16 10 25 30 Innovative Healthcare Benefits Serve As Brake On Inflation - Ryan Day, HST How Quality Child Care Benefits Businesses - Jessica Harrah, KinderCare Learning Companies Designing Health Benefits That Attract And Retain Talent Sam Sphar, Quest Diagnostics Movember: It’s Men’s Health Awareness Month Kiljon Shukullari, Peninsula Canada NOVEMBER 2022 • Vol.09 • No.11 (ISSN 2564-1980) Themed Edition on Benefits Trends 2023 BRIDgIng 2022 AnD 2023: FInAncIAl BeneFITS ARe A gROwIng PRIORIT y FOR eMPlOyeeS - Krystal Barker Buissereth, Head of Financial Wellness, Morgan Stanley at Work

Articles Bridging 2022 And 2023: Financial Benefits Are A growing Priority For employees Employers should wrap their arms tightly around employees’ whole financial lives – Krystal Barker Buissereth, Head of Financial Wellness, Morgan Stanley at Work 07 On the Cover I n D e X Employee Benefits & Wellness Excellence NOVEMBER 2022 Vol.09 No.11 32 The Solution To What’s Ailing Employers And Employees Isn’t As Complicated As We Think More than ever, today’s employees know what they want – Liz

CEO

Founder, Financial Finesse 36 To Support Their Teams, Leaders Must First Take Care Of Themselves When leaders

teams

–

38 Tips And Tools For Increasing Your Stress Tolerance

you

you eliminate barriers to achievement –

EI Experience (ISSN 2564-1980) 13

Growing

Stress

Workplace

18 Cracking

Management

22

Sponsored Content Themed Edition on Benefits Trends 2023

Davidson,

and

practice self-care, their

are motivated to succeed

Magdalena Nowicka Mook, Director and CEO, the International Coaching Federation (ICF)

When

believe that anything is possible,

Carolyn Stern, President and CEO,

The

Impact of

on

Well-being The employer’s role in lessening the impact of a modern epidemic - Alight

the Code on Referral

How an integrated, team-based model improves member satisfaction while lowering the cost of care – Stephen Ezeji-Okoye, CMO, Crossover Health

How To Beat The High Cost Of Life Insurance It’s hard to attract good employees these days and even harder to hold onto them – Bob Gaydos, Founder and CEO, Pendella Technologies 28 How To Offer Student Loan Assistance As An Employee Benefit Student loan debt is one of today’s greatest financial hardships – John Newcome, Vice President and Senior Consultant, Kelly Benefits Strategies (KBS)

Innovative Healthcare Benefits Serve As Brake On Inflation

A number of positive trends are beginning to take hold

- Ryan Day, President, HST

How Quality Child Care Benefits Businesses

4 ways employers can step up in 2023

- Jessica Harrah, Chief People Officer, KinderCare Learning Companies

Designing Health Benefits That Attract And Retain Talent

Tips to optimize the health and engagement of a heterogeneous and distributed workforce

- Sam Sphar, VP and GM, Quest Diagnostics Employer Population Health

10 16 25 30

Movember: It’s Men’s Health Awareness Month

Here’s what employers can do to support staff

- Kiljon Shukullari, HR Advisory Manager, Peninsula Canada

Top Picks

INDEX

Benefits & Wellness Excellence - Monthly Interactive Learning Journal

This monthly interactive learning experience captures key metrics and actionable items and keeps you focused on your Benefits and Wellness planning goals and solutions.

Benefits and Wellness Virtual Events

Employee Benefits and Wellness Virtual Events ensure attendees stay compliant and up-to-date with the latest changes to employee benefits and wellness regulations. Each event varies on topics such as healthcare legislation and compliance related to employee benefits and workplace wellness programs including COBRA, FMLA, Medical Benefits, the Affordable Care Act (ACA), Outsourcing Benefits, Retirement Benefits, Voluntary Benefits and Work-Life Programs. Wellness topics encompass injury prevention, battling obesity, disease prevention, how technology is affecting wellness. Each Virtual Event consists of up to 10 credit webcasts.

Benefits and Wellness Webcasts for Credit

HR.com webcasts deliver the latest Benefits and Wellness industry news, research trends, best practices and case studies directly to your desktop. Webcasts are available live online with a downloadable podcast and a copy of the slides (PDF) available before and after each webcast. Earn all of the required recertification credits for aPHR, PHR, SPHR, GPHR, and SHRM Certifications. HR.com’s onehour webcasts, in every HR specialty including Benefits and Wellness, are pre-approved for HRCI and SHRM credit (excluding Demo webcasts).

Benefits and Wellness Community

Join more than 100,000 HR.com members with a similar interest and focus on Benefits or Wellness. Share content and download research reports, blogs, and articles, network, and “follow” peers and have them “follow” you in a social network platform to communicate regularly and stay on top of the latest updates. This well established Benefits and Wellness Communities are an invaluable resource for any HR professional or manager.

our Employee

How are

Benefits & Wellness Products and Services helping to make you smarter?

Use these invaluable Employee Benefits & Wellness resources today! For more information phone: 1.877.472.6648 | email: sales@hr.com | www.hr.com

Debbie Mcgrath

Publisher, HR.com

Since the pandemic and economic uncertainty, employees have greatly appreciated their benefits. Workers are now looking for employers who provide excellent benefits packages. With 2023 fast approaching, it is time to decide on employee benefits that not only help you attract new employees but retain your current ones. How can employers keep employees supported and benefits programs successful throughout the holidays and into 2023?

The November edition of Employee Benefits & Wellness Excellence includes informative articles focusing on innovative healthcare benefits, tips to optimize the health and engagement of a heterogeneous and distributed workforce, and much more.

Taking the time to assess and pivot your benefits program for the coming year starts with recognizing that your employees are on a complicated financial journey. If you’re not sure where to start, check out Krystal Barker Buissereth’s (Morgan Stanley at Work) article, Bridging 2022 And 2023: Financial Benefits Are A Growing Priority For Employees, which highlights why employers should wrap their arms tightly around employees’ whole financial lives.

Childcare needs are a core concern driving the future of work. While adding a childcare benefit may seem daunting to some leaders, the first step should be, taking the time to listen to your employees’ needs. Company leaders have an opportunity to step up to meet working parents where they are and offer the support they need to thrive. Read Jessica Harrah’s (KinderCare Learning Companies) article, How Quality Child Care Benefits Businesses, which shares 4 ways employers can step up in 2023.

The Great Resignation has shown that employees are more likely to apply for or stay at a specific job with benefits that align with their needs. Businesses can leverage this opportunity to enhance their employee benefits package with student loan repayment benefits. Kelly Benefits Strategies’ (KBS) John Newcome in his article, How To Offer Student Loan Assistance As An Employee Benefit, stresses the importance of offering employees the choice between student loan repayment and retirement.

November is Men’s Health Awareness Month. Kiljon Shukullari’s (Peninsula Canada) article, Movember: It’s Men’s Health Awareness Month focuses on ways to raise awareness and push back against the stigma surrounding men’s health.

In brief, in today’s employee-driven labor market, it’s crucial to find a balance between protecting your company’s budget and offering employees benefits that are important to them. And this can help your organization stand out as a great place to work in 2023.

Disclaimer: The views, information, or opinions expressed in the Excellence ePublications are solely those of the authors and do not necessarily represent those of HR.com and its employees. Under no circumstances shall HR.com or its partners or affiliates be responsible or liable for any indirect or incidental damages arising out of these opinions and content.

eDITOR’S nOTe

We hope you enjoy reading all articles included in this issue and get back to us with your valuable feedback.

