3 minute read

6 STEPS TO CREATING PRODUCER ACCOUNTABILITY

SIX STEPS TO CREATING PRODUCER ACCOUNTABILITY

M a r s h B e r r y - V i e w p o i n t Z a c k P i t t m a n , M a r s h B e r r y V P

Are you holding your producers accountable? According to MarshBerry ’s 2022 Insurance Brokerage and Compensation Study – the answer is no.

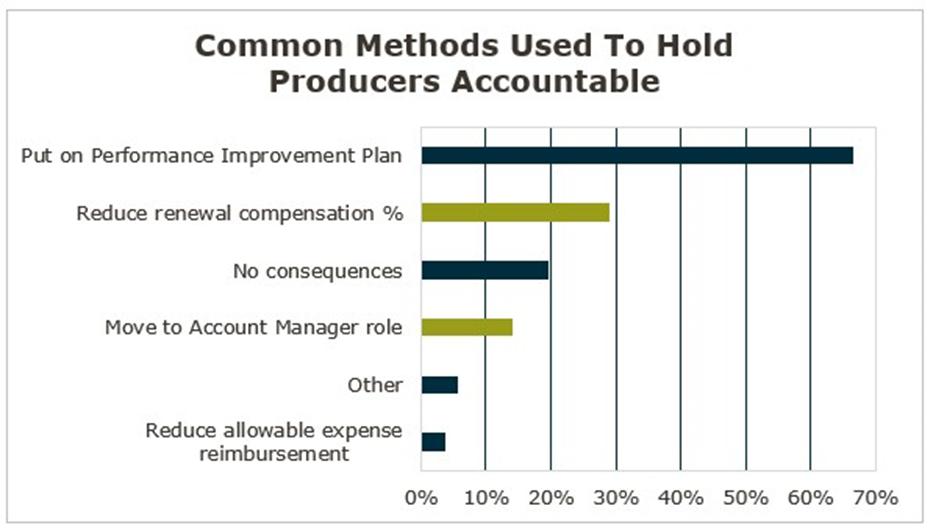

In 2021, roughly 75% of validated producers wrote less than $100,000 in new business.1 However, 70% of firms noted that the only recourse in their firm for not meeting sales goals was to put producers on a Performance Improvement Plan, while nearly 20% of firms reported that there were no consequences for not meeting sales goals (with the exception of eventual job loss). Firms that are evaluating producer performance, transitioning non-producing producers out of roles where they ’re not successful, and reacting swiftly are more likely to reach growth goals.

If your firm is looking to achieve double-digit growth, here are six things you should be doing now to drive producer accountability:

1) Set Defined Expectations & Goals: Setting individual producer goals requires historical reflection on several years of production, strategic planning and potentially a sales planner. Here are some categories of goals to set:

Minimum Goal: Minimum amount of new business to maintain producer status. Also used for enforcing negative consequences. Individual Goal: Producer’s stated personal goal. Stretch goal: Best case scenario goal

2) Implement Incentives: Ensure you have a measurable spread between new and renewal commission percentages. MarshBerry typically recommends a 15% to 20% difference between new and renewal rates, which helps producers focus on new business production over renewal compensation, as new business is vital to the firm’s success.

3) Create Accountability in the Sales Process:

Producer accountability should be based on a mandatory minimum level of new business production (e.g. $100,000 in revenue) and a stretch goal (e.g.$150,000 in revenue). The plan should also incorporate negative and positive compensation incentives. For example, a producer who does not meet the minimum should face an automatic renewal rate reduction (e.g. from 25% to 20%). Those who hit the stretch goal should be

eligible for enhanced new business commissions (e.g. from 40% to 50%).

4) Establish Minimum Account Thresholds: Small business units (SBUs) are accounts comprised of accounts below a certain commission dollar amount that are handled by dedicated service staff. Firms striving to increase growth should establish a minimum account threshold for which producers are not paid renewal commission.

5) Hire!: According to MarshBerry ’s proprietary financial management database, Perspectives for High Performance (PHP), approximately 28% of producers are under the age of 40 in average firms compared to 41% in the Best 25%. High growth firms have a tendency to hire new, hungry talent which not only fosters growth – but also coaching, mentoring and perpetuation candidates.

6) Invest to Improve Recruiting: There are proven recruitment processes that can help ensure your firm finds and hires the right producers. Leadership may assume that the current recruiting process is sufficient, but a third-party evaluation may uncover deficient areas. Given the current competitive environment for candidates, there are also ways to improve your interview process that can boost hiring rates. Having an effective training, onboarding and development program can help employee retention, skillset development, and bench strength.

Firms can do more to improve sales and growth strategies, including fine-tuning producer goals and accountability. A firm that commits to planning and execution in this area can achieve double-digit organic growth that also greatly enhances its value.

If you have questions about Today ’s ViewPoint, or would like to learn more about how you can drive growth acceleration for your firm, email or call Zack Pittman, Vice President, at 440-220-4100.