62 minute read

People

National

Venture Insurance Programs , a West Chester, Pa.-based national insurance program administrator, has launched Community Care, a new insurance program for community and social services, including nonprofits and for-profits. In conjunction with the launch, Venture has brought on former GuideOne Social Services Underwriter Erin Crawford Peterson to be its new practice leader.

Communi ty Care will be written on an admitted and non-admitted basis through three carriers rated “A” (Excellent) or better by A.M. Best. Community Care provides liability, property, auto, inland marine, crime and umbrella coverage for lines of business that include commu nity services, counseling and tr eatment centers, food and nutrition services, residential facilities and shelters, sports and recreation, education, arts and culture, animal-related and associations and clubs.

P rior to joining Venture Programs, Peterson served as nonprofit and human service commercial underwriter for GuideOne Insurance in Des Moines, Iowa. She has also served as senior underwriter in the human services department for Philadelphia Insurance Companies.

East

EverQuote Inc., an online insurance marketplace, has added Michael Aldous as vice president of Insurance Data and Product Services. Aldous joins EverQuote from Liberty Mutual Insurance, where he led teams responsible for the development and launch of digital accident and health products. Aldous also led Liberty’s Voluntary Benefits Underwriting Organization.

Thr oughout his 15-year tenure with Liberty, Aldous worked with numerous products at all stages in the insurance product lifecycle. According to Lee Bossio, execu tive vice president of Insurance Da ta and Product Services, Aldous’ experience at Liberty Mutual will be beneficial as it continues to invest in further supporting the growth of its marketplace offerings.

ABD Insurance and Financial Services has named Deirdre Finn as senior vice president of the company’s Executive Risk Solutions (ERS) National Practice. Finn will be based out of ABD’s NYC offices.

In this r ole, Finn will oversee the company’s management liability insurance lines of business, which include directors and officers liability, employment practices liability and fiduciary liability, and will join the Executive Steering Committee.

Finn joins ABD aft er nearly a decade at Beazley where, as West Coast manager, she oversaw premium growth. Her previous positions include senior vice president and West Coast manager at Navigators Management Company, as well as similar roles at Axcelera Specialty Risk and Reliance National Insurance Company.

ABD’s ERS practice offers management liability professionals, certified risk managers attorneys and claims advocacy. ABD Insurance and Financial Services provides risk management, insurance brokerage, human resources and retirement consulting services.

Miniter Group has named Donald Marthey as vice president Don Marthey of Business Strategy and Tracking Operations. In this role, Marthey will oversee the strategic direction of Miniter’s Borrower-CentricSM insurance tracking operations.

H e joined Miniter as a vice president of sales in 2019 and helped contract lenders in the Western states, including Alaska and Hawaii. Earlier this year, Marthey was called upon to transition to operations and assist with the growth of the tracking operation.

He began his career as operations section manager at National City Bank. He then moved to American Modern Insurance Group, where he spent the next 21 years. During this time, he took on roles with increasing responsibility, culminating in a position as strategic planning director. Before joining Miniter Group, Marthey was the director of operations for Seattle Specialty.

Miniter Group is a Norwell, Mass.-based provider of collat eral risk transfer solutions to the lendin g industry, providing blanket and lender-placed insurance solutions to more than 550 lenders in 45 states.

Southeast

The Tennessee Department of Commerce & Insurance Joshua Clark (TDCI) has hired Joshua Clark as its new director of Business Development f or the Insurance Division. As the director of Business Development for the Insurance Division, Clark will focus on expanding the use of captives as a risk management option for businesses.

Clark most recently served as a consultant for EXL Loss Control. As part of his new role, Clark will establish objectives with the Tennessee Captive Insurance Association to help them promote captive insurance within the state.

T ennessee currently has more than 203 licensed captive insurance companies and 471 approved cell companies for a total of 674 risk-bearing entities, compared to 652 at the end of 2019.

CRC Group has promoted Mississippibased Claire Willis as CRC Group’s national Claire Willis Personal Lines Practice leader. The move comes as part of the company’s increased focus on the personal lines marketplace, according to the company.

W illis joined CRC Group in 2006 as a personal lines underwriter. Since joining CRC, she has managed a large personal lines book of business and worked closely with personal lines carriers. As the Personal Lines Practice leader, Willis will work to grow CRC Group’s personal lines footprint nationwide and will represent CRC Group with key markets to assist with its expansion and gain more market support.

CRC Group CEO Dave Obenauer said the company has invested in new personal lines talent across the country over the past 12 months while at the same time investing in technology to establish an

online personal lines agent portal that is scheduled to rollout this fall.

USG Insurance Services Inc. , a national wholesaler Mark Morgan and managing general agency, has hired Mark Morgan as a producer and broker in Tampa, Fla. Morgan has 19 years of industry expe rience, most recently serving as dir ector of New Business Development for CAT Program at Community Association Underwriters in Tampa.

At USG, Morgan will focus on the development of retail agents and brokerage property markets as part of the National Brokerage Property division, specifically specializing in complex CAT driven property accounts. USG said the move was part of its plan to continue expanding its Brokerage Property team nationally.

South Central

Dallas-based Risk Point Underwriters LLC named Scott A. Hoy as executive vice president for the specialty auto dealer underwriting unit. Hoy will be responsible for driving growth and serving customers through independent agents across its Risk Point programs for dealer open lot and garage package for franchised auto, motorcycle, RV and heavy truck dealerships.

Hoy’s leadership background in these industries and specialization comes from 25 years of experience at Victor, Marsh & McLennan’s managing general agency business, SeaFire Insurance Services, a managing general underwriter specializing in automotive dealerships, and as the national vice president of sales for Zurich and Universal Underwriters Group.

Western Security Surplus (WSS) , a part of XPT Partners, hired industry veteran Suzy Baird as senior broker and underwriter with Houston Surplus Lines (HSL), a division of WSS. Baird is based in Houston.

Most recently, Baird held the position of production underwriter with Southwest Risk in Houston. Her previous experience includes serving as assistant vice president and branch manager with MJ Hall & Company in its California and Alaska offices. She began her career with AIG, later followed by Bowes & Company.

WSS is headquartered in Plano, Texas, with employees also located in California.

Midwest

Chicago, Ill.-based HUB International Ltd. added Geoff Hatfield and Scott Webb to the Central region executive team.

Ha tfield joined as chief strategy officer and Webb as chief sales officer - new roles responsible for driving growth in the Central region. Both will be based in Chicago. Both were regional sales leaders at Aon and then held national sales leadership roles at Gallagher.

HUB is an insurance brokerage providing property and casualty, life and health, employee benefits, investment and risk management products and services.

W estfield Center, Ohiobased property and casualty insurance company, Westfield, added Jennifer Palmieri as

chief people officer. With more than 20 years of human Jennifer Palmieri resources leadership experience, Palmieri is leading all aspects of Westfield’s talent management strategy, people related practices and the human resources team. She serves as a leader on the Enterprise Leadership Team, driving an integration between Westfield’s business strategies and talent management capabilities with a focus on building diversity across the workforce and ensuring an inclusive culture. Prior to joining Westfield, Palmieri spent nearly 18 years at Cigna, a global health services company, where she most recently served as vice president of HR with the global technology team. Early in her career at a boutique HR con sulting firm, Palmieri delivered talen t solutions across a variety of companies with a focus on the technology sector.

St. L ouis, Missouri-based POWERS Insurance & Risk Linsey Morris Management added Linsey Morris as commercial lines account manager. M orris has more than 15 years of experience in the insurance industry. In this position, she will be responsible for the ongoing management of commercial clients, retaining new and renewal clients and assisting the company’s producers in order to enhance business development. Morris previously worked for POWERS in its personal lines department for five years.

P rior to rejoining POWERS, she worked at various local insurance agencies in different capacities.

West

The Liberty Company Insurance Brokers has named Kip Tryon as vice president of marketing and branding.

Tr yon has been involved with Liberty’s outreach mar Kip Tryon keting efforts, and aft er four years in roles of increasing responsibility, he will now oversee a team dedicated to promoting Liberty.

