Successful CEOs are those who have the ability to inspire and motivate others, to build strong teams, and to lead by example.

- Cyril Ramaphosa

Inanerawhereregulatorylandscapesarebecomingincreasinglycomplex,RegTech(Regulatory

Technology)companiesareplayingapivotalroleinhelpingbusinessesnavigatecompliancewithspeed, efficiency,andprecision.Byleveragingadvancedtechnologiessuchasartificialintelligence,machine learning,blockchain,andbigdataanalytics,thesecompaniesarerevolutionizinghoworganizationsmanage risk,meetregulatoryrequirements,andenhancetransparency

ThefeaturedRegTechcompaniesinthiseditionareattheforefrontofinnovation,redefiningcompliance throughautomation,predictiveanalytics,andreal-timemonitoring.Theircutting-edgesolutionsarehelping financialinstitutions,enterprises,andregulatorybodiesstreamlineprocesses,mitigaterisks,andreduce operationalcostswhileensuringadherencetoever-evolvingregulatorystandards.

Thesecompaniesareaddressingcriticalchallengessuchasfrauddetection,anti-moneylaundering(AML), KnowYourCustomer(KYC)compliance,dataprivacy,andcybersecurity.Byofferingcloud-basedandAIpoweredcompliancesolutions,theyempowerbusinessestostayaheadofregulatorychanges,improve reportingaccuracy,andenhancedecision-makingprocesses.

Asthedemandforseamlessandcost-effectivecompliancesolutionscontinuestogrow,theseRegTech innovatorsaresettingnewbenchmarksfortheindustry Theirimpactextendsbeyondfinancialservicesto sectorssuchashealthcare,realestate,anddigitalassets,whereregulatoryoversightiscrucialformaintaining trustandsecurity

AsweexploretheachievementsandcontributionsofthesetopRegTechcompanies,itisevidentthattheyare notjustkeepingbusinessescompliant—theyareshapingthefutureofregulatoryframeworksandrisk management.Theirworkisdrivinganeweraofdigitalcompliance,whereautomationandintelligence redefinehoworganizationsmeetregulatoryobligationswithconfidenceandagility

-AlayaBrown

08. AML Partners’ RegTechONE® Platform The Future of Compliance and Financial Crime Prevention

14. 18. A R T I C L E S 7 Essential Trends in Compliance Technology for 2025 How to Leverage Risk Management Tech for Business Resilience C O V E R S T O R Y

