In partnership with our clients, Assurant supports more than 300 million customers across the globe. We develop innovative products and services that support, protect and connect major consumer purchases. And we do this for some of the world’s most recognised brands, enabling us to anticipate the evolving needs of consumers, and continually deliver an enhanced customer experience.

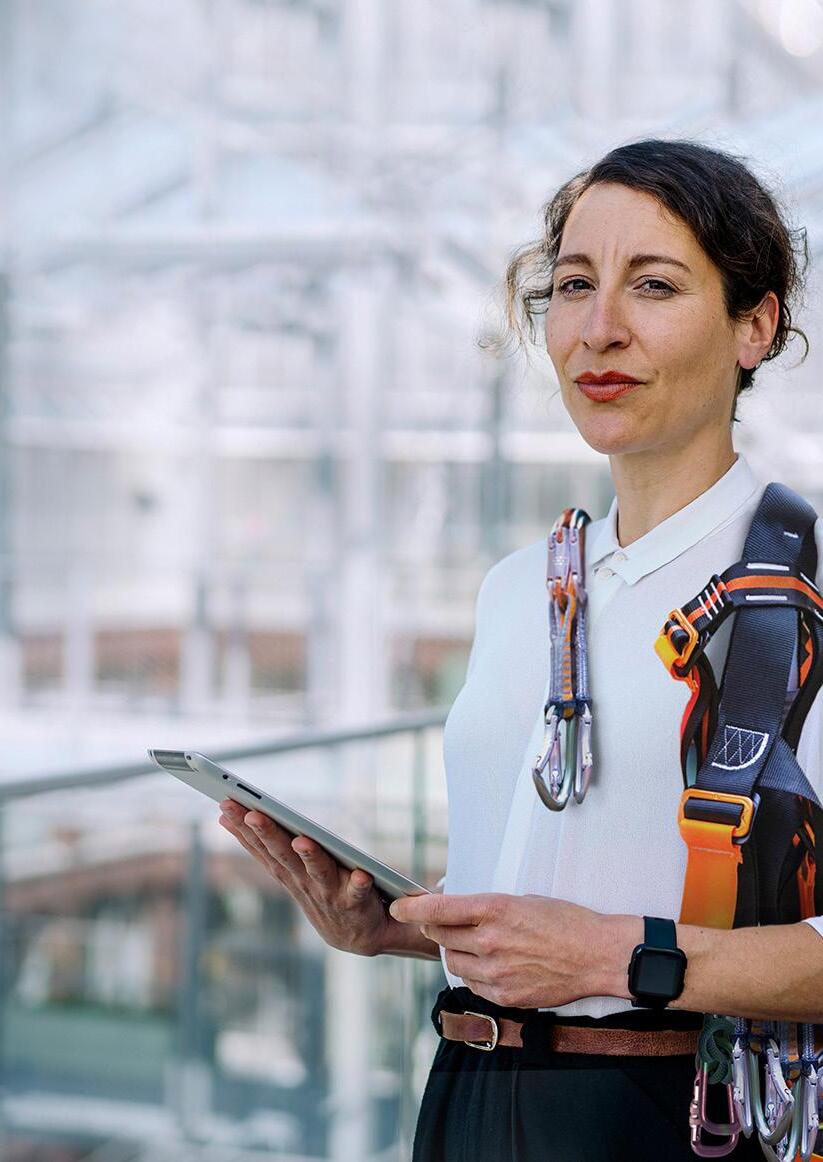

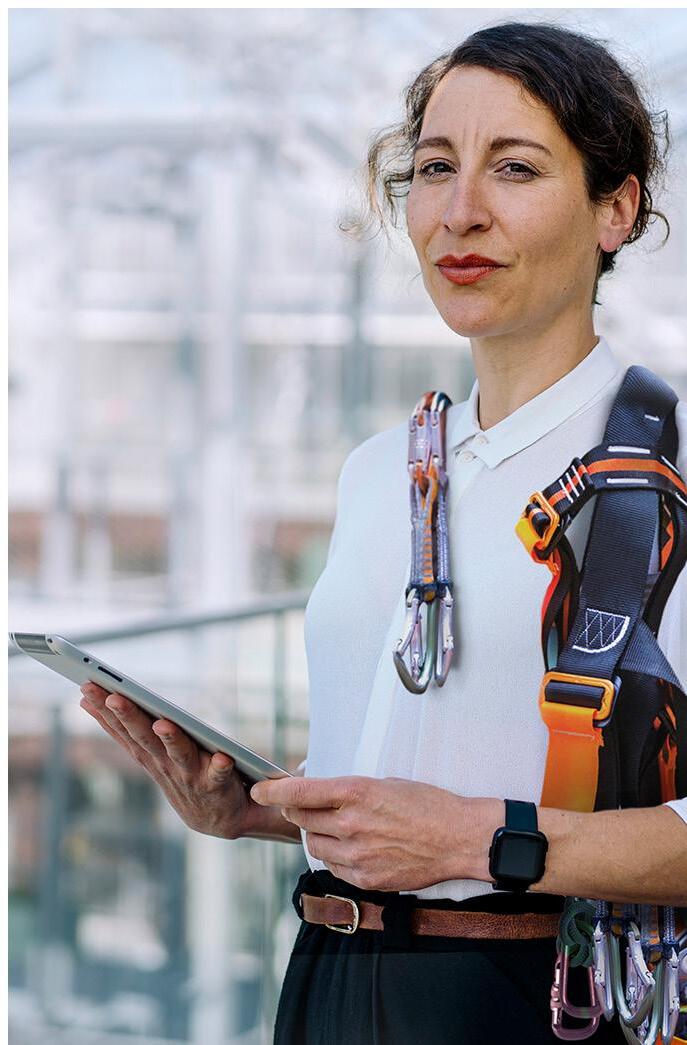

Assurant is providing a range of protection products and services to help people thrive in a connected world, partnering with Vodafone to bring protection to life.

Today’s consumer has over 20 different wifi-enabled gadgets in their home, underlining the size of the gadget protection opportunity. Assurant – a leading global business services company that supports, protects and connects major consumer purchases, serving more than 300mn customers – is focusing on insurance products and services that empower consumers to protect those gadgets.

“We focus on everything that sits around the device,” Assurant UK Managing Director Chris Woolnough explains. One of Assurant’s brands is Pocket Geek,

cancel at any time. Protect Your Bubble provides valuable real-time insights for the company based around consumer behaviour, which it can use to hone its B2B propositions.

Culture vitally important to the way Assurant does business

Woolnough says that culture is particularly important to Assurant. “Our culture is pretty special and we call it the Assurant Way,” he says. “Within that, we have a set of values. Those values are common sense, common decency, uncommon thinking and uncommon results. Everything we do hooks back into those.”

This platform of trust has allowed it to enjoy a

We produce Digital Content for Digital People across 20+ Global Brands, reaching over 15M Executives

Digital Magazines

Websites

Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

Events: Virtual & In-Person

Work with us

Earlier this year the editorial team discovered ChatGPT. This Open AI platform that can scrape facts and put them into reasonably literate formats was the source of great excitement. Of course, as seasoned industry writers with years of experience behind them, this chatty bot has been a curiosity rather than a threat – an interesting tool that can dig up a few facts to help with research – all formatted properly into human English afterwards, of course.

But, as ChatGPT learns and develops, it will improve in both style and voice – and research ability. Its very presence is a sharp reminder that AI is now a very clear part of our everyday lives.

This month, we’ve explored the power of automation and AI in the insurance industry, and the changes it's bringing. We also have our usual line-up of exclusive interviews and deep-dives: into the ever-changing world of insurtech.

Happy March – we hope you enjoy the issue!

JOANNA ENGLANDjoanna.england@bizclikmedia.com

“This chatty bot has been a curiosity rather than a threat”

014 BIG PICTURE

Could insurance save crypto firms from cliff-edge?

016 THE BRIEF

Improve diversity by focusing on staff retention, Wiley says

018 TIMELINE

The journey of life insurance

020 TRAILBLAZER Karen Lynch

024 FIVE MINUTES WITH Tom Lawrie-Fussey

Legacy, disconnected systems no longer cut it in the highly competitive payments market. Whether you serve the enterprise or retail markets, FIS offers end-to-end services that help you unleash the power of modern payments networks. Deploy how you choose – in the cloud or as a fully-managed end-to-end service. Our payments solutions offer speed to market, robust resilience and complete compliance.

