20 13 28 33 Another Attack On NonCompetes: The NLRB Joins The Fray - Dawn Mertineit, Jesse M. Coleman & Katherine Perrelli, Seyfarth Shaw LLP Avoiding The Pitfalls Of Artificial Intelligence In HR And The Workplace - Chandler Aragona and Emily Mack, Burr & Forman Return To Office: Legal Challenges And Opportunities - Laura Balson, Constangy, Brooks, Smith & Prophete, LLP Minnesota Employment Law: Legislative Reforms And Their Implications - Daniel G. Prokott, Charles F. Knapp, Nicole A. Truso, Rhiannon C. Beckendorf and Zoey A.Y. Twyford, Faegre Drinker JULY 2023 • Vol.10 • No.07 (ISSN 2564-2022) 3 TIPS FOR MANAGING COMPLEX TAX AND COMPLIANCE ISSUES FOR A GLOBAL WORKFORCE - Katherine Loranger, Chief People Officer, Safeguard Global

- Michael Schulman, Partner and Sadé Tidwell, Associate, Morrison Foerster

31

New York set to become the fifth state to ban non-compete covenants

- Lawrence J. Del Rossi, Partner, Gerald T. Hathaway, Partner, Matthew A. Fontana, Partner, and Daniel Dorson, Associate, Faegre Drinker

37 E-Verify: Immigration Law Compliance For Employers With Florida Workforces

A quick take on SB 1718, Florida’s new immigration law

- Anna Scully, Partner and Doug Gartenlaub, Partner, Burr & Forman

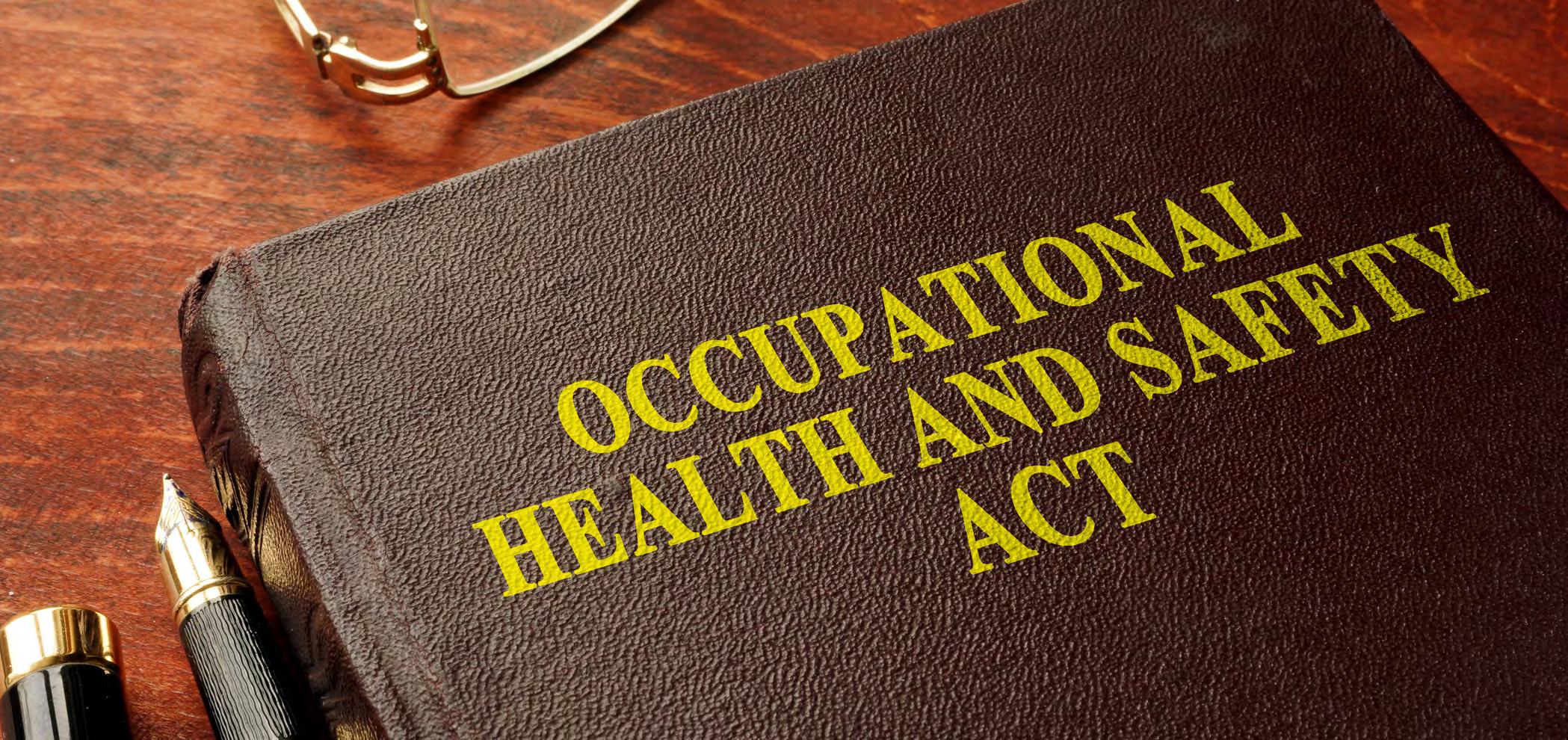

41 Naloxone Kits: Addressing The Opioid Crisis In Ontario Workplaces

With naloxone kits becoming mandatory, how can employers comply with the new requirements?

- Michelle Ann Zoleta, Health & Safety Advice Manager, Peninsula Canada

On the Cover INDEX HR Legal & Compliance Excellence JULY 2023 Vol.10 No.07 (ISSN 2564-2022)

Tips For Managing Complex Tax And Compliance Issues For A Global Workforce Balancing global standards with local regulations

Safeguard

07 Articles 10 Helping a High-Growth Marketing Firm Scale through Global Talent 16 Navigating Reasonable Accommodation And Confidentiality For Employees With ADHD: Best Practices And Legal Considerations Exclusive Interview with Peter John Veysey, Of Counsel, Nelson Mullins Sponsored Content PERFORM[cb] Case Study Straight Talk with HR.com

For

the latest developments

3

- Katherine Loranger, Chief People Officer,

Global

23 Artificial Intelligence: EEOC’S Guidance

Employers Key takeaways on

A Closer Look At New York’s Non-Compete Ban

Another Attack On Non-Competes: The NLRB Joins The Fray

- Dawn Mertineit, Partner, Jesse M. Coleman, Partner, & Katherine Perrelli, Partner, Seyfarth Shaw LLP

Avoiding The Pitfalls Of Artificial Intelligence In HR And The Workplace

- Chandler Aragona, Associate and Emily Mack, Partner, Burr & Forman

Return To Office: Legal Challenges And Opportunities

- Laura Balson, Employment Lawyer, Litigator, and Managing Partner, Constangy, Brooks, Smith & Prophete, LLP

TOP PICKS 13 20 28 33

Minnesota Employment Law: Legislative Reforms And Their Implications

- Daniel G. Prokott, Partner, Charles F. Knapp, Partner, Nicole A. Truso, Partner, Rhiannon C. Beckendorf, Counsel and Zoey A.Y. Twyford, Associate, Faegre Drinker

INDEX

How are our Legal & Compliance Products and Services helping to make you smarter?

Legal & Compliance Excellence - Monthly Interactive Learning Journal

This monthly interactive learning experience showcases solutions to deal with the latest legal and compliance issues facing corporations and legal departments.

Legal and Compliance Webcasts for Credit

HR.com offers various informative webcasts on a variety of topics including the latest HR compliance updates and legal considerations for employers and all HR professionals. Webcasts are available live online with a downloadable podcast and a copy of the slides (PDF) available before and after each webcast. Earn all of the required recertification credits for aPHR, PHR, SPHR, GPHR, and SHRM Certifications. HR.com’s one-hour webcasts, in every HR specialty including Legal and Compliance, are pre-approved for HRCI and SHRM credit (excluding Demo webcasts).

