ROSHN: Shaping Saudi’s Urban Vision

With five projects having already been launched across three Saudi regions as of February 2024, demand for ROSHN infrastructure continues to grow

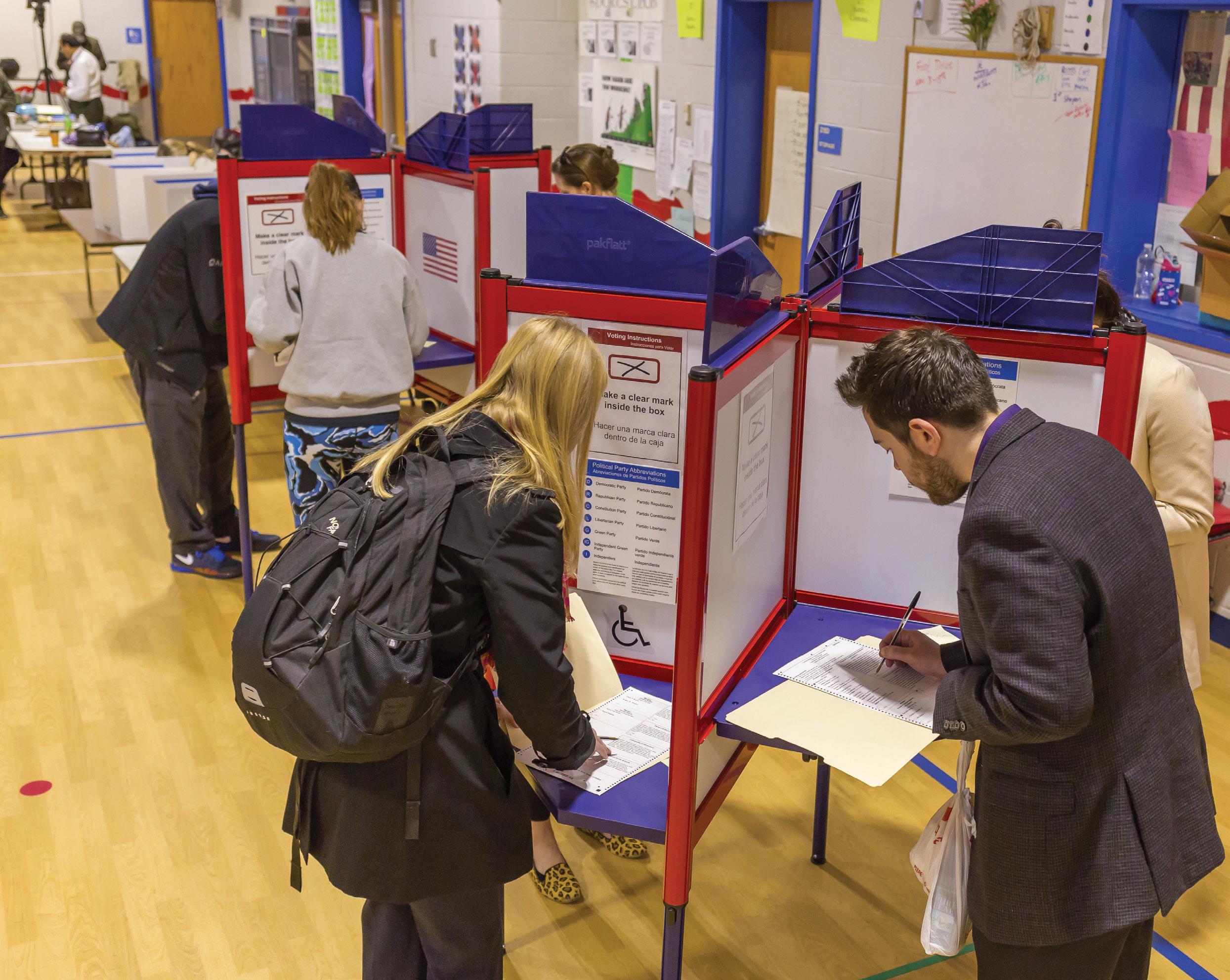

Charting Bidenomics’ future in an election year

Apple in 2024: What's Tim gonna 'Cook'? UBS's

Credit

Issue 39 Volume 24 MAR - APR 2024 UK £4 Europe ¤5.35 US $6

Suisse takeover: From crisis to success

Shaping Saudi’s Urbanisation

In early 2024, Tim Cook, the CEO of Apple, found himself at the helm amidst a flurry of formidable challenges. The renowned tech titan encountered patent disputes, resulting in the removal of key features from two of its flagship smartwatches, compounded by the weight of antitrust lawsuits. Furthermore, Apple's diminishing market share in China loomed ominously over its worldwide trajectory. Adding fuel to the fire, Wall Street analysts voiced concerns about the overvaluation of Apple's stocks. Now, the onus falls squarely on Tim Cook to craft a masterful strategy to navigate Apple through these turbulent waters and emerge stronger than ever.

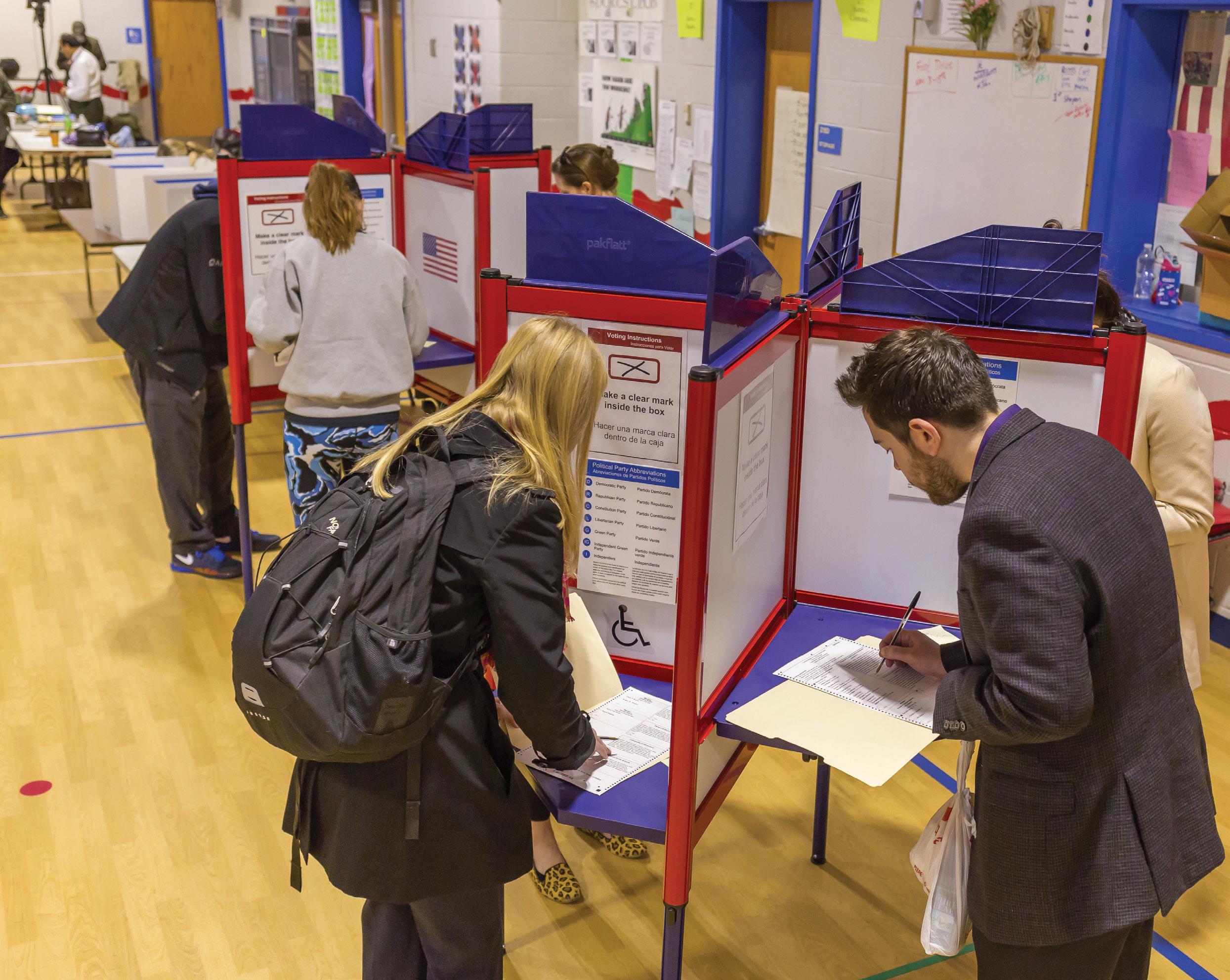

Meanwhile, all eyes are on President Joe Biden as the United States gears up for another election cycle. As the country braces for a potential rematch between Biden and Trump, it's imperative to scrutinise the state of the American economy. Has the touted "Bidenomics" strategy delivered on its promises, and what can we expect from a Biden 2.0 administration? International Finance Magazine delves into these pressing questions.

It has also been precisely one year since the UBS Group finalised its acquisition of its Swiss counterpart, Credit Suisse Group. The merger, orchestrated on March 19, 2023, under the watchful eye of Swiss authorities, aimed to avert potential turmoil in global financial markets. We undertake a comprehensive evaluation to determine whether this acquisition has proven to be a lucrative venture for UBS.

And finally, gracing the cover story of our March-April 2024 edition is the remarkable tale of the ROSHN Group.

Saudi Arabia's premier national real estate developer ROSHN Group stands as a beacon of visionary progress in the Gulf nation's journey towards diversification. Through its dynamic developments, which seamlessly fuse tradition with innovation, ROSHN Group is reshaping the future of the Kingdom's urban living.