Retail Payments:

• Prepaid, Credit, Debit

• Digital • Payments as a Service

FIS in the Philippines:

• FIS works with top 6 out of 10 Philippine banks for Payments Technology

• Bancnet operates on FIS IST/Switch

• With over 60,000 employees globally, Philippines is fully supported by local employees

• Over 10 million cards have been issued from an FIS owned platform

Enterprise Payments:

• Open Payments Framework Hub

• Real-time payments

• ISO 20022-native solutions

• FIS IST/Switch is the world’s #1 open platform payments switch

• FIS has been around for more than 50 years and is a Fortune 300 company

• With over $12 Billion in annual revenues and $90 Billion in Market Cap, it’s the #1 FinTech provider globally

At FIS, we’re ready to make payments your competitive advantage. Let’s Power Next at fisglobal.com. Connect with us at getinfo@fisglobal.com.

At TCS, we believe in creating sustainable growth for our stakeholders. Our innovative framework, digital capabilities, agile business model and ecosystem, are helping forward-looking financial institutes to build a purpose-driven business and provide financial, physical and mental wellbeing to their customers.

Vinay Singhvi, VP & Business Unit Head of Banking, Financial Services & Insurance, UK & Ireland at TCS, discusses transformation and change in the industry

Tata Consultancy Services (TCS) is one of the leading IT and tech service providers the UK, as per the latest software and IT services ranking by Tech Market Review; and is the largest provider of IT services in the UK. “TCS is part of the Tata Group and we have been in the United Kingdom for over 50 years,” says Vinay Singhvi, Vice President and Business Head for UK and Ireland Banking, Financial Services, and Insurance (BFSI) unit for TCS. “We have the privileged position of being the purpose-led transformation for our customers, including vitality.”

As the world recovers from the pandemic, we are seeing businesses across industries - not just financial services - accelerating their use of technology. “Organisations are now looking to adapt new business models to build more customised products and services, as the needs of the end-customers are changing so rapidly.”

The segment will also continue to have a lot of competitive differentiation. “We are, for

example, seeing the rise of a lot of challenger banks,” says Singhvi, “especially over the past two or three years, as well as Insuretechs, Fintechs and innovative, creating the right competitive tension within the industry to make sure that the existing organisations are able to cater to their end-customers in much more predictable, efficient, agile and nimble ways.”

To summarise, Singhvi says, “I believe that all of this is leading to our customers focusing on understanding their own end-customers better. They are looking at hyper-personalisation in terms of what products and services they offer. They want to service them through seamless end-to-end digital journeys, and most importantly all of this depends upon making sure that the data and personal information that we have is kept secure.”

Get in touch

Washington DC

Reflections in the front facade of the Securities and Exchange Commission (SEC) building. The co-founders of crypto insurance company Evertas have suggested that mandating insurance for Web3 businesses would be more effective at reducing the number of insolvency events –and minimising damage to consumers when they occur – than tighter regulation. Some crypto holders lost thousands of dollars when the crypto exchange FTX collapsed at the end of last year. Its founder, Sam Bankman-Fried, was arrested on suspicion of eight different charges, including fraud and money laundering, before being released on bond in December.

INSURTECH SUPERSCRIPT RAISES $54.5MN IN SERIES B ROUND

READ MORE

UK-based insurtech Superscript, a digital-first insurance provider to small businesses and high-growth tech companies, has completed a US$54mn Series B funding round to help fund its growth strategy.

READ MORE

According to reports, the round was led by existing investor BHL UK, owner of Comparethemarket, with participation from new investor and Fortune 500 insurer The Hartford. Other existing investors, including Concentric, also took part.

Superscript, which was launched in 2015, covers both simple and complex risks through a highly personalised experience and deep level of customer engagement. This is enabled through its proprietary triaging technology and unique multi-carrier model, which gives it access to insurer capacity across broad markets and regions.

CHRIS

READ MORE

The insurtech provides modern businesses with complex risk, flexible, and tailored coverage through the advisory and broking service known as SuperscriptQ. Less complex businesses, meanwhile, can obtain coverage in a matter of minutes through the online platform.

“IF YOU DON’T HAVE A CLIENT - FIRST CULTURE, YOU WON’T EMBRACE CHANGE AND IT’S GOING TO BE A REAL CHALLENGE FOR YOUR BUSINESS”

MOORE Head of Apollo ibott 1971

“BY STORING DATA ON THE BLOCKCHAIN, INSURANCE COMPANIES CAN REDUCE THE RISK OF HUMAN ERROR WHEN COMPLETING TASKS LIKE PROCESSING CLAIMS OR UPDATING RECORDS”

NISH KOTECHA Chairman, Finboot

“IN THE CURRENT MACROECONOMIC CLIMATE, A FULL ‘RIP AND REPLACE’ STRATEGY FOR LEGACY SYSTEMS MAY PROVE TOO COSTLY AND RISKY”

MARIANA HENRIQUES Product Marketing Director, Insurance FintechOS

71% Yes

29% No

The San Franciscobased insurtech, which delivers a cloud-based cyber risk analytics platform for use in the insurance industry, has announced a further US$50mn in funding.

JOYN INSURANCE

T he New York insurtech, which offers a leading underwriting and workflow pl atform for the E&S space, has secured over US$17mn.

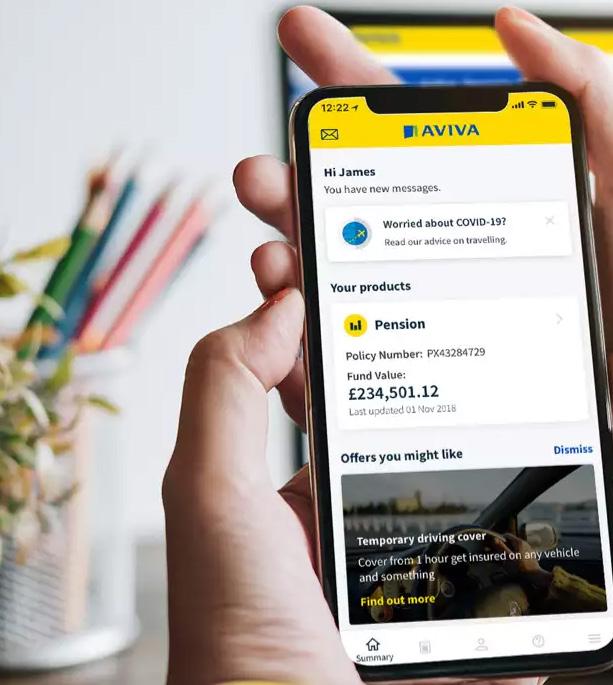

Aviva is aiming to encourage the acceleration of renewables by underwriting offshore wind projects for the first time.

Vitality will start using data from Apple Watches to track and monitor customer health as part of its ActiveLife insurance product.

Previsico has said it's ready to connect to the US$4.5bn Meteosat satellite system, allowing it to deliver more accurately and timely flood warnings.

ICARE

Australian stateowned insurer icare defends the awarding of executive pay increases, despite controversy around underpaying workers' comp insurance and a AU$1.9bn bailout.

MEDIBANK

Australian health insurer Medibank discloses that the details of nearly 10mn customers have been breached as part of a massive ransomware attack.

G O O D T I M E S B A D T I M E S

MAR23

Life insurance can trace its history all the way back to the ‘burial clubs’ of Ancient Rome. Romans believed that failing to bury people properly was a bad omen for the afterlife, so troops would regularly contribute to burial funds to help pay the cost of their funerals, and, later, a stipend upon death.

1583

The earliest example of life insurance appears to be William Gibbons, a salt merchant in London, whose acquaintances took out a policy on his life in 1583. When he died in the final month of the policy, the underwriters tried to avoid paying out but were unsuccessful in court.

1759

The first life insurance policies in the US were designed to assist the families of Presbyterian ministers after they died. The funds were originally criticised for being in poor taste, but they provided much-needed relief to widows and paved the way for America’s insurance industry to grow over the next 100 years.

Few things in the modern world can claim to trace their history back 2,000 years – but life insurance can. Here’s the history of this vital line of insurance

By the 19th Century, life insurance was big business. In the 1820s, the author Sir Walter Scott – himself a director of an insurance company in Scotland –took out three life insurance policies totalling £6,000 (over £500,000 in today’s money).

In the 1940s, the legs of Hollywood actress Betty Grable were insured on the Lloyd’s market by her movie studio for US$1mn – a staggering amount of money at the time. It was all part of a publicity stunt for one of the world’s most recognisable

The invention of Apple’s iPhone and other smartphones opened a new frontier for insurance. Although insurers have been generally slow to modernise, the internet and smartphones have led to a

Karen Lynch is the President and CEO of CVS Health – one of the largest health insurance providers in the US. In 2021, she also became the highestranking female CEO on the Fortune 500 list

Born in Ware, Massachusetts, in 1963, Karen Lynch’s story is one of triumph over adversity and the importance of family support in a crisis.

