8 minute read

6.5 Opportunities for Hungarian-owned large companies

One of the most important subjects of the past nearly 30 years in the history of the Hungarian economy was attracting FDI and the regional competition for FDI. Until now, Hungarian companies’ investments abroad could not be in the focus of foreign economic policy due to the simple reason that there are not many Hungarian-controlled strategic companies that are also able to operate successfully in foreign markets. At the same time, Hungarian large

corporations’ active investments abroad will also be necessary in the future to narrow the GDP–GNI gap as

indicated in the macro path. This is in the interest of not only the national economy, but it is also the well conceivable self-interest of companies.

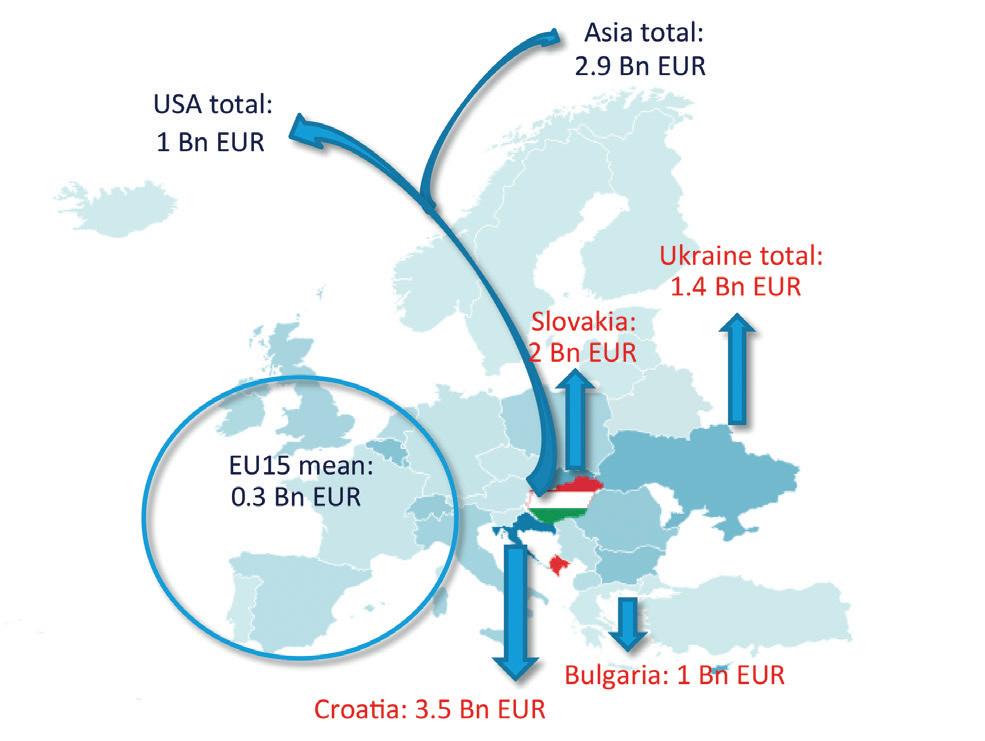

Chart 6-29: FDI abroad, cumulative transactions since 2001

Note: Net of capital in transit and asset portfolio restructuring. Source: MNB.

Large Hungarian companies that are currently active in investments in foreign markets prefer the countries in the region (Chart 6-29). FDI outflows to the V4 countries and

Hungary’s neighbours since 2001 account for 40 percent of

all investments abroad. 124 There may be various reasons for this geographical concentration: in Podgorica, 2018).

1.

2.

3.

4.

geographical proximity: company managers prefer the markets that are easy to reach personally as well, and this aspect may work in an inversely proportional manner to the size of the company;

high growth potential: as a result of the lower initial level of development, over the long run expansion in these markets will presumably exceed West European growth rates;

lower language barriers: where Hungarian minorities are present, Hungarian-speaking workforce is available, and in many cases one of the main European languages is spoken in the target country;

relatively low prices: compared to the more developed regions, the firms of the countries in the region (including the Balkan countries) can be acquired at a favourable price, also taking account of their market penetration; 125

5.

political situation: considering that many of the countries in the region are candidates for EU membership, Hungarian investments are welcome by other states. 126

In light of all this, it is clear that the Central East European

region will remain the scene for Hungarian FDI. Nevertheless, it is still likely that the weight of investments flowing to countries within the European Union will remain significant, which is also facilitated by a number of institutional factors (e.g. legal certainty, legal harmonisation, free flow of capital and labour, lower transaction costs). At present, however, only some companies that are considered important players at regional level as well are able to pursue this activity on a larger scale; without exception, they employ at least 10,000 people and are concentrated only in certain sectors

124 It is important to note here that we did not categorise the companies according to owners. 125 ‘We are primarily looking at the region where we see growth potential, but we are not going to enter a new market with low market share... It is very typical of the bank and myself as well that we have a conservative approach to all financial decisions, whether it is about risk management, provisioning or investment.’ Sándor Csányi CEO of OTP Bank to Portfolio.hu (7 Nov 2017). 126 The Prime Minister of Montenegro, Dusko Markovic, thanked Hungary for supporting Podgorica on its way to NATO integration and for helping with the accession to the European Union. ‘The EU is a priority for us.’ He also said that Hungarian investors are welcome in Montenegro. (Embassy of Hungary (Chart 6-30).

