For most investors, 2022 was a very tough year. The trends and relationships between asset classes that we had come to take for granted, broke down, and we were left questioning the assumptions we rely on to guide decision-making.

To recharge for 2023, I thought would do some light reading during the December break. “Children of Sugarcane”, by Joanne Joseph, is a novel set against the backdrop of 19th-century India and the British-owned sugarcane plantations of Natal. It is a harrowing but lyrical account of an important but relatively poorly understood chapter in South Africa’s history, and one made extra relevant for me given my Indian heritage. Joseph’s book provided deep insight into the interactions between communities in our chequered history, as well as the various ways in which wealth was accumulated in South Africa. For my immigrant ancestors, investment was made in the education of the next generation. This investment has finally led to wealth creation three generations later. All that I have is because of those that sacrificed before me.

This long-term approach has sparked me to think that we tend to place too much focus on the short term and lose sight of the big picture. As a business, we have intentionally been thinking about the changes we should prepare for in the next decade and beyond. Clients have investment horizons far longer than 10 years, so it is appropriate to spend time considering what lies beyond the next market cycle.

It is appropriate to spend time considering what lies beyond the next market cycle.

We have intentionally been thinking about the changes we should prepare for in the next decade and beyond.

Sangeeth Sewnath

Deuty Managing Director

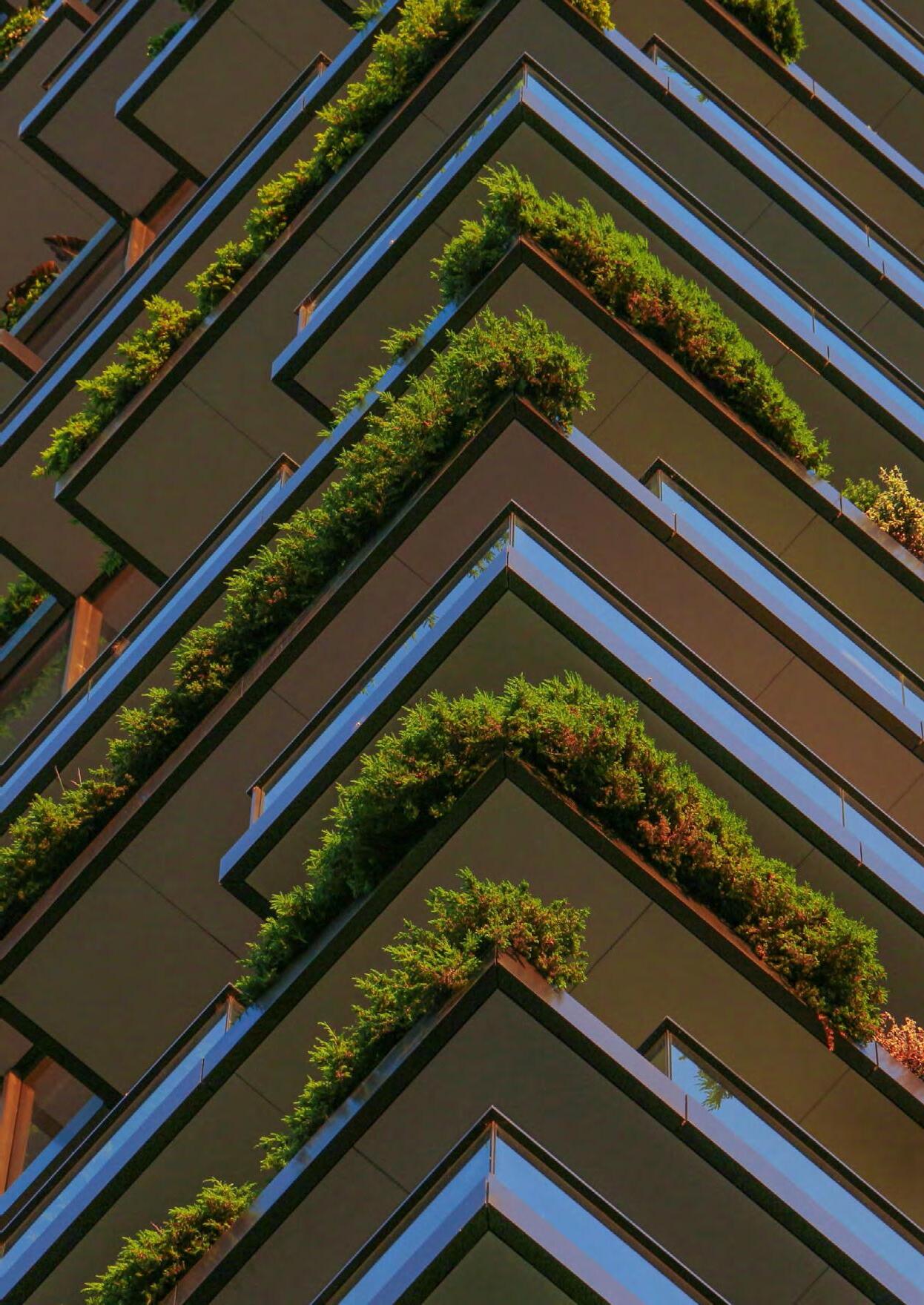

One of the biggest structural changes – and challenges – of our generation is the imperative to decarbonise the global economy. The world needs to invest far in excess of $4 trillion p.a. to combat climate change, and the Ninety One Global Environment Fund invests in companies enabling this transition. In this edition, portfolio managers Deirdre Cooper and Graeme Baker set out why they believe investing in climate solutions offers the structural growth opportunity of a lifetime, and why it is therefore possible to generate compelling returns over the long term while contributing to a positive real-world impact. We’re pleased to share that the randdenominated Ninety One Global Environment Feeder Fund has now also been FSCA approved.

If we unpack 2022, there were three key trends to consider. Firstly, the much relied-upon negative correlation between bonds and equities completely broke down, resulting in the worst combination of returns seen in decades, with global equities shedding 18.4% and global bonds down 18.3%. Secondly, the relationship between big tech and US equities also failed, as the assumption that big tech would always outperform was proved wrong. Who would have thought that amongst the tech giants Meta would lose two-thirds of its market value, Amazon, Nvidia, Netflix and Tesla would lose half of theirs and Microsoft decline by a third? And finally, the decade-long trend of low interest rates and low inflation was well and truly reversed.

The much reliedupon negative correlation between bonds and equities completely broke down.