Legal and Compliance Community

Join almost more than 30,000 HR.com members with a similar interest and focus on compliance on legal regulations in HR. Share content and download research reports, blogs, and articles, network, and “follow” peers and have them “follow” you in a social network platform to communicate regularly and stay on top of the latest updates. This well established Legal and Compliance Community is an invaluable resource for any HR professional or manager.

SEP 2017 Vol. No. 09 Use these invaluable Legal & Compliance resources today! For more information phone: 1.877.472.6648 | email: sales@hr.com | www.hr.com

Editorial Purpose

Our mission is to promote personal and professional development based on constructive values, sound ethics, and timeless principles.

Excellence Publications

Debbie McGrath CEO, HR.com - Publisher

Dawn Jeffers VP, Sales

Sue Kelley Director (Product, Marketing, and Research)

Babitha Balakrishnan and Deepa Damodaran Excellence Publications Managers and Editors

HR Legal & Compliance Excellence Team

Deepa Damodaran Editor

Koushik Bharadhwaj Junior Editor Arun Kumar R Design and Layout (Digital Magazine)

Chandra Shekar A K Magazine (Online Version)

Submissions & Correspondence

Please send any correspondence, articles, letters to the editor, and requests to reprint, republish, or excerpt articles to ePubEditors@hr.com

For customer service, or information on products and services, call 1-877-472-6648

HR Legal & Compliance Excellence (ISSN 2564-2022)

is published monthly by HR.com Limited, 56 Malone Road, Jacksons Point, Ontario L0E 1L0 Internet Address: www.hr.com

Debbie Mcgrath Publisher, HR.com

TheU.S. workplace landscape is experiencing significant transformations.

Companies are venturing offshore to tap into new talent pools. The ban on non-compete covenants is gaining momentum with New York and the NLRB joining the movement. Moreover, workplaces are encountering an increasing number of accommodation requests from employees dealing with ADHD and opioid recovery.

As new technologies like AI and chatGPT find their way into the human resources (HR) space, several legal and compliance challenges await HR.

It is crucial for HR leaders considering offshore talent to plan meticulously and grasp the tax and compliance implications involved, as emphasized by Katherine Loranger from Safeguard Global in her article, 3 Tips For Managing Complex Tax And Compliance Issues For A Global Workforce. Katherine shares a few tips for managing complex tax and compliance issues for a global workforce.

The recent memo by NLRB General Counsel Jennifer Abruzzo, stating that non-competes violate the National Labor Relations Act, raises questions about potential cases and their success based on past decisions. Delving deeper into this development, Dawn Mertineit, Jesse M. Coleman, and Katherine Perrelli from Seyfarth Shaw LLP, in their article Another Attack On Non-Competes: The NLRB Joins The Fray, explore the impact on employers and provide measures to ensure compliance.

Advancements in AI technology carry both promise and potential challenges for HR and

Deepa Damodaran Editor, HR Legal & Compliance Excellence

employers at large. Chandler Aragona and Emily Mack from Burr & Forman shed light on the pitfalls to avoid in their article, Avoiding The Pitfalls Of Artificial Intelligence In HR And The Workplace

In line with California, Oklahoma, North Dakota, and Minnesota, New York is poised to become the fifth state to enforce a complete ban on non-compete agreements. Lawrence J. Del Rossi, Gerald T. Hathaway, Matthew A. Fontana, and Daniel Dorson from Faegre Drinker provide a closer look at New York's non-compete ban, outlining its implications and significance in their comprehensive article, A Closer Look At New York’s Non-Compete Ban

This edition also features an exclusive interview with Peter John Veysey, Of Counsel at Nelson Mullins, who shares valuable insights into the complexities of navigating reasonable accommodation and confidentiality for employees with ADHD. His emphasis on best practices, legal compliance, promotion of diversity, equity, and inclusion, as well as mental health support, will help HR foster a supportive workplace.

As the U.S. workplace continues to evolve, it is essential to embrace these changes and adapt accordingly. Check out the July edition of HR Legal & Compliance Excellence as we explore different perspectives to help you navigate the dynamic landscape.

Happy Reading!

Write to the Editor at ePubEditors@hr.com

Disclaimer: The views, information, or opinions expressed in the Excellence ePublications are solely those of the authors and do not necessarily represent those of HR.com and its

Under

HR.com

damages arising out of

and

EDITOR’S NOTE Staying Compliant while Embracing Change Subscribe now for $99 / year And get this magazine delivered to your inbox every month Become a Member Today to get it FREE! SIGN UP OR

Advertising Opportunities, email: sales@hr.com

©

part of

publication may be reproduced or transmitted in any form without written

from the

Quotations must be credited.

employees.

no circumstances shall

or its partners or affiliates be responsible or liable for any indirect or incidental

these opinions

content.

For

Copyright

2023 HR.com. No

this

permission

publisher.

In a world of unparalleled challenges (global pandemic, racial injustice, political rivalry, digital 4.0, emotional malaise), uncertainty reigns. Finding opportunity in this context requires harnessing uncertainty and harnessing starts with reliable, valid, timely, and useful information. The Excellence publications are a superb source of such information. The authors provide insights with impact that will guide thought and action.

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

Excellence publications are my ‘go-to’ resource for contemporary and actionable information to improve leadership, engagement, results, and retention. Each edition offers rich and diverse perspectives for improving the employee experience and the workplace in general.

Julie Winkle Giulioni Author, Virtual /Live Keynote Presenter, Inc.’s Top 100 Leadership Speakers

Julie Winkle Giulioni Author, Virtual /Live Keynote Presenter, Inc.’s Top 100 Leadership Speakers

I regularly read and contribute to Leadership Excellence and Talent Management Excellence. I use many of the articles I read to augment my own presentations and I often share the articles with my clients. They are always quick, right on target for the latest issues in my field, and appreciated by my clients. If you want to stay up to date on the latest HR trends, choose a few of the different issues from the Excellence series of publications.

We’re eager to hear your feedback on our magazines. Let us know your thoughts at ePubEditors@hr.com

WHY EXCELLENCE PUBLICATIONS?

Dave Ulrich

Dr. Beverly Kaye CEO, BevKaye&Co.

3 Tips For Managing Complex Tax And Compliance Issues For A Global Workforce

Balancing global standards with local regulations

By Katherine Loranger, Safeguard Global

Employees in the post-pandemic world have consistently expressed a preference for more flexibility in where and how they work. Companies that embrace remote and hybrid work can attract and retain great employees, and teams that receive the right support from human resources (HR) can be more productive working remotely.

North America-based employers that allow employees to work remotely can also dramatically expand the pool of available candidates, which helps them address persistent skills gaps that result from a tight domestic labor market. At the same time, they can reduce labor costs by up to 40%, which is why the number

of remote workers in Central America and the Caribbean rose 300% between 2020 and 2023.

While the prospect of achieving higher employee satisfaction, better productivity and a larger labor pool are all excellent reasons to consider hiring staff outside the U.S., it is critical for HR leaders who are thinking of hiring offshore talent to plan carefully and fully understand the tax and compliance implications. Here are three tips to help you prepare to welcome a global workforce:

1. Be familiar with all applicable local accounting laws: Business accounting and reporting practices vary by tax jurisdiction, and the correct approach is often a moving target since laws can

change over time. That is why it is essential to familiarize yourself with local accounting laws and follow them to the letter. For example, in some jurisdictions, governments require offshore employers to maintain accounts in local language and English. Setting accounting systems up to comply with local rules from the first day can help you avoid being out of compliance down the road.

Conducting a transfer pricing study before you hire abroad is also a good idea. A transfer pricing study is a detailed economic overview of your company, service, products, and related intangibles, and it functions as a planning tool you can use to create your offshore business structure.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 7 Submit Your Articles

COVER ARTICLE

A transfer pricing study provides useful information on the tax implications of an overseas operation by region, helps facilitate tax efficiency, and can protect your business in case of a tax audit.

2. Create global workplace policies and customize them for each region: One mistake employers make is implementing workforce policies from their home country in offshore regions when expanding globally. That does not work well because, like business accounting practices, employment legislation varies considerably across regions. A better approach is to develop a

new global policy that meets the baseline requirements for policies like paid time off for illness, parental leave, etc., in all regions and then create custom variations for each region to comply with local rules.

