45 minute read

Filling The Generational Pipeline

MARK SQUIRES made a name for himself as “The Medicare Whisperer,” but his practice serves the Medicare generation’s children and grandchildren as well.

BY SUSAN RUPE

Filling the generational pipeline

Mark Squires was 42 years old when he decided what he wanted to do when he grew up. He found his calling — to make sure no one else has to deal with what he faced after he lost everyone in his family except his children over the course of seven years.

Today, Squires is president and CEO of Wise Choices Financial, an Independence, Mo., financial services firm he founded in 2002 that has grown to a team of seven professionals. But prior to becoming an advisor, he worked in the trucking industry and eventually became parts manager of a trailer dealership. His father’s death during that time left Squires with some jagged financial pieces to pick up.

“As the youngest child in the family, I was the person who had to deal with everything — Medicare, Medicaid, veterans benefits,” he recalled. “That was quite a challenge because my dad was a Merchant Marine during World War II, and the Merchant Marine benefits were completely different than they were for other World War II veterans. And then I had to deal with pension plan elections, 401(k) payout options, estate planning done horribly wrong.”

Settling his father’s estate took so much effort that Squires found he couldn’t continue working in his parts manager job and take care of his father’s estate at the same time. So he returned to his family’s trucking business for awhile.

During this period, Squires’ brother was killed in a car accident and Squires also became a single father of two while serving as caregiver to his former father-in-law during his last 13 months of life.

“When this period of my life was over, it occurred to me that maybe God put me through this experience for a little higher calling, because somehow he wired my brain to understand the complexities of all of this,” Squires said. “After everything was done, I decided that I wanted to help people navigate the waters that I navigated without any help at all.”

Squires studied for the appropriate licenses, passed the exams and decided he wanted to become an independent advisor.

“The reason I wanted to be independent? I’ll give you an example. If I want to sit down with an 86-year-old woman and spend an hour and a half talking with her about her garden and not try to sell her something, I don’t need a manager out of state yelling at me about that. And that 86-yearold woman just turned 101 this year. She has been my client for years and so have her children and grandchildren. And if you ever talk with her, she will tell you the reason she chose me is because I never asked her about her money.”

The Medicare Whisperer

Squires has a passion for serving the Medicare market, and Medicare makes up a big part of his practice. He trademarked the name The Medicare Whisperer, and he has become somewhat of a local celebrity, discussing Medicare on radio talk shows and in a series of YouTube videos.

“As The Medicare Whisperer, I have a fairly sizable presence in the Medicare market in the Kansas City area,” he said. “I have a team in my practice that is focused purely on educating and advising people in the world of Medicare and in selling Medicare. We solve problems. But whatever the need is, we’re here for more than just the sale. If we have a client who has a question or a problem, we don’t tell them to call the toll-free number on their Medicare plan card unless we have to. We will get involved, and we will educate our clients.”

Steve Kuker is the founder of Senior Care Consulting and is the host of a local radio show, “Senior Care Life.” Squires is a frequent guest on his show, and Kuker calls him “the most knowledgeable person about Medicare I’ve ever met.”

“I took my own mother to meet with him about her Medicare coverage, and he was able to get her in the right plan and save her money in the process,” Kuker said.

But Medicare is only one of three different divisions at Wise Choices Financial. Squires doesn’t want to serve only the 65-and-older crowd. He wants to serve clients of all age groups and help set them up for financial success.

“Our mission is to help people, change lives and simplify the complex,” he said. “And to be a lifetime advisor. We routinely tell clients when we onboard them, this is not a one-and-done for us. We have a responsibility to you, and we’re looking for a lifetime relationship. We’re not looking to make a quick sale and move on. We want to be a part of your life. We want to know about your children, your grandchildren, your great-grandchildren.”

Walking A Tightrope

Squires takes aim at the 55-plus age demographic by advising them on what he calls “the pillars of your financial life.” Serving that age group is the focus of the second division of his practice.

“We educate people and help them set up their estate plans, their retirement income plans,” he said.

Squires likens investing and saving for retirement to walking a tightrope.

“Walking on a tightrope could be a thrilling and life-changing experience, or it could be a horrifying and deadly experience,” he said. “It depends on two variables. One is how high the tightrope is from the floor. That’s what we call your risk tolerance. The second variable is how good your coach

is. If your coach is Nik Wallenda, the first person to walk a tightrope across Niagara Falls, you’re going to have a little more confidence in what he’s telling you.

“Well, I function as the coach as a financial advisor. But I believe the most important variable is how big and how well-anchored your safety net is. That’s where we start talking about end-of-life planning.”

Although he said end-of-life planning is “kind of an odd thing to talk to a 55-yearold about,” Squires said he tries to inject some fun into the discussion as he knows it is one of the major concerns retirees have.

Debt Free Destination

Over the years, Squires’ older clients would refer their children and grandchildren to him. As he helped them sort through their financial goals — whether it was saving for their children’s education or saving for a house — he found most of these younger clients had one thing in common.

“The first thing we looked at was their overwhelming debt, most of which is student loans,” he said.

He began to research ways to help young adults get out of debt and found that although there are many ways to become debt-free, most of those methods call for severe financial sacrifices that few people are willing to make for very long.

“Most people aren’t willing to do anything draconian for more than three months,” he said. “So I tried to figure out how I could teach people and assist them in setting up a plan to get out of debt that doesn’t require them to eat beans for every meal or deliver pizza every evening after they work their regular job because people aren’t going to stick with that.”

