7 minute read

Growing Future Leaders

Finding, developing and retaining quality talent is a priority for your institution, and growing these future leaders for your banks and companies is one of our main IBA goals. We take great pride in being the top resource for the development and training of our industry’s future leaders. And remember – the effort to grow our future industry leaders doesn’t just start when you hire a new employee. It begins early with financial literacy training, internships and scholarship opportunities for those wishing to begin a career in financial services.

Here is a glimpse into all we have to offer. For more information, visit our website at ilbanker.com or connect with us at 217-789-9340.

Advertisement

BankTalentHQ

BankTalentHQ, a full-scope talent management resource for the financial industry, helps connect qualified candidates with financial institutions.

• Post job openings with the ability to purchase a single 30-day post • Fill multiple vacancies with a discounted posting package • Post internships at a discounted rate • Take advantage of ancillary services currently being offered: industry news and articles, resume writing, career learning center, bank program college and university listing and coaching Begin your search at banktalenthq.com.

Build your next generation of bank leaders through the Future Leaders Alliance Program (FLA). FLA was developed to create a leadership framework for new and seasoned bankers that emphasizes professional and personal development, community service and networking. The goal is to provide quality educational programming through blended virtual and in-person programming. To date, over 200 individuals have graduated from this program.

Illinois Bankers Scholarship Fund

This program provides scholarship funding to high school graduates and college students seeking a degree in the financial services industry in order to promote the development and continuation of a vibrant talent pool of future leaders in the field of banking. Applications are accepted between January 1 and March 31 of each year, with award recipients announced by May 31.

All donations to the Illinois Bankers Scholarship Fund will be paid into and held in a segregated fund within Illinois Bankers Education Services, a not-for-profit subsidiary, EIN 36-4271815, of the Illinois Bankers Association, and will be used exclusively for the purpose of granting scholarships under this program to further professional careers in banking. Donations paid into and held in this fund may be tax deductible as charitable contributions to the extent permitted by law. No proceeds from this fund will be used for government advocacy or other purposes.

Four Ways to Contribute

• Online (Secure): Giving Guide at https:// my.ilbanker.com/About-Us/Giving-Guide • Mobile Text: 44-321 with the message “IBGIVE" • Mail: Illinois Bankers Education Services, Inc. 3201 W White Oaks Drive, Suite 400 Springfield, IL 62704 Checks made payable to Illinois Bankers Education Services Inc. • Amazon Smile: Place your orders thru Amazon Smile (Illinois Bankers Education Services Inc.)

Take advantage of this comprehensive source for training and education available through the Graduate School of Banking at the University of Wisconsin-Madison. From onboarding to early management to specialized lines of business, you can get ahead—fast. Enroll today and get ready to learn, advance and lead. • Graduate School of Banking • Bank Technology Management School • Human Resource Management School • Financial Managers School • Bank Management Forums • Online Seminar Series