Separately, The Liberty Company Insurance Brokers has also named Sean Borchardt as a partner in the Woodland Hills, Calif., office. B orchardt has more than 15 years of experience. He previously has Sean Borchardt held positions at Gallagher, Relations Insurance and Tolman & Wiker.

The Liberty Compan y Insurance Brokers is an inde pendently owned broker with offices thr oughout the U.S.

Ir vine, Calif.-based Burnham Benefits Insurance Services Inc . has named Chris Martin as chief growth officer.

Martin has 30 years of experience in the healthcare and insurance Chris Martin industries. Prior to joining Burnham Benefits, he was chief business development officer at Crossover Health. Burnham Benefits is a privately held employee benefits consult ing and brokerage firm.

COVID-19: No One Avoids the Impact Workers’ Compensation Premiums Down 8% in First Half of 2020

Prior to dis cussing the r esults of our review of aggregate workers’ By Joseph L. Petrelli compensation insurance written in the U.S. during the first half of 2020 versus the first half of 2019, permit me to offer Demotech’s perspective on the impact of COVID-19 on the insurers comprising the property/casualty and life and health insurance industries.

COVID-19 has been, and may continue to be, solely an earnings event. With more than 4,000 insurers, P/C and life/health, reporting data to the National Association of Insurance Commissioners, the number of carriers whose solvency is threatened by the COVID-19 is immaterial.

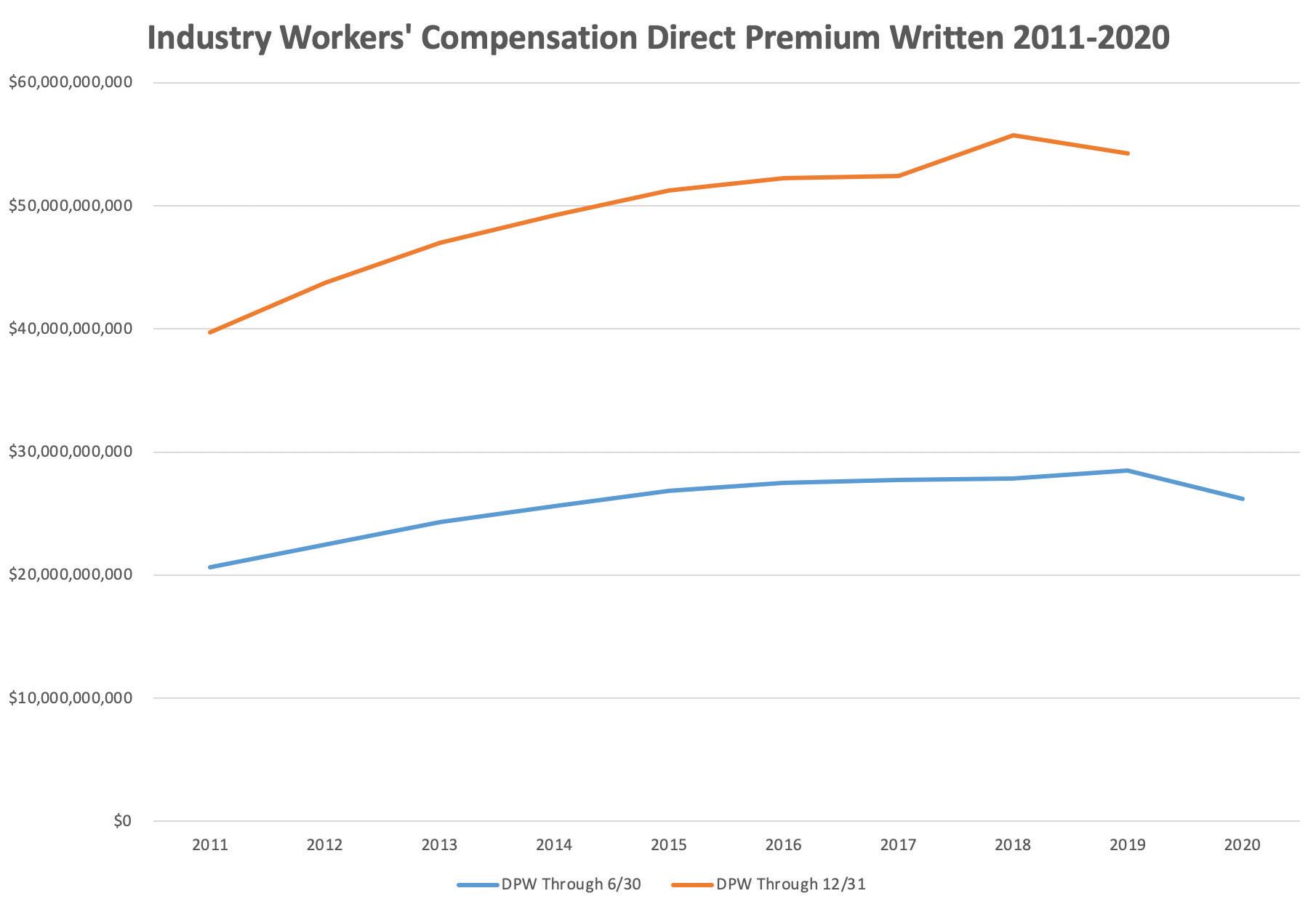

As t o direct written premium in workers’ compensation, in the aggregate, our mid-year to mid-year comparison of workers’ compensation direct

premium written indicated an overall decrease of approximately 8% was reported in the U .S. for the first six months of 2020 versus the same period in 2019.

Although sev eral members of the Top 25 carriers, those with the largest dollar volume of workers’ compensation business volume, were able to resist that trend a bit, the Top 25 saw a period-to-period direct premium written decrease of 5%. This occurred despite several members of the Top 25 reporting increased direct premium written or holding their own: Zurich American Insurance (0%), Insurance Company of the West (32%), American Zurich Insurance (3%), Old Republic Insurance (0%), ACE American Insurance (12%), Arch Insurance (5%), Indemnity Insurance Company of North America (9%), and National Union Fire Insurance Company of Pittsburgh, PA (13%).

With the Top 25 writers of workers’ compensation outper forming the aggregate sector on r etention of direct written premium, the premium written by insurers ranking number 26 through 689 declined by 9.4%.

The dollar decline of w ork ers’ compensation premium v olume in the sector from YTD June 30, 2019, to YTD June 30, 2020, was a decrease of nearly $2.3 billion, or 8% overall.

P utting this situation in perspective, direct written premiums reported at mid-year 2019 were nearly $28.5 billion, an all-time high for a mid-year report. To get additional per spective on the growth that led t o that record in June 2019, the dollar amount of direct written premium on June 30, 2010, was $18.8 billion. Yet, based upon our review of second quarter 2020 data, year-end 2020 workers’ compensation direct written premiums may result in the second consecutive yearend over year-end decline.

Clearly , with a premium base consisting of payroll by classification, growth in workers’ compensation premium volume between the June 30, 2020, report, and the upcoming year-end 2020 report is highly dependent on changes in employment levels. Given the relative impact of COVID-19 by state, in part, year-end 2020 direct premium written will depend on the breadth, depth and scope of the re-openings of the economies in the states that have not yet fully done so.

Sta te by state unemployment results have been and remain dependent on the degree to which economies are re-open ing. This should be based upon the degr ee to which COVID-19 related personal and business restrictions were in place through June 30 yet abated or removed over the period July 1 through Dec. 31.

The influence of several populous states with estab lished centers of finance and commer ce will shape the relative workers’ compensation direct premium written level for the second half of 2020. Concurrently, the ability of the larger states that initiated re-openings earlier than other states will shape the final yearend 2020 results for workers’

compensation insurance.

Similarly , the behavior and response of the employers impacted by COVID-19 will continue to shape the recovery of the workers’ compensation insurance sector. Having reduced payrolls, employers have also reduced their cost of worker’s compensation cover age. If the effort of employees who w ere laid off, terminated or separated is not apparent and is not missed, why would those employers be incentivized to add back the additional payroll and the related cost of the employees’ workers’ compensa tion insurance?

Concurrently, with travel restrictions in place and interac tion with clients and prospects bein g redefined and working from home a new normal, might employers reclassify personnel from higher cost classes to lower cost classes, thereby reducing the cost of workers’ compen sation even though payroll and head coun t increase.

