MARY HOLM’S TIPS HEY, PAY ME MORE! GET RICHER Frances Cook explains Martin Hawes: It's all How to get the best how to get a pay rise about risk and reward out of term deposits

608002 9 772744

ISSN 2744-6085

NZ$11.95 INC. GST

Will your properties still be profitable after the tax changes? opespartners.co.nz WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2

The government tax changes will significantly impact property investors who own existing properties. From 1st October, the government’s interest deductibility tax changes started to come into effect. Investors will pay more tax on some properties, and this new reality will change the types of properties Kiwi investors choose to buy. Here’s what that means for you as a property investor. Any properties within your portfolio will gradually start to pay more tax. Once fully implemented, a property with a $600,000 mortgage will be about $5,000 worse off per year. While your properties might be cashflow positive now – providing a small passive income – you may soon need to top-up their bank accounts. But there are strategies you can use to avoid being punished by the new changes. Government announcements suggest that New Builds will not be impacted by these changes. With no extra tax paid, newly built rental properties will soon have a significant tax advantage compared to other properties on the market. This may make New Builds a more practical investment for you if you want to get ahead and earn the flexibility to live life on your terms. Opes Partners’ Finds New Builds Properties For Investors You can view New Build investment opportunities from developers around New Zealand when using Opes to find your next investment property. This includes projects from developers with a national brand name and smaller organisations that only the locals know. • Investment properties sourced from 47 different developers • 63 projects currently under construction • We find investment opportunities across the country • Investment recommendations based on solid economic analysis • The New Build-finding service is provided complimentary. We are paid by the developer when we find the right investment property for you.

The simplest way to become a property investor. Go to www.opespartners.co.nz to learn about our New Build finding service.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3

Contents IN THIS ISSUE

REGULARS

12 What We Like

46. Are We at the Bottom Yet?

We find the hottest products, services, and places.

Pie Funds CEO Mike Taylor explains how to keep a cool head during tough times.

14 Subscribe to Informed Investor Subscribe to informed Investor for just NZ$20 for 4 issues at www.informedinvestor.co.nz.

48. Strategies to Survive Volatility When market corrections happen, you can hedge this risk, says Chris Smith, of CMC Markets.

52. Why Women Struggle With Separation PERSONAL FINANCE

Women are separating ill-equipped to cope with money. Brenda Ward talks to Bridgette Jackson.

56. When Money is Tight

20. Get Better Returns

As living costs increase, more retirees are turning to reverse mortgages. Heartland’s Andrew Ford explains.

Can you get a safe investment with stellar returns? Martin Hawes suggests some strategies.

60. Survive the Cost of Living Crisis

24. The Overwhelm Effect

The cost of living is starting to bite. Amy Hamilton Chadwick says it’s going to get worse.

Worrying about money can lead to ‘overwhelm’. Lynda Moore talks about financial anxiety.

64. Can’t Earn Money? Get Prepared

28. Is it the Right Time to Quit?

If you can’t work, your life plan could go out the window. Kris Ballantyne says income protection insurance can save you.

The Great Resignation means there’s never been a better chance to earn more, says Amy Hamilton Chadwick.

66. Invest in Kiwi Tech Start-ups

32. How to Get a Pay Rise You can get rich faster by having more income to invest. Frances Cook explains how to get pay rises.

35. Mid-Career Crisis If your role isn’t the right fit, could you start all over again? Ben Tutty talks to people who did.

38. Why your Profile is Worth a Million Bucks When employers check out your LinkedIn profile, what should they see? Brenda Ward talks to expert Stanley Henry.

Cool companies and clever Kiwis lie behind this Innovation Fund. But it’s a high-risk investment, writes Amy Hamilton Chadwick.

68. How the TV3 Case Changed the Game TV3 journalist Tova O’Brien couldn’t break a restraint of trade clause. Charlene Sell explains what this means.

70. The Secret of Laddering Mary Holm says laddering term deposits should give you a better return from your bank.

40. Mr Bond Lives Again

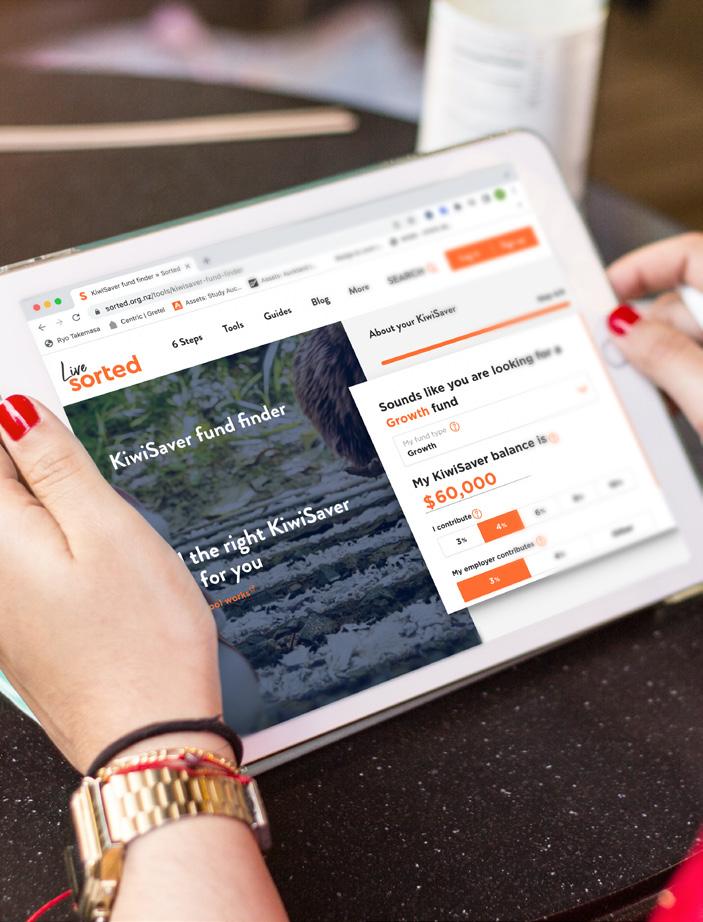

74. Your Guide to KiwiSaver: First Home Buyer’s Guide

Perhaps there’s a case for owning bonds again, writes Mark Riggall.

KiwiSaver is a great way to save for your first home. Here’s a guide to help you reach your goal.

42. Inflation Negation

78. ESG: Why Good Governance Works

Can you use investments to safeguard your money against rising inflation? Ben Tutty discovers you can.

Victoria Harris, of Devon Funds, explains why the G in ESG matters.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4

$0 commission on US share CFDs Back your views on Apple, Tesla, Netflix & more. Trade your way FX | Indices | Commodities | Shares | Cryptos cmcmarkets.com We will waive any ordinarily applicable commissions on US share CFDs for trades placed until 30 September 2022. Commission rates will be automatically updated on our trading platform. FX fees may apply. With derivative products, you could lose more than your deposits. You do not own or have any interest in the underlying assets. Investing in derivative products carries significant risks. Seek independent advice and consider our PDS and the relevant Terms and Conditions of Trading at cmcmarkets.co.nz when deciding whether to invest in CMC Markets products. CMC Markets NZ Limited (CN 1705324).

PROPERTY

84. Should I Use a Mortgage Broker? An adviser gives you a better chance of getting a yes (and it’s free), says Peter Norris.

88. Investing Across Generations Many people want to see their family set up for life. Scott McKenzie says that’s why PMG started the Generation Fund.

90. There’s a Clear Shift in Market Dynamics There's been a cooling in investor demand, but the property market is still attractive, says Jen Baird, Chief Executive at REINZ.

84

92. Buy a Business and Be Your Own Boss Buying a business could be the best investment you’ve ever made. Neil Barker explains why.

LIFESTYLE

95. Young Investor Get your young people learning about money to improve their financial skills.

96. Snuggly Style Take inspiration for your home as the season changes.

102

98. Wellbeing: A Better Version of Me Simple changes, and a policy of progress, not perfection, help Brenda Ward make lasting lifestyle changes.

101. Book Reviews Sarah Ell reviews two of the latest hot reads.

102. Travel: Tropical Breezes Crypto columnist Jenny Rudd drives across the world-famous bridges of the Florida Keys.

104. Fashion: Winter Warmers Rich russets and tawny tones get you ready for winter weather.

MARKET INSIGHTS

110

106. Going Up, Going Down Economist Cameron Bagrie takes a good, hard look at New Zealand and how we are going as a nation.

