3 minute read

Factoring and Supply Chain Finance

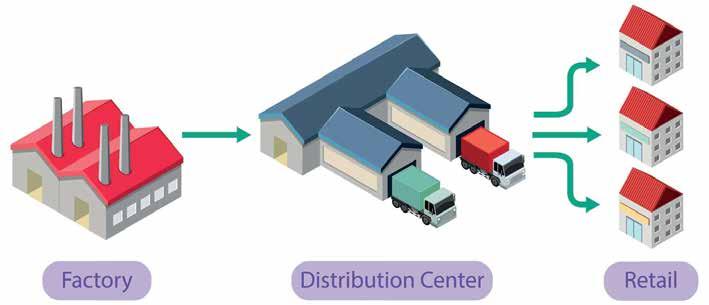

his year marks thirty years since Bank of Cyprus started providing factoring services and products to Cypriot businesses, through a specialised factoring unit. In other words, acting as an intermediary between a supplier and its debtors, purchasing trade receivables and providing key services, such as receivables collection and management and credit risk insurance, generating instant liquidity. Over the years, the Factoring Unit, has evolved into a reliable partner for Cypriot businesses, offering factoring solutions tailored to the needs of each customer.

Throughout the various cycles of the Economy of Cyprus over the recent years, factoring services have maintained their flexibility and have continued to evolve. The Factoring Unit of The Bank of Cyprus, has been effectively supporting Cypriot businesses to deal with liquidity issues, to eliminate the exposure to credit risk and the stressful burden of collections, enabling them to focus on the essence of their business.

The portfolio of the factoring services offered today by the Bank of Cyprus, includes the following:

• Discounting of invoices/trade receivables at a rate up to 85%

• Managing and collecting trade receivables on behalf of customers

Integrated solutions for working capital finance, receivables management and credit risk insurance. Factoring solutions from The Bank of Cyprus

• Assessment of receivables collectability and debtors’ creditworthiness

• Credit coverage at a rate up to 95% –Debtor insurance through granting credit limits

• Import and Export factoring Factoring services can be combined and offered as a complete factoring solution, to meet the specific requirements and needs of the client.

Today, factoring services are used by hundreds of companies of all sizes and from various segments of the economy. With our unsurpassed know-how and professionalism, the Factoring Unit has established itself as a recognised body which acts as a catalyst at all stages of the supply chain, from the time of creation of the receivable, until its timely settlement. The Unit also plays an important role and contributes to the smooth running of Cypriot businesses, even in unprecedented conditions, such as the coronavirus pandemic, where the liquidity of businesses was a decisive factor for their viability. Following the Bank’s digital and technological transformation and the international developments in the sector, the Factoring Unit is constantly modernizing its operations. Through a new Factoring core system which will soon be introduced, we will offer improved services, introduce new flexible and innovative products and provide our customers with enhanced communication and upgraded experience. At the same time, debtors will have the ability to settle their debts through the 1bank service of the Bank, as well as through other digital channels.

In today's volatile and demanding business environment, the need for alternative, direct and flexible sources of working capital finance is critical. Financing through the provision of a holistic receivables management services can play an important role in supporting strong business development. We, as the Factoring Unit of The Bank of Cyprus, want to remain a valuable partner to our clients and be their first choice for working capital solutions, by offering high quality and flexible business Factoring services. Our goal is to add value to our customers, to the Bank and to our people.

Factoring solutions of The Bank of Cyprus are offered by a highly specialised Factoring Unit, within the Corporate & SME Division. The Factoring Unit has a local market share of over 90%, with factoring clients’ facilities exceeding 200 million euro, to different sized companies from a broad industry segment. It Is the only Cypriot full member of the largest factoring network association in the world (FCI), which covers more than 90 countries and has over 400 members worldwide.

QUOTE FROM MR PETER MULROY, SECRETARY GENERAL, FCI

‘’Cyprus is quite a special and unique market within the EU and its factoring roots date back to the early 1990s, when the Bank of Cyprus joined FCI as a member in August 1993. The island country has over €3.2 Billion in annualized factored volume, and 16% of the receivables purchased is cross border. The industry has been growing over the past 7 years at a CAGR of 5%, about the same as the average growth rate experienced in the EU region and the volume accounts for app. 11% of its national GDP, slightly above the average of 10% in the entire EU. We enjoy strong bonds with Bank of Cyprus, the only full member from Cyprus at the moment, who hosted the FCI Executive Committee in April 2022 and where we had the chance to meet all of the four FCI members (full, associate and affiliates) from Cyprus. ‘’