Although this article has focused on the year-to-year premium volume changes for workers’ compensation, permit me a few random thoughts on other challenges that COVID-19 has created.

R eturn to work programs and light duty efforts have been impacted, whether those that were in place prior to COVID, and those that might have been put in place had COVID not manifested itself.

Less than six months after experiencing one of the stron gest economies in U.S. history, bankr uptcy, downsizing and right-sizing are under serious discussion by employers.

CO VID’s impact on healthcare providers, i.e., hospitals, employer health plans, Medicaid, Medicare, etc., also impacts patients requiring medical or wage replacement benefits associated with workers’ compensation.

The ultimate impact and influence of “working from home” has not yet been seen.

V ocational training needs to be reconfigured to reflect the “Beyond COVID economy.”

In conclusion, measuring and reporting year-to-year dollar changes in workers’ compensa tion insurance is an arithmetic e xercise. Assessing the impact of the emergence of the one in 100- year pandemic known as COVID-19 on workers’ compen sation insurance will be directly corr elated with the changes that COVID-19 has on employment, payrolls and employers.

Stak eholders should be comforted that the insurance industry, due to the statutory accounting principles enforced by regulators, is uniquely positioned to respond to the impact of COVID-19, known or unknown.

I sta te again: COVID is an earnings event, not a solvency event.

Petrelli is the president and co-founder of Demotech Inc., a Columbus, Ohio-based financial analysis firm. Website: www.demotech.com.

continued from page 25

Industry Workers’ Compensation Direct Premium Written (DPW) Year DPW Through 6/30 Growth (Loss) % Change DPW Through 12/31 Growth (Loss) % Change 2011 $20,618,828,533 $1,804,093,421 9.6% $39,743,363,214 $3,473,588,572 9.6% 2012 $22,484,181,779 $1,865,353,246 9.0% $43,755,244,979 $4,011,881,765 10.1% 2013 $24,324,470,907 $1,840,289,128 8.2% $46,981,116,563 $3,225,871,584 7.4% 2014 $25,587,654,011 $1,263,183,104 5.2% $49,245,124,906 $2,264,008,343 4.8% 2015 $26,871,226,504 $1,283,572,493 5.0% $51,241,191,346 $1,996,066,440 4.1% 2016 $27,471,995,741 $600,769,237 2.2% $52,253,269,883 $1,012,078,537 2.0% 2017 $27,750,183,279 $278,187,538 1.0% $52,414,653,131 $161,383,248 0.3% 2018 $27,851,664,718 $101,481,439 0.4% $55,727,832,353 $3,313,179,222 6.3% 2019 $28,474,143,475 $622,478,757 2.2% $54,246,197,003 ($1,481,635,350) -2.7% 2020 $26,177,784,452 ($2,296,359,023) -8.1% -- -- --

Data Source: The National Association of Insurance Commissioners (NAIC), Kansas City, Mo., by permission. Information derived from an S&P Global Market Intelligence product. The NAIC and S&P Global Market Intelligence do not endorse any analysis or conclusion based upon the use of this data. This exhibit is based upon the initial reporting of second quarter 2020 data, estimated to be more than 95 percent of the companies that report quarterly. It excludes several large state funds (e.g. California, New York, Pennsylvania) which have not always reported second quarter data.

Top 25 Workers' Compensation Writers Based Upon Dollar Amount of Direct Premium Written (000s omitted)

Rank Company Name 1 Zurich American Insurance Company 2 Travelers Property Casualty Company of America 3 Insurance Company of the West 4 State Compensation Insurance Fund 5 Texas Mutual Insurance Company 6 American Zurich Insurance Company 7 Technology Insurance Company Inc. 8 Old Republic Insurance Company 9 ACE American Insurance Company 10 Accident Fund Insurance Company of America 11 LM Insurance Corporation 12 Arch Insurance Company 13 New Hampshire Insurance Company 14 Twin City Fire Insurance Company 15 Starr Indemnity & Liability Company 16 NorGUARD Insurance Company 17 Charter Oak Fire Insurance Company 18 Pinnacol Assurance 19 Federal Insurance Company 20 Phoenix Insurance Company 21 Indemnity Insurance Company of North America 22 Wesco Insurance Company 23 National Union Fire Insurance Company of Pittsburgh, Pa. 24 Travelers Indemnity Company of America 25 Zenith Insurance Company Top 25 Total Next 25 Total All Others (639 Companies for 2020) Total (689 Companies for 2020) Second Quarter 2020 (YTD) $870,906 $634,040 $558,763 $529,813 $497,364 $445,152 $381,329 $366,998 $362,797 $333,470 $288,101 $274,227 $270,411 $268,099 $264,904 $261,941 $253,128 $247,406 $241,211 $237,790 $234,080 $229,432 $223,454 $221,357 $219,050 $8,715,222 $4,191,822 $13,270,741 $26,177,784 Second Quarter 2019 (YTD) $870,893 $700,660 $424,501 $597,569 $565,141 $431,740 $417,771 $366,521 $324,811 $350,487 $321,363 $260,259 $322,641 $291,121 $267,557 $322,150 $279,423 $296,906 $309,979 $247,327 $215,661 $308,641 $196,910 $240,244 $271,771 $9,202,048 $4,596,467 $14,675,629 $28,474,143

Data Source: The National Association of Insurance Commissioners (NAIC), Kansas City, Mo., by permission. Information derived from an S&P Global Market Intelligence product. The NAIC and S&P Global Market Intelligence do not endorse any analysis or conclusion based upon the use of this data. This exhibit is based upon the initial reporting of second quarter 2020 data, estimated to be more than 95 percent of the companies that report quarterly. These figures exclude premiums for several large state funds (e.g. California, New York, Pennsylvania) that have not always reported second quarter data. % Change 0.00% -9.51% 31.63% -11.34% -11.99% 3.11% -8.72% 0.13% 11.69% -4.86% -10.35% 5.37% -16.19% -7.91% -0.99% -18.69% -9.41% -16.67% -22.18% -3.86% 8.54% -25.66% 13.48% -7.86% -19.40% -5.29% -8.80% -9.57% -8.06%

Steep Drop in California Workers’ Comp IMRs in First Half of 2020

The number of independent medical deny or modify. reviews used to resolve California IMR took effect for all workers’ compensation medical disclaims in 2013, and CWCI putes fell sharply in the first half of 2020 began monitoring IMR as the pandemic took a toll on the state’s activity in 2014. In its economy with statewide unemployment latest review, the institute spiking to a record level and workers' tallied 70,273 IMR comp claim volume on the decline. decision letters issued in

That’s according to the latest tally by the first half of 2020 in the California Workers Compensation response to applications Institute. submitted to the state

Under California law, every workers’ compared with 85,318 comp claims administrator must have a letters issued in the first utilization review program to assure that six months of 2019 – that’s the care provided to injured workers is down 17.6%. While IMR volume was down, a review supported by clinical evidence outlined in Once again, about 40% of the letters of IMR outcomes in the first half of this medical guidelines adopted by the state. included decisions on multiple services, year saw little change.

Most treatment requests are approved but with the decline in letter volume, the “After reviewing the medical records by UR, but in 2012, state lawmakers adopt total number of primary service decisions and other information provided to support ed IMR to give injured workers a chance fell by 19.3% from 148,069 in the first half a disputed treatment request, IMR doctors to get an independent medical opinion of 2019 to 119,514 in the first half of 2020, upheld the UR physician’s modification or on treatment requests that UR physicians according to CWCI. denial of the service in 88.8% of the IMRs in the first half of this year compared to the 88.2% uphold rate from 2019,” the CWCI stated. As has been the case since IMR was first adopted, prescription drug requests accounted for the largest share of the January through June IMR decisions

Free CE Webinars (39.8%), though that percentage was down from nearly half of all IMR disputes prior LIVE! to the state’s adoption of the opioid and chronic pain treatment guidelines at the THE SURPLUS LINE ASSOCIATION end of 2017 and the Medical Treatment OF CALIFORNIA is now offering live Utilization Schedule Prescription Drug continuing education (CE) WEBINARS for all California surplus lines licensees. Formulary in January 2018, according to CWCI. Even with the guidelines and the for Coming up: courses on CANNABIS mulary, opioids still accounted for 29.2% (OCTOBER 14) and ACTIVE SHOOTER of the 2020 prescription drug IMRs – down (OCTOBER 21). only slightly from 30.9% in 2019. The top 10% of physicians identified in the IMR To see all our exciting course offerings— decision letters issued in the 12 months offered free of charge—please go to ending in June 2020 accounted for 83% of the SLA LEARNING CENTER at HTTPS:// the disputed service requests during that LEARNINGCENTER.SLACAL.COM/COURSELIST. period, while the top 1% accounted for 40% of the disputed service requests. Additional analyses on the IMR data has slacal.com been published in a bulletin, which CWCI members and subscribers will find under the Communications tab on the CWCI website.