110. Bitcoin Scales Up Jenny Rudd went to Bitcoin 22 and discovered that changes are revolutionising crypto.

114. Snapshot We take a look at some of the events around the world affecting the global economy.

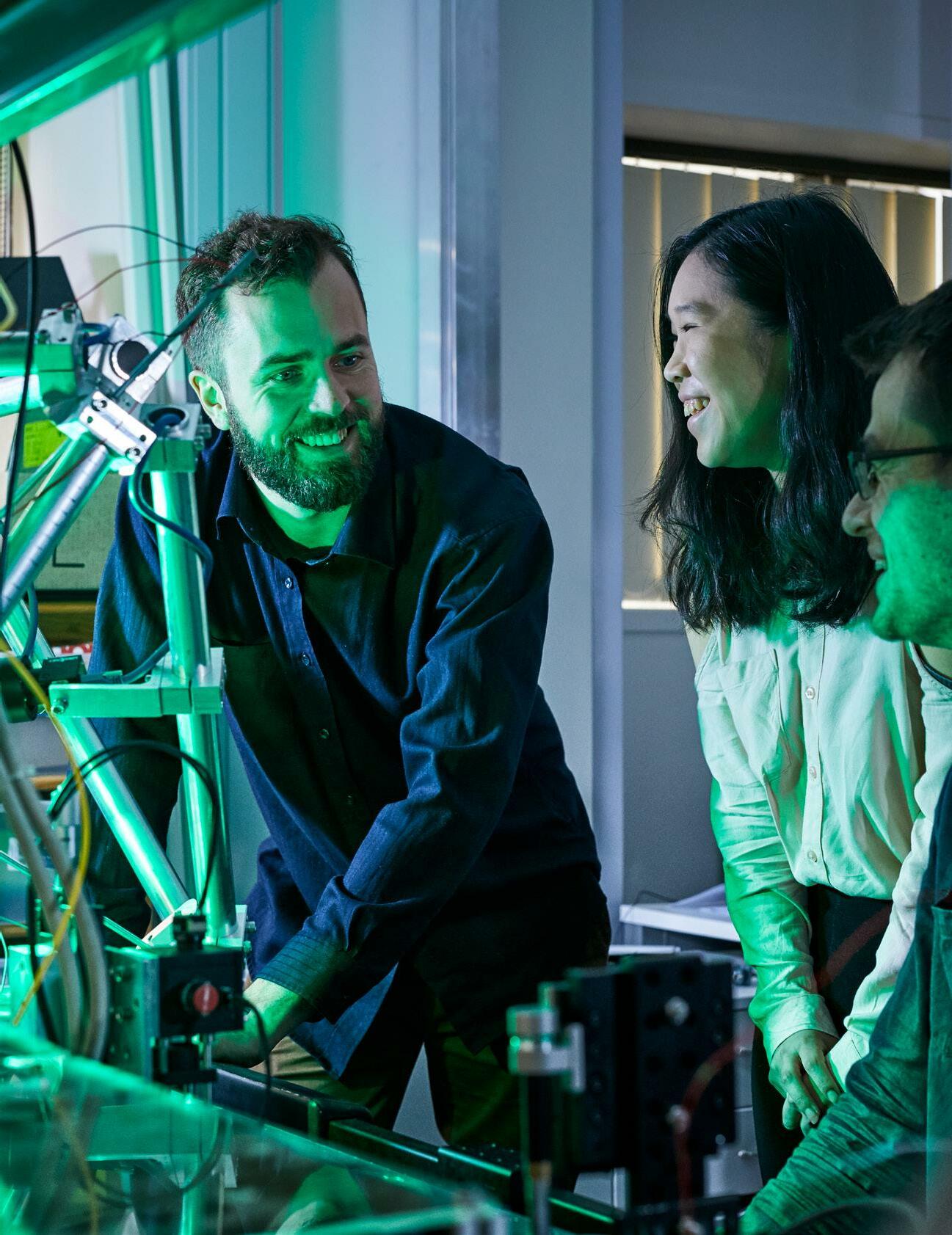

116. The Good Fight Against Inflation Optimism for 2022 went out the window, says Greg Smith. But if we can get inflation under control there could be positives ahead.

118. How Will Ukraine Hit the Markets?

118 WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 6

The war in Ukraine will affect equity, bond, currency, and commodity markets. Andrew Kenningham suggests some outcomes.

Find an insurance broker or adviser at vero.co.nz

EDITOR’S LET TER

Published by: Opes Media Informed Investor Level M, 17 Albert Street, Auckland Central, Auckland. www.informedinvestor.co.nz

It’s All About You The keys to earning more are within reach, writes Brenda Ward.

Investing is all about generating returns, seeing interest build up, and buying assets that will go up in value, right? No, there’s something else – there’s the value of you. A really important factor few people realise is that your pay packet is closely tied to investing. Simply put, you can’t invest if you have no money left at the end of the week. So, in this issue we look at ways of boosting your earning power. An extract from Frances Cook’s new book tells us a new job is the best time to get a pay rise, but she also has top tips for twisting your boss’s arm when you ask for more money. Social media guru Stanley Henry explains how to increase your personal value in the workplace by giving your LinkedIn profile a facelift.

If you’re thinking of shifting up a gear at work, you’re not alone. Our story on the Great Resignation shows more of us are leaving jobs or retiring than ever before. Amy Hamilton Chadwick finds out why. Also in this issue, you’ll learn how to get better returns, how to deal with volatility without panicking, and what to do when you’re overwhelmed with money worries. This editor’s letter is the last you’ll read from me. I’m sad to be leaving but I’ve taken on an exciting new role at BusinessDesk. I leave the magazine in great hands and with a wealth of fascinating topics to entertain and inform you. I hope it’s helping you to have a richer, more comfortable life.

And is a career change the right move for your personal development? Read our story on The Mid-Career Crisis.

Brenda Ward Informed Investor Editor

Editor Brenda Ward – brenda@informedinvestor.co.nz

Resident economist Ed McKnight

Art Director Mark Glover

Printer Crucial Colour

Senior Writer Laine Moger

Retail Distributor Are Direct

This magazine is subject to NZ Media Council procedures. A complaint must first be directed in writing, within one month of publication, to the editor’s email address, brenda@informedinvestor.co.nz. If not satisfied with the response, the complaint may be referred to the Media Council PO Box 10-879, The Terrace, Wellington 6143; info@mediacouncil.org.nz. Or use the online complaint form at www.mediacouncil.org.nz. Please include copies of the article and all correspondence with the publication. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 8

Informed Investor is an investment magazine published quarterly by Opes Media. You need Informed Investor’s written permission to reproduce any part of the magazine. Advertising statements and editorial opinions in Informed Investor reflect the views of the advertisers and editorial contributors, not Informed Investor and its staff. Informed Investor’s content comes from sources that Informed Investor considers accurate, but we don’t guarantee its accuracy. Charts in Informed Investor are visually indicative, not exact. The content of Informed Investor is intended as general information only, and you use it at your own risk: Informed Investor magazine is not liable to anybody in any way at all. Informed Investor does not contain financial advice as defined by the Financial Advisers Act 2008. Consult a suitably qualified financial adviser before making investment decisions. Informed Investor magazine does not give any representation regarding the quality, accuracy, completeness or merchantability of the information in this publication or that it is fit for any purpose. To advertise in Informed Investor, you must accept Informed Investor magazine’s advertising terms and conditions. Please contact Stephanie@informedinvestor.co.nz about advertising. Informed Investor is printed on environmentally responsible paper. The paper is produced using elemental chlorine-free pulp, sourced from sustainable and legally harvested farmed trees. The magazine is recyclable. PRINT ISSN 2744-6085 DIGITAL ISSN 2744-6093

crane-brothers.com

Meet Some of Our Contributors CAMERON BAGRIE

STEPHANIE BRYANT

Cameron is the managing director of Bagrie Economics, a boutique research firm. He was previously chief economist at ANZ, a position he held for over 11 years.

Stephanie is Informed Investor’s new advertising manager. She also sells advertising for another Opes Media magazine, NZ Property Investor.

MARTIN HAWES

MARY HOLM

Martin is the chairman of the Summer KiwiSaver Investment Committee. He’s an authorised financial adviser and offers his services throughout New Zealand.