The American businesswoman – who is currently CEO and President of CVS Health –heads up one of the top 10 fastest-growing companies in the US and was named in 2021 as the highest-ranking female CEO on the Fortune 500 list.

This fact makes the journey of her career, from humble and tragic beginnings to a worldclass business leader, all the more impressive.

Raised in a single-parent home, when she was just 12 years old, Lynch’s mother took her own life, leaving her adolescent daughter and three siblings as orphans. Just four short years later, when Lynch was 16, her aunt –who had become a guardian for the children in the aftermath of their mother’s death –was diagnosed with terminal lung and breast cancer, leading to her premature death.

But, in the face of such overwhelming sadness, tragedy, and upheaval, Lynch was a hard-working, diligent student. She attended Ware Junior and Senior High School, graduating in 1980.

After that, she moved on to Carroll School of Management at Boston College, where she earned a bachelor’s degree in Accounting and became a Certified Public Accountant (CPA). Once graduated, Lynch began a financial career in the Boston office of Ernst & Young, where she decided to specialise in insurance.

Her decision to enter that space was heavily influenced by the grief of her early years. She once told an interviewer: "When you have those personal events happen reasonably early in your life, I had that mission and passion to be able to help transform how people transform healthcare.”

Lynch spent the first decade of her career working in insurance, but then returned to education to complete an MBA. This was a deliberate decision to expand her skills and broaden her financial background to provide her with the tools necessary to run a company.

The move paid off, and, in 2004, Lynch was appointed president of Cigna Dental, a global health insurance service company.

“When you have those personal events happen reasonably early in your life, I had that mission and passion to be able to help transform how people transform healthcare”

By 2005, Lynch was promoted to a newly-created position that combined leadership of Cigna Group Insurance and Cigna Dental. But, in 2009, she felt ready to tackle new challenges and left to become president of Magellan Health Services.

Just three years later, Lynch joined Aetna as its Executive Vice President and Head of Speciality Products. Within months, she had led the merger between Aetna and Coventry Health Care, an industry-first, in that it was the largest healthcare acquisition at that time.

By now, it was perfectly clear that Lynch was a force to be reckoned with in the global insurance industry, and she was made Aetna’s first female President.

When Aetna was acquired by CVS Health in 2018, via a US$70bn deal, she retained the role and subsequently led CVS Health through the storm of COVID19 the former leader, Larry Merlo, retired. This is despite the fact that, in 2019, Lynch suffered a serious accident when she flew over the handlebars of her bicycle onto a cobblestone street while on a cycling trip in the Netherlands. The event caused a broken hip and hand, and damaged her ribs. Lynch flew back to the US for surgery to pin her hip back together and used the hospital stay to view, first-hand, the customer experience offered by CVS.

Lynch is a member of the Business Roundtable, the World Economic Forum Global Coalition for Value in Healthcare Executive Board, and, in 2022, was named by Fortune as the most inspirational CEO. She was also awarded an honorary Doctor of Commercial Science from the University of Hartford in 2022 and an honorary doctorate of humane letters from Becker College in 2015.

Lynch married Kevin M. Lynch in 2018. He is the Founder, President, and CEO of the Quell Foundation, a non-profit organisation with a mission to remove the stigma around mental health and reduce the number of suicides, overdoses, and incarceration of those with mental illness.

Tom Lawrie-Fussey is Director of Automotive at LexisNexis Risk Solutions Insurance, U.K. and Ireland. We caught up with him to find out what motivates him, what inspires him, and which tech he can’t live without

Q. WHO WAS YOUR CHILDHOOD HERO AND WHY?

» I didn’t have a specific hero as such, but I used to love watching lorry drivers reverse into our local supermarket car park – it’s a real skill! I’d watch them for hours and spent my entire childhood wanting to be a lorry driver!

Q. WHAT'S THE BEST PIECE OF ADVICE YOU EVER RECEIVED?

» “If a job’s worth doing, it’s worth doing properly” – my Gran always drummed this into us, and I find it’s applicable to just about everything in life, from how to bring up a family, to doing the dishes, to building new digital products.

Q. WHAT WAS THE LAST BOOK YOU READ – AND HOW LONG AGO DID YOU READ IT?

» Birdsong by Sebastian Faulks, because my wife told me I’d like it. And I did. Excellent book, I devoured it in about a week, very recently.

Q. NAME ONE PIECE OF TECHNOLOGY YOU COULDN’T LIVE WITHOUT AND TELL US WHY

» At the end of a long day I love listening to music, played on proper hi-fi, where, with your eyes closed, you can just about pretend to be at a concert.

Q. WHO DO YOU LOOK UP TO IN TERMS OF LEADERSHIP AND MENTORSHIP?

» I’m fortunate to have an excellent manager at LexisNexis Risk Solutions! Outside of work, I’ve always admired what James Dyson built, from humble beginnings tinkering with his inventions in his garage.

I’ve also never come across a better leader than James Allison, who I worked with briefly at the Renault F1 Team. James is now CTO of MercedesAMG Petronas F1 and rightly so. He’s phenomenally clever, but also (and this is the rare part!) incredibly gifted at leading a team to a common goal.

Data – in the capacity of regarding who owns what and how publicly available data should be used in quote-and-claims journeys. Insurance providers have quite rightly been cautious about exploring new datasets, but, with data ownership and privacy concerns allayed, there has been a big shift in recent years in the appetite for new data insights to obtain an accurate view of risk in a fair and transparent manner.

We’ve got lots in the pipeline. My focus is on supporting motor insurance providers and without giving too much away, we’re accelerating how we leverage vehicle data to serve our insurance clients better. Vehicles are becoming significantly more complex, and more expensive, but also more capable, and more able to avoid a collision and hence reduce claims.

Our solutions will help uncover yet more details about the car, the safety and risk implications of emerging technologies, and how this impacts pricing, underwriting, and claims.

» LexisNexis Risk Solutions is an innovator and enabler, bringing data together to create an enriched and valueadded service for our clients. The pace of change and disruption in our sector is unprecedented right now, and it’s this that excites and inspires me.

We’re positioned to be able to serve both insurtech and large, established insurance brands together, and we look forward to bringing more vehicle insights to them, curated in such a way that insurtechs can easily access and extract the value they need to build and grow.

“IF A JOB’S WORTH DOING, IT’S WORTH DOING PROPERLY’ – MY GRAN ALWAYS DRUMMED THIS INTO US”

We don’t just create real-world transformation. Driven by our purpose, we amplify the impact insurers have on the worldempowering employees and helping communities thrive.

Discover how we can make a difference together.

Sameer Dewan, Genpact’s global business leader for insurance, discusses how the insurance industry is embracing a new age of data and lifetime customer journeys

Genpact is a global professional services firm delivering business transformation by putting digital and data to work to create competitive advantage.

It’s guided by its mission – the relentless pursuit of a world that works better for people. Genpact is focused on delivering ESG outcomes for both itself and its ecosystem of shareholders, stakeholders, employees, and the communities it operates in. As global business leader for insurance, Sameer Dewan partners with insurers, brokers, and MGAs to drive transformation, develop digital and analytics capabilities at a fast pace, and deliver business growth and efficiency.

The role Genpact plays - as detailed in its report Insurance In The Age of Instinct - is to help the insurance industry tackle challenges such as changing consumer expectations, the explosion of data, and a fast-moving technology landscape. “How insurers respond today will lay the foundation for future resilience, and Genpact

is a key partner in helping organisations connect, predict, and adapt to become instinctive insurers and lifelong protectors in their customers’ lives,” adds Dewan.

The Standard provides insurance, retirement and investment products and services, with total assets under administration of USD$45.36 bn. Genpact creates value for them as an extension of The Standard’s team, creating growth with agile operating models that can scale up to meet demand and running operations to ensure they deliver value.

“We started by assessing the current state of operations and customer journeys and the choke points in each. This led to a redesigned operating model, with customer journeys at the heart of designing the new process - driving a better customer experience and growth. But transformation is not a ‘one and done’ project, we also created a transformation roadmap to consciously and continuously drive improvements, meeting The Standard’s goals of growth and profitability over the long term.” said Dewan.

Learn more

WRITTEN BY: İLKHAN ÖZSEVIM

PRODUCED BY: JOE PALLISER

WRITTEN BY: İLKHAN ÖZSEVIM

PRODUCED BY: JOE PALLISER

Gary Ho, Chief Technology Officer of AXA Hong Kong and Macau, has been in digital technology for over 2 decades. “Having been the Chief Lead Architect, I have a solid technical background, primarily focusing on leading enterprise solutions architecture. I have formulated IT strategies and driven multimillion-dollar transformation projects in insurance firms. Changes in enterprise architecture are inevitable alongside digital transformation, and these projects have helped me to understand how the commercial world and technology could go together to create positive impacts,” he says of his tenure within the digital tech sector.