But while the challenges of high interest rates and inflation are well documented, their benefits have largely been unexplored. It is worth bearing in mind that high interest rates and inflation significantly increase the importance of capital allocation. When capital is costly, investors should be a lot more discerning about the businesses in which they choose to invest. In this environment, we believe quality businesses with strong balance sheets and good capital allocation should thrive. Be sure to read Clyde Rossouw’s contribution to this edition, in which he explores some new areas of interest and weighs up whether they are appropriate for inclusion in the Ninety One Opportunity Fund .

Turning to SA, unlike global markets, the total returns from domestic assets were at least marginally positive, with SA equities delivering 3.6% and SA bonds returning 4.3%. It’s cold comfort for investors, however, given that real returns are still negative. Inflation topped 7% and the rand weakened by more than 6% against the US dollar over the year. Many investors fixate on trying to time the currency when they invest offshore. So for this issue, we undertook an analysis to understand what impact the rand/dollar exchange rate at the time of initial investment has on the overall longer-term return of the investment. The findings may surprise you.

So where to from here? We can either believe that the last 2 years were a short-term deviation from the trends set over the last decade, and that we will revert to the old ways, or we can take the view that this is a significant structural shift in markets. In our view, the key macro themes, such as an accelerated energy transition, deglobalisation, defence spending and the end of a decade-long US household deleveraging cycle, will result in the next cycle looking very different to the last. Don’t miss Iain Cunningham’s contribution to this edition, in which he sets out where to find pockets of opportunity against this backdrop.

As a parting thought, even though each of the last 3 years was characterised by vastly different events, the lessons we could take forward are remarkably similar. They are to stay invested for the long term, with wellconstructed portfolios and the guidance of a good financial advisor.

Thank you for your support.

One trend that has not reversed over the last 5 years is that of industry flows. Fixed income – particularly the multi-asset income sector – continued to be the dominant flow taker in 2022, with the Ninety One Diversified Income Fund a significant beneficiary.1

Global equities also continued to attract new flows, with the Ninety One Global Franchise Feeder Fund the biggest net flow taker in the sector. The biggest loser was the multi-asset low-equity sector, as investors continued to opt for fixed income. However, with the possibility of growth picking up, we may see some interest returning to the sector. Much investor capital is still held in household bank deposits. These stood at R1.64 trillion at the end of November, having grown by more than R100 billion in the last 11 months.

Many investors fixate on trying to time the currency when they invest offshore.

Sangeeth Sewnath Deputy Managing Director

In our view, the key macro themes will result in the next cycle looking very different to the last.1. We will be reducing the Ninety One Diversified Income Fund platform share class fee by approximately 11% for one year. The H-class fee will reduce from 0.45% (ex VAT) per annum to 0.40% (ex VAT) per annum, effective from 1 April 2023 to 31 March 2024.

The global forecast looks brighter than it did towards the end of last year. Back then, the consensus was that central banks, led by the Federal Reserve, would raise rates too high in their quest to kill inflation, destroying growth and plunging the global economy into recession for 2023. The proverbial “hard landing” was consensus. By January, it looked like the global economy was headed for a soft landing, and markets ran accordingly.

DirectorRecent US data shows both growth and inflation surprising on the upside. While this will see inflation and interest rates “higher for longer”, markets much prefer growth to recession. It will unfortunately keep the US dollar firmer which is less positive for emerging markets like South Africa.

From being almost certainly headed for recession, it is now predicted that the US might narrowly avoid a recession. If the US does have one, it should be milder than expected.

In the final quarter of last year, Europe was grappling with rocketing electricity and gas prices, as a result of the war in Ukraine, and was facing the very real prospect of loadshedding – possibly even an economic crisis.

Thanks to a much milder January than expected, the Europeans survived winter. They’ve also stored enough gas for this winter and next, thereby avoiding the anticipated economic crisis. Whilst the region still has a while to go in terms of rate hikes, the outlook is certainly better. This is important to us, as Europe is a major trading partner.

Similarly, the UK – predicted to be the only G7 country in recession this year – looks set for a milder than expected recession, with some now even saying it could end the year with flat to slightly positive growth.

China’s about-turn on its zero Covid policy will lead to Chinese growth rebounding, and that, coupled with some recovery in the housing market, has seen China moving from being declared by most of the developed world as “uninvestable” in the final quarter of 2022, to one of the most exciting markets for 2023.

China’s about-turn on its zero Covid policy will lead to Chinese growth

All of the above should contribute to another year of outperformance for commodities. It should also ensure that emerging markets are the place to be this year as risk sentiment improves.

Although 2023 should see better days for emerging markets and commodity currencies as they bask in the strength of a rebounding China and recovering world, these happy days may bypass South Africa altogether.

Back home, we are suffering a crisis of confidence, largely of our own making. Years of government neglect, corruption and general incompetence have left our state-owned enterprises on their knees and barely functioning.

Rolling “state of disasters” (and yes, there is an “s” on the end of that) may allow government quicker access to funds to fix electricity and infrastructure, but this also circumvents government spending protocols and poses the risk of a covid-style corruption feeding frenzy.

Ironically, the good news is that the problems have intensified to a point where the noise is impossible for government to ignore. And for the first time in our democracy, the ruling party is likely to be held accountable next year.

Whilst this accountability is important and should yield results, there’s a more than likely chance that the ANC will still be in power following elections next year. Recent polls put ANC support around 40%, but that is because people being polled today are currently bearing the brunt of the worst load-shedding in our history. There is no doubt that government will do anything to lessen load-shedding prior to elections, even if – according to analysts – it jeopardises the long-term health of the power stations involved.

So, while a reduction in load-shedding will be welcome, and should raise ANC support ahead of elections, the question remains, if the ANC gets less than 50%, with whom would it partner? A Ramaphosa ANC in coalition with a similarly aligned opposition party could be a great result for the country; however, an ANC alliance with a populist party could be disastrous.

So, this year, it’s up to government to decide if South Africa enjoys the macroeconomic tailwind blowing, or not. And it’s up to the ANC to decide if 2024 will be a celebration of 30 years of democracy (and in power) or sorrow at the polls.

We are suffering a crisis of confidence, largely of our own making.

For the first time in our democracy, the ruling party is likely to be held accountable next year.

There is no doubt that government will do anything to lessen load-shedding prior to elections.

China should see a robust recovery in economic growth and corporate earnings over the next year. We have taken advantage of depressed equity valuations in Asia, and our portfolios are biased towards China and Hong Kong.

There are attractive opportunities in high-grade government bonds in countries where housing markets and households are already feeling the effects of current hiking cycles.

A reacceleration in Chinese growth and a tightening cycle from the Bank of Japan present notable headwinds to the US dollar through 2023.

This year may well offer significant opportunities in developed market equities and credit, but these could take time to come to fruition.

Is there light at the end of the tunnel?