Mary writes in the Weekend Herald, presents a financial segment on Radio New Zealand, and is a best-selling author. She’s a former director of the Financial Markets Authority.

MARK RIGGALL

CHARLENE SELL

Mark is a portfolio manager at Milford Asset Management. Previously he worked with Morgan Stanley in London and Hong Kong as an equity derivatives trader.

Charlene Sell is a partner at Wynn Williams. She advises businesses and not-for-profit organisations on legal matters for their day-to-day operations.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 1 0

FRANCES COOK

VICTORIA HARRIS

Frances Cook is a reformed money mess who now works as a personal finance writer. She is the author of two books on investing. The latest is Your Money, Your Future.

Victoria is a Portfolio Manager at Devon Funds. She has over 10 years’ experience in financial markets, across a broad range of markets, specialising in ESG.

LYNDA MOORE

ANDREW NICOL

Lynda Moore spent 20 years in her own accounting practice before co-founding Money Mentalist. She blends psychology and neuroscience with money coaching.

Andrew is an authorised financial adviser and the managing partner of Opes Partners. He has more than 15 years’ experience in banking, finance, and property.

CHRIS SMITH

MIKE TAYLOR

Chris is the general manager at CMC Markets. He has more than 15 years’ investing experience in financial markets, global equity, commodity, and forex markets.

Mike is the founder and CEO of Pie Funds. He’s also Portfolio Manager of Pie Funds’ Chairman’s, Global Growth 2 and Conservative Funds.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 1 1

REGULARS

What We Like A showcase of the hottest products and places that are the talk of the town. Fable tells a beautiful story What’s not to like about golf, skiing, breathtaking scenery and great food and wine? There is somewhere where you can get it all, at a luxury resort in Canterbury. The iconic Fable Terrace Downs Resort has just started a new chapter with a new owner after becoming part of the Fable brand in March. Just an hour’s drive from Christchurch and nestled in the shadow of Mount Hutt and the Southern Alps, the luxury resort has become a destination in its own right. It features a prestigious 18-hole golf course, a clubhouse, restaurant, conference, event facilities and 25 luxury villas. CPG Group Operations Manager, Ronnie Ronalde, says the opening of this, Fable’s third property in the South Island, signals a new chapter for the resort. “It has a rich legacy in this area and we’re looking forward to elevating Fable Terrace Downs Resort even further to become the premier luxury resort in the Canterbury region.” Golf draws many to the resort. Views over the Southern Alps and the Rakaia Gorge make it a truly unique scenic alpine course. The par-72 Fable Terrace Downs Resort golf course was designed by Sid Puddicombe and has been ranked by New Zealand Golf magazine in the country’s top five courses. If you want more than golf, there’s also horse riding, archery and clay bird shooting available. After a day skiing or playing golf, enjoy the best of local produce at The Clubhouse Restaurant, which has a menu focused on local inspiration, whole foods and sustainable produce. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 1 2

W H AT W E L I K E

Softy, Softly Cashmere has long been referred to as ‘soft gold’, says the Kiwi founder of Modern Love Cashmere, Jo Lloyd. “It’s the standout choice for warmth and versatility, while the composition of the fibres allows for a higher level of design,” she says. “Also, if like me you can’t wear wool next to your skin, cashmere is a dream.” Lloyd has designed a collection of cashmere winter classics designed and made using 100 per cent pure cashmere, meaning it has not been mixed with other yarns. She believes consumers today are demanding more sustainable choices, so she supports a move to slow fashion – to pieces that are not trend-driven, but wearable season after season. She also traces each garment to the fair-trade Mongolian farm the yarn was sourced from. Lloyd launched her brand in 2020, after a long love affair with cashmere. “I can still remember buying my first piece, aged 23, at a vintage cashmere store in New York,” she recalls. “It made me feel like one of the models you saw stalking around Soho! It was a beautiful shade of pink, so soft, and when I pulled it on with my black jeans and high suede boots, I was enthralled.” Lloyd says she’s part of a huge trend globally. “The market for luxury goods has taken a notable step away from short-lived trends. “Modern Love Cashmere is part of that movement – a boutique retailer with sustainability at the core of the brand, starting at the very beginning of the supply chain. “Each batch of yarn can be traced right back to the goat, and farm it comes from. “To know that the animals, farmers and grasslands are being looked after and protected is incredibly important to me, and to our customers.” www.modernlovecashmere.co.nz

Think pink Yes, it’s a beer, and yes, it’s pink! Garage Project and Resene have joined forces for a colourful craft beer they’ve called Scrumptious. The beer’s soft kettle sour base has been saturated with purple pitaya (dragonfruit) and pineapple. It pulls off a convincing taste sensation matching the fuchsia of Resene’s Scrumptious paint colour. The collaboration was born because both businesses started in Wellington garages. Resene’s first ColorShop is just metres away from Garage Project’s Wild Workshop, so it made sense they should join forces. Buy it at www.garageproject.co.nz WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 1 3

Subscribe for just $20 For 4 issues of Informed Investor (one year)

Never miss an issue! Informed Investor (formerly JUNO) magazine is a New Zealand luxury investment and lifestyle magazine which explains in plain English your financial options and how to build wealth. It covers the share market, property investment, KiwiSaver, personal finance, the economy, books, travel, and all the good things in life you can buy when you invest wisely.

Subscribe now and get one year (4 issues) of this premium magazine for yourself or a friend, for just $20, a saving of $27.80. Or subscribe for two years and get eight issues for just $40. Go to: www.informedinvestor.co.nz/subscribe

Terms & Conditions 1. All prices for magazine subscriptions include free New Zealand delivery. 2. Please allow up to 10-13 weeks for your first delivery. 3. Your subscription will begin with the next available issue in late August 2022, and in most cases your magazine will be in your hands before it goes on sale in the shops. 4. Informed Investor magazine is published by Opes Media Limited, which handles delivery and stipulates the lead time shown above. 5. Offer expires on 20 August 2022. 6. Offer available to New Zealand postal addresses only.

“The key to

performance in 2022 will be nimble stock picking.”

MIKE TAYLOR Founder & CEO

Boutique. Bespoke. For you. Contact us on 09 486 1701 to find out how we can help you.

PIEFUNDS.CO.NZ

In times of high volatility, defensive, solid sectors like infrastructure and healthcare can perform well. Infrastructure has been a stable sector when the outlook is uncertain, and when consumer discretionary spending is under pressure due to rising costs. Companies in the infrastructure industry have provided strong opportunities for the Australasian Dividend Growth Fund. One example of this is Johns Lyng Group, an Australian-based building and restoration services company. There is strong demand for this type of work, particularly after the severe weather events in Australia. Digital infrastructure has been a strong-performing area too. Uniti, an Australian company, provides broadband internet infrastructure. Uniti is the fund’s largest position; a position justified by the multi-year growth profile, defensive nature of cash flows and strong demand for fibre assets globally, supporting its valuation. Pie Funds’ active management strategy means we can also be nimble and take advantage of opportunities in growth companies and sectors across Australasia, in this ever-changing environment. This strategy is used for our award-winning Australasian Dividend Growth Fund. Its portfolio favours companies exposed to structural growth tailwinds, led by founders or management with skin in the game. The fund has a risk rating of 5 out of 7 (high risk).

Pie’s award-winning Australasian Dividend Growth Fund: + Aims for long-term capital growth + Makes six-monthly distribution payments + Invests in hand-picked smaller high growth Australasian companies

YEA

RS

ESTABLISHED 2011

ND GROWTH F DE UN VI I D

D

GROWTH END FU ID N IV

D

D

+ Has been one of Pie’s best performing funds

SED UALI ANNINCEPTION E C SIN

Past performance is not a reliable indicator of future performance. Returns can be negative as well as positive and returns over different periods may vary. View the Product Disclosure Statement (including details of the risks associated with this fund), plus our duties and complaints process and how disputes are resolved at www.piefunds.co.nz. Figures are after fees and before tax as at 31 March 2022, showing the fund’s annualised return since inception of 18.1%. The market index return for the same period is 4.8%. Market index used is XSOAI S&P/ASX Small Ordinaries Total Return Index (NZD). Information is current as at April 2022. Pie Funds Management Limited is the manager of the funds in the Pie Funds Management Scheme. Any advice is given by Pie Funds Management Limited and is general only. Our advice relates only to the specific financial products mentioned and does not account for personal circumstances or financial goals. Please see a financial adviser for tailored advice. You may have to pay product or other fees, like brokerage, if you act on any advice. As manager of the Pie Funds Management Scheme investment funds, we receive fees determined by your balance and we benefit financially if you invest in our products. We manage this conflict of interest via an internal compliance framework designed to help us meet our duties to you. Pie’s Australasian Dividend Growth Fund has been named the winner of Research IP’s Australasian Equities Fund of the Year. Fund Manager of the Year Awards were announced by Research IP on 2 December 2021. These awards should not be read as a recommendation by Research IP. For further advice on the relevance of this award to your personal situation, please consult your financial adviser, or visit research-ip.com.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 1 8

ISSUE 33

WINTER 2022

Earn \ ˈərn \

(transitive verb)

1. To receive as return for effort and especially for work done or services rendered. 2. To bring in by way of return. – Merriam-Webster Dictionary

“

”

If you want to earn more, learn more.

