Beyond globalisation

The British Virgin Islands’ contribution to global prosperity in an uncertain world

SUMMARY REPORT

A report for BVI Finance

November 2022

The British Virgin Islands’ contribution to global prosperity in an uncertain world

A report for BVI Finance

November 2022

The British Virgin Islands’ contribution to global prosperity in an uncertain world Nina Emmins, Clare Leckie, Rebecca Munro and Mark Pragnell

With research fieldwork support from Kedrick Malone, NorthStar Consulting

November 2022

This report has been commissioned from Pragmatix Advisory Limited and funded by BVI Finance.

The views expressed herein are those of Pragmatix Advisory Limited. They are not necessarily shared by BVI Finance.

While every effort has been made to ensure that the data quoted and used for the research behind this document is reliable, there is no guarantee that it is correct, and Pragmatix Advisory Limited can accept no liability whatsoever in respect of any errors or omissions. This document is a piece of socioeconomic research and is not intended to constitute investment advice, nor to solicit dealing in securities or investments.

Cover image by Joachim Wendler, Adobe Stock.

Pragmatix Advisory Limited enquiries@pragmatixadvisory.com pragmatixadvisory.com

Registered in England number 12403422

Registered address: 146 New London Road, Chelmsford, Essex CM2 0AW

© Pragmatix Advisory Limited, 2022

As we turn the pages to the next chapter, the last few years have taught us that the future though unpredictable at times, can yet be inspiring. Five years ago, the predecessor to this report was described as a “line in the sand”. Few could have predicted how the sands would shift in the intervening years.

Since 2017, we have witnessed one unprecedented event after another: devastating climate events, the Covid 19 pandemic, the war in Europe, global political tensions and geo economic challenges, and more.

Yet, through these extraordinary times, the British Virgin Islands (BVI) international business and finance centre’s resilience has been nothing less than inspiring. The BVI has remained steadfast, attracting companies and individuals from around the world to do business, supporting the domestic economy and enabling investment around the world.

This continued success lies in the expertise and services that the British Virgin Islands offers across the whole lifecycle of a company, from incorporation, through mergers and acquisitions, public listings, privatisation, digitalisation, restructuring, litigation, insolvency, and liquidation. These services are provided by a network of BVI specialised practitioners from the world’s leading corporate firms, trust companies, law firms and accounting firms.

The jurisdiction’s tax neutrality, agile corporate framework, low administrative costs, and strong legal sector have long created the perfect ecosystem to conduct business. The BVI’s commitment to a robust regulatory framework and international standards, in lock step with its dedication to driving innovation in financial services, have also been key components of its success.

The experts doing business in the British Virgin Islands’ international business and finance centre are engaged in the types of substantive, high value transactions essential to the functioning of global markets. Our financial services sector’s ability to remain resilient and prosper while operating in a shifting economic and regulatory landscape has enabled the jurisdiction to remain competitive and consolidate its position as one of the world’s leading offshore centres.

But given the complexities of the work of our international business and finance centre, misunderstandings can arise both at home and abroad about what it is the British Virgin Islands does. For this reason, BVI Finance commissioned independent United Kingdom based economics and strategy research consultancy Pragmatix Advisory to undertake this work.

Beyond globalisation: the British Virgin Islands’ contribution to global prosperity in an uncertain world demonstrates the significant and ongoing contribution we make to the world economy, as well as to employment and government revenues at home. It sets out the ongoing and future challenges we are facing as a jurisdiction, both domestically and internationally.

Our financial services industry and its success were born of globalisation and the benefits of cross border trade and mobility. Still, we recognise those benefits have yet to be universally felt. Pressure has been building since the global financial crisis, and the events of the last five years have only increased pushback. The findings of this report set out three indicative scenarios for the future of globalisation and, in turn, for what the future may look like for the BVI. There are important discussions for us all to have on how we navigate these changes and how best to take advantage of the opportunities that arise. The climate, new

technology, and the rise of digital and economic blocs will all feature heavily in those discussions.

Whatever form the next evolution of globalisation takes, international financial centres like the British Virgin Islands will remain vital cogs in boosting the global economy by enabling investment, facilitating sophisticated transactions, and making for a more efficient global marketplace. To remain a leading offshore centre, however, we will all need to work together to build our future, evolve and innovate, ensuring our offer is just as attractive to clients as it has been for decades.

Elise Donovan Chief Executive Officer BVI Finance Limited

Pragmatix Advisory have been commissioned by BVI Finance to assess the role and value of the British Virgin Islands and its international business and finance centre in the global economy in what are increasingly uncertain times.

This report combines new analysis of official statistics, information and research along with horizon scanning and the results of a major quantitative and qualitative research programme among firms operating in the jurisdiction’s international business and finance centre. There are six key findings.

1. The British Virgin Islands are a constructive, responsive and innovative jurisdiction that supports growth in and helps to resolve challenges facing the global economy

• The islands have been part of the growth story of emerging economies over recent decades. For example, they have established themselves as a respected hub for international investment and trade with China.

• The international business and finance centre is well positioned to serve new and developing digital asset and sustainable markets in a way that is more accessible than ever to clients around the world thanks to the rise of remote working.

• The territory has been instrumental in helping to enforce sanctions implemented in response to the Russian invasion of Ukraine.

2. Despite its relatively small population and land mass, the British Virgin Islands’ economy is sound, balanced, and sustainable.

• The jurisdiction has maintained a sound fiscal position despite the impacts of Hurricane Irma and the global pandemic. Between 2014 and 2020 it has run an average fiscal deficit equivalent to just 0.4 per cent of gross domestic product, and more often than not has been in surplus.

• With gross domestic product of US$43,000 per capita, the jurisdiction’s levels of prosperity are some of the highest in the Caribbean.

• The territory’s economy is remarkably well balanced for its size. Tourism accounts for a quarter of jobs and the international business and finance centre accounts for one in ten Just over half of the islands’ economic output comes from these two industries.

3. The British Virgin Islands is home to a globally respected, unique international business and finance centre

• The territory is one of the largest centres in the world for the incorporation of companies. Home to a cluster of specialist financial, legal and accounting firms, it specialises in the creation of vehicles to facilitate cross border trade and investment and serves clients all over the globe.

• The international business and finance centre directly employs around 2,000 people on islands and supports an additional 2,600 jobs. It generates US$469 million of gross value added for the domestic economy and accounts for two thirds of all government revenues

• Three in five jobs in the British Virgin Islands are held by BVIslanders and Belongers

4. The BVI Business Company is a widely used, respected and dependable vehicle to facilitate cross-border trade and investment

• There are currently just over 370,000 active BVI Business Companies, roughly 45 per cent originating in China. Clients from Europe account for around one in five.

• The assets held by the islands’ vehicles have an estimated total value of US$1.4 trillion. Over half of the value can be attributed to corporate assets.

• Foreign direct investment data shows the important role the jurisdiction plays in the flow of international investment. In 2021 the United Nations found that the British Virgin Islands was the eighth largest recipient and the thirteen largest source of outward flows of foreign direct investment.

5. The British Virgin Islands is a safe and reliable centre which has worked diligently to meet international standards and regulations. It is not a tax haven.

• It has no banking secrecy rules and when compared with other jurisdictions, it performs well in international standards for tax information exchange, transparency, anti money laundering and in its measures to combat the financing of terrorism.

• The territory’s tax neutrality does not make it a centre for corporate profit shifting. A company that is incorporated in the British Virgin Islands is still liable for full taxation in other jurisdictions.

• They are a leading jurisdiction in the fight against financial crime, responding swiftly and proactively to international initiatives to improve transparency and tackle financial crime. The world leading Beneficial Ownership Secure Search system established in 2017 ensures their regulatory and enforcement bodies have access to up to date beneficial ownership information for all BVI Business Companies

6. The British Virgin Islands support jobs, prosperity and tax revenues worldwide through its direct employment, trade and facilitation of cross border business.