Asset markets and investors experienced a tough year in 2022. Both global equities and bonds declined sharply, resulting in a passive 60/40 global equity/bond portfolio returning -18.1% in US dollars and having its worst year since 2008. The culprits where a combination of stretched starting valuations, major central banks moving to fight inflation and recessionary conditions in China.

Starting with China: 2 years ago, the Politburo, the principal policymaking committee of the Chinese Communist Party, talked about using 2021 as “a window of opportunity to address structural imbalances”, “anti-monopoly” and “curbing the disorderly expansion of capital”. This set the stage for the material macro policy tightening and regulatory reset experienced up until early 2022. Subsequently, policy pivoted towards incremental policy easing, and China’s regulatory cycle peaked. The lagged effects of tightening and then zero-Covid policies weighed heavily on the economy for the remainder of 2022 and more than offset any easing efforts. Heading into 2023, the Politburo has called for “significantly boosting market confidence”, “forceful monetary policy” and “reinforcing fiscal policy”. This doubling down on policy, coupled with a rapid unlocking of the economy post the abandonment of zero-covid polices and considerable pent-up household demand, should drive a robust recovery in economic growth and corporate earnings over the next year. At the same time, equity valuations in China and Hong Kong are depressed, and investors generally remain pessimistic on the region. We continued to accumulate equity positions in these markets through the second half of 2022, and our portfolios are biased towards or overweight the region as a result of these dynamics.

Turning to developed markets (DMs), our central scenario is that the developed world will likely suffer the consequences of last year’s rapid and material tightening in monetary policy, as the lagged effects feed through into growth and earnings in 2023. We see a higher likelihood of a recession than is currently priced into asset markets. The much-anticipated “Fed pivot” seems unlikely in the near term. We don’t anticipate a change in policy until notable weakness in the economy has materialised – likely a precondition to sufficiently weaken the labour market and lower underlying inflation pressures. Our conviction comes from the fact that the Federal Reserve remains focused on addressing inflation and tightness in the labour market, with “the level of wage growth remaining inconsistent with inflation returning to 2%”, according to Fed chair Jerome Powell. Soft landings of the economy have also historically been associated with longer and shallower hiking cycles, while the pace and magnitude of this hiking cycle has historically been associated with a deeper recession. In our view, these expectations are yet to be priced into DM equities. Last year’s sell-off was a function of multiple derating as interest rates and bond yields rose, but there has yet to be much in the way of downward revisions in earnings. During a recession, earnings usually experience a 15-20%-plus decline. Consequently, we maintain a lower than average or underweight exposure to equities overall in portfolios, with the above noted bias towards China and Hong Kong.

During a recession, earnings usually experience a 15-20%-plus decline.

Is there light at the end of the tunnel?

Another area where our central scenario for the developed world is yet to be priced is in DM government bonds. In US Treasuries and other select DM government bonds, real interest rates – a measure of value – are the highest they have been in 12 years. In particular, we see the best opportunities in highgrade government bonds in countries where housing markets and households are already feeling the effects of current hiking cycles. These nations include South Korea, Canada, Australia, New Zealand and Sweden. For example, South Korea has just entered its first phase of deleveraging since the Asian financial crisis, and the housing market in Sweden has already declined 17% from its peak. These nations face notable headwinds to growth and domestic inflation through 2023. We have established a higher than average or overweight position in defensive duration over the past 6 months, relative to a material underweight a year ago, with a strong bias towards these nations.

Is there light at the end of the tunnel?

Turning to currencies, we entered 2022 with a notable long position in the US dollar versus Asian and European currencies. This reflected expectations of macro policy divergence; we expected the Fed to fight inflation and tighten policy swiftly, while the People’s Bank of China would move towards easing. Looking forward, we believe the US economy remains structurally more healthy than European countries and the above noted nations and will likely tolerate higher rates for longer. However, a reacceleration in Chinese growth and a tightening cycle from the Bank of Japan present notable headwinds to the US dollar through 2023. In our portfolios, the active currency overlay is currently structured to take advantage of the above noted country-level vulnerabilities. We remain defensive but more diversified than last year, being long the US dollar, Swiss franc and Japanese yen versus the Swedish krona, Canadian dollar, Australian dollar and New Zealand dollar.

All being said, 2023 will likely be a year where significant opportunity will be presented in DM equities and credit – just not yet.

A reacceleration in Chinese growth and a tightening cycle from the Bank of Japan present notable headwinds to the US dollar through 2023.

The US economy remains structurally more healthy than European countries.Clyde Rossouw Co-Head of Quality

N ew investment options have become available for SA multi-asset portfolios at a time when more traditional asset classes have experienced increased volatility. While a wider opportunity set should be beneficial for investors, it does create risks and will widen the dispersion of returns between managers.

I n our view, allocations to many of the new alternatives are not suitable for our Ninety One Opportunity Fund investors from a liquidity and risk perspective. Despite the changes, our preferred opportunities remain within global equities and SA bonds, where our outlook has improved after a tough year.

Almost a year ago, National Treasury surprised the investment community by announcing several amendments to Regulation 28, the key change being to allow exposure to foreign assets up to a maximum of 45%. Final amendments, published in July 2022, also confirmed new limits for infrastructure, private equity and hedge funds, as well as a definition (and prohibition) of crypto assets.

The changes are particularly relevant for multi-asset portfolios, where an increase in the potential allocation to a wider array of domestic and global assets has significant consequences. There is a growing narrative that the additional flexibility will automatically boost returns while possibly dampening risk. However, given the expanded range of opportunities and the impact of foreign exchange movements, the variability of returns naturally widens.

Figure 1: Will global equities continue to deliver long-term growth?

These new investment options have also become available at a time when more traditional asset classes have experienced increased volatility as the end of cheap money created financial upheaval. As a result, last year was incredibly challenging, especially given that relationships and trends that investors have relied on either broke down or, worse, reversed.

This begs the question, do we see a return to the old trends, where our positive view on global equities largely benefited performance, or does a new investment environment continue to emerge?

Global equities (MSCI ACWI ZAR) Global bonds (WGBI ZAR) SA property (SAPY) SA bonds (ALBI) SA inflation-linked bonds (CILI) SA equities (Capped SWIX) SA cash (STeFI) ZAR/USD Global cash (LIBOR-USD) ZAR

Source: Ninety One, as at 31 December 2022.

Volatility takes its toll on investors and increases the possibility of poor investment decisions, particularly in the short term. But heightened volatility can create more opportunities to buy or rebalance assets at lower prices. This applies not only to traditional options but to the additional choices. Given the increased opportunity set, it is therefore critical to assess whether what has worked for portfolios remains optimal for asset allocation and selection. And, with greater flexibility, do investment teams have the breadth and depth to fully benefit from the full range of options now available, or are they even appropriate?

