The purpose of this research and concept direction development book is to guide you through my personal journey of research and influences when in preperation of creating my final major project. This book aims to showcase how I went about researching different inspirations, discovering potential path outcomes and possible campaign narratives for my final creative campaign. This process of research was really beneficial in guiding my final major project, after allowing me to gain a deeper understanding and gain more knowledge across many fields within the fashion industry. My research is broad-ranging, thorough and was carried out with an open mind, in hopes of being drawn to topic areas, gaps in a market and allowing concept and narrative of my project to form.

The Fabricant is an example of a digital fashion brand that creates virtual reality based clothing that consumers can use and ‘wear’ virtually on social media and in media, photography and videos. The brand is well-followed across social media and is known for their more futuristic and fantasy elements of their clothing design, as opposed to every day fashion wear. “All NFT holders can create, trade and wear digital fashion collections. All holders have exclusive access to co-creation events, private drops, free garments, learning classes and IRL/URL fashion experiences. We are building the wardrobe of the metaverse, growing the decentralized fashion industry together.”

“Fashion is about mixing and matching, customizing your garments and expressing your own unique identity. The Fabricant enables anybody to realize this potential. From passive consumers we become active creators, monetizing our craft and sharing our creativity. Royalties are equally split among all participants involved in the co-creation of the digital fashion items.” (Fabricant, T. 2023).

Auroboros is another example of a luxury digital fashion creative brand, who also specialises in creative NFT creation. Again, Auroboros tends to be more fantasy element based within their design choices, and their social media presense is really strong in communicating the idea of showcasing the large scale that digital fashion design has reached in regards to creativity and technology. As an alternative solution to resolving issues within sustainability within fashion, I think the idea of brands such as Auroboros creating whole new contemporary concepts of fashion communication can really help to widen the eyes of younger consumers, particularly people such as Generation Z who are so well responsive to new technology. “In 2020, fashion entered a state of flux. With the coronavirus shifting the industry further into the digital realm than ever before, brands are currently recalibrating for the new age we find ourselves living in: with some finding it easier than others. Step forward AUROBOROS. The London-based, science-meets-techmeets-fashion house was founded by creative directors Paula Sello and Alissa Aulbekova last year, and takes its name from an ancient symbol depicting a snake eating its own tail (representative of eternal change).” (Onufrocwics, M . 2021).

Founded in 1910 and since become a global empire, luxury fashion market and Haute Couture giant, Chanel, has really been such an influencial brand across decades within the fashion industry. The brand’s ability to revolutionise the wearing of the colour black into the everyday consumer’s wardrobe, the introduction of women wearing the power suit and the iconic creation of the history that is the ‘Little Black Dress’, Chanel is a pioneer within the industry when thinking about brand contributions. Chanel is a brand who knows how to leave a legacy and evoke a sense of true status, wealth, adoration and desire to buy into the fashion brand, arguably being one of fashion’s most ‘exclusive’ brands out there. Chanel has been able to curate this idea of ‘perfectionism’ and ‘elegance’ over the years, with some of their core brand values of quality, attention to detail in design and construction, and the idea of thinking that less is more when it comes to fashion. When it comes to industry change, progression and viral trend creation in the way of creating products which are still so loved and desired even in 2023, I think Chanel really knows how to make an impact as a brand, letting other brands further down the market level pyramid take note of their impact.

Who is the Chanel target consumer? My research into the brand allowed me to open my eyes to the reality of consumers who shop and are loyal to the Chanel brand. “Chanel’s key consumers are built up by women who want to identify themselves with everything that a brand like Chanel stands for, elegance, modern simplicity and class. Being able to wear clothes that are comfortable but yet still high fashion” (Blance, D. 2020). The Chanel consumer can be said to be similar of those who are ‘classic luxury market consumers’, in the way of having a strong brand following due to it’s product creation of the Chanel Number 5 fragrance, the Little Black Dress and the Classic Black Flap bag. I feel like Chanel gives off a feminine feel to the styles of clothing they design and create, a lot of which revolves around the creation of high qaulity tweed suit sets and different tweed combinations. I think by doing this style of creative design, Chanel is able to define their target audience quite well in the way of creating a strong brand look within their clothing garments, and one of which is now quite unusual within the luxury market. Brand’s now rarely design this style of clothing which is very preppy, elegant, chic and a more traditional style. This is probably due to the rise of interest and love for contemporary and streetwear brands such as Balenciaga and Comme des Garcons, especially amongst the younger audience markets.