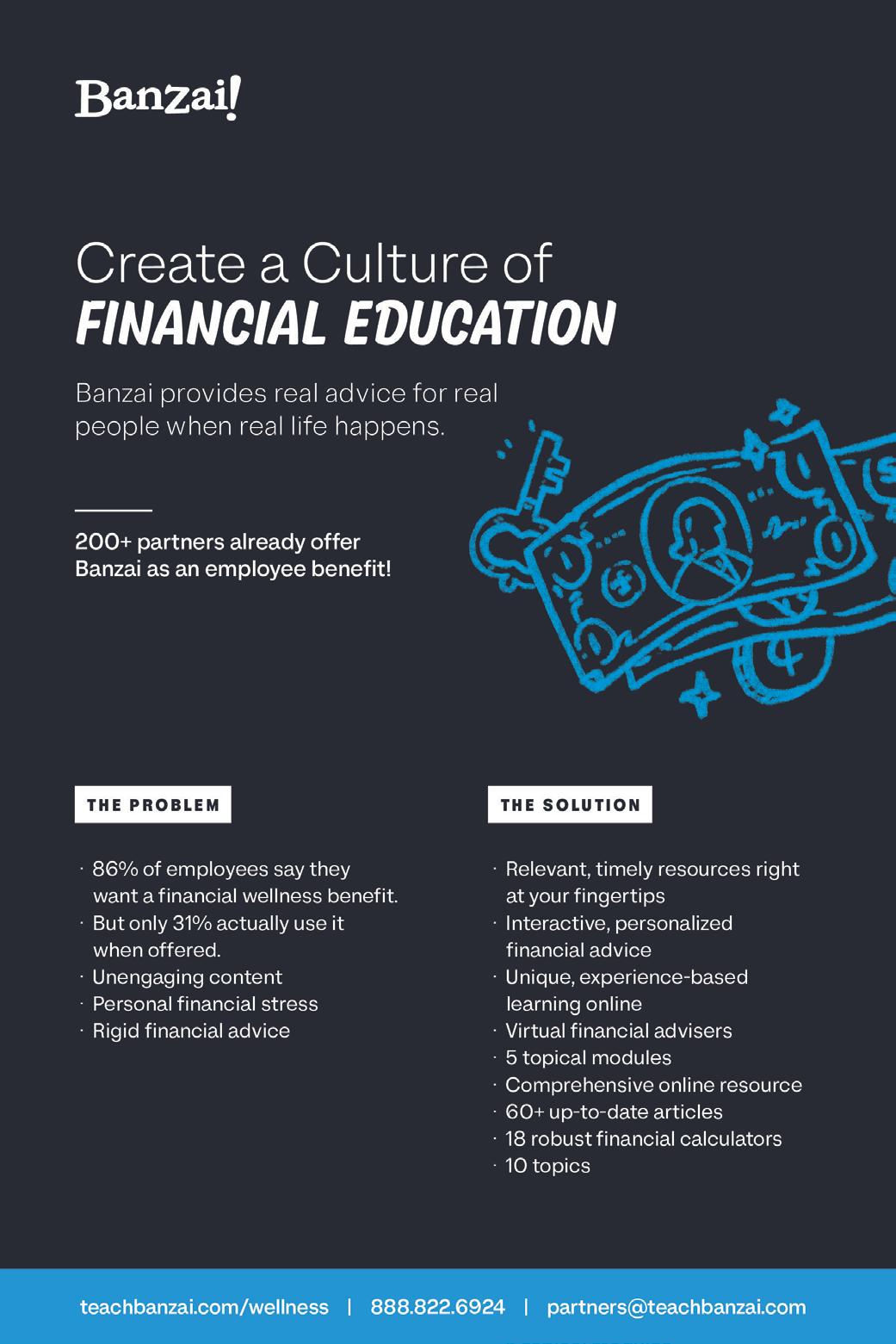

The IBA has a brand new partnership with Banzai, a web-based financial literacy program for all ages and groups, including K—12 schools, community programs, employee onboarding, and even families. Our partnership with Banzai provides an opportunity for Illinois banks to enhance their existing financial education initiatives and deliver the latest technology to local schools through a private-labeled program that teaches, assesses and certifies students in a variety of personal finance topics.

Working with Banzai allows you to use financial education to build brand loyalty, multiply customer touch points, and get you in classrooms for face-toface interaction. The Banzai curriculum supports the learning objectives for the Economics and Personal Finance course required for Illinois high school students. Over 40,000 math, business, family and consumer science, and computer teachers have joined the program nationwide.

Be A Bank Sponsor & SAVE IBA Members who become Banzai bank sponsors receive a 20% discount on new reservations made with schools or with the Banzai direct platform. Banks do not pay for Banzai until a school activates the account. Schools are reserved on a first-come, first-served basis. Email Education@ilbanker.com to confirm school availability. Get started by connecting with Banzai's James Barsdorf at 801-709-3913.