There is a growing narrative that the additional flexibility will automatically boost returns while possibly dampening risk.

Infrastructure assets benefit from a combination of defensive fundamentals and structural growth drivers, with the ability to generate inflation-protected income. They also typically have a low correlation with other assets, low sensitivity to the economic cycle and sustainable cash flows. Investing in infrastructure has become more common globally. It also has relevance for South Africa, given the deterioration of government’s fiscal position and effectiveness, as well as the lack of funding within state-owned enterprises (think investment opportunities in private electricity generation).

But infrastructure investments carry two significant risks for investors. They are illiquid and may not be saleable at the time an investor had originally planned to exit. They are also typically highly leveraged, which results in a heavy interest burden. We argue such investments are, therefore, not appropriate within the daily-priced/traded funds that we manage.

From a portfolio construction perspective, global credit provides substantially more liquidity and diversification benefits than domestic credit. However, woeful yields have, to date, all but excluded global credit as an asset class for consideration. Now, as yields have moved up (and spreads widened), the asset class has started to garner more interest. Unfortunately, central banks have severely distorted certain markets, and it will take time for those distortions to work through the system. For example, the yields now available on lower quality credit are eye-catching, yet a large part of the repricing has been driven by the increase in government bond yields.

So, while valuations may appear compelling, volatility in the global credit market remains significantly elevated. Despite the improvements in yield, when assessed on a risk-adjusted basis, we are of the view that the prospective return does not yet compensate investors for the volatility of the asset class. We further argue that while the economic cycle remains uncertain, credit carries default and spread risk, which is not appropriate for our typical investor. Once interest rates peak and global credit finds a footing, equities should outperform, and we would therefore prefer to continue to hold equity over credit.

The amendments also allow Regulation 28-compliant portfolios to allocate assets to private markets such as private equity funds, up to a limit of 15%.

However, private equity investments involve a higher degree of risk and may result in partial or total loss of capital. By their nature, alternative investments are complex, speculative investment vehicles. To add, the lock-up period of private equity makes it illiquid, and the speculative nature of many such opportunities are not in line with our philosophy. In short, we do not believe it is suitable for the typical investor within our Ninety One Oppor tunity Fund

Given the market disruption, what is our view on more traditional asset classes that have been overlooked for some time?

Global central banks raised rates aggressively in 2022, pushing borrowing costs to their highest levels since 2007 across most key regions, as they continued to fight inflation. Despite this, most opportunities still do not provide a real return. On a medium-term outlook, we see better opportunities elsewhere. That said, global cash can provide a defensive ballast in a period of continued uncertainty. Currency diversification is an important further consideration.

While yields have risen in line with central bank measures, they are not compelling enough to allocate to meaningfully, in our view. We continue to see better risk-adjusted opportunities elsewhere.

Global property does not typically provide enough portfolio diversification benefits, and we are able to find better risk-adjusted opportunities within other global asset classes, in particular, global equities. We therefore hold limited allocations within the portfolio.

Is there a way to effectively allocate to ideas that remove South Africanspecific risks? We argue that EM opportunities outside South Africa are too highly correlated with domestic opportunities, given the nature and tradability of our market. While the bulk of our exposure must still remain within our borders, we are unlikely to utilise our offshore allocation for assets that do not bring diversification and risk-adjusted return benefits. To add, within the global equities we own, many derive a significant proportion of their revenue streams and growth opportunities from EM countries, which should be considered.

Will the US enter recession? What is the rand doing in the next 6 months? How much is a barrel of oil going to cost next year? Most people forecast too much because it is easy and the thought of being right is reassuring. That is risky, because forecasts start to become something you do to justify how you want the world to work, rather than analysing how it actually works.

Most people forecast too much because it is easy and the thought of being right is reassuring.

Predicting what is going to happen, particularly in the short term, is hard and nearly impossible to repeat consistently. Most macro events that experts try to forecast are infinitely more complex than we assume, and with so many forecasts made, accountability is lost. It is also easy to reverse-engineer the answers once things have happened to give an inflated sense of accuracy.

If it is so hard to forecast accurately, how then do we construct portfolios?

Asset allocation does not simply live on a neat spreadsheet, and we are cognisant of short-term influences. Robust models do form the fundamental basis of providing a firm foundation. Our asset allocation is built from the bottom up, based on the investments we own (or can own), on a 5-year forward-looking view. We buy companies where we have developed a deep understanding of their outlook through fundamental analysis. The select businesses we own tend to be less reliant on macro forecasts and the economic cycle, which provides a greater degree of certainty to the outcome.

Global

SA propertySA cashUSD cashGlobal bonds

Source: Ninety One, for illustrative purposes only. This is not the return of the Fund. Five-year expected asset class returns are based on disclosed reasonable assumptions and are not a reliable indicator of future results.

We have the ability to tilt the portfolio towards defence, growth or cyclicality based on our views.

Figure 2: After a tough year, the opportunity set has improved January 2022 vs. January 2023 – expected 5-year returns

New investment opportunities on the horizon? New investment opportunities on the horizon?

While commentators flip-flop between whether this year’s headlines will be dominated by an economic recession or a market rally, we will continue to look through the noise. Real returns are available within the investment options we have at our disposal, and we will continue to allocate diligently on behalf of our clients. These options have not changed dramatically, despite regulation amendments and a shake-up of markets. Our preferred asset class remains global equities, which still provide the best opportunity for growth. Domestic bonds counterbalance this view and provide real return opportunities. We believe we are through most of the pain and will not shy away from allocating meaningfully to risk assets when appropriate, while recognising that timing the market can be a hazardous endeavour.

Critics may suggest that we are overlooking opportunities, some of which have resulted from changes to regulation. But greater flexibility increases complexity and will not necessarily result in better outcomes for investors. Skilful managers with global expertise should, however, benefit. We have an established track record of successfully managing assets within the Ninety One Opportunity Fund , creating long-term wealth for our investors. Over the last 20 years, the Fund has been the best performer in its sector. In this time, regulation and market opportunities have changed meaningfully. We have adapted, stayed disciplined and deepened our global investment team. Let time put the odds in your favour as compounding only works if you give an asset time to grow.

1. Past performance is not a r eliable indicator of future results, losses may be made.

Source: Morningstar, dates to 31 December 2022. Performance figures for the A class are based on a lump sum investment, NAV based, inclusive of all annual management fees, gross income reinvested. Initial charges are not applicable to this fund. A-class inception date 2 April 2000. An individual investor's performance may vary depending on actual investment dates. Highest and lowest annualised returns (rolling 12-month figures): Jul-05: 43.8% and Feb-09: -15.7%. Please also refer to the Ninety One Opportunity Fund page on our website.