The Debt Free Destination was born, and that is the third division of Squires’ practice.

The plan centers on helping the participants find their inefficient dollars and redirect those dollars into a monthly account, such as a whole life policy, and use the accumulated cash value to pay off their debt as efficiently as possible.

“What we’re able to do is take a 25-year-old client and show them how to relieve themselves of debt by just paying another bill. All they’re doing is paying another bill. And then we show them how to use that as their own bank, how to give every dollar four jobs to pay off their debt. For the average client who doesn’t have a mortgage, we have them out of debt — including credit cards, consumer loans, student loans and car loans — in about 2.9 years.

For those who have a mortgage, we can have most people completely debt-free in nine years or less, and we do it without significantly changing their spending habits.

“It’s quicker than they ever dreamed possible, and they save thousands of dollars of interest. Then we show them how to turn that around. We teach a lot about compound interest and how it works. We teach them how they can build assets that will serve them for life. And it’s the most wonderful part of our business that I enjoy.”

Squires also began hosting a podcast called “Adulting Done Right,” which is aimed at young adults. He is a fixture on YouTube, producing videos on a variety of financial topics with real-life applications. “We’ve been talking about things such as what to do if you lose your job, how to write a resume,” he said of the podcast series. “We will have some of our friends who are in the real estate business and the mortgage business coming on to our video series to talk about how to prepare to buy a house. We’re constantly educating people on what resources are available.”

When he isn’t advising clients or preparing for his next video, Squires enjoys gardening and landscaping around his home. He and his wife are active in their church.

He believes his work is a mission to help people change their lives.

“I didn’t get into this business to make a million dollars,” he said. “I want to walk the journey of life with my clients and be there for them every step of the way.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

1. VUL Defender ranks #1 85% of the time for lifetime and guarantees to A100. Average premium ranking based on combined averages for VUL Defender and Eclipse Protector II IUL against top competitors for the following scenarios: lifetime no-lapse guarantee, ages 20-70, male/female, Preferred Best, Preferred and Standard underwriting classes, full, ten and single pay, death benefit amounts of $250,000, $500,000 and $1M. Companies/products included:

Lincoln Financial: VULOne

Nationwide: VUL Protector

Pacific Life: Pacific Admiral VUL

Penn Mutual: Protection VUL

Prudential: VUL Protector

Securian Financial: VUL Defender

Securian Financial: Eclipse Protector IUL

Nationwide: IUL Protector II 2020

North American: Protection Builder IUL

Symetra: Protector IUL 3.0

This comparison does not take all material factors into account and must not be used with the public. These factors include but are not limited to: applicable separate account and indexed account options, rider availability, surrender periods, or fees and expenses. For information regarding these and other factors please consult each company’s respective prospectus. Product features and availability may vary by state.

Variable products are sold by prospectus. Your clients should consider the investment objectives, risks, charges and expenses of a portfolio and the variable insurance product carefully before investing. The portfolio and variable insurance product prospectuses contain this and other information. A prospectus can be obtained at securian.com

Please keep in mind that the primary reason to purchase a life insurance product is the death benefit. Insurance policy guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company. Variable life insurance products contain fees, such as mortality and expense charges, and may contain restrictions, such as surrender periods. There may also be underlying fund charges and expenses, and additional charges for riders that customize a policy to fit individual needs. Charges and expenses may increase over time. The variable investment options are subject to market risk, including loss of principal. Uncapped indexed account participation rates are subject to change and may be less than 100%. This could have the impact of the indexed account credit being less than the change in the reference index. Agreements may be subject to additional costs and restrictions. Agreements may not be available in all states or may exist under a different name in various states and may not be available in combination with other agreements. These materials are for informational and educational purposes only and are not designed, or intended, to be applicable to any person’s individual circumstances. It should not be considered investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action. Securian Financial Group, and its subsidiaries, have a financial interest in the sale of their products. Insurance products are issued by Minnesota Life Insurance Company in all states except New York. In New York, products are issued by Securian Life Insurance Company, a New York authorized insurer. Minnesota Life is not an authorized New York insurer and does not do insurance business in New York. Both companies are headquartered in St. Paul, MN. Product availability and features may vary by state. Each insurer is solely responsible for the financial obligations under the policies or contracts it issues. Securities offered through Securian Financial Services, Inc., member FINRA/SIPC, 400 Robert Street North, St. Paul, MN 55101-2098, 1-800-820-4205. Securian Financial is the marketing name for Securian Financial Group, Inc., and its subsidiaries. Minnesota Life Insurance Company and Securian Life Insurance Company are subsidiaries of Securian Financial Group, Inc.

For financial professional use only. Not for use with

the general public. The information presented above is solely intended for use by financial professionals. Such information is not intended for public consumption or dissemination.

INSURANCE INVESTMENTS RETIREMENT

Want #1 ranked protection products?

We’ve got you covered.

With Variable Universal Life Defender (VUL Defender®), you can offer clients highly ranked, guaranteed protection with:

• Competitive premiums

Ranked #1 3 out of 4 times for lifetime guarantees1

• Flexibility in times of uncertainty

Chronic Illness option, capped/uncapped indexed accounts, 70 subaccounts

• Hassle-free, digital experience

From application, underwriting to delivery (with WriteFit UnderwritingTM)

Not variable licensed? Ask about Eclipse Protector II Indexed Universal Life.

Learn more

Visit securian.com/VULDefender or call us at 1-888-413-7860, option 1

securian.com

Insurance products issued by Minnesota Life Insurance Company

Learn more

Why Aren't They Returning To Work?