Illinois Bankers Education Services, a subsidiary of the Illinois Bankers Association, is the licensee of The Stock Market GameTM in the state of Illinois. This important program connects students to the global economy with virtual investing and real-world learning. Illinois banks are encouraged to bring The Stock Market GameTM to their local school districts and partner with them to sponsor the program at no cost to the school.

• Contact your local school to see if they participate and, if they do not, connect them with the SMG site to register. • Offer to sponsor teams from your local school (just $10 per team). • Volunteer to help be a mentor or facilitator. • Volunteer/Register to be a judge for the InvestWrite competition, a highly-successful extension of the SMG program designed to help students sharpen critical thinking skills as they compose essays on investment-related topics. • Share your knowledge and expertise with participating classrooms through SIFMA's Invest It Forward program. For more information, connect with Debbie Kerman at dkerman@niu.edu.

The IBA has teamed up with the Association of House of Chicago and BankWork$© to train young adults from low income and minority communities for lasting careers in the financial services industry. This 8-week free training program already has propelled more than 3,000 graduates in the U.S. into rewarding careers with exceptional results, and we invite you to join other area banks as a financial industry partner in this innovative program that expanded to the Chicago area in 2017. Interested? Connect with Sherri Richardson, Association House of Chicago at 773-772-7170.

Harper College

Banking & Finance Apprentice Program

The IBA teamed up with Harper College in Palatine, which is the only community college in the state that qualifies as a program sponsor of Registered Apprenticeship Programs. These programs combine job-related credit courses with structured on-the-job learning experiences, which offer employers the opportunity to strengthen and build their workforce providing a tailored high-quality talent pipeline. Harper currently offers several industry-related apprenticeship programs, including Banking & Finance, Sales & Retail Management, and Cyber Security.

With the industry becoming much more skill-oriented, potential employees are expected to have the training and knowledge necessary to fill these positions. Harper’s Banking / Finance program provides students with these necessary skills to succeed in any specific field of the banking industry.

The Banking / Finance Apprenticeship is a 2-year program with 12-week semesters and classes on Tuesdays and Thursdays. Apprentices work Monday/ Wednesday/Friday and have a dedicated mentor at the hiring company.

Apprentices who complete the Banking / Finance Apprenticeship earn an AAS Degree in Business Administration with a concentration in Financial Management, a certification from the Department of Labor indicating they are fully qualified for their occupation, and at least 2 years of experience. www.harpercollege.edu/apprenticeship/ finance/index.php

Marquette

Commercial Banking Program

Since its inception, the IBA has been represented on the Advisory Board. In the fourth year of the program, it continues to grow. Dr. Kent Belasco has plans for the advancement of the program, and he is under contract with Cognella Publishing to write a textbook for the Introduction to Commercial Banking course.

The Commercial Banking Program at Marquette offers a diverse range of courses, including an entrylevel course in banking, an overview of the primary leadership functions in the banking environment, and a course focusing on risk management and the risk evaluation process which banks engage in as they execute their duties and responsibilities.

Connect with kent.belasco@marquette.edu, 414-288-6882 (office) or 630-817-8270 (mobile), for opportunities to get involved. www.marquette.edu/business/banking

DePaul University

Banking and Financial Services

The John L. Keeley Jr. Center for Financial Services prepares students for a finance career by offering academic tracks within an undergraduate finance major. The center will soon offer the Banking & Capital Markets track, which is based on a multifaceted Student Success Model that includes:

• Cutting-edge curricula within the finance major • Industry-led academies and workshops to further advance professional development and first-hand access to the financial services industry in Chicago • Opportunities for related part-time work and formal internship programs to prepare you for the job market

business.depaul.edu/about/centers-institutes/ keeley-center-financial-services/Pages/FinanceAcademies.aspx

resources.depaul.edu/career-center/ career-advising/communities/businessentrepreneurshipconsulting/Pages/bankingand-financial-Services.asp