6 minute read

Picturing the Past

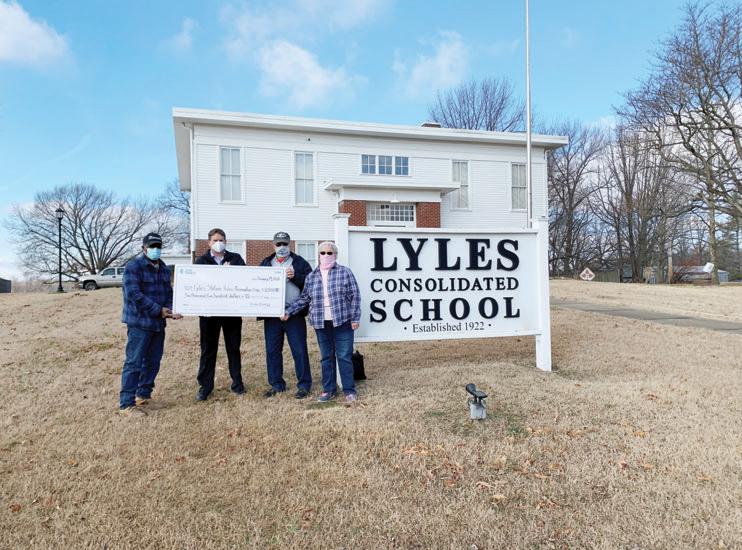

The Smokers Host Discount Tobacco shop opened January 6th. They are located in the former Edward Jones office down from El Rodeo on W. Broadway in Princeton. They offer cigarettes, tobacco, vaping products, and a drive through window for quick pickups. Lyles Station – A Duke Energy Foundation grant, in the amount of $2,500, was presented to board members of the Lyles Station Historic Preservation Corp. The funds will be used for the creation of recycled benches that will used by tour groups that visit the facility. The Lyles Station Museum displays and walks visitors through the story of the black community and recreates a sense of life and learning in the town during the 1920s.

Advertisement

Former Gun & Archery Store Opens With New Name & New Owners

Pictured L-R are Lyles Station Chairman Stan Madison, Kurt Phegley of Duke Energy, and Oakland City/Princeton Lions Club members, Dale and Sue Lefler who have helped Lyles Station as a service project.

On January 9th, Full Metal Armory had a “soft” opening and then on Saturday, January 23rd, held their grand opening. They are in the former Right to Bear Arms Building on Hwy. 41 in Haubstadt.

Habitat House is Coming Along

Liberty Tax Announces New Office Manager

Haley Beasley is the new manager at Liberty Tax Service in Princeton. Haley was born and raised in Princeton. She graduated from PCHS in 2011, with an academic honors diploma and is currently enrolled at Independence University pursuing a bachelor’s degree in business administration with an emphasis in marketing. Haley says she found a love for accounting at a young age while helping her

Story & Photos Courtesy: Felicia Bowden grandma, Nancy Thompson, at her job working for a local CPA. Haley spends the rest of her time with her two kids Joshua, 12, and Jaxsyn, 6. She says she is so happy to be able to help the people in Princeton that she’s known for so long to file their taxes, especially with the difficulties that have arisen this year. Above is how the new Habitat house on South Race started in November. Below is how far the volunteers have come as of January 12th.

Buying a new home? Need help?

Here to serve you and all your real estate closing needs

• Title Insurance • Lien Searches • Abstracts • Closings Now Serving the Following Counties -

In Illinois: Wabash, Lawrence, Edwards, Richland In Indiana: Gibson, Knox, Pike, Vanderburgh, Posey, Warrick