Benefits 2023: What Do Employees Want? Subscribe now for $99 / year And get this magazine delivered to your inbox every month Become a Member Today to get it FREE! SIGN UP OR For Advertising Opportunities, email: sales@hr.com Copyright © 2022 HR.com. No part of this publication may be reproduced or transmitted in any form without written permission from the publisher. Quotations must be credited. Editorial Purpose Our mission is to promote personal and professional development based on constructive values, sound ethics, and timeless principles. Excellence Publications Debbie McGrath CEO, HR.com - Publisher Dawn Jeffers VP, Sales Sue Kelley Director (Product, Marketing, and Research) Babitha Balakrishnan and Deepa Damodaran Excellence Publications Managers and Editors Employee Benefits & Wellness Excellence Team Babitha Balakrishnan Editor Chinnavel Design and Layout (Digital Magazine) Chandra Shekar A K Magazine (Online Version) Submissions & Correspondence Please send any correspondence, articles, letters to the editor, and requests to reprint, republish, or excerpt articles to ePubEditors@hr.com For customer service, or information on products and services, call 1-877-472-6648 Employee Benefits & Wellness Excellence (ISSN 2564-1980) is published monthly by HR.com Limited, 56 Malone Road, Jacksons Point, Ontario L0E 1L0 Internet Address: www.hr.com Write to the Editor at ePubEditors@hr.com

Happy Reading! Employee

Employee Benefits

Babitha Balakrishnan Editor,

& Wellness Excellence

In a world of unparalleled challenges (global pandemic, racial injustice, politi cal rivalry, digital 4.0, emotional malaise), uncertainty reigns. Finding opportu nity in this context requires harnessing uncertainty and harnessing starts with reliable, valid, timely, and useful information. The Excellence publications are a superb source of such information. The authors provide insights with impact that will guide thought and action.

Dave Ulrich

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

Excellence publications are my ‘go-to’ resource for contemporary and action able information to improve leadership, engagement, results, and retention. Each edition offers rich and diverse perspectives for improving the employee experience and the workplace in general.

Julie winkle giulioni

Author, Virtual /Live Keynote Presenter, Inc.’s Top 100 Leadership Speakers

I regularly read and contribute to Leadership Excellence and Talent Manage ment Excellence. I use many of the articles I read to augment my own presen tations and I often share the articles with my clients. They are always quick, right on target for the latest issues in my field, and appreciated by my clients.

If you want to stay up to date on the latest HR trends, choose a few of the dif ferent issues from the Excellence series of publications.

Dr. Beverly Kaye CEO, BevKaye&Co.

We’re eager to hear your feedback on our magazines. Let us know your thoughts at ePubEditors@hr.com WHY EXCELLENCE PUBLICATIONS?

Bridging 2022 And 2023: Financial Benefits Are A growing Priority For employees

employers should wrap their arms tightly around employees’ whole financial lives

By Krystal Barker Buissereth, Morgan Stanley at Work

It’s safe to say 2022 has been a wild ride. In fact, our research shows that factors like inflation, geopolitics, and economic uncertainty changed the way

employees look at their workplace benefits. And we can all agree the holidays can exacerbate financial stress for all of us, your employees included.

As many of us take a moment to pause and reflect this holiday season, there are many learnings we can draw from this year and many insights we can apply as we

Employee Benefits & Wellness Excellence presented by HR.com November 2022 7 Submit Your Articles

cOVeR ARTIcle

move forward to the next. So how can benefits leaders learn from what we’re seeing and adapt to keep employees supported and benefits programs successful throughout the holidays and into 2023?

next to normal

Amid today’s new economic challenges, rather than a “return to normal,” we are all adapting to a new reality. Employers are being called upon to work even smarter to stay ahead of evolving employee expectations, with the role and value of financial workplace benefits such as financial wellness, retirement preparation, and equity compensation carrying new weight.

Our second annual State of the Workplace II Financial Benefits Study1 found that employees increasingly cite money-related stress as having a negative impact on their performance at work. They are paying greater attention to their workplace benefits, and many feel that their needs are not being fully addressed. An overwhelming 96% of HR leaders also agree that their company must do a better job to help employees maximize their financial benefits.

Given this context, it makes logical sense that nearly all employees and HR leaders (90% and 96%, respectively) have made it a top priority to re-evaluate their benefits packages.1 How are your benefits offerings stacking up? It takes data to unpack this

question, so measure everything you can—from engagement and analytics reports to segmented employee surveys. These insights will reveal what your employees need and can serve as the lens through which you filter all your decisions in the coming year.

It’s important to make sure your benefits strategy is aligned with what is going on in your employees’ lives. For example, we found that while over half (52%) of employees believe that working with a Financial Advisor would be the single most beneficial retirement planning tool for them, HR leaders only ranked providing access to a Financial Advisor as a tie for third choice—demonstrating a disconnect between employees and employers.1 It’s time to bridge this gap.

Building the Bridge

As employees increasingly expect financial support beyond a simple paycheck, it’s key to balance strategic plan design against an effective participant experience to help drive satisfaction. When your employees look to their workplace benefits for help, it’s important that the workplace is ready to tell a cohesive and coherent story about how it all intersects and connects.

If you’re not sure where to start, harvest the low-hanging fruit first:

● If your company offers any financial benefits, communicate early and often, and make sure employees are hearing

it beyond the noise. Use all communications with employees as an opportunity to reiterate how your benefits suite can help them with their financial needs: 47% of employees reported that they have either never thought to or are unsure if they are allowed to reach out to their employer for assistance with their personal finances.1

● Also, build the right benefits lineup. Offering employees access to financial wellness and financial professionals through the workplace can help them identify and implement a personalized strategy to meet their short- and long-term financial goals—and weather stormy seas, like today’s environment. The Employee Benefits Research Institute (EBRI) says personalized financial counseling, coaching, or planning and basic money management tools are some of the most popular and in-demand benefits today.2 And a survey from Statista Research also found more than half of US employees would feel less stressed about their overall finances if their employer offered financial wellness benefits.3

● It’s not enough to just offer financial benefits out of 200 companies surveyed by US News, only 23% provided any financial education benefits.4 Make sure to help employees build up

Employee Benefits & Wellness Excellence presented by HR.com November 2022 8 Submit Your Articles

Bridging 2022 And 2023: Financial Benefits Are A Growing Priority For Employees

their own financial wellness skills and knowledge so they can make the most of the workplace in a way that makes the most sense for their individual situation. Survey employees about how they prefer to learn and receive information and what financial education topics interest them. Then, use all your available technology and work with your providers to ramp up your financial education programs

● Whatever benefits you offer, your employees are looking for help understanding, utilizing, and personalizing their experience. Whatever is on tap, make sure you back it up with real support. For example, retirement plans may seem like table stakes, but our research shows 93% of employees see retirement planning assistance as a priority when choosing where to work.2 So if you don’t already, consider opening access to financial advice through the workplace, such as with a financial coach or 401(k) retirement plan Financial Advisor.

Financial wellness is often talked about separately from financial planning or workplace benefits, but it helps to think of it as the bridge that connects every area of our financial lives both in the present and the future. Taking the time to assess and pivot your benefits program for the coming year starts with recognizing that your employees are on a complicated financial journey. It’s more important than ever for employers to wrap their arms tightly around employees’ whole financial lives.

Notes

1. The data from the Morgan Stanley at Work State of the Workplace Financial Benefits Study comes from a survey of 1,000 U.S. employed adults and 600 HR executives. Quotas were set for both audiences to match representative distributions, including for company size, benefits status and seniority. The survey was conducted on behalf of Morgan Stanley at Work using an email invitation and an online survey between September 21st and September 28th, 2021 by Wakefield Research . Wakefield Research is neither an employee of, nor affiliated with, Morgan Stanley Smith Barney

LLC (“Morgan Stanley”). The study has been prepared solely for information purposes. The information is in-part based on, derived from, or includes information generally available to the public and has been obtained from sources believed to be reliable. Morgan Stanley Smith Barney LLC does not guarantee their accuracy or completeness. The study includes select statements made by certain survey participants. Morgan Stanley makes no representation or warranty concerning the content of such statements and is not implying an affiliation or approval with/of any such persons or the views expressed by such persons.