International Finance | March - April 2024 | 3

editor@ifinancemag.com www.internationalfinance.com

MAR - APR 2024 VOLUME 24 ISSUE 39 EDITOR’S NOTE

ROSHN: SHAPING SAUDI’S URBAN VISION

With five projects having already been launched across three Saudi regions as of February 2024, demand for ROSHN

IN CONVERSATION

‘PRIORITISING CONTINUOUS LEARNING IS KEY TO SUCCESS’ Sodexo UK Corporate Services MD Jade Boggust noted that for aspiring leaders in facilities management, prioritising continuous learning is key

UBS reported a net loss of $785 million for the June-to-September 2023 quarter, driven by

THE BATTLE AGAINST SIM CARD THEFT

The lucrative opportunities that SIM card theft presents to criminals is one of the main causes of the recent surge in SIM card theft

46 MOLIM:

68

88

4 | March - April 2024 | International Finance INSIDE 22 THE GREAT CANADIAN HOUSING SAGA Affordability is a big concern in Canada, particularly in Ontario and British Columbia, where RBC's Hogue highlights that high house ownership expenses have reduced resales ELECTION YEAR

White House maintained that Bidenomics helping the US economy to add over 13 million jobs by June 2023

The

MERGER

ANALYSING UBS CREDIT SUISSE

the

Suisse rescue deal,

in

$2 billion issues surrounding the AI capabilities 52 94 16 74 INDUSTRY ECONOMY BANKING AND FINANCE TECHNOLOGY IF MAR - APR 2024

costs tied to

Credit

which came

at

continues to grow

infrastructure

36

INSIGHT

104

Transforming Credit Reporting

NBD

Delivering innovative financial solutions

Emirates

Egypt:

finexis advisory ensuring growth for HNWI clients

12 The battle over ‘Nakamoto’ identity

32 ASML: Powering the semiconductor industry

48 Future banking: Tech-first solutions

58 Financial planning for families: The success formula

70 Understanding currency fluctuations

80 RCT: The science of decision-making

90 Apple in 2024: What's Tim gonna 'Cook'?

108 Innovate & adapt: Next-gen fleet management

www.internationalfinance.com

OPINION

OPINION

Embedded finance refers to the integration of financial services into non-financial products and services

International Finance | March - April 2024 | 5 ANALYSIS

REGULAR 03 EDITOR'S NOTE Shaping Saudi’s Urbanisation 06 TRENDING Sterling Bank to boost FX earnings 08 NEWS

group raises bid for Macy's 62 GRAHAM KITCHING THE ROLE OF EMBEDDED FINANCE IN 21ST CENTURY

Investor

BANKING

# TRENDING

Sterling Bank to boost FX earnings

Sterling Bank, the top commercial bank in Nigeria, and Export And Sell Nigeria Limited (EAS), a preeminent international trade consultancy, have announced a strategic alliance to host the "Export to Wealth" conference. This innovative programme intends to equip at least 2,000 export-ready companies with the knowledge and resources they need to make profitable sales on global e-commerce platforms. Another significant step in Sterling Bank's ongoing commitment to support economic growth and enable Nigerian businesses to succeed in the global market is the partnership with Export and Sell Nigeria Limited.

AUS to drive IoT

In a recent on-campus Memorandum of Agreement ceremony, American University of Sharjah (AUS) and Waseela, a leading master systems integrator that specialises in large-scale ICT (information and communication technology) projects throughout the Middle East, joined forces to advance engineering education and innovation in the Internet of Things (IoT) field. Under the new framework, Waseela will support AUS students' training through internships, offering priceless practical experience to supplement academic learning and fulfil graduation requirements. Both parties will work together to supervise chosen capstone and research projects, promoting industry-relevant research and encouraging innovation.

UK economy turns a corner

ECONOMY TECHNOLOGY

The United Kingdom’s services sector remained in the greener territory in February 2024. The S&P Global/CIPS UK services PMI survey showed a reading of 53.8 during the month, as growth slowed marginally from 54.3 in January.

Economists said that the data suggested the “UK economy turning a corner." Tim Moore, economics director at S&P Global Market Intelligence, said, "New business intakes were a particularly bright spot as service providers reported the fastest order book growth since May 2023. Survey respondents cited rising business and consumer spending, linked to improved optimism towards the broader economic outlook."

Intel brings Bitcoin mining chip

Intel Corporation has made waves in the cryptocurrency mining industry by revealing details of its new mining chip, designed to significantly enhance Bitcoin (BTC) mining efficiency. During the IEEE International SolidState Circuits Conference (ISSCC), a pivotal event for the electronics and chip manufacturing industry, Intel introduced Bonanza Mine (BMZ2), its secondgeneration Bitcoin mining ASIC. This ultra-low-voltage, energy-efficient mining chip promises to deliver a robust 40 terahashes per second (TH/s), setting a new benchmark in the field.

At Glance

Top Freight and Logistics Companies in UAE and their market share

Deutsche Post DHL Group

143 Million

Agility Logistics

132 Million

Ceva Logistics

89 Million

Aramex International LLC

83 Million

Al Futtaim

66 Milliont

Careem

58 Million

Source: mordorintelligence.com

Source: mordorintelligence.com

6 | March - April 2024 | International Finance

BANKING

ECONOMY

China targets economic growth of 5%

Chinese Premier Li Qiang recently stated that the world's second largest economy aiming for an approximately 5% growth by 2024. Speaking at the 14th National People's Congress (NPC), he outlined the primary development goals for this year, which include over 12 million new urban jobs and a roughly 3% increase in the Consumer Price Index (CPI).

Li Qiang also mentioned the expansion of personal income in tandem with economic growth, fundamental balance of payments

equilibrium, the production of more than 650 million metric tons of grain, a decrease of roughly 2.5% in the amount of energy used per GDP unit, and ongoing environmental advancements. Li acknowledged reaching the target "will not be easy," adding a proactive fiscal stance. According to the Chinese Premier, all municipalities and government agencies should enact more policies supporting maintaining stable employment, economic growth, and expectations.

Ones to Watch

CARL COOK

CEO OF THE COOK GROUPT His company announced plans to sell its West Lafayette-based subsidiary, Cook Biotech, to RTI Surgical, a surgical implant contract development manufacturing organisation headquartered in Alachua, Florida

DAVID DUFFIELD FORMER CHAIRPERSON OF WORKDAY

David Duffield company's shares fell more than 5% recently, trading close to the $275 per share mark after the company missed the cut to be included in the S&P 500

JEFFERY HILDEBRAND CEO OF HILCORP ENERGY COMPANY

JEFFERY HILDEBRAND CEO OF HILCORP ENERGY COMPANY

His company agreed to pay $34.6 million to resolve claims it knowingly underpaid royalties for oil and natural gas it extracted from leased federal lands, the US Department of Justice said

International Finance | March - April 2024 | 7

NEWS | INSIGHTS | UPDATES | DATA

Value of investments in Cloud IT infrastructure worldwide from 2013 to 2022 (In Billion US Dollars) Source: Statista 2013 3.4 2014 4.7 2015 4.9 2016 5.2 2017 5.5 2018 5.7 2019 6.3 2020 6.9 2021 7.7 2022 8.4

By the Numbers

The bidders released a statement stating that the new offer represents a 33.3% premium over the closing price of Macy's shares

Malaysia Airlines Flight 370, a Boeing 777, vanished from view as it was travelling from Kuala Lumpur to Beijing

Investor group raises bid for Macy's

An investor group has improved its bid after being rejected in December 2023 from its initial offer to purchase the failing US department store chain Macy's.

Arkhouse Management and Brigade Capital Management increased their initial offer of $5.8 billion to $24 per share, up from the previous figure of $21. The move now puts the acquisition's value at $6.66 billion.

The bidders released a statement stating that the new offer represents a 33.3% premium over the closing price of Macy's shares.

Additionally, they stated that they could provide additional details regarding the proposed deal, such as the fact that "Fortress Investment" and "One Investment Management" were participating with financial contributions. Brigade Capital Management and Arkhouse made an unsolicited takeover offer, which Macy's rejected in January.

The 166-year-old department store chain, best known for its annual "Thanksgiving Day Parade" in New York, revealed that it would close nearly a third of its namesake stores by 2026 in order to focus on growing its luxury Bloomingdale's and Bluemercury brands. It also announced in January 2024 about cutting

31.5% of its workforce.

"We remain frustrated by the delay tactics adopted by Macy's Board of Directors and its continued refusal to engage with our credible buyer group," the investors said.

"While the restructuring plan Macy's unveiled last week (in February 2024) failed to inspire investors, the fourth quarter earnings and year-end results have given us further confidence in the long-term prospects of the Company if redirected as a private company," the statement said.

According to Macy's annual report, as of the 2022 end, it employed about 94,500 people and ran 722 stores. It now intends to shut 150 of them down. The company released its year-end results for 2023, revealing declining revenues and a sharp decline in profits.

According to the company, sales were $23.1 billion, which was a 5% decrease from the prior year. Net profits also dropped steeply by 91%.

For years, department stores have struggled with declining sales as customers shift their shopping habits online.

This trend has been made worse by the COVID-19 pandemic.

8 | March - April 2024 | International Finance

IN THE NEWS

FINANCE BANKING INDUSTRY TECHNOLOGY

MH370 search: Malaysia may start new mission

The search for flight Malaysia Airlines MH370 may resume ten years after its disappearance, with Malaysian Prime Minister Anwar Ibrahim declaring that he would be "happy to reopen" it in the event that "compelling" evidence surfaced.

"If there is compelling evidence that it needs to be reopened, we will certainly be happy to reopen it," he said when asked about the matter during a visit to Melbourne.

His remarks were made on the tenth anniversary of the aircraft's disappearance in the Indian Ocean, which had 239 people on board.

"I don't think it's a technical issue. It's an issue affecting the lives of people and whatever needs to be done must be done," Ibrahim noted further.

On March 8, 2014, the Boeing 777 vanished from the radar as it was travelling from Kuala Lumpur to Beijing. The search operation (being the biggest in the aviation industry's history) was halted in January 2017.

Transport Minister Anthony Loke informed that "Malaysia is committed to finding the plane...cost is not the issue," while stating his plan to meet the representatives of the Texas-

based marine exploration company Ocean Infinity, which carried out an earlier, fruitless search, to talk about a potential new mission.

As per the latest news, Ocean Infinity has submitted a proposal to the Malaysian government for a new search in the southern Indian Ocean where the MH370 is believed to have crashed.

The Texas-based marine robotics company, which had last attempted in 2018, to identify the aircraft, has now proposed an all-new nofind, no-fee search.

Reports even suggest that Loke has promised Ocean Infinity that, if the venture can provide credible evidence on the flight's final resting place, he would push to greenlight the mission.

Ocean Infinity's CEO Oliver Plunkett told the media, “We now feel in a position to be able to return to the search for MH370, and have submitted a proposal to the Malaysian government."

There was very little evidence of the aircraft in an earlier Australia-led search that scanned 120,000 square kilometres in the Indian Ocean, with only a few pieces of debris being discovered.

International Finance | March - April 2024 | 9

In February, there were 198 ships that called at Qatar's three ports

Tether issues a stablecoin, designed to maintain a constant value of $1

Egypt's MoF to borrow $14.87B

Egypt's Ministry of Finance hopes to raise EGP 459.5 billion in March 2024, with the issuance of 26 T-bills and bond tenders, totalling EGP 440 billion for 16 T-bills and EGP 19.5 billion for 10 bonds. This is a component of the Abdel Fattah El-Sisi government's plan to borrow EGP 1.647 trillion from the market to finance the budget deficit and pay off maturing debt in the third quarter of FY 2023-2024. The Central Bank will hold four tenders for 91-day, 182-day, 273-day, and 364-day Treasury bills, each worth EGP 100 billion, EGP 120 billion, EGP 100 billion, and EGP 120 billion, respectively. In addition, the Central Bank will tender two zero-coupon bonds worth EGP 4 billion.

Qatar's TEU containers handling

In February 2024, 111,341 twenty-foot equivalent units (TEUs) of containers were handled by the Mwani Qatar ports, an increase of roughly 8% from January. According to Mwani Qatar on its X platform, the ports also saw growth of 186% in RORO units, 127% in livestock, and 186% in general and bulk cargo. In February, there were 198 ships that called at Qatar's three ports. In addition, the ports handled 169,212 tonnes of shipments of general and bulk cargo, 7,163 RORO vehicle units, 71,219 livestock heads, and 40,898 tonnes of building materials. One of the main objectives of the "Qatar National Vision 2030" is economic diversification, which is supported by the container terminals' design.