Millions of laid-off workers have yet to return to the job market even though there are near-record job openings. Enhanced unemployment benefits ended nationwide on Labor Day, and so far the evidence suggests that additional money didn’t play a big role in keeping workers on the sidelines. So why aren’t people coming back to work? A number of factors are at play, according to economists. They include COVID-19 health risks, early retirements, caregiving duties and built-up savings. A record 4.3 million people quit their jobs in August. Front-line workers in sectors like restaurants, bars and retail quit at the highest rates, which lends credence to the idea that fear of contagion and hazards of in-person work are playing a role. Meanwhile, workers

in the 55-plus age bracket account for 89% of the increase in those who aren’t looking for work right now. Economists said older workers may have opted to start drawing Social Security and live off their nest egg instead of taking a health risk at work.

Those who have caregiving responsibilities and can’t work from home also have opted out of the workforce for now. And finally,

households amassed record savings during the pandemic,

with cash balances up 50% in July over the previous year, according to the JPMorgan Chase Institute. People who have a little extra in the bank may decide they don’t have to take a job at the moment.

QUOTABLE

The labor market hasn’t fully recovered yet.

— Lawrence Gillum, fixed income strategist for LPL

Financial

Allstate is putting the For Sale sign on its Northbrook, Ill., headquarters as 95% of its employees continue to work remotely.

Allstate has been a corporate fixture in Northbrook since 1967, when it moved its offices from Skokie, Ill., to a six-building complex on a 122-acre campus. The company’s existing office space in Chicago will continue to be available to employees.

Allstate has more than 7,800 employees in Illinois and more than 44,000 across the U.S.

FED STARTS TAPERING BOND PURCHASES

The Federal Reserve made a long-awaited announcement that it would begin to unwind one of its biggest and most unprec- Jerome Powell edented market interventions undertaken in the wake of the pandemic. The Fed said it would start tapering bond purchases in November, a process that will involve a $15 billion monthly reduction from the current $120 billion a month it previously was buying.

Meanwhile, the Fed announced it would continue to keep interest rates at near zero.

Fed Chairman Jerome Powell described the current inflationary climate as “transitory,” although he also acknowledged that the supply chain disruption had created “sizable price increases” in some parts of the economy.

Since June 2020, the central bank has been purchasing $120 billion in bonds — $80 billion in Treasuries and $40 billion in mortgage-backed securities — every month to add liquidity and keep the financial system working efficiently. Powell

said that the Fed would begin reducing those purchases by $10 billion and

$5 billion, in November. The Fed will continue to step down by those increments, though Powell said the bank was “prepared to adjust the pace of purchases if warranted by changes in the economic outlook.”

ALLSTATE SELLING CORPORATE HEADQUARTERS

The work-from-home phenomenon has claimed the long-term corporate complex for one of the nation’s leading insurers.

LIFE EXPECTANCY IN US FALLS SHARPLY

Life expectancy for U.S. men dropped by 2.3 years in 2020 — from 76.7 to 74.4. Women’s life expectancy fared slightly better — dropping by 1.6 years, from 81.8. to 80.2. Only Russia saw a greater drop in expected life spans.

The U.S. had the second-steepest decline in life expectancy among high-in-

come countries during the pandemic, according to the British Medical Journal.

One surprise: The drop in life expectancy in the U.S. was driven by the deaths of young people, said Dr. Nazrul Islam, a researcher at the University of Oxford. COVID-19 was a factor, but it was not the only one. Drug overdose deaths and homicides also increased during 2020.

DID YOU KNOW ?

33% of Americans said the pandemic triggered conversations Source: National Association for Business Economics Source: LIMRA with close family members about end-of-life plans. Source: Edward Jones

JOIN US IN OUR SEARCH FOR THE “ONE”

We’ve surveyed the industry to find ONE Individual, Carrier, IMO/ BGA, Technology or Product that is disrupting the status quo and shaping the future of the insurance industry.

INSIDE

with Jeffrey Parrish of Resolution Reinsurance

with Mike Kiley, CEO of Security Benefit

PAGE 21

They may not always admit it, but chances are your employees are thinking about a child, an elderly parent or a disabled spouse — someone for whom they are responsible.

Today, 73% of U.S. employees are caring for a child, parent or friend.1 When a regularly scheduled caregiver suddenly becomes unavailable, it places a burden on the employee.

Undue anguish and stress, distractedness, decreased productivity and, inevitably, absenteeism are frequently the results.

CareAssist from Resolution Reinsurance Intermediaries is an affordable solution.

How it works

For less than $25 a month per employee, CareAssist gives employees up to 10 days of backup care per year using Care.com’s network of vetted in-home and in-center providers to find care for children and adults. They also get unlimited access to a premium membership on Care.com’s platform to find regular care for children, adults or pets; locate tutors; and more. With these two services you can help your employees find care for their planned needs, and backup care when regular care is not available.

“Whether you have existing regular care arrangements or hire regular help through the Care.com platform, CareAssist fills the gap when that care falls through,” says Jeffrey Parrish, vice president of sales and marketing for Resolution Reinsurance Intermediaries (ResRe), the Columbia, South Carolina-based health, accident, and property and casualty reinsurance broker that created CareAssist.

Jeffrey Parrish

The caregiving crisis

According to a 2019 study by Ready Nation, child care needs alone cost the nation nearly $57 billion annually in lost earnings, lost productivity and lost revenue.

