14 minute read

Future Tech

Part One

Floating farms, brain wave passwords, and coffee-powered cars are just some of the incredible inventions and innovations that will shape our future.

Advertisement

Every day, people around the world come up with new ways to make the future brighter. Over the next three months, we’ll put together a list of some of the most exciting advances in future technology that will change our world. Whether it’s improving health, solving food shortages or just making virtual reality even better, these innovative ideas are sure to amaze you.

Airports for drones and flying taxis Drown forest fires in sound

Forest fires could one day be dealt with by drones that would direct loud noises at the trees below. Since sound is made up of pressure waves, it can be used to disrupt the air surrounding a fire, essentially cutting off the supply of oxygen to the fuel. At the right frequency, the fire simply dies out.

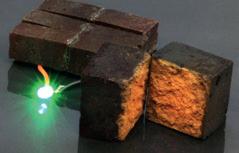

Organisations like the Civil Aviation Authority are looking into the establishment of air corridors that might link a city centre with a local airport or distribution centre. With our congested cities in desperate need of a breather, plans for a Energy storing bricks different kind of transport Scientists have found a way hub - one for delivery drones and electric air-taxis - are Artificial eyes to store energy in the red bricks that are used to build becoming a reality, with the Belgian scientists have developed an artificial houses. first Urban Air Port (pic, iris fitted to smart contact lenses that correct a Researchers have below) receiving funding number of vision disorders. And scientists are developed a method that from the UK government. even working on wireless brain implants that can turn the cheap and Powered completely off-grid by a hydrogen generator, the idea is to remove the need for as many delivery bypass the eyes altogether. Researchers at Monash University in Australia are working on trials for a system whereby users wear a pair of glasses fitted with a widely available building material into “smart bricks” (pic, below) that can store energy like a battery. vans and personal cars on camera. This sends data directly to the implant, Scientists claim that walls our roads, replacing them which sits on the surface of the brain and gives made of these bricks with a clean alternative in the the user a rudimentary sense of sight. could store a substantial form of a new type of small amount of energy and can aircraft, with designs being be recharged hundreds of developed by Huyundai and Airbus, amongst others. thousands of times within an hour.

Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could:Unlock the cash from your home and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home and are looking to boost your retirement finances, your home could Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: help. By releasing tax-free cash from your home, you could: Unlock the cash from your home Unlock the cash from your home

Gift money Go on Clear credit cards Make home and and are looking to boost your retirement finances, your home could and are looking to boost your retirement finances, your home could garden improvementshelp. By releasing tax-free cash from your home, you could: help. By releasing tax-free cash from your home, you could: to family holiday and loans Make home and Gift money Make home and Go on Gift money Clear credit cards The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Replace the car Pay off an existing mortgage Clear credit cards and loans The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, to familygarden improvements The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, to family holiday and loansgarden improvements Replace the car Pay off an existing mortgage Clear credit cards and loans Gift money to family Go on holiday Pay off an existing mortgage Clear credit cards and loans Make home and garden improvements Gift money to family Go on holiday Clear credit cards Make home and garden improvements Gift money to family Go on holiday Clear credit cards Make home and garden improvements Unlock the cash from your home

To find out more or to arrange a FREE, no-obligation consultation, contact me The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement.so we’ll be able to recommend the equity release plan that could help transform your retirement.The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, homeowner aged over 55 and are looking to boost your retirement finances, your home could on the details below; so we’ll be able to recommend the equity release plan that could help transform your retirement.To find out more or to arrange a FREE, no-obligation consultation, contact me To find out more or to arrange a FREE, no-obligation consultation, contact me so we’ll be able to recommend the equity release plan that could help transform your retirement.so we’ll be able to recommend the equity release plan that could help transform your retirement.The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, Unlock the cash from your homehelp. By releasing tax-free cash from your home, you could: Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of on the details below; Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk on the details below; Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; so we’ll be able to recommend the equity release plan that could help transform your retirement. Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Replace the car Pay off an existing mortgage Clear credit cards and loans To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; so we’ll be able to recommend the equity release plan that could help transform your retirement. Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Replace the car Pay off an existing mortgage Clear credit cards and loans The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Gift money to family Go on holiday Replace the car Pay off an existing mortgage Clear credit cards and loans Make home and garden improvements If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Gift money to family Go on holiday Replace the car Pay off an existing mortgage Clear credit cards and loansgarden improvements the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity release may involve a lifetime mortgage, which is a loan secured on your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is competely free of charge; as our usual advice fee of 1.99% of Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of 61the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and

View our interactive Flintshire magazines on your tablet, smartphone or laptop

Search for LOCAL vouchers

Shop directly See our latest video reviews Connect with local businesses and their websites Read lots of interesting editorials

To subscribe to our free interactive online magazine or to add your business: E: reg@insideflintshiremagazine.co.uk T: 01352 870 760 Subscribe here W: www.insideflintshiremagazine.co.uk