10 | March - April 2024 | International Finance

IN THE NEWS FINANCE BANKING INDUSTRY TECHNOLOGY 2013 372 2014 388 2015 446 2016 487 Market Size of Artificial Intelligence in Mining from 2013 to 2022 (In Million) 2017 521 2018 538 2019 634 2020 667 2021 767 2022 783 Source: GlobalData

Stablecoin Tether exceeds $100 billion tokens

The number of dollar-pegged stablecoins issued by Tether has crossed the $100 billion mark, amid the bitcoin setting up new price records throughout March 2024. Blockchain-enabled platform Tether issues a stablecoin, designed to maintain a constant value of $1. The product is widely used to move money in cryptocurrency without being exposed to price swings. At just over $100 billion in circulation, Tether has now emerged as the third-biggest cryptocurrency, with around $27 billion worth of the tokens having been issued in 2023, stated market tracker CoinGecko. Tether said that it maintains its dollar peg by holding dollar-based reserves which match the volume of cryptocurrencies it has created.

AI will create hunger for talent: Jeremy Jurgens

Jeremy Jurgens, Managing Director of the World Economic Forum, stated that contrary to popular belief, the use of technology and artificial intelligence will not result in a decrease in the need for labour. “Overall we continue to see geopolitical tensions, inflation is subsiding but not at the pace everybody would have liked, resulting in high levels of economic uncertainties. Amidst all this India has emerged as a positive spot globally. While all this is happening in the global economy, we also see the emergence of technology especially AI, renewables, synthetic biology etc. So we have these ongoing tensions alongside these opportunities," he said, while delving into the current scene of global economies.

International Finance | March - April 2024 | 11

2013 21.5% 2014 33.1% Annual growth rate of mine production worldwide with help of AI from 2013 to 2022 (In percentage) 2015 36.3% 2016 43.1% 2017 52.1% 2018 59.7% 2019 61.4% 2020 63.2% 2021 65.4% 2022 65.8% Source: Statista

ANALYSIS NAKAMOTO BITCOIN

Craig Wright mostly cleaned up his internet personas but did not initially reply to claims that he was Satoshi Nakamoto

The battle over ‘Nakamoto’ identity

IF CORRESPONDENT

The world first saw Bitcoin in October 2008, thanks to Satoshi Nakamoto. But the truth is nobody is still unaware of Nakamoto's identity. One individual emerged from the conjecture: Craig Wright, an Australian computer scientist who has claimed to be Nakamoto since 2016. Since then he has been trying to provide evidence to the court of his identity.

In the wake of the 2008 global financial crisis, Nakamoto published a white paper outlining plans for a peer-to-peer payment system

Wright's claim to Satoshihood will be contested in a trial that will start in the United Kingdom High Court. The Crypto Open Patent Alliance (COPA), a nonprofit organisation of tech and cryptocurrency companies, is bringing the case in response to numerous lawsuits that Wright has filed against other parties and Bitcoin developers, attempting to claim intellectual property rights over Bitcoin as its purported inventor.

The COPA alleges that Wright's actions have had a "chilling effect," discouraging developers and impeding Bitcoin’s development. It is asking for an order prohibiting Wright from denying that he did not write the original code and that he does not possess the copyright to the white paper that first suggested Bitcoin. In essence, COPA is requesting that Wright be declared not to be Nakamoto by

the court.

The decision will directly affect a complex web of related cases that will decide whether Wright can restrict the use of the Bitcoin system and prohibit developers from working on it without his consent.

"There are a lot of stakes involved," said a representative of the Bitcoin Legal Defence Fund, a non-profit that supports Bitcoin developers in court. The representative asked to remain anonymous out of concern for Wright's potential legal retaliation.

“Wright is asking for ultimate control over the Bitcoin network in the eyes of the law," the source told WIRED.

In the wake of the 2008 global financial crisis, Nakamoto published a white paper outlining plans for a peer-to-peer payment system and new electronic money that would do away with the need for unreliable middlemen like banks. He sent the first Bitcoin transaction in January of 2009. After that, he vanished into thin air a little over two years later. Finding Nakamoto became a mission.

Nakamoto mystery deepens

According to Jameson Lopp, a software developer and early adopter of Bitcoin, the lack of a "leader" has helped Bitcoin in the interim by requiring it to develop under an unadulterated anarchy system, which has made it "robust."

Anyone who volunteered their time to work on Bitcoin could have a say in its direction, free from

12 | March - April 2024 | International Finance

INDUSTRY

the censorious influence of a founder. However, Wright's assertion that he is Nakamoto raises potential complications.

Wright was first nominated as a potential candidate by both WIRED and Gizmodo on the same day in December 2015. The original story, based on a trove of leaked documents, proposed that Wright had “either invented Bitcoin or is a brilliant hoaxer."

WIRED released a follow-up article a few days later, highlighting inconsistencies in the data that bolstered the latter conclusion.

Wright mostly cleaned up his internet personas but did not initially reply to claims that he was Nakamoto. However, by the next year, he had started to identify himself as the person who created Bitcoin. He has made numerous attempts—using a variety of techniques—to unequivocally substantiate the assertion, winning himself a devoted following of believers.

In 2016, Wright succeeded in persuading Jon Matonis, the former director of the advocacy group Bitcoin Foundation, and Gavin Andresen, an early contributor to the underlying software of Bitcoin. The billionaire Calvin Ayre, whose venture capital firm recently bought a majority stake in one of Wright's businesses is his most outspoken supporter.

Is Wright’s narrative falling apart?

Wright hasn't been able to change the consensus that the identity of the founder of Bitcoin is still a mystery. Lopp asserts that only a small percentage of Bitcoin users—those who "really want for there to be a Satoshi figure"—buy into Wright's narrative. Recently, Andresen reversed his stance, saying, "I now realise it was a mistake to trust Craig Wright as much as I did. I regret getting sucked into the 'who is (or isn't) Satoshi's game,' in response to a previous blog post.”

Wright appears to have turned to litigation as his main strategy for pursuing his claim since 2019. He has accused those responsible for maintaining the Bitcoin codebase, exchanges, and developers of violating his copyright. He has also filed libel suits against those who have publicly criticised him.

According to Lindsay Gledhill, IP partner at Harper James, Wright's approach in the lack of a patent appears to be to utilise legal action to "cobble together a basket of rights" that, when taken collectively, serve a similar purpose. Wright says she has tried to "use the wrong tool to do the job of a patent" in an attempt to claim ownership of Bitcoin. That's the main idea behind it.

Wright has brought three lawsuits, one against a group of Bitcoin developers and the other against cryptocurrency exchanges Coinbase and Kraken,

International Finance | March - April 2024 | 13

ANALYSIS NAKAMOTO BITCOIN INDUSTRY

all based on the theory that he is Nakamoto. As a result, Edward James Mellor, the judge overseeing the cases, has made arrangements for the COPA proceeding to start first. In the vernacular of the courts, it will function as a preliminary issue trial, the decision of which will also be honoured in the related disputes.

According to IP specialist Rachel Alexander of the legal firm Wiggin, the identity problem is fundamental.

"It becomes much more difficult to pursue the broader claims if COPA can put an end to that," the expert noted.

It is anticipated that the COPA case will last six weeks. Wright is scheduled to testify early, and the majority of the remaining time will be devoted to evaluating the veracity of the documentary evidence supporting his claim to be Nakamoto.

Charges against Wright

The principal accusation is that Wright falsified numerous of these records to give the impression that they were written at a specific period. A COPA representative requests that their identity not be made public in order to shield themselves from potential legal action from Wright.

"COPA has filed extensive evidence that we believe shows Wright has fabricated and forged," the representative said, while asserting that, "COPA systematically reviews and dismantles the documents in reports filed with the court, pointing out 'anachronisms' that undermine his claim to have been Satoshi Nakamoto."

Several individuals in the Bitcoin community, such as Lopp and blogger-podcaster Arthur

van Pelt, have made prior efforts to enumerate Wright's purported misrepresentations. Van Pelt refers to Wright's actions as a "Satoshi Nakamoto cosplay" and the narrative he has created as a "Potemkin village." Wright has written off criticisms of this nature as "basically fluff." He declared before a Norwegian court in September 2022 that he had "never changed any documents or manipulated any documents."

According to Gledhill, it is noteworthy that one of the highest courts in the UK is permitting COPA to make forgery claims.

She continued, "The courts will not let you make vague suggestions." This is not an accusation that the court will automatically accept. Strict guidelines apply. To put it another way, COPA would not be permitted to accuse Wright of forgery unless the court determined that it had sufficient justification to do so.

According to Alexander, the disagreement over the documents will be the "heart of the case." That will be the main problem the court has to deal with. Wright's chances of winning the COPA case and those who depend on its outcome would be harmed if the judge finds him

14 | March - April 2024 | International Finance

Top 10 Blockchain Statistics

About 46 million Americans own a share of Bitcoin

29% of all millennial American parents own cryptocurrepncy

An estimated 1 billion people around the world use cryptocurrencies

There are more than 250,000 confirmed transactions of Bitcoin daily

Around 50 million unique addresses have a non-zero balance of Bitcoin

Research from July 2021 shows that 89% of American adults have heard of Bitcoin

24% of Americans said they don’t understand how cryptocurrency works, let alone a Bitcoin wallet

By 2025, financial analysts say, the global blockchain market will grow by $39.17 billion US Dollars

51% of Americans in May 2021 had bought cryptocurrency for the first time within the last 12 months

Cryptocurrency creator Satoshi Nakamoto is thought to own 1 million bitcoins, worth $40 billion to $60 billion US Dollars

guilty of forgery. It could also result in a contempt of court charge against him.

Alexander continued, "The punishment for this could be a fine, imprisonment, or both."

Wright made COPA an unexpected settlement offer on January 24, two weeks before the start of the trial. Under the terms of the proposal, Wright would give up the right to pursue IP rights over Bitcoin and halt his own legal action in the related cases.

COPA would be required to acknowledge Wright as Satoshi Nakamoto in exchange for a number of other requirements. Tweeting that there were "loopholes that would allow (Wright) to sue people all over again," COPA declared that it would "hard pass" on the offer.

The representative for COPA states that the organisation hopes a decision in its favour will "create a safe space" where developers won't be "bullied or cowed" into stopping work on crypto-

currency technologies.

What if Wright wins the case?

Wright's victory would essentially mean the opposite of COPA's, which would be a return to business as usual. It would be easier for Wright to prevail in the related cases in which he is the plaintiff if the court determines that Wright is, in fact, Nakamoto, the author of the Bitcoin white paper. Wright accuses Bitcoin developers of violating his intellectual property rights by making "fundamental changes" to the system without first obtaining a license or authorisation in the most well-known of those cases, which is colloquially referred to as the Database Rights Case.