Be�er Regula�on Ltd be�erregula�on.com

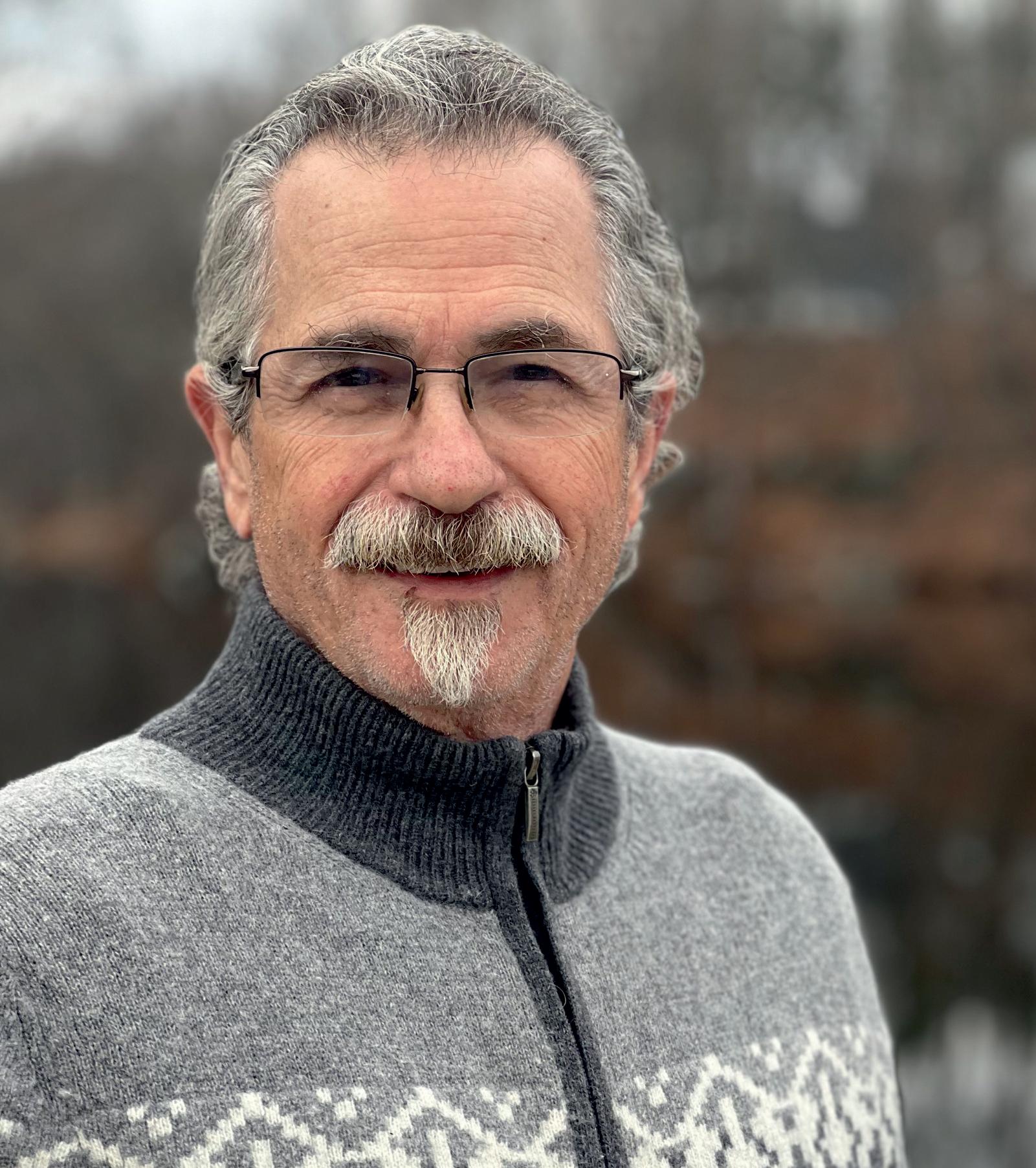

Frank

Cummings

CEO

Sonia Veluchamy CEO Ben Parker Founder

With a focus on adap�ve technology and seamless integra�on, AML Partners empowers organiza�ons to meet global regulatory requirements, mi�gate risks, and improve customer due diligence (CDD) and know-your-customer (KYC) processes.

Be�er Regula�on Ltd is a trusted provider of regulatory intelligence solu�ons, offering a comprehensive pla�orm that delivers real-�me updates, analysis, and insights on legal and compliance developments.

Celegence LLC is a specialized regulatory consul�ng and technology solu�ons provider dedicated to the life sciences and medical device industries.

By leveraging cu�ng-edge technology and deep industry exper�se, Eflow empowers financial ins�tu�ons to navigate the complex regulatory landscape with confidence and efficiency

Andrey Yashunsky CEO

David Ross Wood CEO AML Partners amlpartners.com Celegence LLC celegence.com Eflow Ltd eflowglobal.com Prytek prytek.com

Prytek is a global technology and investment group that focuses on building and scaling disrup�ve businesses across mul�ple industries, including financial services, cybersecurity, HR tech, and educa�on.

Navigatingthecomplexitiesofregulatory

complianceoftenfeelslikesolvingapuzzlewith ever-shiftingpieces.Organizationsfacemounting challengestoadaptquicklyandseamlesslytochanging requirementswithoutoverburdeningtheirresources.

