Russia's trade growing with Africa

In this interview, Alisa Prokhorova, Managing Director for International Activities and Interaction with Business Councils, and Group of companies of the Russian Export Center o ers in-depth information and statistics about Russia's trade with Africa.

Russia, set the grounds for raising trade collaboration across various areas and work towards a new dynamism in the existing economic cooperation with African countries.

By Kestér Kenn KlomegâhIn our conversation, Prokhorova stressed that as the African continent undergoes positive transformation, platforms for dialogue on trade between Russia and Africa are emerging too. She refers to the newly created continental free trade zone in Africa for potential Russian investors and enterprises, facilitating their quest for interaction with industry organisations in sub-Saharan African countries.

Here are the interview excerpts:

Question: Is the African market

promising from an economic point of view? What are the prospects of Russia playing a unique role on the African continent?

Answer: What is the peculiarity of the African continent? The demand is very high (a large territory of the continent, 54 countries), but many countries are not creditworthy. Large corporations plan a strategy to enter the market with a deferred e ect. So, they invest. For example, China which enters many African countries takes signi -

cant projects but implements them at its own expense because it is challenging to achieve high demand from the African population.

Russian companies do not have enough resources to engage in such investment expansion. The market is potentially the largest, Africa - is the continent of the future, but at the moment, the demand is generally limited.

By Werner HoyerThe Ghana Cocoa Board (COCOBOD) says it has lost GH¢4.8 billion worth of investment in 35 hectares of cocoa farms to illegal mining (galamsey) activities at Boinso in the Western Region. The investment covered the planting of new cocoa trees and plantain suckers, compensations to landowners and farmers, ex-

In ful llment of government assurance to bondholders who did not tender their old bonds, the Ministry of Finance is taking administrative steps to ensure that payments of coupons and principals of the old bonds resume by

Gold Fields production drops by 4percent in 2022

Production for Gold elds Ghana dropped by four percent to 838,000 ounces (koz) in 2022 from 871, 000 (koz) in 2021, mainly driven by decreased production at the Damang Mine due to completion of the Damang pit cutback as well as lower production at Asanko.

The Company indicated that all-in costs across the three mines increased by 10 percent to US$1,220/oz in 2022 from US$1,112/oz in 2021. However, the mines produced adjusted free cash ow, excluding Asanko, of US$219million in 2022 compared to US$292million in 2021. Its interim Chief Executive O cer (CEO), Martin Preece, in a statement also noted that assets in the company’s portfolio are maturing and reaching the end of their lives, highlighting low output by the Damang Mine.

“There are assets in the portfolio which are maturing and reaching the end of their lives. 2022 was the last year of steady-state production at Damang post reinvestment in the pit cutback. In 2023, production from Damang will come from a combination of ore from the Huni pit and stockpiles, with only stock-

Secondly, the USSR (Russia's 2

2

Ghana International Bank trains over

bankers on Trade Finance

tension services, among other activities it was undertaking to scale up the country’s cocoa production.

Rev Edwin Afari, Executive Director, Cocoa Health, and Extension Division said a recent visit to the area saw that all the cocoa trees they planted had been cut down

Ghana International Bank (GHIB), a wholly-Ghanaian bank incorporated in the United Kingdom, has facilitated a trade nance training programme for over 60 bankers from across six West African countries.

The four-day trade nance training seminar in Ghana focused on various international trade nance products that banks can use in serving their customers.

Speaking to the media at the closing ceremony of the training, Baafuor Ohene Abankwah, the Country Representative, Ghana and Head, Client Coverage Africa, said

the training is part of GHIB’s e orts to deliver quality banking services and provide a bridge to Ghana's banking institutions.

"As a wholly Ghanaian bank incorporated in the UK, we have been the heart of trade nance in Africa for many years, dating back to the 1950s." We believe that we have a role to play in building trade nance capacity so we are passionate about organising such

six

Payments of coupons, principals of old bonds to resume by March 13training programmes. This is the eighth session, and we have over 60 bankers from across countries in West Africa present to be equipped on how to facilitate trade between the countries they represent and the rest of the world".

Russia's trade growing with Africa

predecessor, the Union of Soviet Socialist Republics) was very active in Africa. It had built and invested a lot, so since those times, Russia has a positive image. Besides the past achievements, it is necessary to form an economic strategy for the future.

Q: What are the dynamics of economic relations between Russia and Africa over the past ve years? Which changes are being tracked?

A: Russian exports to African countries have generally shown a steady upward trend (adjusted for several speci c factors). If in 2010 exports amounted to only US$ 5 billion (less than 1.5% of the total), then in 2019—already US$ 14 billion (3.3%).

Due to the low share of fuel in the supplies, Africa's role in non-commodity exports is much more significant. Over the past ve years, Russian non-commodity export to Africa has consistently exceeded US$ 10 billion (2018 was a record year, exports amounted to US$ 14.4 billion).

Speaking about Africa, we need to clearly distinguish the countries of this continent into two groups: the northern and southern parts. Russia traditionally has good economic relations with the countries of North Africa (trade turnover of US$ 11.7 billion in 2019), where there is a dynamic growth of Russian non-resource non-energy exports.

With the South African countries (trade turnover of US$ 5 billion in 2019), the statistics are more inconsistent, where the export of Russian non-commodity goods over the ve past years ranges from US$ 1.8 billion in 2015 to US$ 2.2 billion in 2019. Despite that, 2018 was the most successful year with an export volume of US$ 2.7 billion.

Q: How much does Russia export to African countries on average per year? Which of them have the largest share in the Russian trade balance?

A: As I have already noted, Russia works most actively with Northern Africa countries where Egypt stands out. Algeria and Morocco can also be distinguished.

Non-commodity exports 2019 (USD

million): Egypt – 5407, Algeria –2985, Nigeria – 367, Morocco –332, Sudan – 271, South Africa –260, Tunisia – 170, Kenya – 156.

