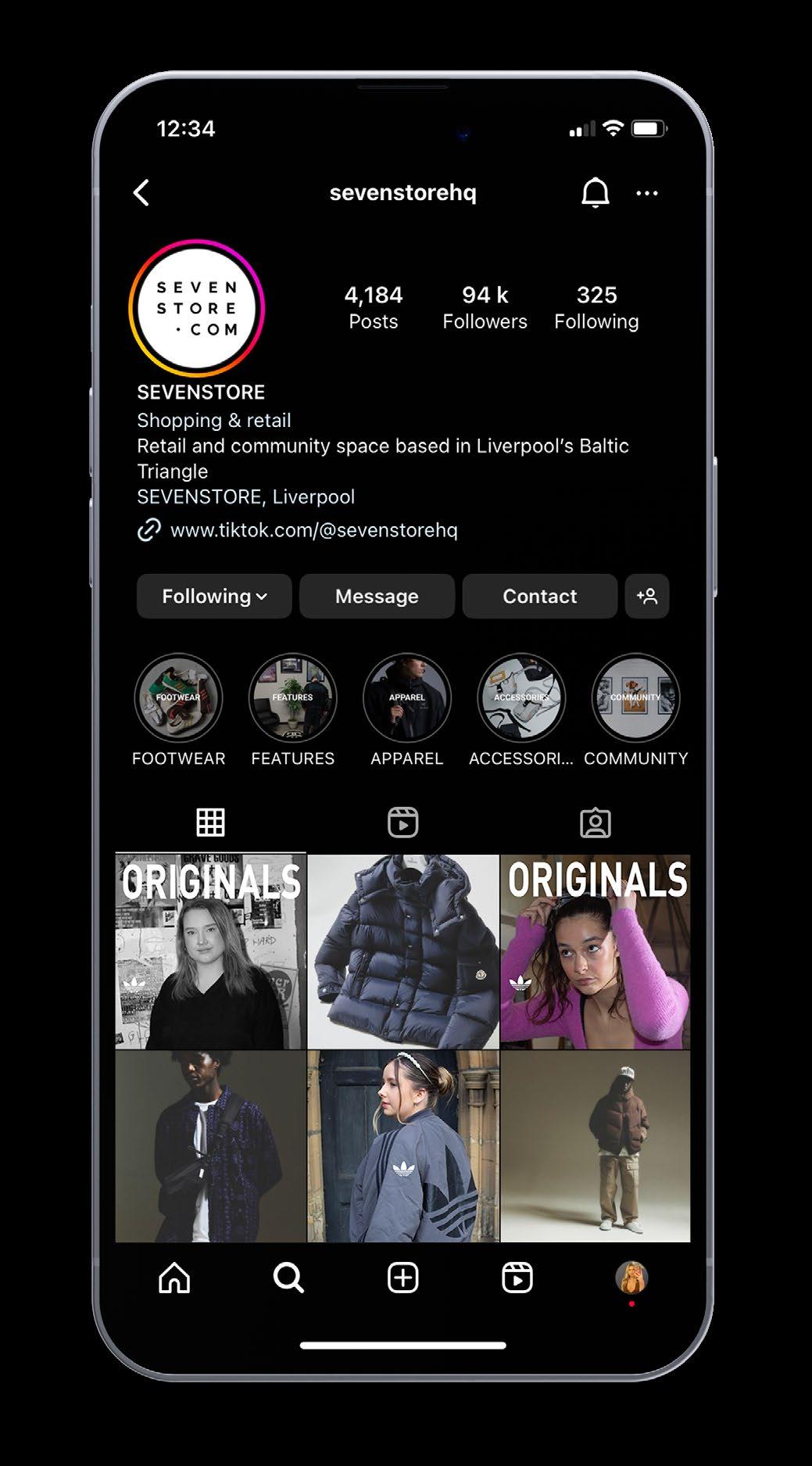

Sevenstore is a high-end streetwear and sportswear retailer, that houses a curated selection of world renowned designers alongside up-and-coming brands (Brain, 2019). Inspired by Liverpool’s roots, the store resides in a renovated warehouse creating an overarching industrial style through exposed brick and polished concrete elements (Flaherty, 2023). The store was built as a consumer frst creative, hybrid retail space, with a modular design so it can be transformed to host a range of events (Sevenstore, 2023a).

Sevenstore’s brand identity is built around their trustworthy and authentic brand values, displayed through their use of real people and stories in their marketing materials. They are true to their roots and proud of their Liverpudlian heritage, targeting their consumers through an approach that is “localised with a global outlook” (Allen, 2023).

Sevenstore are positioned as a contemporary premium retailer who build hype through in-store activations as well as exclusive partnerships and product launches only available to buy through a rafe. Using a brand positioning map I have compared Sevenstore with other luxury streetwear stores based in the North West in terms of price and style vs function. Sevenstore is placed in the upper middle as the products they sell are expensive and fashionable while also serving a functional purpose.

