4 minute read

That sinking feeling

That sinking feeling

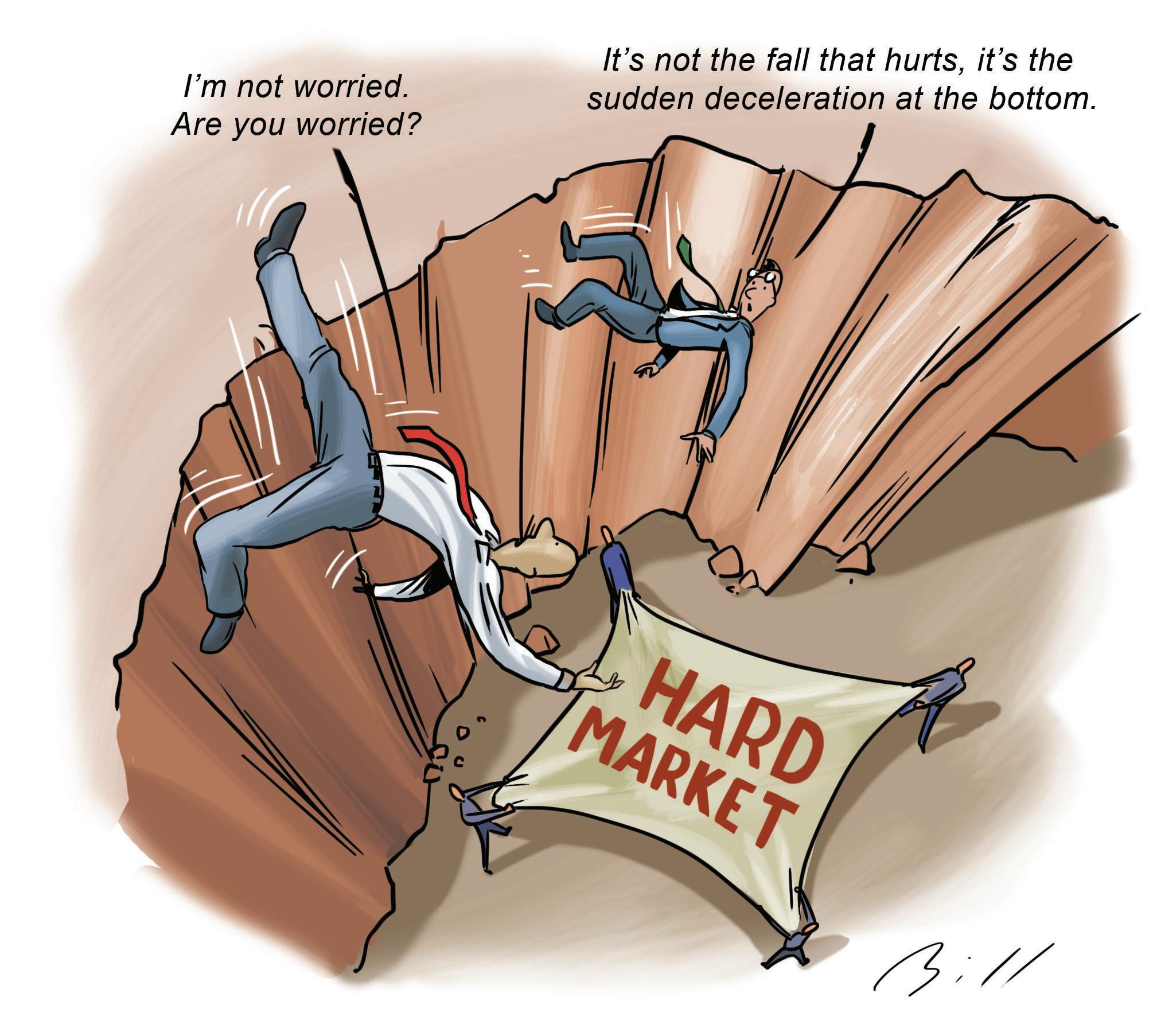

Insurer profitability just “fell off a cliff”, but actuarial firm Finity believes there’s no need to panic

Advertisement

By John Deex

Australian insurers have traditionally targeted a return on equity (ROE) of about 15%.

