Young consumers don’t always trust the insurance industry, but most do, according to a new study from the Society of Actuaries (SOA) Research Institute, which found that on average, younger consumers rated insurance companies a six out of 10 in terms of trust.

The study analyzed how younger consumers understand, evaluate and purchase insurance plans. The study also investigated younger consumers’ perception of risk and the impact of the COVID-19 pandemic on how they value insurance.

The majority of young consumers see insurance playing a positive role in their lives and some 61% of younger consumers intend to purchase one or more types of insurance within the next 12 months.

Roughly half of those surveyed prefer to purchase insurance online. Additionally, younger consumers are most likely to own automobile and health insurance, and least likely to own critical illness, disability and accident insurance.

Other key findings include:

• 41% of young consumers feel it is important to have insurance.

• 63% surveyed consider themselves risk neutral, while 23% consider themselves more risk averse, and 14% consider themselves risk tolerant.

• Between 60% and 80% of younger consumers are somewhat or very concerned about the financial impact of each of 12 financial and insurable risks, such as car accidents, damage to personal property or damage to residence.

The report also studied the level of risk tolerance of younger consumers, and their willingness to engage in risky behaviors. Those surveyed who are risk averse are more concerned about accidents and health risks.

But there was a disconnect between the perceived likelihood of an event and concern over it. For example, when asked about their concern of the financial impact of insurable risks, 79% of younger consumers reported concern about being in a car accident that results in significant repair or medical costs, but only 35% of respondents cited they are likely to be in a car accident within the next 10 years.

“It’s clear that young consumers’ perception of insurance varies based on their unique level of risk tolerance or aversion, as well as their perception of certain risks,” says Ronora Stryker, ASA, MAAA, senior practice research actuary, SOA Research Institute. “Despite these differences, the general attitude towards insurance companies among younger consumers is positive, with affordability and level of coverage being the most important factors when purchasing insurance.”

The survey also found younger consumers were motivated to purchase insurance they felt was needed, even if the type of insurance is required. For example, 47% of respondents cited necessity as their motivation for home insurance, compared to 27% who cited purchasing because of a mortgage lending requirement.

The survey report, “Perceptions of Younger Generations on Risk and Insurance,” was conducted online and garnered 1,000 responses from young consumers ages 21-42, who reported having an income of at least $25,000. They also could not work in the insurance industry.

Andrea Wells Vice President, ContentChairman of the Board Mark Wells | mwells@wellsmedia.com

Chief Executive Officer Joshua Carlson | jcarlson@insurancejournal.com

ADMINISTRATION / CIRCULATION

Chief Financial Officer Mark Wooster | mwooster@wellsmedia.com

Circulation Manager Elizabeth Duffy | eduffy@wellsmedia.com

Staff Accountant Sarah Kersbergen | skersbergen@wellsmedia.com

EDITORIAL

V.P. of Content Andrea Wells | awells@insurancejournal.com

Executive Editor Emeritus Andrew Simpson | asimpson@wellsmedia.com

National Editor Chad Hemenway | chemenway@insurancejournal.com

Southeast Editor William Rabb | wrabb@insurancejournal.com

South Central Editor/Midwest Editor Ezra Amacher | eamacher@insurancejournal.com

West Editor Don Jergler | djergler@insurancejournal.com

International Editor L.S. Howard | lhoward@insurancejournal.com

Content Editor Allen Laman | alaman@wellsmedia.com

Assistant Editor Jahna Jacobson | jjacobson@insurancejournal.com

Copy Editor Stephanie Jones | sjones@insurancejournal.com

Columnists & Contributors

Contributors: David Blades, Sharon Emek, Jim Sams, Elsie Tai

Columnists: Tony Caldwell, Catherine Oak, Mary Newgard

SALES / MARKETING

Chief Marketing Officer

Julie Tinney | jtinney@insurancejournal.com

West Sales Dena Kaplan | dkaplan@insurancejournal.com

Romeo Valdez | rvaldez@insurancejournal.com

Kelly DeLaMora | kdelamora@wellsmedia.com

South Central Sales

Mindy Trammell | mtrammell@insurancejournal.com

Southeast and East Sales (except for NY, PA, CT)

Howard Simkin | hsimkin@insurancejournal.com

Midwest Sales

Lisa Whalen | (800) 897-9965 x180

East Sales (NY, PA and CT only)

Dave Molchan | (800) 897-9965 x145

Advertising Coordinator

Erin Burns | eburns@insurancejournal.com

Insurance Markets Manager

Kristine Honey | khoney@insurancejournal.com

Sr. Sales & Marketing Coordinator

Laura Roy | lroy@insurancejournal.com

Marketing Administrator Alberto Vazquez | avazquez@insurancejournal.com

Marketing Director Derence Walk | dwalk@insurancejournal.com

DESIGN / WEB / VIDEO

V.P. of Design

Guy Boccia | gboccia@insurancejournal.com

Web Team Lead

Josh Whitlow | jwhitlow@insurancejournal.com

Ad Ops Specialist Jeff Cardrant | jcardrant@insurancejournal.com

Web Developer Terrance Woest | twoest@wellsmedia.com

Web Developer Jason Chipp | jchipp@wellsmedia.com

V.P. of New Media

Bobbie Dodge | bdodge@insurancejournal.com

Videographer/Editor Ashley Waldrop | awaldrop@insurancejournal.com

ACADEMY OF INSURANCE

Director Patrick Wraight | pwraight@ijacademy.com

Online Training Coordinator

George Jack | gjack@ijacademy.com

‘41% of young consumers feel it is important to have insurance.’

Simple solutions for complex times® is more than just our tagline at UFG Insurance.

We’ve made it our mission to create simple solutions for doing business with us, which begins with providing trusted insurance protection and service that exceeds expectations.

For a carrier committed to making insurance simple, think UFG. After all, insurance can be complicated and we all deserve simple solutions in these complex times. ufginsurance.com/services

Simple solutions for complex times INSURANCE

Analysts at Fitch Ratings predict a better underwriting result for U.S. property/casualty insurers in 2023 compared to 2022, but the combined ratio is still going to hover above breakeven, according to their forecast.

Fitch forecasts a 100.4 industry combined ratio for the full year in 2023. Aboveaverage catastrophe-related losses and sharp deterioration in auto results drove the industry statutory combined ratio to 102.5 in 2022 — coming in above the 99–100 range for the previous four years. With premium rates rising significantly in 2023 in those underperforming automobile and property segments, underwriting results are likely to improve. Still, claims volatility amid higher inflation and macro uncertainty may impede a return to underwriting profitability, the analysts said, explaining the go-forward forecast. (Note: Fitch’s estimate of the 2022 statutory combined ratio, 102.5, published in mid-April, differs slightly from a late March estimate of 102.7 published by AM Best. Like Fitch, AM Best analysts do not forecast an industry underwriting profit for 2023.)

In addition, commercial lines combined ratios in aggregate are anticipated to slightly deteriorate from current favorable

underwriting profit levels.

Recapping last year, Fitch notes that declining underwriting performance in personal lines drove a 31% drop in statutory earnings in 2022 for the P/C industry. Policyholders surplus fell 7% to $980 billion at year-end, largely from large unrealized investment losses.

On the top line, direct written premiums jumped by more than 9% for the second straight year in 2022, with both commercial and personal lines insurers increasing rates. In 2023, Fitch foresees direct written premium growth moderating slightly but staying above historical norms because of the rating momentum in personal lines.

Also impacting underwriting profitability this year is higher potential claims cost volatility, which may result in future adverse reserve development. In 2022, the P/C industry reported the 17th straight year of favorable calendar-year reserve development.

Overall reported reserve redundancies declined to 0.6% of earned premiums in 2022, from levels averaging 1% in 20192021 and a level of 2% in 2018. Significant reserve deficiencies emerged in both

personal and commercial auto liability last year, Fitch said, adding that other liability lines also experienced adverse development.

The biggest driver of the overall redundancy continues to be the workers’ compensation line. The Fitch report notes that 2022 was the sixth straight year in which favorable workers’ comp development represented over 12% of calendar-year premiums.

On an accident-year basis, Fitch noted that litigation-related losses, which fueled adverse development in liability lines for accident years 2016-2019, reversed amid the pandemic in accident years 2020 and 2021. Also impacting accident year 2021 were inflation and supply chain shortage effects on loss severity, leading to the reported adverse development in the 2021 accident year for personal and commercial auto liability.

Fitch suggests there is higher potential for adverse development in accident year 2022 in multiple segments due to ultimate effects of inflation and economic volatility on key claims factors, including construction materials, auto parts, contract labor, medical services and litigation costs.