2. Employee Benefit Research Institute, EBRI Financial Wellbeing Employer Survey, October 2021

3. Statista Research Department, Effects of employers offering financial wellness benefits, July 2020

4. US News, Survey of 200 Companies, June 2022

you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 9 Submit Your Articles

2022 And 2023:

Krystal Barker Buissereth is the Head of Financial Wellness at Morgan Stanley at Work Would

Bridging

Financial Benefits Are A Growing Priority For Employees

Innovative Healthcare Benefits Serve As Brake On Inflation

A number of positive trends are beginning to take hold

By Ryan Day, HST

At a time when even half of insured Americans worry about covering their deductibles and some simply can’t afford to see a doctor or get a prescription filled, no party to healthcare transactions—employee, employer, health system or payor—is immune to the impacts of rapidly accelerating inflation in the market.

To top it off, when we are seeking medical care, it’s unhelpful, to say the least, not to mention scary, when health systems ask us to sign on the dotted line to say we will be responsible for all the costs—when we don’t know the cost upfront. And if you can’t pay, they might come after your house.

Fortunately, a number of positive trends are beginning to take hold as the healthcare industry as a whole search for ways to put the brakes on rising costs while boosting value, transparency, and quality in healthcare benefits. The federal No Surprises Act has been helpful in this regard, requiring health systems to reveal upfront whether any providers who will be involved in a procedure or other medical care are out of network. According to Forbes, in theory, this level of transparency could force healthcare prices down (though some economists warn it could also encourage some providers to raise their rates if they feel they’ve been underpaid).

Employee Benefits & Wellness Excellence presented by HR.com November 2022 10 Submit Your Articles

Top Pick

In addition to transparent pricing, other concepts that are being put into play to keep a lid on and lift the lid on healthcare costs are:

Bundled payments, are models of care that work to reduce costs while boosting quality and care coordination. Bundled payments work to align incentives among providers such as physicians, hospitals, and post-acute care centers, which enable them to work together more closely across specialties and locations, according to the Centers for Medicare and Medicaid Services (CMS).

As one example of how bundled payments work, if you’re going to have a baby, you will be told upfront the price for the hospital itself, the physicians, any physical therapy you might need, a lactation consultant, and anything else. It’s all included, and you shouldn’t expect another surprise bill. Bundled payments are beneficial to health systems because they know how much they’re receiving and that they will be paid quickly.

Direct-to-employer (DTE) contracting, in which an employer, most often self-insured, contracts directly

with healthcare systems, enabling said employer to negotiate down to a granular level the healthcare benefits terms for its employees and their families.

I suspect you will see more employers shift in this direction as they decide they don’t need expansive networks, realizing that they’ve been there before, and the price has only gone in one direction. By partnering with a particular health system and its entire network of doctors, employees can still go elsewhere, but they’re incentivized to stay if they want the best price—and potentially the best quality that goes with it.

Direct-to-employer contracting is especially attractive to those who prefer not to take the risks and just to know upfront what they will end up paying.

Reference-based pricing (RBP) is an attractive option for employers because it provides plan holders at least some ballpark of their expected costs upfront, along with transparency into what they did pay in the end, and why. Our metrics show they will save between 20% to 30% over more typical employer medical plans, which they can either reinvest in their

Employee Benefits & Wellness Excellence presented by HR.com November 2022 11 Submit Your Articles

Serve As Brake On

Innovative Healthcare Benefits

Inflation

business or refund to employees via lower premiums. In addition to potentially gaining that windfall, knowing what they will pay in advance helps employees avoid getting buried in debt.

Reference-based pricing also shares quality metrics on providers and facilities, so patients are empowered with knowledge going into an appointment or procedure. Because of the increased transparency around costs and quality, we expect employer adoption of RBP to rise in 2023. Some industry estimates forecast we’ll see the current 4-5% of claims processed with reference-based pricing jump to 15-20% in the next two years.

With RBP, employees also have access to a wider range of healthcare options, which is especially advantageous for people of modest incomes who are most concerned about affordable deductibles and thus tend not to seek care in the first place. And refer ence-based pricing plans provide access to apps that reveal how well different providers perform in terms of cost and quality metrics, according to the Centers for Medicare and Medicaid Services.

Boosting benefits while reducing contributions, which employers are offering despite projected 5% increases in healthcare benefits costs during 2022. Again, a benefit of RBPs, many lower-income workers who may have been disincentivized to seek care at all, are more likely to elect healthcare benefits with a lower contribution but not lower quality care. This part of an overall trend to increase employee recruitment and retention also includes adding mental health coverage and stipends and providing retirement accounts.

We know health benefits are an important factor for employees when considering a job. A study from the Employee Benefit Research Institute and M Mathew Greenwald & Associates, Inc.’s Value of Benefits Survey found 60 percent of employees rank health insurance as the most important benefit. During open enrollment, the cost of healthcare benefits is on everyone’s minds. Employers can show they are doing their part with an inflationary economy but lowering healthcare costs for employees.

Simplifying healthcare purchasing is an option self-insured employers are undertaking to bring about transparency and quality while realizing savings as they contain costs. Larger companies with significant purchasing populations like Amazon and Walmart have been drawn toward this methodology. They’re going to purchase healthcare a little differently, using their buying power to dictate pricing and access to the best care.

For example, if a member is getting a high-cost procedure, and the hospitals they typically use are not giving them the price they want, they might place that person on a private jet and get them bundled care elsewhere at the right price and quality.

Or if someone has a rare cancer that a local hospital might only see once per year, they deliver them to a hospital in another state that specializes in it and sees it day in and day out.

Bottom line: innovations like bundled payments, direct-to-employer contracting and reference-based pricing—along with additional initiatives like boosting benefits, reducing contributions, and simplifying healthcare purchasing—are all helping to move the needle in terms of slowing cost increases and providing greater transparency and quality.

Ryan Day, President, HST, a MultiPlan Company, oversees operations and product development, bringing to HST an extensive background in finance, developing innovative technology solutions, and strategy. He started his career with a boutique Wall Street firm specializing in investments and employee benefits for nonprofits and hospital systems.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 12 Submit Your Articles

Innovative Healthcare Benefits Serve As Brake On Inflation

The growing Impact of Stress on workplace well-being

Are stress levels on the rise, or does it just seem that way? According to a study by Gallup, our experiences of stress, worry, and sadness have reached record levels. Even before the pandemic, the World Health Organization (WHO) had classified stress as the “health epidemic of the 21st century,” and the disruptions and volatility brought on by COVID-19 only added to this.

The Impact on the world of work

It’s no surprise that increasing levels of stress are also having an impact on the workplace. For example, Alight’s 2022 International Workforce and Wellbeing Mindset Study (2022 Mindset Study) found that the majority of employees in the U.S. and western Europe rate their current stress levels as moderate or high. The study also found that 43% of U.S. employees are experiencing at least one symptom of burnout, with 14% reporting symptoms that won’t go away. Those symptoms can include feelings of energy depletion or exhaustion, increased mental distance from one’s job, feelings of negativism or cynicism related to one’s job, and reduced professional efficacy.