IntroducingAMLPartners’RegTechONE®platform,an integrationandorchestrationpowerhousedesignedto revolutionizecompliancethroughno-codeconfigurability anduseofanyAPIagentdesired.Byfullyintegratingall modulesandorchestratingbothinternalandexternal systems,RegTechONEempowersuserstostreamline processesandrespondtoevolvingregulationswithagility

Followingthe9/11terrorattacks,co-foundersFrank CummingsandJonathanAlmeidaweredrivenbyashared determinationtosupporteffortsaimedatpreventing terroristsandcriminalsfromexploitingtheinternational bankingsystem.Withextensiveexperienceinthefinancial industry,particularlyinheavilyregulatedU.S.branchesof foreignbanks,theyidentifiedthegrowingcomplexitiesof AML/CTFregulationsandthepressingneedfor transformativecompliancesolutions.

TheirvisionledtotheestablishmentofAMLPartners,a companyfoundedontheprinciplesofcombatingfinancial crimethroughinnovation,adaptability,andacustomerfocusedapproach.Theorganization'sAMLandGRC solutionsaredesignedtoprovidescalableandintuitive RegTechtoolsthataddressthechallengesofanincreasingly complexregulatoryenvironmentwhileenhancingrisk managementandsimplifyingcomplianceprocesses.

Future-ProofingCompliance

RegTechONEservesasacutting-edgeintegrationand orchestrationplatform,offeringno-codeconfigurabilityand seamlessplug-and-playAPIconnectivity.Unlike competitorswhomarketfragmentedsystemsrequiringthe separatepurchaseofnumerousadd-ons,AMLPartners providesacomprehensivesolutionwithallessential featuresincluded.

RegTechONEisdesignedtodeliveraflexibleandrobust risk-managementsystemthataddressesboththecurrentand futureneedsofitsusers.BysimplifyingAMLcompliance, riskmanagement,andGRC,AMLPartnersensuresthese processesarenotonlymoreaccurateandefficientbutalso future-proofedtoadapttoevolvingchallenges.

ThetransformativeimpactofAIandmachinelearning (AI/ML)onfinancialcrimeissignificant—notonlyinhow criminalsandterroristsattempttoperpetrateandconceal illicitactivitiesbutalsoinhowfinancialinstitutionscan detectandpreventsuchcrimes.RegTechfirmsmustlead thechargeinenablingfinancialinstitutionstoleverage AI/MLtostayaheadintheever-changinglandscapeof financialcrimeandterrorfinancing.

ThefutureofRegTechinAMLcomplianceliesinthe developmentofagile,intelligent,andsecuresystems capableofadaptingtothedynamicnatureoffinancial crime.EmergingtechnologiessuchasAI/ML,blockchain, andreal-timeanalyticswillplaypivotalrolesincombating moneylaundering,terrorfinancing,andotherfinancial crimes.Financialinstitutionsthatproactivelyadoptthese technologiesandseamlesslyintegratethemintotheir complianceframeworkswillbebetterequippedtonavigate thecomplexitiesofregulatoryrequirementsandmaintain theircompetitiveedge.

AMLPartnersisprioritizingtwocriticaladvancementsin itsmissiontoinnovatecompliancesolutions.Thefirstisthe provisioninRegTechONEof“DirectedIntelligence,” whichenablesclientstotraintheirAI/MLsystemsusing theirowninstitutionaldata,processes,andapproaches.

Thisapproachrepresentsasignificantbreakthrough,asit allowsorganizationstodevelopbespokeAI/MLtools tailoredtotheirspecificneeds,instarkcontrasttogeneric AI/MLsystemstrainedwithopaquemethodsandexternal datasets.DirectedIntelligencethusensuresgreater transparency,customization,andoperationalrelevance.

