LaTasha

Whenyouthinkofbuyingyourdreamhome,the

questionoffinancearises,towhichtheanswer isamortgage.Foryears,themortgageindustry wasonasteadyrise,butthechallengingtimeofthe pandemicskyrocketedtheindustryrapidly.Analysts worldwideweren'texpectingthissoaringchange;however, mortgageindustryleaders'uniqueapproachandinnovative strategiesmadetheimpossiblehappen.

Eventhoughthecrisisledtomanycriticalissues,one marvelousthingthatthepandemicpushedforwardwasthe collectiveeffortsofwomenleaderstosupporteachother andinvariouscollaborativeinitiatives.Theseinitiatives focusedonmitigatingthehealthriskswhilepivotingthe businesstowardsadigitalplatform.Tomeettherobust demandinthepandemic,thesewomenleadersnavigated throughtherestrictionsandutilizedtheirstrongpositionsin themarkettodrivetheimpactingchange.

Womenleadersdrovetransformativechangeswith compassionanddedicationthatbuiltastrongrelationship withtheirclients,whichprovedtobeanessentialkeypoint forresolvingproblems.Evenbeforethepandemic,these leaderswerecomingupwithstrategiesthatwouldupscale theindustryoffersmorebenefitstotheirclients.

Theriseintheleadershiprolesintherealestateindustry hasseenwomenleadersempoweringotherwomento ventureintotheindustryastheyholdthecapability, commitment,andcalmnesstodealwithsuddenchanges. Foryears,therehavebeenaparadigmshiftandmore womenventuringintothemortgagewiththeir

entrepreneurialjourneyandfulfillingdreamsof themselvesandclients.

Comeacrosstheinspiringstoriesofwomenleaders inthiseditionof "The 10 Most Empowering Women in Mortgage Industry, 2021." Fromfacingchallenges toovercomingthemwithacompassionateapproach, providinginnovativesolutionswiththought-out strategies,theseleadersarerootingthemselvesto openupdoorsforaspiringwomenintheirrespective industries.

Featuringonthecoverstoryisoneoftheleaders reshapingthelandscapeandpavingthepathfor emergingfemaleprofessionals,LaTashaRowe.She istheGeneralCounselandChiefCompliance OfficeratNFMLending,anaward-winning,multistateresidentialmortgagelenderlicensedin42 states.

Diveintotheplethoraofsuchinspiring entrepreneurialjourneysthatimpactthemortgage spaceandgaininsightsabouttheindustrythrough theCxOstandpointsoftheleadingexperts.While flippingthroughthepages,makesuretogothrough thearticleswrittenbyourin-houseeditorialteam.

Letusbegin!

sourabh@insightssuccess.com Sourabh More

AmyBuynoski VPBuilderService Manager

SouthStateBank southstatebank.com

ChristaDevers WilliamsOwner

COMFEMortgages comfemortgages.com

SouthStateisoneoftheleadingregionalbanksinthe Southeast,servingmorethanonemillioncustomersvia275+ locationsinFlorida.

COMFEMortgageshelpclientsfacilitatethemostappropriate mortgage.

DesiréePatno CEOandPresident

GalindaFleming Sr.LoanSpecialist

NAWRB NAWRB.com

MIDFLORIDA Mortgage midflorida.com

WomenintheHousing&RealEstateEcosystem(NAWRB)is aleadingvoiceforwomen.

MIDFLORIDACreditUnionoffersfriendly,personalized serviceforclientsfinancialneeds.

KathyMorris ManagingDirector

LaTashaRowe GeneralCounseland ChiefComplianceOfficer

SmartLendMortgage smartlend.com.au

NFM,Inc nfmlending.com

LeslieWish SeniorLoanOfficer

LuisaHough MortgageProfessional

McLeanMortgage mcleanmortgage.com

SmartLendMortgagehastheexperienceandknowledgeto understandwhichlendingoptionswillbestsuityourhomeloan needs.

NFMLendingisamulti-stateresidentialmortgagelender currentlylicensedin42states.

McLeanMortgagewillhelpyouconsiderallofyouroptionsby discussingyourfinancingneedstocreateaclearpathfrom findingtheperfecthousetogettingtherightloanthatfitsyour needs.

AdvantageMortgage findtheadvantage.com

RenaMalkah MortgageBroker

SarahSloane Founder

CYRFunding BrokersTeam cyrfunding.com

MintMortgage mymintmortgage.com

AdvantageMortgageisalocallyownedcompanyoffering expertiseinmortgages.

CYRFUNDINGINC.™isoneoftheleadingindependent Ontariomortgagebrokerfirms.

MintMortgagecompanyisadivisionofPointMortgage CorporationserveclientsinthegreaterMiamiandFort Lauderdaleareas.

NFMisdedicatedtoremainingan innovativeindustryleaderbyproviding ourclientsandbusinesspartnerswith exceptionalserviceandopen communicationthroughouttheloan process,workingtogetherasa passionateandreliableteam,and supportingthecommunitiesweserve.

