6 minute read

Leases • A. Residential Leases • B. Fixture Leases

Contract Addenda

Other Addenda: • Buyer's Temporary Residential Lease

Advertisement

• Seller's Temporary Residential Lease • Seller Financing Addendum • Loan Assumption Addendum • Addendum for Release of Liability on Assumed

Loan /Restoration of VA Entitlement 1 12/05/11 Form #16-5

12/05/11 Form #15-5 11/02/15 Form #26-7 12/05/11 Form #41-2

2/05/11 Form #12-3

• Addendum for Coastal Area Property 12/05/11 Form #33-2

• Addendum for Property Located Seaward of the

Gulf Intercoastal Waterway 12/05/11 Form #34-4 • Addendum for Property in a Propane Gas System Service Area 02/01/14 Form #47-0 • Environmental Assessment, Threatened of

Endangered Species, and Wetlands 12/05/11 Form #28-2 • Short Sale Addendum 12/05/11 Form #45-1 • Non-Realty Items Addendum 10/10/11 Form #OP-M

Contract References

• 2. Property: OP-M (Non-Realty Items) • E. Reservations: 44-2 (Minerals) • 3. Sales Price • B. Sum of all financing described in the attached: • 40-9 (Third Party), • 41-2 (Assumption), • 26-7 (Seller Finance). • See also 49-1 (Appraisal), 10-6 (Sale of Other Property), 45-1 (Short Sale), 12-3 (VA

Release). • 4. Leases • A. Residential Leases • B. Fixture Leases

Contract References Cont’d

• 5. Earnest Money and Termination Option: 50-0 (Termination) • 6. E. Title Notices • (2) Membership in Property Owners Association(s) 36-8 (POA) • (4) Tide Waters 33-2 (Coastal Area) • (9) Propane Gas System Service Area 47-0 (Propane Service System) • 7. Property Condition: • Access Inspections and Utilities 48-1 (Hydrostatic Testing) • B. Seller’s Disclosure Notice OP-H (not an attached addendum) • C. Seller’s Disclosure of Lead-Based Paint OP-L (Lead Based Paint) • G. Environmental Matters 28-2 (Environmental)

Contract References Cont’d

• 10. Possession: 16-5, 15-5 (Leases) • 11. Special Provisions: Must use promulgated addendum, if one. See e.g., 10-6 (Buyer

Sale of Other Property) • 12. Settlement and Other Expenses: 45-1 (Short Sale) • 15. Default: 38-6, 50-0 (Notices of Termination) • 19. Representations: 11-7 (Back Up Contract) • 22. Agreement of Parties: See listed addenda.

• Don’t Forget 39-8 Amendment • Others without specific references: • 10-6 (Buyer Sale of Other Property), 34-4 (Property Seaward of Intracoastal Waterway).

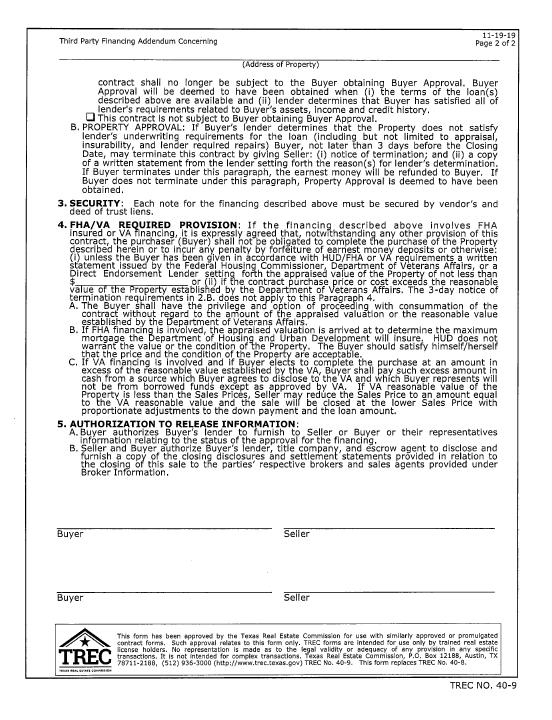

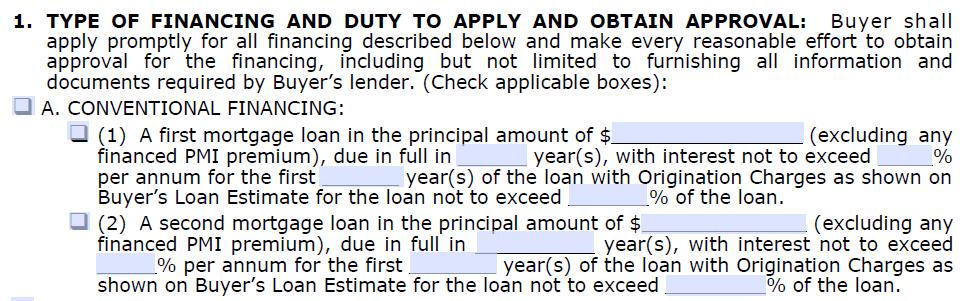

Third Party Financing Addendum

• Discuss with Buyer as to what type of financing they require in order to purchase the property.