• The international business and finance centre has been catalyst for the rapid growth in global prosperity of recent decades

• The territory provides jobs and incomes to 5,000 people from countries in the wider Caribbean region as well as supporting around 12,000 jobs in the United Sta tes through its imports

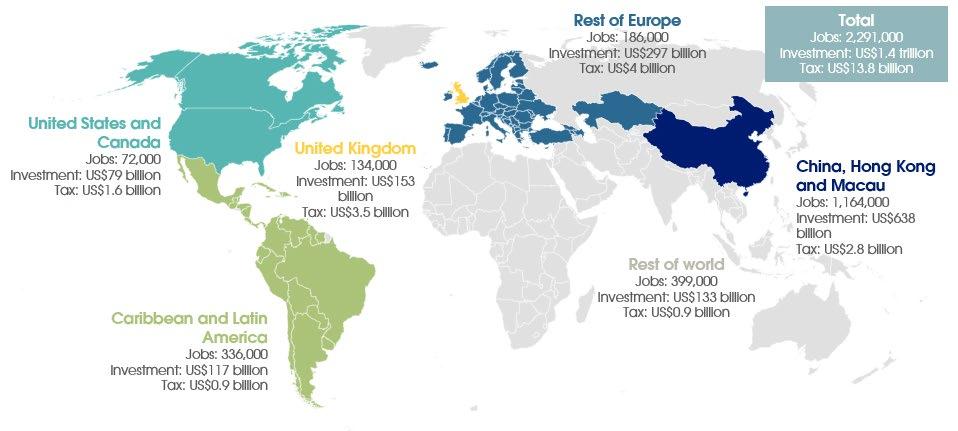

• Investment mediated by BVI Business Companies supports around 2.3 million jobs globally China, Hong Kong and Macao account for nearly half of the employment, with more than one in ten of those employed located in Europe.

• The jurisdiction is a substantial net benefit to governments worldwide due to the scale of its contribution to investment and jobs.

Looking into an uncertain future and beyond the globalisation of recent decades, there are many different scenarios for geopolitics and economics, but the need will remain for expert, neutral and innovative centres, like the British Virgin Islands’, to support cross-border trade, investment and mobility.

Pragmatix Advisory have been commissioned by BVI Finance to assess the role and value of the British Virgin Islands and its international business and finance centre in the global economy in what are increasingly uncertain times.

The development, role and future of the British Virgin Islands as an economy and as an international business and finance centre can only be understood in the context of wider international social, political and economic trends, especially globalisation.

Throughout humanity’s long history, cross border trade and mobility has been associated with improvements in wealth and prosperity around the world. The end of the Cold War marked an acceleration in global trade and a (temporary) period during which the major powers aligned with a rules based system of international cooperation. Strong growth in emerging markets went hand in hand with stable and low inflationary environments in Western economies. All nations gained from this globalisation, but the benefits have not been evenly distributed. Discontent has been steadily building over the past decade or so.

The global financial crisis marked the start of decades of disruption. The 2007/8 crisis sen t shockwaves throughout the world, leaving major economies with large public sector debts necessitating austerity policies, and leading governments to focus on reducing tax evasion and avoidance as a way to raise additional revenues. The economic development and growth of China has both driven global trade in the 21st Century and been fuelled by it, while technology has changed lives, created new business models and posed new problems. The covid pandemic and Russia’s invasion of Ukraine have further fragmented the global economy and saddled governments with more debt as lockdowns hit economic output and jobs around the world and prompted questions for governments and businesses about their longer term dependency on global supply chains. Overall, the three decades since the fall of the Berlin Wall have seen the world change dramatically economically, socially and politically. The scale and patterns of power, prosperity, trade and investment are markedly different and looking to the future, we can expect further change.

The past two decades have seen substantial international cooperation to address cross border financial crime. There are a host of tax information exchange agreements in place and to help fight financial crime, an increasing number of jurisdictions around the world are systematically capturing and recording details of the beneficial owners of companies and other assets and sharing the information with other competent authorities. While some smaller jurisdictions such as the United Kingdom’s overseas territories are being compelled to make their registers public, the implementation by some major nations appears somewhat haphazard and slow. As large nations have sought to restore their public finances, many have looked to reclaim tax revenues that they believe have been lost to other jurisdictions through unreasonable competition, or through avoidance or evasion, using cross border activity. What was initially concern over profit shifting has resulted in big nations imposing a global minimum corporate tax, despite the Organisation for Economic Co operation and Development itself finding that corporate taxes are the most harmful to growth.

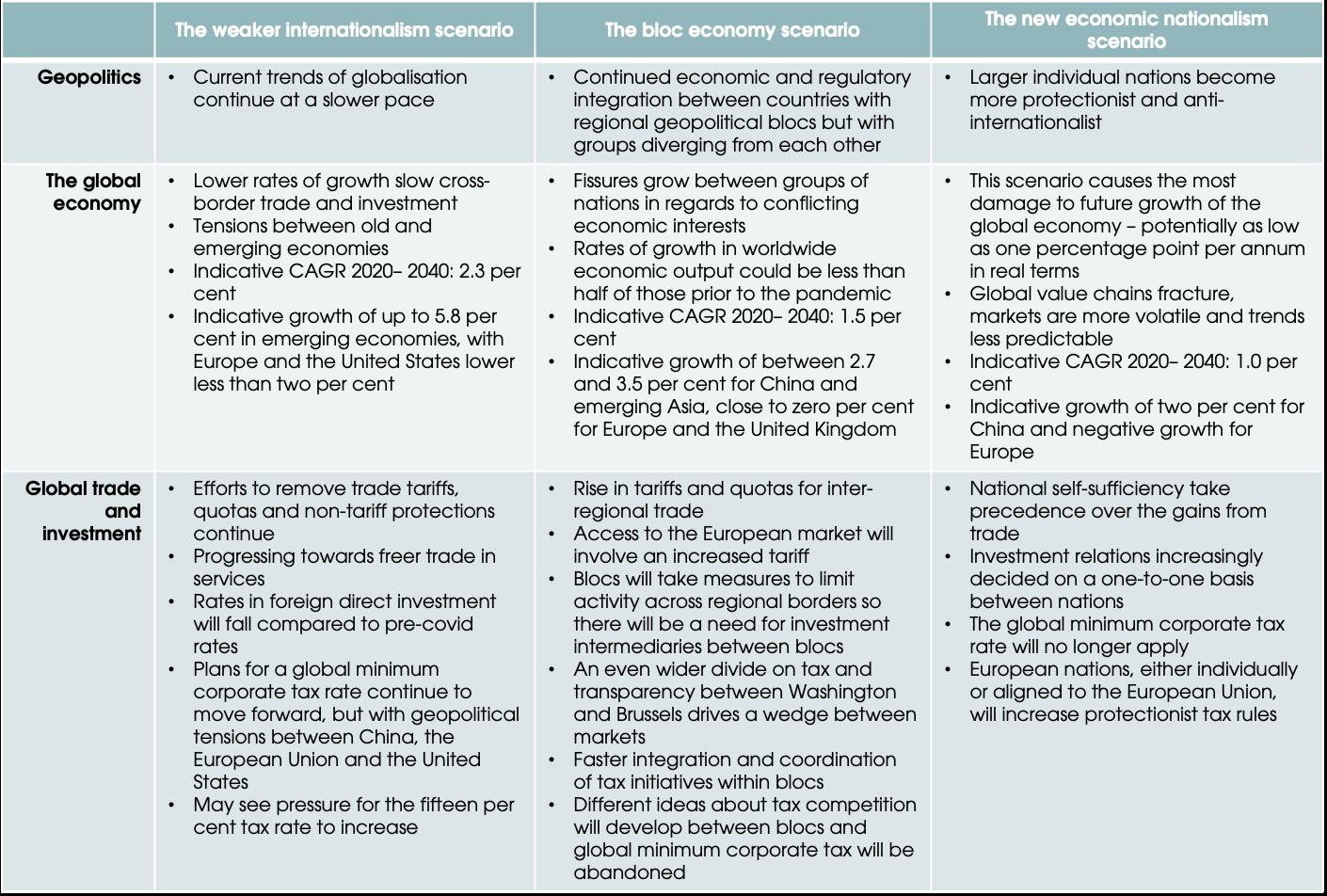

Globalisation is dead. Long live globalisation. The future is uncertain for the global economy, and for globalisation. But the logic of trade, freedom of mobility and globalisation remains even if the trajectory has been changed. To illustrate the range of directions and outcomes, we have developed three narrative scenarios. The first scenario, ‘weaker internationalism’, sees no change in the direction or nature of globalisation but these trends continue at a