By essentially requesting a ruling, he would gain control over the primary software and prevent developers from making changes to the Bitcoin code without his consent. The effects would also be felt globally.

"Each country will analyse a copyright case on their own basis, but

the general principles underneath copyright law are harmonised by an accord that has been ratified by the vast majority of nations," James Marsden, a senior associate at the law firm Dentons said.

In other words, if a United Kingdom court finds that Wright is Nakamoto, courts all over the world will probably conclude the same.

According to Lopp, the architecture of the Bitcoin network prevents code changes from being enforced on the parties operating the client software, or "nodes," which support the payment system. Changes are intended to be suggested only, not imposed. This implies that Wright would be unable to alter Bitcoin on his own.

However, if he prevails, Wright might use the validation of his intellectual property rights to bring legal action against people who do not apply for a license, making it more difficult for developers to work together freely on the Bitcoin codebase—thereby ruining the unspoiled anarchy. It might be necessary for project developers to work in secret in order to keep themselves safe.

"We'd have to become much more ardent cypherpunks. The system's functionality and health may suffer if developers become less and less willing to take legal action. There's a chance that Bitcoin will become less well-known over time," Lopp said.

International Finance | March - April 2024 | 15

Source: explodingtopics.com

INDUSTRY FEATURE CANADA HOUSING

Affordability is a big concern in Canada, particularly in Ontario and British Columbia, where RBC's Hogue highlights that high house ownership expenses have greatly reduced property resales

The great Canadian housing saga

The last few years have seen a rollercoaster ride for the Canadian housing market. Since rent increased by 8% in 2023, you may wonder if 2024 is the right year to purchase a home.

Nearly one-quarter (24%) of Canadians between the ages of 18 and 34 say they might or probably will purchase a home in 2024, while 22% of those between the ages of 35 and 54 are considering buying this year, according to Wahi's most recent 2024 Homebuyer Intentions Survey. Of those considering a home purchase, 49% await how home prices develop, and 48% want to wait to see how interest rates change.

Whether a first-time or seasoned home buyer or if you're considering purchasing a home this year, there are a few things to consider before making the important call.

Economists’ perspective

As per the Canadian Real Estate Association (CREA), despite interest rates being at a 22-year high, there has been an increase in activity in the home market.

CREA chair Larry Cerqua said, "The market has been showing some early signs of life over the last couple of months, probably no surprise given how much pent-up demand is out there."

Home sales activity increased 3.7% between December 2023 and January 2024, according to CREA data, building on the 7.9% month-over-month gain seen recently.

The Greater Toronto Area, Hamilton-Burlington, Montreal, Greater Vancouver the Fraser Valley, Calgary, and the majority of areas in Ontario's Greater Golden Horseshoe and cottage region lead the nation in sales increases once again.

"The biggest year-over-year gain since May 2021 was observed in the actual (not seasonally adjusted) number of transactions, which came in 22% above January 2023. Having said that, the double-digit gain was more indicative of the base effect from the

FEATURE CANADA

IF CORRESPONDENT

comparison to January 2023, which was the worst start to almost any year in the previous 20 years, given that current activity is still running below average levels," CREA said.

In January 2024, the number of newly listed homes increased by 1.5%, although it was still very near the lowest level since June 2023.

Robert Hogue, Assistant Chief Economist at RBC, stated that "the larger window of opportunity for buyers is likely to open only after interest rates have dropped materially—something we foresee in the latter stages of 2024 or 2025. This is particularly true for first-time purchasers who might have more limited funds.”

According to Hogue, "There will be a lot of pent-up demand to satisfy in the market once confidence returns, which could heat things in a hurry. If interest rates start to decline in the middle of the year as many predict. Expect little to no decline in home prices, nevertheless, since poor affordability conditions will restrain the recovery."

Pent-up demand may drive up prices, but shocks from mortgage renewal payments (as mortgages renew at much higher rates) may cause more homeowners to list their properties on the market, balancing supply and demand.

Hogue projected a 9.2% increase in Canadian home resales for 2022, following declines of 25.1% and 11.1% in 2021.

A "return to the rollicking price gains of recent years, and previous highs for some locations, is unlikely at this point," according to BMO Senior Economist Robert Kavcic. This is good news for purchasers in areas like Ontario, where he anticipates further pricing pressure in the spring. However, costs would remain high, and "the subsequent rebound

will likely be temperate due to stillchallenging affordability."

The Bank of Canada is probably done raising interest rates and will start lowering them shortly, according to Kavcic, who agrees with most analysts: "We believe the Bank will be in a position to cut rates around mid-year, with 100 bps or 1% of easing through 2024. Mortgage rates will drop as a result of those reductions.”

Despite a spike in home sales in December 2023, Marc Desormeaux, Principal Economist at Desjardins, predicts lower prices and sales this spring.

Desormeaux does, however, also anticipate a broad-based increase in housing prices in the middle of the year that will last into 2025, in keeping with the Bank of Canada's anticipated interest rate reductions in the middle of 2024.

He predicts that the more expensive areas of Toronto and Vancouver, which are more susceptible to changes in interest rates, would see the biggest recoveries. But by historical standards, price increases will be "mild," particularly when compared to the pandemic-era real estate boom, when prices nationwide increased by more than 20% when loan rates were still low.

Bank of Canada's stance

Because the Bank of Canada's monetary policy influences mortgage interest rates, its perspective on the housing market is significant. To curb consumer spending when inflation increases, the Bank hikes rates; but, when inflation approaches its target of 2%, the Bank is more likely to lower rates. The prime rate, now 2.2% higher at 7.2% than the overnight rate, is impacted by increases in the overnight lending rate.

Lenders utilise the prime rate to

Number of housing units sold in Canada from 2018 to 2023, with a forecast by 2025

2018

457,600

2019

489,873

2020

552,433

2021

665,934

2022

498,269

2023

443,511

2024

489,661

2025

525,498

Source: Statista.com

determine the interest rate on various products, including variable-rate mortgages. Consequently, the cost of borrowing increases as the prime rate does. However, the shelter component of the Consumer Price Index, or CPI, the most widely used inflation indicator, includes mortgage interest rates in addition to rental expenses. Thus, high mortgage rates lead to pressure on inflation.

The Bank of Canada maintained its 5% overnight rate target in its most recent rate decision, stating that while inflation is declining, certain CPI components are still too high to lower rates just yet. One of the most prominent elements is housing: according to Bank Governor Tiff Macklem, "Inflation in shelter services remains high—close to 7%—because of rising mortgage rate costs, higher rents, and other housing costs."

Macklem stated that while there was a "considerable uncertainty" around property prices, he anticipated that the

18 | March - April 2024 | International Finance

INDUSTRY FEATURE CANADA HOUSING

market would "rebound" in 2024 with predictions for interest rate decreases later in the year. He stated that although buyer demand would determine whether or not the Bank anticipates a "modest increase" in property prices.

Nevertheless, Macklem also stated that the apex bank is powerless to address the issue of home affordability.

For many years, the supply of housing has lagged behind the demand for housing, according to Macklem.

"There are numerous causes for this, including labour shortages, zoning constraints, and ambiguities and delays in the approvals process. Monetary policy cannot solve any of these issues,” the official continued further.

Industry's outlook

CREA has revised its projections for home sales and average home prices, citing the continued influence of interest rates as a primary factor shaping things for 2024 and 2025. The forecast

anticipates a modest 2.3% increase in the national home price, reaching $694,173 in 2024, with further growth expected in 2025. National home sales are predicted to rise by 7.3% in 2025, accompanied by a 4% increase in average home prices.

Significant sales gains are anticipated in provinces with robust housing demand, such as Alberta, as well as in regions experiencing a rebound from lower sales volumes, including Ontario, and Nova Scotia. Moreover, several provinces, including Alberta, Quebec, New Brunswick, Nova Scotia, and Newfoundland, are forecasted to see price gains surpassing the national average. Conversely, British Columbia and Ontario are expected to see prices remain stable. Contextually, the decline in home sales by 11.1% in 2023, compared to 2022, marked the lowest annual level since 2008.

Immigration and housing

There has been a lot of finger-pointing

as the nation's housing crisis worsens: at foreign investors buying up residential real estate, at local governments and their onerous zoning laws, and now, at immigrants and international students, who are the most recent group to come under fire for making the situation worse.

Canada, leading among G7 nations in growth rate, crossed the 40 million population threshold in June 2023 after experiencing an increase of more than a million in 2022. Immigrants made up almost all of those new Canadian citizens. The number of international students has also increased dramatically; as the country is expected to welcome 900,000 overseas students in 2024, three times the number from 2013.

Immigration Minister Marc Miller stated that "volume is volume, and it does have an impact," on the immigration wave, even though Canada's main political parties have been careful not to hold immigrants responsible for housing issues. The federal government is thinking of capping the number of overseas students to relieve some of the burden, but it is not going to back down from its recently raised annual objective of 500,000 new permanent residents by 2025.

However, Carolyn Whitzman, a housing policy researcher at the University of Ottawa and a specialist advisor to the University of British Columbia's Housing Assessment Resource Tools project, asserts that restricting immigration is not the answer.

"We have an inaccurate view of the problem because the millions of Canadians who currently live there as well as anticipated arrivals are not included in currently estimated housing needs. Immigrants are an easy target. We discussed the pressing need for a national social housing programme, the

International Finance | March - April 2024 | 19

FEATURE CANADA

lack of statistics on who genuinely needs housing, and our eagerness to turn the conversation toward immigration," she said.

How is this significant?

Overall, economists anticipate interest rate reductions to commence in mid-2024, contingent upon the Bank of Canada's assurance that inflation is managed. Interest rates impact the demand for property by potentially deterring purchasers from entering the market and influencing supply as homeowners with current mortgages may choose to sell when faced with interest rate fluctuations during renewal. This could result in a market favourable to buyers.

CMHC Senior Specialist of Housing Research Tania Bourassa Ochoa predicts that 2.2 million mortgage borrowers,

accounting for 45% of all outstanding Canadian mortgages, will need to renew their mortgages between 2024 and 2025.

"The majority of these borrowers secured their fixed-rate mortgages at historically low interest rates, most likely during the peak of housing prices around 2020 to 2021," she observed.

Decreasing interest rates may prompt potential buyers who have been holding off due to less favourable rates to reenter the housing market. This can lead to an increase in house prices, which is anticipated by the middle of 2024. Sales volumes and prices are projected to rise nationwide.

As per the CREA, recent price decreases have mainly occurred in Ontario markets, especially in the Greater Golden Horseshoe region, and to a lesser degree in British Columbia. In most parts

of Canada, prices remain stable, but certain regions, such as Alberta, New Brunswick, and Newfoundland and Labrador, continue to experience price increases.

Note that there are significant variations in market circumstances across different locations. A house located in a metropolitan area like Toronto will have a higher price compared to a house in a smaller town or village. Urban areas may have higher demand leading to competitive bidding among buyers, favouring the seller. In contrast, rural properties may take longer to sell, making sellers more willing to negotiate on price.

Will 2024 be favourable?