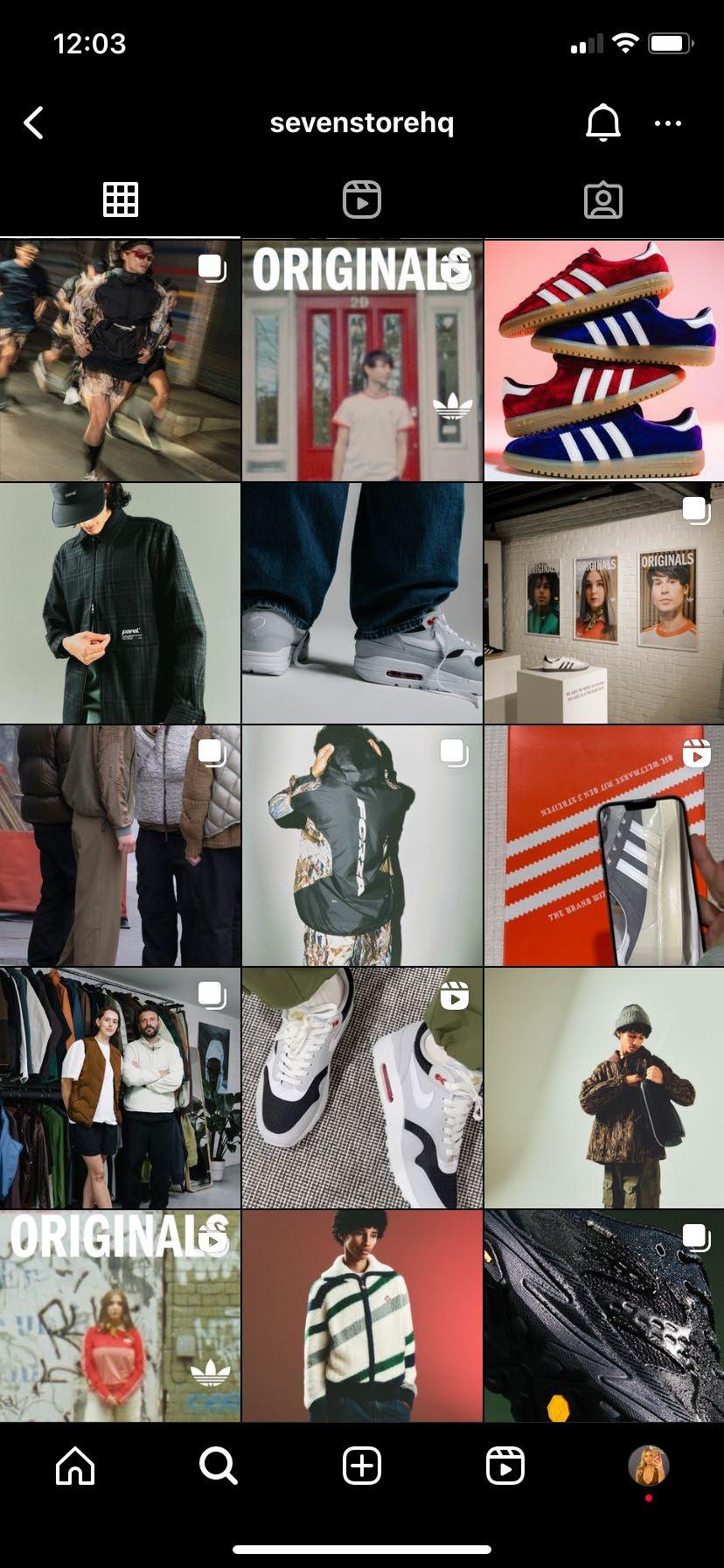

Sevenstore utilises an omnichannel marketing strategy for their campaigns with an emphasis on experiential and community building, through in store activations, events and installations, to increase brand awareness and store footfall (Hagen, 2021). Their digital advertising is content led, posting social and community coverage across their social channels as well as website banners, editorial features and mailers (Allen, 2023). For their campaign with Adidas Originals they employed guerrilla marketing tactics utilising billboards and fyposters.

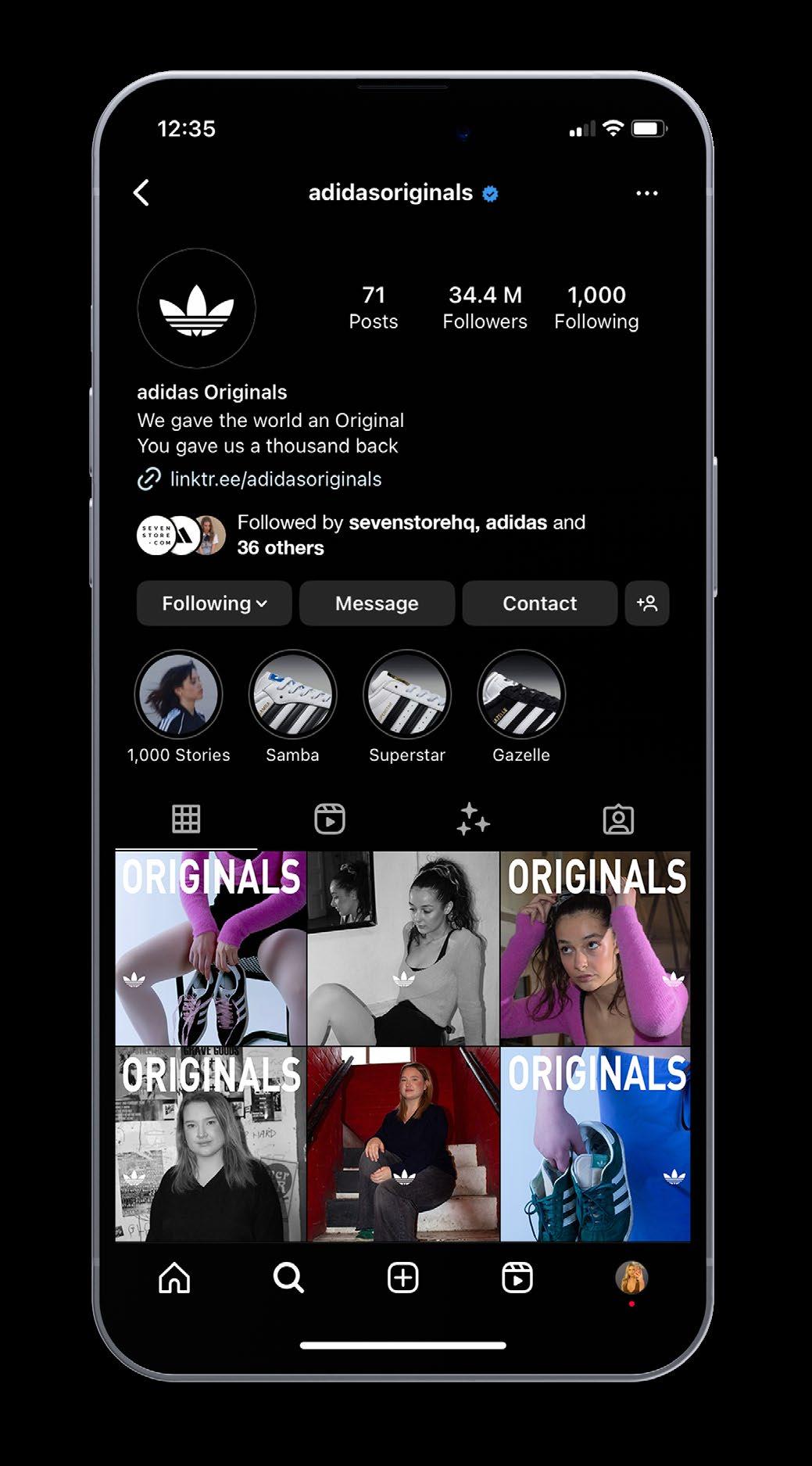

Launched in 2001, Adidas Originals is a subdivision of Adidas specialising in heritage, lifestyle and retro sportswear products. It has since evolved into a high-end casual sportswear and streetwear brand following their collaborations with designers, musicians and celebrities on exclusive product drops which reinterpret the classic iconic sneaker silhouettes, reinforcing the brands heritage (Highsnobiety, 2023).

Adidas is extremely successful within the sportswear and activewear market, ranked second worldwide in terms of sales (Smith, 2023). Adidas Originals operates as a mid-price brand, with their footwear being the most sought after products. In comparison to their competitors, Adidas Originals is more afordable and style focused. Their lower prices ofer an entry into luxury heritage streetwear, targeting a new demographic of younger luxury focused consumers.

Adidas Originals’ brand identity is constructed around culture and community. The brand is culturally symbolic and synonymous with hip-hop and streetwear due to the adoption of their footwear by a variety of subcultures and world renowned artists such as Run-DMC and Oasis (Mukhametzyanova, 2019).

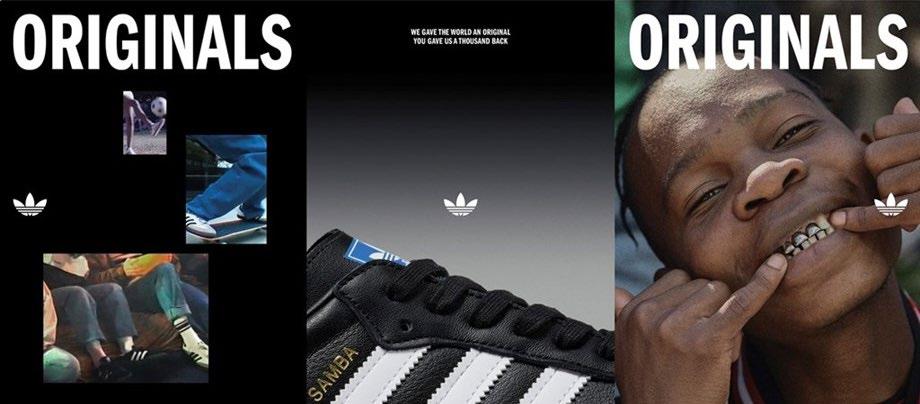

Within their campaigns Adidas Originals embraces authenticity, using short flms to form an emotional connection with their consumers, cementing Gen Z’s engagement with a brand (Drapers, 2023, para 67). Their most recent campaign, ‘We Gave the World an Original. You Gave Us a Thousand Back’, urged consumers to “embrace and express their own originality” (DDB Hong Kong, 2023, para 2). The campaign was rolled out globally and adapted to appeal to local communities, spotlighting the various subcultures that embraced the three trainer silhouettes over the decades (Miller, 2023a).