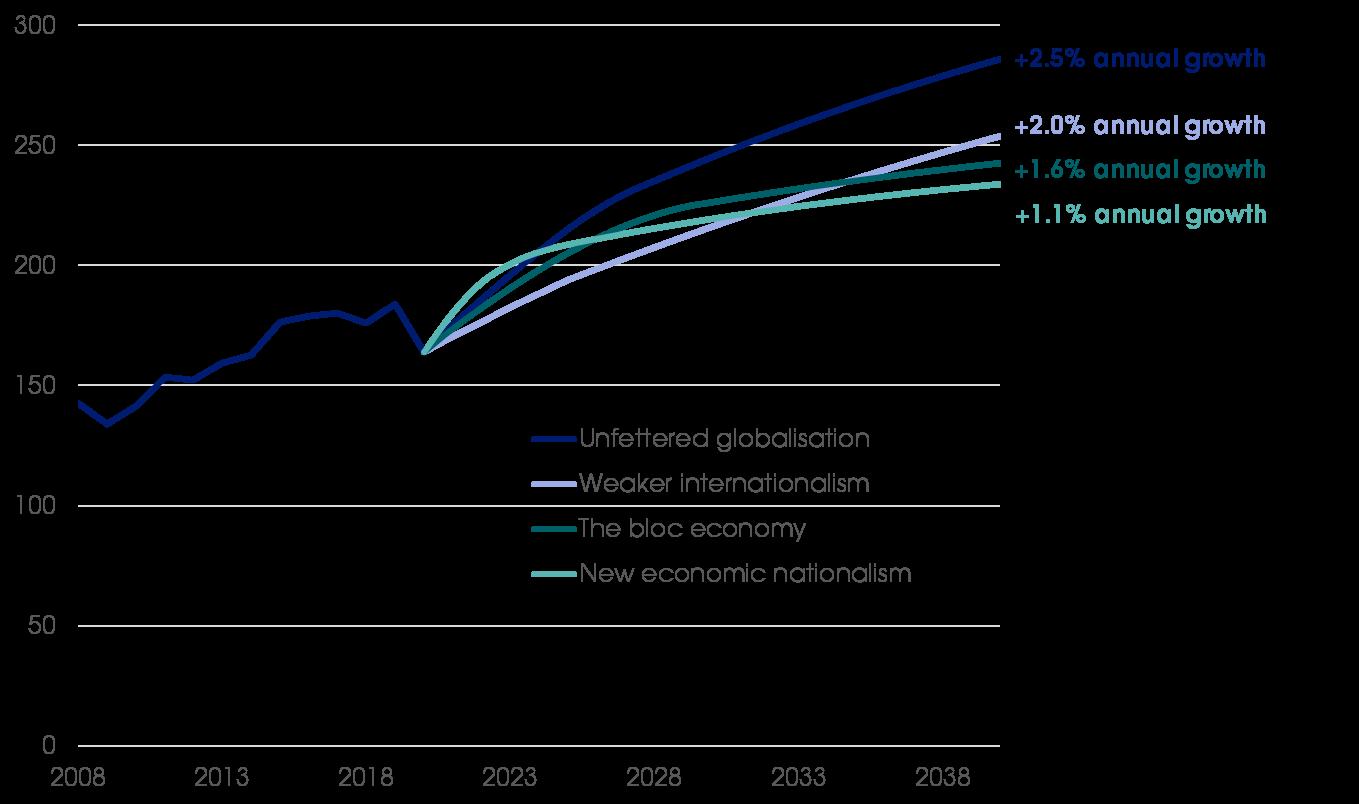

slower pace. It has the most positive outlook for the global economy of our three scenarios, but it still represents a material reduction on historical growth rates. The second scenario, ‘the bloc economy’, envisions continued economic, regulatory and, in some cases, political integration between countries within predominantly regional geopolitical blocs, but with these different groupings diverging from each other. It offers a less positive outlook for the global economy than the weaker internationalism scenario or recent history. The third scenario, called 'new economic nationalism’, sees many of the larger individual nations increasingly go their own way and become more protectionist and anti internationalist. Out of our three scenarios, it would cause the most damage to the future growth of the global economy potentially pushing it as low as one percentage point per annum in real terms. None of our three scenarios for the future will deliver as much growth in the world economy as would have occurred with unfettered globalisation, however. Regardless of the geopolitical and economic outlook, the world faces a climate emergency that will impact on all our futures. Major natural disasters are no longer contained to once in a generation events, and their increasing frequency and severity will have far reaching consequences for the global population.

Source: Pragmatix Advisory

Source: Pragmatix Advisory

International finance centres have evolved in response to the changing needs and demands of individuals, families, businesses, financial institutions and governments with interests, operations, customers, investors or assets in more than one country or jurisdiction. They have developed with and as a result of globalisation, and their futures are inextricably linked to that of the global economy.

International finance centres aren’t all islands and aren’t all offshore. Despite what the term ‘offshore’ suggests, they can be onshore, and they can be large economies Their role has evolved over the decades, originating as offshore ‘safes’ and acting as a place to store assets, then changing as investors sought returns from beyond their national borders. As capital markets became increasingly more global, investors began accessing wider sources of finance and international finance centres were well placed to facilitate global investment flows. Many offshores developed into ‘pipelines’ where cross border transactions between two or more usually corporate parties are structured. Some centres formed regional or global hubs, attracting investment from all over the world and facilitating investment into other regional centres, while others facilitate the provision of capital in developing economies. International finance centres uphold global standards and have responded positively to the various tax and transparency initiatives of recent times, implementing new regulations, reporting requirements and standards. Often, they have reacted better than large nations.

Campaigners frequently misrepresent offshores. Over the years, various reports, articles and books have repeated incorrect information regarding offshore finance centres and created a false narrative of what they do. They have encouraged a belief amongst some members of the population that tax neutral international finance centres support and encourage tax evasion, and that money held there is done so for illicit reasons, but their evidence is often unreliable. Sometimes it has come from anonymous sources many years before the piece is written, and on other occasions the alleged proof of wrongdoing stems from the misinterpretation of official statistics. Tax neutrality doesn’t mean no tax. What it does mean is the jurisdiction itself doesn’t tax the profits or gains of entities resident in the jurisdiction. Those profits or gains are, however, still subject to tax in the location where the assets generate profits and gains. Both the country where an investment is made, and the country in which the ultimate investor is resident can still apply their own tax rules to any returns generated. Where the use of an offshore tax neutral jurisdiction provides a tax advantage, it is more likely due to the tax rules of the onshore government.

We have used our three scenarios to consider the future of international finance centres. Weaker internationalism is the least precarious scenario, nonetheless, the industry must change and evolve. In the bloc economy, demand for services could remain robust b ut international finance centres may struggle to keep simultaneous access to increasingly opposed regimes. A new economic nationalism would damage the global economy the most, however perversely this may reinvigorate the raison d'être for international finance centres and provide a potentially sizeable albeit temporary fillip to their businesses’ revenues. Sustainability is the emerging corporate standard and supporting businesses and governments in tackling the climate emergency, along with the emergence of environmental, social and governance present an opportunity for international finance centres. There is growing competition for new ESG funds with international finance centres around the world competing to host newly established ESG based funds and similar vehicles, and with them the potentially profitable administration, professional services and asset management revenues. There has been strong growth in assets under management within ESG funds and the value of assets invested sustainably is rising.