LaTasha Rowe General Counsel and Chief Compliance Officer NFM Lending

LaTasha Rowe General Counsel and Chief Compliance Officer NFM Lending

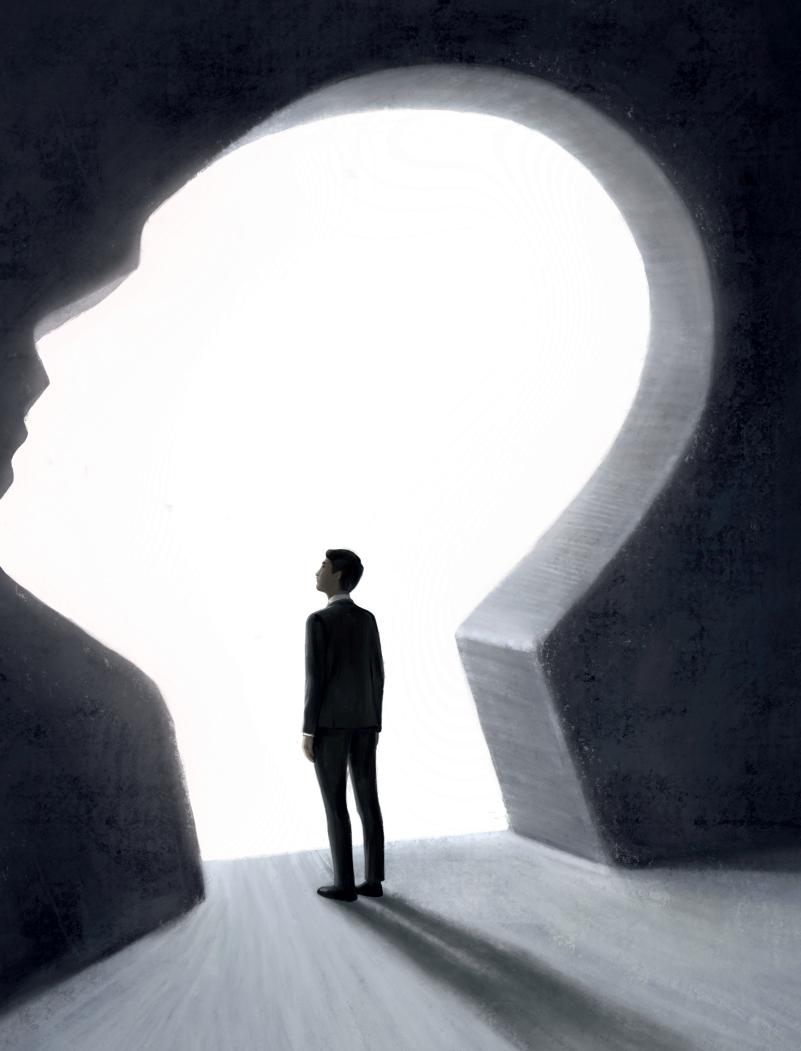

Traditionally,themortgagebusinesshasbeen surroundedbymen,butthefaceoftheindustryhas beenchanging.Women,whotendtobringa differentperspectiveandcomprehensiveapproachto leadershipanddecision-making,havemadetheirmarkin almosteverydiscipline.Thefinancesectorisnoexception.

Whenitcomestothemortgageindustry,womenare reshapingthelandscapeandpavingthepathforemerging femaleprofessionals.AmongthemisLaTashaRowe

RoweistheGeneralCounselandChiefCompliance OfficeratNFMLending,anaward-winning,multi-state residentialmortgagelendercurrentlylicensedin42states.

Shehasbeenprominentinunlockingthedoorsofsuccess forthecompany,andherpassionforfairlendinghasguided hertowheresheistoday Abigreasonforherachievements istheemphasissheplacesongivingeveryoneachanceat homeownershipand,inreturn,onbuildingcommunities. Whileshewouldn'tchangeathing,Rowesaysherjourney sofarhasn'talwaysbeensmooth.

In2008,whentheworldwasinthemiddleofsignificant financialturmoil,Rowegavebirthtoherson,Joshua.She decidedtoleaveprivatepracticeandbecameastay-at-home momtoJoshuaandhisoldersisterGabrielle.Bythetime Joshuastartedpre-school,therealestateindustryhadbegun itsrecovery,andRowethoughtitmightbeagoodtimeto returntotheworkforce.Whenshestartedapplyingfor positions,shewonderedhowshewouldgetuptospeedon thechangesthatoccurredduringherhiatus.Toherfortune, herfriendandformercolleague,StephaniePyron(formerly Bogan)wasthecurrentGeneralCounselandChief ComplianceOfficeratamortgagecompanycalledNFM, Inc.

Afterherinterviewandmeetingtheotherleadershipteam members,sheknewshewantedtobeapartofNFM.Two yearsintoLaTasha'srole,StephanieleftNFMforanother opportunity,butnotbeforeteachinghereverythingshe knewaboutthemortgageindustryandrecommending LaTashaforherrole.

UnderLaTasha'sleadership,thecompany's accomplishmentsaremany.NFMhasobtaineditsFannie Mae,FreddieMac,andGinnieMaeapproval,whichallows ittosellmortgagesdirectlytothegovernment-backed lenders.ThecompanyrebrandedasNFMLendingand addedtotheNFMLendingFamilywithdivisionsBluPrint HomeLoans,FreedmontMortgageGroup,andMainStreet HomeLoansinthelastfewyears.Theorganizationhas grownfrom175employeeswhenshestartedtoover1,100 todayandislicensedinover40states,furtherestablishing NFM'snationalfootprint.Tosaythatthisrolehasexceeded herexpectationswouldbeanunderstatement.

Inherrole,RoweoverseesNFM'sfairlendingplatform, promotingequityinthehomeloanprocessforwomenand minorities.Equalaccesstocreditisherpassionandthe reasonshejoinedNFMLending.Ithasallowedherto partnerwithseveralorganizationstoclosethetechnology divideandcreateaffordablehousingforlow-to-moderateincomefamilies.

Roweisimpressedbyhowmanywomenarenowemployed inthemortgageindustrybutsaysitisstillevolving,with moreroomforwomenandminoritiesinleadership.She appreciatesherseatatthetableandconsidersherrole"to scootoversothatanotherwomanorminoritycanhave

space."Iftherewasonethingshecouldchange,itwouldbe thecurrentcreditscoringmodelusedtoapprove consumers.Inheropinion,expandingwhatfactorsinto credithistorywouldsignificantlyincreasethenumberof womenandminoritieseligibletobuyahome.

