9 minute read

How to Improve the Insurance Customer Experience

By Benedict Clark

“Yes, I’m satisfied with my insurance provider” – said a paltry 29 percent of surveyed customers. And with only 16 percent willing to buy more products from their providers, it’s clear the insurance industry has got some way to go in the eyes of consumers.

But how do you keep your customers satisfied when they’ve come to see your very service as not much more than a necessary evil? Choosing an insurance policy isn’t exactly high up on people’s lists of how to spend an afternoon.

Insurance Companies Can Do More

The battle for consumers’ attention has traditionally played out as a kind of frantic price limbo, suppliers jostling around to prove just how low they can go to tempt people in. But, clearly, this isn’t a sustainable approach. Insurers can’t simply keep on eroding profit margins all the way down to zero.

So, what does represent a more practical route forward – and one that still resonates with consumers?

According to research from Newsweek Vantage, the answer is “a differentiated customer service experience”.

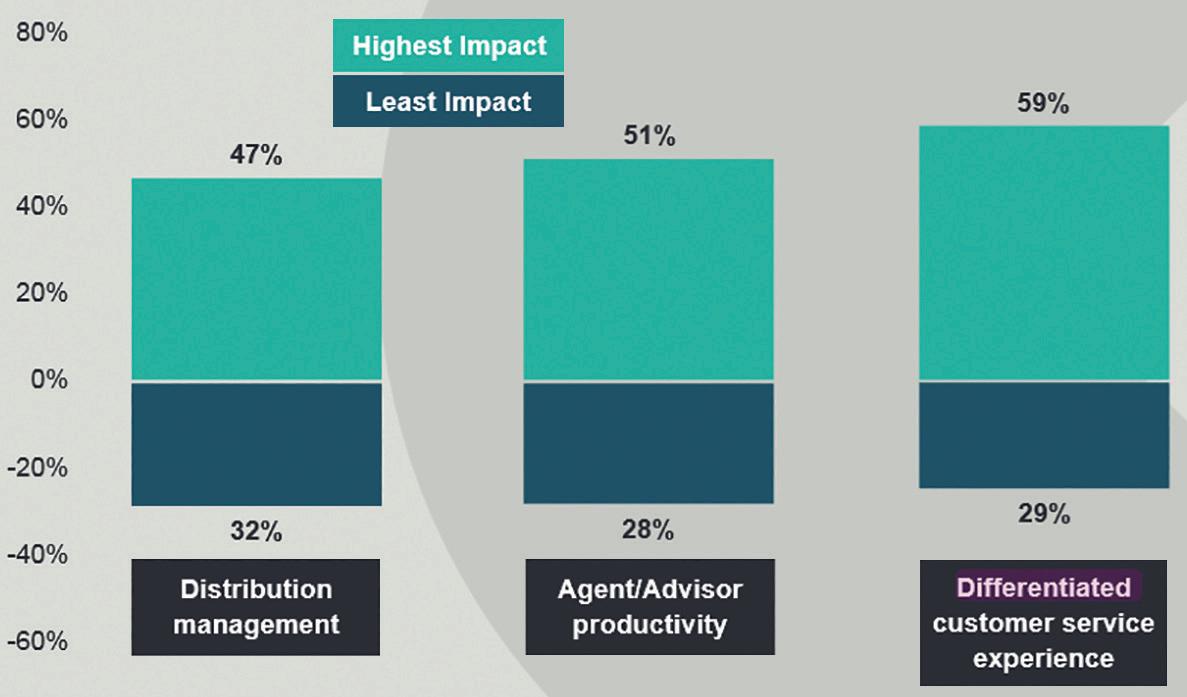

Figure to the lower left shows top three options in terms of impact on successful competition

Source: https://c1.sfdcstatic.com/content/dam/web/en_us/www/documents/ industries/financial-services/insurance_competition.pdf

And the proof of this approach is very much in the pudding. Over a five year period, for example, US auto insurance carriers consistently providing best-in-class insurance customer experience generated two to four times more growth in new business and around 30 percent higher profitability than companies showing an inconsistent customer focus.

So, it’s clear that creating a great insurance customer experience is crucial. But what exactly does that experience consist of?

What Your Insurance Customers Want Now

Ultimately it comes down to the expectations of the modern-day consumer. Let’s take a look at what those are.

A frictionless experience

Incidents leading to insurance claims may hit like a bolt out of the blue. This means customers need to be able connect with insurers at any time, in any place, through any method. At what could be one of the most stressful times in their life, the last thing they need is more unnecessary hassle. That’s why a Bain & Capital survey of more than 174,000 retail insurance consumers in 18 countries, showed customers everywhere value quality and ease of use.

A company that stands out from the crowd

With experience replacing price as the distinguishing factor between insurance brands, you need to be something different to stand out. US insurer Lemonade understood this only too well, making a name for itself with a fresh digital approach to claims processing. At the start of 2017,

its virtual assistant Jim set a world record as it reviewed, processed, and paid a claim in three seconds flat – and all with no paperwork to boot.

A conversational experience

Interactions between insurers and their customers have traditionally centered around incidents and policy renewal. But these days customers are looking for a more conversational experience - genuine two-way dialogue populated with easy and accessible back-and-forths on chat or voice. It seems insurance companies are some way off this - over 90 percent of insurers don’t talk to their customers throughout the whole year and, globally, 44 percent of customers have had no interactions with their insurers in the last 18 months.

A personalized approach

The circumstances of each individual are entirely unique to them. While insurance quotes and policies are sometimes based on understanding these subtle nuances, the same can’t be said for all customer journey touchpoints, where interactions are often generic leaving customers feeling like a small cog in a rather large machine. But with customers encountering these personal experiences elsewhere, particularly in the retail industry, they have come to believe the same should be available in insurance, too - 48 percent expect their insurers to use their data to offer more relevant services, according to Accenture.