There are compelling reasons for investing offshore; however, many investors fixate on trying to time the currency.

O n average, the rand has depreciated by approximately 6% p.a. over rolling 5-year periods, contributing to an offshore investment’s overall rand return.

O ur analysis illustrates that the rand/dollar exchange rate at the time of initial investment (i.e. whether the rand had appreciated or depreciated over the preceding year, used as a proxy for investors’ perception of where the currency will go) does not make a material difference to the overall longer-term return of an offshore investment.

When investing offshore, investors should take a longer-term view and look past the shorter-term movements in the currency.

Paul Hutchinson Sales ManagerWhere you choose to invest offshore is therefore more important than the shorter-term movements in the currency.

Does the exchange rate really matter when investing offshore for the longer term?

While investors accept that there are compelling reasons for investing offshore: diversification benefits; access to asset classes, industries and companies not available in South Africa; reduced emerging market and SA-specific risk; and maintenance of ‘hard’ currency spending power, they tend to spend an inordinate amount of time trying to call the direction of the currency.

Over the longer term, the performance of the rand contributes to an offshore investment’s overall rand return. Rand depreciation adds to the offshore investment’s total return calculated in rands, and rand appreciation detracts from the overall return. Figure 1 shows that over rolling 5-year periods, the rand has experienced periods of both depreciation (81% of the time) and appreciation (only 19% of the time) against the US dollar. On average, however, the rand has depreciated by approximately 6% per annum over rolling 5-year periods, over the last 22 years.

–

Does the exchange rate really matter when investing offshore for the longer term?

Many investors are fixated on the exchange rate when making an offshore investment. We therefore analysed the performance of the Ninety One Global Franchise Fund from April 2007 1 to December 2022 to determine whether the movement of the rand/dollar exchange rate (i.e. whether it appreciated or depreciated) in the year prior to an initial investment matters. Note that we used the 12 months prior as a proxy for investors’ views on where the rand/dollar exchange rate is likely to move in future.

The analysis split the data into two series:

Periods where the rand was stronger in the year preceding when an investment into the fund was made, continued rand strength being what investors are concerned about and attempting to avoid

Periods where the rand was weaker in the year preceding when an investment into the fund was made, continued rand weakness being what investors are trying to benefit from

The investments allocated to either of the two series are then held from their respective inception dates to 31 December 2022. The annualised results are summarised in Figure 2.

1. Fund launch date: 4 July 2009. Performance is based on the UK-domiciled Global Select Equity Fund from 10 April 2007 which then merged into the Luxembourg-domiciled Global Franchise Fund on 4 July 2009. Performance prior to 4 July 2009 has been simulated.

Does the exchange rate really matter when investing offshore for the longer term?

O f the 165 1-year periods, 56 (or approximately one-third) were periods where the rand strengthened and 109 (approximately two-thirds) where the rand weakened (this outcome should not be unexpected).

The average annualised return was similar for periods of rand strength (13.1% p.a.) and rand weakness (12.3% p.a.).

M any investors would have expected a lower return for investments made following periods of rand strength, but they forget that the performance of the hard currency asset also matters.

This result suggests that the exchange rate entry point is not as material a consideration as many investors may think.

The maximum annual return was also very similar (18.2% for periods when investments were made following rand strength and 17.5% when it weakened).

Again, many would have expected more material outperformance for investments made following periods of rand weakness.

The difference in the minimum annual return was more meaningful. But even at -6% following a period of rand strength, this is not a significantly negative number or cause for concern for a growth-oriented investor. The minimum return following a period of rand weakness was -12.3%. This is somewhat surprising but coinciding with the 2022 bear market in global equities, where the MSCI All Country World Index was down 18.4% (US dollar). So, even though the rand depreciated by more than 6% against the dollar over the year, it could not protect investors fully from the collapse in global equity prices.

The rand tends to be a risk-on/risk-off currency (i.e. a cyclical asset). Simplistically, in a risk-on environment, investors switch exposure from developed markets (DMs) to emerging markets (EMs), depressing DM asset prices and strengthening EM asset prices and currencies like the rand. In a risk-off environment, the reverse is true, with investors moving their allocation back to DM assets, resulting in a weakening rand, which then acts as a ‘shock absorber’ for an offshore investment.

So, what the rand may give you in terms of a potential offshore investment entry point, offshore asset valuations (and asset price momentum) tend to take away, and vice versa.

Finally, to make a discretionary offshore investment more tax efficient, investors should consider investing in an offshore unit trust via the Ninety One Global Life Portfolio, available on the Ninety One Investme nt Platform

Interestingly, Clyde Rossouw, Portfolio Manager of the Ninety One Opportunity and Ninety One Global Franchise Funds, continues to favour select global equities despite the expected slowdown in global growth:

“While 2022 was undoubtedly a tough year for investors, the fall in asset prices resulted in improved prospective return expectations. This is especially true for the high-quality global companies we hold. Despite the fall in their share prices, the fundamentals of these businesses remain strong. They are ideally positioned to navigate the tough macroeconomic environment that lies ahead. Their strong pricing power and low debt levels are a formidable bulwark against inflation and rising interest rates. We remain confident about the runway for growth and the ability of these companies to compound their cash flows. Given these factors, we are increasingly optimistic about the prospective returns from the global equities we hold. Global equity remains our preferred asset class.” 2

This talks to the benefit of paying attention to the offshore assets selected rather than the currency.

The Ninety One Global Life Portfolio offers investors, subject to high tax rates, a significant reduction in the rates of tax applicable to their investment. In addition, Ninety One Assurance Limited takes care of all tax administration by undertaking the calculation and payment of any tax due. This is possible because a sinking fund is taxed in terms of the five funds approach, which means the policyholder fund is the taxpayer and not the end investor.

Clyde Rossouw Co-Head of QualityWhen investing offshore, we would therefore argue that investors take a longer-term view and look past the shorter-term movements of the currency. Furthermore, the majority of South Africans investing offshore should look to global equities or high-equity global multi-asset solutions with long-term track records that have proven their mettle through investment cycles, such as the Ninety One Global Franchise and Ninety One Global Strategic Managed Funds. 2. N inety One Opportunity Fund Manager commentary, as at 31 December 2022.