In addition to factoring in baseline requirements for local regulations, you will also need to evaluate the competitiveness of your policies in each market so you can attract and retain employees. This assessment will directly impact the formulation of a standard global policy since you will want to ensure your company can

compete effectively everywhere you operate.

3. Tap the expertise you need to expand globally: Creating a structure for a global workforce requires setting up banking, payroll, tax withholding and reporting systems, which takes time and money. Many HR leaders determine that working with experts who have the experience and know-how to create compliant policies and accounting practices is a better option since it allows the HR team to focus on core competencies while reducing risk overall.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 8 Submit Your Articles

3 Tips For Managing Complex Tax And Compliance Issues For A Global Workforce

Keep in mind that companies that run into conflict with local regulations can incur penalties and harm the brand’s reputation, so tapping outside expertise may be the best solution. Working with a global employer of record (EOR) is one option that can reduce risk. An experienced global EOR can establish an overseas entity so you can bring employees on board quickly, with the EOR handling labor, payroll, tax, banking and work contract requirements.

Whether you decide to work with an expert or go it alone, keep in mind that planning is the key to successfully setting up a global workforce. You will need to establish a legal business entity in the countries where employees are based and put systems in place to handle business accounting and reporting according to the rules in each jurisdiction.

You will also need a policy framework for your global workforce that ensures you are competitive in the marketplace and compliant with all local regulations. That can be a daunting task, but if you are familiar with each country’s accounting rules, create customizable policies and get the expertise you need in-house or by working with an experienced partner, you can access the talent you need — anywhere in the world.

Would you like to comment?

HR Legal & Compliance Excellence presented by HR.com JULY 2023 9 Submit Your Articles

Katherine Loranger is the Chief People Officer at Safeguard Global. She strives to align the human resources strategy with the strategic goals of the organization and promote a culture of innovative, accountable, ethical, and high-performing team members.

3 Tips For Managing Complex Tax And Compliance Issues For A Global Workforce

Helping a High-Growth Marketing Firm Scale through Global Talent

Perform[cb] is committed to providing modern marketers and affiliate partners with performance-based solutions that maximize their return on marketing dollar investment.

Voted the number one cost-per-action (CPA) network in the world for the past five years, Perform[cb] has offices in Sarasota, Florida, Denver, and Colorado, as well as in Banja Luka, Bosnia.

Challenge

The company’s success story attracted talent from countries like Canada and Israel, and it needed to retain this talent without setting up a legal entity in those countries. Perform[cb] wanted a straightforward solution that reduced its administrative HR burden and ensured compliance while increasing its access to, and management of, skilled individuals in target markets.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 10 Submit Your Articles

Sponsored Content

Case Study

Solution

Atlas’ Direct Employer of Record model allowed us to step in to assist with complex and changing employee circumstances that were previously outside Perform[cb]’s remit. In 2020, the pandemic meant that the company required support with restructuring the workforce and Atlas ensured that the process was handled compliantly and with care.

The relationship with Atlas took less than a month to implement across Perform[cb]. Initially, information and contracts moved back and forth as systems were set up – a complex process now met with standardized and clearly defined contracts. Today, Perform[cb] has the ability to onboard global talent in record time thanks to Atlas’ many local entities, cutting down additional time and money from working with third-party vendors.

Our end-to-end AI-enabled technology platform has transformed Perform[cb]’s manual invoicing process. The team now manages invoices and commission from a central dashboard and gains immediate

visibility into vacation time and payroll. When Perform[cb] moved from one private equity firm to another, the team had access to all the necessary data on demand. Atlas is a trusted partner, providing the service and compliant support the company needs to ensure its employees are connected and cared for.

Impact Smooth and Swift Onboarding

Perform[cb] can now quickly onboard employees across multiple countries while providing benefitsdriven packages that include healthcare and unlimited leave.

Payroll and Data Management

Perform[cb] uses the data provided by our cloudbased technology platform to manage payroll, time off and employees more efficiently in minutes. The platform has become an essential tool that has simplified the process and cut down on time spent on people operations admin.

Streamlined Offboarding

Atlas smooths over bumps in the offboarding road, helping to manage terminations in alignment with different country requirements. Perform[cb] can now pay former employees correctly and manage the process thoughtfully.

Global Expansion

Atlas provides Perform[cb] with the tools and support it needs to tap into a global talent pool without limitations or unexpected complexities. Perform[cb] trusts that Atlas will help them move into new countries and take care of the paperwork, people and regulatory problems that may arise.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 12 Submit Your Articles

Helping a High-Growth Marketing Firm Scale through Global Talent

like to comment?

Would you

Another Attack On Non-Competes: The NLRB Joins The Fray

Are other restrictive covenants at risk?

By Dawn Mertineit, Jesse M. Coleman & Katherine Perrelli, Seyfarth Shaw LLP

The Federal Trade Commission (FTC) is not alone in taking aim at non-competes. Recently, the National Labor Relations Board’s (NLRB) General Counsel

Jennifer Abruzzo issued a memo to all regional directors, officers-in-charge, and resident officers at the NLRB stating that non-competes in employment agreements and severance agreements violate the National Labor Relations Act except in rare circumstances.

Specifically, Ms. Abruzzo claims that such covenants interfere with workers’ rights under Section 7 of the act, which protects employees’ right to self-organize, join labor organizations, bargain collectively, and “engage in other concerted activities for the purpose of collective bargaining or other mutual aid or protection.” Thus, Ms. Abruzzo concluded that non-competes typically violate Section 8(a)(1) of the act, which

makes it an unfair labor practice for an employer to interfere with an employee’s Section 7 rights.

The Memo’s (Dubious) Reasoning

Ms. Abruzzo’s rationale for her determination is similar to the FTC’s: the memo claims (with scant support, we would add) that non-competes “are overbroad,” and can be construed by employees as “deny{ing} them the ability to quit or change jobs by cutting off their access to other employment opportunities that they are qualified for based on their experience, aptitudes, and preferences as to type and location of work.”

While some non-competes used by employers may be overbroad, Ms. Abruzzo treats it as a foregone conclusion that all non-competes are overbroad — notably without citing any support for this statement. And this determination ignores

state law, which typically requires that a non-compete be no broader than necessary to protect an employer’s legitimate business interests.

Ms. Abruzzo also infers — again, without support — that non-competes chill protected activity because employees who perceive that they cannot seek new employment may be discouraged from threatening to resign en masse (although the memo concedes that there is not a recognized Section 7 right to “concertedly resign from employment”), concertedly seeking to join a competitor, and more. While primarily focused on non-competes, the memo potentially spells trouble for other restrictive covenants as well, including non-solicits; Ms. Abruzzo claims that agreements prohibiting employees from soliciting their former colleagues could run afoul of Section 7 rights as well.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 13 Submit Your Articles

TOP PICK

And while the memo does not explicitly mention non-disclosure agreements, query whether the NLRB would scrutinize such agreements as potentially chilling employees’ desires to seek new employment, too (similar to the FTC’s proposed “de facto” test to determine whether an agreement includes a supposedly unlawful non-compete).

Ms. Abruzzo acknowledges that non-competes may be permissible if they are “narrowly tailored to special circumstances justifying the infringement on employee rights,” which does not include a covenant whose only purpose is the employer’s “desire to avoid competition.” But again, this ignores that courts have agreed for centuries that competition is permitted — unfair competition is not.

While Ms. Abruzzo points to low-wage and “middle-wage” employees with no access to trade secrets being bound by overbroad non-competes, she conspicuously avoids discussing the dozen states that have enacted wage thresholds for non-competes (see here, here, and here) and even non-solicits in some states, and the four state legislatures that have banned non-competes entirely (including most recently Minnesota).

As for the circumstances in which Ms. Abruzzo believes non-competes may be permissible? Like the FTC’s proposal, they are extremely limited. She only mentions

restrictions on an individual’s “managerial or ownership interests” in a competing business and “true independent-contractor relationships” (although she does concede that there may be other circumstances in which a narrowly tailored covenant is “justified by special circumstances,” but notably declines to give examples of such circumstances).