WS• Successful collaborations with designers and celebrities which have gained global recognition.

• Integration of future fashion technology with their web3 artist residency the ‘Three Stripes Studio’ (McDowell, 2023).

• Investment into LGBTQ+ people and women within the sportswear category (Maguire, 2022).

• The brand has a globally recognised logo which could be at risk of counterfeiting.

• Continued fallout and proft loss from their controversial partnership with Kanye West and questions about disposal of remaining Yeezy inventory (Loh, 2023).

O• Utilise TikTok within their digital marketing strategy to appeal to younger consumers.

• Capitalise on their relationship with hiphop by collaboration with artists and creating streetwear merch for tours and festivals (Miller, 2023c).

T• Competition: sportswear and streetwear are highly saturated markets.

• Sustainability: Adidas received a sustainability rating of ‘not good enough’ in terms of their policies regarding environment, animal welfare and worker’s rights (Good On You, 2023).

• Exclusive brand partnerships with high end sportswear labels.

• Community engagement: strong relationships with the local community built through events and store activations which fosters self-expression (Wahi and Medeiros, 2023).

• Environmental policies: committed to being net carbon zero by 2030 (Sevenstore, 2023b).

• Their focus on brick and mortar during a time of “tech-celleration” and digitised shopping experiences could lead to decreased footfall (Wahi and Medeiros, 2023).

• Poor customer service experiences could afect brand reputation and lead to a loss of customers.

• Expansion into other regions within the UK by opening more stores.

• Womenswear/unisex collections: “The women’s business is the sports industry’s greatest failure and its greatest opportunity,” (Powell, 2022, para 3).

• High delivery costs which could deter customers from purchasing online.

• At risk of theft and shoplifting which has increased 21% as a result of the cost-ofliving crisis and soaring infation rates (Saunter, 2023).

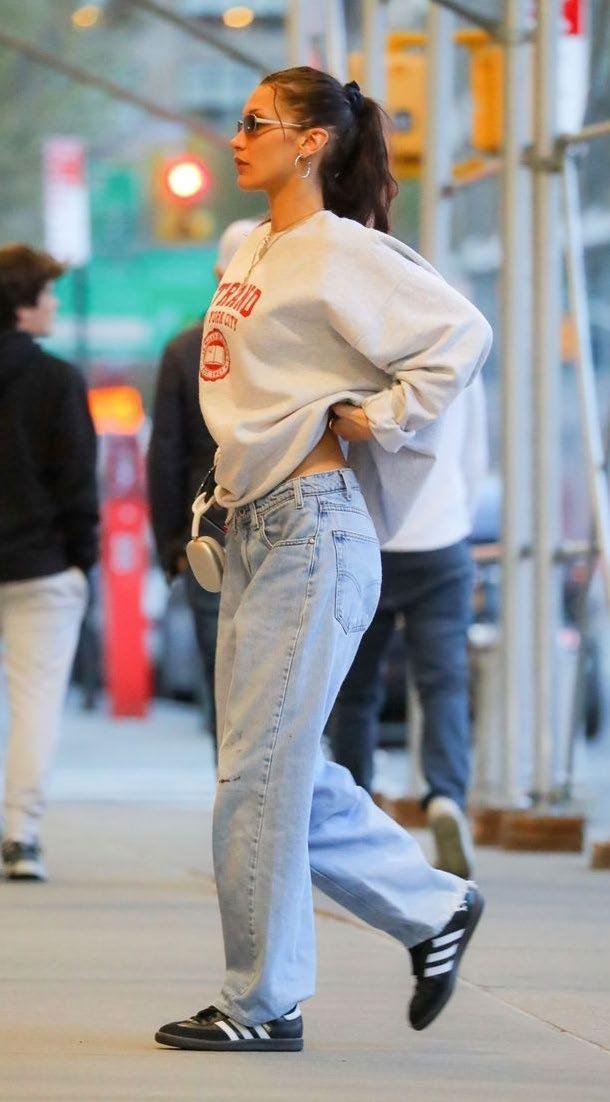

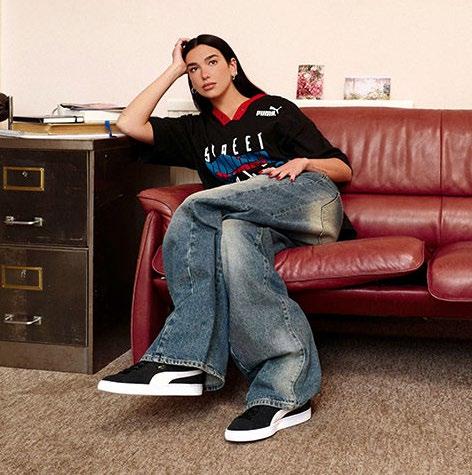

Through the completion of a SWOT analysis, I identifed a gap in the market and a key opportunity for Sevenstore which is appealing to women. They sell women’s sneakers although it’s not clear from the website nor is it advertised. In the past few years Adidas has made a signifcant investment into women’s sportswear, developing female specifc products and representing real women’s stories within their campaigns (Maguire, 2022). However, women are often overlooked within the streetwear category specifcally with trainers. When new colourways and collaborations are dropped they often only come in mens sizes. According to WGSN, a top barrier to purchase besides price was “products available in my size” for sneakers in the UK and US (Tiburcio & Paredes, 2023). While women shop in the mens section for clothing, it’s often not marketed towards them, 59% of streetwear products are categorised for men rather than for women (Edited, 2021). Therefore, within my campaign I will explore how women style their Adidas trainers, looking to combine comfort and style.

After completing a PESTLE analysis (see Appendix 1) I identifed many issues which could afect the markets in which Adidas Originals and Sevenstore operate. The cost of living crisis and rising infation rates are causing global economic fragility, resulting in European consumers buying less, particularly apparel and footwear (McKinsey, 2023b). Despite this, the luxury market continues to grow, as Gen Z and Millennials shift their spending away from fast fashion (Kennedy, 2023). According to research by Bain&Company (2023) Millennials and Gen Z are projected to be the biggest buyers of luxury, representing 80% of global purchases. Due to Covid-19, working from home has become the new norm and many consumer behaviours have shifted, such as the desire for comfort in all areas of life. This ranges from footwear and clothing to the content they consume, for example “soothing social” in which Gen Z are rewatching old TV shows for the nostalgia and comfort it provides (Napoli, 2022). Hybrid working has also accelerated the relaxation of dress codes in the workplace which is driving the business casual trend.