– Zig Ziglar, author, salesman, and motivational speaker.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 1 9

YO U R I NVE STI N G

Get Better Returns The holy grail of investing is a safe investment with stellar returns. Martin Hawes has searched for 40 years and never found one, but he suggests some strategies that might work.

We all want our money to work as hard as possible, and to grow our money as fast as we can.

The trick with investment is to get the best investment returns for a certain level of risk.

Finding the best investments, the ones that will give us better returns, seems to be the name of the game.

We all want high returns with low risk, but after 40 years as an investor, adviser and financial author, and 40 years of hunting for such an investment, I have never found it.

However, the problem with investment is that every time you mention the word “returns” you have to remember the word “risk”. When people go out to get better returns, they often do so by taking on more risk. This may be no bad thing of itself but there is one big proviso: you have to be sure that you can tolerate that extra risk. History is littered with impoverished investors who have come unstuck because, in the good times, they took on more risk than was right for them. What is risk? Risk comes down to the proportion of shares and property which are in your portfolio, compared to the amount of fixed interest and cash. This is all about getting the right investment mix, called ‘asset allocation’ in the jargon. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 0

In fact, I can confidently say that such a paragon of an investment with low risk and high returns doesn’t exist. The first thing any investor should do is consider how much risk they can tolerate. If you take on too much risk, in the next major downturn you’ll end up very uncomfortable, and probably sell up at the bottom of the market. If you take on too little risk you’ll miss out on a good bit of return. You want the ‘goldilocks’ amount of risk, not too hot and not too cold. Check your risk level I’d encourage all investors to do a “risk calculator”. There are many of these tools available on-line. Government financial education site www.sorted.org. nz has one and some KiwiSaver providers have them.

PERSONAL FINANCE

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 1

YO U R I NVE STI N G

There are lots of people trying to do the same as you and for every winner, there’s a loser.

They’ll ask you a few questions and then tell you the type of investor you are (conservative, balanced, or growth). These descriptions are a way of expressing the amount that you should have in each of the main asset classes, that is, your asset allocation. In essence, these calculators ask questions about things like: •

Your financial capacity, which is your ability to withstand a major economic shock.

•

The length of time you’re investing for, because the volatility of shares and listed property mean that they need time to get their better returns, and

•

Your psychological makeup. If you worry a lot about your money, you’re more likely to be rattled out of the market in the next slump.

These kinds of questions will establish your risk profile and you need to be very careful before you even think about taking on more risk than your profile suggests. Once you know your risk tolerance and the asset allocation that you should have, you can start to think about improving your returns within that risk tolerance. How to improve returns There are three main ways to improve your returns. Pick the right shares First, you can try to improve your investment selection. This means that you try to select the best investments within each asset class, the best securities that will outperform the average. To do this, you’d spend a lot of time reading about and researching high-growth companies and companies that are under-priced compared to their future prospects. Pick the right industries Second, you could try to find the right industries and invest in them. For example, you may decide that automation and robotics is an area likely to achieve a lot of growth and, instead of trying to identify specific companies, you could buy funds that are based on these. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 2

Tactical Asset Allocation Third, you could use ‘tactical asset allocation’. This means that you temporarily tweak the asset allocation that you’ve set according to what you think will happen in the immediate future. For example, you may think shares are very expensive and, with other things that are going on, decide that a recession and market slump is imminent. In these circumstances, you’d sell down some of your shares to buy fixed-interest investments or hold more cash to wait for a future buying opportunity. Taking more or less risk is dangerous because predictions are always difficult and you may be stranded with too little or too much exposure to shares, but it can be a very successful means to extra returns.

None of these three things (tactical asset allocation, identifying the best future industries and selecting the best securities) is easy. There are lots of people trying to do the same as you and for every winner, there’s a loser. Nevertheless, I think it’s certainly better to do these things rather than just take on more risk permanently – and if you spend the time diligently researching, there’s no reason why you shouldn’t join the winners. The information contained in this article is general in nature and is not intended to be personalised financial advice. Before making any financial decisions, you should consult a professional financial adviser. Nothing in this publication is, or should be taken as, an offer, invitation or recommendation to buy, sell or retain a regulated financial product. Martin Hawes’ disclosure document can be found at www.martinhawes.com

Booster Innovation Fund Supporting the next generation of innovative Kiwi start-ups.

Search BIF on NZX or visit booster.co.nz/bif

Early-stage company investing is generally considered the riskiest type of equity investing because many more early-stage companies fail than mature companies. You may lose some or all of the money you invest. You should consider whether the degree of uncertainty about the fund’s future performance and returns is suitable for you. See the PDS for the risks associated with investing in this fund. Booster Investment Management Limited is the manager and issuer of the Booster Innovation Scheme, Booster Innovation Fund (Fund). The Product Disclosure Statement for the Fund is available at www.booster.co.nz

YO U R I NVE STI N G

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 4

PERSONAL FINANCE

The Overwhelm Effect Worrying about money can put us at risk of ‘overwhelm’, says Lynda Moore. Here’s how to deal with financial anxiety.

Does the idea of checking your bank balance leave you in a cold sweat or with a feeling of dread? If it does, you could be suffering from ‘overwhelm’. The technical term for overwhelm is financial anxiety. First, you need to understand that anxiety is a normal emotion.

that financial anxiety was ranked number two in terms of what is stressing Americans out. I think it would be the same here in New Zealand. Before I go any further, let me just bust a myth. Financial anxiety doesn’t just happen to people who are struggling financially. It can hit you regardless of your net worth, income, or financial stability.

It’s a healthy, temporary response to stress, and it shows up in the way we think, feel, and behave.

Know the signs How can you tell when overwhelm is affecting your life?

It’s anxiety that gives you the sweaty palms, dry mouth and dread feeling in your tummy you get before you make a speech or do something outside your comfort zone.

When we are feeling anxious, we go into Fight, Flight, or Freeze mode.

We’ve all felt like this and it’s fine. In small doses anxiety can be beneficial. With financial anxiety you feel the same – on edge, nervous and worried about money – and the feeling isn’t going away. We’re seeing more overwhelm It’s not too surprising that after two years of living in a pandemic, financial therapists like me are seeing more cases of financial anxiety. In April 2020, not that far into the pandemic, the Financial Therapy Association noted

We do things to make the anxiety go away. We make unwise choices: like sitting on the couch watching Netflix with a bag of potato chips instead of heading out for a walk and getting some fresh air and exercise. From a financial perspective, this can lead us to make irrational decisions, like buying a brand-new big-screen TV when we’re facing job uncertainty and we’re worried about paying our rent. We don’t think through our decisions, or we’re paralysed and avoid making any decisions at all. These symptoms can all have a long-term impact on our future financial security.

Distorted thoughts We get caught up in the Thought – Feeling – Behaviour cycle. Our thoughts become distorted, or just not true – but we think they’re true. We tell ourselves: “I’ll never get my spending under control. I’m doomed, I’ll never have enough money for retirement. I’ll never be able to buy a house. I’m such an idiot.” Then the anxious feelings kick in. We worry, we feel on edge and nervous. This can also show up physically with a tightness in the chest or throat, stomach aches, tension, or headaches. You may notice these feelings more when it’s time to pay the bills, log into your bank account, or when you need to have a conversation about money with your partner, or boss. If you’re waking up in the night with your stomach churning because you’re worrying about money, that’s a pretty good indicator that you have some level of financial anxiety going on in your life. Two sides of the story The two ends of the behaviour’s spectrum are ‘perfectionism’ or ‘procrastination’.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 5

YO U R I NVE STI N G

•

•

Perfectionism shows up as being superorganised, rigid, and inflexible. You’re over-researching everything, constantly refreshing and checking banking apps to make sure everything is correct. Procrastination is just not starting things: “I’ll do it tomorrow”. And as we know, tomorrow never comes. So, you don’t cancel subscriptions you no longer need. You don’t fill in the forms to increase your KiwiSaver contributions. You don’t look at your banking app and you continue to overspend.