The amount Florida property insurers will be assessed on all premium for new and renewing policies to help the Florida Insurance Guaranty Association fund outstanding claims from the liquidation of United Property & Casualty Insurance Co., which was deemed insolvent in February. The emergency assessment will be the fourth surcharge needed for FIGA in the last two years. It will kick in Oct. 1 and will continue at least until Sept. 30, 2024.

The approximate area percentage of California that remains in drought as of mid-April, according to the U.S. Drought Monitor. At the start of the water year on Oct. 1, 2022, more than 99% of the state was estimated to be covered by drought.

$100,000

The approximate amount in dimes that thieves apparently made off with after breaking into a truck containing hundreds of thousands of dollars’ worth of dimes while it was parked overnight at a Philadelphia store in April. The tractor-trailer driver had picked up about $750,000 in dimes from the Philadelphia Mint and was planning to transport them to Florida.

The estimated amount of global economic natural disaster losses, including both insured and non-insured losses, during the first quarter of 2023, according to Aon’s Q1 Global Catastrophe Recap Report.

Private and public insurance entities saw an estimated $15 billion of global losses during the first quarter — close to both average and median losses of the last 10 years, Aon’s report shows. Potential loss development is likely to increase the total further, according to Aon.

“Make no mistake: many crypto trading platforms already come under the current definition of an exchange.”

— U.S. Securities and Exchange Commission

(SEC) Chair Gary Gensler said in prepared remarks regarding the SEC’s decision to re-open public comment on its proposal to expand the definition of an “exchange,” clarifying that its existing rules on exchanges also apply to decentralized cryptocurrency platforms (also known as DeFi platforms). The SEC voted 3-2 to take additional comments from the public after crypto firms criticized the plan as vague and aimed at roping in DeFi platforms that would otherwise not be subject to oversight.

“They said it would be art elsewhere … It’s just not art here. … The town should not have the right to police art.”

— Said Sean Young, owner of a bakery in Conway, New Hampshire, referring to the mural high school art students painted over his shop’s doorway depicting the sun shining over a mountain range made of sprinkle-covered chocolate and strawberry donuts, a blueberry muffin, a cinnamon roll, and other pastries. The town zoning board decided the painting was advertising and could not remain as is because of its size. Faced with modifying or removing the mural, or possibly dealing with fines and criminal charges, Young sued, saying the town is violating his freedom of speech rights.

“It not only solved a chapter in the nation’s darkest day in lumber history, but also showcased a team of historians who have dedicated their lives towards making sure these stories aren’t forgotten.”

— Ric Mixter, a board member of the Great Lakes Shipwreck Historical Society and a maritime historian, said after Michigan researchers found the wreckage of two ships that disappeared into Lake Superior in 1914. The researchers hope the discovery will lead them to a third that sank at the same time, killing nearly 30 people aboard the trio of lumber-shipping vessels.

“Whether Savage had to buy as much insurance as it did is beside the point. … What matters is that it did obtain that insurance.”

— States a Texas Supreme Court opinion reversing a Court of Appeals judgment that held ExxonMobil Corp. was not insured under excess policies purchased by Exxon contractor Savage Refinery Services.

As a result, two excess insurers may be liable for the more than $20 million Exxon paid to settle lawsuits filed by Savage employees who were badly burned while working at an Exxon refinery. The appeals court had ruled that a service agreement between Exxon and Savage limited coverage to $2 million, but the high court’s 6-0 decision says the agreement stipulated a minimum amount of coverage, not a maximum.

“While in-restaurant purchases and transactions continue to operate, affected customers have reduced capabilities on specific Aloha cloud-based and Counterpoint functionality that has impacted their ability to manage restaurant administrative functions.”

— Atlanta-based NCR Corp., one of the largest makers of payment systems, self-checkout technology and ATMs, said after it was hit by a ransomware attack, affecting some customer restaurants. An NCR data center was disabled by the attack, which was confirmed on April 13. Businesses most affected were using NCR’s Aloha cloud-based services and Counterpoint systems.

“Following the line fill process, the pipeline will be operated in accordance with the restart procedures that were reviewed and approved by the Pipeline and Hazardous Materials Safety Administration.”

— Houston-based Amplify Energy Corp. stated after receiving federal regulatory approval to restart an offshore pipeline involved in a 2021 oil spill that fouled Southern California beaches. Amplify said it settled with firms associated with two ships accused of dragging anchors and striking the pipeline during a January 2021 storm, leading 25,000-gallon crude oil spill. Fishermen, tourism companies and property owners sued Amplify and the shipping vessels seeking compensation for their losses. Amplify agreed to pay $50 million and the vessel companies agreed to pay $45 million to settle those lawsuits.

Insurers paid out more than $1 billion in dog-related injury claims in 2022, a 28% increase over 2021 even though the number of claims decreased last year, according to the Insurance Information Institute (Triple-I) and State Farm. There were 17,597 dog-related injury claims in the U.S. in 2022, down from 17,989 in 2021, according to a Triple-I

analysis of homeowners insurance claims data. Despite a 2.2% decline in the number of claims, the total cost of claims increased significantly — from $882 million in 2021 to $1.13 billion in 2022.

The average cost per claim was $64,555 in 2022, a 31.7% increase from $49,025 in 2021. Across the U.S., the average cost per claim rose 131.7% from 2013-2022 due to increased medical costs, as well as the size of settlements, judgments and jury awards given to plaintiffs, which are trending upward.

More than a third of the dog-related injury claims in 2022 were filed in five states: California (1,954 claims); Florida (1,331); Texas (1,017); New York (969) and Michigan (905). California also had the highest average cost per claim at $78,818, followed by Florida with an average cost of $78,203.

In 29 states, dog owners are

liable for injuries caused by pets, with some exceptions, such as if the dog was provoked, according to a Triple-I analysis of dog bite laws compiled by the American Property Casualty Insurers Association as of March 2021. There are no laws for dog bites in four states — Arkansas, Kansas, Mississippi and North Dakota.

Homeowners and renters insurance policies typically cover dog bite liability legal expenses up to limits typically between $100,000 and $300,000. Some insurance companies will not insure homeowners who own dogs categorized as dangerous. Others decide on a case-by-case basis, according to Triple-I. Pennsylvania and Michigan have laws that prohibit insurers from canceling or denying coverage to owners of particular dog breeds in some policies.

According to information compiled by Triple-I, about 69 million U.S. households own dogs. About 4.5 million people are bitten by dogs each year — most of them children.

Although the pandemic may appear more distant in the rearview mirror, its lasting impact on the personal auto insurance industry may be larger than initially expected.

Private passenger automobile insurance is the largest segment of the U.S. property/ casualty insurance industry, accounting for almost 70% of the personal lines segment and a third of U.S. P/C net premium written. It is a critical line of business for many insurance companies.

Historically, the personal automobile line’s underwriting results have been stable, nearing breakeven in most years. However, personal auto insurers reported stronger-than-usual performance in 2018-2019, and results remained favorable in 2020 as the pandemic

surged, unemployment spiked to the highest levels in years and miles driven plummeted. Because of the drastic drop in miles driven during the

early months of the pandemic, personal auto insurers returned approximately $14 billion in premiums to policyholders.

Unfortunately, it has been an

uphill road ever since.

Auto insurers recorded an underwriting loss of more than $4.1 billion in 2021, with a rapidly worsening loss ratio through the first six months of 2022. AM Best’s private passenger auto composite shows an additional $10 billion in underwriting losses through the first nine months of 2022. Although bottom-line results for 2022 have not yet been finalized, indications are that they won’t be pretty: AM Best has estimated a combined ratio of 110.1 for 2022 — a two-year deterioration of nearly 18 percentage points.

These results are dragging the entire P/C segment’s performance metrics down. Preliminary results for 2022 show a steep decline in underwriting results for the entire segment — a $26 billion loss, for which the personal auto

lines of business are primarily responsible. Early results of the leading private passenger auto insurers also indicate a dramatic downturn in 2022 on a direct basis (prior to the effects of reinsurance ceding).

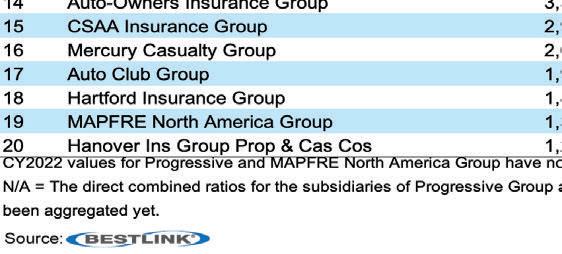

AM Best has aggregated 2022 direct premiums written (DPW) for 18 of the top 20 insurers of 2021 (Exhibit 1). DPW for those companies increased modestly, by 5.6%, but that increase was outpaced by a greater increase in losses. In 2021, only five of the top 20 auto writers produced direct combined ratios above the breakeven measure of 100.0. In contrast, 16 of the 18 companies for which 2022 combined ratios have been calculated thus far have ratios above 100.0.