Non-commodity exports for eight months in 2020 (USD million) amounted to Egypt – 1624, Algeria – 1148, Nigeria – 279, Sudan – 203, Morocco – 199, South Africa – 155, Kenya – 115, Tunisia – 102.

As for major export contracts, the following deserves attention:

The supply of 1.3 thousand passenger railcars for Egypt, for about 1 billion euros, was won by Transmashholding in cooperation with its Hungarian partner (the head contractor is the Tver Carriage Building Plant). Deliveries under this contract have already begun, and by October, 117 railcars (US$ 59 million) were shipped. EXIAR and EXIMBANK of Russia also take part as I know.

Q: What is the role of non-commodity exports in trade with African countries? Are there any major infrastructure projects with the participation of Russia?

A: Russian Export Center pays priority attention to the development of relations with sub-Saharan Africa. The outcome of 2020, the volume of non-commodity export amounted to US$ 432.1 million. There was support for the supply of Russian products in 34 countries of the region.

The main destinations of Russian non-commodity exports were: Rwanda (165 million), South Africa (32 million), Zambia (27.5 million US dollars), Tanzania (17.8 million US dollars), Ghana (17.1 million US dollars), Kenya (16.6 million US dollars) and Uganda (14.6 million US dollars). The primary export industries are agriculture, mechanical engineering, chemical industry, timber industry, and metallurgical.

At the moment Russian Export Center takes part in the development of prospects for the participation of Russian companies in many infrastructure projects, in particular, the equipment and construction of hydroelectric power plants in several countries in East Africa, the construction of

a railway in one of the countries in West Africa.

Today, our portfolio also includes projects for supplying products from the Russian automobile industry to Ghana, Nigeria and Ethiopia. A project for providing agricultural and railway equipment to several countries in South Africa is being worked out. In total, the work is carried out on projects in 18 countries of the region.

With the participation of the Russian Export Center the implementation of many landmark projects of Russian companies in Africa in critical industries, whose products are most in-demand on the continent, is being discussed. It’s about the mining industry, metallurgy, chemical industry, agricultural products, infrastructure projects.

Special attention is paid to the development of exports of Russian high-tech products, the possibilities of supplying medical equipment, high-tech solutions in the eld of hydro and solar energy, communication and security systems are being worked out. It is important to note that most of these projects are long-term, and their full implementation and delivery of results require long-term collaboration with African counterparts.

Q: Economic partners from which African countries are interested in obtaining accreditation? And which of the services are in demand?

A: We are also stepping up our efforts to expand our foreign network. Since December 2021, the Russian Export Center has accredited partners in countries such as the Democratic Republic of the Congo (DRC), Angola, the Republic of the Congo, Ivory Coast, and Rwanda. Partners in countries such as Ethiopia, Kenya, Tanzania, Ghana, and Senegal are in the process of accreditation.

We record an increase in the interest of Russian exporters in providing both nancial services (lending and insurance) and non- nancial services (search for a foreign buyer, top-level search for a partner) in West Africa (Nigeria, Benin, Ghana, Ivory Coast) and many East African countries (Tanzania, Kenya, Ethiopia).

By Kestér Kenn KlomegâhWe note an increase in the number of requests to nd a Russian supplier from sub-Saharan Africa. Companies from such countries as South Africa, Nigeria, Ivory Coast, Ghana, Ethiopia, Tanzania, and Benin are most interested in increasing imports of Russian companies' products. We frequently receive requests to search for suppliers in such industries as mineral fertilisers, food products and petrochemicals.

Q: Are you planning to establish cooperation with regional organisations and, if so, with which ones?

A: We plan to expand the channels of interaction with industry organisations and business councils of the sub-Saharan African countries. Particular emphasis will be placed on cooperation with regional integration groupings (for example, the Southern African Development Community-SADC, the Economic Community of West African Countries-ECOWAS and the East African Community-EAC)

Besides, several projects can be noted: the activities and plans of the Coordinating Committee on Economic Cooperation with Africa (AfroCom), a Russian Business NGO, at the Russian Chamber of Commerce and Industry (CCI) in the direction of Africa, the Russia-Africa Summit 2022, and the possible opening of a tasting pavilion in one of the African countries.

Q: Why is African business is low or completely absent, compared to Asian countries, in the Russian Federation? Under the circumstances, what should be done to improve the current situation, to make a two-way trade?

A: The development of bilateral re-

lations in the business environment depends on the intergovernmental commissions. These commissions work out the terms of cooperation and resolve issues of economic, technical and legal nature. To improve the situation in two-way trade, it is necessary to develop state cooperation.

Moreover, the remoteness and insu ciency of developed transport networks with Africa are also vital issues of bilateral cooperation. The elimination of trade barriers and dialogue at intergovernmental commissions will allow countries to improve two-way trade links.

Q: With the adoption of African continental free trade, what is your interpretation of this free trade, and how useful it could be for Russian corporate exporters?

A: The African free trade zone opens up opportunities for the free movement of services, goods, capital and labour in the region. This reduces costs and facilitates trade between countries, making Africa even more attractive to other states.

Russia supports the African free trade zone because it is very convenient for exporters who get the necessary certi cates and trade permits in one country and then sell their products to other African states. This free trade area allows producers to reduce the costs and time of transportation of goods. It increases the attractiveness of the African market and makes it more signi cant for Russian exporters..

Gold Fields production drops by 4percent in 2022

piles being treated from 2024 onward,” he said.

He however noted that his out t is concerned with the political and economic environment in the country, particularly in the latter part of 2022 and early part of 2023 as it has become more challenging for businesses in the country to operate

“It is however, engaging with government individually and through industry bodies to reiterate its stance on key matters as the process of claiming certain rebates relating to Development Agreements has become more burdensome,” he said.