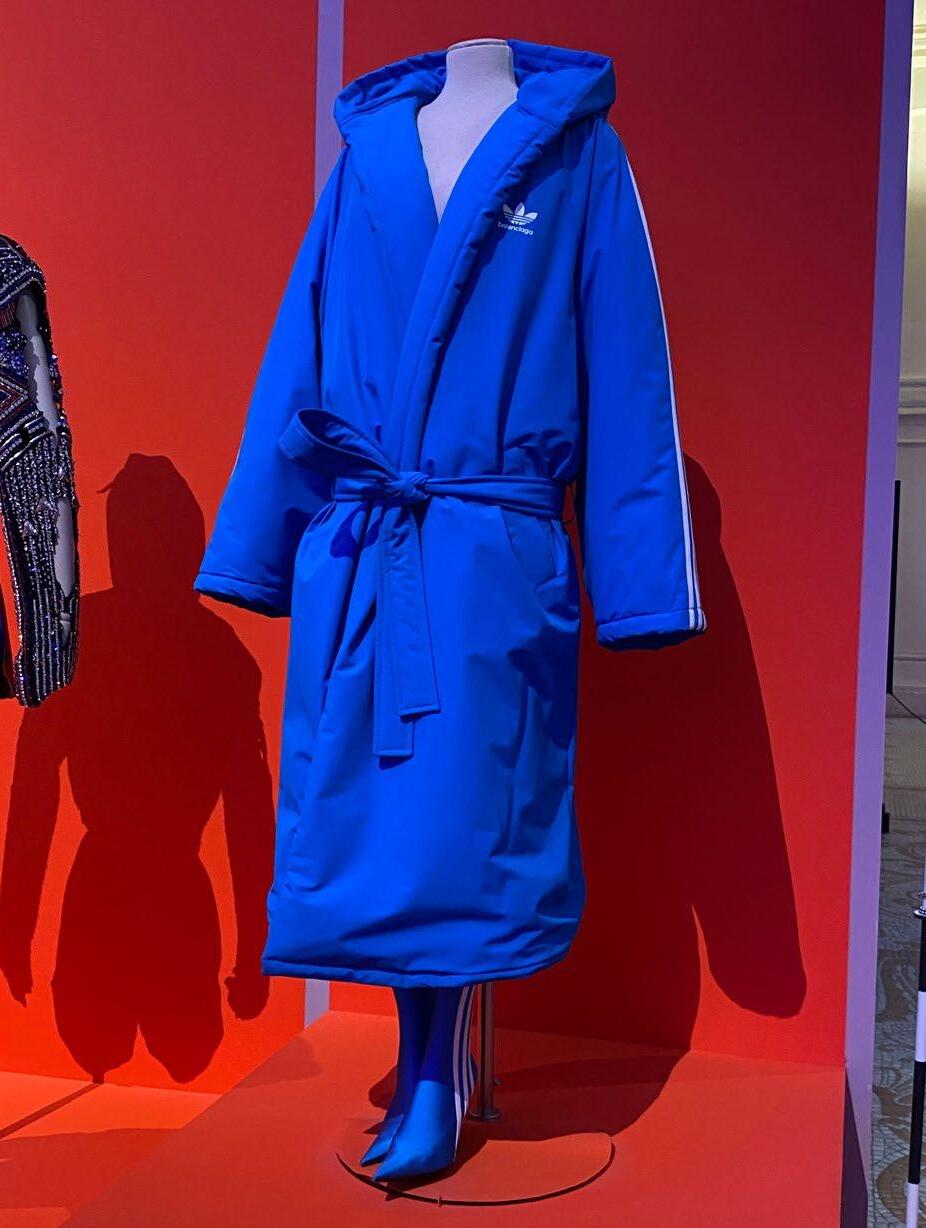

While in Paris I visited an exhibition which explored the relationship between fashion and sport, displaying the “evolution of sportswear and its infuence on contemporary fashions” (Lemahieu, 2023). The exhibition featured various designs from Adidas highlighting their innovative collaborations with Balenciaga and Yohji Yamamoto.

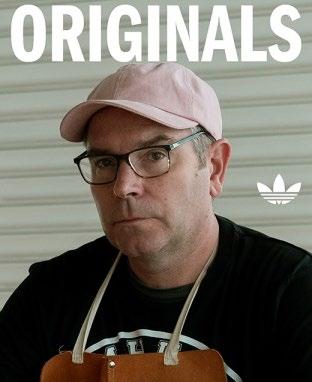

This pop-up exhibition celebrated 50 years of hip-hop culture in Manchester, featuring a collection of items “that encapsulate the evolution and impact of hip-hop on our city’s artistic, social, and political landscape” (Unity Radio, 2023). Adidas was heavily featured within the exhibition due to the brands interwoven history with Manchester’s hip-hop scene since the 1970’s.