It’s ironic that in an era where a growing number of employers are recognizing the economic value of positive employee experiences, almost one-third (32%) of U.S. employees say they dread going to work or starting their workday (according to Alight’s research). That discontent can have a profound effect on a

company’s culture and ongoing viability. High stress levels can translate directly into a lack of motivation, reduced productivity, poor performance, and higher absenteeism rates. The WHO even estimates that employers lose a staggering $1 trillion each year due to burnout.

How employers can Help Flip the Script on Stress

The good news is that employers aren’t helpless in the face of rising stress levels. They can take steps to help employees manage stress more effectively and deliver a better overall employee experience. Here are some suggestions:

1. Talk it out. Alight’s research found that roughly half of U.S. employees have spoken to their supervisor about high stress. It can be an uncomfortable topic for all parties. So, it’s time to remove the stigma. Focus on creating a more open and supportive culture where people are comfortable sharing their challenges and raising their concerns.

2. Equip management with the right tools. The 2022 Mindset Study also found that fewer than one-third (32%) of employees would be comfortable reaching out about mental and emotional health challenges. At the same time, 78% of senior managers wished their employer offered more resources and/or time

Employee Benefits & Wellness Excellence presented by HR.com November 2022 13 Submit Your Articles

The employer’s role in lessening the impact of a modern epidemic

off for mental health. Employers can close that gap by ensuring that managers have the tools and resources to hold open and productive discussions on stress, its causes, and possible solutions.

3. Stay flexible. Empowering employees with the ability to decide where and when they work can be a huge stress reliever. When possible, consider offering flexible work schedules and the option to work remotely to foster a better work/ life balance.

4. Get creative. There’s no single solution to relieving workplace stress. But little things can make a big difference. Tools like benefits navigation and concierge solutions can provide simpler and faster access to information and services on childcare, eldercare, financial planning, and healthcare. They also free up time so that employees can focus more on the things that matter most to them.

5. Turn to tech. Innovative technology can provide a one-stop shop for accessing benefits information when and where employees need it—and help them make better decisions on utilization. Easier access alleviates confusion and gives employees greater control in managing their well-being.

It’s unrealistic for employers to aim to eliminate stress altogether. After all, manageable levels of stress can be motivating and energizing. Stress can spur employees to stretch themselves, expand their horizons, and work through tough challenges. But overlooking rising stress levels is shortsighted. When stress gets too intense, it can compromise the employee experience and quality of life—and ultimately hurt the bottom line. Employers can do the right thing for the business and the right thing for their people by making a concerted effort to help employees cope with stress.

For more information on rising workplace stress and ways to counteract it, download Alight’s white paper, Healthy balance: Empowering employees to better manage stress today.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 14 Submit Your Articles

The Growing

of

on Workplace Well-being

Impact

Stress

Welcome to

wellbeing

for everyone. Take care of your employees’ health and wellbeing. They’ll take care of your organization. Learn more at alight.com

working

How Quality Child Care Benefits Businesses

4 ways employers can step up in 2023

By Jessica Harrah, KinderCare Learning Companies

By now it’s a well-known fact: The pandemic has reshaped work and workplaces. For some, work is now fully remote, while other workplaces are experimenting with hybrid models or returning to the office full-time. In the same way, our ways of working have shifted, the benefits being offered by employers to attract and retain workers have also changed.

With a U.S. unemployment rate of 3.7%, the labor market remains competitive. Despite this, some

employers are rolling back some of the most popular employee benefits that were boosted during the pandemic—and it’s hitting working parents hardest.

We think one of the best ways to bolster your workforce – your current talent and the future talent you want to attract – is to implement policies that give your employees the support they need to thrive both inside and outside of the office.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 16 Submit Your Articles

Top Pick

The Problem: working Parents Feel left Behind

According to the Society for Human Resource Management’s 2022 Employee Benefits Survey, fewer organizations are offering employees dependent care flexible spending accounts, subsidized child care centers, and child care referral services.

Yet research also suggests child care needs are a core concern driving the future of work. According to KinderCare’s 2022 Parent Confidence Report, 74% of working parents reported they switched jobs or would change jobs to be more available for their children. More surprisingly, 55% say they would take a pay cut to work for a company that offered quality childcare.

Company leaders have an opportunity to step up to meet working parents where they are and offer the support they need to thrive. Seeing as one-third of the country’s workforce are parents, childcare benefits of any kind can help employers tap into a talent pool that’s as wide as it is deep. After all, 60% of working parents agree that offering childcare benefit would keep them at their current job.

what your HR Team can Do next

While adding a childcare benefit may seem daunting to some leaders, the first step should be taking time to listen to your employees’ needs. Listening can help build trust and uncover valuable information that can help employers determine the best action plan.

After active listening, there are a few scaled options that companies can consider:

● Accelerate access. Many early childcare providers offer ways that employers can help facilitate or guarantee employees a spot at a care center.

● Subsidize child care tuition. The most commonly offered child care benefit, given its flexibility for both employers and employees, subsidized tuition benefits help cover some of the costs employees pay at their local com munity-based center. It also allows employers to select their subsidy rate and employees to customize their care, including where their

children go, the time of day, and the kind of care needed.

● Backup care support. Take family support even further by giving working parents backup care they can rely on if regular care falls through (i.e. school closes, the sitter cancels, etc.).

● Build an on-site child care center. While this may be the boldest approach, building a custom on-site child care center at, or near, your workplace can be the best option, especially if your workforce is returning to the office full-time.

● For example, Whirlpool’s The Eddy and AriensCo’s early learning center, both built-in child care deserts, were designed to attract and retain talent by offering employees subsidized child care at work.

Data shows that when employers support their people with childcare solutions, those employees have confidence in their professional and personal decisions creating a more engaged, loyal, and productive workforce. That’s what makes 2023 the right time for employers to bring new creativity and additional investment into attracting and retaining the working parents their workplaces want—and need—to succeed.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 17 Submit Your Articles

Jessica Harrah is Chief People Officer at KinderCare Learning Companies

How Quality Child Care Benefits Businesses

Would you like to comment?

cracking the Code on Referral Management

By Stephen Ezeji-Okoye, Crossover Health

By Stephen Ezeji-Okoye, Crossover Health

The process of managing specialist referrals has long been a source of pain for patients, providers, and payers (be they self-insured employers or health plans). Patients shoulder an unnecessary “burden of treatment” and suffer poor care experiences, including the need to courier their health data from one provider to the next. Primary care providers consistently $750B Annually in healthcare wasteful spending or over treatment struggle to coordinate and close the loop on downstream specialist care. But despite these pain points, specialist referrals have continued to increase over the past decade and now account for 25% of total medical expenditures, putting significant financial pressure on self-insured employers who must absorb these skyrocketing costs without corresponding improvements in

outcomes and patient satisfaction to show for it.

referral rates and more care fragmentation.