While Damang gold production decreased by 10 percent to 230,000oz in 2022 from 254,400oz in 2021 due to lower yield as a result of lower grade of ore processed, Tarkwa gold production increased by 2 percent to 531,600oz in 2022 from 521,700oz

in 2021, mainly due to higher tonnes processed and improved yield.

Asanko which is an Equity-accounted Joint Venture also saw gold production decrease by 19 percent to 170,300oz (100 percent basis) in 2022 from 210,200oz (100 percent basis) in 2021, of which 76,700oz (2021: 94,600oz) was attributable to Gold Fields.

The decrease was mainly due to lower yield, which decreased by 17 percent to 0.91g/t in 2022 from 1.10g/t in 2021. The lower yield was a direct result of lower grade ore processed from stockpile in 2022 compared to higher grade fresh ore and stockpiles in 2021.

For Damang, yield decreased by 11 percent to 1.50g/t in 2022 from 1.68g/t in 2021. This was due to the completion of Damang Pit in November 2022, and mining through transition in the lower

grades of Huni pit.

In Tarkwa, Yield increased by 1 percent to 1.18g/t in 2022 from 1.17g/t in 2021 due to higher grades processed. Ore rehandled from stockpiles was 1,250kt at a head grade of 1.42/t in 2022 compared to 3,336kt at a head grade of 0.78g/t in 2021.

The Company noted that it will continue to work on the future of both the Damang and their share in Asanko and will provide an update to the market in due course.

It also noted that assets in the company’s portfolio are maturing and reaching the end of their lives, highlighting low output by the Damang Mine.

“There are assets in the portfolio which are maturing and reaching the end of their lives. 2022 was the last year of steady-state production at

Damang post reinvestment in the pit cutback. In 2023, production from Damang will come from a combination of ore from the Huni pit and stockpiles, with only stockpiles being treated from 2024 onward,” the company said. Gold Fields says it has limit-

ed organic growth opportunities in its current portfolio, and as such will need to pursue inorganic opportunities to bolster the pipeline. These options will include green eld targets, development projects or bolt-on acquisitions of producing assets.

Ghana International Bank trains over 60 bankers on Trade Finance

"Also, there are huge opportunities for trade nance on the African continent. Here in Ghana, we have several products that are required in West Africa, and banks and nancial institutions can do more to facilitate that. Some of the ways in which banks can do that are to provide the nancing that allows factories to expand and businessmen to make and receive

payments. "Banks have an important role to play, and intentional efforts such as this training to make sure we work together to promote trade in Africa will really help,", he added.

On his part, John Awuah, Chief Executive O cer of the Ghana Association of Banks, said the training

is timely for banks in West Africa to further understand trade nance instruments that can help in the African Continental Free Trade Area (AfCFTA).

"The good thing about trade nance is that it makes transaction costs a bit manageable because it is cheaper compared to

conventional nancing, so trade nance products provide that bridge that enables businesses to access nancing in a more cost-e ective manner."

"We have had a very engaging session with the facilitators of this programme focused on understanding trade nance instru-

ments—the instruments that we use to undertake international trade as banks working for our customers. We can only refer the right nancial instruments to our customers to undertake the trade and get their goods delivered to their doorstep when banks better understand this topic," he concluded.

GHIB has contributed immensely to Ghana’s economy since its inception by working very closely with some banks in the Ghanaian space. The bank has facilitated the import of goods and the export of some of the commodities that Ghana produces. GHIB has been at the heart of some of the biggest syndicated transactions that Ghana has been engaged in and has been involved with remittance ows in Ghana and west Africa.

COCOBOD says it lost GH¢4.8b investment to galamsey

for galamsey.

“We have not even accounted for the harvesting that will be coming. It is just the investment; all the work we have done over there has gone to waste and so you can imagine what is happening,” he lamented.

He was speaking to the Ghana News Agency (GNA) on the sideline of a ceremony to award some 15 blind cocoa farmers, a novelty by the Board to whip up interest in cocoa farming, particularly among Persons with Disabilities. He observed that galamsey had had a dramatic impact on the cocoa industry in Ghana over the last 10 years, and as a major earner of foreign exchange, the country could su er the blunt if the illegality continued. Rev Afari averred that the State

cocoa company was facing a hard time reviving the industry as cocoa farmers were giving out their farms willingly or under compulsion for galamsey.

“In the southern part of the Western North and some parts of Ashanti Region, especially the Manso Adobea, Antoakrom and the Enyinam areas, a lot of the miners are causing us a lot of trouble.

“They are cutting away all the newly planted cocoa trees that we have, and it is really causing us a lot of investments, “she said.

He said Ghana risked losing its cocoa and, therefore, called on government, the Minerals Commission, and chiefs to help ght the menace to save the industry by not giving out concessions in

cocoa-growing areas.

“Because this is what gets us foreign exchange and shores up our Cedi when it is depreciating, and also gives government more room to invest in all the development areas,” he said.

And to the farmers, Mr Afari noted that “the lump sum money may be good now but not in the future because cocoa is there all the time.

“If you do it well and you get 25 bags per hectare, you will be getting more money than you are getting now.”

He further expressed concerns over the aging population of cocoa farmers, citing the attendant looming dire impact on the economy and general development.

He was worried that many young

people were not interested in agriculture in spite of the vast potential in the sector.

He admonished the youth, especially professionals from all elds, to venture into cocoa to create wealth for themselves and the

Payments of coupons, principals of old bonds to resume by March 13

market.

“The Ministry of Finance will work with relevant stakeholders, as agreed, to ensure that these new benchmark securities become the basis for deepening the domestic sovereign debt market”, it pointed out.

The Finance Ministry said this acknowledges the successful completion of the Domestic Debt Exchange Programme with a successful delivery of new securities to bondholders, adding, “In doing so the selective default is substantially cured”. It continued that the above stated milestone is further expected to accelerate the engagement with the country’s creditors, adding, “The government also takes this opportunity to assure our external creditors of equal importance to the Republic of Ghana.”

