2 minute read

Tennessee's Insurance Data

What Trends Can We Determine from '19 P&C Marketplace Data prepared by Paul Buse, RISC

Insurors recently worked with industry expert and longtime head of the Big I Advantage for-profit programs, Paul Buse, to analyze 2019 data of the insurance industry for the U.S. and Tennessee with some interesting results. Through his new consulting firm, Real Insurance Solutions Consulting, Paul reviewed the data and has determined some key insights for agents. This report will be updated in 2021 as the data is assembled at the National Association of Insurance Commissioners (NAIC) and aggregated by industry data-watchers, such as A.M. Best Company, Inc.

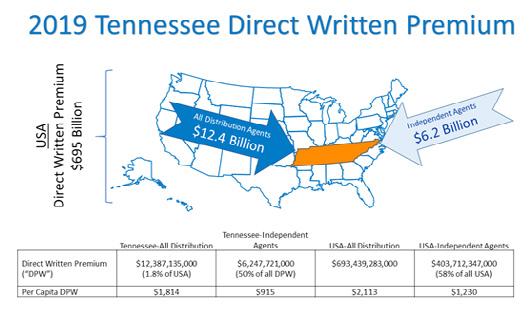

Tennessee accounts for about 1.8% of all U.S. direct written P&C premiums or a total of $12.4 billion in direct written premiums. That is proportionately just below the national average as can be seen in the per capita premiums. That is, with approximately 6.8 million persons in Tennessee versus the 328 million persons in the U.S., P&C premiums per person in Tennessee are $1,800 and the U.S. is just over $2,100.

Charts and Appendices

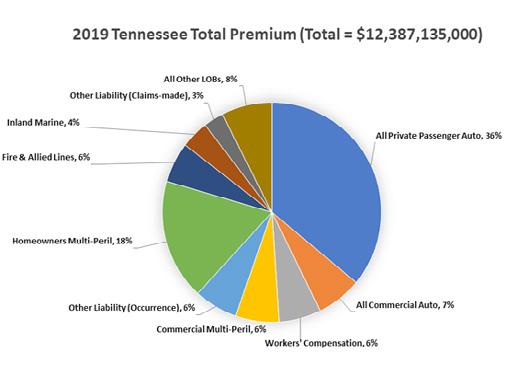

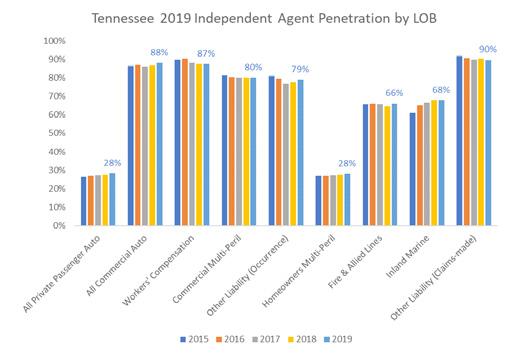

What follows is a numeric and visual summary of the P&C insurance marketplace in Tennessee. It is intended to give you perspective on the entire market as well as insights on loss ratios, commissions and key insurers. The report starts with a pie chart of the Lines of Business (“LOBs”) written by independent agents in Tennessee for 2019 ranked from most direct written premium to the ninth-most with the last chart being all remaining LOBs combined. Immediately after, for contrast, is the same two charts for the total United States.

Some items of note available in the full report:

• Tennessee has 934 affiliated and unaffiliated U.S.-based insurers writing premium in the state. That is 41% of all such insurers in the U.S. • Grouped insurers write 96% of the premiums in Tennessee. • Tennessee has seen a 5-year trend of 4.5% growth in P&C premium, just below the national trend of 4.7%.

Thanks to our Partners, the full report and all the data is available for free to Insurors members by logging in to our website at https://bit.ly/3ePLbhC u

OPEN SEMCI

Single-entry, multiple-company interface (SEMCI) is like magic!

Acuity, long recognized as a leader in agency interface technology, is committed to supporting SEMCI in commercial lines. SEMCI drives efficiency in the quote and application process and allows you to choose how you want to do business with Acuity. Acuity currently partners with several of the leading commercial lines insurtechs. We are building, exploring partnerships, or expanding with numerous other independent agency technology solutions. And Acuity is on the forefront of integration technology, continually building the connections necessary to be ready to connect to new insurtechs as they emerge.