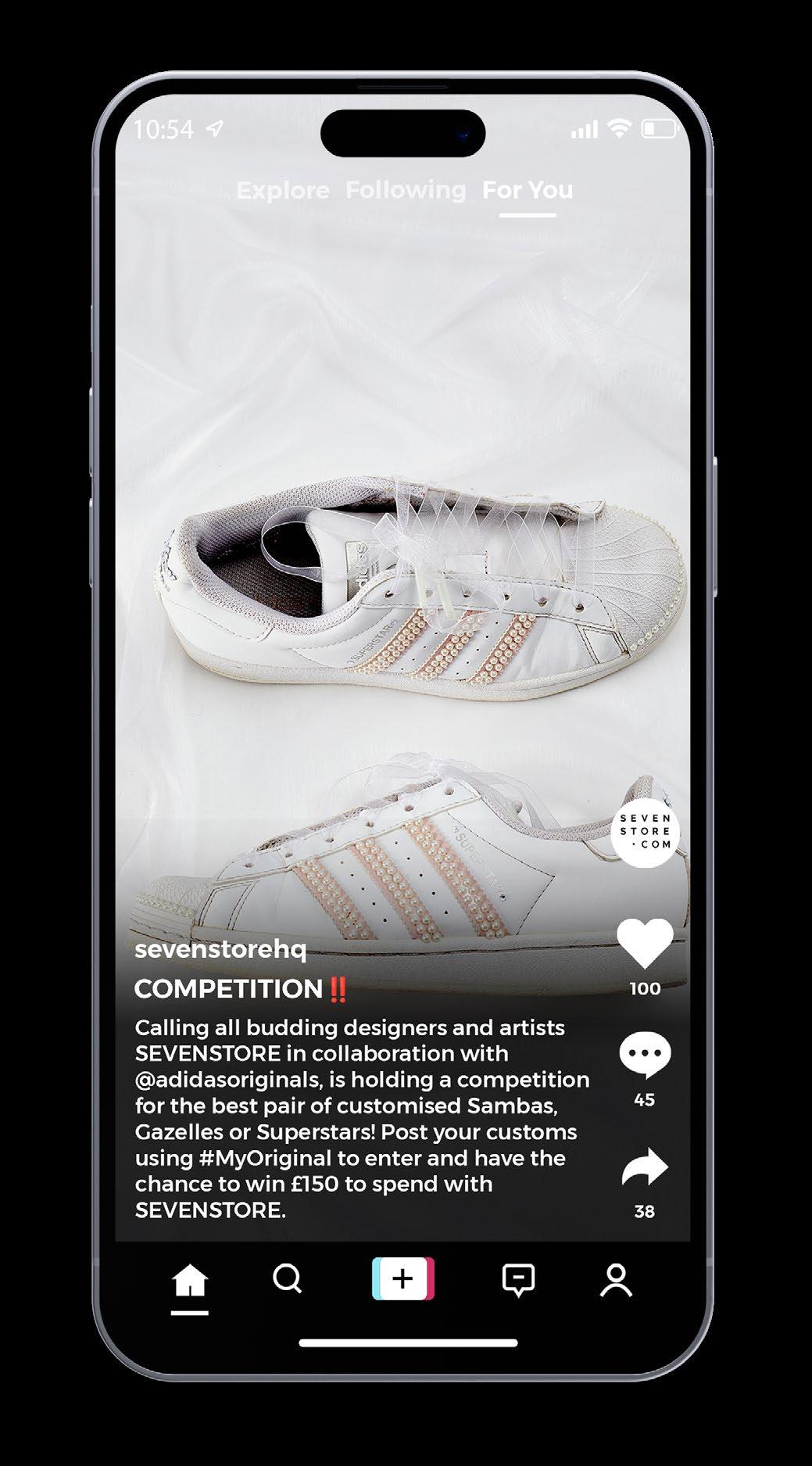

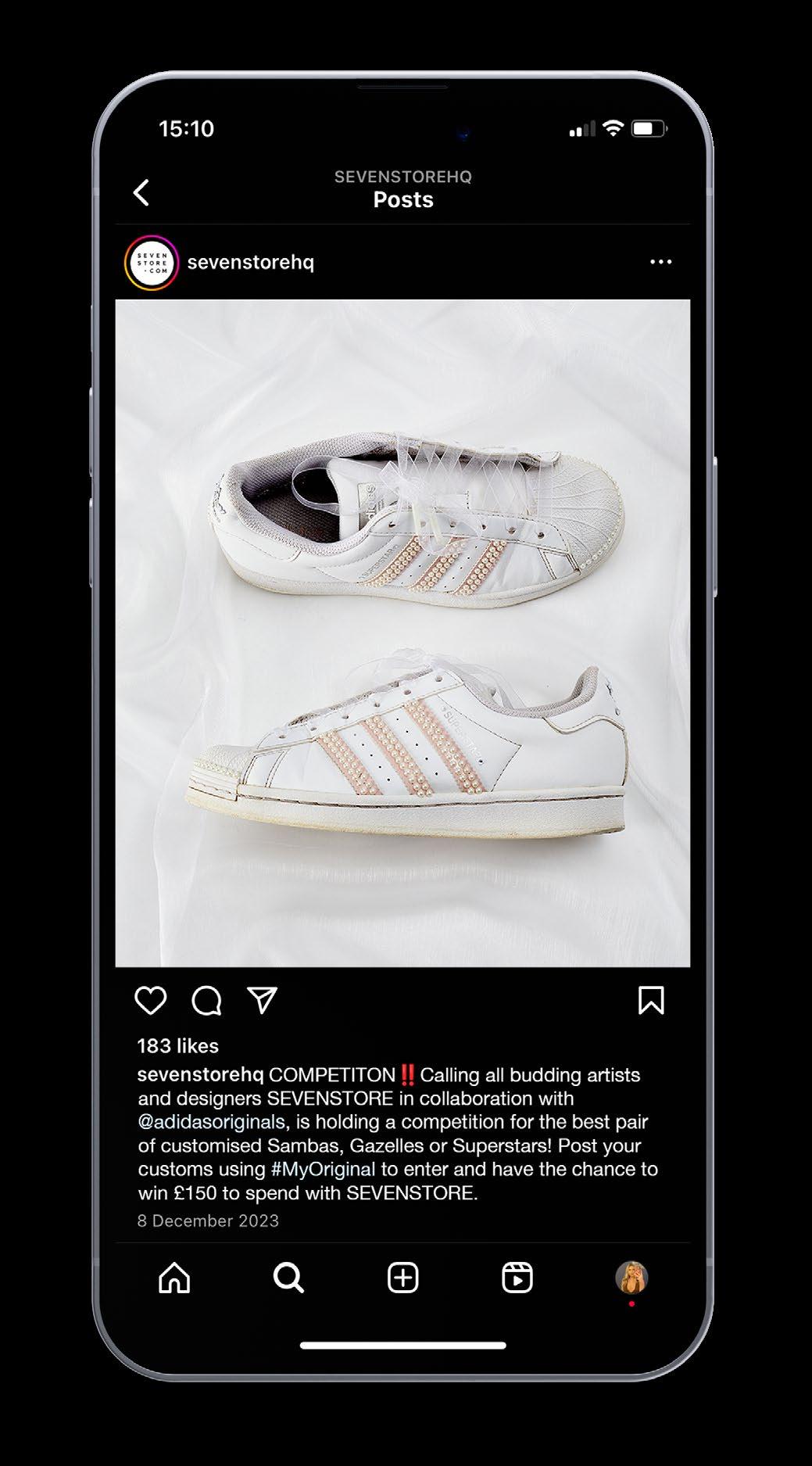

One cabinet displayed a custom design for a pair of Adidas Superstars created by Benji Blunt with a QR code linking to his website. His company Blunt Shank crafts customised shoes and has appeared in an Adidas Originals campaign due to his love of Superstars. Blunt describes customisation as a way “to make each pair unique and fresh” (Footpatrol, 2023). Customisation and personalisation of trainers is a booming industry as consumers increasingly search for one-of-a-kind items (Wightman-Stone, 2022).

The 90s was defnitive for Adidas, seeing three key communities adopting their trainers which transformed their brand image from sports into lifestyle and fashion, leading to the launch of Adidas Originals. Besides the terrace casuals many of the subcultures are infuenced by music. The release of ‘My Adidas’ Run DMC’s tribute to Superstars in 1986, marked the beginning of a long-lasting relationship with hiphop for Adidas. Run DMC’s tour, inspired their thousands of fans to purchase the trainer and “lift their Adidas sneakers in unison” during their shows (Yeung, 2016). This led to a groundbreaking partnership for Adidas with musicians instead of athletes, opening the door for many future collaborations. Heading into the 90’s the Beastie Boys were often seen wearing Superstars and Gazelles and later signed an endorsement deal with Adidas, appealing to their adolescent fans who were desperate to emulate their style (Warnett, 2016a).

In the mid 90’s Gazelles rose in popularity during the emergence of grunge and britpop, after being adopted by supermodels and rockstars. A pair of maroon Gazelles became symbolic of the grunge era after being spotted on the feet of Kate Moss and Ewan McGregor’s character in the cult classic flm Trainspotting (Yeung, 2016). In Britpop culture, Gazelles were worn on stage by those defning the genre: Blur, Supergrass and importantly Oasis. Their lead guitarist, Noel Gallagher went on to represent the Gazelle’s synonymity with Britpop when he began collecting Adidas trainers and later collaborated with Adidas on his own collection (Owen, 2013).

I identifed three key sneaker related trends, which have an underlying theme of comfort in common. For each of the trends I have selected a trainer that best represents it. This research serves as inspiration for my initial photoshoot ideas.