Take back control How can you take back control of your life and commitments? Recognising you have the signs of financial anxiety is a good place to start. Realise it’s just a stage. You can move through it and come out the other side. You might just need some help and some tactics to help relieve the anxiety. Listen to your thoughts. Have a conversation with yourself and find proof against the thought. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 6

How true is the thought, “I’ll never get my spending under control”? Think of times when you haven’t spent all your money. Be aware of your feelings. If your heart is racing before you open your banking app, take a few deep breaths first and ground yourself in the here and now, not the past or future.

Financial anxiety can hit you regardless of your net worth, income, or financial stability. If you’re stuck in perfectionism, set yourself a challenge to not open your banking app for 24 hours. Set some boundaries to slow yourself down. If you’re procrastinating, you need to do the opposite. Set a time to do whatever it is you need to do. Start with a tiny 10-minute task and build up from there. You might need to set an alarm to make sure you do it!

Do I need help? If anxiety isn’t dealt with, it can spiral out of control into depression. Don’t let it get that far. If the techniques I’ve suggested aren’t helping, and you’re feeling even more anxious, then ask for help. Talk to your partner, a close friend, your GP, or a financial therapist. Find someone you can trust to have an honest and open conversation with about how you’re feeling. This is not the time for a stiff upper lip, fix-it-myself mentality. At some point in our lives we’ll all feel financial anxiety, even if just briefly. Help others, too If you see warning signs in others, ask if they’re okay. Don’t push your views or offers of help too hard, as you may not know which stage they’re in – fight, flight, or freeze. Suggest they get some help. When they’re ready to face their anxiety, let them know you’re there to support and help them in any way you can.

YOU’RE 1 IN

Everyone has different hopes, dreams and of course health needs. At nib our purpose is your better health, we’re here to help Kiwis and their families live healthier and happier lives. We also believe healthcare shouldn’t be one size fits all. Speak to an expert adviser who can help tailor health plans, that put you and your wellbeing first.

To find out more, talk to your financial adviser today. To find an adviser visit nib.co.nz/adviser-plans Terms and conditions apply.

YO U R I NVE STI N G

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 8

PERSONAL FINANCE

Is it the Right Time to Quit? Across the globe, workers are quitting their jobs. And this means there has never been a better opportunity to earn more money, says Amy Hamilton Chadwick.

Since 2021, we’ve been hearing about the Great Resignation: employees quitting their jobs in huge numbers. In the US, 4.4 million people quit their jobs in February this year, driven by factors like low wages, job dissatisfaction, and people’s changing priorities, thanks to the pandemic. Lockdowns made people reassess their lives, and some realised they didn’t like their jobs, or couldn’t face returning to the office after working from home. Online movements like r/antiwork on Reddit fuelled the fire, championing those who demanded better conditions or quit. Most workers moved on to higherpaying jobs, but some left the workforce altogether, leading to labour shortages that have been exacerbated by widespread Omicron infections. Employers beg for staff Have we had our own version of a Great Resignation here in New Zealand? Yes and no, says economist Finn Robinson of ANZ. Our labour laws and healthcare make New Zealand a better place to be an employee than the US, he says. But New Zealand is definitely part of the global trend that’s seen the balance of power shift from businesses to employees. Where employers once called the shots, they’re now having to bend over backwards to keep their staff.

“A worker generates income for an employer,” Robinson explains, “and what share of that income the worker receives depends on how tight the labour market is. “Here we’re seeing quite a different dynamic to the post-global financial crisis period where employers could dictate terms. “Now we have close to record job vacancies, and employees can more easily get other job offers, so the employer has to pay up. “That fundamental shift from the previous labour market is one reason why inflation is expected to be so persistent over 2022.” Perfect time to hunt for a job With our borders closed for so long, our worker shortage has worsened, with businesses competing for the same pool of local talent. Employers have had to get creative to make themselves attractive, primarily with higher pay, but also with work-from-home options, greater flexibility, and more emphasis on treating employees well. All these factors are encouraging Kiwis to quit jobs they’re not happy with and make the switch into a new higher paying role or jump into an industry they’re more passionate about. It’s even attracting people to stay in the workforce longer or return from retirement, particularly in the face of rising household costs.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 2 9

YO U R I NVE STI N G

“In the US, millions of people left the workforce and never came back, which means a big chunk of the labour supply is gone,” Robinson says. “But in New Zealand, labour force participation is close to the highest it’s ever been. That’s surprising because structural demographic changes mean our workforce is getting older, so you would expect that to reduce participation. “Instead, higher wages are pulling people back into the labour force – whether that lasts is another question.” With unemployment at a record low, and underutilisation close to pre-pandemic levels, there are very few workers to go around, so employee negotiating power has never been stronger. It could get worse Kiwi workers have already jumped at opportunities to move up the career ladder, says Warrick Ryan, sales consultant at CCR Group, which specialises in bringing migrants to New Zealand for employment. Labourers, for instance, have taken their chance to get builders’ apprenticeships, setting them on a pathway to an extra NZ$7 to NZ$10 an hour. That’s leaving significant numbers of job openings that, before the pandemic, might have been filled by new migrants. But with our borders closed, bringing in migrant workers is much more difficult, which is putting the squeeze on employers. “Over the past couple of years, migrants coming here to work completely stopped,” says Ryan. “Our economy kept growing and developing, and now there are not enough people to do the jobs we need. “Unemployment is at 3.4 per cent, and the majority of people in that category don’t want to work. So, employers are having to pay high rates to get migrants to come to New Zealand to fill roles, but they’re prepared to do that because they just can’t find Kiwis to do the work.” Migrants can come here to work in specific roles where there are severe labour shortages, including ski workers, forestry, deep sea diving, vets, tech sector workers, teachers, and dairy workers. All these workers must be paid at least NZ$27 an hour, in some cases NZ$28 an hour, while ‘other critical workers’ must be paid NZ$40.50 an hour or NZ$84,240 a year. Each job is advertised locally at that rate before the employer can apply for an approval for a migrant worker – these rates are helping push up average wages in New WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 0

Zealand, but still don’t attract workers. “Even at $28 an hour, Kiwis are still not applying for those jobs,” Ryan says. “The border policies haven’t opened up quickly enough to keep the economy moving as fast as it could. “We’re going to miss the boat – the situation for employers is going to get worse before it gets better.” Wages likely to keep rising Ryan believes that the government isn’t going to return to the days of allowing large volumes of low-skilled workers to come here and fill minimum wage positions. That’s for the best, he says, because it should encourage businesses to invest more in productivity and not rely on low-paid labour – which means wages are likely to keep rising. Robinson’s forecasts agree. He says that while wages aren’t yet keeping up with inflation, real wage growth is on the cards for 2023 and 2024. “Wages are sticky. It’s much easier for them to go up than down. A decade of low

nominal wage growth is a hard habit to get out of, but we think they will catch up.” For employers, this means there’s no relief in sight. For the time being, it’s vital to find ways to hold onto your workers and attract new team members – or spend the time and money bringing in a migrant to do the job. It also means thinking hard about how to invest in systems or tools that will lead to higher productivity, so your business can run with fewer staff. Workers have the power If you’re an employee, you hold the balance of power in a way that has probably never happened before in your lifetime. This is a time of opportunity – whether that’s switching jobs, asking for a pay rise, or negotiating on some other aspect of your work that you’re not happy with. We don’t know how long this shift in balance will last, so make the most of it. This is your chance to either jump up your current career ladder, switch to a new ladder, or move into a job that does a better job of delivering the kind of lifestyle you want.

Invest like an expert (without having to be one)

Join an Investment Fund to invest with confidence $1,000 & you’re in Claudine, 27 — Digital Marketer Invests with Milford Past performance is not a reliable indicator of future performance. Please read the Milford Investment Funds Product Disclosure Statement as issued by Milford Funds Limited at milfordasset.com. Before investing you may wish to seek financial advice. For more information about our financial advice services please visit milfordasset.com/getting-advice.