We, will therefore, continue to work together to advance the progress of our external debt treatment, in order to ensure Ghana’s long term macroeconomic stability”, it concluded.

WhatEurope’s economy needs now

Faced with growing investment gaps, most European policymakers seem to think it is time for another broad-based stimulus package, despite high in ation and high levels of public debt. But I am afraid they are wrong.

Stimulus would simply force the European Central Bank to increase interest rates further and faster. What we need instead is targeted support, namely investments in sectors that are green and likely to promote resilience and competitiveness. The necessary resources must be mobilized quickly and on an EU-wide scale, with the express goal of mobilizing private investment. There has been much handwringing in Europe over the threat posed by the US In ation Reduction Act. Yet despite all the fears it has provoked, the IRA is ultimately a step in the right direction. It provides massive support for green sectors where more investment is urgently needed, and it shows that the United States and Europe are nally aligned in pur-

suing a sustainable economic transformation. Europeans should welcome US eagerness to scale up its renewable-energy capacity, and that it is putting its money where its mouth is.

The IRA’s goal of building modern low-carbon infrastructure is not itself a problem for the European economy. On the contrary, in sectors like wind energy, where Europe is a technology leader, higher investment demand is a positive development. In addition to having a positive e ect on the climate, US subsidies will provide new business opportunities for European rms.

To be sure, some elements of the new US policy present challenges. The IRA o ers substantial support for solar panels, wind power, energy storage, and clean hydrogen equipment, but most of these bene ts are limited to producers who can claim “made in America” status. This setup of course excludes European manufacturers, who do not receive the same subsidies from the European

Union. That raises the risk that some European equipment manufacturers and hydrogen producers pull up stakes and move to the US, adding to the plight of the EU’s already undernanced innovation sector. Just when we need to reinforce the emerging supply chain for green tech, some of the IRA’s provisions could disrupt it – bene ting America at Europe’s expense. But, by keeping open communication channels with our American partners and targeting our own investments to the right sectors, Europe can neutralize the problematic parts of the IRA while still capitalizing on the good parts. Such dialogue is crucial, because we do need to persuade the US to reconsider some of the IRA’s provisions, especially those that go against longstanding principles of open and fair competition. In pursuing such talks, however, we must not present ourselves as victims. Europeans should accept that many of our current investment gaps lie far beyond the scope of the

IRA. As the European Investment Bank’s annual agship report shows, over the past ten years, Europe has invested 2% less per year in productivity enhancements than its competitors have. The IRA should be seen as a wake-up call for addressing this under-investment. We urgently need to funnel more money into European clean power, cleantech manufacturing, and digitalization – all of which are crucial to the green transition and future competitiveness.

This may sound like a big job, but the truth is that we already have most of the tools that we need. The EIB Group provides a wide array of risk-sharing and long-term nancing solutions that can make promising innovations more palatable for private investors. Our model for crowding-in capital has allowed us to kick-start major breakthroughs in life sciences, the energy sector, quantum computing, and satellite technologies. We can send a strong signal to the market that EU institutions and governments are willing to promote

By Werner Hoyercutting-edge technologies with debt and equity investment from the very early stages of development. We are ready to work with the European Commission and EU member states to create a new pan-EU equity fund to support large ventures that are strategically important for the net-zero economy. Some might wonder why we would focus on large ventures, given that “ventures” tend to call to mind start-ups that entrepreneurs launch in their garages. But, in fact, we are seeing more and more massive ventures emerging at the cutting edge of innovation. Consider battery producer Northvolt, with its new giga-factory in northern Sweden. It is a startup, but you would need a thousand garages to accommodate it. Ventures of this size are precisely what Europe needs, and they require multibillion-euro investments up front, usually in the form of equity and equity-type funding. An EU equity fund thus could add signi cant value by helping more cutting-edge rms get started. And

though the investments I am talking about are huge, they would also be precisely targeted.

The beauty of this approach is that it is pan-European. It would promote a level playing eld for EU member states and thus protect one of our key achievements: the single market. It also would help us confront our global challenges without casting aside our values. It would be a quintessentially European response to the IRA and to the broader geopolitical challenges Europe faces.

Huawei joins UNESCO Global Alliance for Literacy to step up talent cultivation

Huawei announced it has joined the UNESCO Global Alliance for Literacy (GAL) today as part of the company’s lead up to the Mobile World Congress 2023. The announcement was made at a Digital Talent Summit co-hosted by Huawei and the Institute for Lifelong Learning (UIL) which serves as the Secretariat of the GAL.

At the Summit, Huawei and the UIL agreed to jointly promote the use of technology to raise literacy. The two parties also signed a cooperation agreement under which Huawei will fund an expansion of the UIL’s current initiatives to enhance educators’ use of technology in developing countries. Currently, the UIL initiative operates

in Bangladesh, Côte d’Ivoire, Egypt, Nigeria, and Pakistan.

Huawei is the rst private company to become an associate member of the GAL and the company is excited its own goals align with the GAL’s vision of eradicating digital illiteracy in young people.

UIL Director David Atchoarena explained at the event, “Our rapidly changing world calls for concerted e orts and strong partnerships to achieve quality education and lifelong learning for all.”

Atchoarena continued, “Huawei’s expertise in the area of innovation in learning will be a great asset to the Global Alliance for Literacy. Collaborative projects such as ours

will ensure that no one is left behind on this journey.”

Huawei’s own Vice President of Corporate Communications Vicky Zhang also commented, “Getting the right education is often the key to success in life. As a major player in the technology sector, Huawei feels it has a responsibility to provide technology skills in all parts of the world, trying our best to include as many people as possible.”