Borrowing costs are high, although home prices have decreased from their peak levels during the pandemic. Prices

20 | March - April 2024 | International Finance

HOUSING

INDUSTRY FEATURE CANADA

are anticipated to remain low in the first half of 2024, potentially encouraging buyers to enter the market. Affordability is a big concern in Canada, particularly in Ontario and British Columbia, where RBC's Hogue highlights that high house ownership expenses have greatly reduced property resales.

Long-term trends indicate an increase in home prices, which can create pressure for first-time buyers to enter the market promptly. Let's examine two situations to observe how interest rates and purchase costs impact your monthly budget. Both alternatives presuppose a minimal down payment.

Scenario A: Elevated interest rate, reduced house price. Buying a $500,000 home with a 5-year fixed-term mortgage at 5% will result in monthly mortgage payments of $2,873. By the end of the five years, you will have paid a total of $172,388, comprising $56,773 in principal and $115,615 in interest.

Scenario B: Involves a reduced interest rate and an increased house price. If the home's value increases to $525,000 (a 5% increase) and you obtain a 5-year fixedterm mortgage at 4.75%, your monthly mortgage payment will be $2,934. By the end of the five years, you will have paid a total of $176,046, consisting of $61,242 in principal and $114,804 in interest.

During the five years of the mortgage, you will pay a higher amount towards the principal and a lower amount towards interest, resulting in slightly increased monthly mortgage payments. Based on this example, it appears more advantageous to purchase a property when interest rates decrease.

If the price of the $500,000 house increases to $550,000, your monthly mortgage payment at a 4.75% interest rate will be $3,067. Over the five-year term, you will have paid $64,022 towards the principal and $120,017 in interest. You have reduced the principal amount more

significantly, although the total interest cost has increased. Additionally, you may not have the financial means to cover this increased monthly payment.

Setting aside these eventualities, it is hard to predict the timing of the housing market or the stock market, and these forecasts are not definitive.

According to the CREA, there was a 1.2% monthly decline in the Aggregate Composite MLS Home Price Index in January 2024. Compared to the 1.1% decline seen in December 2023, this indicated an acceleration of the decline.

The Greater Golden Horseshoe region of Ontario and, to a lesser extent, British Columbia has seen the most price reductions.

In other parts of Canada, prices are either barely changing or, in certain situations, notably in Alberta and Newfoundland and Labrador, are

still rising.

In January 2024, the real, nonseasonally adjusted national average house price was $659,395, a 7.6% increase from the same month in 2023.

"Sales are up, market conditions have tightened quite a bit, and there has been anecdotal evidence of renewed competition among buyers, however, prices are still trending lower in areas where sales have shot up most over the last two months," Senior economist at CREA Shaun Cathcart said.

When combined, these patterns point to a market that is beginning to recover from the past two years' difficulties, but still navigating them. So before you start your house search, keep your finances organised.

International Finance | March - April 2024 | 21 FEATURE CANADA

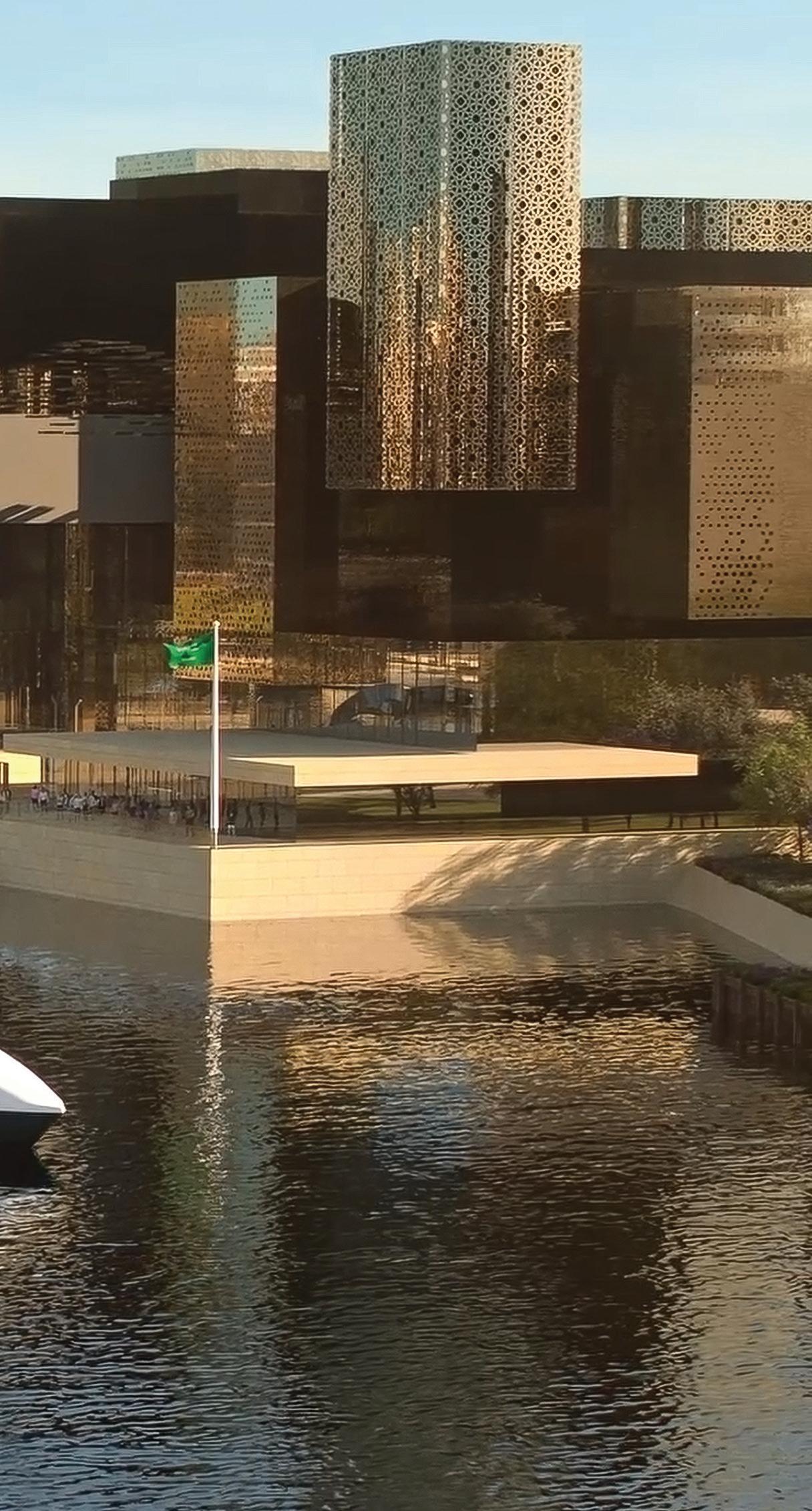

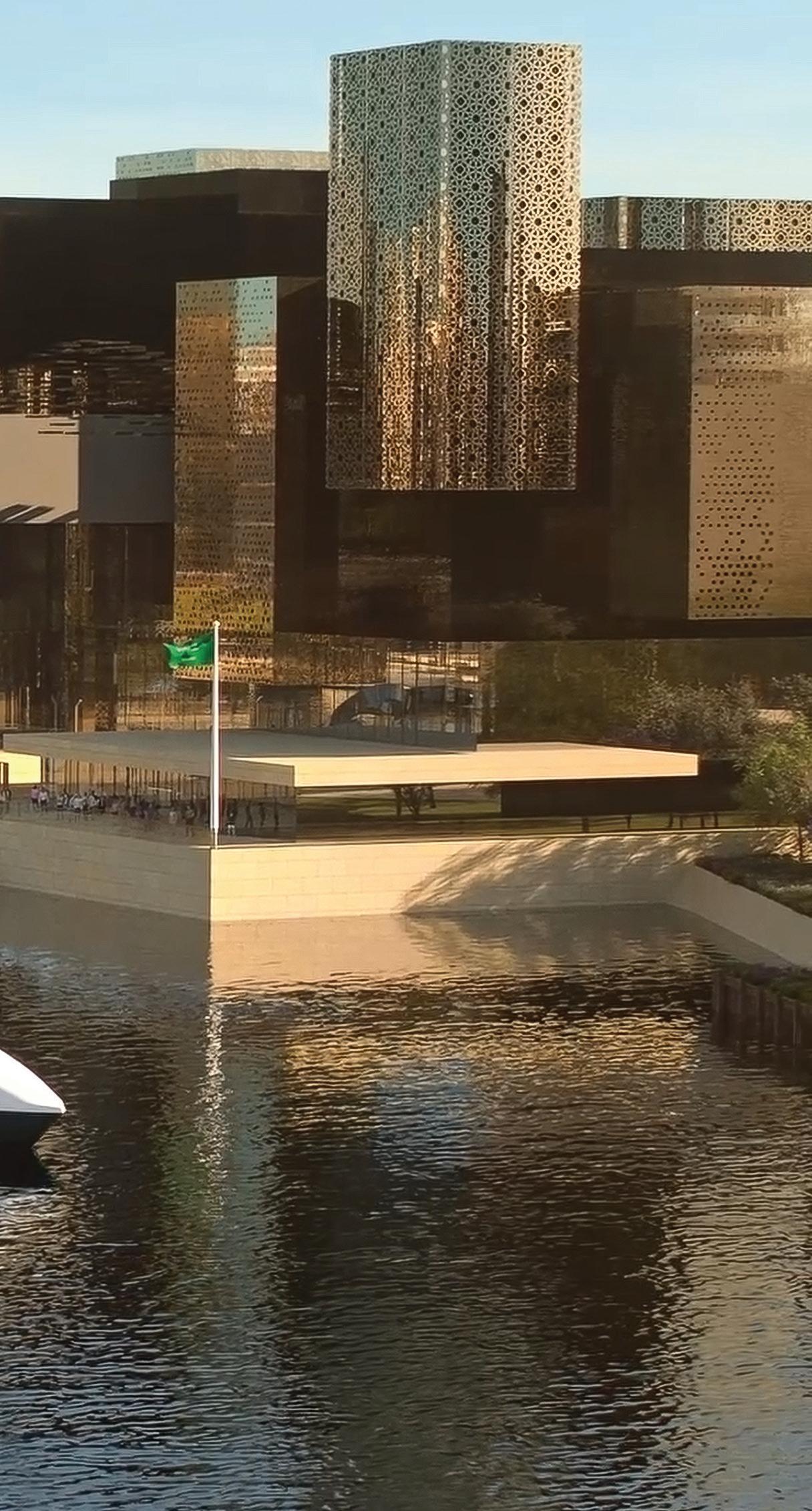

ROSHN: Shaping Saudi’s Urban Vision

IF CORRESPONDENT

COVER STORY INDUSTRY

With five projects having already been launched across three Saudi regions as of February 2024, demand for ROSHN infrastructure continues to grow

As per the market research firm IMARC Group, Saudi Arabia’s residential real estate market size will exhibit a growth rate (CAGR) of 6.89% during 2024-2032. As government subsidies and financing solutions facilitate home buying galore, the property sector is stimulating economic growth, and improving living standards.