California Governor Planning to Ban Sale of New Gas Vehicles in 15 Years

By Adam Beam

California will ban the sale of new gasoline-powered passenger cars and trucks in 15 years, Gov. Gavin Newsom announced in late September, establishing a timeline in the nation’s most populous state that could force U.S. automakers to shift their zero-emission efforts into overdrive.

The plan won’t stop people from owning gas-powered cars or selling them on the used car market. But in 2035, it would end the sale of all new such vehicles in the state of nearly 40 million people that accounts for more than one out of every 10 new cars sold in the U.S.

California would be the first state with such a mandate while at least 15 other countries have already made similar com mitments, including Germany, France and Norway.

Newsom used the hood of a red, electric-powered Ford Mustang Mach-E to sign an executive order directing state regulators to develop new regulations to meet the deadline.

He urged Californians to “pull away from the gas pumps” and encouraged other states to join California for the good of the environment and public health.

“If you want to reduce asthma, if you want to mitigate the rise of sea level, if you want to mitigate a loss of ice sheets around the globe, then this is a policy for other states to follow,” Newsom said.

While environmental groups cheered the announcement, the oil industry panned it and the automakers’ industry group sought a middle ground, saying it’s committed to increasing zero-emission vehicles but through cooperation among governments and businesses, not by mandates.

Meanwhile, White House spokesman Judd Deere said flatly: “President Trump won’t stand for it.” And Larry Kudlow, Trump’s economic adviser, labeled it a “very extreme” position that he doesn’t think other states will follow.

Democratic presidential nominee Joe Biden’s campaign didn’t comment directly on Newsom’s plan.

But spokesman Matt Hill said Biden believes electric vehicles can create “good-paying union jobs, dominate a fast-growing market worldwide, and meet the demands of the climate crisis.”

Tailpipe exhaust from cars, pickups, tractor-trailer rigs and other transporta tion are the single largest source of air pollution, and California has by far the most cars on the road than any other state.

In 2017, the federal government said California emitted 266.5 million tons of carbon dioxide from the burning of petroleum. That’s about the same as the total emissions from Egypt, which has 2.5 times the population.

Newsom says his order will reduce greenhouse gas emissions by 35%.

But he stressed the benefits went beyond the environment, saying electric cars and trucks are “the next big global industry and California wants to domi nate it.”

California is already home to 34 electric vehicle manufacturers – including Tesla, the world’s top-selling maker – and accounts for about half of all electric vehicle sales in the U.S.

Some auto industry analysts warned the timeline could be too fast for technology to catch up to customer’s expectations. Battery life and manufac turing costs are still issues that haven’t been resolved, said IHS Markit principal analyst Stephanie Brinley, who studies the North and South American auto markets.

Tesla recently announced plans for cheaper batteries with higher energy density, but they are well into the future, she said.

“Even if you get a battery like Tesla is talking about, it’s going to take time and money to get there,” Brinley said.

The oil and gas industry, meanwhile, criticized Newsom for holding a news conference in front of nearly $200,000 worth of electric cars “as he told Californians that their reliable and affordable cars and trucks would soon be unwelcome in our state.”

“Big and bold ideas are only better if they are affordable for us all,” said Cathy Reheis-Boyd, president of the Western States Petroleum Association. “Our industry and the energy we provide will be the part of any solution.”

About a dozen states follow California’s lead on auto emissions standards that are more restrictive than federal rules. If those states follow suit on zero-emission vehicles, it could have a huge impact on the U.S. automobile industry.

“Newsom can’t claim climate lead ership while handing out permits to oil companies to drill and frack,” said Kassie Siegel, director of the Center for Biological Diversity’s Climate Law Institute. “He has the power to protect Californians from oil industry pollution, and he needs to use it, not pass the buck.”

Associated Press writers Tom Krisher in Detroit, Ellen Knickmeyer in Oklahoma City and Seth Borenstein and Kevin Freking in Washington, D.C., in contrib uted to this report.

Copyright 2020 Associated Press.

The Role of Mentorships in Building a Strong Workforce

Mentorships are a key component of a comprehensive employee devel opment program. Whether thr ough a formal program By Phokham O'Connor or more organic and casual interactions, insurance organizations have much to gain from encouraging and facilitating mentor ing relationships across the organization.

By embracing mentorships, insurance organizations are able to increase employ ee satisfaction and advance leadership dev elopment, among many other benefits.

Recognizing the Organizational Value

The organizational impact of mentorship programs spans far and wide. At the individual level, mentees are able to gain insight and guidance on various challenges or opportunities they are facing.

F or instance, individuals may seek out mentors to help them successfully transi tion through a promotion or departmental mo ve, take on additional responsibilities or pursue professional aspirations. Often, individuals may want to hone specific skills or build competencies vital to their longer term career growth.

In turn, men tors will have an opportuni ty to give back by sharing their experiences w ith others who may be facing situations similar to ones they’ve overcome. They’ll have an opportunity to connect with individuals they may not otherwise interact with, hear fresh perspectives and gain personal fulfillment by helping others achieve their goals.

Additionally, the managers of those being mentored will have engaged and motivated employees, who are actively working toward honing their skills and building additional competencies. These individuals will help build bridges among teams and foster interdepartmental relationships outside of their day-to-day interactions, which can pay dividends in the long run. And the overall organization will build a well-rounded workforce and confident future leaders who are wellequipped to take on new challenges.

Mentorships at All Professional Stages

While mentoring relationships often continued on page 28

continued from page 27 occur between a more junior mentee and more seasoned mentor, it’s important to note that mentorships are not just for young professionals. Mentorships are a valuable tool throughout one’s entire professional career, and their dynamics will shift based on current career stages and needs. Even the most accomplished individuals will benefit from the perspec tives of trusted advisors.

P eer mentorships and reverse mentorships are also common and have their o wn unique sets of benefits, such as better connecting professionals with younger generations and providing perspective on new tools and technologies. Individuals who are in the same stages of their careers are able to provide support and guidance to one another at the peer level, as they are likely going through similar situations and can directly relate to issues at hand. There’s no limit to the number of mentoring relationships a person might participate in, depending on their career stage, aspirations and current needs.

Building a Successful Relationship

Successful mentoring relationships take work and dedication. Both parties must be committed to the process and make themselves available for regular meetings. To be most impactful, these relationships must be built on trust and honesty; both parties should feel comfortable sharing openly and honestly and value an outside perspective. Acknowledge the role of the mentor is to inspire, guide and advise, not to simply solve a problem or tell someone what they should do.

Additionally, it’s important to set clear expectations around what the mentee would like to get out of the experience. Make sure the mentee has clear goals, and the person in the mentor role is the best individual to help them on their journey. For instance, if an individual wants to build a specific soft skill, such as presenting more effectively in front of groups or building deeper professional relationships, someone who is skilled in those areas would be best suited to provide support. If an individual’s goal is to secure a leadership position, a successful leader who understands how to build strategic relationships and navigate the corporate landscape may be an ideal match.

In many cases, it’s helpful to determine the parameters of the relationship upfront. How often will the mentor and mentee meet? How will the mentee be held

accountable? What is the timeframe for the mentoring relationship?

While men toring conversations may have previously taken place in person, they’re just as impactful in the remote environment. It’s still possible to share coffee over a morning Zoom conversation or schedule a 30-minute virtual lunch meeting. Face-to-face interactions will always be important; try to leverage video conferencing platforms as much as possible. This enables you to read facial expressions and body language to connect on a more meaningful level.