ThesecondfocusisthetransitionofRegTechONEintoa fullyAI/ML-enabledsystemthatincorporatespredictive analytics,adaptivelearning,andadvancedalgorithmsfor enhancedriskscoringanddetection.AMLPartnersis activelydevelopingAI/ML-drivencapabilitiesfor RegTechONE’stransactionandbehaviormonitoring, sanctionsscreening,andFinCEN314acompliance. Leveragingthesetechnologies,RegTechONEwillidentify transactionalanomaliesbasedonbothpredefinedrulesand behavioralpatterns.Additionally,theplatformwillprovide comprehensivecasesummariestosupportAMLanalystsin makinginformeddecisionsandimprovingcompliance outcomes.

Theever-evolvinglandscapeoffinancialcrimesand tighteningregulatoryframeworkspresentssignificant challengesforinstitutions.Complianceteamsmuststay aheadofnewregulationsacrossmultiplejurisdictions, addingcomplexitytotheirprograms.Atthesametime,the risingcostsofimplementingandmaintainingrobustantimoneylaundering(AML)systemsstrainresources,asthese solutionsrequiresubstantialinvestmentsintechnology, skilledpersonnel,andoperationalinfrastructure.

TraditionalAMLsystemsfurtherexacerbatetheissueby generatingexcessivefalsepositives,overwhelming complianceteamsandwastingvaluableresources.

Fragmenteddatasilospreventinstitutionsfromobtaininga holisticviewofcustomerandtransactionalrisks,limiting theeffectivenessofcomplianceprocessesanddecisionmaking.Thesophisticationoffinancialcrimes,including theuseofcryptocurrenciesandshellcompanies, complicatesthedetectionofcomplexlaunderingschemes.

AMLPartnersaddressesthesechallengeswithits innovativeRegTechsolutions,particularlythe RegTechONEplatform.RegTechONEisahighlyscalable, configurableplatformdesignedtostreamlineandintegrate complianceprocesses,offeringno-codecustomizationand workflowcreationtohelpinstitutionsquicklyadaptto regulatorychangesacrossjurisdictions.Theplatform's abilitytointegratedatafrommultiplesourcesbreaksdown silosandprovidesaunifiedviewofrisks,enhancing decision-makingcapabilities.

ByofferingworkfloworchestrationandAPIintegration, RegTechONEmaximizesautomationandreducestheneed formanualprocesses,allowinginstitutionstooperatemore efficientlyandreduceoperationalcosts.RegTechONE providesacomprehensivesolutiontomitigaterisks, improveoperationalefficiency,andmaintainregulatory alignment.WithRegTechONE,institutionscanreduce costs,automatecomplianceworkflows,andensuremore effectiveAMLmanagement,allwhilestayingaheadof changingregulations.

RegTechONE’sno-codeinterfaceempowersusersto ComplyontheFly,givinginstitutionstheflexibilityto adaptquicklytoevolvingregulatorylandscapesacross globaljurisdictions.Designedwithano-codearchitecture andintuitivewhiteboardworkflowcapabilities, RegTechONEallowsauthorizedenduserstoeasilyadd, remove,ormodifycompliancerequirementsasregulations change.Thisdynamicapproachensuresthatfinancial institutionscanmaintaincompliancewithouttheneedfor extensiveITresources,allowingthemtostayagileina rapidlyshiftingenvironment.

Inaddition,RegTechONEfacilitatesthecreationofeKYC GoldenRecordsinacentralizedlocation,whilestill offeringflexibilityforbranchlocationstotailorKYC collectionstotheirspecificgeolocations.Thisbalanceof centralizedcontrolwithlocalizedcustomizationallows institutionstomeetbothglobalandlocalregulatory demandseffectively.

AMLPartnerscollaborateswithtop-tierAMLconsultants, suchasDeloitte,andformsstrategicpartnershipswithfirms offeringRiskManagementtools.Thesepartnershipsensure thatRegTechONEcanmeetthediverseneedsof institutions,regardlessoftheirsizeorcomplexity.Asan orchestratorandintegrator,RegTechONEprovidesthe uniqueadvantageofincorporatingtoolsfromothervendors, enablinginstitutionstobuildafullycustomizedcompliance systemthatbestsuitstheirrequirements.