Moreover, roughly 10,000 Americans turn 65 every day, according to Home Health Care News — and some 70% of them need long-term assistance with everyday tasks.

The U.S. Centers for Disease Control and Prevention estimates that at least 20% of adults age 45 or older currently provide care for a loved one. The need is so great that some experts are calling it a “caregiving crisis.”

Yet fewer than 1-in-5 of employers offer any kind of backup care for their employees.2

“Caregiving needs — especially the unexpected ones — put people in a bind,” says Parrish. “That’s why we created CareAssist.”

More than two years in the making

ResRe began designing CareAssist more than two years ago. The company built it to help people be whole during caregiving emergencies, and to keep businesses running smoothly.

Employees who are worried about loved ones aren’t at their best. The stress takes a toll on how they do their job and on their mental health. Many employees have to use vacation days for caregiving, which can lead to burnout. For employers, that means high absenteeism and constant turnover.

In fact, 61% of employers consider caregiving benefits to be a top priority, and 84% believe that having a caregiver-friendly workplace is important for retaining and attracting talent. They just don’t know how to provide it. CareAssist is a costsaving answer.

Phenomenal benefits

According to a report from Harvard Business School, the advantages of easing the distractions, doubts and fears around caregiving are nothing short of phenomenal:

80% improved morale. 70% increased productivity.

70% less turnover. 60% greater profitability.

These are benefits every employer wants.

It’s what employees want, too, but can rarely find

Some jobs may provide child care or paid family leave, but most of those have limits and can be expensive. CareAssist is unique in that it …

• Addresses a broad spectrum of caregiving — child care, adult care and elder care.

• Is prepaid like other core benefits packages, so it’s always there if needed.

“Employers need a differentiator to recruit and retain talent,” says Parrish. “Those who offer CareAssist will find it easier to hire and keep good people.”

Plan for the future

As the population keeps aging, the need for caregiving will only increase. CareAssist can help you keep up. It’s the kind of benefit that all employees will be looking for in the future, but that only the best employers will provide.

“Be ahead of the market as it evolves and demand grows,” says Parrish. “CareAssist is a cost-effective win-win for employers and their employees alike.”

Visit CareAssistWinWin.com for more information and your free product overview.

Innovation Is Driving Force for Security Benefit

Mike Kiley, Chief Executive Officer, on how Security Benefit disrupted the staid insurance segment and went on a tear in the past decade, quintupling assets and helping usher in a new era of innovation.

While we didn’t set out to reshape the U.S. retirement space, we ended up doing just that. In 2010, we took action to rebuild and allow the company to recover from the financial crisis of 2008. The first year was critical—we gave our people the chance to step up—and they did. We changed up how we approached the market, and set some clear priorities around our business model that played out successfully in the decade following. That included our effort to expand both the product line and distribution reach, while introducing some innovations.

We took advantage of ongoing market trends that saw an aging population (but with people living longer), constrained retirement saving (leading people to be afraid of outliving their savings) and an historic low rate environment, coupled with high market volatility. Our revamped product mix was strategically positioned to meet the challenges these trends created. Among our accomplishments:

• We were the first to deliver custom index account options in our fixed index annuities in 2012

• We became the creator of a new annuity product category, floating rate annuities, in 2016

• Developed our first commission-free FIA for the RIA market in 2019 with DPL Financial Partners

• Launched a new mobile app and financial wellness platform for DC participants in 2019

• Launched an institutional-level open architecture DC platform in 2020

• Launched a series of accumulation-focused FIAs to meet short and long-term retirement needs in 2020

• Ranked by LIMRA as one of the top four 403(b) companies in the K-12 education market as of 2020

• Developed a multi-factor index in 2021 that is now distributed by S&P and featured in multiple FIAs

We matched our disruptive product development effort with a refocused distribution strategy that turned the traditional model upside down — putting the focus on our sales desk instead of field staff. We also picked up on another trend some of our competitors missed: advice still sells. We built partnerships with a select set of independent financial professionals, and the industry’s leading independent marketing organizations (IMOs), that drove our growing sales volume.

We started our turnaround coming off one crisis, only to end this decade with another one. COVID has presented a unique, modern-day challenge but Security Benefit is not new to disasters. This wasn’t our first pandemic, having faced the severe flu outbreak of 1918. When COVID hit, our people took decisive action, shifting the entire firm into a fully connected, remote working environment. Forward thinking helped prepare us for the unexpected, by putting in place critical technology solutions and partners we could rely on.

This kept momentum strong as our fixed annuity (MYGA and FIA) sales increased nearly 70% year-over-year in 2020.

Challenging the status quo is in our DNA. When we were founded in 1892, we were one of the first companies to create an insurance fund for those who otherwise couldn’t afford it. Today, we are fully focused on the retirement market across a broad range of wealth segments and have nearly quintupled our assets under management in the past decade to nearly $50 billion (as of June 30, 2021). Our unique and timely approach confirms that after almost 130 years, we are not running out of good ideas.

We built partnerships with a select set of independent financial professionals, and the industry’s leading independent marketing organizations (IMOs), that drove our growing sales volume.

Find out more about what we can do for you at SecurityBenefit.com.

Life Insurers: Lessons From The Past, Looking Toward The Future

COVID-19 made consumers more aware of their mortality and more aware of why they need life insurance. But can the industry keep that momentum going in 2022?

BY SUSAN RUPE

Will the life insurance industry see a repeat of what happened after a historic pandemic swept the world about a century ago?