Do you have an IRA or a 401(k) that you are drawing from either because you are retired or out of need due to Covid? Retirement distributions – both before and after death – have been included in the changes with the 2020 Cares Act. Here’s what you should know: In simple terms, The Coronavirus Related Distribution (CRD) Exception allowed for up to a total amount of $100,000 to be drawn from retirement accounts per individual from January 1, 2020, to December 30, 2020, and not be subject to a penalty tax for early withdrawal as long as the individual or spouse was diagnosed with COVID-19 or had adverse financial consequences due to COVID-19. December 30, 2020, was the last day to take a CRD, and Congress did not extend this exception into 2021. You should have notified your plan provider at the time of distribution it would be a CRD. If you failed to do this you can still qualify for the exception you will just need to properly document and report the exception at tax time using form 8915-E. These distributions are still treated as taxable income. They can be reported either for the 2020 tax year or they can be spread out ratably over a three-year period so the total tax burden would not be felt in 2020. If your situation improves and you want to retain your retirement savings, you can repay the CRD over that three-year period. As an added benefit, the rules for required minimum distribution from defined contribution plans have changed. The first change that was made moved the starting age for RMDs from 70 ½ to 72. However, the new CARES Act allows account owners to skip both their 2019 RMD if it was their first year and had not yet made an RMD by April 1, 2020, and their 2020 RMD. If the distributions were already taken before the bill was passed, there are options to repay the distribution. In prior years, in the case of death of a taxpayer who leaves their IRA to a beneficiary, the beneficiary would be required to take the same RMD the taxpayer took for the year of death and then could take the distributions over their lifetime with certain conditions. With the new bill, the RMD for the year of death is no longer required. Also, the account must be depleted in 10 years after death. There are many, many requirements and details that need to be considered before accessing your retirement funds and even before reporting them on your tax return. If you have been the recipient of any retirement fund distributions for 2020 you will want to contact a tax professional and or a financial advisor to assure you are fully informed of the options and consequences. The savings could be significant.

Want a financial advisor How much will you need to that puts you first? retire? Let’s talk.

Christian G Burch, CFP®, CRPC®

Financial Advisor 403 East Broadway Princeton, IN 47670 812-386-6857

Member SIPC www.edwardjones.com

Princeton Theatre Four Old Broads Feb. 11th, 6 pm & Feb. 13th, 10 am To volunteer for venue help call 812-664-8106 Special Olympics Polar Plunge

Saturday, Feb. 27th Salvation Army Gibson St., Princeton Feb. 5th - 8 am - 1 pm

Knights of Columbus Bingo

Senior Center Activities

Open to Public every Thursday Princeton K of C 6 pm Blood Drive K of C, Princeton Monday, Feb. 1st 2 - 6 pm Walk-ins Welcome Appointments Appreciated Gibson County Council on Aging Monday 9:30 am - Bingo Tuesday 9 am - Exercise Class Wednesday 1 pm - Quilters Thursday 1pm - Art Class/Painting Friday 9 am - Exercise Class pending covid status R’z Cafe, Ft. Branch Thursday, Feb. 11th 4 pm - 9 pm proceeds Bonnie Martin scholarship FB VFW #2714 Aux Meeting

Meeting Feb. 9th Hwy. 41, Fort Branch

~ Help with Food in the Community ~ UMC Delivers Dinners

East Gibson Food Pantry Lord’s Pantry

Trinity United Methodist Church, 405 S. Mulberry St. Every Wednesday 9 am - noon Salvation Army Free Fort Branch Every Wednesday 9 am - noon Owensville Food Pantry 303 Church St. Tuesday & Thursday 8-12 & 1-4 pm Food Give Away Gibson St., Princeton Each Tuesday, 9-11 am Every other Friday, 2:30 - 4 pm Check Facebook for details.

Salvation Army Free Grab & Go Community Meal

Gibson St., Princeton Tuesday, Feb. 2nd, 9th, &16th 5 pm

Food Pantry for Seniors

The Center for Gibson County Seniors, Princeton, behind Rural King Wednesday, Feb. 10th & 24th 1 - 3 pm Hillside Church, Princeton Monday, Feb. 8th Call 812-385-2910 Salvation Army Food Pantry

Gibson St., Princeton Every Monday & Wednesday, 9-11:30 am & 1-3 pm

Looking For a Job? Need Employees? Call Today!Call Today! Call Today! Modern Personnel Services (812)386-5627

Sullivan's Diner in Union

Breakfast - Lunch - Dinner

Call In •Take Out • Dine In Sullivan’s Grocery Sullivan’s Sullivan’s Grocery Grocery

Now Serving Fair Fish

Hwy. 65 in Union 812-354-2919

Mon. - Sat. 5 am - 9 pm Sunday 6 am - 8 pm

Princeton Auto Parke

“Financing solutions available for ANY credit situation” Now offering customer detail services.

812-386-8282

820 S. Main St, Princeton, IN 47670

www.theautoparke.com