Illustrative scenario forecasts of the volume of cross border activity, with compound annual growth rates for 2022 to 2040, indexed 2000 = 100

Source:

Pragmatix Advisory

Pragmatix Advisory

As centres for evolution and innovation in the past, international finance centres are ideally placed to meet growing demand for digital assets. They are neutral locations with well established asset holding vehicles which are already attractive to traditional investors. With the total addressable market estimated to be worth up to US$13 trillion by 2030, offshores will need to ensure they have the framework in place to take advantage. 1 The most concerning risks for the future of digital assets are those relating to market integrity and functionality. There is a short history to measure cryptocurrency risk and the history available is peppered with boom and bust cycles. This year like many other stocks, cryptocurrency’s volatility has been steered by the war on Ukraine, inflation and ever changing monetary policies.

1 Ronit Ghose et al, Metaverse and Money (Citi, New York), March 2022. https://www.citivelocity.com/citigps/metaverse and money/ (Accessed 27 October 2022)

The British Virgin Islands, with a population of around 33,000, punch well above their weight with a strong and balanced economy, sound public finances and a respected international business and finance centre. Looking beyond the recent decades of globalisation, there are opportunities, but also threats, to the islands

As a United Kingdom overseas territory, it has some but not all powers. It is self governing and receives no direct funding from the United Kingdom. The political system is a multi party parliamentary representative democracy with independent judiciary and a written constitution. King Charles is sovereign and head of state and is represented on the islands by the locally resident Governor who is appointed by the Crown. The head of government is the Premier, a member of the House of Assembly that is selected by the governing party and formally appointed by the Governor.

Tourism and cross border finance are the pillars of the economy The spread of employment across industries means the Islands have developed a more stable and resilient economy than other jurisdictions of a similar size. The Islands’ economy outperforms most of its Caribbean and Latin American neighbours, with a gross domestic product per capita of around US$43,000, and residents are reasonably prosperous. The jurisdiction provides work and support to other nations in the region, with four in every ten of the 21,000 people working in the territory employed on a work permit.

Employment (2019) and gross value added (2018) by sector, British Virgin Islands, per cent

Source: Pragmatix Advisory and Central Statistics Office *Agriculture and fishing less that one per cent of gross value added and employment

Tourism accounts for a quarter of jobs. The Islands are an attractive destination for visitors from across the world, and there were over a million inbound international tourists in 2016. The sharpest rise in visitor levels across the last decade came as the jurisdiction continued to recover from Irma with a 123 per cent increase year on year to a total of 877,000 visitors. As was the case all over the world, covid’s closure of borders had a significant impact on the territory’s tourism industry, with visitor numbers dropping by two thirds in 2020. However, the

jurisdiction retained its decade long position of being the second most visited destination amongst small island nations in the Caribbean

Volatility in the tourism sector is balanced by the islands’ international finance centre. The territory is home to an internationally established and respected cluster of professional and financial services businesses that specialise in facilitating cross border investment and trade for clients across the globe. The international business and finance centre (including its regulatory agencies) employs around 2,000 people, equivalent to nine per cent of all jobs on the islands.

The islands benefit from sound public finances. A large share of government revenues come from the financial services sector. With little or no recourse to United Kingdom resources, the Islands are fiscally self reliant. To fund the running of the public services, the territory levies taxes on residents, visitors and businesses with local operations and charges fees on the establishment and maintenance of international businesses registered there

Over half of government revenue comes from financial services. In 2020, the Financial Services Commission collected US$217 million from the international business and finance centre on behalf of the government, retaining 12.4 per cent of this collection. The US$190 million due to the government was equivalent to 56 per cent of total government revenue. The territory tends to run a relatively small deficit, and in less turbulent years often runs a surplus. Borrowing is minimal, with any government loans usually tied to specific capital expenditure projects In the wake of Hurricane Irma, the Government of the United Kingdom did not provide the Government of the Virgin Islands with any direct funding to support recovery, only the promise of a loan guarantee.

The jurisdiction’s fiscal position has been and continues to be managed prudently. This is despite significant external events including natural disasters and the global pandemic causing turmoil. Hurricane Irma hit the British Virgin Islands on 6 September 2017 with wind speeds of up to 185 miles per hour. Four people lost their lives, 125 were injured and twenty per cent of the population were displaced from their homes. Following Irma, approximately 3,000 people, ten per cent of the overall population, emigrated. The hurricane caused damage to the islands valued at US$2.3 billion.

The economy was hit by the covid pandemic with a 73 per cent drop in visitors. Early border closures limited the health impacts, but the tourism sector unsurprisingly suffered disproportionately. As cruises and flights were suspended, income from visitors dried up, with the impact of the pandemic on tourism exceeding that of Hurricane Irma. Air arrivals and stopover visitors decreased by 73 per cent in 2020 compared with 2019, positioning the islands in the five worst affected countries in the Caribbean. Indeed, there were more overnight visitors in 2018, when the islands were rebuilding after 85 per cent of buildings had been damaged, than in 2020 and 2021 combined.

The BVI is a globally significant finance centre Over the past four decades, Road Town has been home to a cluster of global, regional and local firms that constitute the international business and finance centre. Collectively, these firms facilitate clients conducting cross border trade and investment, while working within the parameters of a highly respected business c ompany law. This activity has centred around the use of a specially developed company vehicle, the BVI Business Company, and its predecessor

A BVI Business Company is a legal stricture, not a business. It is important to avoid confusing or conflating businesses with companies. Businesses have active operations which typically

generate revenues from customers and incur costs to suppliers and employees. In contrast, companies are a form of contractual relationship established with their own independent legal personality; these operate within the parameters of the incorporating jurisdiction’s prevailing company law, while their constitutional documents set out agreed articles and prescribe the roles, rights and obligations of various stakeholders, such as equity shareholders. Many, but not all, businesses are established as companies, but not all companies are businesses.

BVI Companies have pedigree. They have their origins in the International Business Companies Act, 1984, which built on but enhanced Delaware company law. Many BVI Business Companies are dynamic and active businesses, which trade and operate in the same manner as their onshore counterparts. But most do not have business operations and instead are legal structures to facilitate efficient and effective cross border cooperation, investment and trade. They include some of the largest and most valuable holding companies, multinational companies and joint venture companies in the world.

There are 370,000 active BVI Business Companies. The jurisdiction has a lot of companies for its size and is a major offshore incorporator, but is nowhere near as large as some onshore nations. The entities represent 370,000 legal contracts, not businesses. The number of active companies has fallen in recent years, but that partly reflects the changing use of BVI Business Companies.

Corporate service providers contribute US$136 million in GVA. Their main role is to establish and maintain BVI Business Companies, trusts and other vehicles on behalf of their global clients. 2 The sector employed over 800 people, contributing US$136 million in gross value added and paying US$220 million in fees and taxes in 2019.

Law firms contribute US$185 million in GVA. Professional services, including legal, insolvency and accounting firms, employed almost 700 people in 2019, contributed US$242 million in gross value added and paid US$15 million in taxes. At approximately 60 per cent, the largest share of their revenues c omes from corporate clients, while private wealth clients account for fourteen per cent. 3

The jurisdiction is not a major location for offshore banking. Local providers are focussed on domestic customers – albeit these include the businesses in the international business and finance centre. In 2019, the banking sector employed over 250 workers, contributed US$49 million in gross value added and paid US$5 million in taxes.

The economic contribution of the cluster domestically is not as big as other finance centres. In comparison to other international finance centres and with respect to the business and financial services contribution to total gross domestic product, the British Virgin Islands are more balanced than jurisdictions such as Bermuda, the Cayman Islands and the Crown Dependencies.

The centre supports 4,500 jobs overall. The economic contribution extends beyond the direct activity of the businesses in the cluster themselves. There is the indirect impact from those firms’ expenditure on local suppliers. In addition, there is the induced impact resulting from employees in the centre spending their wages in the local economy. As their earnings tend to be greater than those in other sectors, there is a strong jobs multiplier effect here.