As life insurers ride a wave of increased sales in the wake of COVID-19, one industry leader looked to the Spanish flu pandemic of 1918-19 and expressed his hope that a post-pandemic sales slump won’t be around the corner.

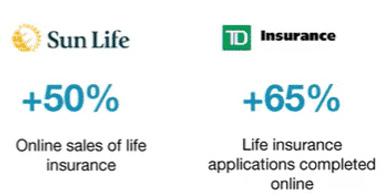

COVID-19 made consumers more aware of their mortality and more aware of why they need life insurance. The result: in the first half of 2021, life insurance sales reversed a decadeslong slump to rise to their highest level in nearly 40 years. In the first six months of 2021, the total number of policies sold increased 8%, compared with prior-year results. This is the highest policy sales growth recorded since 1983.

But can the industry keep that momentum going in 2022? Or will consumers go back to complacency and reluctance about buying coverage?

David Levenson, president and CEO of LOMA, LIMRA and LL Global, noted that the Spanish flu pandemic inspired a similar spike in life insurance sales followed by a sales slowdown in 192122. But he is optimistic that history won’t repeat itself as the world emerges from COVID-19.

“Our data tells us there are still a lot of people out there who are likely to buy life insurance,” he told InsuranceNewsNet. “There’s more of an awareness. People are seeing the value of life insurance.”

Life insurance sales will continue to increase but at a slower rate, Levenson said.

But COVID-19 will not necessarily be the driving force behind increased sales, he noted. Life insurers learned some lessons from the pandemic that will help make the life insurance purchase process easier for consumers and encourage more of them to buy.

“Insurers realized they have an opportunity to change the perception of our business and become much more client-centric,” Levenson said. “Insurers had to make advances in digitization, initially for survival. But now they realized this was great for business, great for our customers. Now consumers can engage with us the way they want, and we can speed up the process. A lot of that is going to stick as we go into the coming year.” Levenson cited research that found eight out of 10 insurers who implemented digital processes or strategies plan on expanding them in the future, and he predicted consumers will be the winners. “This is making the buying process easier and faster. Meanwhile, coverage remains cheaper than most people think it is.”

Levenson

Product Trends: UL Products

Catching Up

Levenson predicts growth in life sales across the board, but some products may see more growth than others. “We see whole life and term continuing to grow but maybe at a slower rate than previously,” he said. “When you look at growth rates since 2020, you saw strong growth in digital products, especially term. But now you see universal life products catching up. So I think we’ll still see whole life and term growing — maybe at a slower rate than what they’ve been recently — but we do think they will be higher than pre-pandemic levels.”

Interest Rates Still Problematic

Low interest rates “are the headwinds that life insurers are facing,” Levenson said. “But I think you’re seeing the industry

Technology Will Be The Leading Challenge For Insurers Over The Next 5 Years

Technology Interest rates Growth Regulation Customer experience Change management New ways of working

Source: BCG and LIMRA

26% 24% 22% 21% 20% 19% 37%

continue to adapt and act on that,” he said. “It depends on where you sit in the industry. Some carriers have had to get out of certain lines of business. And you’re seeing private equity shops buying these blocks of business.”

Levenson was reluctant to predict where interest rates might be in the coming year, but an upward or downward rate spike “is never good for anyone because that means something’s wrong in the economy.”

“But if it’s a slow, steady trend upward, that’s good for the industry; it gives them more room to work.”

Appealing To Younger Consumers

How does the industry get young adults to buy life insurance? Although insurers made inroads with the millennial generation during the pandemic, Levenson said more needs to be done.

Increased digitalization is one way the industry can appeal to young adults, he said. “Making the process easier and faster and letting consumers engage with it where and when they want are the keys.”

The industry also must address misconceptions young adults have about life insurance, he said.

“Our studies show that young adults believe life insurance costs four or five times more than it actually does,” Levenson explained. “Many millennials believe they don’t even qualify for coverage. So the industry and advisors need to incorporate some talking points addressing those issues when they present life insurance to young adults. If you can couple that information along with increased digitalization, that’s how you get younger people to buy.”

As younger generations of adults hit many of life’s milestones — buying homes, getting married, starting families — more young adults will see the need for life insurance, Levenson predicted. “They’ll realize, ‘Life insurance serves a real purpose, I have a real need for it, it’s valuable to me and I need to get it.’”

The War For Talent Is Real

This past year was marked by what some call “the Great Resignation,” in which millions of workers changed careers, retired earlier than planned or left the workforce for other reasons. The life insurance industry is feeling the effects.

In his opening remarks at October’s LIMRA annual conference, Levenson said about 17% of the industry’s employment base has been hired since the start of the pandemic, and carriers must be able to train and develop those new employees amid hybrid and remote work. Meanwhile, the industry must find talent to replace those workers who are looking to retire or change jobs.

Retention is as much of a challenge as is recruitment, Levenson said. And retention rates vary among carriers.

“Some companies are seeing better retention rates than usual, so fewer people are leaving than would normally do so,” he added. “But during the pandemic, some companies reported 30% to 40% turnover. One thing that tells us is that the ability for talent to connect to the firm and to be part of the culture is crucial, and it’s much more difficult to do when so many people are remote. So firms are really struggling with that.”

But other companies are finding opportunities in the talent wars.

“Some are saying the aspect of being remote and being more flexible can attract people to their company,” Levenson said. “Now they can hire people in Chicago, in New York or wherever for a company in wherever they might be. They’re seeing it as a real positive to attract talent.”