One of the main factors accounting for the deterioration in the results of auto insurers is the rise in loss severity,

attributable to a higher rate of fatalities. One reported trend during the pandemic was vehicles traveling at higher speeds on mostly empty roads in 2020. After vehicles started returning to U.S. roadways, accidents occurring at these elevated speeds have on average been more serious, causing greater damage and driving up claim values for third-party liability and auto physical damage.

Recent National Highway Traffic Safety Administration (NHTSA) statistics show that 31,785 people died in traffic crashes in the first nine months of 2022, compared with 27,019 during the same period of 2018. In April last year, Cambridge Mobile Telematics reported that, although speeding levels are well below the highs of 2020, they are still elevated compared with pre-pandemic years.

In 2021, the number of fatalities jumped by 11% over

the previous year. Additionally, the average cost per private passenger auto claim rose by 14%, reaching almost $10,000 per claim. (Related research: “Numerous Pressures Create Tough Terrain for Personal Auto Insurers,” AM Best, Nov. 11, 2022.)

Distracted driving and poorer driving habits post-pandemic have played meaningful roles in the deteriorating auto results. NHTSA statistics show that roughly 14% of injuries in traffic accident crashes are due to distracted driving. This issue is proving difficult to rectify despite measures taken by the NHTSA and others to reverse recent negative trends.

Whether the distractions are from talking with passengers, talking or texting on cellphones, adjusting vehicle controls, eating, or other activities, they generally fall into one of three categories, as noted by the Insurance

Information Institute: Visual — drivers taking their eyes off the road; Manual — drivers taking their hands off steering wheels; Cognitive — drivers taking their minds off driving when behind the wheel.

Rising medical costs are also an issue that insurers are grappling with. Third-party auto claim costs have been on the rise over the past few years due to many factors, including social inflation, nuclear settlements and rising medical costs. These costs, coupled with escalating prices of motor vehicle parts and equipment — up by 15% year over year in the first half of 2022, according to the U.S. Bureau of Labor Statistics — have also contributed to the poor personal auto results.

FarmersInsuranceGrp.4321.71.51.81.81.7

AmericanFamilyInsuranceGrp.3761.61.31.62.93.0

USAAGrp.2830.91.01.52.01.1

AmicaMutualGrp.1674.65.26.45.17.4

NationwideGrp.1661.51.31.21.00.9

AutoClubEnterprisesInsuranceGrp.1142.02.02.22.32.4

TravelersGrp.1090.30.30.30.40.4

NMInsuranceGrp.950.50.91.22.34.9

HartfordInsuranceGrp.870.40.50.60.60.6

CSAAInsuranceGrp.510.50.20.31.31.2

MercuryGeneralGrp.441.01.01.00.91.1

ElephantInsuranceCompany3313.513.715.815.915.4

AutoClubGrp.310.70.70.71.01.1

LemonadeInsuranceCompany2985.713.313.39.87.9

AllianUSPCInsuranceCompanies290.30.30.10.20.5

Many insurers continue to raise rates in pursuit of improved premium adequacy to offset rising loss cost severity, but their efforts have not yet succeeded, especially as the rate approval process in many states for this highly regulated line is very restrictive. Most approved rate changes have been for less than companies’ actuarial indications, resulting in the need for additional rate filings. Furthermore, the backlog in rate approvals in 2022, particularly in California, didn’t start to clear up until later in the year.

With auto results declining in 2022, returning to a favorable — or even a breakeven — combined ratio will take time given the need for improvement in several areas, such as adverse loss severity and rate adequacy. AM Best forecasts a combined ratio of 106 for 2023.

If current inflationary pressures persist through the year, higher vehicle repair costs are continued on page 26

Worcester, Massachusetts.

TJ Woods was founded in 1949, and is a property/casualty agency, providing personal and business insurance.

Terms of the transaction were not disclosed.

World Insurance Associates is headquartered in Iselin, New Jersey.

Arch, Thimble

Arch Insurance has acquired Thimble, an insurtech platform that enables small businesses to get insurance coverage by the job, month or year using app, website, or over the phone.

Terms were not disclosed.

Arch said the acquisition expands its suite of digital solutions for small business customers and brokers. Since May 2018, Thimble has delivered more than 170,000 policies to small businesses across the U.S. Thimble works with a variety of carriers including Markel and Employers.

Thimble will continue growing the business with its existing carrier partners and offer new solutions through Arch.

Benefit Advisors Network (BAN), an international network of employee benefit brokers and consulting firms from across the U.S. and Canada, and the National Benefits Center (NBC), are spinning off from Alera Group, an independent, national insurance and wealth services firm, to become an independent organization.

Perry Braun, who previously held the role of BAN’s executive director, will lead the organization moving forward.

Most recently serving as managing director of business consulting at Alera Group, Braun is acquiring BAN from Alera Group. Braun assumes the position of president and chief executive officer of BAN. He will use his extensive expertise to oversee the transition of BAN to an

independently owned company.

Prior to joining Alera Group, Braun was part of the team that helped launch Alera Group in 2017. In his role as managing director of business consulting, he focused on key initiatives including working with managing partners to improve business performance contributing directly to stronger results, and partnering with the property/casualty team to build a new premium finance program for Alera Group’s P/C partners.

Global insurance broker Hub International Limited acquired the assets of Weiss-Schantz Agency in Pennsylvania. Located in Lehigh Valley and serving eastern Pennsylvania, Weiss Schantz is an independent insurance agency that serves commercial and municipal insurance clients.

Tim Schantz Sr., president, and Tim Schantz Jr., vice president, and the Weiss Schantz team will join Hub Three Rivers. Terms of the transaction were not disclosed.

Headquartered in Chicago, Hub International has more than 16,000 employees in offices located throughout North America.

Insurance broker World Insurance Associates acquired the business of Thomas J. Woods Insurance Agency Inc. of

National specialty insurance broker Risk Strategies has acquired May, Bonee & Clark Insurance, a Connecticut-based business and personal insurance, employee benefits and risk management firm. The firm also offers securities and investment advisory services.

Formed through the merger of May, Bonee & Co. and the Clark Agency, MB&C has served the greater Hartford area for more than 35 years. Today, the firm is based in Glastonbury, and led by its principals, Tom and Daniel Clark and Ryan Friedman.

Terms of the deal were not announced. Risk Strategies has more than 100 offices and more than 30 specialty practices serving commercial companies, nonprofits, public entities, and individuals, and has access major insurance markets.

Hub, Horizon Agency

Hub International has acquired the assets of Horizon Agency Inc. (Horizon Agency), located in Eden Prairie, Minnesota.

Terms of the transaction were not disclosed.

Horizon Agency provides commercial and personal insurance, and employee benefits. Horizon specializes in various industries, including real estate, entertainment and sports, and healthcare, which supports Hub’s specialty practices by complementing and strengthening Hub’s existing capabilities.

Dan Scattarella, founder and CEO; Jake Hoeschler, principal; Neal White, president, and the Horizon Agency team will join Hub Great Plains.

Horizon Agency was represented by

the consulting firm BH Burke & Co. for the transaction.

Arthur J. Gallagher, Boley-Featherston Insurance

Arthur J. Gallagher & Co. has acquired Wichita Falls, Texas-based BoleyFeatherston Insurance.

Terms of the transaction were not disclosed.

Boley-Featherston is a retail insurance agency with expertise in oil and gas, construction, health care and benefits consulting, serving clients throughout Texas and the surrounding region.

Josh Andrajack, Cameron Cremeens, Robbie Martin and their team will remain in their current location under the direction of Bret VanderVoort, head of Gallagher’s South Central retail P/C brokerage operations.

One General Agency (OGA) of Oklahoma City has acquired Jaeger + Haines Inc., a wholesale broker in Fayetteville, Arkansas.

Since 1976, Jaeger + Haines has served agents across Arkansas, Missouri, Oklahoma and Tennessee, writing excess and surplus lines commercial insurance.

