How to Get Ahead of the Curve

Presented by:

Adrian Cronje, PhD CFA, a long-time Vistage member and sought-after speaker

The Consequences of Overstimulation?

Inflation: A Return to the 1970’s?

2 -Year Inflation Rate

Inflation Broadening

Contributions to Y/Y Headline Inflation

A Cleansing: Speculation Unraveling

Will today’s inflation inevitably lead to a recession in the next 12 -18 months?

What needs to happen to avoid such an outcome?

Tools for you to monitor how the outlook evolves in real time. Tactics to prepare your business now to become a predator, not a prey.

Resources

Balentine’s Investing Cardinals

First Generation Wealth

Additional Resources

Capital Markets Lead the Economy

Indicator

Stock Market

Key Message

Future corporate profitability

Bond Market

Future interest rates & Fed policy

Credit Market

Commodity Market

Optimism in corporate sector

International economy (esp. China)

Resource: “Are Recession Red Lights Flashing?” at balentine.com/insights

CAPITAL MARKET UPDATE

Reasons to Sell the Stock Market

Past performance is not indicative of future results

Beneath the Surface of the Stock Market The Battle of Growth vs. Value

Russell

2022: Productivity Growth A Return to the Roaring 1920’s?

Bond Market: Slope of the Yield Curve

Slope of the Yield Curve Since 2020

2022: Interest Rate Expectations

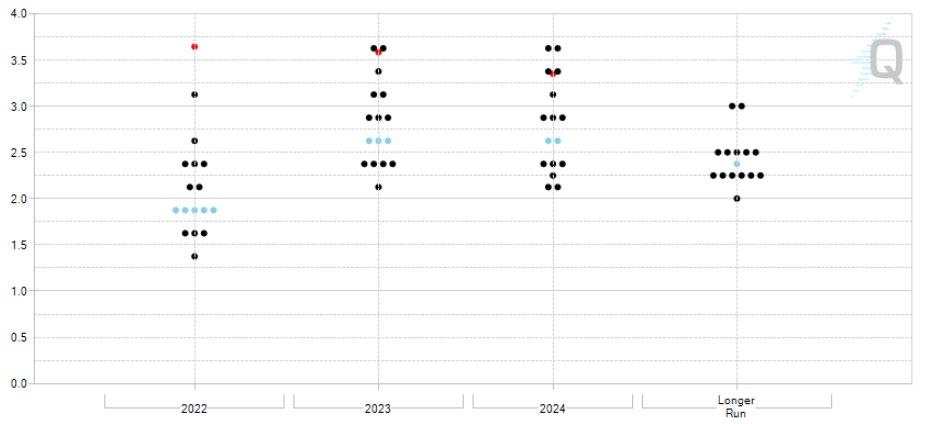

FOMC Participants’ Assessments of Appropriate Monetary Policy: “Dot -Plot”

Blue dots indicate the median projection. Data is based on the economic projections published on March 15, 2022 Red dots indicate the effective rate implied by the year-end FedFundpicture price.

Note: Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant's judgme nt of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run. One participant did no t submit longer-run projections for the federal funds rate.

Labor Market Dynamics and Wage Growth

Beveridge Curve

Additional Resources: Read “Revisiting the Beveridge Curve: Why Has It Shifted So Dramatically?” at RichmondFed.org

Credit Market Spreads

Commodity Market Index

Capital Markets Lead the Economy

Stock Market

Bond Market

Credit Market

Commodity Market

Resource: “Are Recession Red Lights Flashing?” at balentine.com/insights

In Summary

Chances of a recession as high as 50% over the next 12 -18 months

Outcome depends not just on the Federal Reserve:

Supply chain disruptions

China lockdown

War in Ukraine

Potential for productivity growth under -appreciated

Labor market dynamics are key

Developing Themes for 2022/2023

Length and duration of any slow down likely to be short and shallow:

Consumer flush from stimulus

Better capitalized, safer banks

Bumper corporate profitability

Consequences:

Watch the emerging world and the global economy

Mid -term elections – a return to populism?