Getting Started

It can be intimidating to create a mentorship program. However, the best thing to do is just start. Ev en if your initial launch is informal, with loose parameters, employ ees will benefit. As the program evolves, solic it feedback from both mentors and mentees, learn from your mistakes and make adjustments.

Disc uss the program with your leader ship team and gain organizational buy-in. Partic ipating in a mentorship relationship should be encouraged at all levels of the organization and seen as a commitment to professional development. Ask leaders to help champion the cause and encourage their teams to participate.

As y ou begin to formalize your program, there are a number of considerations. How will you measure the success of a mento ring relationship? Are there specific milestones individuals should work toward? H ow will mentors and mentees be held accountable? You may even choose to offer micro-mentorships, where individuals can work on a specific skill for a short amount of time.

M entorship programs are a fantastic opportunity to demonstrate your commit ment to employee growth and development. By encouraging these relationships, in vesting in employees and helping them reach their professional goals, you’ll build an engaged and driven workforce.

Phokham O’Connor is a talent delivery manager at The Jacobson Group, a provider of talent to the insurance industry. Phone: 800- 466-1578. Email: psiriboun@jacobsononline.com.

Put drivers in control

with custom savings.

Off er personalized savings based on your clients’ driving behavior with innovative solutions from Nationwide.

Our telematics off erings use individual driving data to help customers save. Like SmartRide®, which rewards safe drivers with discounts of up to 40%. And with SmartMiles®, low-mileage drivers pay based on the miles they drive.

Innovative solutions that help you keep customers and win new ones. It’s what you can expect from a partner like Nationwide. To learn more, visit nationwide.com/proudpartner

SmartRide: Availability varies; program criteria diff ers in California. Stated discounts are approximations. Discounts do not apply to all coverage elements; actual savings vary by state, coverage selections, rating factors and policy changes. Enrollment discount applies during data collection; fi nal discount is calculated on driving behavior and could be zero. Final discount applies at the next policy renewal and is subject to change based upon actuarial support at subsequent renewals or with changes in drivers or vehicles on the policy. SmartMiles: Availability varies. SmartMiles includes a base premium plus a variable premium based on the coverages in force and the days and miles driven. Nationwide Mutual Insurance Company and affi liates. Columbus, Ohio. Nationwide, Nationwide is on your side, the N and Eagle, SmartRide and SmartMiles are service marks of Nationwide Mutual Insurance Company. ©2020 Nationwide.

2020 Winners

OVERALL RightSure, Tucson, Ariz. EAST Gold - William A. Smith & Son Inc., Newbur gh, N.Y. Silver - D eland, Gibson Insurance Associates, Wellesley, Mass. Bronze - Stant on Insurance Gr oup, Cherry Hill, N.J. WEST Gold - Wood Gutmann & Bogart Insurance Brokers, Tustin, Calif. Silver - The Liberty Compan y Insurance Brokers, Woodland Hills, Calif. Bronze - The Buckner Company Inc., Sal t Lake City, Utah SOUTH CENTRAL Gold - G&G Independent Insur ance, Fayetteville, Ark. Silver – INSURICA , Ok lahoma City, Okla. Bronze - Upshaw Insurance Ag ency, Amarillo, Texas MIDWEST Gold – The Starr Group, Greenfield, Wis. Silver – DSP Insurance Group, Scha umburg, Ill. Bronze – Korotkin Insurance Group, Southfield, Mich. SOUTHEAST Gold – SouthGroup Insurance Services, Ridgeland, Miss. Silver - Fisher Brown Bottrell Insurance, Jack son, Miss. Bronze - Darr Schackow Insur ance, Gainesville, Fla.

Is your agency on this list? Tell everyone! For reprints, badges, plaques and more, call (800) 897-9965 x125 or email us at: reprints@ insurancejournal.com

The votes are in for the 2020 Best Independent Insurance Agencies to Work For. While 2020 has been an unusual year for agency employees – many of whom have worked remotely for months – the pressures that have come with a global pandemic didn’t sway what they value most about their workplace.

Employees in 2020 highlighted the importance of competitive salaries, employee benefits, training and education, and other employee perks as drivers of satisfaction in the workplace. But it’s not all about compensation and benefits. Happiness in the workplace has a lot to do with people, relationships and the agency’s culture. Employees of the winning agencies cite high personal job satisfaction; rate their relationships with their immediate boss or supervisor

as positive; and express a high opinion of their agency’s owner or principals and their agency’s reputation in the community.

Man y employees are grateful the best agency owners support local charities and the community. Employees are grateful for the opportunities their agencies provide for them to participate in community service. Employees take pride in working for agencies that are respected and hold strong values and ethics. Employees appreciate the generosity of their agency owners in sharing revenues in the form of bonuses and trips.

The best agencies also provide ways to help their employees grow — by giving them the tools and technology they need, and supporting them with education, training, annual performance reviews and, in some cases, mentors. The survey results clearly show employees value this support.

As e xpected, the winning agencies score high for overall employee benefits including wellness programs and for working conditions that include flex-time and alternative schedules that allow employees to work from home.

The best ag encies to work for also provide employees with a strong sense of work-life bal ance, and deliver a workplace en vironment where employees feel supported wholeheartedly by management and their peers. Many of the employees say they feel like family in their agencies.

Insurance Journal wishes to thank the nearly 4,000 cus tomer service representatives, accoun t executives, producers, managers and other agency staff who took the time to nominate their independent insurance agency in this year’s survey.

Overall RightSure Insurance Group Tucson, Arizona Tech-First Agency Tackles the ‘Difficult Things’

By Andrea Wells

From standup comedy and acting gigs to selling insurance – not the typi cal career path for the everyday independen t agency owner but that is how Jeff Arnold, founder of RightSure Insurance Group, this year’s winner of Insurance Journal’s Overall Best Agency to Work For, got his start in the business.

“I li terally was an out of work standup comic returning from Hollywood where I had no gigs lined up for the next 10 weeks. I needed to eat and pay rent, so I answered an ad Jeff Arnold for the most cliché of things, “Wanted: Insurance Salesman,’” Arnold said. “From day one of my new career, I was hooked. I could not read enough, learn enough or digest enough about this wonderfully exciting industry.”

Arnol d’s enthusiasm for the insurance business trickles down to RightSure’s employees who nominated the agency for its top-notch working condi tions, overall employee benefits, supportive management, communi ty involvement, and how the agency is maneuvering through COVID-19.

One employee described RightSure as: “a great company, feels more like a family than a business, they support their employees, the owner and management go to extremes to help us. Best company ever by far, without exaggeration.”

Arnold founded RightSure just 12 years ago, but he has been working in the insurance industry for nearly three decades. Through his company, Abbey Road Insurance Holdings, he is active in several joint ventures with online aggregators, comparison websites and insurance portals. That entrepreneurial spirit and tech-forward thinking is one attribute Rightsure’s employees noted as important. “We are a tech nology company first, an insurance agent second,” one employee wrote. “We are constantly creating new ways for a better customer experi ence online and creating more a venues for clients to obtain and learn about insurance.”

Arnol d says that RightSure is increasingly powered by AI initiatives, and he believes that gives the agency the “feel” of a tech incubator, which is attractive to younger, more mobile focused staff.

The ag ency, with 52 employ ees in two Arizona offices, r eported property/casualty revenue of $4.4 million in 2019. Arnold says staff consists of a mix of millennials, Gen Z and more seasoned insurance professionals. “Having that diversity of more mature and experienced with younger, less experienced people makes for a great environment,” Arnold added.

“Part of our internal mantra is ‘do the difficult things.’ The things that most people want to avoid but if faced and accomplished will lead to more improvements, greater revenue, deeper employee engagement.” That’s what sets RightSure apart from others in the indus try, he added. “Calling back an unhapp y renewal client, solving a difficult onboarding practice, having that difficult conversation with that one employee,” he said.

One of the most diffic ult things in recent history has been COVID-19, and Arnold’s leadership through the crisis was mentioned by employees again and again.

“ Our boss’s ability to get his employees through a pandemic seamlessly, without fear or panic, allowing everyone to continue in their role, working from home, and giving us all the technology needed to be successful in a different environment” was cited as one reason why they felt proud to work at RightSure.