This picture has only grown more complex with the recent rise in adoption of virtual care. As many traditional virtual urgent care providers wade into the waters of virtual primary care they find themselves ill-equipped to handle the broader referral management challenge, with care models limited to managing episodic visits rather than longitudinal care across conditions, specialties and geographies. The resulting care is by nature limited in scope, ultimately leading to higher

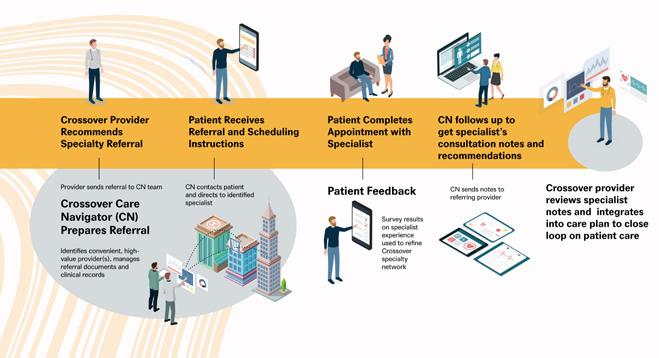

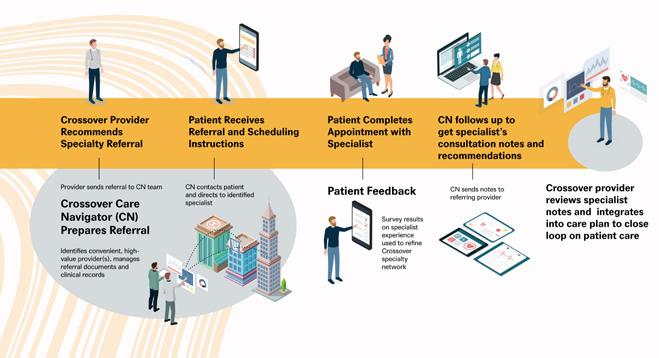

So, what’s the solution to this costly, chronic challenge? An alternative approach is to embed referral management via care navigators directly into a comprehensive, integrated Primary Health team. This model includes dedicated primary care, physical medicine, mental health, and health coaching providers, and is a model that can be equally effective in both virtual and in-person settings.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 18 Submit Your Articles

How an integrated, team-based model improves member satisfaction while lowering the cost of care

To clearly highlight the advantages of embedded referral management within a Primary Health team, Crossover Health conducted a first-of-its-kind peer-reviewed study of referral management from December 1, 2018 through December 31, 2020 (notes on methodology below), recently published in the Journal of General Internal Medicine. The study found that Crossover’s unique model reduced referral rates, increased employee satisfaction, and reduced overall costs for Crossover employers relative to the community.

referral management model significantly increases member satisfaction — with members rating their specialist care experience highly (4.33 out of 5) — a level of satisfaction that reflects a strong and enduring member-care team relationship. Moreover, the vast majority of referred members reported a wait time of less than 10 minutes before being seen by their referred specialist. In a disconnected healthcare system where patients consistently report frustration with the care experience, our high satisfaction scores reinforce that this model is working better for everyone.

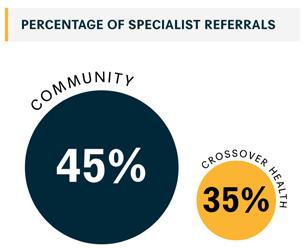

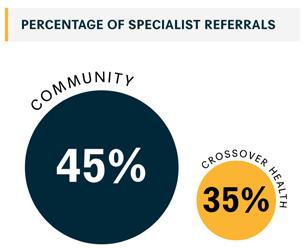

Additionally, the study supports the continued trend of Crossover’s Primary Health care teams reducing the total cost of care by deploying embedded care navigators who direct required referrals to high-quality, cost-effective options. Across a diverse set of employers and member populations, Crossover has consistently reduced specialist costs by 35% to 17%, representing significant savings for self-insured employers in a time of heightened financial pressures.

contribute to the skyrocketing cost of employer-based healthcare. Estimates suggest the healthcare industry wastes as much as $750B a year in unnecessary or redundant tests and treatments. In sharp contrast with this status quo, we were encouraged to see in our review that patients receiving comprehensive, integrated care from Primary Health teams at Crossover were referred to specialists at a rate 22% lower than patients receiving care in the community (35.1% compared to 45% in the community).

Notably, the study demonstrated that Crossover’s embedded

comprehensive care from the Primary Health Team Means 22% Fewer Specialist Referrals Referral rates from primary care to specialties such as imaging, cardiology and gastroenterology have been on the rise for years in the U.S. They constitute more than half of all outpatient visits and

What are the key factors driving success here? In Crossover’s Primary Health every touchpoint with the patient is used to screen for and address gaps in care, ensuring that every specialist referral made is evidence-based and the best option for the member — not simply the default choice. This approach to referral management is further reinforced by Crossover’s outcomes-based payment model which compensates providers not for visit volume but for doing what’s right for the patient.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 19 Submit Your Articles

the Code on Referral Management

Cracking

expert care navigation Slashes costs for High-Frequency, Highcost Specialist Visits

When patient needs cannot be met within the Crossover Primary Health team and a specialist referral is required, expert embedded care navigation is another key factor in lowering costs and boosting patient satisfaction. Traditionally in healthcare, specialist referrals are initiated by ordering clinicians based on established networks and prior relationships. However, clinicians often lack the resources to maintain up-to-date knowledge of high-quality providers across various specialties and geographies.

Crossover addresses this challenge by centralizing the referral function within a team of dedicated care navigators who combine regional expertise, databacked navigation tools, knowledge of community resources to address social determinants of health, and high-touch support for members when they need it most. With this embedded care navigation model, this study found we were able to dramatically reduce costs for some of the most frequent and costly specialty visits in our member population relative to the community. Sleep medicine visits were a dramatic 22% lower; gastroenterology was 14% lower; and, allergy, asthma and immunology was 9% lower. Imaging visits, which have emerged as one of the greatest contributors to the high cost of healthcare in the US, cost a significant 8.3% less than in the community

crossover embedded care navigation experience

guiding every Step of the care Journey

Specialist referrals will continue to be a part of healthcare, whether patients choose to seek their care in-person or virtually. In a future that continues to see steady, if not increased, rates in the use of virtual urgent care it will be essential to have a smartly orchestrated approach to longitudinal care —one that ultimately leads to lower costs for employers and a better care experience for members. This paper reveals the key ingredients of an approach that cracks the code on referral management, underscoring the critical role that employers play in the care journey. First, by simplifying the healthcare experience and providing team-based care in a tightly integrated, multidisciplinary setting,

Crossover is able to address member health comprehensively and proactively, reducing unnecessary referrals. Second, when a specialist referral is required, our dedicated care navigators are equipped with the tools and regional expertise to direct members to high-quality, cost-effective care.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 20 Submit Your Articles

the Code on Referral Management

Cracking

The result? Seventeen percent lower specialty care costs for employers, better overall health outcomes, and an improved care experience for both members and providers.

Note on Methodology: The study utilized two separate propensitymatched samples to examine patient and encounter level data. The Crossover research team matched a cohort of 3,129 patients who received most of their primary care (75%+) in a Crossover employersponsored clinic between January 1, 2019 and December 31, 2020 with a cohort of persons eligible for employer-sponsored services who did not access care from Crossover during the same period. Our researchers then compared overall specialist utilization and cost of care trends between the two populations. Patient satisfaction was collected and analyzed for the Crossover population. Specialist care cost (17.1% in savings) refers to the per-user-per-month cost associated with specialty care with savings largely associated with care avoidance.

A second encounter-level matched study was conducted to assess the impact of Crossover’s Care Navigation on specialist visit costs. Speciality referrals facilitated by a care navigator at Crossover Health were matched to comparable speciality visits in the community

As Chief Medical Officer, Dr. Stephen Ezeji-Okoye oversees the company’s national medical group, which consists of in-person and virtual care teams and spans primary care, physical medicine, mental health, health coaching and care navigation. He is instrumental in the design of Crossover’s interdisciplinary, team-based care model, as well as the company’s hybrid, surround-sound approach to care delivery. He also plays a lead role in scaling the national medical group across new markets and partnerships. Prior to his promotion to Chief Medical Officer in July 2019, Dr. Ezeji-Okoye served as the Medical Director at Life @Wellness (Crossover’s clinic at Meta).