Rowehadtoovercomemanyhurdlestoreachwheresheis. AsChiefComplianceOfficeratNFM,shefindscompliance verydifferentthanwhenshejoinedadecadeago.Soon afterbeingpromotedtoGeneralCounsel,shesawthe ConsumerFinancialProtectionBureau(CFPB)takecontrol ofregulations.Guidingthebusinessbecamedependenton reviewingmultipledirectivesandenforcementactions. StayingengagedintradeorganizationsliketheMortgage BankersAssociationhelpedtremendouslytoprovidemore certaintyastheCFPBevolved.

Rowenotesthatcomplianceisnotalwaysawelcome departmentintheindustryasitisaverysales-driven business.Reframingtheperceptionthatitisthedepartment of"no"oranobstacletoinitiativestakeswork.Building relationshipsinternallyhashelpedRowetremendouslyin gainingthetrustofhercounterpartsthroughoutthe organization.Inmostinstances,shesaysthereisamiddlegroundsolutionwhereeverybodywins.

WhenthewaveofCOVID-19arrived,itrequiredNFM Lendingtofast-tracktechnologyprotocolsthat,innormal circumstances,wouldhavetakenyears.Likeothersinthe financialservicesindustry,NFMisdependentonmany partiestocloseahomeloan.Attheheightofthepandemic, appraisershadlimitedaccesstohomes,titlecompanieshad

todeterminehowtohaveclosingswhilecomplyingwith safetyprotocols,andtheworkforcetransitionedtoaremote environment.Rowesaysthatherteamwouldhave crumbledwithouttheforesightoftheleadershipteamat NFMLending.Fortunately,theleadershipteamisseasoned atthecompanyandintheindustry;theyhavebeenthrough stormstogether Thisleveloffamiliarityshinesintough times,anditbeamedduringCOVID-19.LaTashaasserts, "The true heroes are our staff. In 2020 our sales tripled. Our corporate team did not. Without their grit and agility, we would not have gotten through."

Rowebelievesthatstayingengagediscriticaltopreserving agreatworkculture. "If we are not vested in the success of each of our employees, we cannot survive," shesays. Duringthepandemic,NFMLendingcontinuesgatherings forteamsocialevents,birthdays,andmilestonesvirtually PresidentJanOzgaandCOO/CAOBobTysonhost regularlyscheduledhappyhourswitheachdepartment,and Founder/CEODavidSilvermanholdsquarterlyTownHall meetings.InthewakeoftheGeorgeFloydmurder,Rowe, Mr.Ozga,MadisonGrey(DirectorofHumanResources) andGregSher(ChiefBusinessDevelopment Officer/CreatorofNFMTV),launchedtheDiversity, Equity,andInclusioncommittee(DEI)withafocuson greaterinclusioninwhattheteamcallsthe3“Cs”:the Company,theCommunity,andtheConsumer

NFMisafirmbelieverinemployeerecognition,withone ofitsmostextensiveprogramsbeingitsValueAwards. Employeesnominateotheremployeesbasedonthe companyvaluesofService,Innovation,Teamwork,and Excellence.Winnersarealsorecognizedinaquarterly videoandreceiveaplaquetheyproudlydisplayontheir desks.ThecompanyregularlysendsoutNFM-branded swagtoemployees,whosubmitpicturesofthemselves wearingthegearfordisplayonitssocialmediachannels.

Roweasserts, "It is essential to check in and listen to how the staff is feeling. While getting the work done is important, I am grateful NFM Lending has a culture that cares about the employee achieving personally and professionally.”

Whenaskedheropiniononthenecessityforbusinessesto aligntheirofferingswithnewertechnological developments,Rowestatesthatprovidinganoptimal

‘‘

IamgratefulNFM Lendinghasa culturethatcares abouttheemployee achievingpersonally andprofessionally

consumerexperiencerequiresexploringwherethecompany canimplementtechnologyinallstagesoftheloan transaction.

Buyingorrefinancingahomeisthebiggestpurchasemost willmakeintheirlifetime.Creatingtheabilitytoapply, uploaddocumentation,andreviewtheapplicationstatus fromalaptopormobiledevicecreatestheabilitytoreach moreconsumersandprovideloandecisionsmore efficiently.Byinfusingtechnologyintoitsinternal processes,thestaffofNFMLendingfindsiteasierto analyzethedatainsteadofthetime-consumingtaskofdata entry.

Rowefirmlybelievesthatineverything,thereis opportunity.Sheopinesthathomeownershipopensthedoor towealthcreation,andNFMisjustscratchingthesurface onwhatitcandototransformtheideaofowningahome intoareality.

DavidSilvermanformedNFMin1998alongwithhiswife, Sandy,anditisoneofthefewmortgagecompaniesstill standingthroughthemanychallengestheindustryhas

facedoverthelasttwodecades.Timeandtimeagain,the companyhascomeoutofuncertaintyevenstronger After 9/11,ittransitionedfrombrokertoacorrespondentlender.

Afterthehousingcrisisof2008,thecompanychangedits focusfromrefinancingtopurchase.Asitemergesfromthe pandemic,theorganizationhasagreateremphasisonthe importanceofinclusion.EmployeesofNFMLending embodytheagilitymindset.Becauseofthis,Rowebelieves thecompanywillbeahouseholdnameinthenextfive years.

Inheradvicetoupcomingwomenleaders,whoaspireto enterthemortgageindustry,shesays, “Don't limit yourself. No one wakes up and says, 'I want to be in the mortgage industry!' As a result, many in our field have varied backgrounds, and it is that mixture of skills and experiences that make our industry great. We are an industry of resilience. If you learn your niche, you will always have a place no matter how much the industry changes. Having an open mind and being a sponge will take you far. Secondly, find a mentor and a sponsor (man or woman) who can help you navigate and network."