Third Party Financing Addendum

Third Party Financing Addendum

Third Party Financing Addendum

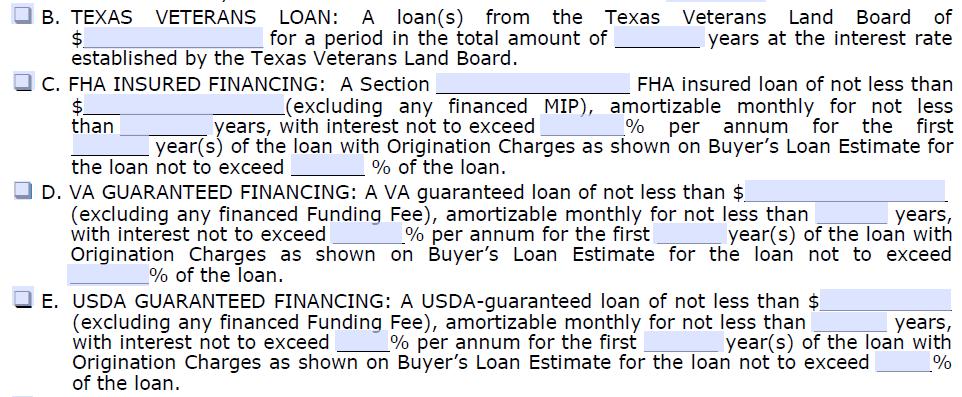

• ¶2A Buyer Approval: ❑ Buyer to give written notice of termination within X days to Seller. If Buyer does not terminate within time period, contract is no longer subject to Buyer Approval. ❑ Contract not subject to Buyer obtaining Buyer Approval

Third Party Financing Addendum

• ¶2B Property Approval: Buyer to give written notice of termination at least 3 days before closing and must provide written statement from lender setting forth the reasons for lender’s determination.

• If Buyer does not terminate timely, Property Approval is deemed to have been obtained.

Third Party Financing Addendum

Third Party Financing Addendum

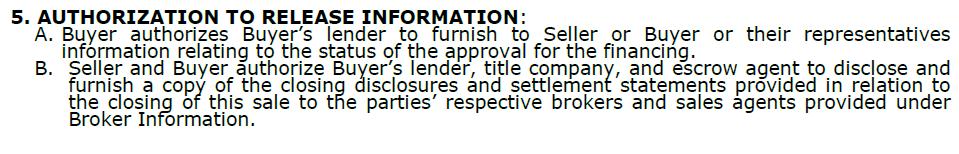

• ¶5 includes “settlement statements” in addition to closing disclosures that may be released to brokers and agents as provided under Broker Information on page 9.

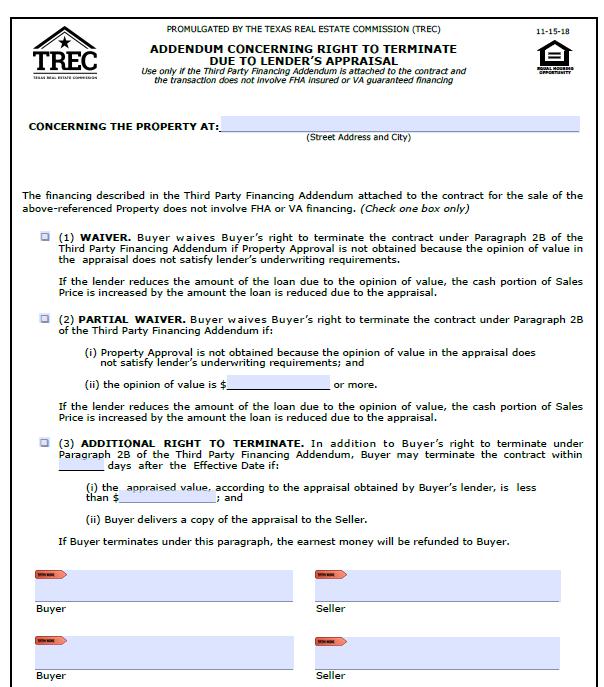

Addendum Concerning Right to Terminate Due to Lender ’s Appraisal

• Not required to be used with Third Party

Financing! • Can be used when the

Buyer wishes to modify the right to terminate under ¶2B of the Third

Party Financing

Addendum. • Cannot be used if the transaction involves

FHA or VA financing.