Dr. Ezeji-Okoye joins Crossover from VA Palo Alto Health Care System (VAPAHCS). His success at the VA can be attributed to several cutting-edge initiatives he spearheaded that continue to enable the organization to support the health and wellbeing of veterans, including redesigning systems from the ground up to abide by the Principles of Lean Manufacturing in which he is an expert. His innovative use of disease prevention, chronic disease management, social determinants of health, and complementary and integrative health practices to promote self care among veterans led to his appointment as a national consultant to the VA on the use of Integrative Medicine and an Advisory Council member to the National Institution of Health’s National Center of Complementary and Integrative Health.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 21 Submit Your Articles

Cracking the Code on Referral Management

How To Beat The High cost Of life Insurance

By Bob Gaydos, Pendella Technologies

As businesses search for ways to retain valuable employees, they often think about expanding their benefits. And for good reason. Roughly 50% of employees see benefits as one of the top factors influencing their decision to stay or leave their current jobs.

Life insurance is one benefit that can help employers stand out from the crowd. Offering life insurance to employees can help them feel that you genuinely care about them and their families. Unfortunately, most basic group life insurance policies have fairly low

coverage, so the financial protection such policies may offer employees’ families or dependents is very limited.

While many employers allow workers to purchase supplemental life insurance to raise their coverage, the approval process can take weeks and be fairly expensive, mainly because underwriting is a complex and expensive process for insurers. Processing a single life insurance policy can cost up to $2,500, depending on the complexity and policy parameters, and underwriting is a high percentage of that cost.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 22 Submit Your Articles

It’s hard to attract good employees these days and even harder to hold onto them

In other words, expensive underwriting drives up the overall cost of an individual or supplemental policy. This high cost is what keeps two-thirds of uninsured Americans from getting coverage. If businesses hope to decrease that number and provide affordable insurance options for employees, they need to uncover the root cause of these high costs and find ways to bring them down.

Plus, as the world emerges from the Covid shutdown, this is an especially good time to address the problems in the life insurance industry. Roughly a third of consumers have said they are more likely to buy life insurance now than when the pandemic began.

why Is Underwriting expensive?

So, why is life insurance underwriting so expensive? Well, because it’s not an easy thing to do. Underwriting is how insurers determine whether someone is eligible for insurance and how much the premiums will cost. Therefore, an underwriter needs to be an expert who can dig into mounds of data to determine the level of risk for an insurance prospect. Finding and sorting through all the relevant data needed for an accurate assessment takes time and effort, so hiring a good underwriter tends to be expensive.

Here’s how the process usually works:

A life insurance agent reviews a prospective client’s application to confirm any information if necessary. Then the policy goes to underwriting. The underwriter may have additional questions beyond the initial application, and they will likely need information from third-party medical sources. But getting the data can take a lot of time and effort, especially since the healthcare industry as a whole has been overwhelmed since the outset of the pandemic. After collecting all the relevant data, the underwriter has to apply expertise and personal judgment to determine the outcome.

In all, the process could take weeks or months and require dozens of hours of effort for an experienced and highly-trained underwriting expert. Thus, underwriting for life insurance is unusually laborintensive and time-consuming: i.e. expensive.

Hurdles for Insurers

One way a lot of insurers have tried to bring down underwriting costs is through accelerated underwriting, which eliminates the need for a medical exam. The convenience of this process is very appealing. About half of Americans say that they are more likely to buy life insurance with simplified underwriting compared to the traditional underwriting process.

But since simplified underwriting doesn’t pull together the same kind of data as traditional underwriting, it brings more risk to insurers. To offset the risk, some life insurance companies charge more for policies based on accelerated underwriting, which means these companies are in effect reducing insurance options for individuals with limited financial means.

Because of the increased risk, not every insurer offers accelerated underwriting, so many policies still require an exam and extensive medical data. So, despite the length and complexity of the traditional underwriting process, it remains to be the backbone of life insurance today.

Traditional underwriting has additional issues beyond its cost. For example, personal bias will always be a

Employee Benefits & Wellness Excellence presented by HR.com November 2022 23 Submit Your Articles

To

The

Of Life Insurance

How

Beat

High Cost

part of traditional underwriting, since it’s all up to the individual underwriter how much the policy costs and whether or not an individual is qualified. This raises all kinds of issues regarding the fair treatment of people across gender, race, socioeconomic status, and other demographic categories.

can Insurers Solve the Issue?

These problems have led many people, both within the industry and from the consumer side, to call for replacing traditional underwriting with a process that is data-fueled and automated. Change won’t come easily in such an entrenched industry, but one major factor affecting change will be the rise of insurtech companies—carriers that rely on cutting-edge technology to provide insurance. As a result, life insurance may become more accessible to millions.

Automated underwriting based on AI and machine learning algorithms can save much time and effort. Insurtech companies have already started using automation and artificial intelligence for claims processing, thereby reducing the amount of manual work required by around 80% and cutting processing time in half. Applying the same kind of automation to underwriting could allow insurers to easily collect and process large amounts of data.

What’s more, the objectivity and faster processing speeds of automation and AI may help remove bias from the underwriting process. Questions remain, however, about whether automated underwriting could increase the risk for insurers through inaccuracies or inadequate data sources.

Data-fueled automated underwriting may be particularly helpful for creating better group life insurance offerings through employers. This is where businesses and HR can help bring down costs. Insurtechs are fueled by the data, and businesses generally have a lot of that employee data on hand already, and because that data is generally high quality and reliable, this helps reduce the risk for insurers. The result could be a dramatically accelerated underwriting process for group life insurance plans—and, in the future, enhanced individual plans that employees can opt for to

increase their coverage, offered through partnerships between insurers and individual companies.

So in the end, reducing the cost of life insurance underwriting comes down to big data. Underwriting pulls in data from a vast number of sources and then an underwriter has to make a decision based on all that data. But by leveraging automation, AI, machine learning, and data sources provided by employers, insurers can largely automate underwriting while keeping estimates accurate, keeping premiums relatively low, and cutting down on work hours for insurers and insurance agents.

There’s no easy answer to the high costs of underwriting in a huge industry that is slow to adopt new technologies. Still, insurtechs have already started to lead the way. The technology is available. Providers that make use of automated underwriting and leverage big data can reduce costs and thereby make insurance more accessible to a wider client base.

Bob Gaydos is the Founder and CEO of Pendella Technologies. Bob is a successful entrepreneur and recognized insurance benefits expert. Early in Bob’s career, he established himself as an innovator. As a co-founder of Choice Plus of New England, he pioneered the development of level-funded health plans. Over the last 10 years, Bob has founded, invested, advised, and operated innovative companies in the benefit & insurance industry.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 24 Submit Your Articles

How To Beat The High Cost Of Life Insurance

Designing Health Benefits That Attract And Retain Talent

Tips to optimize the health and engagement of a heterogeneous and distributed workforce

By Sam Sphar, Quest Diagnostics

By Sam Sphar, Quest Diagnostics

Human resource executives and other C-Suite leaders are grappling with unprecedented strain caused by “The Great Resignation” wage inflation and, more recently, concerns about a potential future recession. Never has the challenge of keeping employees healthy, safe and engaged been more fraught.

While these complex issues elude an easy fix, a recent survey from Quest Diagnostics suggests HR executives are overlooking the retention power of a perk they already provide: health benefits. According

to 1,269 HR executives and employees surveyed, 36% of employees who were thinking of leaving their jobs cited a desire for better healthcare benefits as a top reason.

At Quest, we know firsthand the criticality of strategic employee health benefits design to medical cost management and employee engagement. We delivered approximately $60 million in estimated savings over the past 5 years in employee-related medical costs through a combination of tight vendor management to minimize inappropriate healthcare

Employee Benefits & Wellness Excellence presented by HR.com November 2022 25 Submit Your Articles

Top Pick

utilization as well as data-driven population health strategies in place of traditional wellness screening programs. And we accomplished this during the height of Covid-19 when about half of our workforce was in essential roles providing laboratory testing and related services to support the nation’s pandemic response.

