PIMFA BULLETIN

9 October 2023

Consumer Duty - Joint Trade Association Distributor Feedback Framework

PIMFA’s ongoing collaboration with trade association colleagues on data sharing to meet Consumer Duty obligations has now completed phase two, which focused on the distributor feedback loop.

• The joint working group envisage the standardised approach will assist members in meeting their data sharing obligations with firms aligning to the framework.

• A joint statement from the working group and the final pdf version of the framework, which includes the Distributor Feedback Template is available for members on our website here

Featured: Consumer Duty - Joint Association Distributor Feedback Framework

Featured: Consumer Duty - Joint Association Distributor Feedback Framework

in browser PRESS RELEASES ABOUT PIMFA CONSUMER DUTY WEALTHTECH

View

PIMFA WEEKLY NEWS BULLETIN

PIMFA Operations Forum - Wednesday 27 September Recording now available on PIMFA website

The September Operations Forum has now been posted on the PIMFA website here. The recording includes:

• Regulatory update from Alexandra Roberts, PIMFA's Head of Regulatory Policy and Compliance, highlighting the Financial Conduct Authority (FCA) director of consumer investments, Lucy Castledine's speech at the PIMFA’s recent Compliance Conference, the progress of the Online Safety Bill, a Consumer Duty update; consultation responses on the cold calling ban and the Anti-Money Laundering (AML)/Combating the Finance of Crime (CFT) supervisory regime, and a new publication from the FCA on Diversity & Inclusion. (00:27)

• CREST update from Charlie Pugh and Glenn Cooper, Euroclear, including commentary on the Digitisation Taskforce Interim Responses, US and UK T+1, revised CREST GUI, CREST modernisation, CRH, and dividends in CREST. (09:25)

• Introducing ShareGift, the share donation charity - Gabbi Stopp, chief executive and David McIntosh, Head of Operations at ShareGift. (20:26)

• Using a Cash Management platform to reduce risk, save time & increase returns - Giles Hutson, Chief Executive of Insignis Cash. (28:03)

If you are from a PIMFA member firm and would like to attend the next Operations Forum on Thursday 26 October at 3pm, please contact HeidiB@pimfa.co.uk

Join PIMFA's Talent, D&I Working Group

The FCA is consulting, alongside the Prudential Regulatory Authority (PRA), on proposals to introduce a new regulatory framework on Diversity and Inclusion (D&I) in the financial sector.

The regulator considers that greater levels of diversity and inclusion can improve outcomes for markets and consumers by helping reduce groupthink, supporting healthy work cultures, improving understanding of and provision for diverse consumer needs, unlocking diverse talent and supporting the competitiveness of the UK’s financial services sector. The FCA has been clear that diversity and inclusion are regulatory concerns.

In order to gather the sector’s views on the FCA proposals contained in the CP 23/20, we would like to invite members to join PIMFA Talent, Diversity and Inclusion Working Group. The Working Group will meet specifically to look at the proposals and help shape PIMFA’s response.

If you would like to participate in the discussions and provide your feedback to the proposals in the Consultation Paper, please contact MajaE@pimfa.co.uk

Upcoming PIMFA Working Groups

• PIMFA Consumer Duty Working group

The next meeting is scheduled for Tuesday 10 October at 10am.

• PIMFA Vulnerable Customers working group

The next meeting is due to take place on Wednesday, 11 October 10:0011:30am.

Please contact Alexandra Roberts or Yasmin Ataullah for further information.

Mitigo advice on Ransomware attacks: a threat that’s here to stay

It’s Cybersecurity Awareness Month and our PIMFA Plus partner Mitigo is sharing helpful advice and guidance surrounding the topic of ransomware to help improve your firm’s cybersecurity.

Ransomware Guide – 6 minute read

In this guide, Mitigo is helping firms with a strategy to defend against ransomware attacks. It highlights the five layers of defence that you should have lined up against this threat to keep your firm secure.

Download the guide

Beware of the Ransomware Q&A – 9-minute listen

In their latest Q&A, Mitigo partners Lindsay Hill and Kerrie Machin are discussing all things ransomware. In this episode, they cover off: what it is who the attackers are how you know you’re under attack what is demanded and how you pay your reporting obligations and most importantly, how to defend against it.