In 2018/19, the figure was a respectable 13%. But, as Finity’s latest state-of-the-industry Optima report shows, last financial year it dropped like a stone to 4%.

Finity Principal and lead author of the report Andy Cohen told Insurance News “you’ve got to go back a long way” to find an ROE that bad. Two decades, in fact.

“So we really have fallen off a cliff a little bit, perhaps not surprisingly given the bushfires [and other natural catastrophes] combined with COVID.”

Mr Cohen says insurers “have a choice” about which ventures they can go into, or products they can launch, and “will be looking for a certain ROE to make it worth their while”.

“The standard practice a few years ago might have been 15% after tax, but with risk free rates dropping then that target tends to drop.

“If you are only getting 1% on your cash then you are perhaps happy to get something more like 10% on money you invest in an insurance company.

“We tend to think of that target range as 10-15%. My personal view is at the moment it could or should be closer to that 10%. While 13% was a good result, there’s been a big slide down to 4%, well outside of that target range.”

Although they undoubtedly contributed, it wasn’t bushfires or even COVID that caused that number to plunge to such lows. The real culprit was low investment returns that are getting even lower.

“We calculate that eight points out of that nine-point drop are as a result of investment returns collapsing,” Mr Cohen says.

“They were worth $3 billion to the industry in 2019, and they fell to $1 billion in 2020 – one-third the level of the return.

“That $1 billion is equivalent to about a 2% return versus more than 5% the year before, so it’s quite a big drop.

“And I don’t think there will be too many who think there’s lots of investment return to be had in the next 12 months.

“So if insurers are to get improved profitability, it really has to come from the underwriting side, whether that be through lower claims, higher premiums, or better expense control. All those things are quite difficult in the current environment to achieve.”

So then, expect a hard market to get even harder, bringing affordability issues into play.

“There’s that undercurrent of affordability that has been bubbling away for a while,” Mr Cohen says.

“If you are thinking about the business space and property classes, they have seen some quite strong claims inflation over a period of time. For insurers to just stand still and maintain their profit margin they need to put rates up. That is still happening.

“And against that background you have got businesses, particularly SMEs, doing it tough and the economy is depressed.

“It is an issue for insurers and brokers to be dealing with. While we have put some forecasts out there, they are predicated on the hard market continuing.

“That’s because the hard market does need to continue for a number of classes to get back to target profitability.

“But of course the purchaser of the insurance is doing it tougher now than they were a year ago, and are perhaps not as able to absorb an increased insurance premium, so there is quite a tangle there to unwind.”

Finity foresees “a small bounce back” in FY21, but predicts ROE will “languish” at about 7%, still some distance behind target.

In FY21 premium growth is likely to be flat, “based on a combination of declining exposures offset by rising prices”.

Commercial lines will continue to lead the way on pricing, but the collapse of the travel insurance market is a “big blow” to industry premium volumes.

Overall, Mr Cohen is not overly pessimistic. While affordability is a growing concern, businesses will continue to need insurance. And even a 4% ROE is manageable, for one year.

“I don’t think you’d want that to be the long term average ROE for the industry, but it continues to be well capitalised, even after the year it’s had.

“Capital adequacy has slipped back by about 12 points from last year, by the APRA measure, but it’s still sound. You wouldn’t want 4% per annum for evermore, but it is a volatile industry where you get good years and bad years, rather than even years all the time. That is the nature of insurance.

“This year was a year when a lot of things happened that conspired to drive the number down.

“Will that happen every year? No. So I don’t think this year is a problem per se.

“That’s not to downplay the endless challenges the industry has to get back to target profitability, but it’s not a problem from a solvency point of view.”

There is one complicating factor waiting in the wings – La Nina.

Finity’s modestly positive predictions for the next financial year are based on there being no repetition of the Black Summer and its $6 billion claims.

With a La Nina in play, we shouldn’t have severe bushfires again, but we may well have equally severe cyclones, storms and floods.

“In our forecast we have made an assumption that the weather-related claims costs will revert to a broadly long-term average level,” Mr Cohen says. “But clearly that could be quite different.

“[Last summer] was a bad year. If we had that again then obviously reinsurance comes into play, so it doesn’t all drop to the insurers’ bottom line.

“But it would make a $500 million or $600 million impact on industry profit if it happened again.”