Through these experiences, we learned a great deal about employee health risks and steps other employers can take to optimize the health and engagement of a heterogeneous and distributed workforce:

1. your employees Are not Receiving the Medical care They need

It is well known that people have delayed preventive and even urgent medical visits over the past 2-plus years of the pandemic. Indeed, nearly three-quarters (73%) of HR executives we surveyed expressed worry that their employees may be sick with chronic illnesses because they haven’t had wellness checks during the pandemic. Three in five (63%) of employees

say they put off routine medical appointments and/or screening over the past two years.

HR executives need to understand that these delays in preventive care are likely to have long-term impacts on employee health and ultimately medical costs. Research by my colleagues at Quest Diagnostics published in the prestigious medical journals JAMA Oncology Online and Journal of Clinical Oncology, Cancer Care Informatics revealed declines in rates of new diagnoses of eight cancers, most significantly, breast and prostate, during the first two years of the pandemic, likely due to delayed medical care. These cancers didn’t disappear – they will likely manifest in a worse, harder-to-treat, and more costly state in the future.

Companies need to step up to educate employees on the urgency of “returning to care” and help them to access needed preventive services. At Quest, we are taking steps to remind our employees that if they put off care during the pandemic, they shouldn’t delay doing so any further.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 26 Submit Your Articles

Talent

Designing Health Benefits That Attract And Retain

2. wellness Screenings Are Only a First Step to employee Health

Some employers may be tempted to ramp up “wellness” screening programs to increase employee engagement with healthcare. While these programs help employees reengage in healthcare, they work best when connected to ongoing support. This is because conventional wellness screening programs are premised on the theory that individuals, once informed of their health risks, will independently make changes to improve their health, such as scheduling visits with a doctor or losing weight. In reality, providing a lab result to an employee without further intervention may leave them adrift on the care journey, disconnected from the support necessary to spur meaningful change.

A better approach involves population health management. Based on strategies that originated in healthcare, population health strategies use data analytics, based on comprehensive biometric, laboratory, behavioral, and other data, to identify individuals at risk for chronic diseases. With these insights, at-risk individuals can be directed to interventions, such as behavioral modification programs, to potentially lower those risks.

This is not to say that conventional wellness screening services lack value. Certainly, any screening program is better than none, especially when so many people skipped healthcare during the pandemic. Yet, the key to optimizing the value of these programs for the individual -- and the employers’ medical costs – comes from providing ongoing support to spur meaningful change.

For instance, segments of a workforce whose lab results suggest heightened risk for diabetes may be directed through special outreach into diabetes prevention programs, which typically employ online education modules to instill healthier dietary and exercise choices. Among the Quest Diagnostics workforce, individuals who participated in our diabetes prevention program experienced meaningful improvements in several health measures, including weight loss and lower risk of diabetes and cardiovascular disease.

3. Mental Health is as Important as Physical Health

Eighty-four percent of HR executives Quest surveyed are deeply concerned about employees’ mental health, nearly the same proportion (85%) that expressed concerns about employees’ physical health. And yet, the Quest survey found that only about half of employees surveyed (48%) said their employer offered mental health benefits.

At Quest, we have gone to great lengths to help our employees access the mental health services they need. Because our company generated an estimated $60 million in savings through our employee population health and vendor management strategy, we were able to invest in a program providing up to six free mental health services a year. Nearly 13% of our eligible workforce participated in 2022. While most sought therapy, many also engaged the program for other services, like care navigation (14%) and medication management (6%), with potentially significant positive effects on healthcare quality and costs.

While the workplace remains uncertain, there are some certainties we can count on. Employees want to work for an “employer of choice” that makes them feel valued and respected, appropriately compensated -- and supported by quality and cost-efficient health benefits. Employers want to be the “employer of choice” that draws and retains top talent while managing business efficiencies, including medical costs. Employer population health programs are a way to bridge these gaps and position securely in the evolving world of work.

Sam Sphar is the Vice President and General Manager of Quest Diagnostics Employer Population Health. Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 27 Submit Your Articles

Designing Health Benefits That Attract And Retain Talent

How To Offer Student loan Assistance As An employee Benefit

By John Newcome, Kelly Benefits Strategies (KBS)

The Federal Student Loan Waiver will expire on December 31, 2022. With continued uncertainty surrounding forbearance and forgiveness, student loan debt is one of today’s greatest financial hardships.

Millennials and Generation Z, two major demographics in the workplace, are saddled with massive student loan debt. In fact, according to a

2020 household debt study by NerdWallet, the average U.S. household with student debt owes $57,520.

Offer employees the choice between student loan repayment and retirement to avoid adding additional benefits to budgets. At this point in their careers, younger employees are focused on paying student loans before they start saving for retirement.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 28 Submit Your Articles

Student loan debt is one of today’s greatest financial hardships

The Great Resignation has shown that employees are more likely to apply for or stay at a specific job with benefits that align with their needs.

Businesses can leverage this opportunity to enhance their employee benefits package with student loan repayment benefits. Recent research found that roughly one-third of employers expect to contribute to their employees’ student loans by 2023, an 8% increase from last year.

The Coronavirus Aid, Relief and Economic Security (CARES) act allows employers to offer up to $5,250 in tax-exempt student loan repayment assistance to their employees through 2025. This provision will likely be made permanent.

Businesses have some flexibility in how to use student loan repayment as a benefit.

employers can offer

1. A fixed monthly contribution

2. A matched percentage of the employee’s payment each month (similar to 401K)

3. A choice between matching contributions to their retirement fund or their student loan payments

To attract and retain talent, employers must take meaningful steps to provide benefits that support the needs of a multigenerational workforce. It’s essential to know and understand the needs of your employees and continuously reevaluate if your benefits offerings are meeting your employee’s needs.

John Newcome is Vice President and Senior Consultant at Kelly Benefits Strategies (KBS). Newcome joined Kelly Benefits Strategies in 2001 as a Senior Account Manager and has served as a strong client advocate, helping businesses stay informed of industry changes and those impacts on business operations.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 29 Submit Your Articles

To Offer Student Loan Assistance As An Employee Benefit

How

Movember: It’s Men’s Health Awareness Month

Here’s what employers can do to support staff

By Kiljon Shukullari, Peninsula Canada

November is Men’s Health Awareness month.

National Men’s Health Awareness Month is dedicated to bringing awareness to a wide range of men’s health issues. Various movements such as Movember and No-Shave November are helping to raise awareness and support for those dealing with prostate cancer, testicular cancer, and mental health issues.

Open conversations are key to raising awareness and are an effective way to push back against the stigma surrounding men’s health. What better way to start a conversation than at work? Here are three ways employers can raise awareness and support staff.

1. Raise Awareness Among employees About Key Health Issues that Affect Men

Men tend to be less likely to seek out health-related information and are therefore less likely to be fully

Employee Benefits & Wellness Excellence presented by HR.com November 2022 30 Submit Your Articles

Top Pick

aware of risk factors or symptoms to watch out for. Employers can bring that information to employees. This can be done in various ways such as taking part in awareness events/movements, donating initiatives, and simply just sharing information. This will help create opportunities for men to engage with each other and with their health.

2. Provide Tools and Support

Alongside sharing information about men’s health issues, it is important to equip them with tools that can help make positive and healthy lifestyle changes. This includes providing factsheets on how to eat healthy and exercising benefits, offering discounted gym benefits, and encouraging teams to stretch or go for a quick walk, especially if their job involves sitting for most of the day.

3. Have Open conversations About Mental Health

Movember looks at mental health through the male lens and focuses on prevention and support. Breaking down the stigma around how men should behave and react is an important step in allowing men to feel comfortable enough to seek the support they need.