Insurance companies are competing with other sectors of the workforce for employees, and the industry must become more creative and flexible in attracting talent, Levenson said. “I think we will see a lot more around employee wellness and offering different benefits in an effort to win the talent games.”

Adapting To Regulatory Change

Although it’s not known what will happen on the regulatory front in the next year, insurance carriers will continue to adapt their products to work within those rules, Levenson said. And as of this writing, it’s unknown what tax changes, if any, Congress will approve next year and how those changes apply to life insurance sales.

Regarding any future tax changes or rule changes, Levenson said the core value of life insurance to middle-market Americans remains the same.

“Tax policies come and go, administrations come and go, but the fundamental need for life insurance and the opportunity to own it won’t change.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@ innfeedback.com. Follow her on Twitter @INNsusan.

VAs Back From The Dead And Rising Fast

Traditional variable annuity products are hot once again, thanks to talk of tax hikes from Washington. Annuity sales in general look strong for 2022, but could renewed regulation cause problems?

BY JOHN HILTON

Traditional variable annuities are back. Well, sort of.

Thought to be buried in an avalanche of heightened regulation, along with shinier new annuity product designs, VAs are selling well again, thanks to expected tax changes.

As this issue went to press, the Biden administration was continuing to negotiate its spending plans with various key members of Congress. What is virtually certain is that the wealthy will pay more taxes.

Perhaps a lot more in taxes.

Cue the flight to variable annuities again, where the wealthy can stash money in a tax-deferred vehicle, said Todd Giesing, assistant vice president, Secure Retirement Institute.

The tax debate is one that LIMRA and SRI are tracking closely as their annuity sales forecasts evolve in 2022. Advisors should watch out for tax news as well, Giesing said.

“If we have a change in the tax law, this has the potential to bring a different customer to the annuity market,” he explained. “And when you think about individuals who are looking for tax deferral, they’re likely going to be highnet-worth or even ultra-high-net-worth individuals.”

Variable annuities were certainly the story in the third quarter, according to SRI sales data.

Total VA sales were $30.7 billion in the quarter, up 28% from the prior year. VA sales represented 49% of the total annuity market in the third quarter, the highest level since first quarter 2018. In the first three quarters of 2021, total VA sales were $93.4 billion, 32% higher than the prior year.

The VA segment is boosted by new registered indexed-linked products, which dominated sales in recent years. However, traditional VAs rebounded strongly in the third quarter.

Traditional VA sales were $21.5 billion in the third quarter, a 22% increase from third quarter 2020. Year to date, traditional VA sales totaled $65 billion, up 17% from the prior year.

“Traditional VA sales have outperformed expectations this year, driven by the increase of investment-focused VA sales and fee-based annuities, which were fueled by an increased appetite for tax deferral solutions,” Giesing said. “As a result, we expect sales will grow nearly 20%, to almost $90 billion, exceeding our forecasted expectations.”

Forecasts Appear Strong

How annuities sell in 2022 will depend on several economic and market factors, of which tax changes are just one. Equity markets are performing well with low volatility, and that is projected to continue. Interest rates are inching upward but expected to remain very low for the foreseeable future.

The good news for annuity sellers is that a wide range of products fits many different economic scenarios. Most product categories are expected to do well in the year ahead. Giesing broke down the SRI forecasts for each.

Giesing

Registered indexed-linked. This hot product continues to sell well but is slowing down just a bit, Giesing noted. Still, more insurers are entering this market, some with creative offerings. RILAs are expected to sell well through 2022, Giesing said.

“A subset of the RILA market that we’re looking at is guaranteed living benefits,” he explained. “As the inventory of guaranteed living benefits on RILAs increases, that’ll give that segment of the business an opportunity to compete with similar products such as traditional variable annuities and [fixed indexed annuities] that offer guaranteed living benefits.”

Indexed annuities. The SRI is projecting a steady 10% growth for regular indexed products, as 2022 market projections appear promising.

“We’re seeing slow and steady growth as conditions improve from an economic standpoint and under the expectations that interest rates will continue to rise slowly,” Giesing said.

Fixed-rate deferred. What is interesting here is the significant numbers of fixed-rate deferred contracts written over the past three years — about $150 billion

worth. Many of those were short contracts, between three and five years, Giesing said.

“There will be a significant amount of replacement activity that will occur as we move forward,” he added. “Contracts will come out of their surrender period, and likely many owners will go look for another fixed-rate deferred contract.”

Income annuities. Single-premium income annuities and deferred income annuities should see slight growth in 2022, as interest rates remain low, Giesing said. “We do expect sales to increase from this year, but albeit very slowly — maybe a billion dollars higher for both.”

What Could Go Wrong?

The political environment remains a mix of good and bad for annuity sellers. On the one hand, the Setting Every Community Up for Retirement Enhancement bill signed into law at the end of 2019 is resetting the annuity sales environment.

The SECURE Act tweaked and relaxed a host of tax and regulatory guidelines, all aimed to make it easier for Americans to save for retirement.

While companies already can offer annuities in their 401(k) lineups, only 9% do, according to the Plan Sponsor Council of America. The SECURE Act aims to boost that figure and improve retirement readiness by eliminating companies’ fear of legal liability if the annuity provider fails or otherwise fails to deliver.

As of this writing, Congress was considering companion legislation known as the Securing a Strong Retirement Act of 2021. The bill would expand options for contributing to retirement accounts and further ease the use of annuities in those plans.

Things are dicier on the regulation side, where 2022 could see a return of the dreaded fiduciary rule first put forth by President Barack Obama in 2015.