Listen now

For more helpful cybersecurity advice, follow Mitigo on LinkedIn, or head to their blog

Green Technical Advisory Group publishes final advice paper

The Green Technical Advisory Group (GTAG) has published its final piece of advice to the UK government on the design and implementation of a UK Green Taxonomy.

This advice focuses on the long term “institutional home” for a UK Green Taxonomy. In the last two years, since the GTAG was established, the regulatory landscape for green finance has evolved significantly.

An additional 21 taxonomies have been announced, or come into force globally, reaching almost 50 taxonomies in total. Recognising the ever-changing landscape, the GTAG has recommended a considered approach to delivering a green taxonomy in the UK, one that learns from the efforts of those implementing taxonomies in other regions.

The FCA has launched a new Form A

In the week commencing 9 October, the FCA will start to contact Limited scope and Enhanced firms who frequently use Form A via email and provide information on how to take part in public testing of the new Form A.

The email will come from gateway.userresearch@fca.org.uk and contain a link that can be used to submit:

o Standalone applications (those not related to an Appointed Representative, New Authorisation or Variation of Permission application).

o On behalf of solo regulated entities

- The form will be rolled out gradually to frequent users of Form A based on Senior Manager & Certification Regime (CM&CR) category. After which, the form will be released to all firms (including dual regulated entities).

- During the transition period firms can choose to continue submitting Form A applications using the old form, but this will be decommissioned once the new form rollout is complete.

- Applications related to an Appointed Representative, New Authorisation or Variation of Permission application will be updated in due course and will continue to use the current version of the form.

For more information, go to the FCA’s webpage

If you are contacted by the FCA in relation to the above, please use the improved version and provide feedback to the FCA. If you have any issues or questions, please get in touch with alexandraR@pimfa.co.uk

The 2023 Q4 PIMFA Asset Allocation Survey is OPEN

Complete this quarter's survey, and you can: Receive a complimentary, 40-page report, showing how the strategic asset allocations of your firm’s model portfolios compare to the peer average.

Ensure the index weight methodology for the MSCI PIMFA Private Investor and Equity Risk Index Series’ remain relevant benchmarks for the UK wealth management sector. Click here to submit