“We are proud to join forces with UNESCO to better deliver on this responsibility,” Zhang added. Huawei believes digital talent is a key driver in achieving digital transformation, solid economic growth, and better quality of life. Since 2008, Huawei has o ered a

wide and expanding range of talent programs. Under its Seeds for the Future umbrella, Huawei provides tens of thousands of people every year with scholarships and digital training courses targeting all age groups. The company also organizes and sponsors tech competitions where students can expand their knowledge, win prizes, and make new friends.

So far, Huawei’s Seeds for the Future program has helped nurture more than 2.2 million digital talents in over 150 countries. The company’s ICT Academy can train about 200,000 students each year. In 2021, Huawei announced it had

already invested US$150 million and planned invest another US$150 million in digital talent development before 2026, which is expected to bene t an additional 3 million people. About the Global Alliance for Literacy

Since its launch in 2016, the Global Alliance for Literacy has driven international discourse and guided the agenda for literacy provision globally for those who need it most. The alliance includes 30 countries committed to improving youth and adult literacy. It serves as a platform for its members to discuss progress and challenges together, and to exchange knowledge and good practice.

Green & Development, choosing not to choose: Huawei launches the Green 1-2-3 Solution

The Huawei Green ICT Summit was held in Barcelona today.

Peng Song, President of ICT Strategy & Marketing of Huawei, delivered a keynote speech entitled "Green & Development, Choosing Not to Choose".

Peng pointed out that an AI Big Bang is underway. AI brings new bene ts and opportunities to operators. However, it also requires better ICT infrastructure, due to higher bandwidth and increased computing

power leading to a rapid increase in network energy consumption. " The ICT industry seems to be faced with the tough choice to either go green or develop. However, we believe the industry can choose not to choose, and instead go green and develop simultaneously " Peng said.

Peng pointed out that simultaneous green ICT and ICT development is possible if the right balance is struck between

energy e ciency, renewable energy utilization, and user experience. At MWC Barcelona 2023, Huawei will launch solutions that embody this approach to pave the way for the green development of ICT infrastructure networks.

In terms of energy e ciency, Huawei advocates expanding the focus from just improving network energy e ciency to also reducing absolute energy consumption. In light-load sce-

narios, multi-dimensional shutdown technology can be employed to enable intelligent shutdown across di erent dimensions, such as frequency, time, channel, and power. Meanwhile, in ultra-light-load scenarios, equipment can be put into a deep dormancy mode. For example, new materials and processes can be used to solve condensation and low temperature issues when AAU hardware shuts down. This enables the power module to in-

dependently remain in standby, meaning the power consumption of the AAU during extremely light load can be reduced from 300 W to less than 10 W.

In terms of renewable energy, the company calls for a focus expansion, from the scale of green power deployment to the e cient use of renewable energy. An upgrade from network-speci c policies to site-speci c policies can be undertaken in order to improve

the accuracy of renewable energy deployment. Additionally, the time required for intelligent scheduling can be reduced from days to minutes, thus maximizing the economic and environmental bene ts of renewable energy. Multi-dimensional site information such as weather, electricity price, battery status, and service volume can be obtained, and intelligent scheduling algorithms can maximize power generation eciency and load-based power availability, while minimizing overall power cost.

In terms of user experience, Huawei proposes that the focus should no longer solely be on network energy saving and KPI assurance, but extend to user experience assurance. Optimal energy saving policies can be adopted according to di erent

network scenarios. In low-trafc scenarios, basic network KPIs are guaranteed to maximize energy saving, while user experience is guaranteed in high-tra c scenarios. Experience-driven approaches are being upgraded to data-driven approaches, allowing energy-saving policies to be generated in minutes and optimization policies to be delivered in milliseconds.

Peng emphasized that Huawei iteratively updates its green solutions in accordance with its belief in the potential of the three aforementioned areas, and has launched the Huawei Green 1-2-3 solution. Within this solution, "1" refers to one index for green network construction; "2" refers to the focus on

two scenarios: high energy eciency and ultra-low energy consumption; and "3" refers to a systematic three-layer solution that covers sites, networks, and operations. Peng closed his speech by highlighting Huawei's willingness to work with operators worldwide to strike a balance between going green and development, in order to accelerate green ICT development.

MWC Barcelona 2023 will run from February 27 to March 2 in Barcelona, Spain. Huawei will showcase its products and solutions at stand 1H50 in Fira Gran Via Hall 1. Together with global operators, industry professionals, and opinion leaders, we will dive into topics such as 5G business success, 5.5G opportunities, green development, digital transformation, and our

vision of using the GUIDE business blueprint to lay the foundation for 5.5G and build on the success of 5G for even greater prosperity.

A social-enterprise development model

By Andrew Sheng, Xiao GengTackling climate change and inequality would be di cult in the best of times. At a time when the war in Ukraine seems set to escalate, the Sino-American rivalry grows riskier by the day, and many economies are grappling with soaring debts and in ation, surmounting these challenges seems practically impossible. But even under unfavorable conditions, a systemic, bottom-up approach can yield progress. In an increasingly divided global economy, conventional development strategies –which depend signi cantly on international trade and investment – are losing their e ectiveness. At the same time, the budgets of both national governments and multilateral development banks are stretched thin, owing to the demands of climate action, the pandemic recovery, debt repayment, and in many cases, con ict. But the problem is even more fundamental. Poverty, inequality, climate change, and environmental degradation are complex systemic challenges. Yet prevailing policy approaches focus on devising separate solutions to speci c problems, or even speci c facets of problems, with little to no regard for how their solutions – and the underlying problems – interact. The environmental scientist

Donella Meadows de nes a system as “an interconnected set of elements that is coherently organized in a way that achieves something.”

Our planetary system is failing, because the elements of it that humans can control are organized in ways that produce bad outcomes. Only by recognizing the interconnected nature of our social, ecological, and economic systems, and addressing problems holistically, can we optimize their functioning and ensure human and planetary well-being.