As the Kingdom's urban landscape continues to evolve, ROSHN Group, Saudi Arabia’s leading national real estate developer and a PIF-owned gigaproject, establishes itself as a visionary force. With its vibrant developments seamlessly blending tradition with innovation, ROSHN Group is reshaping the future of the Kingdom's urban living. Through its meticulous integration of residential, retail, commercial, and hospitality structures amongst vital green spaces, ROSHN Group has envisioned a new way of living in the Kingdom. The cover story of the March-April 2024 edition of the International Finance Magazine will talk about how the real estate venture is becoming a driving force behind Saudi's urbanisation efforts.

A visionary mandate

As a key enabler of "Vision 2030," ROSHN's mandate

goes beyond the conventional realms of real estate development. It has emerged as a national developer in the Saudi market, with the commitment to delivering a high standard of living and modern integrated communities to domestic customers.

The Group is building integrated developments that reflect both the Kingdom’s rich heritage and the aspirations of its people, with its residential, retail, educational, hospitality, and commercial spaces combining to establish a truly comprehensive and perhaps unmatched real estate portfolio.

As Saudi continues its emergence as one of the most dynamic and robust economies in the world, PIF-owned giga-projects have been strategically crafted to fulfil specific elements of the diversification agenda.

ROSHN has a geographic commitment as broad as Vision 2030’s goals to create a “thriving economy,

24 | March - April 2024 | International Finance

REAL ESTATE SAUDI ARABIA INDUSTRY COVER STORY ROSHN

a vibrant society, and an ambitious nation.” The Group is actively supporting the national vision by enhancing the quality of life and well-being of people across Saudi Arabia and using its scale to act as a catalyst for economic diversification, while working with the private sector to strengthen and localise the construction industry supply chains by working across the full gamut of real estate verticals.

With five projects having already been launched across three Saudi regions as of February 2024 and the latest sales tranche for its flagship Riyadh project SEDRA launched this month, demand for ROSHN projects continues to grow. By 2030, ROSHN seeks to enable Vision 2030’s key goals, by supporting the goal of 70% home ownership.

Building momentum

ROSHN already stands as the first PIF giga-project

to deliver to customers since its flagship SEDRA community welcomed its first residents two years ahead of schedule in October 2022.

SEDRA, situated in Riyadh, will eventually encompass eight phases with 30,000 homes. It has rapidly established itself as one of the capital’s most desirable districts, with every one of the three sales tranches launched so far being sold out rapidly. Building on the demand of the first three phases, the Group recently launched sales for the fourth phase of this flagship development eventually bringing a further 4,860 units over 1.9 million square metres to the community. ‘SEDRA 4’ will also notably include a world-class sports dome, offering year-round, allweather recreation facilities through an agreement with Saudi Sports For All (SFA). SEDRA is also closely integrated with ROSHN Front, formerly known as Riyadh Front. The Group’s acquisition

International Finance | March - April 2024 | 25 COVER STORY ROSHN

ROSHN's master planning of its projects is creating open, green, and walkable neighbourhoods that will empower social interaction, revitalising a way of life that was once much more widespread in the Kingdom. Furthermore, a ROSHN street is a "Living Street," with pedestrian priority, low-speed limits, and natural shade enabling 15-minute walkability through these green spaces to community amenities

and rebranding of this popular retail and commercial destination epitomises ROSHN’s strategic ability to facilitate integrated lifestyles, as SEDRA residents now benefit from privileged access to one of Riyadh’s most popular zones.

ROSHN kept up the momentum and launched ALAROUS in the storied Red Sea city of Jeddah. As 2023 arrived, the venture launched WAREFA in Riyadh, a 2,000-plus unit project expanding and enhancing one of the capital city’s most promising neighbourhoods in the Janadriyyah district. They next turned east to the iconic Dakhna Mountain of the Eastern Province’s Hafouf. Here, ROSHN’s ALFULWA project will bring a new swathe of units to market in a “Garden City” composed of 22% green public space. October 2023 saw the cornerstones for both WAREFA and ALFULWA laid in ceremonies attended by both ROSHN and regional governmental leaders.

Turning to 2024, in February ROSHN broke ground on Jeddah’s MARAFY, the Group’s most ambitious project to date. The project, which links distinct districts with a Red Sea-fed 11km long canal, has become the first of its kind in the Kingdom, apart from becoming an instantly iconic landmark for the city. MARAFY is ROSHN’s largest mixed-use project, and will feature the venture’s signature combination of residential, retail, hospitality, leisure, commercial, and educational spaces. With MARAFY now well underway, hints about the possible announcements of new multifunctional and mixed-use projects fill the air.

Uniquely Saudi

ROSHN is fashioning fully integrated developments that enable health, well-being, and fulfilment by

combining multiple real estate verticals in a humancentric way. It’s a new way of living in Saudi Arabia, where communities and lives are living beyond walls in developments designed from the ground up to create a daily dialogue between a uniquely Saudi past, present, and future.

ROSHN has strived to create a real estate offering that is unique in the Kingdom with a range far wider than just homes. Interlinked facilities, including education, sports areas, shopping malls and commercial areas, cafes and restaurants, and healthcare centres, integrate and interact to encourage genuine community-focused lifestyles.

ROSHN's master planning of its projects is creating open, green, and walkable neighbourhoods that will empower social interaction, revitalising a way of life that was once much more widespread in the Kingdom. Furthermore, a ROSHN street is a "Living Street," with pedestrian priority, lowspeed limits, and natural shade enabling 15-minute walkability through these green spaces to community amenities.

The Group is also committed to ensuring that its projects become an integral part of the Kingdom’s social, urban, and cultural fabric. Walk those living streets of SEDRA or look at the designs of any of ROSHN’s projects and you see exactly how this ambition manifests itself. In SEDRA and WAREFA, buildings hark back to the traditional architectural vernacular of the region, while in ALAROUS and MARAFY in Jeddah and the Eastern Province’s ALFULWA, different forms and colours speak to those regions’ historic buildings.

Meanwhile, the natural environment has become part of the projects as well with the design teams prioritising the preservation of habitats and drainage patterns in the communities, while also adding distinctive green public spaces coloured by native flora in these projects.

Sustainability and ethics at heart

Sustainability is at the core of ROSHN’s operations. It promotes walking and green micro-transport solutions to smart city projects that improve the efficiency of irrigation, street lighting, and waste management. Coupled with cutting-edge materials that cut water and electricity usage, a robust material

26 | March - April 2024 | International Finance

INDUSTRY

REAL ESTATE SAUDI ARABIA

COVER STORY ROSHN

and community recycling programme, and a wideranging planting programme, ROSHN is setting new standards in sustainable development.

ROSHN has achieved the "Diamond category" in the Kingdom’s Mostadam sustainability ratings as well as the internationally recognised "BSI Kitemark Certificate" for Saudi smart cities, which includes the "Smart City Operating Models" for "Sustainable Communities ISO." Recently, ROSHN was presented with an award for the "Best Waste Diversion Initiative of the Year" by the "Saudi Arabia Cleaning, Waste Management & FM Awards" in recognition of its innovations in that area.

ROSHN GROUP also engages in a daily embrace of the same values it promotes: integrity, responsibility, empowerment, opportunity, trust, safety, and sustainability. These guide ROSHN’s internal operations, where employees are engaged in feedback processes, and offered regular opportunities to upskill their existing talents. The Group is playing its part in imbibing these values in the next generation of the Saudi workforce with its

HIMAM graduate programme, which has seen over 70 graduates taken under the ROSHN wing so far.

ROSHN is also setting new standards for corporate conduct, apart from establishing itself as a partner of choice for suppliers. In 2023, ROSHN marked 35 million safe working hours and joined the "United Nations Global Compact" on responsible business practice, thereby becoming the first Saudi giga-project to do so.

The Group has also been recognised with awards as wide-ranging as "Best Developer in the GCC" by Construction Week, the "Best Place to Work in Saudi Arabia" for the second year running by the Best Places to Work organisation, certification as a Top Employer for the past two years, and for Corporate Social Responsibility (CSR) Initiative of the Year.

ROSHN also has numerous ISO certifications, becoming the first Gulf-based developer to secure ISO 9001 for Quality Management and the first company of any kind in the India, Middle East, Turkey, and Africa (IMETA) region to achieve the BSI Kitemark for Smart Cities, ISO 37106:2021.

International Finance | March - April 2024 | 27

COVER STORY ROSHN

A highlight of the "ROSHN Supply Chain Forum" was the venture’s agreement with Partanna, the world’s first carbon-negative concrete manufacturer. The collaboration will see the two entities establish the Middle East’s first carbonnegative concrete production facilities, ensuring the spread of this revolutionary technology across the region, apart from cementing ROSHN’s status as a global pioneer in sustainable development

Partnerships to deliver

As it quickly expanded across the country of Saudi Arabia, ROSHN recognised from the outset the critical importance of establishing strong and flexible supply networks rooted in resilient local and global collaborations. The year 2023 witnessed a significant shift through the establishment of numerous strategic business alliances and agreements with suppliers hailing from various regions in Saudi Arabia and beyond.

ROSHN has secured significant partnerships to enhance the development of essential and lifestyle facilities. Among these partnerships is a SAR 7.7 billion agreement with China Harbour Engineering Company. Additionally, ROSHN has entered into multi-million SAR agreements with key Saudi suppliers. These include PC Marine Services for canal and bridge construction in MARAFY, Abyat for the design and supply of approximately 12,000 kitchens in future ROSHN communities, and Saudi Pan Kingdom Company for primary and secondary infrastructure in upcoming western Saudi communities.

As ROSHN entered 2024, the venture took the game to the next level by hosting the "ROSHN Supply Chain Forum" during which it worked to enhance connections, highlight prospects, and forge fresh collaborations by convening a diverse group of private sector suppliers and contractors under one roof. The event proved to be highly successful, resulting in the signing of eight new agreements with private sector partners from Saudi Arabia and around the globe. These agreements aim to localise manufacturing, pioneer innovative materials, and enhance the efficacy of ROSHN's partnership

procedures.

A highlight of the "ROSHN Supply Chain Forum" was the venture’s agreement with Partanna, the world’s first carbon-negative concrete manufacturer. The collaboration will see the two entities establish the Middle East’s first carbon-negative concrete production facilities, ensuring the spread of this revolutionary technology across the region, apart from cementing ROSHN’s status as a global pioneer in sustainable development.

This approach has not only ensured minimal impact on ROSHN from supply chain disruption, but it has also allowed the venture to have as broad an impact on Vision 2030’s goals as it has on Saudi Arabia’s map, in particular economic diversification targets. This has been achieved through job creation, the expansion of emerging economic domains, and the localisation of manufacturing processes. This process is particularly serving as a catalyst for aspiring Saudi entrepreneurs and invigorating local economies. ROSHN envisions creating a substantial number of job opportunities in the Kingdom by 2030, thereby contributing significantly to the non-oil sector's GDP and aligning closely with the overarching goals of Vision 2030.