Chart 6-30: FDI abroad according to the sector targeted by the investment, cumulative transactions since 2008

Other Real estate

9%

17% 21% Mining and quarrying

Act LXXXI of 1996 on Corporate Tax and Dividend Tax. Background paper for the 3rd Annual Conference of the Background-paper-Going-digital-What-determines

Financial and insurance activities

11%

8% technology-diffusion-among-firms-Ottawa-2018.pdf 34%

Pharmaceuticals

Computer and electronics

Note: Net of capital in transit and asset portfolio restructuring. Source: MNB.

Theoretically, however, opportunities to invest in foreign

markets may be available for smaller companies as well. To the west of Hungary the outsourcing of horizontal types of tasks is already a long-time tradition. In this case, firms outsource partial tasks (e.g. accounting, payroll, technical support, customer service), which

can be operated in a much more economical manner in a country where wage

costs are low than close to the company headquarters. In regions where Hungarians live, the attainable wage differences range from 30 percent (Romania) to even 4-and-a-half fold (Ukraine). A further advantage of outsourcing compared to export contracts is that the outsourcing of services is not subject to customs duties in the receiving countries. The

wage costs saved as a result of the outsourcing may be spent at home on the increasing of capital intensity, which is reflected in the activities that have higher value added.

Outsourcing to territories where Hungarians live outside Hungary also serves the interest of the local people.

According to the latest data, the unemployment rate is

10 percent in Sub-Carpathia (Ukrstat, 2016), 11 percent on average in Central and East Slovakia (Eurostat, 2017), 10 percent in Vojvodina (Opec Srbije, 2018), and thus new jobs

could also be created in these disadvantaged regions, which are often inhabited by Hungarians.

Eurostat (2014): Community Innovation Survey 2012–2014

It is also clear, however, that the smaller a company, the less taking an active role, the state may help in this regard.

References

https://net.jogtar.hu/jogszabaly?docid=99600081.TV

Andrews, D. – Nicoletti, G. – Timiliotis, C. (2018): Going digital: What determines technology diffusion among firms? Global Forum on Productivity of the OECD. Downloadable: https://www.oecd.org/global-forum-productivity/events/

Balatoni, A. – Pitz, M. (2012): The effect of direct investment on Hungary’s gross national income Economic Review, Year LIX, January. Available at: http://epa.oszk. hu/00000/00017/00188/pdf/01_balatoni-pitz.pdf

Bassanini, A. – Scarpetta, S. (2001): The driving forces of economic growth: panel data evidence for the OECD countries. OECD Economic Studies No. 33, 2001/II. http:// www.oecd.org/economy/productivityandlongtermgrowth/18450995.pdf

Bernard, A. – Jensen, B. (1999): Exceptional exporter performance: cause, effect, or both? Journal of International Economics 47 (1999) 1–25.

De Loecker, J. (2007): Do Exports Generate Higher Productivity? Evidence from Slovenia, Journal of International Economics, 73, September, 69–98.

European Commission (2015): Internationalisation of European SMEs. Final Report. https://ec.europa.eu/ docsroom/documents/10008/attachments/1/translations/ en/renditions/pdf

European Commission (2018): European Structural and Investment Funds Data. https://cohesiondata.ec.europa.eu/, downloaded: 28.08.2018

European Commission (2017): Investing in a smart, innovative and sustainable Industry. A renewed EU Industrial Policy Strategy; Brussels, 13.9.2017 COM(2017) 479 final.

able it will be to outsource activities on its own. By under

Eurostat (2017): European ICT usage survey.

Felipe, J. ed. (2017): Development and Modern Industrial Policy in Practice. Elgar eISBN: 978 1 78471 554 0.

Olley, G. S. – Pakes, A. (1996): The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica, Vol. 64, No. 6. (Nov., 1996), pp. 1263–1297., http://links.jstor.org/sici?sici=0012-9682%28199611%2964 %3A6%3C1263%3ATDOPIT%3E2.0.CO%3B2-5

Griffith, R. (2000): How important is business R&D for economic growth and should the government subsidise it? The Institute for Fiscal Studies. http://www.ifs.org.uk/bns/bn12. pdf

Idea Consult (2013): Support for continued data collection and analysis concerning mobility patterns and career paths of researchers. https://cdn2.euraxess.org/sites/default/files/ policy_library/report_on_case_study_of_researchers_ remuneration.pdf

Levinsohn, J. – Petrin, A. (2003): Estimating Production Functions Using Inputs to Control for Unobservables. The Review of Economic Studies.