Founded in 1951, Oklahoma-based OGA is a second-generation, family-owned wholesaler led by Jennifer Dotter, president, and CEO. The firm provides E&S markets, standard markets, and premium financing to independent agents in Oklahoma, Texas, New Mexico, Kansas, Missouri, and Arkansas. It offers a broad array of solutions across various specialty divisions, including cannabis, professional lines, standard lines, and energy and environmental. OAG said the acquisition will allow it to increase their footprint in Arkansas and Missouri and expand into Tennessee.

The terms of the transaction were not disclosed.

Inszone Insurance Services, a national provider of benefits, personal, and commercial lines insurance, has

acquired Champions Insurance Group, an agency with a decade-long track record in the Houston community and a strong reputation for delivering personalized insurance services. Champions has earned recognition for its understanding of Chinese culture and family values, primarily catering to commercial clients in protecting their businesses, employees, and personal interests.

This strategic acquisition enables Inszone to strengthen its presence in the Texas insurance market and expand its reach within the Chinese community. It also will provide Champions Insurance Group’s clients with access to a broader range of insurance products and services.

Tailrow Insurance Co.

Tailrow Insurance Co., part of HCI Group, has been approved by the Florida Office of Insurance Regulation as a domestic homeowners multiperil insurer.

HCI Group, which is the parent company of Homeowners Choice and TypTap Insurance, will hold all 2.5 million shares of common stock in Tailrow, valued at $1 per share.

The OIR consent order shows that the company will put up $300,000 to meet statutory deposit requirements. The office is requiring a catastrophe loss model with probable maximum loss estimate amounts for a one-in-100-year storm, based on exposure, the AM Best rating firm reported.

Tailrow would have to take corrective action to cure any overexposure identified by regulators. It also needs to file a disaster coordination and response plan with the office.

Alera Group, a nationwide wealth services and insurance firm, acquired Wilson, Washburn & Forster insurance agency in Miami.

Wilson Washburn, founded in 1961, offers commercial and personal lines products, including coverage for aviation, food and hospitality, manufacturers, marine

risks, medical facilities, social service organizations and more.

Alera noted that it has some $1.2 billion in annual revenue and offers employee benefits, P/C insurance, retirement plans and wealth services to clients around the country.

Specialty Program Group, a holding company established to acquire specialty insurance firms, has purchased the travel insurance service known as Squaremouth.

Headquartered in St. Petersburg, Florida, Squaremouth offers travel insurance through a digital quote and comparison platform and has insured more than three million travelers.

New Jersey-based SPG is part of Hub International, a global insurance broker.

DOXA Insurance Holdings, an Indiana firm, has acquired Georgia-based Preferred Aviation Underwriters, a managing general agent.

PAU, headquartered in Duluth, Georgia, was founded in 2005 by pilots and industry veterans Kim Stufflet and Tom Adderhold. The MGA offers property, auto, inland marine and excess coverage for airports and adjacent facilities.

Stufflet and Adderhold will continue to lead Preferred Aviation, along with partners Rob O’Neil and Chris Carter.

Hub International Ltd. acquired the assets of DeFranco Insurance Inc. in Seattle, Washington.

John DeFranco, president, and the DeFranco Insurance team will join Hub Northwest.

DeFranco Insurance is an independently owned and locally operated insurance agency specializing in personal and commercial insurance services.

Chicago, Illinois-based Hub is an insurance broker and financial services firm providing risk management, insurance, employee benefits, retirement and wealth management products and services.

National HUB International (HUB) appointed John Meek senior vice president and chief marketing officer and Matthew Sontag senior vice president and chief claims officer for HUB Private Client.

Meek has 30 years of property/casualty insurance leadership and experience and 18 years in the private client marketplace. Most recently, he worked at Chubb Personal Risk Services as senior vice president of distribution.

Sontag has nearly 20 years of experience in the private client industry, he most recently served as the vice president of property claims for PURE.

Verisk named Carrie Barr president of casualty solutions. Barr joined Jersey City, New Jersey-based Verisk as an account executive in 2010 and advanced to leadership positions within sales and operations.

Aaron Brunko has been named Verisk’s president of property estimating solutions. Brunko joined Verisk as a tech support agent in 2001 and served most recently as senior vice president of claims on the property estimating solutions team.

N2G Worldwide Insurance Services LLC named Kevin M. Strong chief executive officer. Strong has more than 20 years of industry experience across global insurer and broker organizations. Most recently, he served as head of multinational at The Hartford,

leading U.S.-produced and incoming global program teams and The Hartford’s global insurer network and Canada branch operations.

N2G is headquartered in Jersey City, New Jersey.

Swiss Re Corporate Solutions appointed Lisa Butera as head of financial and professional lines (FinPro) and casualty North America, effective July 17.

Butera will lead Swiss Re corporate solutions’ FinPro and casualty business in the U.S. and Canada. She will be based in New York, New York.

Butera brings over three decades of leadership experience in the insurance and reinsurance space. She most recently served as head P/C clients markets U.S. in Swiss Re’s reinsurance division.

Ascot appointed Mark Totolos to the newly created role of senior vice president, captive solutions, Ascot U.S. He will be a part of the portfolio solutions group.

Totolos joins Ascot with more than 15 years of experience in the specialty insurance industry, most recently working at Skyward Specialty Insurance Co., where he served as senior vice president, head of captives and programs.

Gaurav Kapoor joined the NFP North America Construction and Infrastructure Group as senior vice president, head of strategy, digital and operations.

Before joining NFP, Kapoor

held multiple positions with Marsh, including, most recently, strategy and operations leader for the global construction practice based in London, England.

NFP is headquartered in New York, New York.

John F. Shannon has been named senior investment officer of Starr Insurance Companies

Shannon previously served as senior vice president and chief investment officer at Alleghany, which Berkshire Hathaway acquired in October 2022. Before Alleghany, he held positions at MetLife and Prudential Financial.

Shannon is based in Starr’s New York, New York, headquarters.

The Workers Compensation Research Institute (WCRI) named Executive Vice President Ramona Tanabe as CEO. She succeeds John Ruser, who will stay on temporarily as an advisor to the CEO.

Tanabe has held several key leadership positions at WCRI, including leading the institute’s line of core benchmarking studies, designing and conducting studies on workplace health policy, and managing WCRI’s data collection and technology investments.

WTW appointed Jackie Bolig as head of property/casualty, corporate risk and broking (CRB), North America.

With more than 30 years of experience in insurance and risk management, Bolig joins WTW from Aon.

Heather Fox has been named chief underwriting officer at Zurich North America.

Fox is based in Zurich’s New York office and will become a member of the Zurich North America Executive Committee.

She comes to Zurich from ARC Excess & Surplus where she started in 2009 and most recently served as general counsel and chief brokerage officer.

Chubb Limited appointed Frances O’Brien executive vice president, Chubb Group, and chief risk officer.

O’Brien was senior vice president, Chubb Group, and deputy chief risk officer, a position she held since January 2022. O’Brien has more than 40 years of insurance industry experience.

Sean Ringsted, formerly Chubb’s CRO, will continue to serve as EVP, Chubb Group, and chief digital business officer. He will remain a core member of the Risk Underwriting Committee. Ringsted has more than 30 years of experience in the insurance industry.

The Hartford named Mark Azzolino head of a new unit, Global Specialty Digital Solutions, which will focus on offering specialty and wholesale insurance products in a fully digitized, end-to-end manner.

Azzolino previously served as The Hartford’s head of management liability in

Global Specialty’s Financial Lines segment, where he was responsible for The Hartford’s private and not-for-profit management liability businesses. In addition, he oversaw the sales and process execution for the management and professional liability lines of business.

East Security Mutual, headquartered in Binghamton, New York, hired Emmett Cavanaugh as a commercial lines underwriter.

Cavanaugh brings more than three years of experience to his new role. He previously worked with Utica First Insurance Co. as a multi-line claim adjuster.

Midwest

Ryan Specialty Holdings Inc. promoted Brenda (Ballard) Austenfeld and Chris Houska to CEO and president of their respective RT Specialty practices, the wholesale brokerage specialty within Ryan Specialty.

Austenfeld, CEO and president of RT Specialty’s National Property Practice, has been with RT Specialty since 2013, joining with the acquisition of Westrope, where she was a partner with the firm.

Houska, CEO and president of RT Specialty’s national casualty practice, joined RT Specialty as part of the original founding group in 2010 and has more than 30 years of casualty insurance experience.

Ryan Specialty is headquartered in Chicago, Illinois.

AmTrust Financial Services Inc. hired Michael Tripp as

regional vice president, head of MidAmerica region. Tripp joins AmTrust from Chubb, where he spent the last four years as national vice president, small business sales.

Before Chubb, Tripp was with The Hanover, where he was branch vice president of Arkansas and Oklahoma, and later, regional vice president of Missouri, Kansas and Arkansas.