“These diverse experiences have allowed me to prepare for uncertainties and challenges. AXA has a strong emphasis on human values – and it somehow reminds me of my past days in technical consulting, and that we must put ourselves in the customers’ shoes, to work out solutions that resonate with them.”

“Recently, in Q1 this year, our team won Asia’s Best Infrastructure Modernisation at the IDC Financial Insight Innovation Awards. This recognition is a very strong external endorsement that we are playing a leading role and are on the right track in strategy, mission, and vision in the IT industry.”

In a climate where it seems every business is undergoing some form of transformation, it has to be asked: what exactly are the focuses of AXA’s digital transformation journey that makes them stand out as giants in the industry?

Ho says: “There are three focal points that set AXA apart, and these are: responding to trends; always being present; and nurturing an environment for sustainable growth. Taken as a whole, these allow us to deliver our promises for both today and tomorrow.”

Being responsive to trends is vital. Customers nowadays are more willing to voice their needs, holding ever-stronger opinions concerning how AXA should approach and communicate with them.

“I see this in a positive light,” says Ho. “Yet, the challenge lies in how we can keep up with their constantly changing needs. We want to be the companion of our customers

GARY HO CHIEF TECHNOLOGY OFFICER HONG KONG AND MACAU, AXAthroughout their lifetime, through the ups and downs, and so we have to understand our customers.”

“To achieve this, we must always be present with them – being there for them through their entire journey shows them that we care and that they matter to us. We need to go beyond mere policy, down to even the most subtle details of Customer Experience (CX). ‘Being present’ also extends to the reliability of our systems. We’ve

“We’re not satisfied with the mere status quo”

invested significant effort in PaaS (Platform as a Service) and SaaS (Software as a Service), supported by a cloud-native architecture that fuels 24/7 operation.”

This approach then spills over into many different areas and aspects of business and operations at AXA.

“But, of course, we’re not satisfied with the mere status quo,” says Ho. “Digital transformation is an ongoing and constant process for us. We work hard to foster an evergreen environment that encourages and nurtures sustainable growth and on-time responses. It’s also necessary to save the turnaround time spent on systems upgrades and patching so that we can dedicate our resources and time to the applications and CX enhancements.”

Developing stand-out products and services with the technology to match Hong Kong possesses a highly competitive insurance market, with many firms trying to make their mark in the territory. AXA tackles this by providing offerings above and beyond those of competitors via a digital system designed to accommodate them. For such market conditions, what does it take for an IT system that can support AXA’s wide spectrum of service and product offerings to be effectively implemented? In short,

AXA aims for a progressively more seamless architecture, for more agile responses to the market and for synchronisation across multiple departments.

“The market can be worlds apart between today and tomorrow,” says Ho. “It’s crucial that we’ve got the right tools implemented in the right places to endure any challenges that may arise from this constant shifting, so having the flexibility to upgrade any system efficiently, with as little impact as possible, is central to this adaptation.”

“To achieve this, we’ve implemented a Microservice Architecture. We are now able to add or remove any product or component of the system much faster than ever before, and this entire process is also virtually seamless. Since we have a thriving partner ecosystem that involves a hybrid of remote and on-premises teams, an architectural design that includes great adjustability is a better fit for us than the traditional setting. It also sets the basis for the continued development of our services.”

149,000

Number of employees (AXA Group – AXA Hong Kong & Macau is a member of AXA Group) 1816

Year founded

AXA is leveraging the increasing importance of data in an exponentially expanding age of information. Ho says: “No doubt, data has become an invaluable asset in itself.

Let’s Create:

• New Ways for Business to Do Business

• Reformed Strategy that Drive Revenue Growth

• More Synergy and Innovation to Exceed Customer Expectations

• New Ecosystems and Redefine How Work gets Done

• Opportunities and Uncover Untapped Potential in your Business

IBM’s Expertise Nurturing Transformational Change in Fintech.

For more information on IBM Consulting and Virtual Enterprise, please visit:

IBM Consulting Hong Kong →

Lets Create with IBM →

For more information on how IBM empower AXA during their Digital Transformation journey, please visit:

Laying the Digital Foundation for Becoming an Innovative Insurer →

IBM uses its expertise to implement transformational change within fintech, partnering with clients on complex organisational and technological challenges.

A consultancy business is only as good as the knowhow it can impart onto clients. So it speaks volumes that, when asked what sets IBM Consulting apart, Lee-Han Tjioe, General Manager for Hong Kong and Macau, points to its expertise.

“We have both business consulting and technology consulting in our scope,” LeeHan says. “We have business consultants that help clients with strategy, new propositions and defining or optimising business processes. That’s one part of our practice. The other part is advising on specific technology topics. We have consultants that are very specialised in key technologies like AI and Hybrid Cloud that can help clients achieve major, technology-enabled operational improvements.”

IBM has been a trusted advisory and delivery partner for decades, developing into an ecosystem provider with recent corporate acquisitions to expand its AI and Hybrid Cloud skill sets and support clients with implementing differentiating industry and technology solutions. Today, IBM works collaboratively with companies to achieve

required business model changes enabled by modern digital solutions which, without reliable partners, would be hard to scale at pace.

An example is IBM’s strong partnership with insurance company AXA, which has endured for many years. Initially, AXA had their applications managed by providers worldwide but was looking to consolidate, recognising that it was hard to achieve consistent levels of service as well as cost effectiveness. AXA brought in IBM to manage those applications and help them innovate.

“Our partnership with AXA means we are delivering multi-year support for the business-critical applications that AXA has,” Lee-Han continues. “Those applications are supporting distribution, sales, and key internal operations. We have transferred knowledge of 60 applications within four months and now support about 100+ applications. This is the foundation for our partnership with AXA. We are now helping with further accelerated deployment of APIbased services on AXA’s digital platform to meet rapidly developing market needs.”

TITLE:

CHIEF TECHNOLOGY OFFICER

HONG KONG AND MACAU

INDUSTRY: INSURANCE

LOCATION: HONG KONG

AXA Hong Kong and Macau is a member of the AXA Group, a leading global insurer with presence in 50 markets and serving 95 million customers worldwide. As one of the most diversified insurers offering integrated solutions across Life, Health and General Insurance, our goal is to be the insurance and wellness partner to the individuals, businesses and community. At the core of our service commitment is continuous product innovation and customer experience enrichment, which is achieved through actively listening to our customers and

GARY HO CHIEF TECHNOLOGY OFFICER HONG KONG AND MACAU, AXA

“Digital transformation is an ongoing and constant process for us”

Having large data-sets gives businesses an opportunity to understand their users, and then enhance customer experience, thereby boosting satisfaction from a scientific point of view.”

Data, scientific approaches and technical sophistication are all potentially linked to human wellbeing. “For example, from existing AXA user-insights, we may offer customers personalised recommendations that could explicitly fulfil a particular individual user’s needs, ultimately increasing customer conversion rates and driving revenue growth,” Ho explains.

“But of course, achieving this is no easy task,” he acknowledges. “First and foremost, a solid data foundation is crucial to this journey. Without it, it’s almost impossible for any organisation to turn their data into an asset. “

“Second, while there is a tremendous amount of data distributed in several data warehouses, not all data is clean nor is it all correct. We could see some of that data as dirty or noisy – which would potentially impact the data model accuracy and the final prediction results. As it turns out, we might spend much more time and effort on data cleansing and pre-processing than expected. “

Brian Kealey, GM and VP for MuleSoft Asia, talks technology and cutting edge solutions for the global insurance industry

MuleSoft, acquired by leading software company Salesforce in 2018, is the only unified platform for integration, APIs, and automation. MuleSoft makes it possible for IT and business teams to create seamless digital experiences faster than ever before. The core aim of MuleSoft is to help organisations through their digital transformation journey by enabling greater speed, agility, and efficiency. Brian Kealey, GM and VP for MuleSoft Asia, leads the MuleSoft business across Asia, which covers the Greater ChIna Region, Southeast Asia and India.

He says, “MuleSoft’s vision is to connect and automate everything. We help organisations to become more composable and agile by unlocking their assets, the data, and the processes they have, and being able to improve their customer experience through technology.”

The trend for focussing on the customer experience is a theme

dominating all industries, and MuleSoft has taken a different approach to achieving its goal. Kealey says, “We saw that more than 70% of customer experiences in Asia have become digital over the last two years. And we’ve seen the pandemic has massively accelerated how organisations think about digital and how critical that is to their growth.”