Hungarian Central Statistical Office (2016): Kutatás-fejlesztés (Research and Development), 2016 publication. http://www. ksh.hu/docs/hun/xftp/idoszaki/tudkut/tudkut16.xls, downloaded: 26.08.2018

Hungarian Central Statistical Office (2018): ÁKM, source and absorption tables. http://statinfo.ksh.hu/Statinfo/themeSelector.jsp?page=2&szst=QPA

Hungarian Central Statistical Office (2018): Labour Force Survey, micro database.

Hungarian Government (2018): Annual development appropriations, March 2018. Available at: https://www.palyazat.gov. hu/ves-fejlesztsi-keretek, downloaded: 28.08.2018

Magyar Nemzeti Bank (2018): Current account balance statistics. http://www.mnb.hu/statisztika/statisztikai-adatok-informaciok/adatok-idosorok/viii-fizetesi-merleg-kozvetlen-tokebefektetesek-kulfolddel-szembeni-allomanyok/ kozvetlentoke-befektetesek/bpm6-modszertan-szerinti-adatok, downloaded: 28.09.2018

Embassy of Hungary in Podgorica (2018): Official visit of Prime Minister Viktor Orbán in Montenegro. https://podgorica.mfa. gov.hu/news/orban-viktor-miniszterelnoek-hivatalos-montenegroi-latogatasa, downloaded: 01.10.2018

Meo S. A. – Al Masri, A. A. – Usmani, A. M. – Memon A. N. – Zaidi, S. Z. (2013): Impact of GDP, Spending on R&D, Number of Universities and Scientific Journals on Research Publications among Asian Countries. https://doi.org/10.1371/annotation/3a739c2a-d5f2-4d6f-9e0d-890d5a54c33d

MKIK-GVI (Hungarian Chamber of Commerce and Industry, Institute for Economic and Enterprise Research) (2018): A magyarországi KKV-k tevékenységének és gazdasági környezetének egyes jellemzői (Certain characteristics of the activity and economic environment of SMEs in Hungary). MKIK GVI. MNB (2017): Growth Report.

Moon, B. (2017): Global Technology Trends & Top Ten Startup Hubs 2017. Presentation. https://www.slideshare.net/ bernardmoon/global-technology-trends-top-ten-startup-hubs-2017, downloaded: 27.08.2018 Ministry for National Economy (2013): Kis- és középvállalkozások stratégiája 2014–2020, társadalmi egyeztetésre készített tervezet (Strategy of small and medium-sized enterprises 2014–2020, draft prepared for discussion). https://www.nth. gov.hu/hu/media/download/256 Ministry for National Economy (2016): Irinyi Plan on the determination of the directions of innovative industrialisation. http://www.kormany.hu/download/d/c1/b0000/Irinyi-terv.pdf National Tax and Customs Administration (2016): Corporate tax database.

National Research, Development and Innovation Office (2018): How are the FIEK university-industry cooperation centres proceeding?https://nkfih.gov.hu/hivatalrol/hivatal-hirei/ hol-tartanak-fiek.

OECD (2005): Oslo Manual 2005. https://ec.europa.eu/ eurostat/documents/3859598/5889925/OSLO-EN. PDF/60a5a2f5-577a-4091-9e09-9fa9e741dcf1?version=1.0

OP3C-Srbije (2018): Labour Force Survey. http://www.stat.gov. rs/en-us/oblasti/trziste-rada/anketa-o-radnoj-snazi/ Pakucs, J. – Papanek, G. ed. (2006): Innovációmenedzsment kézikönyv (Innovation Management Manual). Hungarian Association for Innovation.

Ministry of Finance (2018): Klaszterfejlesztés kereső (Cluster development search engine). http://www.klaszterfejlesztes.hu/ cluster.php, downloaded: 06.07.2018 Portfolio.hu (2017): ‘Csányi: The world of banks is no place for adventurers. Interview with the Chairman & CEO of OTP’. Portfolio.hu. https://www.portfolio.hu/impakt/csanyi-a-bankvilag-nem-a-kalandorok-helye.4.267115.html, downloaded: 01.10.2018

Shih, S. (1996): Me-Too is Not My Style: Challenge Difficulties, Break through Bottlenecks, Create Values. Taipei: The Acer Foundation.

State Statistics Service of Ukraine (2017): Regions of Ukraine 2017.

Van Biesebroeck, J. (2005): Exporting Raises Productivity in sub-Saharan African Manufacturing Firms. Journal of International Economics, December, 67(2): 373–391.

World Trade Organization (2016): World Trade Report. Levelling the trading field for SMEs. Available at: https://www. wto.org/english/res_e/booksp_e/world_trade_report16_e.pdf Yew, L. K. (2011): From Third World to First: Singapore and the Asian Economic Boom. HarperBusiness; International ed. edition. ISBN-10: 0060957514