Valley Insurance Agency Alliance (VIAA), a family of more than 160 independent insurance agencies in Missouri and Illinois, promoted Kaylee Rucker to communication coordinator.

Rucker previously served as an administrative assistant for VIAA’s sister company Powers Insurance & Risk Management.

VIAA is headquartered in St. Louis, Missouri.

South Central

Skyward Specialty Insurance Group Inc. promoted two in its captives and programs divisions.

Ryan Burke has been promoted to vice president, specialty programs. Burke joined Houston, Texas-based Skyward Specialty in 2021 as an underwriting manager. Before joining the company, he held underwriting and leadership positions at Swiss Re, Travelers and RT Specialty.

The company promoted Amy Klatt to senior vice president, captives and programs claims. Klatt joined Skyward Specialty in 2019. She has more than two decades of experience, having held roles at Berkshire Hathaway, Travelers and Gallagher Bassett.

Lockton Companies named Jeff Henningsen chief

executive officer (CEO) for the Texas P/C business, with teams in Dallas, Houston and Ft. Worth, Texas; New Orleans, Louisiana; and Birmingham, Alabama.

Henningsen is based in Houston.

Henningsen has 27 years of industry experience, including 21 years with Lockton. He most recently served as president of Lockton’s Texas property/ casualty business.

Lockton is headquartered in Kansas City, Missouri.

Gunnar Kephart has joined Texas Insurance Professional Services as an agent.

He previously served as a professional liability specialist at the Independent Insurance Agents of Texas Association. Kephart also has been an agency owner and a commercial lines producer in several private and publicly held agencies, primarily in the North Texas area and in San Antonio, Texas.

Texas Insurance

Professional Services is headquartered in Dallas, Texas.

Southeast

Travelers named Marsh Duncan president of Northfield Excess & Surplus, a specialty division.

Duncan will oversee Northfield’s current business while identifying new areas for growth. He is based in Atlanta, Georgia.

Duncan previously worked

at Argo, most recently as president of excess and surplus.

Buckner appointed two new C-suite executives.

Agnesa Bakhshyan is the firm’s new chief growth officer. Lianna Kinard is Buckner’s new chief marketing officer.

Bakhshyan has more than 25 years of insurance industry experience, including as a Nationwide Insurance agency owner.

Kinard has more than a decade in the insurance industry, including a role as Utah Business Insurance Co.’s vice president of marketing.

Buckner is headquartered in Salt Lake City, Utah.

Embroker named Chris Spagnuolo as chief product officer.

Spagnuolo has nearly 20 years of product management experience, most recently as CPO at Wander.

Spagnuolo also founded two startups and spent seven years as a product consultant to organizations such as Blue Cross Blue Shield, Deloitte, Ford Motor Company, Home Depot, Jackson Hewitt, PwC, Riot Games and Under Armour.

Embroker is based in San Francisco, California

In a “deliberate and modest fashion,” the composite rate for commercial property/casualty lines increased 5% during the first quarter 2023, according to MarketScout.

The Dallas-based distribution and underwriting company’s Market Barometer showed cyber lead the way with a rate increase of 15.7% during the first three months of the year. Commercial property was up 9.3%, and commercial auto was plus 7.3%.

MarketScout said the only notable change from the fourth quarter 2022 was in general liability — up 4.3% in Q1 compared with up 6.7% last quarter. EPLI also saw a decrease in rate hikes — to plus 3.7% from 6.3% in Q4 2022.

“It’s not surprising to see rates holding steady in the first quarter,” said Richard Kerr, CEO of Novatae Risk Group. Last November, MarketScout was acquired by managing general agent Novatae Risk Group. Kerr was named CEO. “We will get a better measure of overall composite rates for 2023 in the next two quarters.”

Looking at composite rate increases by industry, transportation was highest with an increase of 8%.

The composite rate for personal lines decreased slightly to plus 5% in Q1, said MarketScout. Increases for homeowners and personal articles insurance moderated but auto insurance rates were up 6.3% compared to 5% in Q4 2022, on a composite basis.

“The real action in personal lines comes during wind and wildfire season,” Kerr said.

“However, even now, catastrophe exposed high value property owners are struggling to find coverage without experiencing significant rate increases and restriction of terms such as higher deductibles and reduced coverage,” he said.

By Chad Hemenway

By Chad Hemenway

W.R. Berkley Corp. President and CEO Robert Berkley said the insurer is not going to follow the directors and officers market “down the drain.”

During a call with analysts to discuss first quarter earnings, Berkley said the D&O marketplace, especially for large accounts, has been “in a state of free fall as far as rate adequacy or pricing.”

Berkely said there have been a lot of new entrants into the D&O market because “there’s not a lot of barriers to entry to getting into that space.”

However, the additional supply is not being met by demand. “We have seen a dramatic reduction in IPOs,” Berkley said. “We’ve just seen a dramatic reduction in a lot of the activity that would drive D&O purchasing.”

This, according to Berkley, includes transactional liability. M&A activity “has

fallen off a cliff,” he said.

“The reality is that the demand has been reduced and the supply has increased, and that has led to an unattractive, competitive environment from our perspective,” Berkley said.

First quarter net income at W.R. Berkley was about $294.1 million compared to $590.6 million a year ago during the same period. The company’s Q1 consolidated combined ratio was 90.6 from 87.8 a year ago. Results included Q1 catastrophe losses of about $48 million and prior year reserve development of about $24 million. Underwriting income was $234 million during the first three months of 2023.

Berkley said the average rate increase, excluding workers’ compensation, was about 8.3% in Q1 but the insurer remains somewhat cautious, considering an

observation the CEO made several times during the call — that product lines are distinct from one another in terms of where each is in the rate cycle.

“We are focused on underwriting margin,” he said. “We are sensitive to social inflation. We see the claims the industry is facing every day … the trajectory is quite steep. And we don’t want to get caught flat-footed.” The company is “not going to expose the capital unless we believe the rate is adequate,” Berkley added.

Property insurance rates are in the “early stages of meaningful firming,” Berkley said. He called the momentum for rate in January “disappointing” but said April included “meaningful traction as far as rate goes.”

“I think you’re going to see us writing some more property,” Berkley told analysts.

Cybercrime is up, properties are underinsured, and the management liability market is softening.

These are a few of the predictions and results revealed in the Risk Strategies 2023 State of the Market report, which examines the trends of 2022 and provides a risk forecast for the coming year. The report digs into various markets and assesses the hurdles those lines may face in 2023.

Ransomware attacks, cyber threats and their costly tolls have increased dramatically in the last few years. Not only is recovery expensive but compromised organizations are left open to lawsuits potentially involving thousands of

exposed parties.

One factor behind the spike is the gaps left in cybersecurity when everyday business shifted to a work-from-home model during the COVID-19 pandemic. The landscape quickly changed as organizations sent workers home with little warning and adjusted timelines for return as the pandemic continued. IT departments were left playing catch up.

More threats and higher costs are forcing

companies to examine their cyber security and increase the insurance they carry to cover damages resulting from a breach. And insurers want to know that prevention measures are in place and that a company stays up-to-date.

The outlook for 2023 is for greater stability than in the previous few years. Insurers have learned more about threats and how to price policies to maintain profitability. Organizations are taking steps to mitigate cyber and ransomware attacks to protect their people and get the cyber coverage they need in case of an attack. Rate increases have leveled — averaging 20% in Q4 2022.

Industry recommendations include early renewals, ongoing dialogues about the risk environment and events, and making

continued on page 22

continued from page 21

sure insureds are maintaining up-to-date security measures across the board, at every level and with every machine tied to the organization. Firms should have an ongoing cyber security maintenance program and update as new threats are detected.

Weather and climate-related events such as wildfires and hurricanes caused losses exceeding $150 billion.

Insureds across the board have seen significant reductions in coverage capacity, as well as higher deductibles, rates and premiums. The market continues to refine its underwriting position on secondary perils such as tornadoes, floods, wildfires, hailstorms and freezes.

As the market continues to face uncertain economic conditions, areas of ongoing volatility, according to Risk Strategies, include:

• Inflation and rising interest rates led to uncertainty about future prices.

• Per NOAA, there were 18 U.S. weather/climate disaster events in 2022, with losses exceeding $1 billion each.

• Ransomware and cyberattacks continue to grow. Approximately 80% of attacks result from human error.

• Higher claims costs from escalating verdicts and rapidly evolving environmental, social and governmental (ESG) conditions affect individuals and businesses.

• Employers are spending more on compensation and benefits to counter continued challenges in attracting and retaining talent.