2 Financial Services Commission, Registered Agents (Financial Services Commission, Road Town), 2022. https://www.bvifsc.vg/regulated entities registered agents?combine=&field_entity_status_tid%5B%5D=72 (Accessed 28 October 2022)

3 Mark Pragnell et al, Creating Value: The BVI’s Global Contribution (BVI Finance, Road Town), June 2017. P112

Factoring in the indirect and induced impacts of the international business and finance centre, the sector supports over 4,500 jobs. This is equivalent to one in five jobs in the territory

Its overall contribution to GVA is over half the jurisdiction’s total. The international business and finance centre contributes US$470 million directly to gross value added. Combined with indirect and induced gross value added, this is a total close to US$780 million, representing over half of the territory’s gross value added.

Real gross value added by economic activity, British Virgin Islands, US$ billion (2021 prices)

The international finance centre supports the territory in times of crisis. In both the aftermath of Irma and throughout covid, demand for the islands’ cross border financial services have remained robust, while the operations of the cluster have been resilient. Business incorporations increased by 25 per cent from the third quarter of 2017 to the third quarter of 2018, with all 2018 quarterly levels above those in 2016 and 2017. In terms of pre hurricane levels, the total number of new incorporations in the third quarter of 2017 decreased by less than two per cent, exemplifying the durability of the finance centre.

The Islands’ judiciary and regulatory authority is well-established. The legal system is based on English Common Law, with right of appeal to the Privy Council in London. It is well developed with the Eastern Caribbean Supreme Court Commercial Division and Arbitration Centre in place. The Financial Services Commission is a well established and respected regulator of the financial services sector.

The territory is open to new advances in digital technologies. Across the international business and finance centre, measures have been taken to welcome and support new technologies and the opportunities they bring. Legislation has been implemented to both encourage and manage the growth in digital asset holding in the jurisdiction.

Without the cluster, the islands would be much less prosperous. Gross value added would be substantially lower, the government would need to borrow to finance services, and public debt would quickly grow. Over the past four decades, the changing industry mix, with increasing employment in the offshore cluster and other service based activities, has proven positive for the economy. The growth in financial services and its associated businesses has been a boost to household incomes, economic activity and consequently, the public purse.

Given the current economic split of industries, the jurisdiction is more prosperous to the tune of nearly US$8,000 per resident with its offshore cluster than without.

The BVI is a tax neutral jurisdiction, not a tax haven. Residents and domestic businesses are required to pay a variety of taxes, including on their payroll, property and goods and services. However, the Islands’ policy of tax neutrality means that local taxes are not levied on transactions conducted by a business company or assets held in vehicles undertaking economic activity elsewhere. This has no bearing on tax liabilities in other jurisdictions but does avoid companies facing double taxation.

It is transparent and shares information with international law enforcement. The jurisdiction has a domestic framework in place to ensure its regulatory bodies have access to the beneficial ownership information of people using BVI Business Companies. The jurisdiction is also a member of several global initiatives to address tax evasion.

BOSSs is a central database of beneficial owners. The Beneficial Ownership Secure Search system stores the details of beneficial owners of registered companies and certain other entities in a central database, accessible to domestic law enforcement, regulators, and international partners Law requires that registered agents verify this information and carry out customer due diligence, with enhanced requirements for politically exposed persons.

A public register of beneficial owners will be introduced next year. Despite legitimate concerns raised by international business and finance centres regarding the risks to privacy and security, the British Virgin Islands has committed to introducing a public register of beneficial owners by 2023 in line with adopted international standards. This register will make the names of business owners and ultimate beneficiaries publicly accessible

The territory is helping to implement international sanctions. The strength of the islands’ transparent system was demonstrated throughout 2022 as it was able to help onshore jurisdictions to deliver on their judicial mandates against Russia where their own systems proved insufficient to trace ultimate beneficial owners. Previously, the territory has helped larger countries uphold sanctions against Iran, and more recently against Belarussian nationals and companies due to the country’s role in the invasion of Ukraine.

The Islands’ links with data hacks reflect geography, not wrongdoing. The jurisdiction has been associated with various database hacks in recent years, but this more a reflection of the geographical nature of the hacked organisation. Often the stolen data refers to historic companies that are no longer active or are not necessarily used for any illicit behaviour.

The territory has introduced economic substance requirements. For a business company to have ‘economic substance’ it must have adequate presence in and/or carry out its economic activities in the jurisdiction in which it is tax resident. The jurisdiction has introduced economic substance requirements in response to obligations set out by the European Union and Organisation for Economic Co operation and Development to prevent harmful tax practices and profit shifting.

The process of strengthening the system is ongoing. In July 2022, further amendments to the BVI Business Companies Act, 2004 were brought to the legislature and will be implemented on 1 January 2023. This includes changes concerning directors, financial reporting requirements, bearer shares and the removal and restoration of BVI Business Companies.

The jurisdiction is dealing with the consequences of the Commission of Inquiry. Enacting the recommendations from the inquiry into governance standards in the islands’ public services are ongoing, but there are reasons to be positive. The inquiry raised no concerns about the international finance centre, the United Kingdom did not impose direct rule, and a new unity government was put in place quickly.

Correspondence banking is causing problems. A specific concern is the implications of current macroeconomic trends on the risk appetites of onshore banks and their regulators. Although the islands use the dollar as their currency, banks in the territory do not have direct access to United States’ clearing regime. Instead, they operate correspondent banking with established Stateside clearers to ensure access to the global system. After the global financial crisis of 2007/8 and the increasing scrutiny of banks by regulators, many institutions took a less favourable view of correspondent banking partnerships, and of the Latin America and Caribbean region more generally, as they looked to de risk. Large North American banks have ceased such operations in the region over the past few years based on strategic risk management calls made at their group headquarters. They are not grounded in any specific risks related to doing business in the jurisdiction but nonetheless have significant consequences.

Weaker internationalism will require evolution. Where pre pandemic globalisation trends continue but more slowly and with greater turbulence, the islands’ offshore cluster is under no immediate threat. It will, however, need to evolve and innovate to respond to an increasingly competitive market, especially for volume incorporations. Sustainability and success will depend on continuing the shift away from the historical business model which focused on increasing volumes of incorporations, towards providing a wider and deeper range of higher value advisory and other professional services.

The bloc economy will limit the choice of markets. Where increasingly integrated geopolitical groups of nations diverge from one another, the islands’ government as well as the businesses in the international business and finance centre face tough choices. It becomes harder to face all markets simultaneously. The costs of compliance with European Union rules make services too expensive for Asian and American customers, while the different blocs take measures to limit activity across regional borders. There will be a role for trade and investment intermediaries between blocs; given its existing global reach, the territory could become such a centre. But this is neither certain nor without risk. Alternatively, the territory must choose between blocs.

A new economic nationalism could provide an initial boost to business. Where individual nations are increasingly protectionist, the global economy is damaged most but the prospects for the territory may be comparatively good (at least initially). Offshore expertise is likely to be sought after as cross border transactions become more complex and costly, and the islands’ long history and global breadth of experience will be appealing. Fee rates rise as offshore intermediation becomes more complicated and valuable to clients overwhelmed by an increasingly complex international business environment. It is likely that more convoluted cross border structures will require more incorporations in offshore territories.

The realpolitik of international relations is an imbalance of power in favour of the large nations and against small island jurisdictions. The British Virgin Islands have limited (and, all too often, no) influence over the international rules, standards and protocols within which it has to operate. Over recent decades, authorities and businesses on the islands have willingly, positively and proactively responded to the requirements of larger nations in relation to anti money laundering, tax transparency and economic substance; they have led the world with

the creation of the BOSSs ownership register. However, the demands haven’t ended there with ongoing pressures to implement a publicly accessible register of beneficial ownership and adopt a global minimum rate of corporate tax. Neither have a sound basis in the international fight against crime, tax evasion or tax avoidance.

Technological advancements will bring opportunities and risks to the jurisdiction and its international business and finance centre. With the ongoing expansion of the digital world and remote ways of working, geographical barriers will continue to erode. Digital connectivity makes the jurisdiction’s financial services industry and the services it provides accessible to clients all around the world, and as investors in developing markets look to expand their portfolios across borders, the jurisdiction is ideally placed to meet those needs.