In the memo’s final paragraph, Ms. Abruzzo encourages NLRB employees to “seek make-whole relief” for employees who believe they have lost employment opportunities based on their employer’s non-compete, “even absent additional conduct by the employer to enforce the provision” (emphasis added).

Don’t Panic, but Be Prepared

While the foregoing sounds alarming, a few words of caution before abandoning the use of non-competes. Ms. Abruzzo’s interpretation of the act is not

binding or precedential. Instead, cases seeking “make-whole relief” as urged by the memo, will first be brought by Regional Directors, who issue complaints of unfair labor practices, and are then decided by Administrative Law Judges (ALJ).

An ALJ’s decision comes with a recommended order which can then be appealed to the full NLRB in Washington, D.C. If no exceptions are filed to the ALJ’s decision, the judge’s order becomes the order of the NLRB. But an ALJ’s decision is not binding legal precedent in other cases unless it has been adopted by the NLRB on review of exceptions. Moreover, if adopted by the NLRB, the matter can then be appealed to the D.C. Court of Appeals or the Court of Appeals where the employer does business. In other words, it may be an uphill battle for the NLRB to successfully challenge and invalidate an employer’s use of non-competes.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 14 Submit Your Articles

Another Attack On Non-Competes: The NLRB Joins The Fray

And that is before you consider that — like the FTC — this is a new tactic without historical support. In the nearly 90 years since the NLRB was created and the act became law, this is the first time that the agency has declared that non-competes violate the act. In fact, prior NLRB cases have held that the conduct of employees acting in concert to become competitors or to undermine their employer’s relationship with other employees is not protected by the Act,{1} and employers who terminate employees for engaging in such conduct do not violate the Act.{2}

In fact, the NLRB’s Division of Advice held in 2012 that a confidentiality and non-solicitation agreement (the latter of which, as noted above, is tackled in Ms. Abruzzo’s memo) did not violate the act, and in making this determination, noted that the agreement did not explicitly restrict an employee’s Section 7 rights, was not adopted in

response to Section 7 activity and employees would not reasonably construe the agreement to interfere with Section 7 rights.{3} While conceivably there may be some non-competes implemented in order to interfere with Section 7 rights, the vast majority are not, and we suspect the NLRB will face challenges demonstrating such an alleged motive.

Where to Go from Here?

It remains to be seen if the NLRB will, in fact, bring cases to invalidate non-competes and, if so, whether it will see any success given past decisions. That said, as always, employers should take measures to ensure that their agreements are narrowly tailored, compliant with relevant law, and only applied to employees that pose a legitimate competitive threat. In that vein, employers should consider the risk in even asking non-exempt, low-wage, or mid-wage employees to execute agreements containing non-competes.

Even if employers have no intention of enforcing non-competes against such employees, various state laws already prohibit merely entering into or maintaining non-competes with such employees, and some allow employees to recoup their attorneys’ fees from employers in declaratory judgment suits seeking to invalidate such covenants. Various enforcement agencies appear poised to target the use of such agreements as well, even without employers’ attempts to enforce them through litigation.

Footnotes:

{1} See, e.g., National Express Corp., d/b/a ATC/Forsythe & Assocs., Inc., 341 NLRB 501 (2004); Clinton Corn Processing Co., 194 NLRB 184 (1971).

{2} See, e.g., Kenai Helicopters, 235 NLRB 931 (1978); Associated Advertising Specialists, Inc., 232 NLRB 50 (1977).

{3} Charles Schwab Corp., 28-CA-084931 (Sept. 14, 2012) (Adv. Mem.).

HR Legal & Compliance Excellence presented by HR.com JULY 2023 15 Submit Your Articles

Dawn Mertineit is a Partner in Trade Secrets, Computer Fraud, and Non-Competes at Seyfarth Shaw LLP

Jesse M. Coleman is a Partner in Commercial Litigation at Seyfarth Shaw LLP

Katherine Perrelli is a Partner in Trade Secrets, Computer Fraud, and Non-Competes at Seyfarth Shaw LLP

Would you like to comment?

Another Attack On Non-Competes: The NLRB Joins The Fray

“One tricky scenario occurs when an employee could, for example, ask for protected leave until they can refill their prescription for ADHD medication like Adderall. The employer should avoid any situation where they check in with employees regularly or randomly to see if the employee filled a prescription. That creates too many legal risks,” said Peter

John Veysey, Of Counsel, Nelson Mullins

In Part I of the interview, we explored how companies can empower neurodiverse employees to reach their full potential, and in Part II, we learned how they can navigate reasonable accommodation and confidentiality for employees with ADHD.

In the third part of the interview, Peter John delves further into the complexities of navigating reasonable accommodation and confidentiality for employees with ADHD, emphasizing best practices, legal compliance, and the promotion of DEI and mental health support in the workplace.

Navigating Reasonable Accommodation And Confidentiality For Employees With ADHD: Best Practices And Legal Considerations

Excerpts from the interview:

Q.Can you provide examples of best practices and items for consideration that employers should be aware of when handling employee issues related to ADHD in light of the medication shortage and broader equity and inclusion goals?

Peter John: Employers should remember that attention deficit/hyperactivity disorder (ADHD) is different for every individual. Establishing some rigid criteria, checklists, or systems may fall short in trying to anticipate, address and accommodate these issues. Indeed, this is exactly why we see overlap with equity and inclusion issues.

How an employee manages something like ADHD may depend heavily on their background, age, gender identity, or socioeconomic status. ADHD is a glaring example of where certain disability conditions dovetail into major issues that organizations are working hard to address in their diversity, equity, and inclusion (DEI) initiatives.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 16 Submit Your Articles

Straight Talk with HR.com

Q&A with Peter John Veysey, Of Counsel, Nelson Mullins

Past traumas, certain disadvantages, or other environmental considerations should factor heavily into how employers manage matters like reasonable accommodations for ADHD and related conditions. It is hard to overstate the importance of creating a workplace culture where employees requiring accommodations feel comfortable enough to ask for them and know where to ask for them.

This will create a format that enables an employer to fully consider the issues just described, including how and if they can apply certain DEI considerations in addressing these issues.

Conversely, and more generally, employers should train managers to know how and where to identify signals that may trigger the employer’s reasonable accommodation obligation and how to handle those requests. The medication shortage is a good opportunity to conduct a refresher on these issues within an organization, and large organizations may even consider formatting some specific process or support resources around mental health-related issues.

It is a good opportunity to bake an organization’s DEI efforts into important functions like human resources (HR) guidelines. For example, “Please remember, if a direct report is having trouble explaining why they need extra help, consider their overall situation, what else may be going on in their life, before you make a mistake like categorically shutting down their request.”

Employers should also consider in advance what accommodations may be possible for workers with ADHD, particularly where they cannot access medication. These may include flexible hours, reassignment, remote working possibilities, or some kind of protected leave. This could help prepare employers to avoid, where possible, a protracted interactive dialogue or certification process that will invariably increase the risk of a costly legal error.

One tricky scenario occurs when an employee could, for example, ask for protected leave until they can refill their prescription for ADHD medication like Adderall. The employer should avoid any situation where they check in with employees regularly or randomly to see if the employee filled a prescription. That creates too many legal risks.

If the employer’s HR team is handling that process, they should also ensure that other employees like, for example, an immediate supervisor – regardless of whether they know why the employee took leave, are also not checking in to see when the employee will return.

A better solution may be, and a caution that this is more of a hypothetical rather than a best practice, some format where the employee requests leave for a certain amount of time. If the employee needs additional time because they cannot find a refill, they should notify the employer accordingly. There is nothing wrong with an employer enforcing a general policy that reserves the right to discipline employees for dishonesty or abusing this process, whether for sick time, leave, or other accommodations.

Similarly, employers are entitled to certify an employee’s need for an extension of their accommodation. For example, where reasonable and legal, an employer can ask employees to verify why they need an additional week of paid sick time while they wait for medication. Employers can also enforce discipline when an employee fails to check in or return after the allotted time. As always, employers should check that any related policies here are clear and in writing.