WithRegTechONE,institutionscanconfidentlyintegrate, automate,andstreamlinetheircomplianceprocesseswhile reducingoperationalcostsandenhancingregulatory alignment.WhetheradoptingAMLPartnersasastandalone solutionoraspartofabroaderecosystem,financial

institutionscancreateabest-in-classcompliance infrastructuretailoredtotheirneeds.

AMLPartnersistremendouslyexcitedaboutthetransition toAI/MLfunctionalitywithinRegTechONE.This advancementwillnotonlyprovideasignificantcompetitive advantageforclientsbutwillalsodeepenthecompany’s understandingoffinancialcrimeandimproveitsabilityto preventit.TheAI/MLtoolswillenableRegTechONEto traindetectionsystemsusingcriminalbehaviorsobserved aroundtheworld.

RegTechONEwilllearninrealtimeaboutemerging criminalactivitiesandmonitorsimilarbehaviorsinevery location.Thisabilitytocontinuouslyadaptanddetect globalthreatswillstrengthencomplianceefforts,allowing institutionstostayaheadofincreasinglysophisticated criminals.ByintegratingAI/ML,RegTechONEwilloffer moreaccurateandproactivedetection,providingclients withthetoolsneededtomitigatefinancialcrimeriskswhile meetingregulatoryrequirements.

Withtheincreasingcomplexityintheregulatory

landscapethatfirmsareexperiencing, technologyforcomplianceisemergingtobreak thecomplexityhindrances.Firmswillberelying increasinglyonadvanceddigitalsolutionsby2025to optimizeregulatorycompliance,lowerrisk,andenhance businessefficiency.Trendsincompliancetechnologyare redefininglegalobligationsmanagement,dataprotection, andgovernancewithinfirms.

Belowaresevenofthemostimpactfulcompliance technologytrendsthatwilldefinetheindustryby2025.

ArtificialIntelligenceto AutomateCompliance

Artificialintelligence(AI)andmachinelearning(ML)are transformingcompliancebyenablingtheautomationof repetitivework,enhancingriskdetection,andexposing suspectedill-doinginreal-time.AIsystemscananalyze largesetsofdata,drawinferences,anddetectlikely complianceriskrisksforthefuturebeforetheyflareupinto crises.Increasingly,firmswill,in2025,useAIsystemsto automateaudit,regulatoryreporting,compliance,andfraud detection.

Complianceiscomplementedbyblockchainthesedaysdue totamper-proofrecord-keeping,security,andtransparency. Distributedledgersofblockchainenablecompaniesto resistseveredataprivacyattacks,tracesupplychain products,andvalidateaccuratereporting.Smartcontracts withblockchainin2025willbeubiquitousforregulationof regulatorycomplianceinfinance,health,andtransport.

Regulatorytechnology,orRegTech,isemergingasthe focalpointofcompliancestrategy.RegTechsolutions leverageartificialintelligence,bigdata,andcloud computingtoenableorganisationstoreacttoregulatory change.Real-timemonitoringofcomplianceallows companiestoidentifyirregularities,monitorregulatory change,andstayinapositionofconformitywith worldwideregulationsatalltimes.RegTech implementationwillbemoreinthespotlightin2025, especiallyinhighlyregulatedindustriessuchasbanking, insurance,andpharma.

Astheincidenceofcyberattacksanddatabreachesgrows, cybersecuritycomplianceisnowimperative.Organizations areembracingnext-gensecurityarchitecturetoaddress rigorousdataprivacyregulationssuchasGDPRandCCPA. Complianceofferingswillbeincorporatedinsecurity softwareduring2025tosupportreal-timethreatdetection, automationofriskratings,andadvancedencryption techniquestosecuresensitiveinformation.

EfficientCloud-BasedCompliance Platforms

Cloudcomputingisrevolutionizingcompliance managementwithelastic,affordable,andaccessible solutions.Cloud-compliancesolutionsenablereal-time reporting,centralizedrepositories,andinternationalteam collaboration.In2025,increasinglymorebusinesseswill shifttheircomplianceinfrastructuretothecloudtobecome moreefficient,minimizecosts,andgainregulatory flexibility.