Imaginewalkingintoabankwhereyoufeelathome,

yourworkprocessiscarriedoutseamlessly,andyou feellikeanessentialaspectofthebank.Seems impossible,right?ButwhenitcomestoSouthStateBank, everythingmentionedaboveistrue.AmyBuynoski,Vice President,BuilderServiceManager,hascultivateda teamthatmakestheirclientsfeellikeafamily

Amyensuresthatherfocusisalwaysonacustomer-first approach;shebelievesinmakingherclientslivesmore accessibleandconvenient.Sheimplicatedvariousfactorsat theworkplace,andSouthStateBankwasvotedoneofthe bestplacestowork.Amywasawardedthe“Lenderofthe Year”byAtlantaAgentMagazineforherdedicatedwork.

SincejoininginDecemberof2019,SouthStateBankis supportedbyacompassionatestaffthatcaresaboutits customerexperience.ThemostcrucialaspectatSouthState isthattheydon'tlookatthecustomerasanapplicationas thecompanyissupportiveandcaresaboutitsclients' experienceasmuchasAmyandherteam.

COVID-19shookeveryworkingsectorglobally,andithas hadadrasticimpactontheentireFinancialServices industry.However,itallowedSouthStateBanktoprovide itsclientswithamoreefficientexperiencethrough improvedtechnology.Ithasthrivedinthisnew environmentwithourexceptionaltechnologyfeaturesand personalizedcustomerservicestoeachclient.

Itwascrucialthaneverthattheclientdeservedtofeela morepersonalconnectiontotheirfinancialinstitution,and SouthStateisproudtoprovidethatineachaspect.COVID hit,andAmyandherteamhadtoadjusttheirusualwayof

doingloans,butthroughthethickofCOVID,theywere supportedandgiventhebesttoolstoend2020onagreat note.

SouthStateBankgaveallthetoolstoitsstaffthatwere neededtocontinuewiththeirwork.Itfoundwaysto communicatewithoutbeinginthesameofficeasotherstaff. Throughzoom,teams,andthegoodoldfashiontelephone iskeptopencommunicationwitheveryone.Itstayed competitivewithratesbyfollowingthemarketandkeeping upwiththedailynews.

Intoday’sworld,whereitisnoteasytomaintainahealthy workenvironment,thatiswhyAmytrulybelievesa positiveworkcultureisimperative.Itsetsthetoneforthe officeanditscustomers.Asateamplayer,Amytriestohelp othersstaypositiveevenwhensomedayspresent challenges.ThroughouttheBuyNowTeamofficeyouwill seemotivationalsignsandsayingsaroundtheoffice,and theteamcommunicatesopenly Thispositivecultureisthen passedontoeachclientineveryinteractiontoshowthey arevaluedandamemberoftheteam.

ThebestwayAmy’steamhasimplemented BuyNowTeam’scultureiswithgreatmutualrespectand admirationforeachteammemberandtheirroleonthe team.Whenclientscometotheiroffice,thefirstthingmost peoplesayishowtheyfeelathome.Eachteammember needstoknowtheyarevalued,andtheywillsharethat valuewiththoseclients,andpartners,thattheyconnect withduringtheworkday

ACompetitiveAdvantage

Innovativetechnologiesarebeingutilized,andithas changedthelandscapeoffinanceindustry.SouthState

Bankhasmovedtoanautomatedsystemthatstreamlines theprocess,allowingittocloseloansquicker.Thatmeans lessfrustrationontheclient’spart,whichisexciting.

SouthStateBankisusingthesetechnologytoolstomake thisimportantprocessmuchmoreefficientforthecustomer anditsinternalteam.Financingthepurchaseorrefinanceof one’shomecanbeintimidatingtoanyclient.However,the company’stechnologydoesagreatjobofmakingita smoothertransactionforeachborrower.

Apartfromworkingatthebank,Amyalsoresidesinthe communityandvolunteershertimeandresourcestohelp strengthenthecommunityoutsideofSouthStateBank.She enjoysvolunteeringatherdaughter’sschoolandcoaching

herdaughterscheerteams.Coachinghasbeenoneofthe bestexperiencesofherlife.IthelpsAmytospendquality timewithherdaughters.Shealsohadanopportunitytobea positiveinfluenceonothergirls.Sportsprogramshave providedjoytoherchildren.

TheinternalcommunityinAmy’sofficegrowsaswell.She doesmanydownpaymentassistanceprogramstohelpfirst timehomebuyers,especiallyinthecitylimitsofAtlanta. Amywouldlikeachancetoarrangeclassesforfirsttime homebuyersandpeoplethinkingofpurchasingahome.To gooverthedosanddon’tsofmortgagesandtheimportance ofkeepingupwithone’screditscore.Foranywoman lookingtoentertheFinancialServicesindustry,Iwould highlyrecommendthatopportunityforlong-termpersonal andprofessionalgrowth.

“You’re going to places, and we’re here to help you plan your next move.”

Inthenextfiveyears,AmyseesSouthStategrowingand becomingwellknownthroughouttheSouth.Sheis constantlylookingforthenextdirectioninimprovingthe Bank'sapproach.SheisexcitedaboutSouthState'sfuture. TheFinancialServicesindustryisgrowingmorecomplex andmorecompetitivewitheachpassingday,andSouth Stateisstrivingtoleavetheirmarkforthelong-terminthis industry.Ascutthroatasthebusinessmaybe,itcannot replacehowonetreatspeopleandprovideclientswith service.