Specific to this issue, remember that many medications to treat mental health or behavioral issues may require some kind of re-acclimation or lifestyle adjustment. Restarting heavier-duty medications like Adderall may require a gradual reintroduction. Employers should also consider possible anxieties or apprehensions that may be secondary to certain mental health diagnoses that a return to the work environment, or returning to work without an accommodation, may trigger. Employers should take care to be flexible and understanding, to the extent reasonable, in this situation.

Employers should maintain and enforce a clear and unmistakable zero-tolerance policy for harassment, discrimination, or bullying that expressly includes mental health, behavioral or neurodivergence issues, including ADHD, and tailor any training materials to reflect the same.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 17 Submit Your Articles

Straight Talk with HR.com

Q.Howcan employers ensure that all employee populations, regardless of background, demographics, or position, have access to mental health resources related to conditions like ADHD?

Peter John: Mental health resources for people with ADHD, like any behavioral or mental health condition, can be very different and will vary per individual. Still, there are a few points we can apply across the board.

First, employers should be amenable to granting time for employees to seek treatment for ADHD. For some, this may look like weekly therapy, psychiatric appointments, mindfulness or behavioral training, or even experimental therapies. As discussed, whether employees previously had resources or support networks to understand if they had ADHD in the first place may vary widely based on their demographic or socioeconomic background. Also, consider how language and immigration status may affect this.

The medication shortage is one factor in increasing regulatory scrutiny on media like telehealth, particularly during the pandemic, where concerns arose that providers were over-diagnosing or prescribing patients without the usual testing rigors attendant to diagnosing ADHD.

If this continues, employers should develop some understanding of what time and resources an employee may need to determine if they have adult ADHD in the first place – which, for obvious reasons, is a lengthier process than something like an X-ray or blood test. If employers are committed to equity and inclusion, they should consider how to address a scenario where an employee says something like:

(1) “I have been struggling at work lately, and I would like time off to get tested for ADHD, which was not really a thing where I grew up – what are my options?” or

(2) “My English is limited and I am not really sure how to navigate the mediation process, but I think it is definitely something I need.” There are obvious legal and equity issues here, and it does not hurt to plan for them in advance.

Also, employers should review their healthcare plans to assess the costs and availability of ADHD

treatments. For example, if you have an employee with a $400 monthly prescription, can they work with HR to get on a Health Savings Account to better afford it? Could you offer reimbursement through some kind of healthcare credit?

Employers will be better positioned to meet their legal obligations and advance their equity and inclusion goals on this issue if they commit to understanding the financial, mental, physical, and emotional realities of ADHD. This will better ensure that every employee with ADHD, regardless of their background, can have fair access and support from their employer.

to

in the workplace, and how can management effectively communicate with these teams to ensure compliance with relevant laws and best practices?

Peter John: Policies are key, and a clear and easily understood process to manage these issues, in writing, is the first and best step.

As we keep repeating, training is also critical. Managers and supervisors are often the first people to hear accommodation requests – given this, they can set the tone for all subsequent interactions relating to a request. HR and legal teams should ensure that supervisors and managers are well-trained on their confidentiality obligations, what they can and cannot ask an employee, and the proper reporting infrastructure to handle these requests. Additionally, employers should coordinate with hiring teams to ensure these protocols are also covered during the application process.

Finally, stay up-to-date on legal and medical developments, and incorporate that into the organization’s policies, training materials and workplace culture. Employers should not only understand the rules as they develop in applicable jurisdictions, but also remain informed on other matters like how conditions like ADHD manifest themselves to better refine workplace policies like those designed to prevent bullying and harassment.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 18 Submit Your Articles

Q.What role can HR and legal teams play in properly handling issues related

ADHD

Straight Talk with HR.com

This is an evolving space in employment and disability law, and it is not exactly obscure – diagnoses for conditions like depression, anxiety, and ADHD account for around 10% of the U.S. population, which may be a low number. Employers have every incentive to consider this a key topic when assessing their workplace culture, equity, and inclusion goals and obligations.

Q.Canyou discuss any unique challenges or considerations that employers should keep in mind when handling employee issues related to the medication shortage itself, in light of the overlay of other related conditions and laws?

Peter John: Aside from how employers should manage accommodations and understanding that an employee’s inability to access something like Adderall may be a legitimate reason to grant them

an accommodation, a few other specific issues arise. Medication shortages increase the risk that patients will self-medicate with other substances, and a lot of data indicates an increased prevalence of substance abuse or dependency for people with ADHD, anxiety, or depression.

Laws like the Americans with Disabilities Act (ADA) and the Family and Medical Leave Act (FMLA) provide similar protections for certain substance abuse or addiction-related conditions, so there is definitely an overlap. Employers must walk a narrow line here. If an employee had or reveals a past issue with addiction, an employer cannot discriminate against them. If an employee signals the need for treatment or rehabilitation, in many cases, that is also protected in some jurisdictions more than others.

That said, employers have other obligations among those to protect their business and other employees. There are fewer or no protections where an employee is obtaining unauthorized prescription medication, working while impaired, or the employer otherwise discovers some evidence of illegal drug use outside of a protected request, like seeking treatment assistance, and employers should proceed accordingly.

Finally, many employers drug test. Prescription medications may appear on certain test results. Employers that drug test should ensure their policies clearly address prescription medication use, including how an employee can address what medications they are taking before or after they submit to testing. While this is an entirely different conversation, it is a good opportunity in this context to remind employers that they cannot discriminate against or harass a worker who they discover is lawfully using a controlled substance like Adderall to treat a condition like ADHD.

Would you like to comment?

HR Legal & Compliance Excellence presented by HR.com JULY 2023 19 Submit Your Articles

Straight Talk with HR.com

Avoiding The Pitfalls Of Artificial Intelligence In HR And The Workplace

AI comes with its own set of risks and pitfalls

By Chandler Aragona and Emily Mack, Burr & Forman

Artificial intelligence (AI) has revolutionized many aspects of various industries, and the human resources field is no exception. AI applications are being utilized in many areas of the workplace, including recruiting, training, onboarding, employee wellness and talent acquisition.

However, this new and emerging technology does not come without risks and pitfalls. As AI technology advances, it is important to be cognizant of the potential negative implications for human resources and employers in general.

The Hiring Process

AI algorithms can quickly screen and evaluate resumes, cover letters, and other job application materials to determine if applicants meet basic job requirements, saving time and allowing human resource professionals to focus on other tasks. But while AI can increase efficiency and objectivity in employment selection procedures, employers using AI in this regard must be mindful of possible disparate impacts on job applicant pools.

Employers are prohibited from discriminating against job applicants based on race, color, religion, sex, or national origin, pursuant to Title VII of the Civil

Rights Act of 1964 (Title VII). Thus, as the Equal Employment Opportunity Commission (EEOC) recently highlighted, the implementation of AI in employment selection procedures raises concerns about potential challenges to the principles of equal opportunity protected by Title VII. For example, if AI algorithms rely on biased data or are programmed with flawed instructions, they could perpetuate existing discriminatory practices or amplify inherent biases in larger quantities.

To mitigate the risks of inadvertent discrimination and to ensure compliance with Title VII, employers should be proactive when implementing AI in employment selection procedures. It is essential that AI algorithms use diverse and representative datasets in their review and selection procedures. Additionally, continuous monitoring and auditing of AI systems should be conducted to identify and remedy any unintended biases that may have emerged over time.

Human oversight is also crucial in interpreting the selections generated by AI algorithms and making final decisions in recruitment. With the right safeguards in place, combining the efficiency of AI with human judgment can strike a balance that respects the legal obligations of employers while simultaneously streamlining the hiring process.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 20 Submit Your Articles

TOP PICK

Automation of Jobs

Another significant and commonly discussed effect of AI on the workplace is the automation of job functions, which has the potential to replace certain jobs entirely. AI-powered systems can certainly streamline repetitive tasks, increase productivity and optimize efficiency. However, as automation expands, concerns arise regarding the displacement of jobs and unemployment. Some roles may even become obsolete, dictating a shift in the skills required for employment.