A winning developer

Recently, ROSHN won International Finance’s "Best Community Residential Project Developer" award for their exceptional performance in 2023. SEDRA, ROSHN's flagship development in Riyadh, stands as a testament to the company's commitment to fostering sustainable, integrated lifestyles.

Comprising eight phases and over 30,000 residential units, SEDRA's strategic location and traditional architecture make it a highly desirable living space. SEDRA is also a pioneer in sustainable design, as it boasts reductions in energy and water usage that are above and beyond the mandated "Saudi Building Code."

ROSHN's other projects, such as WAREFA, ALAROUS, MARAFY, and ALFULWA, also uphold sustainability as a core principle. Emphasising walkable thoroughfares, solar energy, advanced insulation technologies, and abundant natural lighting, these projects play a crucial role in achieving ROSHN's sustainability objectives. The recent collaboration with EVIQ, Saudi Arabia's pioneering electric vehicle charging network, marks a significant achievement in promoting electric vehicle adoption in a nation heavily dependent on cars. This partnership

28 | March - April 2024 | International Finance

INDUSTRY REAL ESTATE SAUDI ARABIA COVER STORY ROSHN

COVER STORY ROSHN

ARABIA

will result in the establishment of charging stations throughout ROSHN's developments, contributing to a more sustainable future.

ROSHN’s Jeddah communities are continuing this legacy of innovation. ALAROUS, ROSHN’s first community in the Red Sea city, and now MARAFY, both showcase the Group’s signature integrated approach, emphasis on sustainable practices, and commitment to traditional architectural heritage, combining residences, amenities, and human-centric design.

The incorporation of classical Jeddah architectural elements pays tribute to the rich Saudi heritage, blending innovation with respect for tradition. Situated prominently as the primary residential area

within the revolutionary MARAFY canal project, ALAROUS emerges as the premier destination in Jeddah, a city that ROSHN endeavours to elevate into the ranks of the world's top 100 most livable cities by 2030.

ALFULWA, ROSHN's first venture into the Eastern Province, has emerged as a harmonious blend of nature, history, and modern living, centred near the iconic Dakhna Mountain on the outskirts of Hofuf. With an abundance of native flora, and a design inspired by the region's architectural heritage, ALFULWA is exemplifying ROSHN's commitment to creating communities that immerse residents in the beauty of their surroundings.

ROSHN now foresees an evolutionary expedition

30 | March - April 2024 | International Finance

ESTATE

REAL

SAUDI

COVER STORY ROSHN INDUSTRY

through different sectors, extending beyond its premises. The Group is carefully designing multifaceted environments that foster centres of health, wellness, and a dynamic social fabric. ROSHN sees its role as shaping a new way of living where opulent regional architectural patterns intertwine with the pinnacle of contemporary design.

Cementing change in Saudi Arabia

ROSHN has assumed a responsibility that exceeds its construction sector activities. It has far-reaching implications for Vision 2030's goals, a thriving economy, a vibrant society, and an ambitious nation. ROSHN's developments act as a catalyst for entrepreneurial Saudis, apart from supporting

domestic supply chains, generating jobs, and stimulating local economies. By 2030, ROSHN aims to create hundreds of thousands of jobs in the Kingdom, making them an important instrument of national development.

ROSHN’s ‘YUHYEEK’ CSR initiative uses its size and reach as a PIF-powered giga-project to extend its commitment to quality of life, sustainability, and community building beyond its projects, benefitting Saudis across the Kingdom through partnerships that uplift, empower, and inspire.

From inspiring the love of reading at Riyadh and Jeddah Book Fairs to supporting events like LIV Golf and the Zahra Breast Cancer Awareness Campaign, ROSHN has become a catalyst for a vibrant Saudi society.

Recognising the importance of local arts in the formation of the Kingdom’s emerging identity, ROSHN has also engaged in sponsorships of the Diriyah Biennale and the Tuwaiq Sculpture Symposium. YUHYEEK is continually seeking new partners to deliver benefits to Saudi society, demonstrated further by its partnership with the Tarmeem Charity to renovate homes for the needy.

ROSHN is dedicated to fostering ambition within the nation, boasting a commendable 72% Saudisation rate alongside a 28% female employment rate. A groundbreaking initiative in Saudi Arabia, ROSHN’s RETURN Programme not only propels societal advancement but also symbolises inclusivity. By providing compensated training opportunities to women rejoining the workforce, this programme is intricately crafted to nurture, empower, educate, and instil confidence in those seeking to reignite their professional journeys.

Aiming to become one of the world’s most diversified real estate ventures, ROSHN continues to make long-term investments across Saudi Arabia, muscling up its presence across a range of verticals.

ROSHN is committed to elevating the quality of life, fostering economic diversification and prosperity, and contributing to the realisation of Vision 2030's objectives by hosting top-tier events in the Kingdom to enhance global involvement.

ROSHN winning International Finance’s "Best Community Residential Project Developer" award is a testament to the venture's transformative impact on Saudi Arabia's real estate landscape. Standing tall, the venture truly symbolises the convergence of tradition and modernity, sustainability, and innovation.

International Finance | March - April 2024 | 31 COVER STORY ROSHN

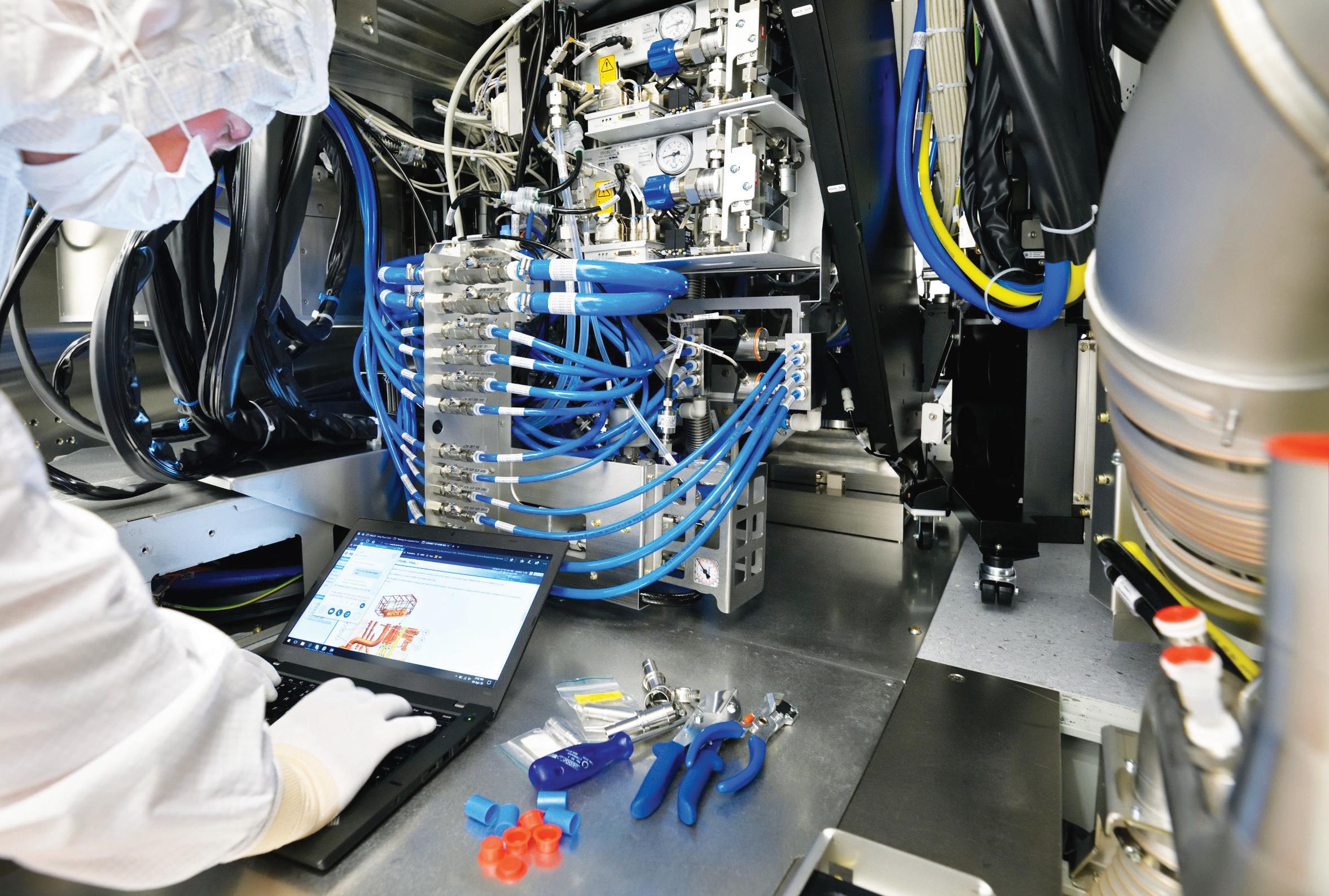

With the tech sector steadily moving towards the 'Everything AI' kind of future, semiconductors will be in great demand in the coming years

