well-being and its impact on the company’s success. This growing emphasis has led to the implementation of innovative solutions across well-being pillars, including physical, mental, and financial health. It has also

exposed the need for HR to provide insights on employee utilization of these programs and its correlation to the bottom line. HR professionals must ensure a measurable strategy is in place across all well-being resources to provide meaningful data on program effectiveness so the organization can continue improving and evolving its well-being offerings based on its employee needs.

Employee Well-Being: A Critical Imperative for HR

HR professionals play a vital role in driving employee well-being programs. By leveraging technology solutions, implementing measurable strategies, and prioritizing the employee experience in the moments that matter most, they can create an environment that fosters employee well-being. The integration of technology, personalization, and measurement is key to the success of these programs, leading to improved employee health, engagement, and overall organizational performance.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 29 Submit Your Articles

Employee Well-Being: A Critical Imperative For HR

Alison Borland is the Chief Well-Being Officer at Alight Solutions

Would you like to comment?

HRCI® & SHRM® CERTIFICATION PREP COURSES

GROUP RATES AVAILABLE

For HR Professionals

Show that management values the importance of the HR function, and has a commitment to development and improvement of HR staff.

Ensure that each person in your HR department has a standard and consistent understanding of policies, procedures, and regulations.

Place your HR team in a certification program as a rewarding team building achievement.

For Your Organization

Certified HR professionals help companies avoid risk by understanding compliance, laws, and regulations to properly manage your workforce.

HR Professionals lead employee engagement and development programs saving the company money through lower turnover and greater productivity and engagement.

A skilled HR professional can track important KPIs for the organization to make a major impact on strategic decisions and objectives, including: succession planning, staffing, and forecasting.

HR.com/prepcourse CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com

1 Less expensive than a masters or PhD program, and very manageable to prepare with

2. legislation and best practices

3. Recognized, Industry benchmark, held by 500,000+ HR Professionals

Group Rate Options

We offer group rates for teams of 5+ or more for our regularly scheduled PHR/SPHR/ SHRM or aPHR courses.

For groups of 12+, we can design a more customized experience that meets your overall length of the course.

Groups rates for HRCI exams are also available as an add-on.

All group purchases come with 1 year of HR Prime membership for each attendee to gain the tools and updates needed to stay informed and compliant

CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com | HR.com/prepcourse

1 2 3

Financial Wellness Programs Should Have Partnership At The Core

Addressing immediate financial needs alongside long-term planning

By Rochelle Gorey, SpringFour, and Assad Lazarus, Purchasing Power

When employers talk about financial benefits packages, traditionally, the discussion gravitates toward a future state – money that can’t be liquidated quickly without penalty. They’ll offer to match employees’ contribution to a retirement fund or offer shares of stock that will deliver value down the road.

Those offerings are important, but today’s employees are just as interested in financial benefits that offer more immediate support. A PYMNTS survey conducted in April found that 69% of urbanites live paycheck to paycheck, as well as 63% of rural and 55% of suburban consumers. They’re turning to costlier avenues – including retirement savings withdrawals, payday loans, and buy-now, pay-later options – to keep their heads above water. Federal Reserve data from Q1 2023 showed credit card balances closing in on a trillion dollars. And with the Fed voting in July to raise interest rates another 0.25%, carrying those balances will soon become even more expensive.

Human resources (HR) professionals should be attuned to these challenges and ensure their financial benefits packages are just as helpful for employees trying to handle today’s financial concerns as they are with supporting planning for tomorrow’s finances. Of course, building a well-rounded financial wellness program requires resources that can’t always be gathered internally. As much as HR will work with

an outside partner to set up and manage retirement accounts, more immediate money management support requires a network of partners that can offer solutions for your employees wherever they are on their financial journey.

Working together to support clients across 50 states in 14 different business categories, we have seen firsthand the benefits that arise from financial wellness programs built on strategic partnerships Specifically, such programs provide three key benefits to employees: tools to manage unexpected or emergency expenses, resources to reduce costs across their spending categories, and support to tackle revolving debt head-on.

Tools to Manage Unexpected Expenses

Employees living paycheck-to-paycheck lack the resources to manage a costly, unforeseen crisis – for example, a critical appliance breaking down, a vehicle needing immediate repair, or a last-minute flight for an important family matter. If they’re unable to cover these expenses right away, their options are typically quite costly over time: they could put it on a credit card, take out a personal loan, or use a buy now, pay later platform with high-interest rates and stiff penalties for late payments. It’s easy to see how these solutions can ultimately trap users in a deeper cycle of debt.