The incentive to tackle the negative impacts of climate change hits particularly close to home for the British Virgin Islands. Ecologically fragile, the small island state is ground zero for the catastrophic risks of intense hurricanes, rising sea levels and torrential rainfall. The tourism industry in the British Virgin Islands and the jobs that rely on the visitor economy are already threatened by rising sea levels, flooding, drought, erosion, and coral and sargassum bleaching. 4 Recognising this, the jurisdiction is well placed to position itself as a centre for green finance with a genuine interest in supporting the cause.

The British Virgin Islands is an attractive location in which to conduct cross-border investment and trade thanks to its robust legal framework, its regulation and compliance in line with international directives, and its cohesive and cost effective administration. The international business and finance centre supports substantial global flows of investment that support jobs throughout the world.

The islands are a significant intermediary for foreign direct investment. The jurisdiction is the thirteenth largest source of outward flows and the eighth largest recipient globally. At US$1.6 trillion, global flows of foreign direct investment returned to pre pandemic levels in 2021 while the total stock reached a record US$45 trillion. 5

BVI Business Companies hold an estimated US$1.4 trillion in assets. Although the rationale for choosing the islands’ international business and finance centre remains largely consistent for prospective and existing clients across the world, there are specific attractors for cross border investment and trade which vary for clients on a regional level.

Examples of why international clients choose to use the British Virgin Islands' international business and finance centre

Source: Pragmatix Advisory

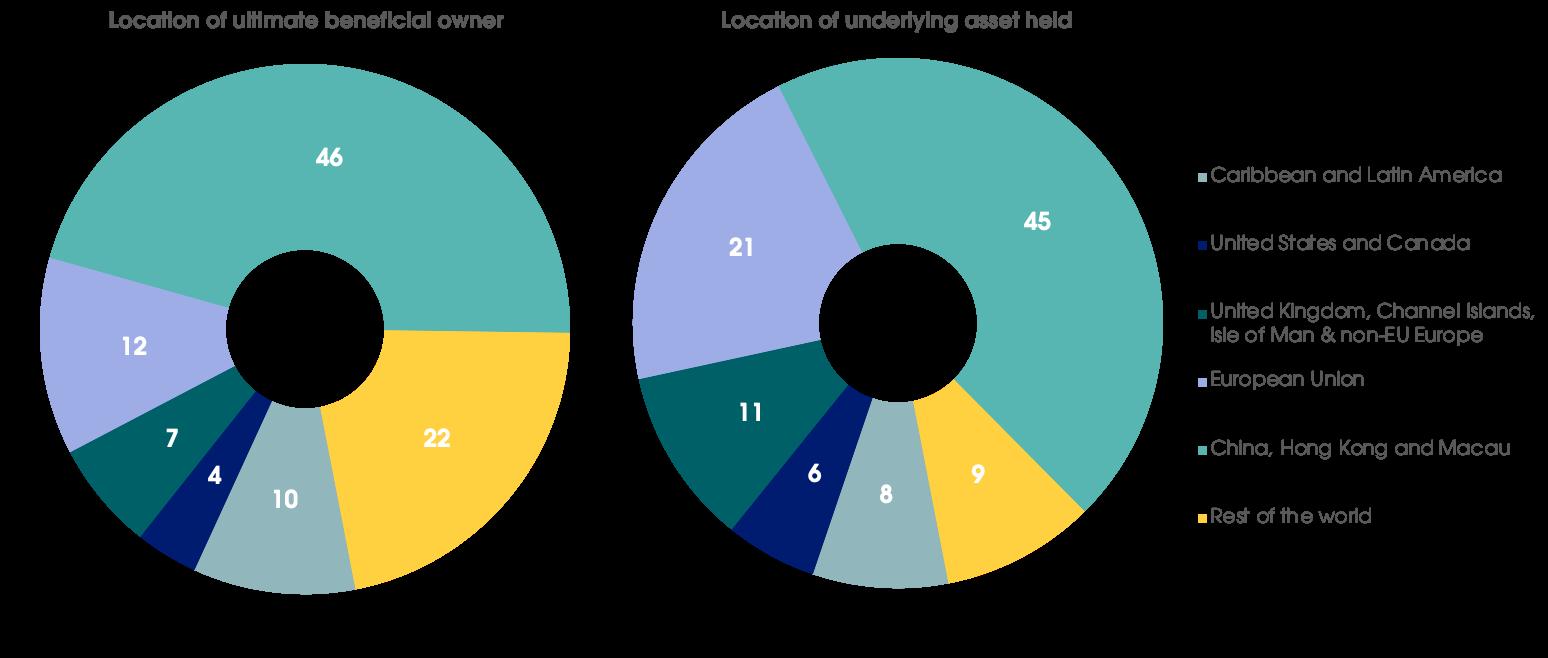

Territory is favoured by businesses in Asia. A majority of BVI Business Companies have ultimate beneficial owners in Asia, with over two-fifths located in mainland China, Hong Kong and Macau. Around a fifth originate from Latin America and the Caribbean. Beneficial owners from the European Union account for less than one in ten, while the those from the whole of Europe and North America combined represent sixteen per cent of the BVI Business Companies. Chinese owners account for just under half of the estimated total value of assets, and a similar value of these assets are themselves located in China (46 and 45 per cent respectively). Businesses, institutions, charities and individuals in the European Union are beneficial owners of an estimated twelve per cent of the total value – whereas 21 per cent

5 United Nations Conference on Trade and Development

of the asset value is located there. The equivalent shares for the rest of Europe (including the United Kingdom) are seven and eleven per cent respectively.

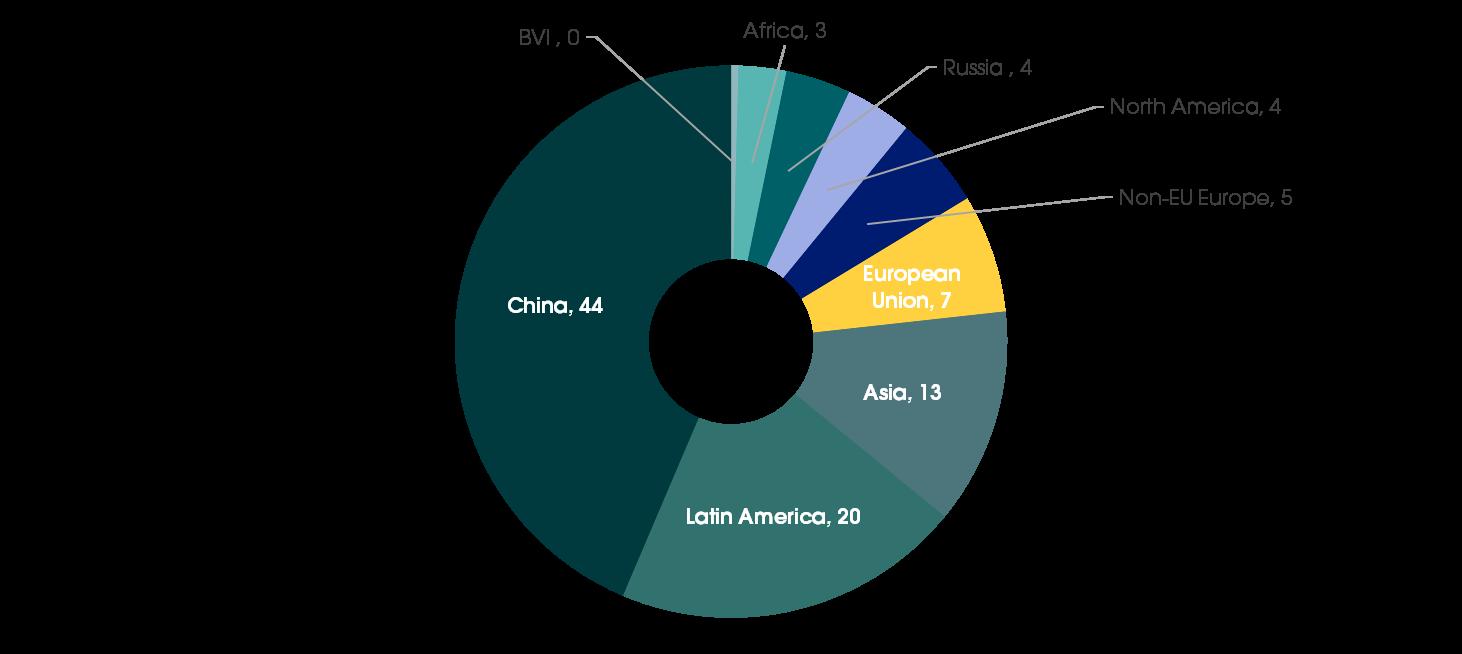

Estimated share of active BVI Business Companies by location of ultimate beneficial owner, 2022, per cent