Analyticsisemergingasthehubofcompliancethrough predictiveanalyticsandproactiveriskmanagement.

Organizationsareusingbigdataanalyticstodiscover patterns,monitorcompliancemeasures,andanticipate potentialviolations.Predictivecompliancetoolswillmake companiesabletoforecastregulatorydevelopments,report automatically,andcompliancedecisionsbasedondatain 2025.

Trainingemployeesandreportingtotheregulatorybody arethemostimportantwaysofensuringcomplianceona day-to-daybasis,eventhoughconventionalmethodsare time-consumingandexpensive.Automationis revolutionizingcomplianceusingAI-poweredlearning software,interactivesimulatedtraining,andreal-time testing.Automatedcompliancereportsoftwarealsohelps organizationsgeneratecorrectregulatoryreportswithless humanintervention.Complianceautomationwill significantlyreduceadministrativeexpensesandimprove compliancetoindustrystandardsby2025.

Theregulatorylandscapeisevolvingatlightspeed,and organizationsmusthoponthebandwagonoftechnologyin abidtobeaheadoftheregulationrequirements.Artificial intelligence,blockchain,RegTech,cybersecurity,cloud computing,dataanalytics,andautomationwillshapethe futureofcompliancemanagementby2025.Organizations canbemoreefficient,reducerisk,andreaplong-term regulatorysuccessiftheyhoponthewavesofthefuture.

ntoday'sbusinessscenariowithuncertainties,businesses Ihavetopreparethemselvesfornearlyanythingsuchas cyber-attacks,lossofsupplychain,economicmeltdown, andregulatoryreforms.Acompany'santicipation, segmentation,andneutralizationarekeydriversforbusiness resilience.Riskmanagementtechnologyisreshaping capabilitiestomakebusinessesmoreresilientbyhavingrealtimeintelligence,predictivemodeling,andauto-basedrisk avoidancemechanisms.

Withtheuseoftoday'sriskmanagementtechnology, organizationsareabletomakemoreinformeddecisions, enhancetheefficiencyofoperations,andpromotelong-term sustainability

Riskmanagementtechnologyconsistsofvarioustoolsand solutionsusedforriskidentification,analysis,andavoidanceof possibleriskfactorstobusinessoperations.Riskmanagement technologyhelpsorganizationsshiftfromtheconventional approachofriskmanagementtopredictiveandproactiverisk management.

Allthekeyriskmanagementtechnologycomponentsare artificialintelligence(AI),automation,bigdataanalytics, cloud-basedinfrastructure,andmachinelearning.These technologiesenableorganizationstoquerybigdata,detect anomalies,andrespondtoriskinreal-time.Riskmanagement technologythatisembeddedwithinthebusinesscanenable organizationstopreventloss,safeguardassets,andenhance resiliencyoverall.

Oneofthebiggestusesofriskmanagementtechnologyis predictiveanalytics.Bylearningfrompastexperienceand deducingbasedontrends,businessorganizationscananticipate futurerisksaheadoftime.

Predictiveanalyticsallowscompaniestoanalyzefinancialrisk, detectfraud,andpredictsupplychaindisruption.Predictive analyticsalsoallowscompaniestopredictmarkettrendand regulatorychangeinorderforthemtomakeintelligent decisionsbasedonintelligence,henceconstrainingthehorizon ofrisk.Companiesthatemploypredictiveanalyticscanavoid reactionarycrisismanagementandachieveproactiveavoidance ofrisksandavertriskofexpensivefailures.

RiskmanagementpracticewastransformedbyAIand automationthroughprocesssimplification,enhancedprecision,

andminimalchancesofhumanmistakes.AI-basedrisk evaluationsoftwarecandealwithcomplexdatasetsand generateriskscoressothatcompaniescanidentifythreats rankedonseverityinpriorities.