Arnold said the single great est challenge for managing in a CO VID world has been making

sure that employees are OK. “ And by OK we mean mentally strong.” That meant moving from one or two monthly company meetings to daily “check-ins” five days a week. Most of the meetings were to simply ask, “Is everyone OK?”

F rom those meetings an informal “Moms Group” developed. “Many of our moms wanted a non-judgmental place to share struggles or ask for guidance – for how others were juggling home schooling, workloads, family life,” he said. “People really are the single greatest asset any company has, so it is extremely important to make sure they are OK, engaged, happy and whole.”

Arnol d’s best advice to other owners – develop a strong culture. “What culture are you wanting in your company and how does that integrate with your overall strategy.” The best laid strategy plans get destroyed by a bad culture.”

RightSure Insurance Group employees value its progressive tech-focused work environment.

East William A. Smith & Son Insurance Newburgh, New York Communication and Teamwork Equal Success

By Elizabeth Blosfield

Not all insurance agents are created equal. At least that’s what William A. Smith & Son Insurance states on its website, a claim that speaks to the agen cy’s mission of serving clients and emplo yees through strong communication and teamwork.

“W e really care about our customers and want win/win relationships,” says Jack Smith, executive vice president and owner of the Newburgh, N.Y.- headquartered independent agency. “We want to make sure that everybody is served and that they feel good about doing business with us.”

With one part-time and 30 full-time employees and annual revenue between $3-$5 million, William A. Smith & Son Insurance is a third-generation independent agency started by Jack’s grandfather. Jack’s father, John Smith Sr., later joined the firm in 1957 and remains as its president, while Jack and his two sisters, Debra Johnson and Cathy McCarty, currently run most of the daily operations as executive vice presidents and owners.

The agency was recently nominated by its employees and won Insurance Journal’s annual Best Agency to Work For Gold award in the East region. Employees, who filled out an anonymous survey as part of the nomination, say this honor is deserved due to the agency’s family-focused atmosphere.

“[John], who is 87 years old and has over 60 years in the business, is the most hard working and caring individual,” one employee writes. “He exemplifies the values of leadership and is the glue that keeps our agency together.”

J ack, who joined the agency in 2003 after spending 10 years with Kemper Insurance as a commercial underwriter and five years with Computer Sciences Corporation selling software, outsourced services and consulting to the insurance industry, says he was originally drawn to insurance because of the impact he felt he could make on the community. He explains that making this kind of impact starts internally with a strong team.

“E ach of the players on your team needs to be kind of a champion in their role,” he says. “You have to take care of the people to make your agen cy the best place for customers t o come.”

Employees say William A. Smith & Son Insurance is no stranger to prioritizing its peo ple, pointing to the COVID-19 pandemic as one e xample.

“Being given the opportunity to work from home during the COVID-19 pandemic is great,” one employee writes. “I have been given the tools I need to keep working with new customers as well as servicing existing clients.”

When the CO VID-19 crisis hit in March, the agency was able to transition immediately to work-at-home for all employ ees due to technology upgrades i t has made over the last few years, one employee writes.

“We’ve always been big on trying to make sure we’re up to date with our technology,” Jack says, adding that tech-enabled communication has served the agency well through these challenging times.

“When people ar e part of your team and your families, you need to over communicate with them,” he says. “Communication enabled by technology has really made it a lot easier for people to deal with what’s going on right now.”

Although man y William A. Smith & Son employees have elected to return to the office, Jack says the agency hasn’t required that as its priorities have always been about protecting its people and customers.

“W e want people to be comfortable and feel safe. And if you’re comfortable and safe, you’re going to do a good job. And if you do a good job, your customers are going to be happy,” Jack says.

W illiam A. Smith & Son Insurance’s employees say this approach is working.

“The company has been

around for nearly 100 years because of its role in the community, how it treats its employees and customers alike,” one employee writes. “No one is a number. They always go above and beyond.”

W ith this in mind, Jack says being recognized as a best agen cy to work for is an important r eminder of why he entered the insurance business in the first place — because of the people and the community.

“I t validates the things that you think you’re doing to try to make it a fun and productive place for people to want to spend their time every day,” he says. “Because other than sleeping and being with our families, these are the people that we’re with most in our lives.”

From Left to Right: Jack Smith, Debra Johnson, John H. Smith Sr., Cathy McCarty)

Special Report: Best Agency to Work For Midwest

The Starr Group Greenfield, Wisconsin

Nothing More Important than Culture

By Stephanie K. Jones “The fact that they were not asks our opinions on how to “ I LOVE working for this business. I look forward to working each day!!!” asked to nominate us but rather felt compelled to nominate our agency ... speaks volumes,” he said in an email to IJ. fix them,” another employee wrote. Tim Starr admitted he was not initially convinced of the

It’s not every day that you Tim Starr said f or him, what importance of culture on a hear an employee of any makes the agency a great place company’s success. “I need given business say that, but it’s to work is: “Culture, culture ed to be educated into how exactly what one respondent to and culture! This is defined c ritical culture is. When I

Insurance Journal’s 2020 Best via numerous variables but started witnessing the chang

Agencies to Work For survey as Mary Starr would share, es and in particular how one, said about working at The Starr ‘Culture by design, not default.’ new people w e interviewed

Group in Greenfield, Wisc. As our Cultural Officer, she has would reference it, and two,

Tha t employee was not alone been the creator, maintainer that it was the number one in expressing admiration for and polisher of this.” reason employees stay with us their agency. The overwhelm In their sur vey response, an I knew I had just learned there ingly positive responses to employee praised Mary Starr, is NOTHING more important in the IJ sur vey have propelled The Starr Group’s executive an organization than culture.

The Starr Group — which has vice president, for continually Cultur e is vague and big.” 34 employees and generates looking at ways for the agency Ethic s and integrity are a big between $5 million and $10 to “do better” and ensuring part of that culture, employees million of revenue annually employees know they are say, and it’s something they — to win the designation of valued and important to the clearly appreciate.

Gold Best Agency to Work organization. “I have been with the orga

For — Midwest. “We have a management nization for over 20 years and

CEO Tim Starr said it is team that seeks out your great ev ery day feels like a new day.

“quite amazing to know” that ness, harnesses it, and uses it to The agency is a very strong the employees nominated the mak e you feel highly engaged values-based organization and agency and participated in the in your job. The owners strength-based organization. survey without management’s actively talk with all employees We focus on the strengths knowledge. to identify problem areas and of individuals and know that differences are needed and accepted,” wrote one employee. “Ethics is a big part of the culture, and it’s not only ‘doing ethical busi ness’ but it is always doin g the right thing when in the office or not,” said another. “Regarding insur ance, they always tak e the high road and do what is right for the client. We

The Starr Group knows how to have fun! Above, agency team members and their do not sell on price, families enjoy the annual family picnic in 2019. we build solid

coverage and risk management programs, and then negotiate for the best value. It is a fun damental difference compared t o many of our competitors,” another employee noted.

Starr said the agency recognized the coronavirus pandemic had the potential to challenge the company’s culture and took steps to protect not only employees, but customers as well.

“ Our number one priority was the safety of our teammates and our clients. Ongoing, transparent commu nication was critical during this time. W e invited our team back to our physical offices in June and the majority have gladly returned with enhanced Work from Home options. It was imperative that we not allow the culture we had worked so hard to build to deteriorate during these changing and challenging times,” he said.

“We have noticed a self-proclaimed improvement in both emotional and mental wellbeing with this return to an in-person and ‘back to normal’ work setting. Instead of becoming paralyzed with fear and uncertainty our team has flourished during these unprecedented times,” Starr added.