YO U R I NVE STI N G

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 2

PERSONAL FINANCE

How to Get a Pay Rise You can get rich faster by having more income to invest. Frances Cook explains how to get pay rises, how to be more valuable at work and how to be strategic, in this extract from her new book.

A new job is the best time to get a pay rise. You look for new opportunities, ones that sound like a good step up from where you are now. In the interview focus on the role and its responsibilities, and what you and the company can offer each other. And then when you are (hopefully) offered the role, you negotiate a salary that’s nicely above what you’re getting now. They’ve already offered you the job, so you know they want you. Try to get them to offer you a figure first – they know more about industry rates than you do, and you don’t want to name a figure that sounds like a lot to you, only to find out later you could have got more. Once they make you an offer, ask for something above that. Bear in mind, that’s how this dance goes every time. They will make you that first offer expecting you to ask for more. They’ve offered you slightly less than they’re willing to give. If you take that first offer, you’re leaving money on the table. When I was at journalism school, one of my lecturers told me about a job offer he had right when he was starting out. When he received the offer, he looked at the person and said, “Once I’ve been here six months, and have started talking to people, will I become unhappy with this offer?” They upped the offer. So, get all the information that you can. It’s your best weapon. After that, here are some concrete strategies to use. Ask for more This is almost too obvious to include, and yet, so many of us fail at this.

For starters, always negotiate when you start a new job. It’s so much easier to negotiate a higher amount at the beginning than it is to ask for a raise once you’re there. Once you’ve been offered a job, you then start negotiating how much you will earn for it. And I promise you, they expect you to negotiate. You also want to negotiate pay rises once you’re in a job, if you can. I’ve always found it helpful to think of it as ‘arguing from the other person’s point of view’. Don’t talk about why you personally want a pay rise. Your boss doesn’t care about that, not from a business perspective. But if you think about what matters to them, and argue based on that, it’s much more persuasive to them. Talk about what you’ve achieved for your boss or your company, how you’ve helped them achieve their goals, and why that should translate into more money for you. It helps if you’ve kept a running ‘show-off file’ of your best work, which shows your wins or money that you’ve brought into the company. Here’s a blueprint to start talking to your boss about salary. Ask your manager for a meeting to talk about ‘career growth’. Then ask for some clear goals of what they would like from you over the next year. Make sure it’s things that are solid, like a new skill they would like, so you can

immediately go and sign up for a free online course and learn it. Have these catch-ups with your boss regularly. Keep notes about the goals and how you’re achieving them. Then, when you want to talk to them about a raise, you have a solid case on how you’ve improved to hit their goals. One of the ways you can start the conversation with your boss is what’s called a ‘gratitude sandwich’. The first slice of gratitude bread is how much you enjoy working at the company. Then comes the meaty filling. You would like a pay rise, because of all the things you’ve been achieving and, according to your research, people doing that are usually paid X amount. Then you finish it off with a last slice of gratitude bread; that you love working there and you appreciate them taking the time to have this conversation with you. Become more valuable A company is essentially paying for the value you give them. So if you can spot the valuable skills, particularly rare ones, and then learn them, you’re going to be worth more. Which should eventually translate into you being paid more. If at all possible, it’s always best to upskill for free first, so that you don’t have to spend the extra money paying off what it took to get you there. There’s an amazing number of places where you can learn new skills for free. The first, of course, is your workplace. Say “yes” when you’re asked to take on new roles, to fill in for people. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 3

YO U R I NVE STI N G

You’re getting experience to add to your CV, and maybe even lining yourself up for a promotion if the company ever needs a new person in that role or area. They already know that you know how it works. It doesn’t even need to be filling in for roles that you’re interested in for the future. At the beginning of my career, I had a rule that I didn’t say “no” if I was asked to take things on. Even if I felt out of my depth, my rule was that I said “yes”, then did what I had to do to figure it out and do it well. This saw me filling in as a producer, a news director, and on all sorts of reporting jobs. I knew very quickly that I had no interest in becoming a radio producer but I continued to fill in for them, because why not? Eventually this led to having skills that I used in an entirely different area – hosting podcasts for the NZ Herald. I produced my own podcasts, as well as hosting them, and doing some of the audio engineering on them. I was very much a one-woman band, which saw projects handed to me sometimes because there was simply nobody else to do them. It worked out well for me and became an important step up on my career ladder. Other places to learn include the library, or tutorials on YouTube. If you really want or need a course, there are free courses from Yale, MIT, Harvard and elsewhere, all online.

So don’t be afraid to take opportunities for small talk; ask your co-workers if they want to grab lunch together or head to the pub.

These can help you learn the skills to level up at home or at work, even if you don’t have a piece of paper to show at the end of it.

This is how true alliances are made, and how new opportunities can come about.

Be smart, be nice… You have to show people what you’ve achieved for them. Success doesn’t come from quietly working hard – make sure people know it. I’ve rarely got jobs through interviews – I’m terrible at them. People need to know you, know your work. It helps if you’re not a nightmare to be around. But more than that, your work is only one of the factors that go into whether someone would hire you again or recommend you for other jobs. The other one is how well you fit in with the team – and boy, I wish someone had told me this one earlier.

And be strategic Then find the roles in your current field for which people are paid more. Start moving yourself in that direction with the extra skills you pick up, the people you network with, and the extra work you take on. I know, ‘networking’ is a horrible word that makes you sound slimy. It really just means getting to know the people working in that area. People like to hire a known quantity – so if they know you, and know you do good work, you’re already well ahead. We all want to work with people who aren’t painful to be around. It’s amazing how far you can get by being a team player and being pleasant.

If you sit in the corner quietly, working hard, and then head home, the sad truth is that people will barely notice your work.

The flip side of this is that you also need to market yourself. Unfortunate but true – you’re not going to get credit for something if people don’t know you did it.

Being someone who knows how to make sure others on the team look good, who can lend a hand, or just share a joke, can get you surprisingly far.

Make sure those you report to know what you’re achieving. And bite the bullet and go to a few industry events so that you can get to know others in your field. That’s how you

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 4

find out about new opportunities before they even officially exist. Be ready to walk away Research shows that those who ‘job hop’ end up earning more money overall. You don’t want to change too often, but every two years or so is often what employers see as acceptable – the median time for people to spend in any one job is between three and five years. If you’ve gone to the effort of improving your skills, building good relationships and building up a good portfolio of work, you’ve made yourself an enticing prospect to other employers, too. If you get another offer, then you can negotiate and see whether your current employer wants to offer more to keep you. The one warning I would give here is, don’t bluff. If you tell your current workplace that you’ve had an offer and that you want them to match it, they could decide they’re fine with letting you walk. Be well prepared and accept that you may need to take up the new offer. This is an extract from Frances Cook’s book Your Money, Your Future (Penguin Books, RRP $35).

PERSONAL FINANCE

Mid-career Crisis If your role isn’t the right fit for you, could you start all over again? Ben Tutty talks to people who retrained and now work in fulfilling roles.

Most of our waking adult life is spent working. Despite that, around 40 per cent of Kiwis hate their jobs, according to a recent survey by culture coach Shane Green. Are you one of them? If you are, there are probably several reasons why changing jobs or retraining seems difficult or downright impossible. And the fact is, you’re right – changing careers is a gigantic undertaking, a leap into the unknown. But for some who’ve found a new calling, it’s well worth the trouble. Crisis sparked a career Liz Barry studied her masters in pharmacology at the University of Otago and got a high-flying job for a large drug company. It aligned with what she wanted to do, and what she felt she should be doing, but for some reason the job was the wrong fit. Then Barry’s parents were killed in a car accident. As the oldest of four, she took on the role of mentoring her brothers and guiding them through life’s obstacles, not to mention their careers. Something about mentoring just felt right. She felt this was her calling so she now runs a thriving Auckland business as a life and career coach.

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 5

YO U R I NVE STI N G

“There’s an unease when you know your job isn’t right. Sometimes it takes life whacking you with a four-by-two for you to realise you’re doing the wrong thing,” Barry says. “We’re often too worried about what we’re socialised to become by our culture and the people around us that we don’t listen to our intuition.” Barry reckons once you face up to the fact you need to change it’s absolutely terrifying – but also liberating. Soul search, research, job search When I got my first big-kid job writing for an online business it started off great, then something changed and suddenly I hated it.

apparently isn’t the best way to change careers. Barry says instead of getting a facial rash and quitting out of the blue, there’s a threestep process you should try first – soul searching, researching, then job searching.