Normalizing conversations surrounding mental health in the workplace will help to build an open and

positive workplace culture. Employers can introduce well-being apps, provide resources for where they can seek help, or set up a men’s talking group where they can gather and have an open conversation.

An experienced HR professional and a Certified Human Resources Leader (CHRL), Kiljon Shukullari is an HR Advisory Manager at Peninsula Canada. He has extensive experience providing consultation to clients on all aspects of HR management and employee relations — offering timely answers and effective solutions to their challenges. In his current role, Kiljon oversees HR advisors on consultations with potential prospects across all provinces where Peninsula operates.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 31 Submit Your Articles

Movember: It’s Men’s Health Awareness Month

The Solution To w hat’s Ailing employers And employees Isn’t As complicated As we Think

By Liz Davidson, Financial Finesse

Imagine the scene: A large truck is trapped at the entrance of a tunnel on one of the busiest highways in the country. For hours, police, EMTs, firefighters, and even local politicians have been desperately trying to figure out a solution—but nothing is working.

With tensions running high, 9-year-old Sam—a passenger and intent observer—makes a run for the scene, yelling “try letting some air out of the tires.”

And, just like that, the traffic jam is cleared.

Whether a true story or a famous urban legend, the point is the same: often the best solutions are right under our noses. The problem is that people fail to have objectivity—throwing valuable time and money at the issue, to only make it worse.

Right now, the country is facing a seemingly unsolvable problem—mental health is becoming a public crisis and financial challenges are only exacerbating the issue. Employees are also leaving

their jobs in record numbers—a trend that is not going anywhere for the foreseeable future—and “quiet quitting” is on the rise

Feeling the pain of a recession, most employers are not in a position to increase pay or add expensive benefits to remain competitive and attract future employees. It is simply too costly and fails to address the core issue: employees want to feel heard, understood, and valued by their employer, not a cog in a profit-driven corporate machine.

The irony is that the solution is hiding in plain sight. Employers can metaphorically “let the air out of the tires,” easing tensions, boosting morale, and improving engagement by becoming true partners to their employees and investing in improving their mental, physical, and financial health. This is the cultural shift needed to not only stem the tide of resignations and retain the best and brightest employees but to ensure that they are thriving.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 32 Submit Your Articles

More than ever, today’s employees know what they want

Here is the crazy part: most employers already have the benefits in place to accomplish this goal, with Fortune 1000 companies spending hundreds of millions, if not billions of dollars per year on employee perks. Best-in-class wellness programs, mental health counseling, legal support and family planning benefits—spanning fertility to pet insurance to daycare—have become a mainstay. Even smaller companies are starting to offer most of these benefits through PEOs and other HR partnerships.

The problem is, most employees do not even know that these benefits exist, let alone how to access them to become more mentally, physically, and financially healthy and to achieve work-life balance. In fact, the Financial Finesse Financial Wellness Think TankTM estimates that the amount spent to help employees fully understand and utilize their benefits is a mere 0.12 percent of overall benefits budgets on average.

This benefits awareness gap represents one of the most significant untapped opportunities that employers have ever had. Investing in personal

financial coaching—available on an unlimited basis— is the best tool at a company’s disposal to help employees receive the guidance needed to maximize all the benefits available at their fingertips. Financial coaching starts with the employee first and provides a safe, confidential forum to get immediate help with pressing challenges and ongoing support to work toward important goals. It is the glue that keeps employees invested in their employers.

And, it is what employees want. According to industry research, nearly 6 in 7 employees believe that financial well-being benefits impact their job satisfaction and desire to stay with their employer. Another study emphasized the impact of employees understanding their employer’s benefits, noting that employees who do are 94 percent more likely to feel valued and appreciated. Some of the nation’s most successful and innovative employers are figuring this out and seeing the tangible results of making financial coaching the center point of their entire benefits offering.

More than ever, today’s employees know what they want—and they have demonstrated a willingness to quit their jobs to find an employer that exceeds their expectations and truly “walks the walk.” For companies, that means financial coaching programs are no longer a nice-to-have, but a business imperative as job openings and resignations remain the centerpiece of the U.S. labor market narrative.

Liz Davidson is the CEO and Founder of Financial Finesse, the largest independent provider of unbiased workplace financial wellness programs.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com November 2022 33 Submit Your Articles

The Solution To What’s Ailing Employers And Employees Isn’t As Complicated As We Think

HRCI® & SHRM® CERTIFICATION PREP COURSES

GROUP RATES AVAILABLE

For HR Professionals

Show that management values the importance of the HR function, and has a commitment to development and improvement of HR staff.

Ensure that each person in your HR department has a standard and consistent understanding of policies, procedures, and regulations.

Place your HR team in a certification program as a rewarding team building achievement.

For Your Organization

Certified HR professionals help companies avoid risk by understanding compliance, laws, and regulations to properly manage your workforce.

HR Professionals lead employee engagement and development programs saving the company money through lower turnover and greater productivity and engagement.

A skilled HR professional can track important KPIs for the organization to make a major impact on strategic decisions and objectives, including: succession planning, staffing, and forecasting.

HR.com/prepcourse CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com

1 Less expensive than a masters or PhD program, and very

with 2. legislation and best practices 3. Recognized, Industry benchmark,

HR Professionals We offer

rates

For

All

CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com | HR.com/prepcourse Group Rate Options 1 2 3

manageable to prepare

held by 500,000+

group

for teams of 5+ or more for our regularly scheduled PHR/SPHR/ SHRM or aPHR courses.

groups of 12+, we can design a more customized experience that meets your overall length of the course. Groups rates for HRCI exams are also available as an add-on.

group purchases come with 1 year of HR Prime membership for each attendee to gain the tools and updates needed to stay informed and compliant

To Support Their Teams, leaders Must First Take Care Of Themselves

By Magdalena Nowicka Mook, International Coaching Federation

When the subject of well-being is being brought up, we tend to think about our people, especially during stressful and uncertain times. Are we, as leaders, doing enough to support them? Are they burning out? Is the environment of the company allowing them to thrive or driving them to “quiet quitting” or outright quitting?

As a CEO of a complex global organization with staff spread across all continents, these are the questions that keep me up at night. I’m confident I am not alone in this. Amid heightened demands and shifting expectations in the workplace, many executives and managers are working long hours to protect their teams’ work-life balance and foster their professional growth, all while striving to advance important overarching initiatives, such as ESG, and continuing to deliver bottom-line results. We have to carry the load, and always feel the need to do more—not only for our organizations but mainly for our teams.

It can be easy for leaders to feel that the weight of the entire organization, or the success of their team, is squarely on their shoulders. And while leaders, often, are more resilient, everyone has their limit. Leaders are also susceptible to burnout, and when it strikes,

it impacts not only one individual but also the teams that managers and executives are working so hard to support.

Here is the fundamental truth: To support their teams, leaders must first take care of themselves.

A leader’s Role

At the International Coaching Federation (ICF), we follow the practices our member coaches utilize. We begin with powerful questions. Typically, when I catch myself feeling overtaxed, the first question I ask is, “Am I focused on the right responsibilities? Am I doing what I am best suited to do? Do I utilize the team in the best way?”

It is common for leaders to look out for their teams by taking on too many tasks themselves. Most professionals, however, want to be trusted, empowered, and supported in doing the job themselves.

When a leader is fully present, energized, and able to show up as their best self, their teams are similarly better equipped for success. More than ever, this requires leaders to delegate, trust and support.

Employee Benefits & Wellness Excellence presented by HR.com November 2022 36 Submit Your Articles

when leaders practice self-care, their teams are motivated to succeed

Self-care for leaders