Partnerswillremembertheprocessandhowtheywere treated.Customerserviceandexperiencewillwinevery time.Peoplewillwanttoworkwithpeopletheycantrust andcareaboutthemselvesandtheirfuture.Amyisexcited tobeapartofsuchagreatinstitutionandknowsthebestis yettocomeforSouthStateBank,herteam,andthe community

Throughouthercareerinthefinanceindustry,Amy's experiencehasgrownexceptionallyinbothaspectsofher life.Shewillcherishthoserewardsandmemorieslongafter thenextgenerationofyoungprofessionalwomenhave enteredtheworkforce.Amysays, "If they have a dream, they can achieve it. It can be somewhat of a challenge to be a successful woman in what is still considered a maledominated business. You will get knocked down, and people will try to run over you.”

"Dust yourself off, stand up tall, and don't give up. If someone tells you no, do your own research and don't take the first few nos. Remember who you are, and don't let anyone change you. If you feel strongly about something, stick with that feeling and keep pushing forward," Amy concluded.

Theinclusionofmorewomeninthemortgage

industryisundoubtedlybeneficialforthegrowth anddevelopmentofcompaniesinthisindustry

Theybringdifferentopinions,ideas,andperspectives, leadingtomorefantasticcreativeinnovations,whichhelps companiestogrowmorerapidlyandsustainably.Female leadershipiscrucialforthesuccessofallindustries,andthe mortgageindustryisalsonoexception.Inclusivenessand celebratingvarietyanddiversityarealwaysfruitfulforall businesses,andsuchcultureshouldbepromotedinall sectors.

Femaleleadershipinthemortgageisnotsocommon because,formanyyears,ithasbeenamale-dominated industry.Thereisanincreasingneedforwomenleadersin themortgagebecauseofthevalueandskillstheybringto thetable.Companiesinthemortgageindustryshould advocateforequity,inclusion,anddiversity Theinclusion ofwomeninthisindustrycanleadtoadiversityofthought, newthinking,andthiscanleadtoinnovationanddisruption andshiftfromtheconventionalapproachofdoingbusiness. Femaleleadershipinthemortgageiscriticalbecauseit inspiresotherwomenindifferentindustriesandincreases theirconfidence.Theinclusionofwomeninalltypesof industriesleadstotheinclusivegrowthofthenation.

Thecompaniesinthemortgageindustryshouldincrease andencouragefemaleleadershipintheindustry

Empoweringwomenfordifferentrolesinthemortgage industrycanbeasignificantstepforincreasingtheservices tofemalesinsociety.Anyindustryshouldnotdiscriminate betweenmenandwomensincebotharecapableof

deliveringsomethinguniqueandvaluable.Womencan mentorandguideotherwomenmoreeffectivelyastheycan relatetothemmorethanmen.Therefore,womenleadership inthemortgageindustrycanresolvedifferentwomen's issuesinsociety,andtheycanhelpthemonalllevelswith properguidanceandsuggestions.

Womenleadersinthemortgageindustryarecapableof workingdiligently.Theydon'tunderestimatetheirpotential. Theyknowthattheybringalotofpositivity,creativity, innovation,andvaluetothecompaniesandcustomersin themortgageindustrybecauseoftheiruniquetalents, abilities,andskills.Theyarereadytothriveinthemortgage industry Theleadershipofwomeninanyindustrymakes thatindustrygrowsignificantly,andalsoitincreasesthe reputationofthatindustrybecauseofitsinclusivenature.

Thecontributionwomenleadersmakeinallindustriesis noteworthy,inspiringformanyotherwomenentrepreneurs andyounggirlsintheworld.Womeninthemortgage industrysetthetoneforallotherwomentosucceedinany field.Theyarenotunderestimatingtheirpotentialare courageousenoughtonotbeafraidofanything.Womenin themortgageindustrybringprofoundvaluetotheindustry throughtheiruniqueideas,talents,skills,newperspectives, andinnovativeabilities,leadingtothevaluegrowthofthe industryinmanydifferentways.Thereforewomeninthe mortgageindustryshouldbewelcomed,encouraged, empowered,trained,andcelebratedsothat,inreturn,they willbeabletoprovideimmensevaluetothecompaniesin themortgageindustry.

Achangefromwithincanhelponetransformtheir

lifetobecomeunstoppableintheirfield;thatis exactlywhatresemblesGalindaFleming.Sheis anunstoppableforceknownasthe Mortgage Woman for herdedicationandassistingapproachtowardsherclients.

GalindaisaSeniorLoanSpecialistatMIDFLORIDA CreditUnion,wheresheoverseestheloanorigination, processing,underwriting,andclosingdepartmentsforher loans.

WeatInsightsSuccesscameacrossGalindainour endeavortofind'The10MostEmpoweringWomenin MortgageIndustry,2021.'Weenteredintoaconversationto knowandunderstandhowGalindachangedherlifeto becomeoneofthewell-knownempoweredleadersinthe mortgageindustry.

Galindasaysthatlifeisallaboutchangeandadaptingto thosechangespersonallyandprofessionally Aftergoing throughadivorce,shestartedanewcareerinthemortgage industryin1992asanOfficeManagerandquicklybecame aMortgageBrokerbytheendofthe1990s.

Ahead-hunterofferedGalindaapositionwithPHH Mortgage/Cendant,whoalsoownednumerousother companies,includingarealestatedivisionthatheld ColdwellBanker,C21,andERARealEstateCompanies. PHHMortgagebecameanin-housemortgagecompany withanewprogramcalledPhone-InMove-In,andGalinda

wasoneof12AccountManagersacrosstheUnitedStates hiredtorollthisprogramout.Duringhertenurewiththem, shehelpedcreatetheSales,Marketing,andMotivational TrainingDepartmentfortheAccountManagersnationwide andcreatemarketingandtrainingresourcescalledthe PowerPak.ShetraveledtheUnitedStatesimplementing thisinformationintheAccountManagers'territories,which becameherpassion,andshelearnedalotaboutpeopleand herself.