A key theme for SS24 is ‘hybrid styling’ which combines comfort and quality such as the #BusinessCasual and #WorkLesiure trends (Ajimal, 2023). In line with this idea of ‘hybrid styling’, the Adidas’s Gazelle and Samba lines provide versatility to the wearer, allowing them to be styled either masculine or feminine and dressed up or down (Wood, 2023). These Adidas trainers have gained “widespread popularity”, which can be attributed to the consumer shift towards preppier sneaker styles and comfer work footwear (Miller, 2023b). This comes as a result of Gen Z starting a career and making an efort to disrupt outdated traditions and stereotypes. Traditional workwear has shifted towards gender fuidity, with gender specifc rules and dress codes being removed (Park, 2023).

In September #customsneakers was the top trending fashion hashtag with 2.8 billion views on TikTok (Maguire, 2023). It allows consumers to create exclusive trainers that express their individual personality and style. The trend is particularly popular among women as streetwear is a male dominated industry and it’s rare that brands release new colourways in smaller sizes. Within this category is the personalisation of white trainers for weddings, a growing industry that luxury brands are adopting, such as Dior and Jimmy Choo. However, many brides opt for a classic like the all white Nike Blazer or Adidas Superstar which is the perfect blank canvas for customisation. According to Lyst’s annual wedding report 2019, searches for ‘white personalised sneakers’ were at a peak “increasing 61% year on year”. On TikTok #weddingsneakers has 34.7 million views, with brides showing of their embroidered, painted and bedazzled sneakers ahead of their wedding day. With this trend, younger generations particularly millennials are breaking more traditions and taking comfort to a new level.

Following Wales Bonner’s recent Adidas Originals collaboration consumers are feeling inspired to customise their Sambas and switch out their shoe laces for coloured ribbons (Silbert, 2023). #ribbonlaces has over 5 million views across TikTok, with Adidas Sambas taking centre stage. This customisation and the use of baby pink ribbons is reminiscent of the balletcore trend. Balletcore arose in 2022 taking TikTok by storm, with 1 billion views to date, it ofers women a chance “to embrace femininity and softness” while combating “limitations to what a ballerina can or should look like” (Bujnosek, 2022). Pink hues have seen growth across the fashion industry, with searches for pink rising 416% in 2022, as a result of balletcore and the hype around the Barbie movie in 2023 (Lyst, 2022b; McCarthy, Reyes and Holmes, 2023).

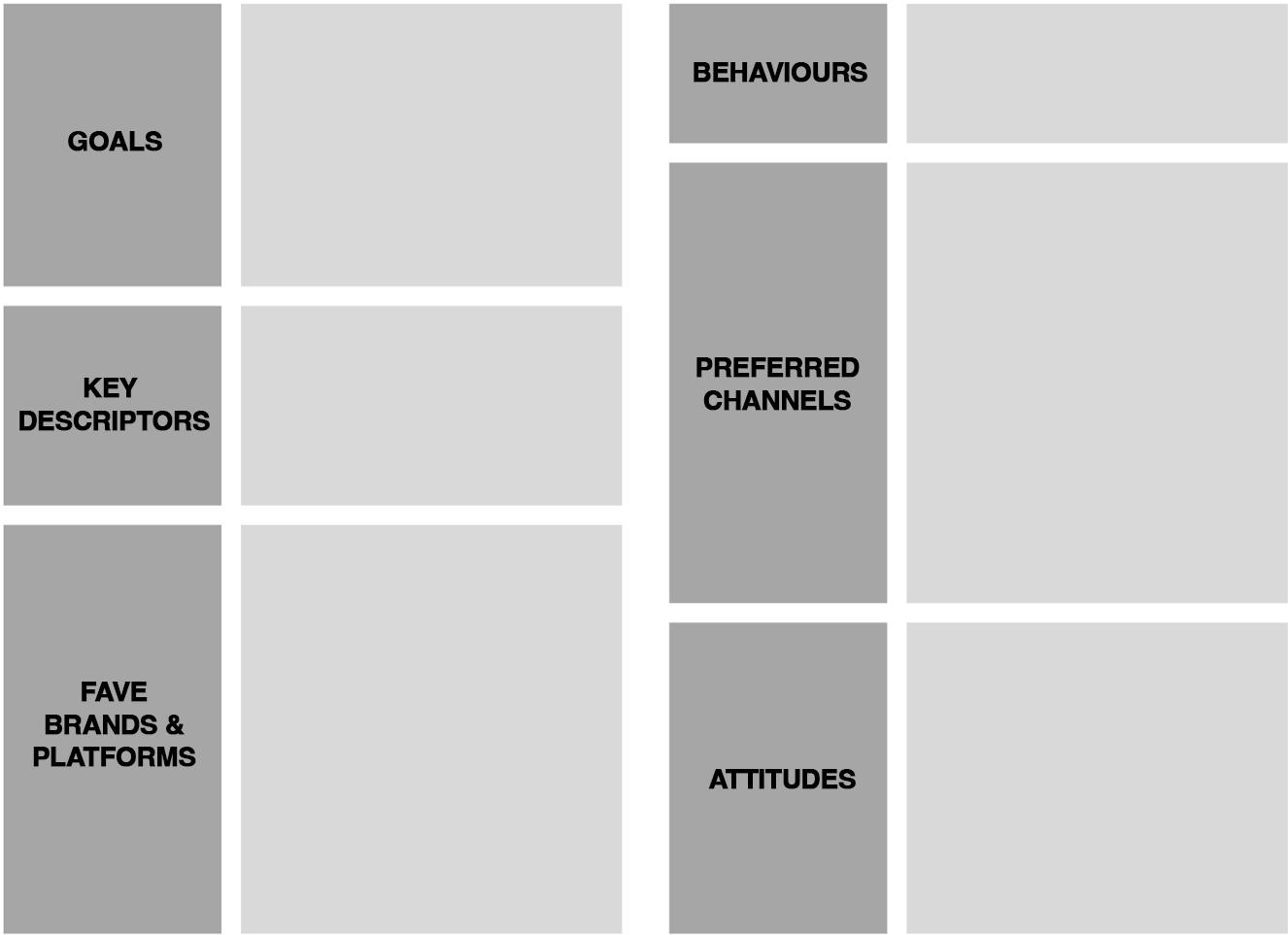

ELEVATED CONTEMPORARY NATIVE SEGMENT

The demographic for this campaign is women, an untapped market for Sevenstore. In line with Sevenstore’s native segment ‘Elevated Contemporary’, this consumer is an early adopter, who reads magazines like I-D and Dazed and listens to podcasts in order to stay updated with art, fashion and culture (Allen, 2023; Goldman, 2023). They are university educated young professionals aged 22-30 (Gen Z and Millennials), who work in a metropolitan city at a creative ofce job, with a relaxed dress code. Therefore categorising them in the NRS social grades B-C1 (Collis, 2009).

This consumer has a higher level of disposable income, according to Hypebeast and Strategy& (2019) women in Europe tend to spend between $100-300 each month on streetwear. However, due to the cost of living crisis and climate emergency these consumers are choosing conscious consumption and therefore ‘splurging selectively’ (Humphrey & Tan, 2023). They are aware of high prices and prefer to shop in store to compare and get a feel for products before they purchase. “60% of Gen Zers and Millennials say that they plan to splurge, particularly on purchases that provide immediate gratifcation” (McKinsey, 2023a).