The DOL’s spring 2021 Regulatory Agenda confirmed that it will be rewriting the definition of fiduciary. The Employee Benefits Security Administration plans to issue the notice of rulemaking by December 2021, the agenda stated.

That timeline will surely be delayed, said Fred Reish, partner at Faegre Drinker Biddle & Reath.

The DOL is likely headed toward a “definition of fiduciary advice such that any recommendation of a financial product to a retirement account is fiduciary advice,” Reish said during a recent conference session.

Watch FIA Treatment

In February, the DOL allowed the investment advice rule, written by the Trump administration, to take effect. That rule replaced the 2015 fiduciary rule, which was tossed out in 2018 by a federal appeals court.

The new rule has two main parts: a new prohibited transaction exemption 202002 and a reinstatement of the five-part test from 1975 to determine what constitutes investment advice.

For now, the DOL is certain to build on PTE 2020-02, Reish said.

PTE 2020-02 applies to advice for rollovers and other movement of retirement money. Broker-dealer representatives and investment advisors can use the exemption to collect compensation for transactions involving 401(k)s or IRAs. Insurance producers can still use PTE 84-24 for annuity and life insurance sales involving retirement funds.

“I think 84-24 will definitely be modified,” Reish said. “There will be provisions of 2020-02 that will be moved over to it. Probably the fiduciary acknowledgement, the best-interest standard and maybe specific disclosures of reasonable compensation limitation. It’ll look a lot more like a fiduciary type rule than it does right now.”

The thing to watch is how the DOL ends up treating fixed indexed annuities, he added. Regulators have tried for years to apply tougher regulations to these products.

“Fixed indexed annuities would be the one type of annuity most impacted by [rewriting 84-24],” Reish said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john. hilton@innfeedback. com. Follow him on Twitter @INNJohnH.

Health Insurance: Stabilized Premiums Despite Nursing A ‘Hangover’

The individual health insurance market will continue to see stabilized premiums. Meanwhile, consumers are making up for care deferred during the pandemic, leading to a possible increase in spending.

BY SUSAN RUPE

The health insurance industry could experience a COVID-19 “hangover” in 2022, as consumers who put off getting elective treatment during the pandemic return to the doctor.

That was a prediction from PwC’s Health Research Institute, which projected employer medical costs to increase 6.5% in 2022, slightly lower than in 2021 and higher than the period from 2016 to 2020.

Contributing to this increased spending are the consumers who received care that had been deferred during the pandemic, as well as the ongoing costs of treating COVID-19, increased mental health and substance abuse issues, and poor pandemic-era health behaviors.

However, on the individual market, most carriers who participate in the Affordable Care Act marketplaces assumed COVID-19 would have no effect on their 2022 costs, according to rate filings.

Kaiser Family Foundation reported that of the 311 rate filings reviewed, 272 plans had a premium change for 2022. Rate changes from 2021 to 2022 range from a 28.5% decrease to a 25.6% increase, although half fell between a 1.8% decrease and a 6.2% increase.

The four consecutive years of declining premiums on the individual market

is good news for consumers, said Matt Eyles, president and CEO of America’s Health Insurance Plans.

“For next year, we anticipate seeing another decline in marketplace plan premiums,” he said. “As we’ve looked at the data, we see the average premium for the typical benchmark silver plan next year will decline by about 3%. And about 80% of individual consumers who are buying coverage on their own should be able to find coverage for $10 or less per month, as a result of the enhanced premium subsidies under the American Rescue Plan.”

Lower premium costs are a sign that the ACA marketplace is moving toward stability after its bumpy early years, he said.

In addition, consumers have more carriers from which to choose in the ACA realm, and some carriers have expanded their coverage areas for 2022.

“I think the story of the individual market is that after several years of trying to figure out what the market would look like, and then some of the changes that we had seen under the past administration, now we continue to see the market mature,” Eyles said. “As more carriers enter the market, some of that, I think, is a reflection that they believe the future is good and it’s the right time to make that investment.”

On the employer side, health insurance and related benefits are more crucial than ever to attract and retain workers as the war for talent heats up in the coming year, he said.

The Expansion Of Government Health Care

An increasing number of Americans receive their health care through government-based programs.

Since 2017, the percentage of managed care organization members who receive care through Medicare or Medicaid jumped from 31% to 41%, according to statistics from Florida Blue. Medicaid currently makes up 25% of the MCO membership mix, while Medicare has 16%. Meanwhile, commercial self-funded insurance makes up the biggest piece of the pie at 43%, although that share decreased from 50% in 2017. Commercial private insurance makes up 16% of the mix, down slightly from 19% in 2017.

President Joe Biden campaigned on a health care platform that would expand Medicaid, lower the Medicare eligibility age and establish a public option. So far, none of these has become reality. But what about in 2022? Eyles was doubtful.

“I think the message is clear that we

should build and improve upon what we have, and I think we’re optimistic that people will recognize that’s still the best way to go over the long term,” he said. But he also said that much of the expansion of government health care could come at the state level. Several states are exploring public options of their own.

Eyles Social Determinants Of Health

The terms “health equity” and “social determinants of health” became buzzwords over the past year or so. Health insurers will devote more attention to those factors in the coming year, Eyles said. “Health insurers are committed to addressing health inequities, and especially the underlying social factors,” he said. “I think that will continue to be important in 2022. We also are focusing on the cost and price of prescription drugs, which take up a big piece of the health premium dollar.” Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan. 2 Other Issues to

Watch in 2022

COVID-19 And The New Normal

COVID-19 forced the health insurance industry to adapt, and some of those changes will become more of a norm in the coming year, Eyles said. He pointed to the increasing use of telehealth services as one example.