• War, in addition to being a humanitarian crisis, is affecting supply chains and consumers worldwide, and adding uncertainty about future policies and regulations.

Despite the volatility and uncertainty, the unemployment rate is at a 53-year

A recent building appraisal analysis showed that nearly 90% of buildings appraised in 2020 and 2021 were undervalued. It showed 68% of buildings were underinsured by 25% or more and 19% were underinsured by 100%. Underwriters continue to focus on the adequacy of replacement cost values amidst inflation, higher labor and material costs, and supply chain issues. Underwriters may look for building and contents value increases as high as 10%-20%, which translates to higher insurance premiums.

The rate disparity between good risks without catastrophe exposures and losses and poor risks with them will continue in 2023. Good quality risks without CAT exposures and losses will see rate increases, on average, of 10%, while poor risks with CAT and loss experience will see

increases of 50% or more.

Many clients with January 1 renewals may have missed the full impact of treaty changes. Some new capacity entered the market, capitalizing on better pricing and terms but not enough to slow the market down. At press time, the April 1 critical treaty renewal period proved to be more challenging than January 1 as reinsurers had a clearer picture of 2022 results and what they need to be profitable in 2023.

The accelerated downturn in the directors and officers (D&O) and management liability space has continued into 2023.

low, inflation is beginning to ease, supply chain issues are being resolved and generally, there is a return to more “normal” business conditions.

Specific to insurance:

• There are signs of optimism as rates moderate in casualty, management liability and cyber. Businesses with a good risk profile will have a competitive advantage.

• Conversely, property rates, particularly in Florida and California, are increasing while capacity and coverages are limited. Other catastrophe-exposed areas are not immune.

Insurance carriers remain disciplined and are looking to manage capacity, control terms and conditions, and adequately price risks. When considering where to utilize precious capital, carriers seek additional underwriting and detail and closely scrutinize risk control measures and the client’s focus and commitment to risk management.

Source: Risk Strategies 2023 State of the Market Report. To view the full report, visit https://www.risk-strategies.com/2023state-of-the-market.

The market is transitioning from hard to moderate/soft. Still, it is facing headwinds from a challenging economic environment, the financial impact of COVID-19, continued high inflation, and an industry that has seen a significant uptick in loss costs impacting carrier profitability. The degree of transition varies by line of business and industry segment.

The new capacity of the past three years has led to much more favorable pricing and expanded policy terms. Less net new business in the market coupled with the new capacity should benefit buyers with attractive risk profiles and little-to-no significant claims activity. Buyers will benefit in terms of reduced premiums, lower SIRs, stable or increased limits of capacity, and expanded coverage terms. However, the challenging macroeconomic environment puts increased financial pressure on clients, potentially tempering the improved pricing environment stemming from the influx of new capacity.

The final impact of pandemic-era securities class action claims is uncertain. The total amount of securities class action settlements was $7.4 billion in 2022, a 75% increase from 2021. Insurance carriers funded a portion of those settlements, and the ultimate impact on balance sheets for this business line remains to be seen.

Increasing environmental, social risks and governance (ESG)-related requirements demand companies address relevant challenges. Failing to address ESG could lead to derivative claims, shareholder claims, and accusations of breach of

fiduciary duties by D&O. Diversity, equity and inclusion (DE&I) issues continue to impact D&O. Equal pay and compensation-related claims are on the rise.

The 2022 casualty market saw a return to a more competitive and nuanced market than in the previous three years. While companies with exceptional loss control in low-to-moderate hazard classes of business achieved good results in 2022, several industries, such as transportation, education, nonprofits and retailers, continue to face headwinds.

In 2023, the casualty market is generally expected to experience rising premiums but at much lower levels than recent results. Concerns with the reinsurance market eased somewhat based on casualty treaty renewals as of January 1, suggesting at least three to six months of stability for many primary insurers.

Emerging and adverse casualty claims are expected to rise in areas such as

“forever chemicals” and other hazardous exposures, and sexual abuse exposures. Workers’ compensation risks are expected to increase. However, while loss ratios are rising again, significant premium increases are not likely. Third-party litigation funding will continue impacting verdicts, which could exceed the inflation rate.

As 2023 progresses, a crucial concern will be the ongoing availability of reinsurance at a reasonable price for casualty insurers, given the pressure now placed on the property reinsurance market.

Broader adoption of captive solutions with a more sophisticated mid-market clientele made 2022 a banner year in the captive insurance industry, and the high demand will likely continue through 2023.

Healthcare costs, nuclear verdicts, cyberattacks, catastrophic climate events and market-specific drivers led to steep commercial insurance premiums, prohibitive exclusions and even a complete lack of

insurability as reinsurance dries up.

A continuing hard market in some lines has made it more challenging to control total cost of risk, making it difficult to lower the insurance premium component of that cost. By retaining more risk in a captive, insureds can choose when to transfer risk to third parties.

The demand for long-term solutions has led to the structuring of different captive programs such as enterprise risk captives, single parent captives, group captives, risk retention groups, sponsored cells, and financial guarantee arrangements. Businesses with a larger employee base who self-fund their group medical benefits are increasingly writing a layer of stop loss insurance in their own captive to retain a level of underwriting profit.

As businesses discover how captives can provide risk financing solutions, the use of captives that can offer a revenue stream complementary to the core business will grow, according to the Risk Strategies' report findings.

With our deep product and industry expertise, we deliver global solutions to address the unique risks you face. Our experts have a comprehensive understanding of your technology business. Let us tailor a solution for your specialized insurance needs.

To learn more, talk to your broker or visit intactspecialty.com

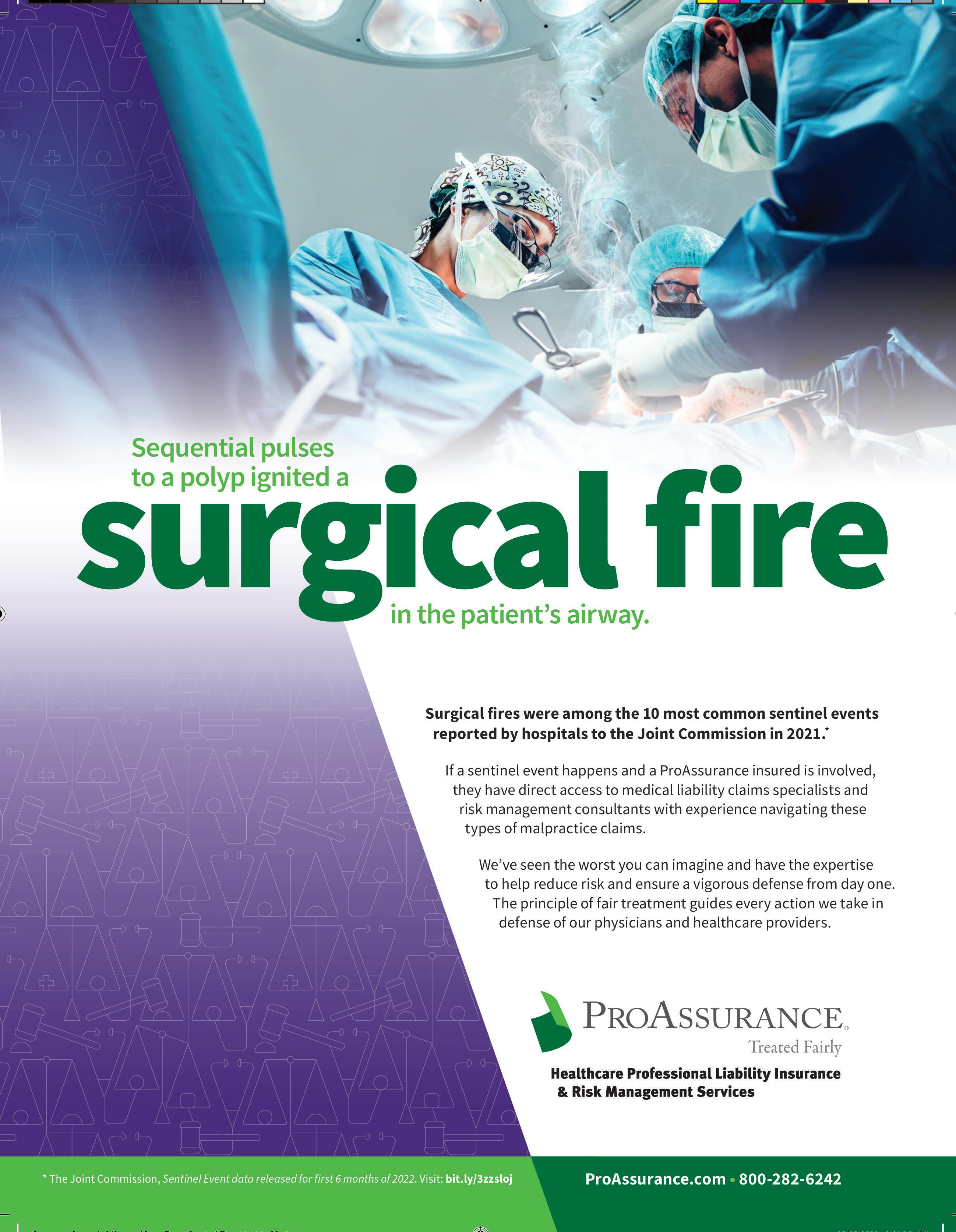

Not a day goes by that a new way to use artificial intelligence (AI) fails to make the daily headlines. AI-powered tools seem to be making their mark on every business sector, including the healthcare industry.