Galindahasreadnumeroustrainingandmotivational books,butthetwothatstickoutthemostare Who Moved My Cheese? An Amazing Way to Deal with Change in Your Work and in Your Life Spencer Johnson, FISH: A ,by and powerful parable to help you see your life and work in a new way. Shewastouchedbythisbookwhenshereviewed itontheplaneridehome.

Galindaexpressesthatthethirdconceptinthebook,"be present"goesbeyondphysicallybeingpresentwhentalking tosomeone,itisaboutgivingyourfull,undividedattention –activelylistening.Itseemssimpleuntilyoutrytodoit–everytime.

AsGalindareadthisconceptandthoughtaboutherson, Levi,andwhattookplacewhenshecamehomefromher tripsafterpickinghimupfromhisdad.Shethoughtto herself,wasI"present"inourconversation?No,noteven close;areyou"present"inyourconversationswithyour spouse,yourchildren–dotheyhaveyourfullundivided

attention-everytime?Ican'tsayeverytime,butIcansay itbecamebetter

TowardsTheDawn Galindacontinuedherjourneythroughthemortgage industry,andfromtimetotime,sheflirtedwiththeideaof workingwithMIDFLORIDA,butthetimingneverseemed right.Shecouldnevergetherfootinthedoor.Herfirstauto loanwaswithMIDFLORIDAinthelate70sandher savingsandcheckingaccount.

Then2007happened,themortgageindustryandworld changed.Everyindustrythatdealtwithhomeswasaffected; lenders,titlecompanies,builders,appraisers,inspectors, insurance,everyoneinbetween,andsmallmom-and-pop businesses.Galinda'sincomekeptdiminishingasitwas basedoncommission.Shekeptherlicenseactivebut neededtofindadditionalincome.AfriendhelpedGalinda obtainapositionasDirectorofDevelopmentwithanonprofitcalledLighthouseMinistriesInc.Ithadvarious programs:a24/48-monthLifeLearningResidential ProgramforMenandWomen/childrenseekingtorecover fromtheiraddictions,destructivelifestyles,and homelessnessduetopreviousabuseorjustbadchoices.

Duringthistime,Galindasharedapartofherlifethatshe doesnotshareveryoften.Thatisofsexual,physical, mental,andemotionalabuseasasmallchildthroughgrade schoolandthenmentalandemotionalabusethrough

adulthooduntilsheendedatoxicrelationshipwithher motherandfinallystartedhealing.

Galindaexpressesthatlifeisaboutdealingwithchange,the ebbandflowcausedbyothersandsomecausedby yourself,andonemustadapt,learnfromit,askforhelpand growtoflourishandhelpothersinthisworld.Shesays, "Be Kind! That smile or kind word just might save a life; instead of suicide, they may turn around and ask for help!"

Aroundthistime,Galindaknewsomeonethatworkedin theMortgageDivisionatMIDFLORIDAandshesenther resume',andtherestishistory

GalindaexpressesthatMIDFLORIDAkickedintohigh geartomakenecessaryaccommodationstoensure employeesafetywhilestillservingmembersbyproviding allthenecessaryequipment,protectivegear,sanitary supplies,anddividersforoffices.

Tothankthestaffforcontinuedsupportthroughthe pandemic,MIDFLORDAgaveeachemployee$25.00to supportalocalbusinesswiththeCreditUnionsCare Challenge.Employees,members,andthecommunityare VERYimportanttoMIDFLORIDA.Ourphilosophyis excellentpersonalattention!

Galindastatesthatfromthemeagerbeginningsofa shoeboxin1954tonow,MIDFLORIDAhasgrowntoover 60branches,morethan1,200employees,andassetsover $5.7billion.ShehopesthatMIDFLORIDAwillcoverthe stateofFloridawithproductsandservicesthatrivalany localbankinfiveyearswhilemaintainingthecreditunion philosophyofexcellentpersonalattention.

Inheradviceforup-and-comingwomenentrepreneurs, Galindasays, "life may give you lemons, so you make lemonade and proudly serve it with a SMILE!" "When dealing with any human being, NEVER lose that personal touch – put the cellphone on vibrate, better yet, turn it off!

“Be Present" in the Conversation! You will always win because it is a win-win for everyone involved! And Remember – Always Be Kind Because you can Always Be Kind!" concludesGalinda.

Whatareyoupassionateabout?Sports,business, travel,movies,poetry,photography,writing?

Forsomepeopleleadingisalsoapassion,and inmyhumbleopinion,ittakesalotofefforttolead. Leadingisacontinuousprocessofimprovement.Today, conventionalleadingpracticesarenotenoughforleadersas theyneedtostayaheadofthecompetition.Leaderswitha passionlearnandgainknowledgeandimplementtheminto theirbusinesspractices.Thesepracticescomeinhandybut workbestwhenthemortgageindustrycomesintothe picture.

Leaders,especiallywomen,haveimpactedthesector worldwideinthemortgagespacebycreatingadentinthe universewiththeirimmenseknowledgeandpassionate drive.Theyhavehelpedtheclientsbyprovidinga personalizedapproach,resolvingtheirclient'sconcerns withtheirskillsetanddedication.So,ifyouareconcerned aboutyourfinancialandmortgageissues,womenleaders willgiveyouthebestguidance,wiselessonsandwillbea perfectfitforyourfinancialproblems.

Everybodyspeaksabouttheproblem;noonetalksabout thesolution.So,itisnotaboutwhattheworldholdsforus, butwhatbusinessleadersbringtotheworld. Businesswomenalwaysshowthewilltolearnnewthings andareflexibletonurturetheemployees,clients,and mortgagecompanies.Andtheirinfluencecanalreadybe seenonthepeople,whichistrulyinspiring.Ofcourse,the industryisfilledwithchallenges,andthesewomencanface themhead-on.