Submit Your Articles Employee Benefits & Wellness Excellence presented by HR.com JUNE 2023 32 Top Pick

Businesses often offer employees access to websites for items such as discounted theater or concert event tickets as a perk; however, HR can also partner with an outside provider to offer purchases to a wider range of products – electronics, appliances, travel –paid for overtime with a regular deduction from the employees’ paycheck. This option makes it easier to handle unexpected expenses without breaking the bank, sacrificing other debt payments, or impacting the employees’ credit scores.

Resources to Reduce Costs

Addressing financial difficulties requires more than a one-size-fits-all approach, as bills weighing an employee down might not primarily be loan payments or credit card debt. These more burdensome expenses could be for basic needs, like groceries and rent, childcare, elder care, rising heating and/or other utility costs, or even the need to save up for a down payment for better housing or a more reliable vehicle. With the federal student loan payment freeze lifting this fall, millions of Americans will face a returning monthly bill, likely in the hundreds of dollars, eating valuable budget space.

In a holistic financial wellness program, HR teams should look not only at their internal resources or resources at the federal level but at the state and local levels as well. With innovative technologies, a strategic partner can handle both the research and execution for HR, helping employees find and apply for non-profit and local governmental programs such as housing assistance, utilities relief, or more affordable childcare needs and education. It’s a simple way to help employees tap into resources they might not have known were available, and it allows them to refocus their monthly budget on paying down debt or building savings.

Support to Tackle Debt Head-On

For employees underwater with credit card debt and loan payments, turning to a credit repair business or debt negotiator may be a tempting option. However, the fees charged and damage to their credit report may have a long-lasting impact on an employee’s financial well-being. Additionally, the stress caused by excessive debt, unrelenting collection calls, and wage garnishment can keep employees from bringing their full selves to work.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 33 Submit Your Articles

Financial Wellness Programs Should Have Partnership At The Core

Instead of leaving workers with little option but to turn to predatory debt relief companies, HR can work with strategic partners that provide an empowerment-based approach. An outside consultant can work one-on-one with employees to help them understand the rules for navigating the credit system and find ways to strategically pay down debt that has the greatest impact on their credit score.

Alternatively, HR can provide employees with tech-driven, self-service solutions that prioritize employee privacy, deliver trusted financial resources, and meet employees’ needs with access to financial counseling and coaching programs.

Improving credit scores isn’t just to have a high score on paper - it has real tangible benefits in people’s everyday lives. Anecdotally, this allows individuals more options, better rates, and lower expenses.

When an employee is empowered to be free from debt, they have the means and opportunity to begin building a rainy-day fund, as well as to participate in longer-term retirement benefits offered through their employer. These changes are what allows families to not only procure generational wealth - but also maintain it. Ultimately, this promotes a culture that allows employees to truly thrive.

Partnerships Across the Journey

Great 401k or IRA (individual retirement account) benefits can be very attractive for those with the means to contribute the maximum. However, centering financial wellness benefits around retirement alone ignores challenging financial realities for more than half of the American workforce that is focused on making ends meet today.

HR has the ability to help employees overcome these rising debts and bills, build savings for unforeseen expenses, and then begin thinking about tomorrow. Creating a network of partnerships will allow businesses to achieve this more holistic approach to financial wellness, tapping credit counselors, fintech, and purchasing programs in the same way they tap investment firms to manage retirement benefits.

It’s time HR teams align benefits with their employees’ complete financial wellness journeys. Building a network of partners to target specific challenges throughout the journey can be the first step. No one entity can do it all. Partnerships benefit each and every one of us.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 34 Submit Your Articles

Rochelle Gorey is the Co-Founder & CEO of SpringFour, a Certified B Corporation and social impact FinTech company, which engages in connecting customers to financial health resources.

Assad Lazarus is the Chief Client & Development Officer at Purchasing Power. He strives for the financial betterment of people.

Would you like to comment?

Financial Wellness Programs Should Have Partnership At The Core

Shaping Employee Benefits In A Transformative Era

A new study reveals 14% surge in lifestyle spending account adoption

By Jaclyn Chen, Benepass

Anew benchmarking study from Benepass illustrates the impact of increasing workforce diversity, return-to-office measures, and a consistently tight labor market on employee benefits offerings.