G&G Independent Insurance Fayetteville, Arkansas

All About 'Exceptional Experiences'

By Stephanie K. Jones position our company to be the well as opportunity to move up T he team at G&G Independent Insurance in Fayetteville, Ark., is best highest producing agency not only locally but statewide and nationwide. We are very ambitious and competitive the ladder.” Above all, it’s the people that make G&G a great place young, ambitious, motivated, which is something I enjoy,” to work, according and passionate about providing wrote one employee in their to Greer. “Our innovative, exceptional service survey response. team is comprised to their customers. And they “I feel like the company is of energetic, motivated, and love where they work. forward thinking and trending customer-centric people that

G&G Independen t Insurance upwards consistently in growth strive to deliver exceptional was selected as Insurance and technology. I do not feel experiences in every interac Journal’s Gold Best Agency to like most insurance agencies tion. When you are surrounded Work For — South Central based are taking the same approach, b y a team that truly comes on the energy, drive, and appre which sets us apart,” said together to achieve big goals, ciation for their employers and another. work is engaging and it’s fun!” peers tha t employees conveyed One emplo yee described he said. in their responses to Insurance the culture at the agency One ag ency initiative that Journal’s 2020 Best Agencies to as “phenomenal” adding: multiple employees expressed Work For survey. “Leadership does an excellent their appreciation for is the

“I’ m elated, humbled, and [job] at picking the right people Exceptional Experiences appreciative!” G&G CEO Jordan and ensuring we are treated Program, designed not only to Greer wrote in an email to IJ fairly and given opportunities motivate staff but to recognize upon learning his agency was to grow within our position as their achievements. a Best Agency to Work “ G&G’s purpose is to For finalist. “This nom provide exceptional ination from the G&G experiences in every t eam is an indication interaction,” Greer that we are heading in said. It’s a philosophy the right direction and that extends beyond that we should continue providing excellent with our efforts to do customer service. everything we can to “We are equally make our agency the focused on the best place to work for employee experience. our team.” One example is the

W ith 18 employees at process by which we the time of the survey, identify, praise, and G&G Insurance has recognize exceptional annual revenues in the experiences that $1 million to $10 million members of our team range and is anything provide to our clients. but static. Not only do we

“We have a young praise and recognize team with high ambition these experiences, to be the best. Our man but we gamify their agement is very smart During child abuse awareness month, G&G efforts complete with and alwa ys looking employees came together in support of the a leaderboard that to be progressive and Children’s Safety Center, a local non-profit advohas each employee think outside the box to cacy group for abused children. playing for a unique

exceptional experience of their own — a bucket list trip they designed before the year began. The employees at the top of the leaderboard are competing for bucket list trips to Australia, Italy, and Mexico,” he said.

S everal team members also highlighted the G&G Foundation — an employ ee-funded and managed nonpr ofit dedicated to serving the local communities where the agency does business.

The f oundation is run “by a committee of employees so you get to be involved with something very exciting and meaningful to the community,” an employee said.

Other emplo yees praised the agency’s management not only for seeking out employee feed back but listening and acting upon the ideas and sugg estions provided by staff.

For Greer, that’s an important part of being “intentional about the employee journey.”

H e said it’s important to involve team members in the process of identifying not only what it means to be a best place to work but also where gaps or opportunities exist that can help take the organization to where it wants to be.

“Create anonymous opportu nities for your team to give you f eedback along the way and, remember, the journey is never over,” Greer said.

Southeast SouthGroup Insurance Services Ridgeland, Mississippi A Big Agency with an Even Bigger Heart

By Amy O’Connor

Employees at SouthGroup environment that promotes e xample. I enjoy coming Insurance Services don’t pride, professionalism and to work each day,” said a just like where they opportunity. respondent. work – they LOVE it. And going “W e consider all of our “I lo ve going to work through the pandemic has employees to be teammates everyday because I work only reinforced their love and on a championship team of at SouthGroup and I love appreciation of their employer, teams,” said Tubertini, who helping people! We have selected as Insurance Journal’s noted employees refer to them over 20 locations, but we Best Agency to Work For - Gold selves as SouthGroupies. “Like function together seamless in the southeast region. all sports or r ock groupies, our ly using tech and messenger

“Durin g this pandemic our SouthGroupies are proud to t ools,” said another. “We help office has pulled together to be associated and care about each other out with ideas and make things feel as normal as SouthGroup and our future.” markets and short cuts to do possible for each and every one Tha t sense of pride in their our jobs better. We work hard that works here as we all have place of business was evident to make all of our communities had different situations occur in the dozens of Best Agency better.” and we have worked as a team to Work For SouthGroup Tubertini said he start ed his to keep moving forward,” said employee survey submissions. first agency at 25 and now 45 one employee. From the company’s generous years later, he is still excited

“I ha ve never worked for benefit options, to employee about being in the insurance a company that has been so growth opportunities to the business and looks forward generous, caring, understand agency’s support services and to any future changes and ing, willing to reward, shows its emphasis on giving back to challenges. appr eciation for the work done, the community, SouthGroup “M ost of our SouthGroup understanding of errors and team members emphasized offices enthusiastically encour advice on how to correct,” said how lucky they feel to be part age a family atmosphere, and another. of the organization. tha t spreads throughout the

The ag ency, based in “Emplo yees are respected entire organization through its Ridgeland Miss., specializes in and treated with fairness collaboration,” he said. personal and business insur and our opinions are valued. That collaboration was ance through its 22 Mississippi Community service is encour noted by employees in regard branch loc ations and also aged, and our leaders lead by to the company’s charitable works with clients in work, which includes Tennessee, Arkansas, supporting hundreds Louisiana, Alabama, of nonprofits and Texas and other states. community groups,

S outhGroup has 135 schools, and sports employees with revenue teams and hosting of just over $18 million. an annual 5K to

President & CEO raise money for Ronnie Tubertini says Blair E. Baton’s he and the SouthGroup Children’s Hospital, partners are very proud located in Jackson, of their dedicated staff. Miss. This cause in One of the independent particular is very agency’s major goals dear to SouthGroup is to provide a friendly SouthGroup Insurance Services newest employees employees’ hearts as a and stable working from its acquisition of The Clark Group. grandson of one team

member was saved thanks to the efforts of the hospital. SouthGroup has raised more than $300,000 for the hospital.

As the ag ency adjusted to the pandemic with flexible working hours and telework opportuni ties, employees said they were gra teful for the support and understanding of their leaders.

“ The flexibility to work from home all the time (before, during and after the pandemic) has been a lifeline for this work ing mom,” said a respondent. “In t oday’s world, flexibility for families is vital, particularly with working moms.”

Tubertini said SouthGroup offered flexible working hours telework opportunities even prior to Covid-19. The agency also places a value on education, encouraging all of its licensed agents to be on a continuous education track.

All agency should “consider your employees as your greatest asset,” he said.

“We are in a service business, whether it is commercial or personal lines, and our agency employees are the face of our agency,” he said. “I’ve always tried to live by the old maxim that you can buy a person’s back, but you can’t buy their heart. I want to have their heart and them have mine.”

Special Report: Best Agency to Work For West When Caring Matters Most

By Don Jergler

The phrase “truly cares” gets thrown around a lot, but it is being used so often by employees at Wood Gutmann & Bogart Insurance Brokers that it was impossible to write it off as a cliché.

“WGB truly cares for its employees,” wrote one employee. That employee also wrote that the firm respects and values women and minorities, who “are given equal opportu nities to thrive in our culture” in an en vironment with “no micromanagement, a lot of autonomy for entrepreneurial spirits.”

Emplo yees at the Tustin, Calif.-based firm voted it as Insurance Journal’s Best Agency to Work For in the West region. WBG earned the Gold Award. The nomination process has employees rank the firm in several categories in online forms and also comment on just why theirs is the best agency to work for.

I t’s not the first time WGB has been recognized. The firm took home the Silver Award in 2017. That’s truly a big accomplishment.

“You got to truly stand behind your principles and your core beliefs,” said Kevin Bogart, CEO of the firm.

What are those core beliefs? “It’s people and families before money, frankly,” Bogart said.

Ther e was no shortage of employees who made mention in their comments of WGB’s response to the pandemic.

In less than a week after stayat-home orders began rolling out, the firm had taken nearly half of its remaining employees who still worked in the office and had them switched over to work-from-home environ ments.

Computers were ordered, those without high-speed internet connections got them set up with the help of IT and many mobile phones were purchased.