The increasing use of AI in the workplace may also result in reduced human interaction and personalization. While digital assistants are efficient in handling routine inquiries, they may not provide the same level of empathy, understanding and nuanced responses that humans would. This lack of personalization may impact employee satisfaction and engagement, resulting in retention issues. Decreased interaction can also weaken the quality of customer interactions, particularly in industries where personal communications and relationships are vital.

Consumers are likely already experiencing both the efficiency and frustrations caused by AI technology in their customer service interactions.

Data Privacy

The increased use of AI technology in the workplace also raises privacy concerns because of its heavy reliance on data collection and analysis. This data collection can create significant concerns about privacy and security in the workplace, as employees themselves may worry about the collection and storage of personal information, as well as the potential misuse or mishandling of their data.

Likewise, employers have reason to be concerned about employees disseminating confidential and proprietary business information into AI systems. It is critical for employers to implement robust data protection measures, ensure compliance with privacy regulations, and establish clear guidelines on data usage and retention to address these concerns. Employers should review and update their employee handbooks to ensure proper guidance regarding privacy and data policies.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 21 Submit Your Articles

Avoiding The Pitfalls Of Artificial Intelligence In HR And The Workplace

AI technology brings both opportunities and challenges to the workplace and human resources professionals. The balance and collaboration between human beings and AI technology nevertheless hold promise for a future of increased productivity

and innovation. By understanding and proactively addressing the impact of AI on employment issues, employers can reap the benefits while creating a foundation that prioritizes and protects the well-being and continued success of the human workforce.

Would you like to comment?

HR Legal & Compliance Excellence presented by HR.com JULY 2023 22 Submit Your Articles

Chandler Aragona is an Associate in Burr & Forman’s Charleston office, where she’s a member of the firm’s Labor and Employment practice group. Chandler defends companies and supervisors in discrimination, harassment, retaliation, wrongful discharge, tort, and contract lawsuits. She has experience in matters involving Title VII, the Americans with Disabilities Act, the Family Medical and Leave Act, the National Labor Relations Act, workers’ compensation matters and state Human Rights Acts.

Emily Mack is a Partner in Burr & Forman’s Nashville office, where she handles employment law and complex litigation matters for businesses. She defends claims for wrongful discharge, retaliation, discrimination, harassment, wage and hour, business torts, trade secrets and other complex matters arising from a variety of laws.

Avoiding The Pitfalls Of Artificial Intelligence In HR And The Workplace

Artificial Intelligence: EEOC’S Guidance For Employers

Key takeaways on the latest developments

By Michael Schulman and Sadé Tidwell, Morrison Foerster

Employers are increasingly using artificial intelligence (AI) to make employment decisions to save time and effort, increase objectivity and decrease bias, and optimize employee performance. The Equal Employment Opportunity Commission (EEOC) issued Technical Assistance Guidance (Guidance) regarding the use of software, algorithms, and artificial intelligence (AI) in employment selection in May. The Guidance is part of the EEOC’s ongoing efforts to ensure employers’ use of new technologies in employment decisions comply with federal anti-discrimination laws.

The Guidance evidences the EEOC’s standards for evaluating employers’ use of algorithmic decision-making tools and provides suggested best practices for employers, but it is not binding and does not have the force of law. The guidance is limited to assessing whether an employer's selection procedures have a disproportionately negative impact on categories protected by Title VII of the Civil Rights Act of 1964 (Title VII), like race and gender. It does not apply to other uses of AI or consider other federal or state laws.

According to the EEOC, “[i]n the employment context, using AI has typically meant that the developer relies partly on the computer’s own analysis of data to determine which criteria to

use when making decisions.” This analysis often utilizes machine learning, computer vision, natural language processing and understanding, intelligent decision support systems and autonomous systems. Examples of common AI tools highlighted by the guidance include resume-screening software, hiring software, chatbot software for hiring and workflow, video interviewing software, analytics software, employee monitoring software and worker management software.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 23 Submit Your Articles

The EEOC Warns Employers to Be Wary of Disparate Impact Discrimination Resulting from the Use of AI in Employment Selection

In the employee selection context, disparate impact discrimination can occur when a neutral employment test or selection tool has the effect of disproportionately excluding individuals based on race, color, religion, sex, or national origin, particularly if the tests or selection procedures are not job-related for the position and consistent with business necessity.

According to the guidance, employers can show that a neutral employment test or selection tool is job-related and consistent with business necessity by ensuring the selection procedure is associated with the skills needed for the specific position, as opposed to a general measurement of applicants’ or employees’ skills. Thus, employers may need to utilize different algorithmic decision-making tools for different positions based on the required skills and apply different assessment criteria for a particular role.

The guidance goes on to state that once an employer shows the selection procedure is job-related and consistent with business necessity, it must determine whether protected classes are adversely impacted and, if so, potentially consider a less discriminatory alternative. In many cases, the less discriminatory alternative might mean having a human perform the selection function instead of using the automated decision-making tool.

The Guidance Highlights the Need for Employers to Validate Results Generated by AI

The guidance emphasizes that employers (not AI vendors) are responsible for any disparate impacts caused by the use of AI tools in employment selection and suggests that employers need to continually audit the employment selection results generated by AI tools. The EEOC directs employers to the EEOC’s Uniform Guidelines on Employee Selection Procedures (UGESP) to evaluate whether the use of AI results in a selection rate for individuals in a protected group “that is ‘substantially’ less than the selection rate for individuals in another group.”

HR Legal & Compliance Excellence presented by HR.com JULY 2023 24 Submit Your Articles Artificial Intelligence: EEOC’S Guidance For Employers

The guidance acknowledges that the EEOC and employers have historically relied on the “four-fifths rule” to determine whether the employer’s (i.e., AI’s) selection process disparately impacts a protected class. Under the four-fifths rule, members of a protected class are presumed to have been disparately impacted by a selection process if the ratio of protected class members selected versus non-protected class members selected is below four-fifths (i.e., 80%). However, the Guidance cautions that while the four-fifths rule is a helpful rule of thumb for employers, a more detailed analysis focused on statistical significance may be required in many circumstances.

What Does This Mean for Employers?

The EEOC’s guidance serves as a helpful framework to anticipate how the EEOC will assess employers’ use of algorithmic decision-making tools. It also highlights the EEOC and other federal agencies' continued focus on employers’ use of AI in employment selection decisions that we predict will only increase with the proliferation of AI usage. Indeed, many other federal agencies, including the Department of Justice, National Labor Relations Board, Consumer Financial Protection Bureau, Federal Trade Commission, and National Institute of Standards and Technology, have recently rolled out AI-related guidance.

Additionally, many states and localities, like Illinois and New York City, have enacted laws regulating the use of AI in employment. Employers who intend on using AI to make employment selection decisions should consider taking the following steps:

● Review current selection procedures (including those designed or administered by third-party

vendors) to determine the extent algorithmic decision-making tools are being utilized.

● If using AI in employment selection procedures, ensure the selection criteria focuses on skills needed for the particular position, as opposed to a general measurement of applicants’ or employees’ skills.

● Ensure in-house and third-party vendor-provided algorithmic selection tools are validated according to the UGESP guidelines. Use the UGESP guidelines to determine whether selection procedures have an adverse impact.

● Vet any third-party provider of algorithmic decision-making tools, including inquiring as to whether the tool is validated and understanding the provider’s process for guarding against discriminatory results.

● Continually audit selection results to identify any potential or actual adverse impact on protected classes, both before using any algorithmic decision-making tool and on an ongoing basis. Consider the extent to which these audits should be conducted under attorney-client privilege.

● If a third-party vendor is designing or administrating AI tools for employment selection procedures, consider negotiating indemnification provisions in the agreement with the vendor whereby the vendor assumes liabilities resulting from flawed or unlawful results generated by the AI tool.

● Keep apprised of legal developments in the space, and consult with knowledgeable legal counsel as new legislation, case law, or regulations are implemented.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 25 Submit Your Articles

Michael Schulman is a Partner in Morrison Foerster ’s Global Employment & Labor Group, where he advises clients on workforce-related counseling, investigations, and transactional and litigation matters.