They take a non-gendered approach to fashion, wearing what makes them feel the most comfortable, often shopping in the men’s section favouring baggy styles from the 90’s inspired by hip-hop trends. WGSN lists gender inclusivity as a key trend for 2023, as consumers are shifting away from traditional gendered ft and proportions (Park, 2023). 56% of Gen Z shop outside their assigned gender category, highlighting the value of targeting this demographic in streetwear (Edited, 2021).

This consumer has preferred brands but they are not brand loyal, they like to have pieces from multiple brands to create cohesive timeless outfts. They take inspiration from female infuencers and trends on Instagram and TikTok such as Matilda Djerf and the ‘clean girl aesthetic’, as well as streetwear brands who have strong social media presence. They are a fashion forward consumer who prioritises comfort, quality and exclusivity, and like to make a statement with their footwear choices.

1. To express themselves through their clothing.

2. To make a statement with their footwear.

3. To challenge outdated traditions and stereotypes.

Frequency: Once a Month Spend: $100-300 “Splurge selectively”

1. They are ‘sensory seekers’, who crave new social experiences and prefer to shop in-store (Rees and Saggese, 2023).

2. Not brand loyal but will prioritise brands that refect their values of quality and authenticity (IBM, 2018).

1. Use brand websites and social media for product research before purchasing in-store (Larsen, 2022, para 13; Zummo, 2022, para 10).

2. Gain fashion inspiration from physical media and magazines.

Using Sevenstore as a vessel this campaign for Adidas Originals aims to authentically represent real people and spotlight women in streetwear. Through a series of images the campaign will follow three young women and how they style their Adidas Originals trainers in a bid to make their daily life more comfortable. The three women will be intrinsically linked to one of three iconic trainers Superstar, Samba or Gazelle also representing one of three current trends: customisation, balletcore or hybrid styling. The campaign will be promoted through Sevenstore’s usual omnichannel approach utilising both print and digital media as well as in-store events.

In terms of IRL marketing, Sevenstore will host a range of activations including a zine making workshop, talks from infuential women in streetwear and a music event with emerging north-west based artists.Interactive workshops help to build ofine communities and promote co-creation while also increasing footfall to the store (Kelly, 2021). It appeals to those seeking tactile sensory experiences that can’t be recreated online (Johnson, 2023). The free music event will showcase local female artists and DJs in the hip-hop community to honour the subcultures that made the shoes the icons they are today. The in-store activities will allow Adidas Originals to engage with consumers on a personal level as “brands must create meaningful experiences amid an era of excess choice” (WGSN, 2023).

Both Sevenstore and Adidas Originals utilise fyposters therefore a series of triptychs from the campaign will be placed around the city centres of Manchester and Liverpool in areas frequented by the target audience such as Northern Quarter and the Baltic Triangle. The campaign will be marketed through full-page adverts and paid advertorials in partnership with I-D Magazine as it “is the leading source of inspiration” for youth culture, fashion, art and music (Vice, 2016). I-D has a shared demographic with the target audience and WGSN has identifed analogue marketing as a key way to appeal to younger generations who have “become fatigued by social media” (Stenberg, 2022; Tan, 2023). Gen Z and Millennials have a newfound appreciation for physical media as it represents an authentic and trustworthy source (Johnson, 2023).

The digital marketing strategy will involve posting a set of triptychs in the style of the other posts from the global campaign rollout, on both the Sevenstore and Adidas Originals Instagram accounts. Additionally, a competition will be held for the best pair of customised trainers using one of the featured styles, the Samba, Gazelle or Superstar. Contestants will enter the competition by posting their custom sneakers on Instagram or TikTok using the #MyOriginal. The winner be announced on both platforms and will receive a £150 voucher to spend in-store.

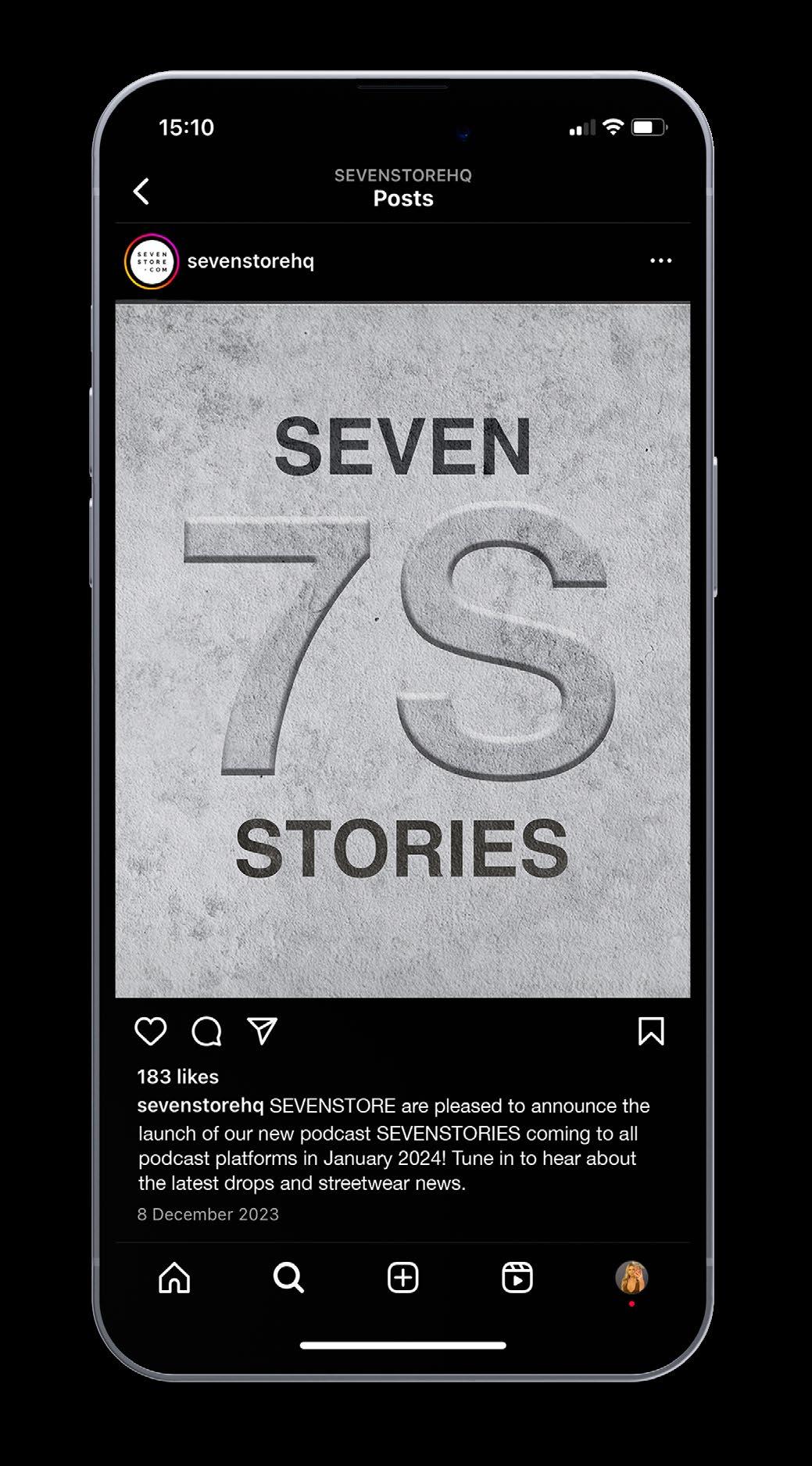

As part of the campaign Sevenstore will launch a podcast, titled ‘Sevenstories’, which will create a community of loyal listeners, who tune in weekly to hear about the latest drops and streetwear news. It’s recommended that podcasts launch with at least three episodes therefore the in-store talks will be recorded and posted as a three episode special (Lee, 2023). In 2022, Spotify saw a 40% increase in Gen Z’s podcast listenership, as beyond entertainment podcasts “serve as spaces for knowledge and learning” (Spotify, 2022). Short clips from the podcast can be posted to TikTok to increase their engagement and reach a wider audience.