“We really made such a shift toward virtual care,” he said. “And we know a lot of the in-person care has resumed. But I do think that we’re all trying to figure out, longer term, what’s that balance and mix going to be in-person versus telehealth services. I think the pandemic has shown how important telehealth services were, especially in certain areas, not just to get treatment and diagnosis for acute conditions but for things also like mental health treatments and services.”

1. Drug spending. Drug costs continue to rise. On average, insurance covers a larger share of retail prescription drug spending than a decade ago, while consumers’ share has leveled off in recent years. 2. Surprise billing. Unexpected medical bills have largely been put to rest with the No Surprises Act, which takes effect on

Jan. 1, 2022. But how this bill will shake out in terms of savings or costs for the industry is unknown. It could lower premiums or shift costs from the consumer to the payer or the employer.

Source: PwC Health Research Institute

They Want Digital Life Insurance

Millennials ‘Unforgiving’ On Tech Expectations

Emerging technology is great for streamlining delivery of insurance coverage using fewer resources. But it is also creating a much more demanding customer, said Martha Turner Osborne, chief marketing and sales officer for Teachers Life, a Canadian fraternal benefit society. "Marketing to millennials is different than any other group," Osborne said during the Society of Insurance Research annual conference. “If you don’t understand this,

you’re going to miss the mark. They are unforgiving in their expectations of technology and customer service. So if our experience doesn’t live up, all the marketing in the world won’t make a difference.”

Despite the challenges presented by the younger generations, they do want life insurance, surveys show. Life insurance being perceived as complex and expensive is their key barrier, Osborne noted.

There is much work to be done to capitalize on the opportunity, Osborne said. “Our key conclusion on the consumer is that millennials put the work in when it comes to their finances,” she added. “But they face much tougher economic realities than many in previous generations. And while their life milestones are happening later, older millennials are in the key life moments now.”

LIFE INSURERS REMAIN ON STRONG FINANCIAL FOOTING

Capitalization remains strong for U.S. life insurers and investment portfolio stress has diminished, according to Katilyn Pulcher, associate director, S&P Global Ratings. Pulcher made her comments during the American Council of Life Insurers annual meeting. Mortality claims have also declined, and demand for life insurance and annuities has led to significant sales recovery for the industry year over year.

The life insurance sector remains a highly rated sector, she added. Ninety-two

percent of companies are rated A or higher, and 93% have a stable outlook. Life insurance sales are stronger than they were before COVID-19.

In addition, second-quarter, year-todate adjusted earnings improved, although they were weighed down by mortality rates during the first quarter of the year. “This appears to be on the rebound,” she added.

KANSAS CITY LIFE ANNOUNCES SALE OF SUNSET LIFE

Kansas City Life announced that it has sold Sunset Life, a wholly owned subsidiary, to Bona Holdings.

Kansas City Life is expected to record a net gain of approximately $5.5

QUOTABLE

There is really an education problem in the group life insurance marketplace.

— James Beem, J.D. Power

million on the transaction.

Sunset Life was founded in 1937 and acquired by Kansas City Life in 1974. Sunset Life operated primarily in the life insurance and annuity market but ceased writing new business in the early 2000s.

METLIFE FINDS MORE CLAIMS FROM YOUNGER COVID-19 VICTIMS

The third quarter proved to be costly for MetLife as COVID-19 deaths among younger workers brought a wave of claims against the company, which is a major provider of workplace-based life insurance.

However, the high level of death-benefit payout was more than offset by unusually strong investment gains from the small slice of the insurer’s investment portfolio held in private-equity funds.

MetLife more than doubled its net income and posted a 31% increase in its adjusted earn-

ings, The Wall Street Journal reported.

MetLife’s COVID-19 details followed reports of elevated deaths at other insurers, including The Hartford and Prudential.

DID YOU KNOW ?

Northwestern Mutual’s $6.5 billion dividend payout for 2022 was its largest ever. Source: Northwestern Mutual

Life Insurance | Annuities | Asset Protection

Protecting what matters most. Together.

Your clients count on you to help them protect what matters most. And for more than a century, you’ve trusted Protective to work as hard as you do for your clients and help you deliver the sense of security they deserve.

Now, more than ever, Protective is here for you with a bold new energy and renewed commitment to helping you make life insurance and annuities more accessible to more people. We’re here to help your clients be more confident, to help you protect more people and to help you grow your business. Because in the end, we’re all protectors.

protective.com/protectors

The Protective trademarks, logos and service marks are property of Protective Life Corporation and are protected by copyright, trademark, and/ or other proprietary rights and laws. Protective and Protective Life refers to Protective Life Insurance Company (PLICO) located in Nashville, TN and its affiliates, including Protective Life & Annuity Insurance Company (PLAIC) located in Birmingham, AL. Insurance and annuities are issued by PLICO in all states except New York and in New York by PLAIC. Product availability and features may vary by state. Each company is solely responsible for the financial obligations accruing under the products it issues. Product guarantees are backed by the financial strength and claims-paying ability of the issuing company. Insurance and Annuities are: Not a Deposit | Not Insured by any Federal Government Agency | Have no Bank or Credit Union Guarantee | Not FDIC/NCUA Insured | May Lose Value CLABD.2925266.07.21