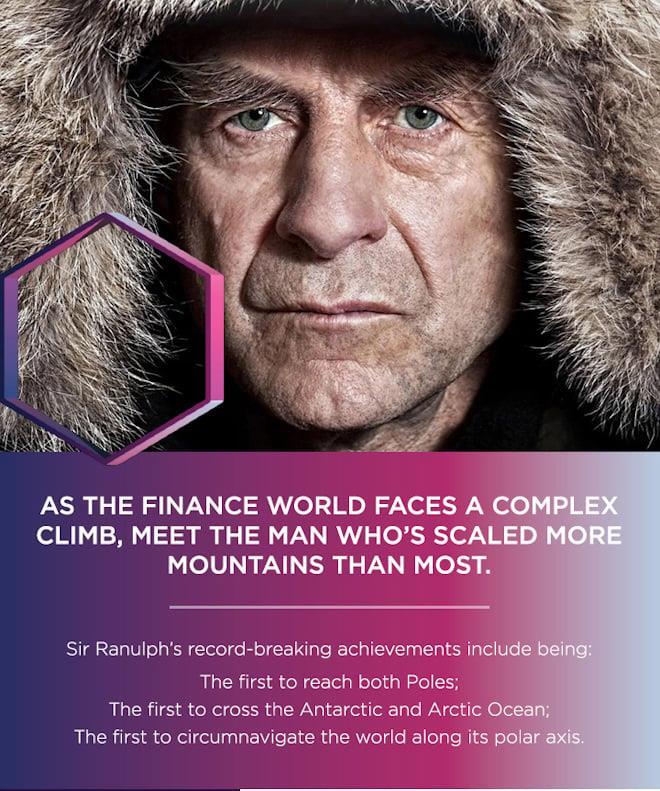

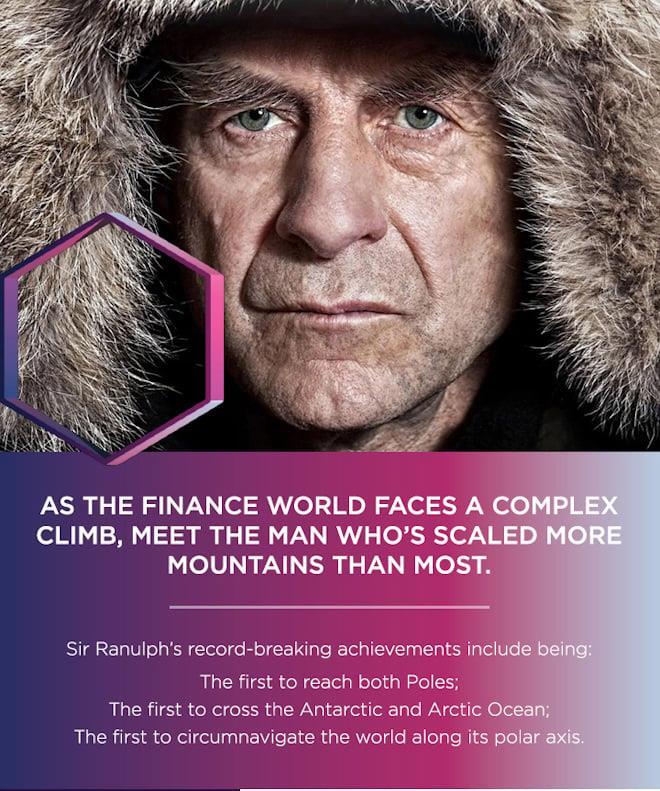

EVENT DETAILS

Date: Thursday 12th October 2023

Location: Eight Club (Moorgate)

Doors Open: 6pm

Event Ends: 10pm

A pioneer in every sense of the word, Sir Ranulph will share tales of pushing beyond limits before a Q&A with the audience.

The occasion will end with refreshments and exclusive networking session in the company of other influential financial industry figures.

PRESS RELEASES

PIMFA calls for clarity on cold calling ban and public awareness campaign

PIMFA WealthTech Partners with NayaOne to Launch Client Analytics & Profiling Tech Sprint

PIMFA delighted the Online Safety Bill has passed its final reading

Advice/Guidance review may lead to simpler advice services as part of a wholesale review, says FCA

PRESS COVERAGE

The Sunday Times: Life cover misselling rife, warns FCA

FT Adviser: No 'bonfire of regulations' post-Brexit, PIMFA says

IFA Magazine: PIMFA calls for clarity on cold calling ban & public awareness campaign

FinTech Alliance: PIMFA WealthTech partners with NayaOne to launch

RSVP HERE

12 October 2023

PIMFA D&I Awards

24 October 2023

Financial Promotions: Fair, clear and not misleading in 2023

In this PIMFA live, two-hour online session you will:

• Assess the potential risks of your marketing and financial promotions against the FCA draft guidance ‘GC23/2: Financial promotions on social media’.

There are many instances of fantastic innovations and great practice which remain hidden or unrecognised in our industry and PIMFA is working to bring them to light to celebrate this work and importantly, to inspire and help drive positive change for a better future.

Join us on 12 October at the Intercontinental Park Lane, London to

• Strengthen your approach to financial promotions in-line with the requirements of Consumer Duty.

• Review control expectations for promotions of any high-risk investment in line with the FCA’s PS22/10.

• Use a proven processes to assess and mitigate the threat of non-compliance with current and future changes in financial promotion regulations

READ MORE READ MORE

celebrate these wonderful achievements and hear the stories shared by changemakers across our industry.

BUY A TABLE

• Ensure your approach to social media and customer communications doesn’t attract the wrong kind of attention.

• Enhance the review and approval process for financial promotions in line with proposed new anti-greenwashing rules.

• Update your social media and influencer marketing governance, policies, and contracts with ‘finfluencers’ and agencies to ensure your firm doesn’t fall short of the guidance the regulator has in place to stop consumer harm.

BOOK NOW

Please note that responses to this email address are not monitored. If you wish to get in contact, please email info@pimfa.co.uk

You have received this email because you are subscribed to 'Bulletin'. If you no longer want to receive these emails, please update your preferences here

Contact us | Visit website | Terms & Conditions Personal Investment Management & Financial Advice Association (PIMFA) 69 Carter Lane, London, EC4V 5EQ (registered in England No 2991400) Unsubscribe | View in

browser

Featured: Consumer Duty - Joint Association Distributor Feedback Framework

Featured: Consumer Duty - Joint Association Distributor Feedback Framework