The company’s second annual benchmarking report, which analyzed benefits data from more than 60,000 employees across the U.S., saw double-digit increases in flexible Lifestyle Spending Accounts (LSAs) across companies of all sizes, the introduction of return-to-office friendly perks such as transit and parking accounts, and a boost in professional enrichment and food benefits.

Lifestyle Spending Accounts (LSAs) rise to the top: LSAs, a relatively new benefit in the market, are non-salaried allowances designed to support employee’s physical, mental, and financial wellness that enables them to choose how to best

assist in their work-life balance and well-being. LSAs are fully funded by the employer and were developed on the basis that flexible, employee-led benefits lead to happier, more productive employees.

In 2023, LSAs rose to the top spot, with 51% of companies offering this flexible perk compared to 37% in 2022. The largest jump in the percentage of companies offering LSAs came from large companies – a staggering 75% of large companies provide an LSA in 2023 compared to just 40% in 2022. Small and medium-sized companies, too, were seen to rapidly embrace LSAs, with medium-sized companies seeing a 33% boost and small companies increasing LSA adoption by 10%. Two bellwether industries in the benefits space, tech and healthcare, saw strong growth in the adoption of LSAs, with tech companies seeing a 25% increase and healthcare and life sciences

companies seeing a 21% increase in LSA offerings.

In a post-pandemic workplace, Health Spending Accounts (HSA) increase in popularity: While Health FSAs remained the most popular type of pre-tax account in 2023, HSAs overtook Dependent Care Flexible Spending Accounts (DCFSA) as the second-most popular type of account in 2023. This could reflect that employers are shifting their attention to healthcare needs now that pandemic-era childcare pressures are subsiding.

Companies implement perks to support return-to-office: Transit and parking accounts are more popular than limited-purpose FSAs in 2023. As more companies implement return-to-office plans, employers may be offering transit and parking accounts to reduce community costs and incentivize employees to come into the office.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 35 Submit Your Articles

Professional enrichment and food benefits amongst top perks: The largest increases in average contributions were in professional enrichment and food benefits, which grew by 35% and 84%, respectively. These perks help companies stand out as employers of choice and provide employees with more funds, increasing employee engagement and satisfaction.

Small and medium-sized companies boost fitness and wellness perks: In an effort to remain competitive with larger company offerings, small companies boosted their fitness and wellness perks by 18%, and medium-sized companies increased the perk by 12% in

2023. Small companies also offered the widest variety of perks in 2023, which reflects the need for companies in their growth phase to provide strong perks so they can attract the talent they need to achieve their goals for growth.

Charitable giving emerges as a new LSA spending category: Companies are harnessing the flexibility of an LSA to spin up eligible categories in response to current events like the war in Ukraine. Millennial and Gen Z employees, in particular, want to work for values-driven companies, with one Deloitte study revealing that 77% of Gen Z respondents consider it important to work for a company whose values align with theirs.

Employee Benefits & Wellness Excellence presented by HR.com August 2023 36 Submit Your Articles

Shaping Employee Benefits In A Transformative Era

Jaclyn Chen is the Co-Founder & CEO of at Benepass Would

you like to comment?

The Future of Talent Acquisition

September 6-7, 2023

The Future of Personalized HR Services and Experiences

September 13, 2023

The State of People Analytics

September 20, 2023

View our Upcoming Virtual Conference Schedule and Register Today!

Unconventional Benefits With Sharlyn Lauby: What Does Your Workforce Really Want?

Building a Talent Magnet Organization: Secrets to Attracting and Retaining Top Talent

AI and the Future of Talent Acquisition

September 5, 2023

September 6, 2023

Are PayCards Still Relevant?

September 7, 2023

HR and the Future of AI—What it Means for HR Professionals

September 12, 2023

-

September 13, 2023

View our Upcoming Webcasts Schedule and Register Today!

VIRTUAL EVENTS & HR.COM WEBCASTS UPCOMING

www.hr.com/upcoming_webcasts www.hr.com/virtualconferences

REGISTER

REGISTER

REGISTER

3:00

4:00

ET REGISTER

PM -

PM

1:00

2:00

ET REGISTER

PM -

PM

10:00 AM

11:00 AM ET REGISTER

-

11:00 AM - 12:00 PM ET REGISTER

11:00 AM

12:00

ET REGISTER WEBCASTS

PM

VIRTUAL EVENTS