It’s about tapping into your network, getting out there and meeting people and talking about what you want to do.

I’d feel nauseous as I walked to work every morning and I got eczema all over my face from anxiety and lack of sleep.

“Soul searching is all about looking at your values and your personality type. It’s not about looking at what you’re good at but what skills you’d like to use; what you’re interested in.

I ended up leaving suddenly one day and doing odd jobs to pay my rent, which

“If you have no idea, think about what conversation topics spark your interest,

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 6

which movies you watch, what you’re reading. There are career clues everywhere.” Once you’ve taken a good look at yourself and figured out what you really, truly want to do, she says it’s on to step two. “Research. Do your due diligence. Research the job market. Speak to people who already do the jobs, find out if you really need a degree to do the work.” Most people skip step one and two and go straight to job-searching, which Barry says is a big mistake. She adds that job searching isn’t purely about jumping on Seek – to get the best jobs you have to access the hidden market. “It’s about tapping into your network, getting out there and meeting people and talking about what you want to do. “LinkedIn is awesome for a place to start.

PERSONAL FINANCE

Think about how you articulate your value proposition and convince someone you’re worth their time and money.” Why it’s worth it Soul searching, researching and job searching is a lot of hassle. Is it really all worth it? Hannah, a psychotherapist from West Auckland, says her career change definitely was worth it. “I was in a senior human resources position at an infrastructure company in Auckland. It was a good job and good money but it didn’t excite me. “I wanted to do something that I was passionate about and make a difference.” While she was soul searching, Hannah realised she liked the parts of the job where she supported the development of young graduates and looked after employee

wellbeing. So, five years ago she started retraining in psychotherapy. “I was studying full-time and working part-time and it was so difficult to switch between the corporate mindset and being a student. It was a huge life transition.

The big thing I’ve lost is money. That’s not my priority, but for some people it is. That may stop them changing careers and that’s OK. ‘’Psychotherapy was much more demanding academically and personally than I thought it would be. There were times when I wondered what I’d gotten myself into.” Hannah adds that there was stress about whether she and her partner could

manage financially, but in the end she got her masters in psychotherapy and now has her own small practice. She says she had to make sacrifices but in the end it was worth it. “The big thing I’ve lost is money. That’s not my priority, but for some people it is. That may stop them changing careers and that’s okay. “Being a woman, I also would have started a family earlier if I’d stayed in HR. If I was still in a stable corporate job, I would have been hanging out for maternity leave, but that wasn’t an option for me. “That said, I wouldn’t change it for the world. I’m 100 per cent certain I did the right thing. “It was really, really hard, but I’m so glad I made the change.” WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 7

YO U R I NVE STI N G

Why Your Profile is Worth a Million Bucks When employers or clients check out your LinkedIn profile, who do they see? An expert or a missed opportunity? Brenda Ward talks to Stanley Henry of The Attention Seeker.

A potential new employer checks you out on LinkedIn. Do they see an impressive CV, that you’re influential, and that you have a welldeveloped network of high-calibre people? Or will they just see an old photo, an outdated resumé and a few dozen connections? Stanley Henry of The Attention Seeker says that’s not enough to get the most out of this influential social platform. He says the first thing many people do after meeting you at an event, being referred to you as a potential client or seeing your job application is check out your LinkedIn profile. And they’ll judge you on it. “Nothing is as effective as personal reputation and relationships in business,” he says. “Networking and connections are part of ‘your brand’. So, don’t leave it to chance. Control it.” If you’ve neglected LinkedIn, it’s not too late to start now, he says. “You can become influential within your own personal or business circles. LinkedIn creates opportunities every day. And it’s not just for when you’re looking for a job.” WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 8

Stanley returned to NZ at the end of 2019 and started The Attention Seeker, just before the first lockdown in 2020. Now he leads personal branding and marketing for multimillion-dollar companies in New Zealand and internationally, has a team of 14 in Auckland and outsources work to the Philippines. A fast-growing platform In 2016 there were just 1.5 million Kiwi users of LinkedIn, but by February 2022, there were 2.3 million. That’s 47.7 per cent of the entire New Zealand population, and 1.4 million of those are people aged 25 to 34. So, why is LinkedIn worth your time and effort, and how can your profile be worth a million bucks? There have been changes at LinkedIn, says Henry. “It’s optimised its algorithm to show relevant content from within a network instead of allowing big influencers to dominate. “Unlike other platforms, this lets small

companies build and grow, not just corporations.” Small start-ups can turn into businesses worth millions or billions by using business-to-business marketing on LinkedIn, says Henry. He cites the example of the owner of a small IT startup he worked with. “It started with a team of two. “Through the power of digital marketing via LinkedIn, the business has grown to having 36 clients and a massive following within its industry. He’s on his way to becoming a thought-leader.” The rise of the thought-leader For a chief executive to become an industry expert, they need to become a thoughtleader in their industry, says Henry. “A thought-leader is more than a marketing strategy and a way of promoting your ideas, your role and work of your company. It can help change the nature of your company culture and industry. “The content you produce as a thoughtleader can help raise the value of ideas and the spread of information in general. You

PERSONAL FINANCE

become a person people want to associate with and connect with.” He says LinkedIn is the perfect platform to host that content and nurture that community. How to use LinkedIn Here’s how to build a digital influence fast, says Henry: 1. Start by using your personal profile. Who you are on LinkedIn is far more powerful than any company profile and will give you more organic reach. Building a personal brand is about ensuring others know you as a person first. 2. People build rapport much faster with faces so we recommend candid shots in a work or professional environment. 3. When you use LinkedIn, think about the content you post. Focus on the why, rather than what you do. Approach each post as a thought-leader within a company, rather than from a company perspective. 4. If you’re a small or medium business, people love it when you share your

business journey – both good and bad. Be authentic with your storytelling. Share the wins, the lessons you have learnt. How have you grown from the experience and what did you learn to help you in the future? 5. If you’re a chief executive or leader, why do you get out of bed every day? What are your core beliefs? What conversations do you want to have? How can these be related to leadership, failure, community, networking, entrepreneurship and team. Post on these subject matters three to five times a week, and also interact with others’ posts. 6. LinkedIn is a conversation, not a speech, says Henry, so engagement is important. Comment and engage with other people’s posts. It’s about having professional conversations. As a user, you don’t need to make your own content, you can comment on other people’s posts instead. They get a notification along with everyone who interacted with that post before you. LinkedIn also displays your

engagement within your network, so your connections know what you’re interacting with. 7. Being consistent is key. Content on LinkedIn doesn’t stay around long. It’s not like social media platforms where your entire profile is content. We recommend dedicating a minimum of 10 minutes a day on the platform so your connections are still seeing you. It is a small time commitment to invest in your business connections and peers, so pick a set time you’ll spend on it and don’t go over it. 8. LinkedIn isn’t stupid. Sharing company content doesn’t really get you much reach. If you want company content to get more reach, you need to pay LinkedIn and run ads. Says Henry: “These strategies are all things we have done as a company at The Attention Seeker to create a seven-figure business.”

www.theattentionseeker.com WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 3 9

YO U R I NVE STI N G

Mr Bond Lives Again The spectre of the death of the bond is receding, writes Mark Riggall, portfolio manager at Milford Asset Management. And he suggests perhaps there’s a case for owning bonds again.

Late last year I wrote an article about the dire outlook for bonds. It was called “So, you expect me to perform? No, Mr Bond, I expect you to die”.

That compares to New Zealand shares, which have fallen by 4 per cent over the same period and global shares which are up 2 per cent over the same period.

These returns aren’t that attractive versus inflation running at 5.9 per cent, but at least now there’s a reasonable alternative to holding cash.

Declining bond returns were expected to have an impact on the performance of diversified funds that hold bonds, including KiwiSaver. They did.

Unfortunately, bond-heavy Conservative funds have borne the brunt of this, largely underperforming Growth funds on a oneyear basis to end of March, despite the falls in share markets this year.

The prospects of future returns are looking better, given these more attractive yields, but what about the risk bond prices might fall further as even-higher interest rates are priced in?

So, bonds have been a terrible investment recently, but should investors still steer clear?