ASML: Powering the semiconductor industry

IF CORRESPONDENT

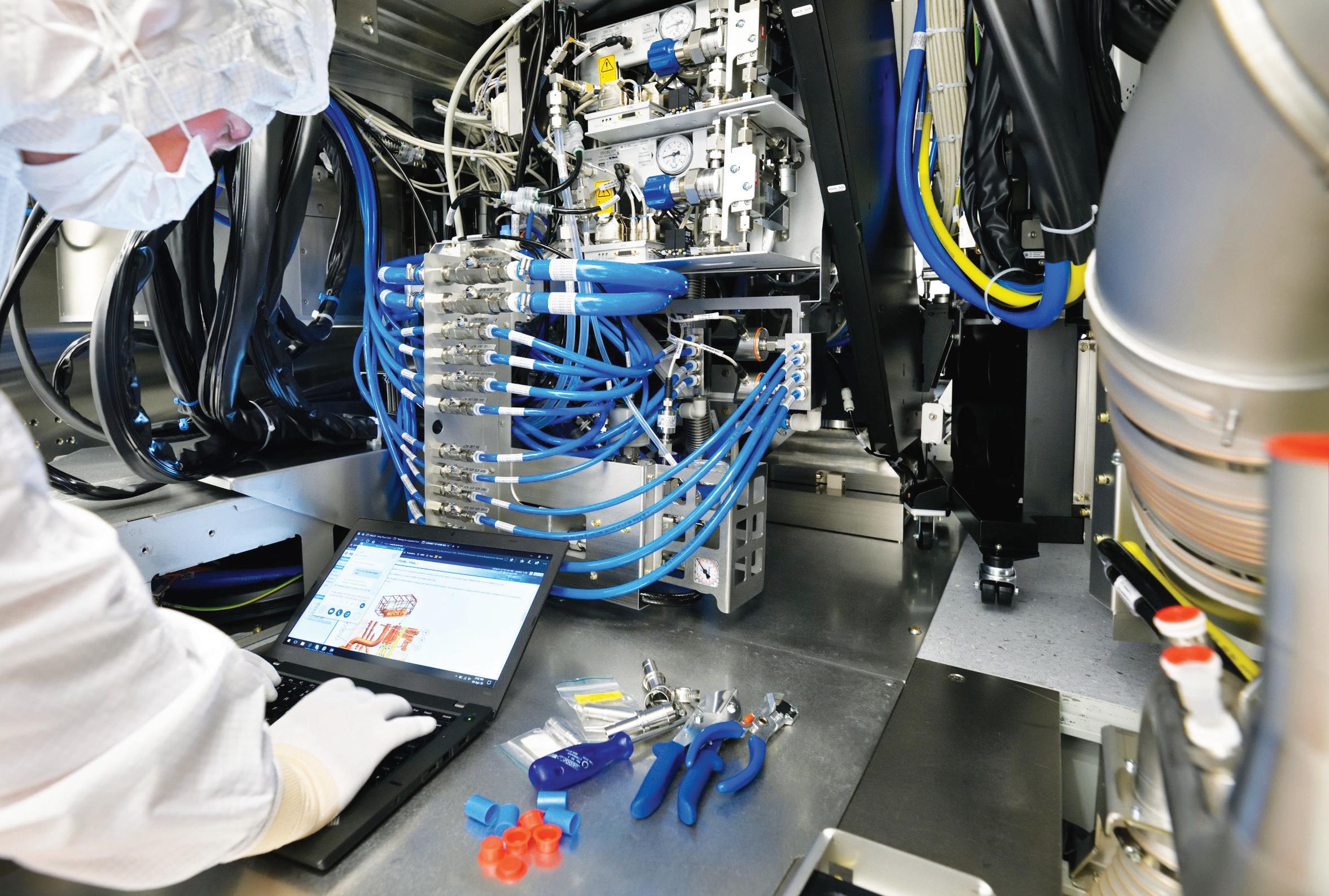

Netherlands-based semiconductor company ASML hit the headlines in January 2024 for its lithography machine, which will project nanoscopic chip patterns onto silicon wafers.

Reporting on the development, The Economist reported, "Ten times a second an object shaped like a thick pizza box and holding a silicon wafer takes off three times faster than a manned rocket. For a few milliseconds, it moves at a constant speed before being halted abruptly with astonishing precision—within a single atom of its target. This is not a high-energy physics experiment."

ASML has also been witnessing record orders for its ultraviolet lithography machines as Intel, Samsung and Taiwan Semiconductor Manufacturing Co (TSMC) are all lining up to induct the tool in their production ranks

On January 5th, American semiconductor giant Intel became the first owner of ASML's latest technical marvel, which it will use for assembling chips at its Oregon factory.

ASML hits a jackpot

As January 2024 passed by, ASML closed at a record high after its orders more than tripled. Order bookings rose to a record €9.19 billion ($9.98 billion) in the fourth quarter from €2.6 billion in July to September 2023, driven by demand for ASML's most sophisticated chip making machines.

What makes ASML's presence crucial for the semiconductor industry is that the company is the only one which produces the equipment needed to

make the semiconductors.

ASML has also been witnessing record orders for its ultraviolet lithography machines as Intel, Samsung and Taiwan Semiconductor Manufacturing Co (TSMC) are all lining up to induct the tool in their production ranks.

"ASML also benefited from strong demand from China last year (in 2023) as chipmakers there rushed to get lithography machines ahead of Dutch export rules meant to hobble Beijing’s semiconductor ambitions. The rise in Chinese demand helped offset the effects of a global chip industry slowdown on ASML, which is the only producer of the equipment needed to produce most advanced semiconductors," Bloomberg noted.

China accounted for 39% of ASML’s sales in the fourth quarter and became the Veldhoven-based company’s largest market in 2023.

However, ASML has been targeted by the United States in the latter's effort to curb exports of cuttingedge technology to China. In 2023 itself, Joe Biden’s administration urged the Netherlands government to prevent ASML from shipping chip making devices to China without a license. US officials also reached out to ASML and gave similar directions to the venture, as per Bloomberg reports.

And as the West keeps on preventing companies from its shores from supplying cutting-edge tech to Beijing, ASML too has fallen in line by restricting its China exports. The venture now expects as much as 15% of its China sales in 2024 to be affected by the new export control measures.

32 | March - April 2024 | International Finance

ASML INDUSTRY

ANALYSIS SEMICONDUCTOR

Why ASML is so special?

Apart from its cutting-edge chip making products, the Dutch venture is also known for its market value being quadrupling since 2019, to €260 billion ($285 billion), thereby ensuring that the company stays as Europe’s most valuable technology firm. Between 2012 and 2022, ASML's sales and net profit both rose roughly four-fold, to €21 billion and €6 billion respectively.

"In late 2023, ASML’s operating margin exceeded 34%, staggering for a hardware business and more than that of Apple, the world’s biggest maker of consumer electronics," stated the Economist.

You can say that Silicon Valley still leads the innovation race, but none of its innovations will see the daylight if it doesn't get powered by cuttingedge semiconductors. That's where ASML comes in handy, by holding the monopoly over this critical supply chain. And the West needs to be thankful because ASML is a Netherlands-based venture, not a China-based one.

The global semiconductor sales are predicted to double to $1.3 trillion by 2032. However, the US-led Western Bloc will be looking to ensure that Beijing doesn't get the cherry. So ASML's business will depend to some extent on geopolitical developments, but to its credit, the company has created a network of suppliers and technology partners across Europe, that itself looks like a well-oiled lucrative

industrial vertical.

"Its business model ingeniously combines hardware with software and data. These unsung elements of ASML’s success challenge the notion that the old continent is incapable of developing a successful digital platform," the Economist commented further.

ASML’s complex machines project chip blueprints onto photosensitive silicon wafers. In 1986, when the Dutch venture delivered its first machinery model, individual transistors measured micrometres and its kit almost looked like a glorified photocopier, states Dutch journalist Marc Hijink.

Jump forward to 2024, with transistors being shrunk by a factor of a thousand, ASML lithography gear has emerged as the most sophisticated equipment ever sold commercially.

ASML and its partners pulled off the shrinking trick through some engineering manoeuvring. It involved powerful lasers incinerating droplets of molten tin, each no thicker than a fifth of a human hair and travelling at over 250kph. The process produces extremely short-wavelength light, which then smoothly gets reflected by a set of mirrors. ASML's latest lithography gear costs over $300 million and exposes enough semiconductors. The object that holds the silicon wafer (known as a 'table') accelerates faster than a rocket and comes to a stop at exactly the right spot.

International Finance | March - April 2024 | 33

Photo Credits: ASML

Entering ASML's supply network

Economist paid a visit to ASML's Berlin factory, where the venture makes the 'mirror blocks', which serve as the main part of a wafer table.

"These are sturdy pieces of a special ceramic material, a square 8cm thick and measuring about 50cm on each side. Some get polished, measured, repolished, remeasured and so on, for nearly a year—until they are exactly the right shape, including allowances for the fact that they will sag by a few nanometres once installed," the media house noted further.

The factory's owner, Berliner Glas, was acquired by ASML in 2020. Berliner Glas, along with 800 other firms (mostly European), helped put together ASML’s machines. ASML

owns stakes in only a few of these businesses, meaning most of these ventures operate as independent units, while being part of ASML's massive manufacturing ecosystem.

ASML outsources over 90% of its manufacturing workloads and directly employs less than half the estimated 100,000 people required for its operations.

This is due to the fact that ASML, during its spin-off in 1984 from the Dutch electronics giant Philips, did not possess its in-house production lines. Since then it has been relying upon specialist component suppliers.

Also, manufacturing the various parts of the lithography machine is cutting-edge in itself. Carrying out all these functions can easily overwhelm ASML. Also, semiconductor economics preaches the decentralisation of the

production networks.

In this particular industry, demand moves up and down in the blink of an eye. With the tech sector steadily moving towards the 'Everything AI' kind of future, semiconductors will be in great demand in the coming years.

The sector is very much prone to supply chain gluts. So the industry stakeholders are now outsourcing some of the component manufacturing duties to its suppliers, which can limit the fallouts by catering to customers working in different business cycles.

The practice which ASML started in 1984, has now become a phenomenon called 'HyperSpecialisation,' which prevents the risk-reducing double sourcing (practice of using two suppliers for a given component, raw material,

34 | March - April 2024 | International Finance

ANALYSIS SEMICONDUCTOR ASML INDUSTRY

product or service).

"In the case of ASML, technical demands are so high and production volumes so low (it shipped 317 machines in 2022) that it would be uneconomical to manage several suppliers for a single part even if they could be found. For such crucial components as lasers and mirrors, which are made by Trumpf and Zeiss, two German firms, respectively, it is impossible,” Wayne Allan, who is in charge of sourcing on ASML’s board, told The Economist.

Approaching things smartly

ASML mostly limits itself to designing the architect of its cuttingedge semiconductor-making tools. After that, the venture decides who (suppliers) does what, apart from defining the interfaces between the main parts of its machines (modules) and carrying out the required research and development activities.

This simplified workload helps the venture to test the machine equipment, certify and assemble them, followed by the transportation of the finished products. The suppliers have also been encouraged to experiment with technologies. The whole thing works on two Ts: 'Trust' and 'Transparency.'

Information flows freely throughout the supply chain. As engineering teams from different firms work together, ideas and patents get shared, along with financial data and profits. Also, suppliers engage in healthy competition with each other.

If a supplier runs into operational trouble, ASML proactively intervenes to ease things out. If the trouble is bigger in size, then the venture ends up buying the

supplier, as it did with Berliner Glas.

Can anyone challenge ASML?

ASML's manufacturing ecosystem is something to envy about. It is a loosely coupled structure that ensures the operational autonomy and financial well-being of all the component suppliers. The whole model is well-oiled enough to outperform an entire industrial vertical.

ASML is now trying to consolidate its market dominance by complementing its chip making hardware with software and data. The goal is to further refine the 'Wafer Table' in the lithography machines. The process will be performed through data mining and machine learning. In that way, ASML will make itself into some sort of AI venture too.

Of the 5,500 devices ASML has sold since 1984, 95% are still in operation and many even send data back to the venture's Dutch headquarters. These data then get used to fine-tune the products further, which in turn leads to higher semiconductor production ratios and generates even more data to help digital services like the Internet and Internet of Things (IoTs) to perform stronger.

"If rivals cannot topple ASML, can anything? Maybe physics. Even with the best AI, you can’t shrink transistors forever (certainly not in a commercially viable way). If technical requirements become too otherworldly the supplier network may unravel. Or maybe economics. Chipmakers may recoil at ASML’s data hunger, which extends to other linked devices in their factories. Some are pushing back against its digital expansion, insiders say," The Economist noted.

"Then there is geopolitics. ASML’s share price dipped after news broke about the cancelled deliveries to China. The worry is less over lower sales; ASML cannot build its machines fast enough anyway. Of greater concern is the risk that strict export controls could in time push China to build its own chipmaking-gear industry. That could one day threaten ASML’s position at the centre of the sector. For the time being, though, the company’s network and its network effects remain indomitable. Who said Europe couldn’t do tech?" it concluded.

International Finance | March - April 2024 | 35

expenditure in