AI opportunities in healthcare — such as helping to identify patient needs, documenting patient notes, and even diagnosing certain disease — seem endless. While AI brings exciting opportunities, it also has risks.

Digital tools in healthcare have skyrocketed since the start of the pandemic.

The number of telehealth services increased dramatically — 15 times the pre-pandemic level, from 2.1 million the year prior to 32.5 million in the 12 months from March 2020 to February 2021, according to data from the Government Accountability Office (GAO).

Healthcare executives are increasingly prioritizing digital automation technologies, according to a recent report from Sage Growth Partners showing that 90% of healthcare executives had an AI or automation strategy in place today. That percentage was up from 53% in 2019. The same study showed that 76% of respondents said automation has become more important because it can help patients recuperate faster by cutting wasteful spending and improving efficiency.

“Everyone is talking about AI but in healthcare specifically we’re seeing these tools being integrated like in a variety of different sectors,” Ellie

Saunders, healthcare team leader, U.S. and Canada at CFC, told Insurance Journal.

The biggest sector of CFC’s digital healthcare portfolio is telemedicine — largely due to its reliance on well-established and widely accessible technology. However, AI has seen 32% growth in 2021, Saunders said.

Artificial intelligence is now being used to help in triaging some patient conditions, most commonly by diagnosing basic illnesses via a chatbot function. Another way AI is helping doctors is with medical scribing, which is an AI-powered tool that provides doctors with automated transcribing of patients’ comments while the doctor is consulting with that patient. This digital tool “essentially helps to streamline their workflows and efficiency, enabling them to focus on the actual practice of medicine rather than spending most of the time documenting and writing up notes,” she said.

One concern that underwriters worry about is that the medical scribe gets things wrong, Saunders said. She said some research shows that AI scribing doesn’t always correctly transcribe “uh-mmm” terms instead of “yes” responses.

“Obviously that can mean a lot in a conversation, but if the scribe doesn’t pick that up, it can completely alter their medical record,” she added. “So, doctors are still having to read through the scribe notes just to ensure it is in line with what they’ve actually encountered.”

But medical records are a logical place to begin because clinicians can quickly identify where AI-produced results were derived, according to Dr.

Greg Ator, chief medical informatics officer at University of Kansas Health System, who is part of the team implementing generative AI technology at the academic health system to aid clinician note taking. Doctors can listen to a visit recording again if the AI misses valuable information.

Right now, it’s not the most

efficient way to take medical notes but Saunders says the hope is to make these AI-tools better in the future.

But there are barriers to improving some AI-powered technologies going forward.

Pete Reilly, practice leader and chief sales officer of global insurance brokerage Hub International’s North Americanhealthcare practice, says while the healthcare industry will become more dependent on AI in the future simply because the technology can “handle all those data points so much more quickly and efficiently than the human brain,” the challenge will be with the data itself. It’s the old analogy of “garbage in, garbage out,” he said. If there’s any malfunction along the line, for example a wrong computer code or inaccurate data, then everything else goes wrong with it, he said.

Even so, Reilly sees great opportunity for the sector’s use of AI-powered tools in the future. “Healthcare is an inefficient system by design. The human body is inefficient, and in many respects, they’re not the same,” he said. “But having said all that, I do see a continued use and need of use in healthcare,” he added. “AI will let us capture and begin to understand massive quantities of data more quickly, and that hopefully leads to long term better medicine.”

One hurdle to expanding AI use is patient acceptance. A Pew Research Center survey conducted in December found 60% of adult U.S. patients would feel uncomfortable if their healthcare provider relied

on AI for their medical care. Less than a third felt the quality of their care would increase as AI was implemented.

Another hurdle lies in capturing accurate data from all patients. Some research shows that current medical data may be lacking in terms of diversity among various ethnic groups.

women than their white peers. The Duke researchers concluded that Black Americans — who have a much higher probability of suffering from a stroke — are also less likely to get an accurate prediction of their stroke risk.

“The data that you get out

off real data and that they’ve got enough of good data, for it to not be biased data,” she said.

While doctors have used several different algorithms to try to capture the true risk of stroke for years, including newer models that use machine learning, a new analysis, led by researchers at Duke University School of Medicine, found that with all models studied — ranging from simpler algorithms based on self-reported risk factors to novel machine learning models — the accuracy of predicting a stroke was worse for Black men and

of something is really only as good as the data you put in and that’s probably one of our biggest concerns as insurers in the space,” Saunders said. “We as underwriters want to make sure that this data set that is providing diagnostics is based

“Certainly, hospitals think that AI can be helpful in delivery of care,” said J. Kevin Carnell, executive chairman of CAC Specialty’s newly launched healthcare division. “It’s obviously a very powerful tool that can run all sorts of scenario projections to help you diagnose a patient or uncover a potential issue on a patient, so that’s great. But as we’ve seen, AI can be wrong,” he said. “It’s ultimately the care provider who has the liability risk, so I don’t think fundamentally that changes. I really don’t know how it’s going to be used or how risky it’s going to be, but people are starting to talk about it.”

Overall, CFC’s Saunders believes the healthcare industry is going in the right direction to correct concerns over AI data and its use. “There are controls that are being implemented and it’s definitely an area which is going to revolutionize the healthcare industry,” she said.

‘Everyone is talking about AI but in healthcare specifically we’re seeing these tools being integrated like in a variety of different sectors.’

continued from page 15

unlikely to improve materially. Ongoing supply chain challenges and recessionary fears will also remain headwinds for auto insurers if they are to realize an improvement in performance.

The U.S. nonstandard auto insurance industry, a subsector of personal auto, has also been beset by losses, based on AM Best’s aggregation of results for the predominant nonstandard auto-focused insurers. Through the first three quarters of 2022, the segment incurred an underwriting loss of almost $1.2 billion due to many of the same market issues the standard personal auto writers are contending with. This substantial underwriting loss follows $1.3 billion in underwriting losses in 2021.

The personal auto segment is well known for its advertising, especially by the top writers (Exhibit 2). The importance of branding in gaining and preserving market share is highlighted by nine of the top 10 insurers also ranking among the top 10 in annual advertising expenses. However, premium volume does not guarantee profitable results, as 12 of the top 20 companies ranked by 2021 private passenger auto net premiums written posted combined ratios of over 100 in 2022 (Exhibit 3). The considerably negative impact of inflationary pressures on personal lines loss trends led to insurers cutting the financial resources allocated to advertising in 2022 to help their underwriting expense load. Again, the regulatory environment, particularly in states such as California and New York, makes raising rate

increases to address price adequacy and lessen the pressure on profitability more difficult.

At the same time, personal auto carriers remain ahead of the curve in terms of pricing sophistication and have likely built on their competitive advantages. The personal auto line has led the charge in the insurance industry in digitization. For many years, the industry has made a push to leverage technology, including claims, underwriting and distribution. Most companies also have updated their legacy systems. These innovative efforts have led to greater efficiencies and enhanced customer experience.

The growing use of telematics and usage-based insurance may help address loss frequency, as insurers can measure driving behavior or implement additional product

innovations such as per-mile insurance. However, this is unlikely to have a meaningful impact over the near term.

Newer vehicles with enhanced safety features account for a growing percentage of vehicles on the road, which may also impact frequency favorably, although their repair costs are higher. With access to needed parts and — just as important — qualified labor limited, the cycle time for repairs has lengthened considerably, resulting in additional loss cost pressures.

Given the persistence of high loss costs, a return to underwriting profitability for the auto segment in 2023 appears highly unlikely. Inflationary trends eventually will plateau, but how long this environment will continue remains highly uncertain. More sophisticated pricing algorithms, along with good risk selection and disciplined underwriting, should help car-

riers chip away at unfavorable results. Some companies may need to reconsider their risk appetites.