Sadé Tidwell is an Associate with the firm Morrison Foerster and is in Washington, D.C. Would you like

to comment?

Artificial Intelligence: EEOC’S Guidance For Employers

HRCI® & SHRM® CERTIFICATION PREP COURSES

GROUP RATES AVAILABLE

For HR Professionals

Show that management values the importance of the HR function, and has a commitment to development and improvement of HR staff.

Ensure that each person in your HR department has a standard and consistent understanding of policies, procedures, and regulations.

Place your HR team in a certification program as a rewarding team building achievement.

For Your Organization

Certified HR professionals help companies avoid risk by understanding compliance, laws, and regulations to properly manage your workforce.

HR Professionals lead employee engagement and development programs saving the company money through lower turnover and greater productivity and engagement.

A skilled HR professional can track important KPIs for the organization to make a major impact on strategic decisions and objectives, including: succession planning, staffing, and forecasting.

HR.com/prepcourse CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com

Why Certification is the Best Choice:

1 Less expensive than a masters or PhD program, and very manageable to prepare with flexible study options.

2. Recertification - ensures HR professionals continue to be up to speed on the latest legislation and best practices

3. Recognized, Industry benchmark, held by 500,000+ HR Professionals

Group Rate Options

We offer group rates for teams of 5+ or more for our regularly scheduled PHR/SPHR/ SHRM or aPHR courses.

For groups of 12+, we can design a more customized experience that meets your organization’s needs. You can have scheduling flexibility in terms of the days, times, and overall length of the course.

Groups rates for HRCI exams are also available as an add-on.

All group purchases come with 1 year of HR Prime membership for each attendee to gain the tools and updates needed to stay informed and compliant.

CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com | HR.com/prepcourse

1 2 3

Return To Office: Legal Challenges And Opportunities

HR strategies for the return-to-office transition

By Laura Balson, Constangy, Brooks, Smith & Prophete, LLP

Since the Covid-19 pandemic began more than three years ago, companies and employees have been battling to find the right balance of working from home. While allowing remote work can bring benefits to both employer and employees, there can also be increased security risks, concerns about employee productivity, and potential loss of company culture –vital in a tight job market.

However, with the pandemic declared over, the initial front-runners of the work-from-home trend, big tech companies, such as Google, Apple and Amazon, are implementing policies for their employees to return to the office. In some industries, however, recent statistics show that hybrid work is gaining popularity. According to The Flex Report, 30% of companies are allowing their employees to have a hybrid schedule, up from 20% in the first quarter of 2023.

This leaves human resource (HR) professionals to grapple with guiding organizations through the decision of whether to require employees to return to the office. Below are some suggestions that HR managers can use in their return-to-office approach.

Clear Communication of Expectations

About 74% of United States companies are using or planning to implement a hybrid work model, according

to a study by Zippia. A hybrid work model simply means that an employee works both in the office and from home. According to a new report from Accenture, this hybrid work model is favorable to 83% of employees. Under this model, clear communication with employees regarding how often they are expected to come into the office is key.

A well-written hybrid work policy should specify which areas of the business or roles are eligible for hybrid work. Any conditions the company is imposing on the ability to participate in hybrid work, whether there is a difference in working hours or responsiveness during the times that the employee is working outside the office, and any other expectations the company has for its hybrid employees. Providing notice to the employees in advance of changes will also make implementation smoother, allowing employees time to make the proper arrangements, such as finding childcare or mapping out their commute.

Another important step companies can take is to create and nurture an environment of communication. If an employee has a concern about a seemingly unfair implementation of the work-from-home policy, they should have a clear avenue to raise that concern with human resources, so that any allegations of potential discrimination or retaliation can be promptly investigated.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 28 Submit Your Articles

Top Pick

Lastly, companies should explain why the policies are implemented so that employees understand the impact of remote work on business needs. If requiring certain days of the week to be in-person days for all employees is important, being transparent about the reason – even if employees do not agree – will help prevent disputes.

Retraining Managers

Returning to the office means that employees will be communicating on a face-to-face basis as opposed to virtually. For a workforce that has become accustomed to working in pajama pants from their couch with a cat on their lap, the professional expectations of working in an office may represent a significant adjustment. As a result, human resources can help prevent some of the tensions associated with this adjustment by training or retraining managers on how to lead their direct reports.

According to a new study by West Monroe Partners, 41% of managers who oversee three to five employees have received no managerial training at all. A poor response from a manager can cause an otherwise minor misunderstanding to escalate into a larger problem and create liability for the company.

It can also be especially challenging for a manager who is overseeing some employees who work in the office and others who work remotely. Many managers

may have negative perceptions of the employees who continue to work remotely, especially if they have not been trained on how to measure and encourage productivity. It is also common for individual managers’ implicit bias to result in providing increased flexibility to certain employees while denying it to others. Being proactive in training managers about how to respond to these requests will help managers and employees avoid unnecessary friction.

Legal Pitfalls

The legal ramifications of returning to the office span a wide range of issues. As one example, the federal Americans with Disabilities Act (ADA) protects people with disabilities from discrimination and requires that employers provide reasonable accommodations to their employees under certain circumstances.

Approximately 29.5 million people are protected by the ADA, according to the Survey of Income and Program Participation. For an organization that has allowed employees to work on a fully remote basis, if there is a change in policy that leads to an influx of employees returning to the office, this could create an opportunity for employers to have to respond to many ADA requests. These requests could include enacting a change to the physical work environment to make it more accessible, being flexible in terms of work schedules, or restructuring job duties to accommodate a protected employee’s limitations.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 29 Submit Your Articles

Return To Office: Legal Challenges And Opportunities

As with any ADA accommodation request, employers should promptly respond and engage in an interactive discussion with the employee. They should then engage knowledgeable counsel to advise on whether a particular accommodation might present an undue hardship to the business.

Another example is employers should revisit any expense reimbursement policies that were put into place when employees first started working remotely. If the company is no longer going to pay for certain expenses related to remote work, the change should be clearly documented and done in connection with a review of state-specific expense reimbursement laws, which impose mandatory reimbursement guidelines in some jurisdictions.

Other existing policies may also require revising, based on changing business needs and expectations of many workplaces: Relaxed dress codes, flexibility

around the use of company-owned computers and phones for personal needs, and increased measures to prevent data security breaches when employees are accessing company information outside the office.

Additional legal pitfalls can arise from failure to enforce a hybrid or in-office requirement. If the policy is mandatory, then failing to enforce it against some employees while others are expected to comply can lead to allegations of discrimination. Also, if employees are required to track their work time on an hourly basis, employers should be careful to ensure compliance with wage-and-hour laws when the system used for remote work differs from the system used to track in-office work.

Times of transition are never easy, but an organization that can use the changing times as an opportunity to reevaluate and realign its policies and practices with its goals and values will emerge stronger than before.

Would you like to comment?

HR Legal & Compliance Excellence presented by HR.com JULY 2023 30 Submit Your Articles

Laura Balson is an Employment Lawyer, Litigator, and Managing Partner at Constangy, Brooks, Smith & Prophete, LLP’s Chicago office. She has broad experience counseling and advising employers across industries to help them manage and minimize risk. She conducts employment practice audits to identify unknown liabilities and assists in due diligence reviews during corporate transactions.

Return To Office: Legal Challenges And Opportunities

A Closer Look At New York’s Non-Compete Ban

New York set to become the fifth state to ban non-compete covenants

By Lawrence J. Del Rossi, Gerald T. Hathaway, Matthew A. Fontana & Daniel Dorson, Faegre Drinker

By Lawrence J. Del Rossi, Gerald T. Hathaway, Matthew A. Fontana & Daniel Dorson, Faegre Drinker

In support of the non-compete ban, the New York Legislature expressed their view that non-compete agreements have a “negative effect on the labor market and economy of New York State” and “prevent workers from seeking employment at entities that may be a better fit” and allow employers to offer less generous wages and benefits “because their workforce cannot seek employment elsewhere.” They specifically called out the prevalence of non-competes in the “medical field” and their view that non-compete agreements “disrupt continuity of care.”