“I think w e bought 75 mobile

Taken at the Wood Gutmann & Bogart lobby. From Left to Right: Bob Gore, president and managing partner of Gore Lieske & Associates Insurance Brokers (an affiliate of WGB); John Janssen, president and partner, WGB Benefits; Peter Barsky, vice president, emerging business group; Kevin Bogart, CEO; Lisa Doherty, executive director, private client services; Rob Lieske, partner and managing director of insurance operations of Gore Lieske & Associates Insurance Brokers; Erik Johansson, president of Performance Bonding (an affiliate of WGB).

phones in one day,” Bogart said. “This has been a harder year money wise due to the expenses to make this happen.”

I t may help that WBG has been steadily growing its size and revenue. When it won Silver in 2017, the firm reported more than $20 million in revenue. At the end of last year, WGB was at about $33 million in revenue — with the help of $4 million coming from its burgeoning benefits division — with roughly 130 employees and counting.

“When the pandemic erupted, they had a contin gency plan within a couple of da ys,” wrote one employee who described WGB’s rapid response to the pandemic. “We held weekly video calls to get the status of our organization and address any concerns anyone had. The leadership isn’t there to simply demand excellence, but their heart is written all over the company. They care.”

Another wrote that the firm “was proactive and took the health and well-being of its employees very seriously and at great expense to them.”

It’s not just the employees who are cared about, another noted.

They ’ve created a staff that works in sync with each other “to deliver the best environment to our team while ensuring the integrity of their products doesn’t get over looked with their customers,” the emplo yee wrote. “Quite simply, I’ve been impressed by how much they care about all

aspects of their business.”

B ogart, believes it is the firm’s values that have helped them weather the pandemic so far, and without a single layoff.

H e’s also looking at 2020 like it deserves to be seen — in the rearview mirror, when better times are upon us — and as an opportunity to achieve in a very brief time what had been a three-year goal to enable more employees to work from home and give them the flexibility to better handle their jobs as well as whatever life throws at them.

“We’ll put an asterisk beyond this year and just call it what it was,” Bogart said. “What was probably a three-year project became a one-week project at the start of this crazy thing.”

F or those who aren’t convinced the firm cares, here's one employee’s comments that should do the trick.

“I have said it before I will say it again, they just care,” the employee wrote. “This company is run by good kind people who care about people. I cannot say enough about the leadership, from the owners to the IT and management, they care about the employees and clients. I really feel they want the best for their employees, and they know if their employ ees are taken care of then emplo yees tend to take care of the company right back. They get it.”

Overall Winner

Remote Work: Protecting Against Employee Crime

The business landscape has changed drastically over the past several months as the world has struggled to combat and adapt to a global health crisis. Many organi zations successfully pi voted their workBy Brian Lester force to remote work, some even reporting inc reased productivity as a result.

While there may be some positive out comes of this forced remote environment as companies r econsider their flexible work arrangements and dollars spent on office space, unintended consequences and risks may also emerge.

F or example, even the smallest breakdown in normal risk management procedures or internal controls can lead to an increase of employee theft claims. Furthermore, with a global pandemic comes global economic uncertainty. Employees are worried about the potential for job loss, economic decline and negative effects on their personal finances. All of these factors also contribute to the likelihood of employee theft.

As we continue to navigate these unprecedented times, there are some key areas businesses can focus on to help mitigate the potential of employee crime.

When opera tions are changed quickly, regular procedures such as accounts pay able and receivable and tracking inventory ar e disrupted. Below are some key factors to consider.

Accounts Payable

Paper Check. Many companies may require dual signatures on documents. If unable to adhere to in-person countersig nature controls during this time, a new

process should be established. Companies can contact their bank to develop an electronic process for issuing paper checks where necessary. This process would require a dual electronic sign-off through a secure portal before the paper check would actually be issued.

Wire Transfer. Ensuring that you are transferring money to the right client is critical. To make sure the appropriate controls are in place, multiple people should be included in the pr ocess to initiate and reconcile the transfers.

Accounts Receivable

When entire workforces shift to remote, what happens to incoming mail, including checks and invoices? A process should be put in place that ensures the secure receipt of mail. If a new process is necessary, for example if the mailroom in a large office building is shut down or not staffed, a P.O.

Box can be used to maintain security.

Monitoring Company Assets. Many companies are struggling to handle inventory and ensurin g accurate accounting when existing controls and methods are no longer available. Modifications might be necessary to bridge the gap during this time.

Vendor/Client Controls. Vendor partners and clients are facing the same challenges. If a vendor is requesting changes to accommodate for their company situation, ensure they are legitimate to avoid any scams. Similarly, speak to clients about their internal controls as company infor mation may be susceptible while in their syst ems.

Mike Henning, a broker at Risk Placement Services, agrees that procedural controls are vital when protecting a com pany against theft.

“It is important that company computer systems are programmed with electronic separation of duties with strict employee authorities and boundaries, dual autho rizations and request confirmations all logg ed and captured,” Henning said. "With less physical employee interaction and oversight, systems have to be programed so employees aren’t able access and process anything over their authority.”

Employee Challenges

We are living through extraordinary times, and companies need to be mindful that their employees are having to handle pressures personally as well as profes sionally. Some of the key areas of concern include:

Technology and equipment

Shifting to remote work means employees, in all permutations of living situations, are relying on their own WiFi networks. Whether they live in a suburban home or in a large apartment or condo building, their network may not be as secure as when in the office. Network security should be a high priority at this time. Additionally, some employees may not have a home office or appropriate technological set-up for long-term remote work. Ensuring employees can work efficiently and comfortably from home is important for business continuity as well as the well-being of employees.

Time Pressure/Stress

In addition to feeling as if they are not properly equipped with technology, many employees have families at home with them. With schools closed and children at home or remote-learning, employees are facing additional stressors while at work/home. This pressure, or perceived pressure, can lead to cutting corners or careless over-sight.

Fewer Employees

Many companies are operating with fewer people. Whether a result of coworkers out of work due to illness or acting as a caretaker for those that are, or pandemic related layoffs and operating with a “skeleton” crew, duties that used to be segregated may not be any longer.

Cybercrime and Social Engineering

In uncertain times, the last thing many of us think about is cybersecurity. Cyber criminals are taking advantage of the world’s distraction due to current events to create new ways of targeting the public and manipulating employees to gain access to company systems. According to Henning, “it is more important than ever to confirm requests coming to employees are legitimate because companies of all sizes are more vulnerable than ever to social engineering attack.”

As smaller businesses receive relief loans from the government, attacks on computer systems are increasing as criminals attempt to gain access to these funds. Companies must remain vigilant in monitoring their system. Some security best practices include the following:

Identify phishing scams. The coronavirus pandemic has led to a rise in email phishing scams. IT departments should provide inf ormation and training so employees understand how to verify that an e-mail is authentic. For example, sometimes email addresses are slightly modified to look legitimate. Employees should care fully check the “from” email address and domain. S ome of the topics criminals are using to draw people into scams include: General pandemic terms or news, including alerts for breaking news and links to fake news websites. Requests for verification of personal information to receive financial relief such as loans or an economic stimulus check f rom the government. F alse shipping notifications. Unsolic ited contact from medical pr ofessionals, government agencies, health or ganizations or any apparent authori ty figure. Infected infographics, maps and trackin g apps. A dvertisements for masks, hand sani tizers or any products that are in short supply , including fake testing kits and bogus c ures and vaccines. Chari table contributions. Airline c arrier and vacation refunds. J ob opportunities.

Avoid Typosquatters. “Typosquatters” take advantage of common misspellings or slightly modify website addresses to re-direct people to malicious websites. If an employee identifies a suspicious email: • D o not click on any links. • Check the w ebsite spelling. • H over over a link to determine if it’s legitimate. • Open a br owser and hand type the w ebsite address.

Ev entually, this pandemic will pass, and we will get back to some form of “normal.” When we do, it’s possible that we’ll have implemented alternate business procedures that we’ll choose to maintain moving forward, helping us to weather future possible events such as natural disasters, technology outages, travel interruptions and future pandemics.

No matter what disruptions may occur, if a company can remain vigilant in con trolling internal procedures, stay mindful of the challen ges their employees face and educate their workforce on emerging cybercrime trends, it will go a long way in preventing crime loss.

Lester is assistant vice president, fidelity, at OneBeacon Management Liability. Website: onebeaconml. com.