In New Zealand, the Reserve Bank is expected to hike rates to over 3 per cent by the end of 2022.

Yields look more attractive The falls in bond prices mean yields going forward are now much more attractive. The yield on a five-year New Zealand government bond was around 3.3 per cent at the start of April.

In the US, interest rates are expected to rise to 2.5 per cent at the end of 2022. With global inflation high and still surging, such expectations of rate hikes are understandable.

Since then, bonds have been terrible performers. Shares have also seen some volatility this year, but global investor appetite for shares appears to be relatively undimmed, with evidence of significant buying from global retail investors this year. Is it time to switch? Can we make a case for owning bonds and is it shares’ turn to kick the bucket? Since July last year, the S&P New Zealand government bond index has fallen by around 9 per cent to the end of March 2022. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4 0

Yields on offer haven’t been this high since early 2015. Yields on five-year high-grade corporate bonds in New Zealand are around 4.5 per cent.

But given the large amount of hiking already priced in, and significant uncertainty about inflation and growth outcomes on the other side, it’s reasonable to assume that we’ve already seen much of

E XP E RT O P I N I O N | M I L F O R D AP SE SR ET EN T S OMNAANLAFGI E NM AN CE

the weakness in shorter-dated bonds. What’s more, if we see economic weakness later this year, chances are these bonds could perform well as investors rein back their expectations for rate hikes. What about shares? How about shares: do their inflationbusting properties mean they continue to be the asset class of choice? In theory, company revenues should rise along with inflation. After all, it is the companies that are setting the selling prices. However, input costs (including labour) are also going up. If consumer demand falls as a result of high inflation, then company margins could be squeezed and profits could stagnate. The starting point of valuations also matter for long-term returns. In times of

uncertainty, like now, investors demand higher future returns and therefore lower valuations.

In the background we can see surging inflation, rapidly rising interest rates and squeezed consumer budgets.

Global share markets are trading at a price of 17 times next year’s expected profits at the start of April, which is slightly higher than the 10-year average of 16 times.

An optimist would hope for a settling of inflation and growth at more modest levels in the next few months, requiring fewer interest rate hikes than currently expected.

While that’s only modestly expensive, it masks a huge divergence in valuations across different types of shares. •

•

High-growth companies have attracted a lot of attention (and investment) in recent years. This leaves them looking very expensive compared to both history and the broader market. Conversely, ‘value’ type companies are looking inexpensive. This segment includes less exciting businesses such as banks and energy companies, and some of these companies have valuations that are downright cheap.

A more cautious investor would be concerned about stagflation – persistently high inflation but stagnant demand. Whichever way the path goes, the outlook for investors is not necessarily poor. Some bonds are looking like solid investments for the first time in years. Meanwhile, share markets are still full of sensibly priced companies with reasonable outlooks. You just might have to look beyond what has done well over recent years. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4 1

YO U R I NVE STI N G

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4 2

PERSONAL FINANCE

Inflation Negation Can you use investments to safeguard your money against rising inflation? Ben Tutty talks to the experts and discovers you can.

Making ends meet in a ridiculously expensive country like New Zealand is hard. A block of cheese will set you back about NZ$17, gas has almost tipped NZ$3 a litre and a house deposit could cost you an arm, a leg and your first-born. The worst part is – inflation is on the rise, so the cost of living here will probably keep increasing. Is this something we should be worrying about and preparing for? And what can everyday investors do to protect our wealth against inflation? The inflation situation Inflation, or the rising cost of goods and services, decreases the buying power of your money, or in other words, after inflation the same amount of money buys less stuff. When inflation is chugging along at 1 to 3 per cent, it’s usually a good thing for us and the economy, but when it’s higher for a sustained period it can be bad news. As of December 2021, inflation was running at 5.9 per cent and ANZ is forecasting it could rise past 7 per cent and beyond. For younger Kiwis this is an entirely new phenomenon, but Mary Holm, New Zealand’s foremost personal finance journalist, says older generations have seen this before. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4 3

YO U R I NVE STI N G

If you’ve got long-term money sitting in the bank or a low-risk fund, be braver with that money, regardless of inflation. “If you were around in the 70s and 80s, inflation was up around 18 per cent, and we just got used to it. We got 16 per cent to 17 per cent on bank term deposits, but inflation was even higher.” As well as decreasing the buying power of your money, inflation can decrease the effectiveness of your investments. After all, an 8 per cent annual return doesn’t look too hot when everything costs 10 per cent more per year, does it? So what’s the solution? The secret to protecting and growing your wealth during inflationary times isn’t really much of a secret, says Holm. “Returns from shares and property tend to exceed inflation. Not always over the short term, but over the long term they do. “A recent study showed that if you invested a dollar in the US share market in 1900 you’d have $710 in 2000, after you adjusted for inflation – and around $17,000 when not adjusted.” Holm adds that the main thing during uncertain times is to think carefully about your investment horizons. Or in other words, when will you need to use the money that you’re investing? If you can wait more than 10 years, you may be better off considering higher-risk, higher-growth investments like shares and property. If you can only wait 3 to 10 years, you might look at bonds, while cash funds and term deposits might be your best bet for shorterterm stuff. Investing in high-growth assets over the short term is always risky and during times of uncertainty large dips in markets can be more frequent and pronounced, meaning you’re more likely to lose money. Opportunity in uncertainty Uncertain is one word for this moment in history, but that may be an understatement. There’s war in Ukraine, a global pandemic, fast-rising inflation, and Will Smith slapped Chris Rock at the Oscars. WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4 4

Despite that, Stuart Millar, chief investment officer of Smartshares, one of New Zealand’s leading investment platforms, says that uncertainty can present opportunities.

Businesses may absorb these rising costs in the short term, but when they continue to increase they may have no choice but to put their prices up.

“People naturally shy away from taking risks when things are uncertain, but actually it can be a good idea to do the opposite. To be contrarian.

Millar explains that while this is certainly true, inflation's roll may be slowing already.

“For example, look at those fallen angel stocks, like Tesla. Some of them have been smashed recently, so they now represent better value than they did a few months ago.” Millar adds that it’s also worth thinking about which assets usually perform well in inflationary or late cycle periods. This may include gold, infrastructure, commodities, and bonds. Last of all, you should keep the future in mind, because the fact is, super-high inflation may not be around forever. When will things get better? The problem with inflation is that it can snowball. For example, employees might go to their employers and ask for a pay rise because everything costs more – which in turn drives prices up further.

“The consumer can only stand so much, so there comes a point when they cut their spending, which can help slow inflation. “Central banks are of course hiking interest rates, which will slow the demand side, and some supply-side stuff and oil prices may ease soon.” What does all that mean for us everyday Kiwis and part-time investors? Mary Holm reckons it’s a case of sitting tight and perhaps even taking more risks. “Just weather the storm and see what happens. Don’t panic. “And if you’ve got long-term money sitting in the bank or a low-risk fund, be braver with that money, regardless of inflation. “Even if you put 25 per cent of your KiwiSaver into a higher-risk, higher-growth fund … just dip your toes in.”

YO U R I NVE STI N G

WI NTE R 2 0 2 2 | I N F O R M E D I NVESTO R 4 6

EXPERT OPINION | PIE FUND S

Managing your emotions is one of the keys to investing success. If you can learn to stay calm, remain rational, and ride out the waves of volatility, you’ll likely do better over the long term. Here’s what I’ve found:

Are We at the Bottom Yet? It can be difficult watching your investments plummet as you wonder where the bottom is. Pie Funds Founder and CEO Mike Taylor explains how to keep a cool head during tough times.

Trying to time the market is difficult. That’s why you’ll hear investment managers say, “It’s about time in the market, not timing the market.” I’ve found that it’s very hard to work out when a market has reached the bottom. In all the market turns I’ve seen over the years, no one rings a bell. It’s very, very hard, even for investment teams to determine exactly when the market’s going to bottom out. Usually, it’s the time when you feel the worst, when you really feel like, “This is terrible, I need to just sell everything and crawl under the couch.” It’s key to always have in the back of your mind that markets do recover. But despite this, you still might be feeling anxious or worried in the short term when you see your investments drop and lose value. That’s a normal feeling. Nobody likes to see their investments drop in value, even if it’s just on paper. I’m afraid the year ahead probably has more volatility in store for us. The world is going through some big events (the war in Ukraine, oil prices and inflation, among others) which are having an impact on a lot of people, and markets can take time to recover.