The result being that all tax is deducted within the sinking fund policy, and the following rates apply:3

3 0% on income (if any), rather than the investor’s marginal tax rate, which may be a maximum of 45%

1 2% on capital gains (40% inclusion rate x 30% income tax rate), rather than a maximum effective rate of 18% (inclusion rate of 40% taxed at the investor’s marginal tax rate, which may be as much as 45%)

The proceeds, when received, are tax-free in terms of current revenue practice. And importantly, in the event of the death of the policyholder, no capital gains tax is payable when the policy is transferred into the name of the beneficiary.

As always, the best approach is to seek professional financial and tax advice.

The proceeds, when received, are tax-free in terms of current revenue practice.3. A pplicable to the 2022/2023 tax year. Taxed in the individual policyholder fund.

The deceleration of inflation globally, combined with the growth impact of China reopening its economy, finds emerging markets in somewhat of a sweet spot.

W ith the inflation picture improving in South Africa and many of the upside risks abating, we are likely nearing the end of the South African Reserve Bank’s hiking cycle.

We expect strong returns from SA fixed income assets in 2023.

Fiscal revenues should remain healthy as we anticipate that commodity prices will stay elevated. This should allow National Treasury to further consolidate the debt burden over the coming year.

The Ninety One Diversified Income Fund is positioned to participate in any bond market rally, while the Fund’s offshore allocation helps to protect capital in times of weakness.

Adam Furlan Portfolio Manager, Fixed Income

Adam Furlan Portfolio Manager, Fixed Income

Are we at the sweet spot? Are we at the sweet spot?

Unprecedented levels of inflation in the developed world sparked a robust monetary policy response that heavily impacted asset returns in 2022. The US Federal Reserve (the Fed) raised its policy rate by 4.25% and embarked on balance sheet reduction with much of the rest of the world following suit. Investors experienced one of the worst years in history for US fixed income assets in 2022. We saw 10-year US Treasury yields rise from 1.5% at the start of 2022 to end the year at 3.9% (when yields rise bond prices decline). US equities retreated 18% and the US dollar appreciated 8.2% against a basket of its major trading partners.

Investors have endured two very challenging years in the US bond market. As Figure 1 shows, the last time investors experienced 2 negative years in a row for US Treasuries was in the 1950s!

The Chinese economy remained in lockdown for much of last year and global food prices spiked, impacted by the war in Ukraine. All of these factors created a very hostile environment for emerging markets (EMs).

Surprisingly, South African assets fared reasonably well in this environment. Despite a depreciation in the rand of 6.9% against the US dollar and the repo rate going higher by 3.25%, the JSE All Share Index returned 3.6% over the year. This can largely be attributed to strong commodity and financial sector returns. On a trade-weighted basis, the rand performed significantly better depreciating only 0.04% against our trading partners.

South African government bonds returned 4.3%, marginally behind cash, in the worst global bond bear market we have experienced in recent history. Despite yields on the 10-year benchmark bond rising 1.1% (lowering their price) over 2022, the income protection inherent in the asset class shielded investors. South African government bond yields rose 0.3% less than their EM peers over the year. This is a significant outperformance, given the 1.4% rise in EM yields.

An income return of 9.7% over the period provided South African government bonds with a significant buffer against a 5.5% loss of capital, leaving a combined return of 4.2%.

Source: Ninety One, Bloomberg, as at 31 December 2022.

With yields starting the year at 10.9%, the outlook for 2023 looks promising with significant income protection on the table.

Figure 2: The power of incomeAre we at the sweet spot?

The deceleration of inflation globally, combined with the growth impact of China reopening its economy, finds emerging markets in somewhat of a sweet spot.

Data out of the US at the start of the year showed continued gains in the labour market. However, there are also indications of some wage normalisation through a slowdown in average hourly earnings. Headline consumer price inflation (CPI) slowed to 6.5% in December, with wage-sensitive services categories more contained. This allowed the Fed to slow the pace of its tightening cycle to 0.25% at its February FOMC meeting. The Fed continues to signal that the federal funds rate should reach a peak slightly above 5%, while markets expect rates to top out at around 4.9%.

Are we at the sweet spot?

Headline inflation peaked in July 2022 at 7.8%, falling to 7.2% in December. Looking forward, we see headline inflation averaging 5.4% in 2023 owing largely to declining petrol prices and a deceleration in food inflation. The South African Reserve Bank (SARB) was proactive in managing inflation over 2022. It started hiking rates early. At 7.25% currently, the repo rate reflects a more neutral policy setting (relative to expected inflation). With the inflation picture improving and many of the upside risks abating, we expect that we are close to the end of the SARB’s hiking cycle.

A relatively warm winter in Europe has softened demand for natural gas and continues to temper energy prices. The relatively benign outlook for global energy prices continues to place downward pressure on global CPI, allowing central banks to take their foot off the throttle and slow the pace of monetary policy tightening.

Late in December, China released new guidelines to significantly relax Covid controls for domestic infections and inbound travellers, which took effect in early January. The reopening of China’s economy has already improved sentiment about Chinese growth this year. This move, combined with measures to support the property sector taken in late 2022, will likely bolster commodity prices and further buoy the commodity-exporting emerging markets.

The growth outlook remains difficult with consumer sentiment slowing after a year of rate increases and high inflation. We remain optimistic about private investment in the energy sector on the back of structural reform underpinning our 1% GDP forecast for 2023. As we expect commodity prices to remain elevated, we see fiscal revenues performing well. This should allow National Treasury to further consolidate the debt burden over the coming year. The economy has shown remarkable resilience to the high levels of power outages in 2022. But with load-shedding set to continue, this undoubtably places a cap on sentiment and our potential growth.

1. FOMC refers to Federal Open Market Committee. Its members determine the direction of monetary policy in the United States – Investopedia. Figure 3: SA inflation and repo rate outlook Source: Ninety One, Stats SA and Bloomberg, January 2023.The reopening of China’s economy has already improved sentiment about Chinese growth this year.

Despite extreme volatility, the Ninety One Diversified Income Fund generated an attractive return over 2022, outperforming bonds and cash while avoiding any negative quarterly returns. We often talk about how the Fund tries to “participate and protect”, and this was very much a year to protect.

For most of the year we thought SA bonds were cheap, but not riskless. So our job was to find a way to own SA bonds, earning the attractive interest on offer, but in a way where we protected the portfolio from the many developing risks.

With global risks subsiding, local inflation likely to have peaked in the third quarter of 2022 and local political risks abating post the ANC elective conference, we are optimistic on bond market returns. Hefty income on the table, combined with dynamic portfolio construction, will continue to help protect capital against global monetary policy and growth volatility, and continued load-shedding locally. We remain overweight the 10-15 year sector of the curve relative to longer-dated bonds as valuations look most attractive in this space. These shorter-dated bonds should benefit further from a slowing or pause in the monetary policy cycle over the first half of the year. With yields on credit looking relatively less attractive given where government bond yields are, we remain underweight investment-grade credit in the portfolio. However, we continue to look for yield-enhancing opportunities in high-quality counterparties.

