5 minute read

It's time to give women top posts in multilateral institutions like UN, World Bank, says GCBL Chairman

The Chairman of the Global Chamber of Business Leaders (GCBL), Dejan Stancer, has called for women around the world to be given top posts in multilateral institutions like the United Nations (UN), the International Atomic Energy Agency and the World Bank.

Mr. Stancer made the call in a speech during a virtual conference organized by the Global Chamber of Business Leaders on March 8, 2023, to celebrate the International Women's Day (IWD).

Advertisement

The 2023 edition of IWD was held under the global theme: 'DigitALL: Innovation and technology for gender equality' and was celebrated world- wide to help raise awareness about the need to create equal opportunities for both women and men in the digital or technological world.

Speaking under the special theme for the virtual conference: "Unleashing The Power Of Innovation And Technology For Gender Equality," Mr. Stancer bemoaned that "women have held just 12 percent of the top posts in the 33 largest multilateral institutions since 1945, and more than a third of those bodies, including all four major development banks, have never been led by a woman."

He explained that since 1945, the 33 multilateral institutions have had 382 leaders, of whom only 47 were women, adding that "and despite progress in recent years, only one third of institutions are currently headed by women."

According to him, ve of those bodies have only had one female president in their history, and that includes the current head of the World Trade Organization (WHO), Ngozi Okonjo Iweala.

Among the 13 institutions that have never had a woman at their head, Mr. Stancer mentioned, are the World Bank, the UN, the International Atomic Energy Agency (IAEA) and the Food and Agriculture

Organization (FAO).

Giving reasons why women must be given opportunities to head multilateral institutions, Mr. Stancer made a demographic argument, saying "Women make up 50 percent of the world's population, so it's demographic justice to begin with.Women bring a combination of leadership, wisdom and empathy. Sometimes women have an even greater understanding of what's going on in the world, and about geopolitics."

Women empowerment at GCBL

Meanwhile, he said at the

Global Chamber of Business Leaders, the situation is completely di erent, saying the share of women occupying leadership positions is almost 46%.

"In the working bodies of GCBL, as we call the committees, of which we have established six, the proportion of women is as much as 50%," he said.

According to him, "Appointments to the GCBL are never made on the basis of race, color, political or religious belief, and especially not on the basis of sex. At GCBL, we appoint exclusively on the basis of knowledge and experience. With us, everyone has the same opportunities, even

As Nigerians prepare to go to the polls on Saturday to elect a new president, a cash shortage caused by a policy to exchange old Naira notes for newly designed bills continues to cripple the economy, creating a rift in the ruling All Progressives Congress (APC) party. The note swap plan championed by incumbent President Muhammadu Buhari has led to violent protests across the country and resulted in a temporary suspension of banking e Supreme Court to overturn the policy, citing severe hardship faced by people and businesses dependent on cash for survival. Buhari’s apparent intention behind the policy is to curb vote buying by politicians, turning a deaf ear to APC governors who have made repeated calls to postpone the implementation of the policy. Amid fears of the current tensions spilling over to political violence, Buhari said he’s mobilising military and security agents to monitor polling stations for evidence of vote rigging. The severe cash shortage has held the currency steady in spite of the economic turmoil, with the Naira strengthening marginally against the dollar to 755 from 756 at last week’s close. In this context, resolving the cash shortage has become more rate likely to hold around current levels until Naira supplies recover.

Rand sinks to lowest in more than 3 months

The Rand depreciated against the dollar, trading at 18.25 from 18.05 at last Friday’s close—its weakest level since early November. The currency is being dragged lower by broad more than half of the power company’s debt over the next three years to help strengthen the balance sheet and avoid the risk of default. We expect the Rand to continue trading with an 18 handle in the near term, mainly due to the

Foreign

Down 18%

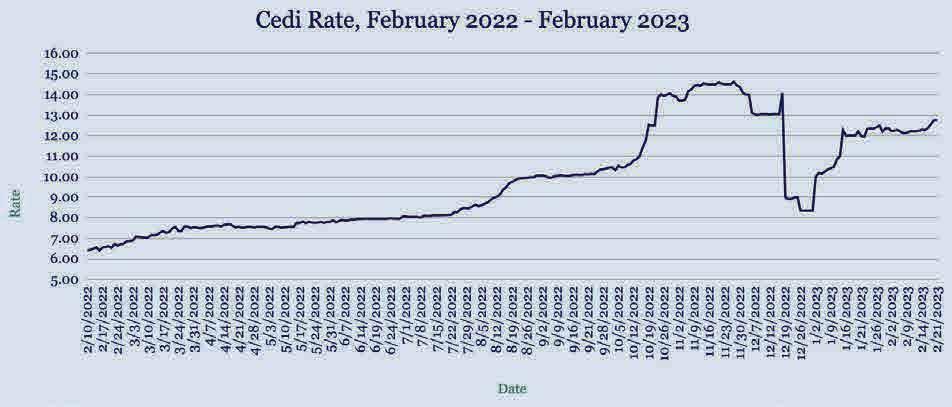

The Cedi weakened against the dollar, trading at 12.76 from 12.38 at last week’s close as Fitch Ratings cut Ghana’s foreign currency credit rating to ‘restricted default’ after the country missed a $40.6m coupon payment on one of its outstanding Eurobonds. The downgrade aligns with Fitch’s local currency rating, which was cut earlier this month. The foreign debt default was largely expected after Ghana said it would suspend payments on certain bonds as part of its restructuring plan to unlock $3bn in emergency funding from the IMF. The country faces pushback from bondholders over preferential treatment for bilateral lenders, who are being slight improvement in January—we expect the Cedi to depreciate further in the near term.

Down Down 99%

Foreign Exchange Down

4.8%

The Pound depreciated against the dollar, trading at 30.60 from bond, or sukuk, raising $1.5bn. The three-year deal priced to yield 11%, having attracted investor demand of more than $5bn. expect the Pound depreciate further in the week ahead mainly due to dollar strength.

Shilling strengthens as Uganda resists rate rise

The Shilling strengthened against the dollar, trading at 3674 from 3684 at last week’s close. Uganda’s central bank kept its benchmark interest rate on hold at 10% for a second consecutive monetary policy meeting. The bank last raised by 100 basis points in October, with rates ending the year 350 basis points higher than they were at the start of 2022. Policymakers said the decision to hold rates was aimed at containing domestic demand pressure and supporting edging up to 10.4% last month. In the near term, we expect the Shilling to weaken amid continued food and energy price

94%

Foreign

Down

32% 11.7%

Kenyan Shilling hits new low as FX reserves dwindle d d e e c clli i n n e e s s b b y y a a b b o o u utt

The Shilling weakened to a fresh low against the dollar, trading at 126.15 from 125.90 at last week’s close amid increased FX demand from the oil and energy sector. The currency has now lost more than 2% of its value this year. Kenya’s foreign currency reserves also dropped to a new record low $6.88bn from $6.94bn secured a $27m funding deal with the European Union to boost exports to the 27-nation bloc and strengthen the overall business environment. The government is also anticipating $3.4bn in tourism-related earnings this year as it expects tourist numbers to exceed pre-pandemic levels. In the immediate term, however, we expect the Shilling to remain under pressure as importers clamour for dollars to meet month-end obligations.

5 0 0 % % iin n m m a arrk k e ett ttu urrn n o o v v e err iin n tth h e e m m o o n ntth h o off F F e e brr u u a arry y

T T--b biil lll s s:: go o v v e errn n m m e e n ntt pu u s s h h e e s iin n v v e e stto orrs s tto o b biid d b b e ello o w w

3 0 0 % % Download