Automation is also playing a big part in MuleSoft’s ongoing strategy. “We allow IT to have the security and governance that they need to make sure the organisation is not at risk,” he says. “Now with automation capabilities, we’re providing the only unified platform that combines the power of integration, API management, and automation on a resilient, secure, and flexible foundation, so companies across industries can easily automate business processes and compose new digital-first experiences, faster.”

He concludes, “That’s been the focus for us for the last few years. And we’re continuing to innovate in security and governance and reliability space as well. So very exciting times for us.”

“To counter this, we have maintained a robust Data Governance Framework (DGF). Within this framework, we’ve established good standards and policies, like regular data cleansing and data quality optimisation. With a modernised and robust data infrastructure, we are proud to say that we’ve broken the silo between data and wider lines of business, to drive our enterprise forward.”

AXA has a Point of Sales System for their distribution partner, iPro, to support the sales journey of its products digitally, with Ho describing the relationship as one where

“iPro helps us to facilitate the sales practices with paperless applications through use of the iPad”.

“We are proud to say that we started the journey of handling our new insurance policies through a paperless process, starting from agency sales to transaction completion in the backend. By using iPro, we can empower our financial planners to increase their working mobility and productivity anywhere, anytime,” he says.

Meanwhile, AXA is modernising all of its legacy applications to remain in-line with sustainability, efficiency, and digitisation goals.

“We believe the cultivation of a cloud-first foundation will uplift the entire technology support to business,” says Ho, “which could deliver a seamless omnichannel experience to AXA customers and colleagues with business value.”

In order to leverage their data, AXA has implemented Digital Backbone, which can create 360 customer analysis for the insurance company’s financial planners. It allows them to provide timely data to support the selling strategies to AXA

“We are also implementing a multi-level cloud programme in AXA to facilitate cloud adoption within the company. When we’re talking about raising our adoption rate to new heights, we have a very aggressive target – nearly 100% cloud utilisation of all applications in Hong Kong.”

GARY HO CHIEF TECHNOLOGY OFFICER HONG KONG AND MACAU, AXA

“There are three focal points that set AXA apart, and these are: responding to trends; always being present; and nurturing an environment for sustainable growth. Taken as a whole, these allow us to deliver our promises for both today and tomorrow.”

customers, acting as the facilitator to continuously engage its customers. It can also further analyse customer behaviours to support business vision and strategy at the same time.

At the foundation of the IT systems, of course, is the IT team. The question then becomes how to build a strong IT team that can support the technology strategy at AXA.

Ho says: “It might be a cliché to some, but to AXA, the most important aspect of a strong team has got to be ‘doing the right thing, instead of doing the thing

right’. We should develop a foundation for solutions, to make sure we are on the right track, including in terms of architecture design, solution and vendor selection, and so on. This brings out a further question, which is: ‘How can we be sure if we are doing the right thing?’. The team should understand the business strategy of the company, and why we are working on a particular solution. They should think from the perspective of customers, to provide an exceptional experience with the applications they develop. “

“We are making the shift towards a start-up mentality and the principle of courage, in which everyone takes responsibility to contribute to the entire team. We would love to establish a culture with an adventurous ethos, where colleagues are never afraid to take risks and are willing to try something new in the market. All of us should work as an alliance to build a technology-vision that business resonates with, so that business and IT can deliver the most positive outcomes together.”

Looking to the future of digital technologies and cloud computing

When asked about his views regarding the

of technology, Ho explains the importance of understanding the reasons behind such moves, saying: “Before we talk about cloud computing adoption, we should understand the reason behind enterprises being so eager to move towards the cloud in the first place.”

For more details, please refer to www.informatica.com.hk or call at +852 8228

GARY HO

“No doubt, data has become an invaluable asset in itself”

“Legacy systems and on-premises servers are not friendly enough if there is any integration or update needed. Colleagues need to spend a huge amount of time on the operation processes and deployment procedures. Very often, things get complicated, which can take a heavy toll on efficiency – even if we only need to apply a minor change. As a result, we notice that more flexibility is needed to keep up with the fast pace in IT. “

“For AXA, we are using a cloud agnostic strategy to leverage the best capabilities from each solution in the industry. We adopt a multi-cloud model with inter-cloud in order to combine both and create a seamless mass-network for all our applications. We can leverage this model to extract the best of each cloud solution and support business growth in the long run.”

He says: “We are also implementing a multi-level cloud programme in AXA to facilitate cloud adoption within the company. When we’re talking about raising our adoption rate to the new height, we

have a very aggressive target, which is nearly 100% cloud utilisation of all applications in Hong Kong. We believe the success of this programme will greatly uplift the performance, stability and availability of technology in AXA Hong Kong and Macau.”

In closing, Gary Ho shares his thoughts on coming trends in the technology industry: “The future of the technology industry has to be the adoption of Web 3.0. It’s a brandnew concept regarding the Internet’s next generation, involving the evolution of the decentralisation of the web, and leveraging it to take it to a new height. Users will be able to own and control their creation of online content and their digital assets. “

“With the evolution of Web 3.0, we will be able to leverage the Metaverse to merge and integrate the Internet and virtual world into our lives, so that we can interact in the virtual world. As we always keep up with the latest trends in technology, AXA France has already taken the first step into the Metaverse through the acquisition of virtual land on a platform, and, in the future, we can definitely see ourselves becoming one of the major players in the field, too.”

GARY HO CHIEF TECHNOLOGY OFFICER HONG KONG AND MACAU, AXA

“We work hard to foster an evergreen environment that encourages and nurtures sustainable growth and on-time responses”

The insurance industry is mid-transition during an economic slowdown and investment drought. So what does the immediate future look like?

WRITTEN BY: JOANNA ENGLAND

WRITTEN BY: JOANNA ENGLAND

It’s fairly safe to say that, when it comes to digital transformation, the global insurance industry was a touch late to the party.

Incumbents were process and paperwork-heavy. Worse still, customers were conditioned to accept the status quo, which involved waiting weeks for claims to be processed and payments to be made – because that’s just how the system had always been.

Then COVID-19 came along and everything changed.

Newly-founded companies with high levels of tech in their business models fared well. But the insurance industry, the vast majority

of which was still traditionally modelled using legacy systems, struggled to adapt.

Three years on, and the space looks very different. But so, too, does today’s global economic climate. And while transitioning to the cloud, adopting new technologies, and launching new products and services for relevance, the whole package comes with a high price tag.

Despite the reluctance of the insurance industry to embrace modern business models in the years preceding the

Easy multi-entity management and reporting

Sage Intacct cloud finance software for financial services

LEARN MORE

pandemic, there have been massive moves within the space to bring to market digital innovations and technologies.

Mariana Henriques, Product Marketing Director, Insurance at FintechOS, explains her view of the industry and its current catch-up conundrum. “The insurance

industry has definitely lagged behind others, like banking, when it comes to digital transformation. Though insurers have already taken major steps towards digitising their business models and the way they engage with customers, there’s still much to be done.

“One of the main challenges for insurers has been the complexity of their business models, which adds to the complexities of deploying and using the technologies themselves.”

Henriques points out that, because the insurance industry has been regulated for a considerable amount of time, updating it has been more complicated. “Being a highly regulated industry – with a complex product portfolio and distribution network – means added complexity in the processes and technology stack needed to support

“IN THE CURRENT MACROECONOMIC CLIMATE, A FULL ‘RIP AND REPLACE’ STRATEGY FOR LEGACY SYSTEMS MAY PROVE TOO COSTLY AND RISKY”

digital transformation. It also requires more specialised technology talent, which insurers have historically struggled to attract and retain.

“Technologies like fintech enablement platforms will play a big role in the next couple of years, enabling insurers to accelerate the pace of digital transformation. By helping insurers reduce the complexities of implementing a modern technology platform and empowering a wider range of roles to contribute to digital product innovation, these platforms will help insurers realise the value of the technology investments they’ve made in the past years.”

Manoj Pant, Senior Director and EMEA Insurance Industry Principal at Pegasystems, agrees: “The insurance industry is currently behind some other industries, for example, banking or telecoms, in terms of digital adoption, but it has come a long way. Insurers are now able to see the huge benefits of leveraging digital technologies

PA. Bringing Ingenuity to Life“THE LAST 12 MONTHS HAVE SEEN A NUMBER OF ECONOMIC PRESSURES, SOME OF WHICH, SUCH AS SOARING INFLATION AND RISING INTEREST RATES, THE INDUSTRY HAS NOT HAD TO DEAL WITH FOR A VERY LONG TIME”

JASON WHYTE INSURANCE EXPERT, PA CONSULTING

to deliver a better customer experience, reduce costs and be more agile. In fact, the ongoing challenges of rising inflation, interest rate increases, and skills shortages have put pressure on insurers to accelerate digital transformation.