Addendum Concerning Right to Terminate Due to Lender ’s Appraisal

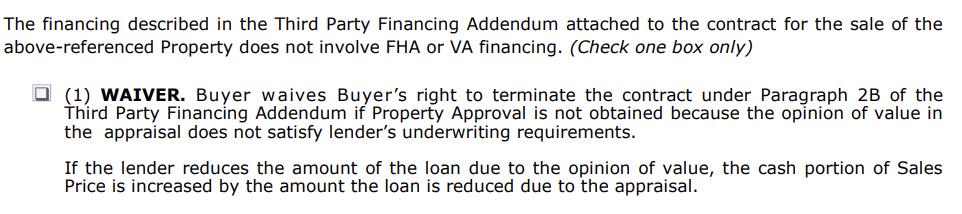

• Box 1

• Buyer agrees to cover the difference if the lender’s appraised value is lower than the sales price. • Buyer must have additional cash to cover this difference • No $ limit on value difference

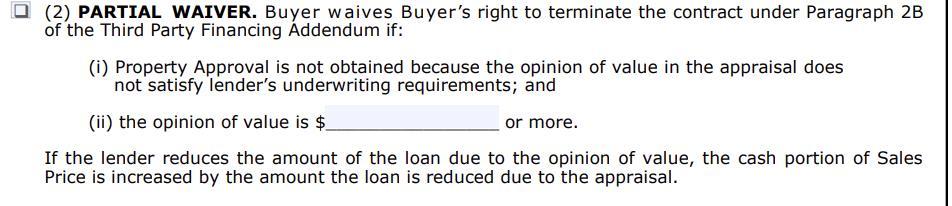

Addendum Concerning Right to Terminate Due to Lender ’s Appraisal

• Box 2 • Basically the same as Box 1, but with a limit on how much additional cash the buyer is willing to supply to cover the difference. • TREC Example: • contract purchase price is $350,000, buyer only wants to cover $20,000 difference. Parties put $330,000 in Box 2 (ii). • If the appraisal comes in at $330,000 or more, the buyer cannot terminate. • If the appraisal comes in at less than $330,000, the buyer MAY terminate the contract.

Partial Waiver – A Different Example

• Sales Price = $500,000 • Loan Amount = $450,000 • LTV Requirement = 90% (note many LTV’s are higher) • Area prices are rapidly increasing appraisals may be running behind or there are other reasons Buyer is willing to pay a premium, but with a cap • Lender may come back an appraisal of value at less than $500,000 – let’s say $450,000.

Partial Waiver – Example - continued

• The next step depends on how the lender calculates the amount it is willing to loan. • If it uses the sales price, it is still at 90%; LTV is satisfied with a $450,000 loan. • If it uses the opinion of value to calculate LTV and loan amount, then it would only loan .90 x $450,000 = $405,000. • So you need to know your lender, but most lenders calculate

LTV using the lower of Sales price or appraised value - a math problem?

Partial Waiver – Example – Cont’d

• So your initial question to the Buyer is “how many more dollars are you willing to put up?” • For the $500,000 example, a $450,000 appraisal of value would create a lesser problem if the acceptable LTV is higher, but even a 97% LTV requirement (permissible loan amount = $436,500) would require an additional $13,500.00 to get to $500,000 – but again this depends on the lender and the loan program.

Partial Waiver – Example – Cont’d

• Even then, if the opinion of value was $425,000 and the lender will loan that amount, will the Buyer put up an additional $25,000? • So a little guess work here, or pre-contract due diligence – will the lender loan the full amount of an appraisal, or some %? How does it calculate its required LTV? • Depending on that, the Buyer needs to put an opinion of value that calculates to the additional cash below the loan amount in the contract that the

Buyer is willing to supplement

Partial Waiver – Example – Cont’d

• If the lender is only willing to loan a % of the opinion of value, determine how much more cash the Buyer is willing to add – let’s say $25, 000.00. • Then the loan amount becomes $425,000, and at a

LTV of 90 % against the opinion of value, the opinion of value needs to be $472,222.22, that is $425,000 divided by .90 = $472,222.22. • Understanding what the lender is going to do with the opinion of value to determine loan amount is critical to determining cash.

Partial Waiver Formula for Determining Opinion of Value

• Sales Price (SP) = Cash + Loan Amount • Loan Amount = LTV x Opinion of Value (OV), so • Sales Price = Cash + (LTV x OV) • Cash = cash in paragraph 3 (3ACash) + Additional Cash(AC), • SP = 3ACash + AC + (LTV x OV) • SP-3ACash-AC = LTV x OV • Opinion of Value = (SP- 3ACash –AC) / LTV