This cannot be achieved with the kinds of top-down, siloed solutions that governments overwhelmingly embrace. For example, when governments deploy specialized agencies to support rural village development, they increase transaction costs by delivering physical infrastructure piecemeal and failing to build shared databases that facilitate coordination. Weak ties to the local community can also undermine the e cacy of interventions.

Multilateral action – implemented by nation-states –tends to be even less ecient. The scale of multilateral development banks and aid agencies is simply too large, with individual entities and actors each operating according to its own goals and standards.

What is needed instead are

bottom-up strategies underpinned by community-based and nonpro t social enterprises (entities with both social objectives, in addition to economic targets). E ective social enterprises are, to borrow management guru Peter Drucker’s description of successful nonpro ts, “dedicated to ‘doing good,’” but also “realize that good intentions are no substitute for organization and leadership, for accountability, performance, and results.” Micro, small, and medium-size enterprises are far better equipped than their large counterparts to deploy the mission-driven management social enterprises require. MSMEs – 90% of all businesses globally – account for 70-80% of total employment. These rms, which often make little or no pro t, are thus responsible for the livelihoods of billions of workers, making them invaluable repositories of knowledge about most people’s needs and interests. These interests include ecological imperatives, which are inextricably linked to economic and social considerations. The poorest and most vulnerable tend to be most a ected by environmental hazards, from pollution to natural disasters. At the same time, poverty can drive communities to over-exploit natural resourc-

es, like forests and sh stocks, in a desperate search for income.

Yet MSMEs do not have access to formal capital markets, let alone the holistic policy and institutional framework – including supporting infrastructure and a consistent legal environment – that would enable them to act as e ective social enterprises. A 2015 UN Development Programme report found that these shortcomings signi cantly impede social-enterprise development. Meanwhile, a small number of massive rms enjoy enormous wealth and market power – often translated into policy in uence. But even as multinationals tout their environmental, social, and governance goals, ESG considerations remain subordinate to pro t maximization. Less connected to local communities, these rms are not

well-suited to provide the kind of bottom-up micro-solutions that, taken together, bring about systemic change. We have the tools and resources we need to tackle the collective challenges we face. There is no shortage of knowhow globally, nor scarcity of funding that could be mobilized from state, corporate, and charitable sources. And we have the means to distribute these assets. Already, technology has enabled the creation of a “global knowledge commons,” through which social enterprises can access the knowhow – and, through trusted accreditation, the nancing –they need. But more must be done to make the most of these assets. Doing so would require leveraging existing technology, knowhow, and business models to help social enterprises achieve both sustainability and impact. More broadly, we must revise our sustainable-development strategies accordingly, recognizing that systemic problems demand systemic solutions.

Labs empowers persons living with disabilities, women, and youth to play entrepreneurial roles in the research and innovation commercialisation value chain

Heritors

Heritors Labs Limited, a Web 3.0 company and a hub for research and innovation services, hosted a two-day training workshop to build entrepreneurship capacity and increase the participation of women, young people, and people with disabilities in the research and innovation commercialisation value chain. The event, dubbed "Levelling Up Training Workshop for Research and Innovation Commercialisation and Entrepreneurship", was held on February 21st and 22nd, 2023, at the Ghana-India Ko Annan Centre of Excellence in ICT (AITI-KACE).

Funded and supported by The Research and Innovation Systems for Africa (RISA) fund,

FCDO and UKAID, the Levilling up training workshop is a part of Heritors Lab's continued e ort to drive the development of thriving value chains in the Science, Technology, Innovation and Research (STIR) ecosystem as well as advance the commercialisation of innovation and research outcomes in Ghana.

It can be recalled that in the year 2022, the Research and Innovation Systems for Africa (RISA) Fund, a multi-country project funded by the UK through the Foreign, Commonwealth and Development O ce (FCDO) to support research and innovation systems strengthening in Africa, awarded Heritors Labs a

grant to boost the commercialisation of research and innovation in Ghana through deepening access to research and innovation programmes and building a robust infrastructure for the communication, advocacy and marketing of research and innovation outcomes. The grant has resulted in the design of programmes and activities to facilitate the inclusion of marginalised and excluded segments of our society, such as women and individuals with disabilities, in the research and innovation value chain.

Participants were introduced to the available support programmes within the R&I Ecosystem and educated on the principles and practise of

commercialising research and innovation. The objective was to successfully equip participants with the skills, knowledge, and platform to commercialise their innovative ideas and prototypes. In addition, participants' condence in pursuing and developing valuable networks was bolstered, and they were encouraged to form meaningful partnerships. Furthermore, other topics treated at the training workshop included nancial management, funding support, research sales and marketing strategies, team building, and company structure and formation.

Derrydean Dadzie, the CEO of Heritors Labs, Ltd., opened the training workshop and addressed the cohort to kick

o the training session. He reiterated that "individuals with disabilities and women are often overlooked and underrepresented in the STIR value chain. Notwithstanding, they can play critical roles using their other physical and intellectual abilities to impact the ecosystem signi cantly."

Mr Dadzie explained that people with disabilities might be unable to work as lab technicians or use delicate scienti c tools and equipment such as microscopes or simple ones like beakers. However, they may be capable of achieving success in elds like project management, research communications, software development, and technology advisory within the research and innovation ecosys-

tem.

The levelling up training initiative aimed to build the innovation capacity of people with other abilities and women on how to commercialise their research and innovation ideas, thus empowering them to create their businesses and achieve nancial independence towards eradicating poverty.' With the majority of participants having disabilities, the workshop provided individualised learning experiences and mentoring opportunities through one-on-one sessions with facilitators. A key highlight of the programme was when the participants were taken through a practical session on moving innovative ideas to market by

renowned guest speaker, a Ghanaian inventor, Mr GM Adjabeng, who engaged them virtually from his North Carolina base in the United States of America. An Alumnus of the University of Cape Coast, Mr Adjaben is an inventor who is also the founder of Ecodyst Scientific, the innovative creators of the next generation of rotary evaporators used by top scientists and scienti c laboratories around the globe.