Developing new systems, however, takes resources. Not only that, but the culture within some incumbents has made the digital transformation journey take longer than it should. Both these elements, coupled with a global economic downturn, have had an impact on the speed of progress.

Jason Whyte, an insurance expert at PA Consulting, believes the current economic climate is having an impact on the maturation of the insurtech industry, as well as the transformation of incumbent companies.

We asked him if the recent drop in investment slowed down the digital transformation for insurance companies, to which he said: “The last 12 months have seen a number of economic pressures, some of which, such as soaring inflation and rising interest rates, the industry has not had to deal with for a very long time. The temptation would normally be to defer major change, but there are too many other pressures to stand still. Suppliers are withdrawing support for old technology, regulators have ever-increasing expectations of operational resilience, and other players in the market are innovating.

“Instead, we expect to see successful insurers take a more hard-nosed approach, streamlining their transformations to focus on getting the fundamentals right while building the flexibility and capability –especially in data – to be able to respond to emerging trends and requirements.”

More intuitive end-to-end customer journeys, making much better use of external data providers

Streamlining of the underlying systems and back-office processes, running hand-in-hand with migration to cloud

Some initial moves towards Open Finance: greater connectivity, moves towards interoperable digital IDs, innovation in financial ecosystems serving multiple needs.

Forrester data shows that most insurance tech executives plan to increase IT spending in 2023, though by a smaller-than-expected amount. This increased investment, however, won’t be homogenous across all tech categories.

With the pressure on profit margins and increased costs, technologies that are able to show immediate ROI in terms of cost reductions or revenue increases will be the most likely candidates for investment.

Insurers will be laser-focused on technologies that will support their business model in 2023, which means we should see massive improvements in customer data, new product innovation, automation, and the adoption of lowcode and no-code platforms.

Insurance providers will interact with their customers by offering personalised products and services, personalised content, seamless customer journeys, and more timely response to their queries and issues.

The insurance industry of the future Agility, fresh products and services, and lean business practices will be big factors for many transitioning insurers over the next 12-18 months, says Henriques: “One of the biggest challenges insurers will have in the next couple of years is how they will tackle legacy system modernisation to become agile in product and service innovation.”

Insurers, she points out, are having to diversify their product portfolio to increase profitability and are competing with startups that are quick, tech-savvy, and have no legacy holding them back.

“For incumbent insurers, maintaining legacy systems eats away as much as 70-80% of IT budgets, leaving them little room to innovate. It may take an incumbent insurer 12-18 months to launch a new proposition, as changes to these systems are hard and time-consuming.

“In the current macroeconomic climate, a full ‘rip and replace’ strategy for legacy systems may prove too costly and risky, and insurers won’t be able to afford to wait years before seeing the ROI of such projects,” Henriques says.

She also says companies can look at building digital twins – which essentially operate alongside an insurer’s core legacy system – to update its services without compromising on performance.

“This allows insurers to innovate on top of their existing systems at speed, while giving them a way to continuously modernise without disruption to their business. As such, it might be the best strategy to weather the next three years. Instead of thinking of digital transformation as a process that is ‘one and done’, it can be tackled as a form of ‘ongoing digital evolution’, that continuously produces business impact.”

Sara Costantini, Regional Director for the UK and Ireland at CRIF, agrees. She says the next 12-18 months will see major adoptions of new technologies taking place – and a wide manner of strategies will be involved that drive forward the industry’s digitisation.

“Through the adoption of open data, insurers will not only be able to better meet their current customers’ needs, but also identify underserved groups and areas for potential new growth opportunities.

“We also expect to see digital services put at the heart of many insurers’ business strategies, with a keener focus on increasing efficiency, creating new digital products, and speeding up their launch to market.”

Constantini adds: “I’m confident that all of this will come together to create an industry that’s more customer-centric than ever before, putting people and their needs at the heart of products thanks to the greater insight offered by open data initiatives.”

“THE INSURANCE INDUSTRY IS CURRENTLY BEHIND SOME OTHER INDUSTRIES, FOR EXAMPLE, BANKING OR TELECOM, IN TERMS OF DIGITAL ADOPTION, BUT IT HAS COME A LONG WAY”

MANOJ PANT SENIOR DIRECTOR AND EMEA INSURANCE INDUSTRY PRINCIPAL, PEGASYSTEMS

WRITTEN BY: JOHN O'HANLON

WRITTEN BY: JOHN O'HANLON

It's not easy to define NFP. Though it stands as one of the biggest insurance brokers in the USA and globally, it's more than just a broker. NFP is an integrated financial solutions company at its heart – focused on benefits that enable employers to win the talent war, wealth and retirement that enhance financial security, and P&C that mitigates risk. And now, due in part to the seismic technological and marketplace changes, NFP is also a user experiencefocused organisation.

NFP’s growth strategy has always focused on acquisitions and partnerships with companies that can complement its vision. But now, partnerships include innovative, digital technologies that enhance the integration and collaboration in a more personalised way.

Mark Rieder has been with NFP since 2002, spending the last four as Head of Innovation. “We launched our innovation efforts in 2018 with a focus on the InsurTech, FinTech and HRtech space, assessing how it was going to influence the way we would do business moving forward.

“Four years later, armed with what we learned, my focus has shifted to helping drive the organisation down a digital transformation path, launching our strategy, and encouraging the whole organisation to rethink the way we do business.”

“ We truly believe that, in order to effect change, we must foster an ecosystem of collaboration”

MARK RIEDER HEAD OF INNOVATION, NFP

The insurance industry has been a laggard when it comes to technology adoption, he adds, even though there have been plenty of examples in other sectors of how digital transformation can change a whole industry for the better.

But without buy-in, change can't happen. “My role is to challenge what we're doing and ask, ‘What if we did this? Would we have a different outcome?’. Unless you're pushed, you sometimes sit back and become too comfortable, so I’m the person who makes things uncomfortable, I guess,” Rieder says with a smile. “The biggest problem people or organisations have when they try to digitally transform is they focus too much on the technology. Innovation and digital transformation are actually much more about people than technology.”

NFP: Innovating in the insurance ecosystem

NFP: Innovating in the insurance ecosystem

“ I think innovation and digital transformation are more about people than technology”

MARK RIEDER HEAD OF INNOVATION, NFP

NFP Connect: a system of engagement

That said, there is a need for infrastructure to help execute the change strategy. Rieder, along with Jayaprakash Subramaniam ‘JP’ and the entire NFP Development team, has partnered to drive the development and subsequent roll-out of NFP Connect.

“NFP Connect is our proprietary platform that's supporting this transformation within the organisation. You may have heard the term ‘system of record’– well, in an organisation like ours with a variety of

business lines and practice areas, we have many different ‘systems of record’. NFP Connect brings those disparate systems and the data within them together in one place – into a ‘system of engagement’.

NFP Connect enables our offices, advisors, clients, and their employees from across our entire enterprise to land on one unified platform and interact in a more personalised way. The way we provide this personalisation is by aggregating data to create information – it's really about connecting people with information.”

Aflac is now providing access to our important coverage outside of the worksite with consumer directed products.

• Products include dental (dental, vision, hearing), accident, critical illness and cancer.

• Polices are self-billed via credit card or ACH.

• Products are offered via a new proprietary digital platform with 100% online journey available.

• Co-branded sites can be set up for partners and their clients or APIs can be used to integrate with existing platforms.

For details on our new consumer directed strategy, contact Ward Garrett at wgarrett@aflac.com.

Policy T71000OK. In Oregon, Policy T71000OR. In Pennsylvania, Policies T71100PA - T71400PA. In Texas, Policy T71000TXR. Cancer/Specified Disease - Policy Series T70000 (Not available in New York ). In Arkansas, Policy T70000ARR. In Idaho, Policy T70000ID. In Oklahoma, Policy T70000OK. In Oregon, Policy T70000OR. In Pennsylvania, Policy T70000PA. In Texas, Policy T70000TX. In Virginia, policies T70000VA & T70000GVA.

Coverage is underwritten by Tier One Insurance Company. NOTICE: The coverage offered is not a qualified health plan (QHP) under the Patient Protection and Affordable Care Act (ACA) and is not required to satisfy essential health benefits mandates of the ACA. The coverage provides limited benefits. Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999 This is a brief product overview only. Coverage may not be available in all states. Policies and riders may also contain a waiting period. Refer to the exact policies and riders for benefit details, definitions, limitations and exclusions.

Z2201009 EXP 10/23

Compared with other industries, he admits insurance has not built the best user-experience reputation. NFP Connect looks to change this by combining ease-ofuse and convenience alongside data clarity and insightful analysis.