Note: ‘China’ refers to China, Hong Kong and Macau; ‘Latin America’ refers to Caribbean, Central America, Mexico and South America; ‘Asia’ refers to Asia and Pacific Region (excluding China, Hong Kong, Macau and Central Asia); ‘Non EU Europe’ refers to Non EU Europe, United Kingdom, Channel Islands and Isle of Man; ‘North America’ refers to United States and Canada; ‘Russia’ refers to Russia and Central Asia; ‘Africa’ refers to Middle East, North Africa, and Sub Saharan Africa. Source: Pragmatix Advisory industry survey, 2021/22

Estimated underlying value of active BVI Business Companies by location of ultimate beneficial owner and by location of underlying asset held, 2021, per cent

Note: ‘China’ refers to China, Hong Kong and Macau; ‘Non EU Europe’ refers to Non EU Europe, United Kingdom, Channel Islands and Isle of Man; ‘North America’ refers to United States and Canada; ‘Latin America’ refers to Caribbean and Latin America; ‘Other’ refers to the rest of the world. Source: Analysis of Pragmatix Advisory industry survey, 2021/22

The majority of companies are used for cross border structuring. BVI Business Companies that support the efficient structuring of cross border corporate groups are responsible for over half of the value of assets mediated through the jurisdiction while accounting for less than one in four of the 370,000 entities. Investment related business, including funds and portfolio investment activity, corporate joint ventures and listings, account for around a third of total value and a quarter of the number.

Estimated underlying value of active BVI Business Companies by primary purpose (outer ring) and estimated share of active BVI Business Companies by primary purpose (inner ring), 2021, per cent

Note: ‘Corporate’ refers to corporate group structuring; ‘Trusts’ refers to family, trust and succession planning; ‘Real estate’ refers to real estate holding; ‘Investment business’ refers to investment business, joint ventures, listing and vessel or aircraft registration. Source: Pragmatix Advisory industry survey, 2021/22

Companies make popular listing vehicles on international stock exchanges. Eleven BVI Business Companies are listed on the Hong Kong Stock Exchange, with the first added in 2010 following the exchange’s decision to add the territory to its list of approved jurisdictions. 6 In March 2018, 25 BVI Business Companies were listed on the Alternative Investment Market and ten on the Main Market of the London Stock Exchange. In the United States at the same point in time, Nasdaq counted 29 BVI vehicles on the New York Stock Exchange 7 They can also be found on the Toronto Stock Exchange, the Singapore Exchange and the Australian Stock Exchange. The islands are also an appealing jurisdiction for entities wishing to structure their investment funds. Indeed, it is the second largest offshore jurisdiction for hedge funds in the world. 8

Vehicles are commonly used for asset holding, too. A variety of assets are held in BVI Business Companies and cross border investment involving real estate, vessels and digital assets will typically use a special purpose vehicle, which can hold a single asset or a portfolio and provides investors with the reassurance of limited liability. One fifth of BVI Business Companies are used primarily to hold real estate, representing one twentieth of total asset value. Despite significant recent growth, given their infancy, only a small proportion of BVI Business Companies are focused on holding digital assets. They represent two per cent of BVI Business Companies and just one per cent of total asset value.

The legacy of private wealth management remains. The services offered by the jurisdiction often attract the business of expatriates and internationally mobile individuals. High net worth individuals still see the islands as an attractive centre in which to hold and manage assets, but while privacy and security remain significant considerations, they are no longer main drivers. Almost a third of entities are used for personal and family wealth, trusts and

6 HKEX, List of overseas jurisdictions where securities of companies incorporated therein have been accepted for trading on the Exchange (HKEX, Hong Kong), 2022. https://www.hkex.com.hk/Listing/Rules and Guidance/Listing of Overseas Companies/List of Acceptable Overseas Jurisdictions?sc_lang=en (Accessed 28 October 2022)

7 Global Legal Insights, Initial Public Offerings 2018

8 Robert Briant et al, British Virgin Islands Investment Funds (Conyers, Road Town), 2022. https://www.conyers.com/services/legal services/investment funds/british virgin islands investment funds/ (Accessed 28 October 2022)

succession planning purposes but these account for only six per cent of the US$1.4 trillion total value. The British Virgin Islands is also a leading jurisdiction for private trust companies, with over a thousand on its register.

The Islands provide employment for people from the wider Caribbean region. There were around 9,000 work permits issued to workers not originating from the BVI in 2019, including 5,800 from the Caribbean. 9 Moreover, the BVI’s residents and businesses imported US$1.55 billion in goods and services in 2019. 10 With the bulk sourced from the United States, imports were estimated to be supporting around 12,000 jobs there in 2017. 11

Investment activity mediated sustains significant economic growth. We estimate that assets held in BVI Business Companies are equivalent to four per cent of all sectors’ total cross border banking liabilities 12 and 1.5 per cent of annual global gross domestic product 13

Two million jobs worldwide are supported by the mediated assets. The islands’ real-world economic impact is spread widely across the globe, with an estimated ⅓ million jobs supported in the Latin America and Caribbean region, and close to a further million supported in China. The Western economies benefit too, with around 400,000 jobs supported across North America and Europe. The economic activity and incomes generated by 2.3 million jobs will likely contribute over US$14 billion a year to public sector revenues around the world. Governments in Europe alone are estimated to benefit by around US$7.5 billion annually. There will be some tax lost from larger nations through the use of offshore vehicles such as those incorporated in the islands, but the scale of these losses has been evaluated before and shown to be small – especially when considered against the benefits of investment mediated via the jurisdiction.

9 Data provided by BVI Central Statistics Office on 22 September 2022

10 The Observatory of Economic Complexity, Trade data (The Observatory of Economic Complexity, Boston) 2022. https://oec.world/ (Accessed 28 October 2022)

11 Mark Pragnell et al, Creating Value: The BVI’s Global Contribution (BVI Finance, Road Town) June 2017. P127

12 Bank of International Settlements, BIS international banking statistics and global liquidity indicators at end March 2022 (Bank of International Settlements, Basel), 28 July 2022. https://www.bis.org/statistics/rppb2207.htm (Accessed 28 October 2022)

13 World Bank, Gross domestic product (World Bank, Washington), 2022. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD (Accessed 28 October 2022)

There would be consequences if the international business and finance centre didn’t exist. Much of the investment mediated through it would likely happen anyway but there would be adverse consequences. The US$1.4 trillion would divide between investments that, in a world without the British Virgin Islands, would otherwise be mediated through jurisdictions with higher costs than the islands, be mediated through jurisdictions with lower costs than the islands, or not happen at all. It is not clear how much of the investment would fall into each of these three but we can consider the implications.