Open, honest, and helpful interactions

The default state of mind for many customers when dealing with insurers is one of caution - if not outright suspicion. In fact, 1 in 3 consumers don’t trust their insurer to do the ‘right thing’ in exceptional circumstances. Consumers want a better understanding of what’s going on behind the scenes, and getting that depends on clear information. Perhaps that’s why, according to one global survey, “knowledgeable salespeople” are the number one customer experience requirement for policyholders.

When it comes to meeting your customer expectations and creating a successful - and sustainable – insurance business, there are a number of practical ways you can go about it.

Get the website right

Back in 2016, 79 percent of consumers said they would use a digital channel for insurance interactions over the next few years. With this shift now in full swing, getting the online user experience right is crucial. And it all begins on your website. Tools such as chatbots can add an extra element, but make sure your house is in order first. Leading Canadian financial services group, Manulife, decided to revamp its website to improve customer experience. Using site analytics, they discovered customers weren’t able to find what they were looking for. To fix this, Forbes reports that the company “consolidated 1,200 web pages to just 250 and centralized web production for greater efficiency.”

Create a quick and smooth application process

A recent survey of the top insurance websites revealed that an online application is the most popular digital method of engaging customers. But, to do an application process well, you must make it hassle-free. Prospects are 20 percent more likely to purchase a life policy as the underwriting and application process gets closer to real time. SE2 Digital Direct Life understands this need well. The Insurtech vendor provides insurers with a fully automated online application process – gathering key identifiers and an eSignature to authorize access to personal data. The system uses that information to perform an automated underwriting process, accurately assessing price and risk, while offering the customer personalized coverage and a mega-fast quote.

Create an easy, speedy claims process

The thought of going through a claims process is enough to put dread in many a customer’s heart. There’s no reason this should be the case. Now you can even make use of AI to deal with claims, keeping the fuss for the customer to an absolute minimum.

Provide round the clock, free support

The need to contact an insurance company is no respecter of convenience. Policyholders will have to get in touch with you come what may. In an ideal scenario, you should have toll-free phone lines manned by experts 24/7. If this genuinely isn’t possible, then you could go for an AI assistant in the form of a chatbot.

“Kate” by Geico, for example, is a digital assistant that answers policy questions for Geico’s mobile app users. Kate helps customers with everything from knowing when their next payment is due to checking balances and fetching documents. There’s no need to search around online or pick up the phone to the contact center. Kate makes it easier to use the mobile app and get answers 24/7.

Be omnichannel

While digitalization has brought convenience to customers, that shouldn’t come at the expense of other channels. And if you truly want to achieve the gold standard, bring all your channels together so communication always continues where they left off, regardless of how customers interact with you.

continued...

At MetLife, for example, the company works to create a cohesive omnichannel experience so that customers are pleased no matter how they connect with the company, customers know that MetLife will always provide the same, high-quality experience.

Use the right tools

Forty-five percent of insurers say that changing customer expectations is the primary business driver triggering investments in new technologies. And with a complicated marketplace packed full of customer touchpoints, it’s vital that you equip yourself to service customers properly. Particularly If you have a complex application process, offering live chat or cobrowse options can help you provide seamless, high-touch customer assistance. For example, with cobrowsing, you can interact with a customer’s screen – with their permission – to see the process from their perspective, making it that much easier to take them through it and resolve any challenges that come up.

Personalize the experience

Even as late as 2016, only 22 percent of insurers had launched personalized, real time digital, or mobile services. Yet, collecting and applying customer data helps you improve insurance customer experience by offering product recommendations based on particular interests, location, and browsing history. Consumers are receptive to these recommendations being automated, too. A recent study showed that 74 percent of customers are very or somewhat willing to receive computer-generated advice on the type of insurance they should buy.

Insurtech startup Trov provides personalization for its customers via flexible, on-demand insurance for a variety of gadgets - think smartphones and laptops. Consumers can switch cover on and off straight out of the app, just by the swipe of a switch.

Make good use of data

One of the best ways you can move away from crude rating factors - the likes of age and marital status - for pricing premiums and emphasize customization, is through the power of data. Data gives you a more complete view of your customers so you are better equipped to offer them the right products at the right time. An innovative example of customer data collection is the Aviva Drive app. A GPS collects data on driving behaviour, with safer drivers getting discounts on their car insurance. It even acts as a Dash Cam to automatically save footage of collisions.

Stress security and safety

In an industry packed with sensitive data, consumers have concerns. A whopping 85 percent consider the risks of privacy and security breaches a disadvantage to sharing their data. But it’s precisely that data that will enable insurers to provide the best insurance customer experience. So, it’s absolutely essential you build trust with your customers when it comes to protecting their data.

Recognize customer concerns around collecting data early in product and business planning, and make the implications of privacy concerns explicit. Honesty and transparency are very much the watchwords, whereas schemes such as the aforementioned Aviva Drive app help to show exactly how data is being put to use – in this case creating savings in the policyholder’s pocket (provided they are a safe driver!).

Into the Future

So, with a rapidly changing landscape and customer expectations shifting – not to mention the glut of new InsurTech startups shaking up the industry – acting to create a superior customer experience is more important than ever.

Providers that gather and act on the richest data will hold the power to create the most relevant and rewarding insurance customer experience. You might need to do a complete overhaul of traditional products and processes, but the payout will be more than worth it.

Originally featured on www.acquire.io/blog.

Benedict Clark is a writer and psychologist with over ten years marketing experience in a range of different roles. He believes avidly in the power of words to connect people and ideas.