Thecovidpandemichaschangedthemortgageindustry drasticallybecausetheentireworkingsfromproviding loanstofinancialguidancehadtobedoneonline.Women

leadersofferedtheperfectsolutionsinsuchsituationswith theirinnovativetechnologicalsetup.Andwefeltthe importanceofhavingversatilewomenleadershipthrough thissituation,asitstoodtallinsuchacriticalsituation. Togrowinthefinancialandmortgageindustry,thegoal youstartedasaleaderisimportant;that'swhatsetsthe cultureofleadershipforothers.Beinginthefinancialand mortgagefieldisademandingandresponsiblecause;itis anactofbuildingthefutureroadmapfortheorganization andtheclients.

Withtechnologicalinnovation,womeninthemortgagewill bethenextbigthingintheindustry.Theresultsspeakfor themselves;itisafieldwherecontinuousimprovementis necessarytorevaluetheirprogressand,moreimportantly, theorganization.

Gainingalltheexperience,everypassingday,wecansay thebestisyettocome,andthemortgageindustryasa wholewillbeastrongforceforwomenleadershipisnot justmortgage,buttheentireindustryasawhole.Thenextgenerationwomenleaderswillhavealottolearnandcatch upwith,andthereisnodoubttheywillshineinevery aspectoftheirwork.

So,dreambig;theskyisthelimitinthemortgage,asthe fieldisfullofopportunities,andmakethemortgageyour own.Lastlynever,letanyonetellyouhowwhattodo,have thecouragetotakerisksinsteadofjustthinkingaboutit becausewhatevertheresultitwillalwaysbe,youwillbe proudofit.Keeppunchingaboveweight;that'sthe platformyouwanttosetforthenext-generationwomen leaders.

Beinvolved;theworldwaitsforsuchcreativewomen's mindsinthemortgageindustry

WhatifItoldyouthatthiswillfeellikea'meeting Morpheus'momentforthemortgagebrokeringbusiness?

Moreoomphthanyouexpectedright outofthegate?Or,areyousmiling insidebecausetheopeningsignalsthat thisstorymaydeliveradashoflevity inaplaceyoudidn'texpecttoseeany?

Fingerscrossedthatit'sthelatter Becausethatmeansthatyoualready knowasecretwhichputsyouaheadof mostbusinesspeople.Thatsecret?

Levitycreatesbalance,comfort,and connection.

Levityhelpedelevatemysmall businessintoabelovedbrand.

Butdon'ttakemywordforit.Justask oneofthemosttrustedentitieson earth:Google.

Goahead,Google'mintmortgage Saskatoon'

(IfGoogleknowsanythingforsure,it knowswhatfolkslike,right?Because mostofustellitourdesiresandneeds onadailybasis--especiallythe unspokenones,don'twe?)

Youcheckedusout?Thankyou!

Younowknowthat(asofearlyOct '21)mintmortgagehasover6505-star Googlereviews,andthatfolks regularlysaythatwe'rethemost attentive,easytoworkwith,andfun mortgagebroker.InCanada.

IsitouremailingskillsthatCanadian mortgageshoppersenjoy?Or,isitour non-businessbusinesscards?Or,isit thefactthattheycanplayagameof Asteroidsonourwebsite?

Wouldyoumaybeliketotakeapage (ortwo)fromourplaybookinaneffort tomakeyourbrandmorebeloved?

Ourplaybookwouldchallengeyou.It challengedme.Holyshmoly,didit everchallengemeatfirst!Thiswasin partbecausemyinvolvementwith mortgagesstartedatabank.Ilearneda lotthere.Metsomegreatfolks,too. (I'mstillintouchwithsomeofthem.)

ButIeventuallystartedtothirstfor morefunatwork.SoIbeganthinking outsidethebranch.Andthatledmeon asafariofthenationalguildsfor independentmortgagebrokersin Canada.

Rememberhowenergizedandgood youfeltwhenyoufirststarted imaginingyourlifeasanindependent mortgagebroker?

Fastforwardyou-name-itnumberof daysoryears..

Isitpossiblethat,nowadays,youoften feellikethesinglegreatestthreattothe qualityofyourlifeisthefactthat you'reanindependentmortgage broker?

Ifyou'renodding,Ihearyou.

Thereasonwhyyoufeelthatwayis likelythis:Yourplaybookis amplifyingthechallengingpartsof mortgagebrokering,ratherthan minimizingthem.

Yousee,beinganindiemortgage brokerisnotintrinsicallybad.It’s actuallytheopposite,asitcanbe meaningful,joyful,andevenmagical! That'swhyyoufeltsogoodaboutitat first.

(BTW,Isayindiemortgagebroker becauseevenifyou'repartofoneof thenationalmortgageguilds,you're stillonyourown.Theguildgivesyou accesstosome‘lines,’justlikeTelusor Rogersconnectyouto'lines',but neitherarereallymakingyourphone ring,right?)

So,wouldyouliketohearmy2¢on howtolevelupyourgame?Before yousay'yes'toourchat,twofriendly headsup:

-I’llfirstlistentoyourstory.

-Youunderstandandagreethathighleveltakeawaysfromourchatmayend upinmybook.(Itsworkingtitleis ‘HowtoSolveBizProblems Hilariously.'Don'taskmeaboutthe releasedate.)

Noconfidentialpartsofourchatwould everbemadepublic,ofcourse. Instead,think,"Amyisamortgage brokerinWesternCanada.Shereached outforsomeinputabout..")

Thenextmoveisyours.Youcangoto thenextpageandforgetthatweever met.:)Or,youcancontactmevia sarah@mintmortgage.metocontinue thisconversation.

You'renotalone.I’mreadywhenyou are.

Sloane,FounderofMint Mortgage Sarah

Marguerita (Rita) Cheng Chief Executive Officer Blue Ocean Global Wealth

Marguerita (Rita) Cheng Chief Executive Officer Blue Ocean Global Wealth

Technologyhasbeendisruptingeveryindustry,and thewealthmanagementindustryisnoexception.