The costs to businesses would be higher, but other factors are more important than low incorporation fees The territory is not the only tax neutral jurisdiction with sound government, respected law and a well developed cluster of financial and professional service providers. The three Crown Dependencies, for example, also offer a common law framework and access to the British legal system, including the right of appeal to the Judicial Committee of the Privy Council. But costs in Jersey, Guernsey and the Isle of Man are higher than in the Caribbean and only certain categories of activity conducted in Road Town would be able to bear them. Alternatively, investors could use offshore jurisdictions which have lower costs. The British Virgin Islands are cost effective, but they are not the cheapest centre; there are a number of locations where international businesses can be incorporated and run at a lower cost. Typically, these jurisdictions have one or more characteristics that may differentiate them from the British Virgin Islands in the minds of investors, including no access to the British legal system, limited track record of high value dispute resolution and/or predictable jurisprudence, short history of sound government and financial regulation, idiosyncratic or unwieldy company law or limited expertise and capacity in local service providers.

The BVI meets international standards. Many of the lower cost centres have not kept pace with the Government of the Virgin Islands in the adoption of international standards for transparency, tax information exchange, anti money laundering and combatting the financing of terrorism. And some, like Delaware, have wide networks of double taxation agreements that may fa cilitate corporate profit shifting. For some investors, its combination of cost effectiveness, sound common law and local specialist expertise will not be matched in other jurisdictions. Here, investors will opt instead for domestic opportunities with, presumably, lower returns while the recipients of the investment, often in developing countries, will either go without or have to pay more.

The globalisation of the post Cold War period, and the stability and certainty it brought, is over But cross border trade, mobility and investment will continue and likely grow (albeit more slowly than over recent decades). The role of the islands will expand both in size and nature and the different scenarios for geopolitics will place new demands on investors and their agents

Globalisation scenarios summary

Source: Pragmatix Advisory

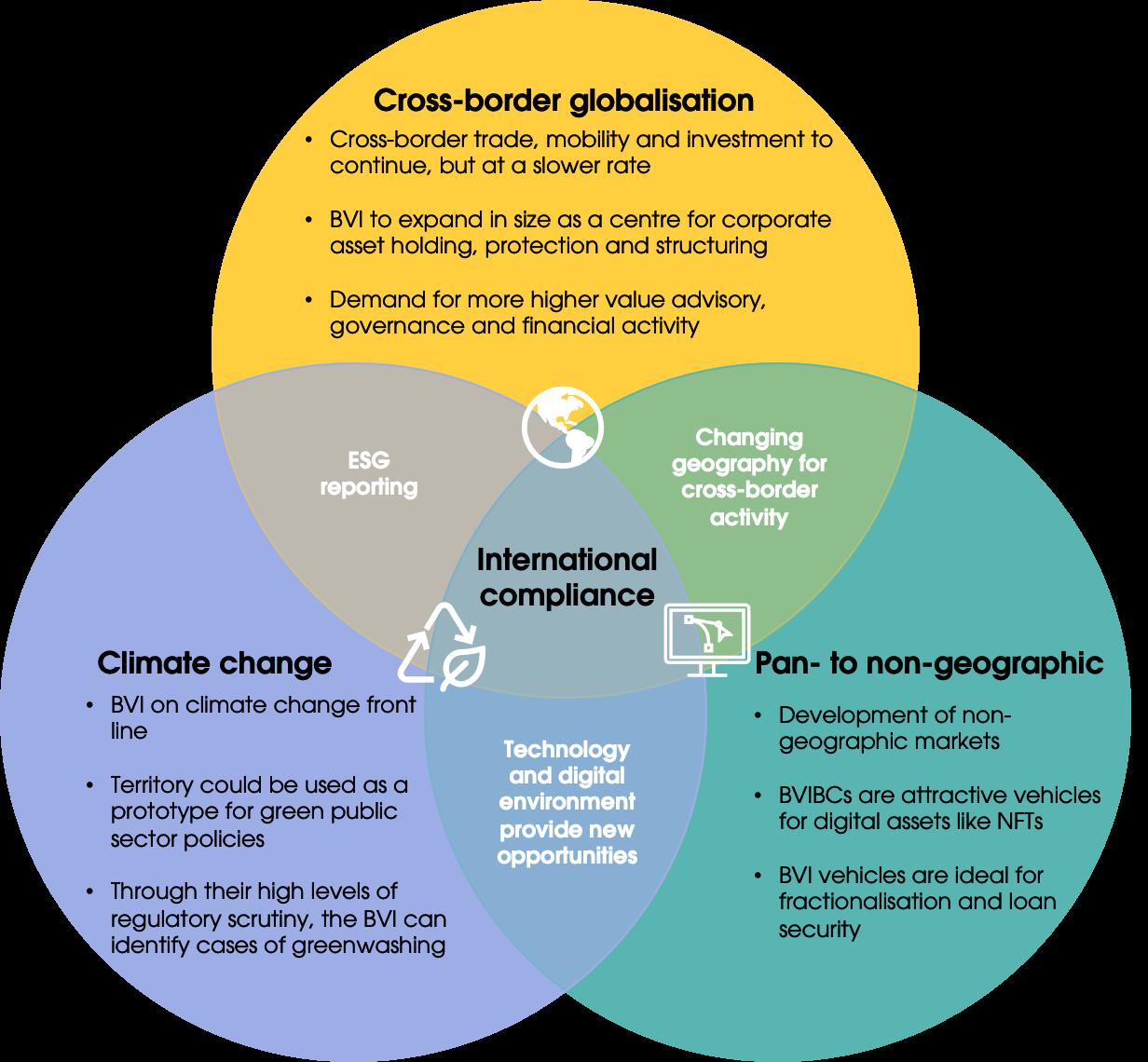

Markets are developing and evolving that are in many respects non-geographic. The international business and finance centre is well placed to serve these markets Technology and the digital environment provide potential new opportunities for the islands’ ongoing contribution to the global economy.

As an island territory under regular threat from hurricanes, the territory is on the climate change front line. The international business and finance centre is well placed to support the fight against climate change, as well as respond constructively to evolving social values worldwide.

The role of the British Virgin Islands in the changing global environment

Source: Pragmatix Advisory

Source: Pragmatix Advisory

It is in the interest (and the responsibility) of the United Kingdom government and the taxpayers they represent to nurture and support the ongoing development of Road Town’s international business and finance centre. Without the cluster, the islands’ economy would be weaker, less resilient and less able to support its own public services or raise funding for needed public investment.

Efforts to restrict the use of tax neutral and well run international finance centres in order to fight tax evasion and avoidance or bolster onshore tax bases are not only groundless, they are an act of economic and fiscal self-harm.

BVIslanders

• The IFC supports the economy, provides jobs and makes the territory more prosperous

• The jurisdiction’s levels of prosperity are some of the highest in the Caribbean

• Without the international business and finance centre, public spending would be less

• Tourism isn’t sufficient to make up the shortfall if there was no international business and finance centre

• Climate change will continue to impact Islanders and the economy

Government of the Virgin Islands

• The international business and finance centre supports the economy, provides jobs and makes the territory more prosperous

• The BVI has a balanced and sustainable economy

• Without the international business and finance centre, government revenues would fall. The islands don’t have the population or the geographical area to support industries that could replace the revenues from financial services

• Addressing the Commission of Enquiry recommendations is essential to ensure the independence and prosperity of the jurisdictionn

International business and finance centre

United Kingdom government

• The global environment both geopolitical and climate are changing, and the industry will need to respond and adapt

• The time of mass incorporations is over, and a new higher value type of business will need to be sought

• The changing global landscape brings opportunities as well as risks

• The Commission of Enquiry found no wrongdoing by the international business and finance centre

• The BVI is a balanced, sustainable and self sufficient economy

• The territory’s tax neutrality does not make it a centre for corporate profit shifting

• The jurisdiction has maintained a sound fiscal position despite the impacts of Hurricane Irma and the global pandemic

• Without the international business and finance centre, significant revenues would be lost, potentially requiring the BVI to be subsidised by the United Kingdom

International policymakers and opinionformers

• The BVI is a safe and reliable centre which has worked diligently to meet international standards and regulations

• The BVI has been at the forefront of implementing new global initiatives, and is committed to establishing a public register of beneficial ownership by the end of 2023

• The BOSSs system has been instrumental in aiding the implementation of sanctions since Russia invaded Ukraine