The portfolio’s currency exposure remains underweight, given dollar momentum waning and elevated terms of trade supporting the rand. Yields on offshore credit, however, look attractive. We hold a material exposure to high-quality SA counterparties issuing in dollars, and US investment-grade credit. This portion of the portfolio yields 6.3% in US dollars.

Turning to listed property, balance sheets are in a healthier position post Covid and the sector is paying out dividends again. We marginally increased our exposure during the fourth quarter of 2022, further reducing our underweight. As we expect a slowdown in economic growth in response to global monetary policy tightening, we remain more constructive on the prospects for SA government bonds relative to listed property.

With inflation decelerating across the world, monetary policy cycles nearing an end, and China reopening its economy, we are constructive on the outlook for EMs. We hold a similar view on monetary policy locally, and combined with continued fiscal consolidation, we expect strong returns from SA fixed income assets in 2023.

We believe that investing in climate solutions offers the structural growth opportunity of a lifetime. Global efforts to cut carbon emissions are driving vast flows of capital, fuelling innovation and creating an enduring tailwind for select companies.

The Ninety One Global Environment Fund invests in leading climate solution companies, focusing on three pathways to a low carbon future: renewable energy, electrification and resource efficiency.

An investment strategy based on this opportunity has the potential to generate compelling returns over the long term while contributing to a positive real-world impact.

Graeme Baker Portfolio Manager, Multi-AssetThe Fund’s focus means it has very little similarity with typical client portfolios and therefore offers a differentiated return signature. Our modelling shows that an allocation to the Fund offers significant diversification benefits to various investment styles, including quality-focused global equity portfolios.

Can you make a real-world impact and earn an attractive return?

Can you make a real-world impact and earn an attractive return?

South Africa benefits from a number of factors that provide the potential for it to be a future leader in the manufacturing and production of climate solutions. According to the South African Department of Energy, most areas in the country average 2 500 hours of sunshine per year, with an average daily solar radiation level across a year of more than double that of Europe. South Africa has an abundance of naturally occurring raw materials that can be used in the manufacture of electric vehicles, including lithium, cobalt, nickel, graphite and manganese. There is also government support to reach net zero by 2050, with a heavy emphasis on greening the power sector.

Can you make a real-world impact and earn an attractive return?

Many SA investment portfolios are exposed to some of these trends by virtue of holdings in domestic mining companies as well as traditional energy companies that will be undertaking a transition in their businesses over time. However, exposure to the globally leading climate solution companies of today, such as those owned within the Ninety One Global Environment Fund, is much more limited. These companies offer the prospect of attractive returns with a real-world impact, which if accessed through a highly selective and conviction approach, provide a compelling addition to both a domestic portfolio and an international portfolio.

Climate change is the single biggest health threat facing humanity, according to the World Health Organisation. The United Nation’s Intergovernmental Panel on Climate Change has warned that to prevent millions of climate change-related deaths, the world must limit global warming to 1.5°C. If we are to get anywhere close to this, there needs to be a significant increase in climate-related finance from current levels, as can be seen in Figure 1.

This climate emergency has resulted in a fast-evolving regulatory and policy backdrop as well as a significant momentum shift in corporate and public attitudes towards climate change. 2 The vast majority of governments around the world have made net-zero pledges. A meaningful and growing number of publicly traded developed market companies now have net-zero targets. Consumer behaviours (including investment related) continue to firmly trend towards a greater consideration of sustainability issues.

1. https://www.climatepolicyinitiative.org/Full-report-Global-Landscape-of-Climate-Fin ance-2021.pdf

2. https://ninetyone.com/planetary-pulse-2022-early-steps-towards-transition

South Africa benefits from a number of factors that provide the potential for it to be a future leader in the manufacturing and production of climate solutions.Figure 1: Global tracked climate finance flows and the average estimated annual climate investment need through 2050

The vast majority of governments around the world have made net-zero pledges.

Can you make a real-world impact and earn an attractive return?

Acting on climate change isn’t just about doing the right thing though. For investors, ‘decarbonisation’ (reducing the world’s carbon emissions) matters because transitioning to a low-carbon economy requires a radical overhaul of everything we do. As the International Energy Agency’s (IEA’s) seminal 2021 report “Net Zero by 2050” highlighted, the transition from a carbon-heavy global economy to one based on clean energy has barely begun. This affords companies that are enabling that transition an unprecedented growth opportunity.

Achieving carbon neutrality by 2050 requires the following milestones to be achieved by 2030, a mere 7 years from now:

A 4x increase in wind and solar capacity

An 18x increase in electric vehicle (EV) sales

A 41x increase in annual EV battery production

US$4 trillion of annual investment in the energy sector alone

Can you make a real-world impact and earn an attractive return?

Can you make a real-world impact and earn an attractive return?

That is only part of the getting-to-net-zero story. The IEA’s energy-sector focused report accounts for only about two-thirds of global emissions. Reducing the remaining one-third will require radical changes to agriculture, food production, industrial processes, buildings and much else besides.

All this is changing the risk and return potential of industries and individual companies. Global efforts to cut carbon emissions are driving vast flows of capital, fuelling innovation and creating an enduring tailwind for select companies.

In our view, investing in climate solutions therefore offers the structural growth opportunity of a lifetime. We believe that companies whose products and services help the global economy to decarbonise, have the potential to grow revenues and profits faster than the market average, with the earnings and growth prospects of these companies typically underappreciated by the market.

If appropriately executed, an investment strategy based on this opportunity has the potential to generate compelling returns over the long term while contributing to a positive real-world impact. Importantly, this isn’t prioritising real-world impact at the expense of returns. In our view, these attractive returns are achievable because of this real-world impact.

The climate-solutions investment opportunity set is extremely broad, extending far beyond the wind and solar farms that many people might think of at first. It also spans companies that are helping to decarbonise the buildings we work in, the homes we live in, the food we eat, the products we consume and the transport we use. Moreover, it encompasses not just the direct beneficiaries of the energy transition, but the entire related supply chains that need to be built up around them. It is also global. We believe emerging markets offer significant additional potential for investors in decarbonisation. Certain companies in China, in particular, are global leaders in technologies that are crucial to efforts to tackle climate change.

Can you make a real-world impact and earn an attractive return?

Finally, contrary to a potential misconception, this isn’t a small/mid-cap play. Although such companies are well represented in the investment universe, we find that the types of companies we are looking for – attractive growth with persistent profitability and strong competitive advantages – lead to a largecap orientation. (Approximately 85% of the portfolio was large cap, as defined as having a market cap >$10 billion, at 31 December 2022.)