AccordingtoRichTopia,thereare11technologiesand innovationsdisruptingtheworldasweknowit:artificial intelligence(AI),theInternetofThings(IoT),space colonization,3Dprinting,medicalinnovations,high-speed travel,robotics,blockchaintechnology,autonomous vehicles,advancedvirtualrealityVR),andrenewable energy.

Whilenotallthesetechnologieshaveadirectimpactonthe wealthindustry,someofthemdo,andthatimpactis provingtobesubstantial.

Inthisarticle,weconsiderhowsomeofthesetechnologies aredisruptingthefutureofthewealthmanagement industry.

Blockchain,Cryptocurrency,andtheOpeningofaNew InvestmentWorld

Beforetheinventionofbitcoin,othereffortstocreatea digitalcurrency—BitGold,HashCash,B-Money,andthe like—hadfailed.

Bitcoinsucceededbecauseofthewayitcombined cryptographywithblockchaintechnology Theuseof blockchainallowedbitcointocombineboth decentralizationandtransparency

Everybitcointransactioncanbeindependentlyverifiedon theblockchainnetwork;inotherwords,theownershipofa bitcoincanbeconfirmedfromthenetwork.Yetthis verificationoftransactionandconfirmationofownership happenswithoutacentralagency:computerusersscattered

allovertheworldcreateblocksofbitcointransactions withoutcentralcoordination.

Becauseofitslimitedsupply(nomorethan21million bitcoinscanbecreated),bitcoinhasacquiredastatusasa storeofvaluebecausenocentralagencycancreatemoreof itandtherebyreduceandweakenitsvalue.

Asaresultofitspotentialasastoreofvalueandameansof exchange,bitcoinhasbecomeaninvestmentasset.Froma marketcapof$250billionin2017,bitcoincrossedthe$1 trillionmarkinMarch2021.

Financialanalystsarealreadytoutingbitcoinasthe“digital gold”becauseofitsstatuscomparabletopreciousmetal.It hasshownalmost-zerocorrelationtothestocksandbonds market,makingitagoodwaytoadddiversificationtoa portfolio.

Consequently,wealthmanagersandfinancialadvisorsare askingiftheyshouldincludebitcoinintheportfoliosthey offertoclients.Theydon’treallyhaveachoice,sincea FinancialPlanningAssociation’sJournalofFinancial PlanningsurveyfromMarch2021showsthat49%of advisorssayclientsarealreadyaskingaboutit

Willbitcoin,withitsblockchaintechnology,endup replacinggoldastheinvestment-proofassetthatprovides diversificationinretirementandotherinvestment portfolios?Orwillbitcoinevenbecomeamoreacceptable meansofexchangethatchangesthe“monopoly”offiat currency?

Howeveritplaysout,whatcannotbedeniedisthatbitcoin, poweredbyblockchaintechnology,isalreadydisruptingthe wealthmanagementindustry

Therobo-advisingindustryisbooming.Theindustryis alreadyworthmorethan$460billion,andanalystsexpectit toreach$1.2trillionin2024.

Robo-advisingreliesondataanalyticstoolsmadepossible bymachinelearningtoprovideinvestmentportfoliosand advicethatbestmatchesthecustomer’sprofile.

However,robo-advisorsarealreadydeployingAImore broadly.Betterment,oneofthepopularrobo-advisors, alreadyusesAItoreducetaxesontransactions.SigFig, anotherrobo-advisor,alsousesAItoautomaticallyallocate assetsinawaythatminimizestaxation.AndWealthfront andFidelityaredeployingAIininterestingways.

Itremainstobeseenhowfarrobo-advisorswilltakeAIin thefuture.Whatcannotbedeniedisthatrobo-advisorsare alreadymakinganimpactinthewealthmanagement industrybyusingmachinelearningandAItechnologies.

AMarketsandMarketsreportpredictsthatthemarketforthe InternetofThings(IoT)infinancialserviceswillgrowfrom $249.4millionin2018to$2.03billionby2023,ata compundannualgrowthrate(CAGR)of52.1%duringthe forecastperiod(2019–2024).

AccordingtoOracle,"TheInternetofThings(IoT) describesthenetworkofphysicalobjects—“things”—that areembeddedwithsensors,software,andother technologiesforthepurposeofconnectingandexchanging datawithotherdevicesandsystemsovertheinternet." Connectingsensorsforthehome,thecar,thesupplychain,

andpersonalhealthoffersmanyinterestingdatapointsfor wealthmanagers.

TheuseofIoTallowswealthmanagerstooffer personalizedcustomerserviceastheygathermoreinsights fromcustomerinteraction.Customerdatasuchasspending habitscanbeusedasabasisforfinancialadviceand discussion.

IoTtechnologiessuchasdevice-to-device(D2D) communicationprotocolsandsensorimplementationare helpingbanksperformabetterriskassessmentofpotential customers.

TheIoTisalsodrivingtheincreaseduseofautomationin businessprocesses.

WhiletheuseofIoThasbeenmorepredominantinbanking andinsurancesofar,itwon’tbelongbeforetheimpact becomesmorevisibleinwealthmanagement.Trackinnois alreadyleadingthewayintheassetmanagementsideof things.

Ofcourse,therearemanyothertechnologiesdisruptingthe wealthmanagementindustry,andtheabovearemerelya selectionfromthebroaderpool.

Wealthmanagersmustalwayskeeptrackofthese developmentssothattheycankeepleveragingthebest technologiestoprovidethebestservicesforclients.

Technologyisnotanenemyofthewealthadvisor;rather,it isapartnerthatimprovesthequalitythatthewealthadvisor offerstohisorherclients.