“Certainly, a lot of technology is embedded in the platform. I could talk in terms of AI, ML, and NLP, but I think terminology can actually prevent our industry from moving forward. We make things more complex when we bring these words into play. We really should talk about creating a better user experience, solving problems, engaging people – this is the recipe for success. Digital technologies are important, but expanding the impact of the actionable data behind the technology is where we can have the most impact. NFP Connect creates an opportunity to provide clients with insights from across their organisation through a single interactive dashboard that is personalised for them.”

TITLE: HEAD OF INNOVATION

INDUSTRY: INSURANCE

LOCATION: AUSTIN, TEXAS

As Head of Innovation, Mark champions, develops and institutionalises the innovation process for NFP inside and outside the organisation. As a catalyst for “what if” thinking Mark works to drive adoption and manage high-quality execution across organisational lines that enhance

1998 Year founded 7,100+ Number of employees

Having served in the employee 25 years, Mark joined NFP’s corporate team in January 2010 to launch the company’s national benefits administration played an integral role in expanding the capabilities to include HR developing the NFP Marketplace – NFP’s exchange solution – and launching NFP’s Innovation efforts, whilst driving Digital Transformation Strategy.

NFP has grown over the years, organically and by acquisition, and has faced the challenges associated with blending diverse systems. Rieder believes the enterprise nature of NFP Connect, which launched in late 2021, is already showing it can be a catalyst for more organic collaboration, in a more efficient and effective way.

NFP Connect takes an ecosystem approach to its platform. Rieder believes it would be naïve to claim – at a time when InsurTech is advancing on a hockey stick curve – that any single technology could tackle every problem.

“Our philosophy is to embrace our legacy partners, the startup community and any other new technologies that help solve employers’ and individuals’ human capital, risk, and financial security challenges. But it is critical that we do so with a watchful eye on building a better user experience at the same time.”

By taking the data out of all of the system silos and allowing users to access the information in one place, rather than through multiple URLs and browsers, NFP Connect creates a better user experience. This convenience and user experience drives more adoption; more adoption drives more data; more data drives more information; and more information drives greater personalisation.

The vision is to advance the organisation down the path of digitisation to digitalisation to transformation. “Transformation is where really cool stuff starts to happen.

“It's where we bring in automated recommendations and start to capitalise on the expertise we've invested in across a larger spectrum of clients, but still in a personalised fashion.”

Rather than project-specific execution, Rieder wants to keep the organisation centred on transformation. “Many organisations seem to be solely focused on developing products, with the use of new technology to solve specific problems. And, whereas this is important to us, we're more about reinventing the way we do business and making it transformative. We're making great strides but are far from done – if ‘done’ even exists. In the world of finance, people don't always like to hear ‘the project's never done’. But the reality is that you are never done with trying to be better, and this is what our platform is intended to do.”

“We're keenly focused on partnerships,” Rieder continues. “We truly believe that to

impact change and effect change in our industry, we must foster an ecosystem of collaboration between our organisation, partners, and customers. When we think about the ecosystem from a technology perspective, there are varying levels of partnership and integration.

“We have our partnership with Applied Systems, Salesforce, and others core to our strategy because they are where much of the data originates. Our P&C operation relies on Applied Systems (an essential insurance cloud management system) and their EPIC platform for policy management and other support tasks, so they are a key partner. Their focus on boosting their product through new development and acquisition makes them extra valuable because as they grow, we grow.”

“Then we have point solutions that solve particular problems – examples include Ascend, TrustLayer, ServiceNow, Bindable and Bold Penguin, all of which help us execute, streamline and create efficiencies within our transactional-related activities. Still, in many cases throughout the industry

“ Transformation is where really cool stuff starts to happen”

MARK RIEDER HEAD OF INNOVATION, NFP

Consumers today expect simple, digital experiences that let them interact with your business when and how they want – whether that be in your office, on the phone or online. To win, you’ve got to be able to meet customers where they are because if you don’t, your competitor will.

Are you ready to stand out from the rest? Let Applied help you differentiate and grow your business.

www.appliedsystems.com/innovationdrive

today, these are tackled manually; if these processes can be automated, it will create better experiences for end users and our teams alike.”

Finally, there are NFP’s carrier partners. “Aflac has been a mainstay partner over time, not only within our benefits practice but now within our digital marketplace, aiding the ability to bring a product to an individual and allow them to approach the whole buying process from a digital perspective. Many buyers are now digital natives

accustomed to doing almost everything on their mobile device, and we think it’s critical to meet them where they are. Partners like Armadillo, a home warranty programme that is a part of our marketplace, are doing just that. We're starting to see more and more companies adopt this digital-first mindset, and we want them to be part of our ecosystem.”

“ Work hard and family first”

MARK RIEDER HEAD OF INNOVATION, NFP

“

For too long, our industry seems to have been in a bubble, but that bubble is starting to pop”

MARK RIEDER HEAD OF INNOVATION, NFP

“The InsurTech space is seeing exponential growth. More and more solutions are coming to market. It's important as an organisation that we have a strategy on how to approach it. But one recipe for how it doesn't work is to focus on the technology first and then find a place to plug it! Our approach is to come together and identify the problems, then go out and find technology that solves those problems.”

That said, he believes in keeping a proverbial ear to the ground, constantly meeting with the innovators bringing these solutions to the table. NFP's innovation lab doesn't set out to create blue-sky solutions; instead, it streamlines and standardises the way it interacts with the innovator community, assessing their solutions and bringing them into its ecosystem – whether established players like Applied Systems and Salesforce, startups such as TrustLayer and Armadillo, or carriers such as Aflac.

Rejuvenating the elderly insurance industry Rieder is convinced the insurance business is at an inflection point and ready for a big shake-up, so it is critical to be acting on a plan. But he also thinks that, with the pace of technological advancements, it's

delusional to think that a detailed five-yearplan is feasible.

While it's important to know the direction of travel, things are currently moving too fast, so the key is to always be adaptive. “For too long, our industry seems to have been in a bubble, but that bubble is starting to pop. As this happens, stagnant thinking companies will struggle to keep market share. Insurance will always be about identifying trends and mitigating risk, but now the industry must take a leap and embrace the new tools that can assist in doing so in a more effective way. There’s so much room for automation of the mundane day-to-day tasks that folks are executing on a regular basis. This is our focus .”

“Can we create a better environment for our employees and make it an industry that young people coming out of college really want to get involved with? They don’t want to plug and chug along with spreadsheets – they don't even know what that is! So, if we want to attract and retain employees, we need to focus on them, not just our customers.

“Better customer experience will come about if we create a better experience for our employees.”

We really want to talk about creating a better user experience, solving problems, engaging people – this is the recipe for success”

Blockchain has the power to completely transform insurance, but are business leaders on board and how do we unleash its full potential?

WRITTEN BY: ALEX CLEREBlockchain technology is one of the most exciting new frontiers for insurance, having the potential to fundamentally transform the way consumers protect their prized assets.

To understand the benefits it can bring to insurers and insureds alike, we must first understand the technology that underpins it.

The blockchain, in its simplest sense, is a network of computers used to store data securely. Because it is a network and not a central authority – like a bank or insurer – any changes to the data must be agreed right across the network for it to be accepted, hence why the blockchain is often described as a ‘truth platform’.

Nish Kotecha, Chairman of blockchain firm Finboot, says: “By storing data on the blockchain, insurance companies can reduce the risk of human error when completing tasks like processing claims or updating records. For example, someone could forget to switch out a name on an insurance policy. When trying to find the original policy, they might accidentally process it with someone else’s information, creating a dispute down the line. Human error makes paying out for claims very difficult – and claims are often processed manually rather than by machine, increasing room for error.”

The consensus of information that exists across the blockchain is

Aflac is now providing access to our important coverage outside of the worksite with consumer directed products.

• Products include dental (dental, vision, hearing), accident, critical illness and cancer.

• Polices are self-billed via credit card or ACH.

• Products are offered via a new proprietary digital platform with 100% online journey available.

• Co-branded sites can be set up for partners and their clients or APIs can be used to integrate with existing platforms.

For details on our new consumer directed strategy, contact Ward Garrett at wgarrett@aflac.com.

Policy T71000OK. In Oregon, Policy T71000OR. In Pennsylvania, Policies T71100PA - T71400PA. In Texas, Policy T71000TXR. Cancer/Specified Disease - Policy Series T70000 (Not available in New York ). In Arkansas, Policy T70000ARR. In Idaho, Policy T70000ID. In Oklahoma, Policy T70000OK. In Oregon, Policy T70000OR. In Pennsylvania, Policy T70000PA. In Texas, Policy T70000TX. In Virginia, policies T70000VA & T70000GVA.