Abbie (22) is a nurse who spends hours on her feet so she opts for a trusty pair of Gazelles to provide the support she needs. Born in Bolton she was exposed to Manchester’s rich culture and thriving music scene from a young age, often going to clubs and to see indie bands when she’s not working.

Growing up Holly (22) trained as a ballerina, she now dances as a hobby as she works full time. Ballet remains a signature aspect of her identity visible through her clothing and footwear which she often customises with baby pink ribbons and bows particularly her Adidas Sambas which she wears to and from training sessions.

Lucy (23) works in marketing where she regularly wears her Adidas trainers to the ofce emulating the business causal style she sees infuencers wearing. She recently got engaged to her boyfriend of fve years and is planning to swap out heels for a comfy pair of customised Superstars on her big day.

This moodboard serves as inspiration for the concept, loaction and and positioning of the model.

Inspired by the Britpop era this shoot will be taken inside an indie nightclub juxtaposed with an image of Abbie in her scrubs, showing how her Gazelles take her from day to night.

Three key shots:

1. Portrait in front of posters

2. Sitting on stairs - focus on trainers, looking up

3. Holding gazelles against scrubs

This is the second attempt at this shoot. I received tutor feedback on the original shoot which suggested the images didn’t ft the brief and that they could be more stylised which I agreed with. The lighting was too dark due to it being an overcast day and the location wasn’t particularly picturesque. So I adjusted my idea to better ft the brief and planned a new photoshoot. This shoot went well, I captured the images I wanted. However, I had planned a second part of this shoot in the nightclub 42’s but they stopped replying so I abandoned that idea.

This moodboard provides inspiration for the positioning of the model and diferent camera angles.

For this shoot I have rented a dance studio in which I will photograph Holly in her ballet outft with her customised sambas as if she is in a training session.

Three key shots:

1. Arrival - wearing streetwear outft

2. Getting ready - sat in front of mirror

3. Training - leg up on bar, close up of Sambas.

I’m really happy with how these images turned out. I learned from doing the frst shoot that more planning was required, which helped a lot on the day as I rented a studio and was under a time constraint.

This moodboard provides inspiration for the concept, styling and poses for this photoshoot.

This shoot will take place at St Wilfrid’s Church, it imagines what Lucy’s wedding day will look like in an exaggerated stylised version with elements of streetwear and a customised pair of Adidas Superstars.

Three key shots:

1. Dress held up revealing custom superstars

2. Side view showing Originals logo on jacket

3. Portrait with veil over her face

I’m also happy with the outcome of this shoot again due to the prior planning. The only element I would have added looking back is some imagery of Lucy at her job to tell her story more clearly.

Podcaster, celebrity stylist, image consultant and educator.

Content creator, designer and founder of women’s streetwear brand GDS.

Radio presenter, DJ and “hip-hop tastemaker” (YMU, 2024).

This PESTLE analysis looks at the current macro socio-economic factors afecting the global luxury streetwearand sportswear market.

E P S T L E

• “Rising geopolitical uncertainty” is making it difcult for brands to plan their global strategies (Mckinsey, 2023)

• Restrictions on trade can limit access to raw materials afecting production and supply chains.

• Living and minimum wages are regularly increasing in the UK due to infation (Elliott, 2023). BTQ+ people within the sportswear category (Maguire, 2022).

• As a result of global economic fragility consumers particularly Europeans are spending less with the biggest cuts being on apparel and footwear (McKinsey, 2023).

• Despite the cost of living crisis the luxury market has grown 4% since 2022 (Kennedy, 2023).

• Many Gen Z consumers (42%) used buy now, pay later schemes to spread the cost of fashion purchases (Magnus, 2022).

• As a result of global economic fragility consumers particularly Europeans are spending less with the biggest cuts being on apparel and footwear (McKinsey, 2023).

• Despite the cost of living crisis the luxury market has grown 4% since 2022 (Kennedy, 2023).

• Many Gen Z consumers (42%) used buy now, pay later schemes to spread the cost of fashion purchases (Magnus, 2022).

• Contactless payment limits are being reviewed in a bid to reduce fraud (Kleinman, 2023).

• Increased expectations for companies to ofer personalised experiences through AI and e-commerce platforms (Amed and Berg, 2022).

• Wearable tech is a growing industry within the sportswear market with an opportunity for brands to capitalise on watches and ftness bands (Sherman, 2020).

• Increased regulations and laws against greenwashing which could be costly for brands if they receive fnes (Stopps, 2023).

• Crackdowns on the exploitation of worker’s rights as the EU brings in human rights due diligence legislations (Fashion Revolution, 2023).

• Data privacy concerns with the use of consumer data for AR, personalised shopping experiences and wearable tech (Wiley, 2022).

• Consumers are demanding supply chain transparency putting pressure on companies.

• Vegan fabric alternatives are being popularised but could also have damaging efects on the environmental (Kent, 2022).

• Global warming is fuelling a shift towards a circular economy with the rise of rental, resale and repair (Webb, 2023).

A timeline of key cultual moments for Samba, Gazelle & Superstar.

The frst iteration of the Samba is debuted, initially designed for football games on icy pitches (Adidas, 2023b).

The Superstar is released as a basketball trainer taking inspiration from the Adidas Supergrip released in 1965 (Adidas, 2023, C).

“For legions of young Brits, Adidas shoes were something of a rite of passage” (Warnett, 2016b).

Gazelles become popular within Britpop culture in the UK and embraced by supermodels and rock stars cementing it as a lifestyle sneaker (Warnett, 2016b).

35 models of the Superstar are released for its 35th anniversary (Adidas, 2022).

The Gazelle is launched as a football trainer and released in two colours which denote their purpose: red for indoor sports and blue for training (Quill, 2023).

The modern Samba silhouette is launched.

The Superstar becomes a cultural phenomenon, worn by Run DMC who paid homage with the song ‘My Adidas’ (Adidas, 2023, C).

Adidas Originals is launched and the Gazelle makes a comeback after a production hiatus with the Gazelle Vintage inspired by the 1960s (Adidas, 2023a).

The Samba Super Battle Pack is released in celebration of the world cup in Brazil (Adidas, 2023b).

The 90s Gazelle model is reissued for a modern audience. Adidas celebrates the 50th anniversary of the Superstar through an interactive “augmented reality powered” campaign (Code and Theory, 2020, para 3).

Sambas are embraced by ‘itgirls’ worldwide and rank number 5 on Lyst’s Hottest products of Q3 in 2022 (Lyst, 2022a; Cary 2023).

The Samba, Gazelle and Superstar sneakers are celebrated in a campaign titled ‘We Gave The World An Original, You Gave Us A Thousand Back’ (Patel, 2023).