New York is poised to become the fifth state in the nation to impose a complete ban on employment-related non-compete agreements, joining California, Oklahoma, North Dakota, and most recently, Minnesota

On June 20, 2023, the New York State Assembly passed A1278B, which followed the Senate’s approval of Senate Bill 3100A on June 7, 2023. The bill is now with Gov. Kathy Hochul, who is expected to sign the bill into law.

In a nod to the Federal Trade Commission’s recent call to ban non-competes, the New York Legislature explained that this bill “would codify such a ban in state law.” This move also comes on the heels of the National Labor Relations Board’s (NLRB) recent decision in McLaren Macomb, 372 NLRB NO. 58 (Feb. 21, 2023) and subsequent guidance issued by the General Counsel of the NLRB

New York’s non-compete law is very broad in its scope. It will add a new Section 191-d to the New York Labor Law to prohibit any non-compete agreement that restricts any person from obtaining employment after the conclusion of the employment. It applies prospectively to contracts entered into or modified on or after the law’s effective date, which will be 30 days after the law is signed by the governor.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 31 Submit Your Articles

The legislature defined a “non-compete agreement” broadly as “any agreement, or clause contained in any agreement,” between an employer and a covered individual that “prohibits or restricts such covered individual from obtaining employment after the conclusion of employment with the employer included as a party to the agreement.” Thus, in addition to standalone non-competition agreements, non-compete restrictions within offer letters, employment agreements, stock option agreements and other employment-related agreements are subject to the law’s prohibition. A “covered individual” includes employees and any independent contractors.

The legislature added some real “teeth” to the law for individuals when employers seek to enforce a non-compete agreement, providing that if an employer seeks, requires, demands, or accepts a non-compete agreement from a covered individual, the aggrieved party can bring a civil action within two years from the later of: (i) when the prohibited non-compete agreement was signed; (ii) when the covered individual learns of the prohibited non-compete agreement; (iii) when the employment or contractual relationship is terminated; or (iv) when the employer takes any step to enforce the non-compete agreement.

Importantly, the law expressly states that a court can void any such non-compete agreement and order all appropriate relief, including enjoining the employer from taking steps to enforce the non-compete, ordering payment of liquidated damages, and awarding lost compensation, damages, reasonable

attorneys’ fees, and costs. Liquidated damages are capped at no more than $10,000.

There are some exceptions to the complete ban on non-competes. Nothing in the new law prohibits an employer from securing a nondisclosure of trade secrets and confidential and proprietary client information agreement. Also, the law carves out non-solicitation of “clients of the employer that the covered individual learned about during employment.” All of these exceptions are conditioned on them not “restricting competition” in violation of this section of the Labor Code.

Interestingly, there is no “sale of business” exception, but it seems that a seller can be restricted from competition for a period of time following the closing of the sale (as opposed to a period of time following the end of employment if the seller is employed by the buyer).

What does this mean for employers? This new law will dramatically change the non-compete landscape for employers, employees and independent contractors in New York. New York employers should immediately review their template employment-related agreements to ensure they are compliant in light of the new law. Once the law is enacted, New York employers should consider other means of protecting their trade secrets, customer relationships, and investments in training, such as permissible nondisclosure agreements, non-solicitation agreements and confidentiality policies.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 32 Submit Your Articles

A Closer Look At New York’s Non-Compete Ban

Lawrence J. Del Rossi is a Partner at Faegre Drinker.

Gerald T. Hathaway is a Partner at Faegre Drinker.

Matthew A. Fontana is a Partner at Faegre Drinker

Would you like to comment?

Daniel Dorson is an Associate at Faegre Drinker

Minnesota Employment Law: Legislative Reforms And Their Implications

Check out the transformative impact of Minnesota's 2023 legislative session on employment law

By Daniel G. Prokott, Charles F. Knapp, Nicole A. Truso, Rhiannon C. Beckendorf and Zoey A.Y. Twyford, Faegre Drinker

Minnesota recently passed the Jobs and Economic Development and Labor Omnibus Budget Bill and other bills, bringing broad changes to Minnesota employment laws.

This article highlights some of the significant changes, including the non-compete ban, paid sick and safe time, wage disclosure protections, protections for pregnant and nursing workers, prohibitions on mandatory employer meetings, and recreational marijuana.

Employers should review their current policies and practices and develop a plan to revise them as necessary to comply with this expansive legislation.

1. Ban on Non-compete Agreements

Effective July 1, 2023, Minnesota law prohibits any post-employment non-compete agreement with an employee or independent contractor, regardless of a person’s income, with two limited carveouts for certain non-competes made (1) in connection with a sale of

a business or (2) in anticipation of a dissolution of a business.

Subject to those exceptions, the law prohibits an agreement between an employee and employer that restricts the employee post-termination from performing: (1) work for another employer for a specified period of time; (2) work in a specified geographic area; or (3) work for another employer in a capacity that is similar to the employee’s work for the employer. The new law does not prohibit confidentiality, trade secret or non-solicitation agreements, or restrictions on working for another business while performing services for a business.

The law also prohibits employers from requiring employees who reside and work in Minnesota to agree, as a condition of employment, to a provision in an agreement that (1) requires employees to adjudicate a claim arising in Minnesota outside of Minnesota; or (2) deprive employees of the substantive protection of Minnesota law for matters arising in Minnesota.

HR Legal & Compliance Excellence presented by HR.com JULY 2023 33 Submit Your Articles

Top Pick

The law creates ambiguity as to whether an agreement between a company and a former employee that includes a covenant not to compete (such as a post-employment separation agreement) is also void and unenforceable. Additionally, there is ambiguity as to whether the choice of law and forum provisions apply to any employee agreement, not just a covenant not to compete.

The non-compete ban law applies to contracts and agreements entered into on or after July 1, 2023.

2. Statewide Earned Sick and Safe Leave

Beginning January 1, 2024, Minnesota employees are entitled to accrue one hour of sick and safe leave (SSL) for every 30 hours worked, up to 48 hours per year. Employees will be able to carry over up to 80 accrued hours each year. Alternatively, employers may front-load 80 hours of SSL at the beginning of each applicable year.

The law allows for absences due to an expansive list of reasons, including for the care of a broad range of “family members”, such as nieces, nephews, aunts, uncles, children-in-law, siblings-in-law, other blood relatives, those whose close association with the employee is equivalent to a family relationship and up to one annually designated individual.

Employers are required to provide certain notices regarding SSL, including in handbooks and earned income statements. Existing employer policies, such as paid time off policies, may satisfy the requirements of the new law if the existing policies meet the accrual and usage requirements set forth in the new statute.

4. Modification to Wage Disclosure Protection

As of July 1, 2023, Minnesota prohibits employers from inquiring into, considering, or requiring disclosure of the pay history of a job applicant to determine the applicant’s compensation or benefits and prohibits employers from discriminating against an employee for asserting rights under the law (for example, refusing to provide past salary).

5. Added Protections for Nursing Mothers and Pregnant Employees

As of July 1, 2023, Minnesota increases protection for nursing employees by expanding the time period under which employees needing to express breastmilk may take breaks beyond a prior 12-month limitation. The law also now provides that break times used for expressing breast milk may run concurrently with other breaks but are not required to do so. In addition, the amendments also remove language that previously allowed employers to deny employees a break to express milk if it would “unduly disrupt operations.”

The law also includes increased entitlements for pregnancy accommodation by providing that accommodations not requiring a healthcare provider’s certification include longer (in addition to more frequent) restroom, food and water breaks. Notice provisions have also been added, requiring employers to inform employees of their rights under the law at the time of hire and when an employee makes an inquiry about or requests parental leave.

6. Changes in Employer Size and Service Requirements for Pregnancy and Parental Leave

Minnesota law requires any “employer” to grant up to 12 weeks of unpaid leave to any “employee”, who is a biological or adoptive parent in conjunction with the birth or adoption of a child or a female employee for prenatal care or incapacity due to pregnancy, childbirth or related health conditions.