Coverage is underwritten by Tier One Insurance Company. NOTICE: The coverage offered is not a qualified health plan (QHP) under the Patient Protection and Affordable Care Act (ACA) and is not required to satisfy essential health benefits mandates of the ACA. The coverage provides limited benefits. Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999 This is a brief product overview only. Coverage may not be available in all states. Policies and riders may also contain a waiting period. Refer to the exact policies and riders for benefit details, definitions, limitations and exclusions.

Z2201009 EXP 10/23

frequently referred to as ‘distributed ledger’ technology (DLT), and it’s this that has the power to reshape the insurance landscape.

DLT has existed for more than a decade and has been widely adopted within the

mainstream of financial services, but insurance is slow to catch up.

“Adoption within insurance firms has certainly been slower than in similar industries, but the tide is turning and we are now seeing more insurance firms examining ways that DLT can support their business growth,” explains Richard Dhuny, UK DLT and Crypto Lead at digital transformation specialists GFT. “One of the main drivers for this is that insurers are beginning to look beyond DLT as an isolated enterprise technology. Instead, they are starting to understand where DLT’s value truly lies – as a catalyst for business ecosystem transformation.”

Dhuny believes that DLT could be used for know-your-customer (KYC) protocols to share data within a private blockchain, meaning that customers only

“By storing data on the blockchain, insurance companies can reduce the risk of human error when completing tasks like processing claims or updating records”

need to submit information once, as well as for fraud detection, pricing, claims handling and underwriting.

One of the reasons that insurance has not fully embraced blockchain is an apparent hesitancy caused by a lack of

understanding around the benefits it can bring. According to market research company GlobalData, a fifth of business leaders think blockchain is “all hype and no substance” with better-understood technologies –like artificial intelligence (AI), cybersecurity and cloud computing –more likely to solicit positive reactions.

“Blockchain has often been a poorly defined and misunderstood topic,” says Benjamin Hatton, Insurance Analyst at GlobalData. “Its association with the world of cryptocurrencies and digital assets has left it with a poor reputation among many. Although this may set back the development and implementation of blockchain in insurance, use cases will remain and continue to emerge in the future. As regulation is

“Adoption within insurance firms has certainly been slower than in similar industries, but the tide is turning”

gradually introduced and strengthened within the space, some firms may get the confidence in the technology they need to reconsider the power of blockchain.”

Despite the seemingly tentative approach to blockchain, the hesitancy revealed by the research is not necessarily borne out by the numbers. According to forecasts from several industry observers, the value of the blockchain in the insurance market is set to skyrocket – from a present valuation of a few hundred million dollars to US$20-30bn by the end of the decade.

Once we overcome the knowledge gap that seems to persist, there are opportunities to be realised: blockchain will make life more convenient for consumers; it will drive efficiencies and unlock new revenue streams for insurers; and it will make the entire process more transparent for all parties.

Richard Dhuny of GFT continues: “Within the insurance sector, there are some really interesting blockchain applications coming from innovative providers that support more robust data infrastructures, less vulnerable to fraud or human error, as well as delivering greener IT practices.

“US insurance provider Lemonade, for instance, recently founded the Crypto Climate Coalition alongside other providers. The coalition functions as a decentralised autonomous organisation aimed at building and distributing at-cost parametric weather insurance for farmers and livestock keepers in emerging markets.

“One key innovation is that Lemonade receives granular weather insights from its partner network, generating models that can be programmed into smart contracts that automatically estimate the accurate premium for insuring crops based on the field’s location, size and topography. By

parametrically measuring rainfall amounts in an insured field, smart contracts can also automatically trigger flood or drought claims, paying farmers without them even needing to file a claim.”

And Finboot’s Nish Kotecha is brimming with enthusiasm about a blockchain future: “Consider a world where each physical asset has its digital twin stored on a blockchain: the ownership can be easily transferred, and each activity is immutably recorded. This digital passport is then used for the provision of insurance, which is based on facts rather than perception of the asset and its historical uses and claims. If insurance provision can be made more accurate, surely it can be made cheaper and more accessible while saving time, money and resources for insurance companies?

“If insurers can track the asset, not the consumer, we have the ability to embed insurance along with the asset, rather than relying on each new owner to update the insurer on the condition or use of the asset. This has the ability to change the insurance industry forever.”

“Within the insurance sector, there are some really interesting blockchain applications coming from innovative providers”

RICHARD DHUNY UK DLT AND CRYPTO LEAD, GFT

WRITTEN BY: BLAISE HOPE

Covéa Insurance PLC is owned by Covéa France, one of the largest insurers in France. The UK arm was founded in 2012 and is something of a laboratory for testing new and innovative approaches in the marketplace. They’re the partner of choice for a number of high-street brands, providing award winning claims handling and customer service to match the reputation of their clients.

Graeme Howard is Covéa’s Chief Information Technology Officer and the leader of a new era heralded by their micro service based approach to insurance platforms. Howard’s journey is a life lived through insurance and technology. A conservative and traditional industry, often slow and resistant to change, but where even minor change has an enormous impact on the end customer.

Covéa Insurance PLC was officially formed through a 1999 merger of three smaller UK insurance companies. Howard’s charge allows for the incubation of Covéa’s most ambitious changes and sees its new platform approach as the launch of a new era in insurance technology.

While applications of this technology are harder in an industry as traditional as insurance, that is precisely why digital

transformation here is so meaningful. Covéa Insurance is a young, dynamic and large business with a heritage behind it, as well as the flexibility and evolution of its offering, fit for the digital age.

Covéa Insurance’s test and learn approach especially applies to the tech side of things, which helps foster innovation and allows Howard the autonomy to choose partners like Camunda and Dell.

The company has created a new micro services, event driven policy administration platform to support the new Vitality Car insurance product. This platform was created in partnership with Vitality and also utilising some of the insurtech Iotatech components. That launched in June and further enhancements to the platform are now in the works.

“I think it's really important that the insurance offerings meet the needs and desires of the customer. It's not necessarily about the cost of product”

GRAEME HOWARD CHIEF INFORMATION TECHNOLOGY OFFICER, COVEA INSURANCE

The convenience of an API for carriers is something Howard is very excited about.

Howard began his career at British Aerospace as an engineer hired through the firm’s graduate scheme as a software engineer. Later, he moved on to Motorola Solutions, helping roll out radio systems across the UK, working his way up into more senior roles including Director roles in architecture and design of software solutions. His last role was designing and implementing a standardised intelligent network management systems to support 350 Managed Service systems across the globe.

“Process automation, process definition, Six Sigma [process improvement], and really understanding, how to write business processes are critical” explains Howard. “Creating those sort of cookie cutter approaches, to a blueprint of how we could operate an IT system, in simplistic terms, and then migrate that out across different networks, across the globe to multiple, different channels and hundreds of customers.”

Howard landed his first Chief Technology Officer role at global relocations firm Santa Fe as it embarked on a large-scale digital transformation for its 98 offices across 48 countries. He was later promoted to the global Executive team as CIO as the rollout gathered pace and complexity.

“There's a lot of transferable skills,” he says, “but by moving industries, there's a huge amount of learning but equally, coming in new to an industry allows you to challenge some of the previous sacred truths.”

After two years at Santa Fe, it was time for a new challenge. “I was looking for somewhere I could really get my teeth stuck into a major transformational role where I could really make a difference. I pretty quickly picked insurance as a sweet

TITLE: CHIEF INFORMATION TECHNOLOGY OFFICER

INDUSTRY: INSURANCE

LOCATION: ENGLAND, UNITED KINGDOM

A dynamic board level CTO/ CIO specialising in the delivery of disruptive transformational digital programs and Agile software development to drive organisational growth, performance, operational efficiency and profitability. Passionate about enabling disruptive digital innovation to flourish within the business while ensuring that technology is fully integrated into the business functions that it supports. Thrives in fast paced environments while combining distinctive problem solving and strategic capabilities with proven success in driving execution with customers, through both regional and global teams as well as virtual organisations.

We’ll stop at nothing to empower you with technology that drives your business forward — from cloud, cybersecurity, storage and beyond. Because when organisations like yours can focus on innovation, the possibilities are limitless.

spot that I felt was ripe for disruption and I felt it was massively underserved from a digital perspective. There wasn't really a huge amount of change going on. You could see what happened within the banking industry, and how much

the digitisation of banking had made an impact. So I was keen to try and find a role in an insurance company.”

That was when Graeme first encountered Covéa Insurance: “We had a discussion and I think it was interesting that they were of the right sort of size to be able to implement a strategy. The leadership team were keen to do something different and it fitted with my aspirations and desire to drive forward.”