Automationisequallyimportantforfrauddetection, compliance,andcybersecurity AIsystemscanidentify potentialfraud,taggingsuspectedfraudevenbeforeitis committed.Incybersecurity,automation-driventhreat detectionsystemsscannetworksroundtheclockfor vulnerabilitiesandreacttobreachesinrealtime.With automatedandAI-drivensolutions,companiescanincrease efficiencyanddecreasehumaneffortspentmonitoringrisks.

Cloudcomputinghastransformedriskmanagementby embracingscalableandcost-effectivesolutionsforsmall, medium,andlargeenterprises.Cloudriskmanagement softwareconsolidatesinformation,automatescompliance monitoring,andfacilitatesreal-timecollaborationamong theteams.

Thesesolutionsestablishacommonunderstandingofrisk acrossdepartmentssothatorganizationscanrespond appropriatelytoevolvingthreats.Cloudsolutionsalso safeguardinformationwithencryptedstorageandbackup independently,loweringthechancesoflosingdataor becomingthetargetofcyberattack.Cloud-basedrisk managementsoftwarehelpsorganizationsattainincreased agilityandresiliencyintoday'sbusinessclimate.

Asmorecyberattackstakeplace,organizationshaveto spendmoneyonbettercybersecuritytechnologytoprotect theirinformationandensurebusinesscontinuity Cybersecurityriskmanagementinvolvestheuseof encryption,multi-factorauthentication,andintrusion detectionsystems.

FirmsutilizecybersecuritytechnologiessuchasSecurity InformationandEventManagement(SIEM)systems, whichpossessreal-timethreatdetectionandincident response.Artificialintelligence-basedcybersecurity technologiesalsoenhancesecuritywiththeabilitytodetect vulnerabilitiesbeforehackerscanexploitthem.Advanced levelsofcybersecuritytechnologiesrenderfirmsresistantto cyberattacks.

Supplychainscanbevulnerabletointerruptiondueto politicalunrest,naturalcalamities,andtransportation problems.Supplychainriskmanagementsoftwareaids companiesinmanagingsuppliers'performancemonitoring, followingshipmentinrealtime,andidentifyingprobable bottlenecks.

WithblockchainandIoTsensors,businessesaremaking supplychainstraceableandtransparent.AI-drivensupply chainriskmanagementsoftwareconsidershistoricaldata andrecommendslow-riskdependencysupplierreduction andinventoryoptimization.Thesecompaniescanoptimize supplychainresiliencemoreeffectivelyandreducethe effectofdisruption.

Regulatorycomplianceisanimportantriskmanagement function,particularlyforbusinessorganizationsthatare engagedinhighlyregulatedsectorslikefinance,health care,andmanufacturing.Itactuallyhasthepotentialto causelegalsanctions,lossofreputation,andlossof business.

Riskmanagementtechnologyoffersregulatoryreporting compliance,policymodificationmonitoring,andindustry standardscompliance.GRCsolutionsofferpackagedrisk governanceandcompliancemonitoring,thusallowing organizationstopossessaformalprocessofrisk governance.Withcomputercompliancetools,or canreducetherisksthatarelinkedtoregulationsandstill enjoyagoodreputation.

Conclusion

Technology-enabledriskmanagementisnecessaryinan efforttobuildbusinessresilienceinacomplicatedworld. Withtheuseofpredictiveanalytics,artificialintelligencepoweredautomatedsystems,cloudinfrastructures, cybersecuritysoftware,andsupplychainriskmanagement software,businessescanactinanticipationofthreatsbefore theyariseandbecomemoreresilienttomanageadversity

Goodriskmanagementisnotsimplyharmprevention—itis theconstructionofasoundbusinessmodelthatisresistant todisruptionandisabletobringsustainedprosperity.As riskmanagementtechnologyrelentlesslyinnovates, organizationsthatareembracingsuchtechnologywillbe positionedwelltodealwithuncertainties,remainresilient, andgrowresponsibly.