Opportunities as capital markets adjust

Prepare to be predator, not prey

PREPARE TO BE PREDATOR, NOT PREY

Prepare to Be Predator, not Prey

COVID Forced Adaptability

Resiliency of Business Model

Agility of Decision Making and Creativity: Organizational Risk Posture

Supply Chain Management: “From Just in Time” to “Just in Case”

Inventories and cash flow management

“Tech -celeration ”: e -Commerce; Digitization; On -Demand Business Models; Automation; Artificial Intelligence ; Blockchain Protocol; Communication; Cryptocurrency and Non -Fungible Tokens; the Metaverse

Resource: Search “Cryptocurrency” at balentine.com/insights

Prepare to Be Predator, Not Prey

Customers: adapt to new buying behaviors

Marketing and Sales in a virtual world

Talent: workforce engagement (culture and flexible time)

Operations: reimagine the workplace with new technology

Financials: balance sheet strength and free cash flow

Pricing power and strategy with inflation as a tailwind

Resource: “Managing Your Business Through Crisis and Beyond” at balentine.com/insights

RESOURCES

Balentine’s Investing Cardinals

Philosophy Implementation

Strategy

First Generation Wealth: A Book for Entrepreneurs, by Entrepreneurs

firstgenerationwealth.com

A guide for wealth creators to learn enduring strategies for building a meaningful and lasting legacy.

Additional Resources

Capital Markets Forecast

This annual research piece is the foundation of our investment process, and the projections herein form the basis of the strategies we design to help our clients achieve their goals.

Cardinal Rules of Investing

Our Investing Cardinals share our most fundamental thinking around investment philosophy, strategy, and implementation to preempt the inevitable question, “How should I invest my portfolio today?”

Wealth & Legacy Series

This series explores the more human side of wealth and legacy within families, providing practical tools to help you aim to increase resiliency, avoid getting lost in a desert of riches, and approach tough family conversations with a renewed spirit of hopefulness and intentionality.

YOUR ORGANIZATION TO TAKE ADVANTAGE OF THE COMPETITION IN A TIME OF STRESS.”

“RECESSIONS PROVIDE AN OPPORTUNITY FOR YOU TO PREPARE

YOUR QUESTIONS

The Peak Performer webinar series is designed to support your leadership climb. This series brings the most trusted experts to the Vistage community to help you navigate new challenges and possibilities.

Disclosures

Balentine is an independent investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Registratio n d oes not imply a certain level of skill or training. More information about Balentine, including our investment strategies, fees, and objectives, is included in the Form ADV Part 2, which is availab le upon request.

General: This information has been prepared by Balentine LLC (“Balentine”) and is intended for informational purposes only. This infor mat ion should not be construed as investment, legal, and/or tax advice. Additionally, this content is not intended as an offer to sell, or a solicitation of any investment product or se rvice.

Outlook: Opinions expressed are solely the opinion of Balentine and should not be relied upon for investment decisions. Certain statem ent s contained herein may constitute projections, forecasts, and other forward -looking statements that do not reflect actual results and are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial information. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. These statements are based on available information and Balentine’s view as of the time of these statements, are subject to change, and are not intended as a forecast or guarantee of future results. Actual results, performance, or events may differ materially from those expressed or implied in such statements.

Third -Party Data: The information presented in this publication has been obtained with the greatest of care from sources believed to be reliable. However, stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. Some material may contain information and data provided by independent, third party sources. While Balentine uses sources it considers to be reliable, no guarantee is made regarding the accuracy of infor mat ion or data provided by third -party sources. Balentine expressly disclaims any liability, including incidental or consequential damages, arising from errors or omissions in this publication.

Risk: Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potent ial for greater long -term growth than most debt securities, they generally have higher volatility. International investments may involve risk of capital loss from unfavorable fluctuation in cur rency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Past performance is not indicative of future results. Th e appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk, and return preferences. Inve stment recommendations may change, and readers are urged to check with their investment advisors before making any investment decisions.

Index Definitions

The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices.

The MSCI ACWI ex USA Index is a free float -adjusted market capitalization -weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of the 23 develop ed markets, including Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore , Spain, Sweden, Switzerland and the United Kingdom; and 23 emerging markets, including Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Me xico, Peru, the Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. With over 1,800 constituents, the Index covers approximately 85% of the global equ ity opportunity set outside the United States.