"We are excited about the impact this program will have on the lives of its participants and anticipate new partnerships in addressing other pressing challenges to bring the social gaps in the research and innovation commercialisation

value chain," Mr Dadzie said. The Heritors Labs Ltd. levelling training program was a crucial initiative that supported the Sustainable Development Goals by promoting gender equality and inclusion (SDG 5) and empowering individuals to achieve nancial independence towards eradicating poverty (SDG 1). Heritors Labs believes it can signi cantly increase representation and meaningful participation of women, marginalised, and underrepresented groups, including persons with disabilities in the research and innovation ecosystem with the continued collaboration with its key partners, RISA Fund, FCDO, UKAID and other well-meaning stakeholders.

FX Insights

As Nigerians prepare to go to the polls on Saturday to elect a new president, a cash shortage caused by a policy to exchange old Naira notes for newly designed bills continues to cripple the economy, creating a rift in the ruling All Progressives Congress (APC) party. The note swap plan championed by incumbent President Muhammadu Buhari has led to violent protests across the country and resulted in a temporary suspension of banking operations in some states. Several governors have petitioned th e Supreme Court to overturn the policy, citing severe hardship faced by people and businesses dependent on cash for survival.

Foreign Exchange Down

32%

Buhari’s apparent intention behind the policy is to curb vote buying by politicians, turning a deaf ear to APC governors who have made repeated calls to postpone the implementation of the policy. Amid fears of the current tensions spilling over to political violence, Buhari said he’s mobilising military and security agents to monitor polling stations for evidence of vote rigging. The severe cash shortage has held the currency steady in spite of the economic turmoil, with the Naira strengthening marginally against the dollar to 755 from 756 at last week’s close. In this context, resolving the cash shortage has become more signi cant for the Naira outlook than the election result—with the rate likely to hold around current levels until Naira supplies recover.

Rand sinks to lowest in more than 3 months

The Rand depreciated against the dollar, trading at 18.25 from 18.05 at last Friday’s close—its weakest level since early November. The currency is being dragged lower by broad risk-o sentiment globally and ongoing domestic concerns about the electricity crisis. In an e ort to ease concerns about Eskom’s nances, South Africa’s government said it will take on more than half of the power company’s debt over the next three years to help strengthen the balance sheet and avoid the risk of default. We expect the Rand to continue trading with an 18 handle in the near term, mainly due to the risk-o mood that is impacting emerging markets FX.

Foreign Exchange

Down 18%

The Cedi weakened against the dollar, trading at 12.76 from 12.38 at last week’s close as Fitch Ratings cut Ghana’s foreign currency credit rating to ‘restricted default’ after the country missed a $40.6m coupon payment on one of its outstanding Eurobonds. The downgrade aligns with Fitch’s local currency rating, which was cut earlier this month. The foreign debt default was largely expected after Ghana said it would suspend payments on certain bonds as part of its restructuring plan to unlock $3bn in emergency funding from the IMF. The country faces pushback from bondholders over preferential treatment for bilateral lenders, who are being o ered better terms in the debt restructuring. Against this backdrop—and with in ation remaining elevated despite a slight improvement in January—we expect the Cedi to depreciate further in the near term.

Foreign Exchange

Down Down 99%

94%

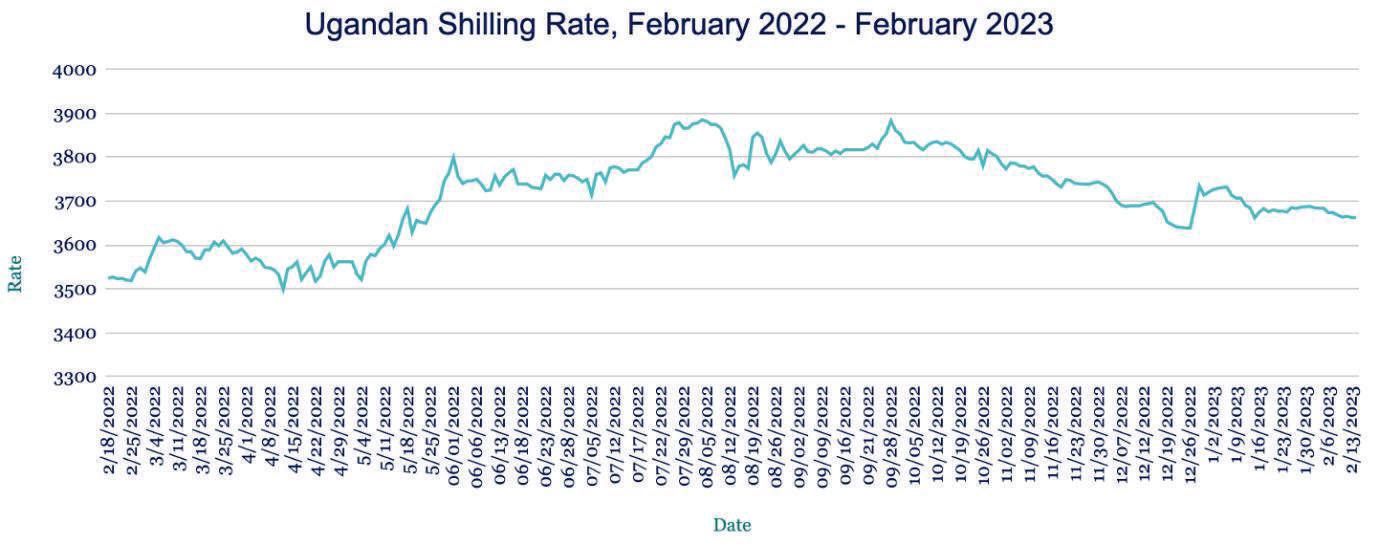

Shilling strengthens as Uganda

resists rate rise

Foreign Exchange Down

4.8%

The Shilling strengthened against the dollar, trading at 3674 from 3684 at last week’s close. Uganda’s central bank kept its benchmark interest rate on hold at 10% for a second consecutive monetary policy meeting. The bank last raised by 100 basis points in October, with rates ending the year 350 basis points higher than they were at the start of 2022. Policymakers said the decision to hold rates was aimed at containing domestic demand pressure and supporting economic recovery. The bank said it expects in ation to slow to its 5% target by the end of the year despite in ation edging up to 10.4% last month. In the near term, we expect the Shilling to weaken amid continued food and energy price in ation.

