1 minute read

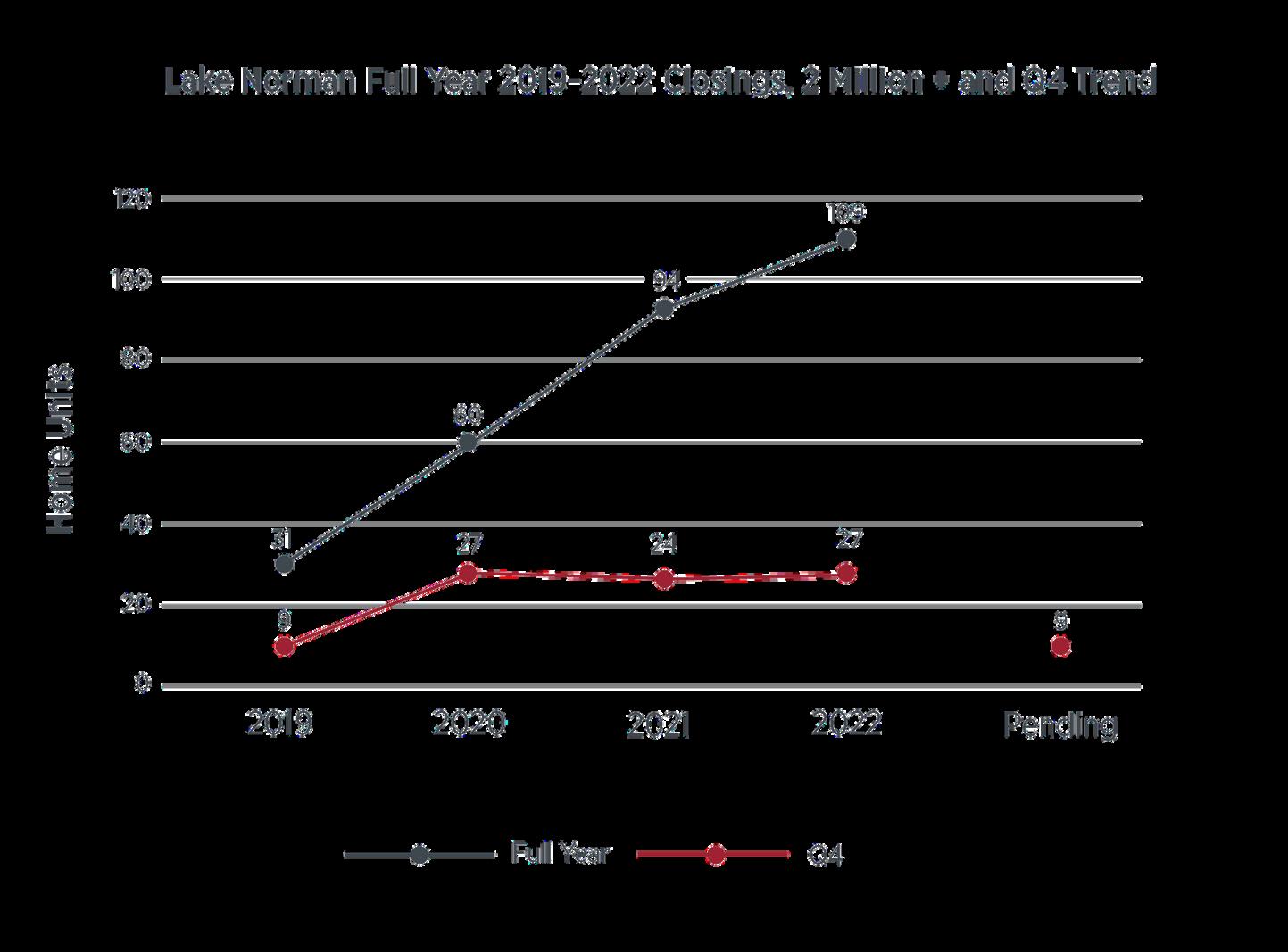

Luxury Market at Lake Norman Tapers Yet Outperforms National Market

The upper price segments at Lake Norman did finally show some tapering in the 4th quarter, with the mid-market and million dollar price segments, which are more interest rate sensitive, showing more tapering than the ultra-luxury range above $2 million in price. Cornelius and Mooresville showed solid activity above $2 million with 26 closings vs. 22 last year. At the same time, the million dollar range recorded the second most active 4th quarter in recent history, albeit off slightly from 2021 ' s final quarter of the year. One of the quarter's surprises included a spike in sales of million dollar homes in the North Shore areas above highway 150 on the lake, as 27 homes closed vs. 16 in last year ' s final quarter.

Cornelius

While the range below $1 million in list price showed a decline from 41 closings to 32 in Q4, this total was still enough to equal one of the top final quarters in recent history, as inventory remained tight in Cornelius (just 12 actives under $1 million with 14 more under contract) In the luxury ranges, inventory shortages remained acute in the million dollar range (4 actives coming off 13 closings in Q4). In contrast, the ultra-luxury range above $2 million saw a surge in inventory to 17 active homes after 11 closed in Q4.