Overall, personal auto insurers remain well capitalized and vigilant in their pursuit of rate adequacy and have benefited from the implementation of advanced technology, which has resulted in greater efficiency. As the use of technology increases across the broader financial services industry, companies will continue to look for ways to meet higher customer expectations. Companies unable to meet rising customer expectations will be at a competitive disadvantage. Fostering innovation in all operational phases will continue to benefit personal auto writers as they focus on achieving adequate rate levels.

Blades is associate director, Industry Research and Analytics for AM Best.

As a child, Lawrance W. McFarland lived on a small piece of land on a Native American reservation in Palm Springs he described as a “little world of its own,” surrounded by the parts of the city that were tourist magnets and depicted in movies.

The retiree recently recalled seeing houses of the diverse, tight-knit community being torn and burned down in the square-mile area known as Section 14.

“We thought they were just cleaning up some of the old houses,” he said.

But eventually his family was told to vacate their home, and McFarland, his mother and his younger brother hopped around from house to house before leaving the area altogether and moving to Cabazon, a small town about 15 miles west of Palm Springs.

Decades later, Palm Springs’ city council is reckoning with those actions, voting in 2021 to issue a formal apology to former residents for the city’s role in displacing them from the neighborhood that many Black and Mexican American families called home.

Those former residents now say the city owes them more than $2.3 billion for the harm caused. The dollar amount was disclosed at a meeting attended by experts such as Cheryl Grills, a member of the state’s reparations task force studying redress proposals for African Americans.

The effort in Palm Springs is part of a growing push by Black families to seek compensation and other forms of restitution from local and state governments for harms they’ve suffered due to generations of discriminatory policies.

California’s statewide reparations task force is evaluating how the state can atone for policies like eminent domain that allowed governments to seize property from Black homeowners and redlining that restricted what neighborhoods Black families could live in. Last year, Los Angeles County officials voted to the return land in Manhattan Beach to a Black family descended from property owners who had

it seized by the city in the 1920s.

Palm Springs officials expect to work with a reparations consultant to decide whether and how to compensate the families displaced from the area. The council may take this up for a vote later this month. The city is home to about 45,000 people today and is largely known as a desert resort community.

The families are also exploring legal avenues for reparations. Areva Martin, a Los Angeles lawyer representing them, filed a tort claim with the city alleging officials hired contractors to bulldoze homes and sent the fire department to burn them.

Julianne Malveaux, an economist and dean of the College of Ethnic Studies at California State University, Los Angeles, said the $2.3 billion figure accounts for the displacement of 2,000 families and the trauma caused to them.

Lisa Middleton, a city council member and former Palm Springs mayor, said it was important to acknowledge the city’s role in displacing Section 14 residents.

“Our history includes some wonderful moments for which we have every right to be proud,” she said at a meeting. “But it also includes some moments for which we have every reason to be remorseful, to learn from those mistakes and to make sure that we do not pass those mistakes onto another generation.”

The tort claim argues the tragedy was akin to the violence that decimated a vibrant community known as Black Wall

Street more than a century ago in Tulsa, Oklahoma, leaving as many as 300 people dead. There were no reported deaths in connection with the displacement of families from Section 14.

Palmdale resident Pearl Devers lived in Section 14 with her family until she was 12 years old. She helped spearhead efforts in recent years to create a group to reflect on their time living there and determine next steps.

Her father, a carpenter, helped build their home and many others in Section 14, she said. She recalled how close residents in the neighborhood were, saying her neighbors acted as a “second set of parents” for her and her brother. She recalled smelling and seeing burning homes until one day her mother said their family had to pack their bags and leave.

“We just felt like we were running from being burned out,” she said.

Alvin Taylor, Devers’ brother, said it’s essential for city officials to listen to displaced residents and descendants before deciding on a course of action.

“An apology is not enough,” Taylor said.

Austin is a corps member for the Associated Press/Report for America Statehouse News Initiative. Report for America is a nonprofit national service program that places journalists in local newsrooms to report on undercovered issues.

Copyright 2023 Associated Press. All rights reserved.

The California Division of Occupational Safety and Health cited Meeder Equipment Co. of Rancho Cucamonga and referred D&D Construction

Specialties Inc. of Sun Valley for criminal prosecution in two separate cases of workers’ deaths related to confined spaces.

Meeder and its successors were cited a

combined $272,250 for serious safety violations following a confined space death of a worker who suffocated in a 10,000-gallon propane gas tank.

In a separate case, D&D faced criminal prosecution for the 2016 death of a worker who lost consciousness and fell 15 feet while cleaning a 50-foot-deep drainage sump. Cal/OSHA’s Enforcement branch also issued citations to D&D, including a serious accident-related citation for failure to conduct a hazard inspection before this work was performed.

In 2022, a mechanic employed by Meeder reportedly entered a tank to spray a valve inside and was later found unresponsive inside the confined space. The Rancho Cucamonga Fire Department rescued the employee and transported him to a nearby hospital where he died.

In a separate and unrelated investigation, Cal/OSHA’s Bureau of Investigations referred for criminal prosecution to the Los Angeles County District Attorney’s office a worker’s 2016 confined-space death.

The victim in the D&D case was employed by a contractor as a laborer and was assigned to clean the bottom of a 50-foot-deep drainage sump.

The victim reportedly stood on a metal bucket attached to a small crane that lowered him into the shaft opening. After 15 to 20 feet, he became unresponsive and fell head-first to the bottom of the shaft. The victim drowned.

The Los Angeles County District Attorney’s office in 2019 filed a felony criminal complaint against D&D.

Market Detail: ProAlly provides monoline health professional liability insurance. Coverage is offered on a claims made and defense within the limits basis, either with or without incident reporting. Includes coverage for current and former employees, volunteers, directors, and officers; vicarious liability coverage, including coverage for acts of independent contractors; defense coverage for abuse and molestation coverage for employee/client/third party; no binding arbitration requirement; dedicated underwriting expertise; next generation claim handling. Has pen; appointment required.

Available Limits: $1 million/$3 million limits standard; retentions as low as $0.

Carrier: Non-admitted; rated A- by AM Best.

States: Available in 50 states plus District of Columbia.

Contact: Mark Fintel; contact@pro-ally. com; 623-473-6277.

Market Detail: Hull & Company / Bridge

Specialty has multiple markets offering: wrap-up policies; project specific policies; owner’s interest policies; discontinued operations; take over wraps/ projects; practice policies — residential artisan contractors*; residential general contractors/home builders.* (*Some limitations may apply to new residential construction or work in CD states.) Primary and supported excess limits are available; will consider liability limits up to $5 million total; minimum retention of $10,000, depending on product line and account characteristics; blanket additional insureds available, depending on product line and account characteristics; waiver of subrogation; primary and non-contributory wording. Appointment required.

Available Limits: Liability limits of up to $5 million total; minimum retention of $10,000, depending on product line and account characteristics.

Carrier: Various; non-admitted; rated A by AM Best.

States: Available in Arizona, California, Colorado, Florida, Hawaii, Idaho, Nevada, Oregon, Wyoming.

Contact: Jeff Case; jeffrey.case@hullstk. com; 866-434-2210.

Market Detail: Community Association

Insurance Solutions LLC offers a community association high-limit umbrella insurance product dedicated to community associations and their specialized coverage needs. The product is available for nonprofit habitational community associations including homeowners’ associations (HOAs), townhomes, residential/commercial condominiums (condos), and residential/ commercial planned unit developments (PUDs). The umbrella policy provides additional liability coverage over the GL, EL, and D&O insurance when the association suffers a catastrophic loss that exceeds those policy limits. Appointment required.

Available Limits: Five limits — $5 million, $10 million, $15 million, $25 million, and $50 million.* (*$50 million limit includes a primary layer of A+ rated $25 million excess liability (including EPLI), and a secondary layer of A++ rated $25 million excess liability, excluding EPLI.)

Carrier: Not disclosed.

States: Available in 50 states plus District of Columbia.

Contact: Gary Deck; gary@caislive.com; 916-212-8310.

Market Detail: Draftrs Inc. offers design professionals E&O insurance covering architects, engineers, interior designers, land surveyors and many other specialties within this professional sector. The product is underwritten by an A-rated carrier and is admitted. Small firms up to $1 million in revenue are covered. Offers full commissions and works with both generalist and specialist agencies. Instant online quotes, billing, endorsements and automatic renewals available. Fast appointments; has pen.

Available Limits: Small firms up to $1 million in revenue are covered.