Foreign Exchange Down

Egypt issues debut $1.5bn sukuk

The Pound depreciated against the dollar, trading at 30.60 from 30.48 at last week’s close, amid broader risk-o sentiment and a stronger dollar. Egypt this week issued its debut Islamic nance bond, or sukuk, raising $1.5bn. The three-year deal priced to yield 11%, having attracted investor demand of more than $5bn. The deal provides some relief to Egypt’s nance ministry given the country’s need to boost FX in ows and repay existing debt. We expect the Pound depreciate further in the week ahead mainly due to dollar strength.

Kenyan Shilling hits new low as FX reserves dwindle

The Shilling weakened to a fresh low against the dollar, trading at 126.15 from 125.90 at last week’s close amid increased FX demand from the oil and energy sector. The currency has now lost more than 2% of its value this year. Kenya’s foreign currency reserves also dropped to a new record low $6.88bn from $6.94bn the previous week. There are signs of recovery in FX ows: Kenya secured a $27m funding deal with the European Union to boost exports to the 27-nation bloc and strengthen the overall business environment. The government is also anticipating $3.4bn in tourism-related earnings this year as it expects tourist numbers to exceed pre-pandemic levels. In the immediate term, however, we expect the Shilling to remain under pressure as importers clamour for dollars to meet month-end obligations.

11.7%

Empowering the Future Generation in Ghana: Vodafone's approach to integrating digital technology in education

As the world continues to evolve and digital advancements shape the way we live, work, and learn, the demand for digital skills and competencies grows ever stronger.

The global economy is rapidly shifting towards a digital-based model, and this trend is re ected in Africa, where the mobile and Internet industries are driving socio-economic growth and development.

However, despite this progress, the digital divide remains a signi cant challenge in many African countries, including Ghana. A survey conducted by the Ghana Statistical Service in 2016 revealed that a mere 8.6% of Ghanaian households had access to the Internet. This highlights the need for greater investment in digital connectivity and access in Ghana.

Moreover, a report by the International Finance Corporation (IFC) highlights that there is a signi cant gap in supply and demand across all skill levels in Sub-Saharan Africa. This digital skills gap presents a major obstacle to realizing the full potential of Africa's rapidly growing digital industries and underscores the importance of prioritizing and investing in digital literacy and technology education across the continent.

It is imperative that Ghana, along with other African countries, takes proactive steps to close the digital skills gap and prepare its workforce for the jobs of the future.

Creating a digital classroom

To address the digital skills gap in Ghana, it's crucial for the country to prioritize and invest in digital literacy and technology education. By doing so, individuals in Ghana will be better equipped to take advantage of the growing number of job opportunities in the digital sector and be prepared for the future workforce.

Vodafone Ghana is taking a leading role in transforming digital education in the country by partnering with the Kwame Nkrumah University of Science and Technology (KNUST) to open a digital learning centre on campus.

The centre is designed to provide remote education to students and is equipped with state-of-the-art digital tools and technology. The project, which is part of Vodafone Ghana's “Connected Education” service, is aimed at contributing to the education of the youth and the future of Ghana.

The Connected Education service o ered by Vodafone Ghana includes a range of mobile services that allow students and school administrators to work together e ciently. The services include discounted mobile data, free calls, access to online resources, and wide-area network solutions with dedicated internet. Vodafone Ghana is also providing managed Wi-Fi and uni ed communication services and enabling a cashless campus through Vodafone Cash.

Upskilling teachers

Soon, Vodafone Ghana aims to empower teachers through its Connected Education service by providing them with the necessary tools and resources to integrate digital learning into their lessons. The compa-

ny realizes the crucial role teachers play in the education system and seeks to support their e orts by o ering training services that cater to their unique needs and help them design e ective hybrid lessons.

Vodafone Ghana recognizes the importance of addressing the digital skills gap, as research shows that a signi cant percentage of teachers lack experience and formal training in using technology in the classroom. The company believes that its Connected Education service will serve as a solution that not only provides access to digital learning tools, but also supports the upskilling of teachers.

Improving access to technology

Vodafone Ghana is committed to providing access to high-quality education and empowering stu-

dents and teachers through technology. To further this mission, the company has partnered with the Ministry of Education and other local educational institutions to launch Instant Schools, the largest philanthropic program in the Vodafone Group Foundation's 25-year history.

Instant Schools provides free access to online learning materials for millions of young people in Africa, including subjects such as Math and Science from primary to secondary level. The educational content is a combination of high-quality global and local content, initially provided by Khan Academy, with the aim of aligning it with the local curriculum in the future.

The service is designed for

simple, low-cost devices with basic data connectivity (3G) and is zero-rated for Vodafone Ghana subscribers, meaning users will not be charged for data usage within Ghana when accessing the content through the company's mobile data network. However, data charges will apply if the service is accessed outside the country.

As a long-term cumulative program, Vodafone Ghana aims to increase the reach, scale, and relevance of Instant Schools over time, including encouraging other major mobile operators in the country to adopt a similar approach. This initiative underscores Vodafone's dedication to using technology to build more inclusive and resilient societies, ensuring that every generation can participate in the digital economy of the future.