In thematic terms, the opportunity set for the Ninety One Global Environment Fund –which is a high-conviction global equity portfolio – can be described as encompassing three pathways to a low carbon future: 1) renewable energy, 2) electrification, and 3) resource efficiency.

Historically, we have owned between 22 and 27 companies in the portfolios, with the top 10 holdings representing 50-55% of the fund. The active share relative to the MSCI All Country World Index (ACWI) has been close to or above 99%, indicating significant variation both in terms of the holdings and sizing relative to global equity indices.

Our approach is deliberately high conviction and highly concentrated. We believe this approach is warranted to ensure we focus only on the best companies in this space. It also means that individual company outcomes matter more for both our investment returns and real-world impact. Finally, it helps us to have more meaningful company engagements.

Can you make a real-world impact and earn an attractive return?

As noted above, there is significant variation between the positions held in the Ninety One Global Environment Fund and the MSCI ACWI. As at 31 December 2022:

There were two holdings that were not even in the index, and only one company within the top 100.

Similarly, there is zero position overlap with domestic portfolios, and typically very little position overlap with international global equity strategies (core as well as sustainability focused).

Further, structural sector biases (i.e. favouring industrials, utilities, materials, green tech and not investing in US mega-cap tech, energy, financials, real estate or healthcare) and country biases (i.e. lower relative exposure to the US and higher relative exposure to China) accentuate these differences.

The result is a very different return signature, and in particular, a lowly correlated/uncorrelated alpha signature.

In a portfolio context this is highly compelling. The differentiated alpha pattern means that the Fund typically generates alpha at different times to other allocations, which can help to smooth the overall portfolio alpha through time. 3 To help illustrate this, Figure 3 models the historical effect of having incrementally added an allocation to the Fund from a global equity portfolio. For the sake of simplicity, we have used the MSCI ACWI Quality Index as the global equity representation here, given many investors have biased their portfolios to the quality style. Figure 3 shows that the addition to the Ninety One Global Environment Fund (“E” in chart) would have historically improved the efficiency of the quality-focused global equity portfolio (“Q” in chart). There is a sweet spot allocation of 10-20% to the Ninety One Global Environment Fund that significantly improves the information ratio without an incremental increase in tracking error. 4

Source: Ninety One, Bloomberg, 31 December 2022. Global Environment data is based on the USD A Acc share class, performance is net of fees. Quality data is based on the MSCI ACWI Quality Total Return Index. Data starts from 1 March 2019.

While the above results show a historical favourable comparison against a quality-focused portfolio, a low correlation between the excess returns of the Fund and the excess returns of other styles is prevalent too. This is shown in the below correlations against growth, value and momentum as well as quality styles (vs. MSCI ACWI):

Q uality = 0.01

Value = -0.12

G rowth = 0.13

M omentum = 0.04

It is not very often that an investment opportunity comes along with strong long-term drivers, providing the potential for attractive returns while contributing to a positive real-world impact. Moreover, the Ninety One Global Environment Fund is highly differentiated and complementary to existing allocations. So, yes, you can make a real-world impact and earn an attractive return – if you do it properly.

South African investors can now also get full exposure to the Ninety One Global Environment Fund by investing in the rand-based Ninety One Global Environment Feeder Fund . We launched the Ninety One Global Environment Feeder Fund on 15 December 2022.

3. A lpha refers to the excess return of an investment relative to the return of a benchmark index – Investopedia.com.

4. The information ratio is a measurement of portfolio returns above the returns of a benchmark, e.g. an index, and considers the volatility of those returns. Tracking error is the divergence between the price behaviour of a position or a portfolio and the price behaviour of a benchmark – Investopedia.com.

Note: [ ] indicates maximum in equities. *As an internal limit, the Fund will normally invest no more than 40% of its value in the shares of companies. The Global Multi-Asset Income, Global Strategic Managed and Global Franchise Funds are available as ZAR feeder funds. The Global Strategic Managed and Global Franchise Funds are available in hedged GBP classes.

All information provided is product related and is not intended to address the circumstances of any particular individual or entity. We are not acting and do not purport to act in any way as an advisor or in a fiduciary capacity. No one should act upon such information without appropriate professional advice after a thorough examination of a particular situation. This is not a recommendation to buy, sell or hold any particular security. Collective investment scheme funds are generally medium to long term investments and the manager, Ninety One Fund Managers SA (RF) (Pty) Ltd, gives no guarantee with respect to the capital or the return of the fund. Past performance is not necessarily a guide to future performance. The value of participatory interests (units) may go down as well as up. Funds are traded at ruling prices and can engage in borrowing and scrip lending. The fund may borrow up to 10% of its market value to bridge insufficient liquidity. A schedule of charges, fees and advisor fees is available on request from the manager which is registered under the Collective Investment Schemes Control Act. Additional advisor fees may be paid and if so, are subject to the relevant FAIS disclosure requirements. Performance shown is that of the fund and individual investor performance may differ as a result of initial fees, actual investment date, date of any subsequent reinvestment and any dividend withholding tax. There are different fee classes of units on the fund and the information presented is for the most expensive class. Fluctuations or movements in exchange rates may cause the value of underlying international investments to go up or down. Where the fund invests in the units of foreign collective investment schemes, these may levy additional charges which are included in the relevant Total Expense Ratio (TER). A higher TER does not necessarily imply a poor return, nor does a low TER imply a good return. The ratio does not include transaction costs. The current TER cannot be regarded as an indication of the future TERs. Additional information on the funds may be obtained, free of charge, at www.ninetyone.com. The Manager, PO Box 1655, Cape Town, 8000, Tel: 0860 500 100. The scheme trustee is FirstRand Bank Limited, RMB, 3 Merchant Place, Ground Floor, Cnr. Fredman and Gwen Streets, Sandton, 2196, tel. (011) 301 6335. A feeder fund is a fund that, apart from assets in liquid form, consists solely of units in a single fund of a collective investment scheme which levies its own charges which could then result in a higher fee structure for the feeder fund. The fund is a sub-fund in the Ninety One Global Strategy Fund, 49 Avenue J.F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg, and is approved under the Collective Investment Schemes Control Act. Ninety One SA (Pty) Ltd is a member of the Association for Savings and Investment SA (ASISA).

This communication is the copyright of Ninety One and its contents may not be re-used without Ninety One’s prior permission. Ninety One Investment Platform (Pty) Ltd and Ninety One SA (Pty) Ltd are authorised financial services providers. Issued, February 2023.