When it comes to Chanel and they’re marketing and communication efforts, my research would suggest that the brand has a very solidified look when it comes to advertising and creating marketing campaign concepts. Looking into a vast array of Chanel marketing campaigns over the last few decades, it would appear that Chanel is a brand who likes to stay positioned within their designated ‘look’ and aesthetic, rarely over stepping out of this comfort zone. “While Chanel’s digital marketing strategy is one of the most robust in its category—the company’s Instagram account boasts 45.8 million followers, the highest of any luxury brand—the company is holding on to its in-store boutique experience for dear life. And to understand why is to know Chanel’s rich history of rebellion, persistence, and commitment to high standards” (Regaudie, T 2022). I think the idea that Chanel is a brand which is very comfortable in their ways and knows what they are doing is a fair statement to make, however my research made me question whether Chanel’s strict ways of not stepping beyond the brand’s ‘look’ did make me question whether the brand is going to survive this newly expected wave of digital and virtual innovation. The Chanel brand is very fond of doing things in a physical sense, such as marketing through print media magazines like Vogue, as well as creating in store shopping experiences within their boutiques. I think the concept of Chanel’s ability to stay relevant as we progress into a more digital space is very interesting to analyse.

Following on from the idea that Chanel is very stuck in their traditional ways in regards to their brand image, social status and marketing communication efforts, I think it’s really interesting to notice the brand’s disconnection between themselves and a youth audience. For decades, Chanel has been known for using their take on scarcity marketing when it comes to not making their products other than beauty products available for the mass market, which I can understand to protect the brand’s level of value and adoration. However, the idea that only the very select few can buy into the brand is really interesting to consider when we are being an audience to other luxury market fashion giants such as Prada, Dolce and Gabbana and Versace enter and progress into the new digitalised world. I think as a result of not wanting to to progress and emerge the brand into 2023 trends, such as TikTok social media campaigns, or event just starting to explore the idea of creating a more virtual and online consumer journey could really hurt the Chanel brand as the industry moves forwards with the progression and development of the Metaverse for example. As Generation Z are an up and coming audience and the new luxury consumer base, it is really important for brands to take note of this idea, and do all they can to capture the attention of youth audiences through creating products and consumer journeys which are fulfilling of the Generation’s brand expectations.

Looking further into this idea of Chanel creating a sense of disconnect between themselves as a brand and a Generation Z audience, I think it’s really interesting to look into what Chanel currently looks like in 2023. I started to research into some of the latest collections that Chanel has released and was quickly drawn to their Spring/Summer 2023 fashion show, which featured a lot of tweed materials, structured blazer co-ordinates and overall a collection which feels very reflective of the Chanel aesthetic and ‘look’. I think this idea of Chanel being stuck into their traditional design ways further comes into play when looking into their latest design releases, as this design level and style is very much not reflectant on the needs, wants or style inspirations which the Generation Z audience are very fond of. “The styling of the collection was a nod toward majorettes, those baton-twirling stars of parades: Think top hats, bow ties, and laced-up boots in gold or white with that famous Chanel two-tone toe cap. Outerwear, whether a tweed coat or a satin cape, came in exaggerated shapes that tented around the body, and tweed shorts which ballooned out from the hip” (McCall, T 2023). It’s interesting to consider what the design element is trying to achieve through this styling, almost as though they are trying to purposefully not capture the attention of Generation Z audiences.

The world of social media and social media marketing in particular had become such a strong and useful tool when marketing new product launches, communicating brand narratives and concepts, as well as overall having the ability to better reach and enage with an audience and consumer base. The benefits of social media are really vast when you think of the abilities that social media can bring for a business in terms of increased levels of brand visability and brand awareness, as well as the idea of creation a pathway of audience communication and creating the vibe of a close connection between a brand and a consumer base. Looking into the benefits of social media marketing, I think it’s a really positive tool that brands across all industries and market levels can use to further solidify conceptual narratives, brand stories and marketing communications from a more personal point of view. With the audience reach potential across social media platforms such as Instagram and TikTok, I think brands should really be taking advanytage of creating engaging, interactive and shareable social media campaigns in order to better promote their products and brand across to the up and coming Generation Z consumer - the social media obsessed cohort of shoppers.

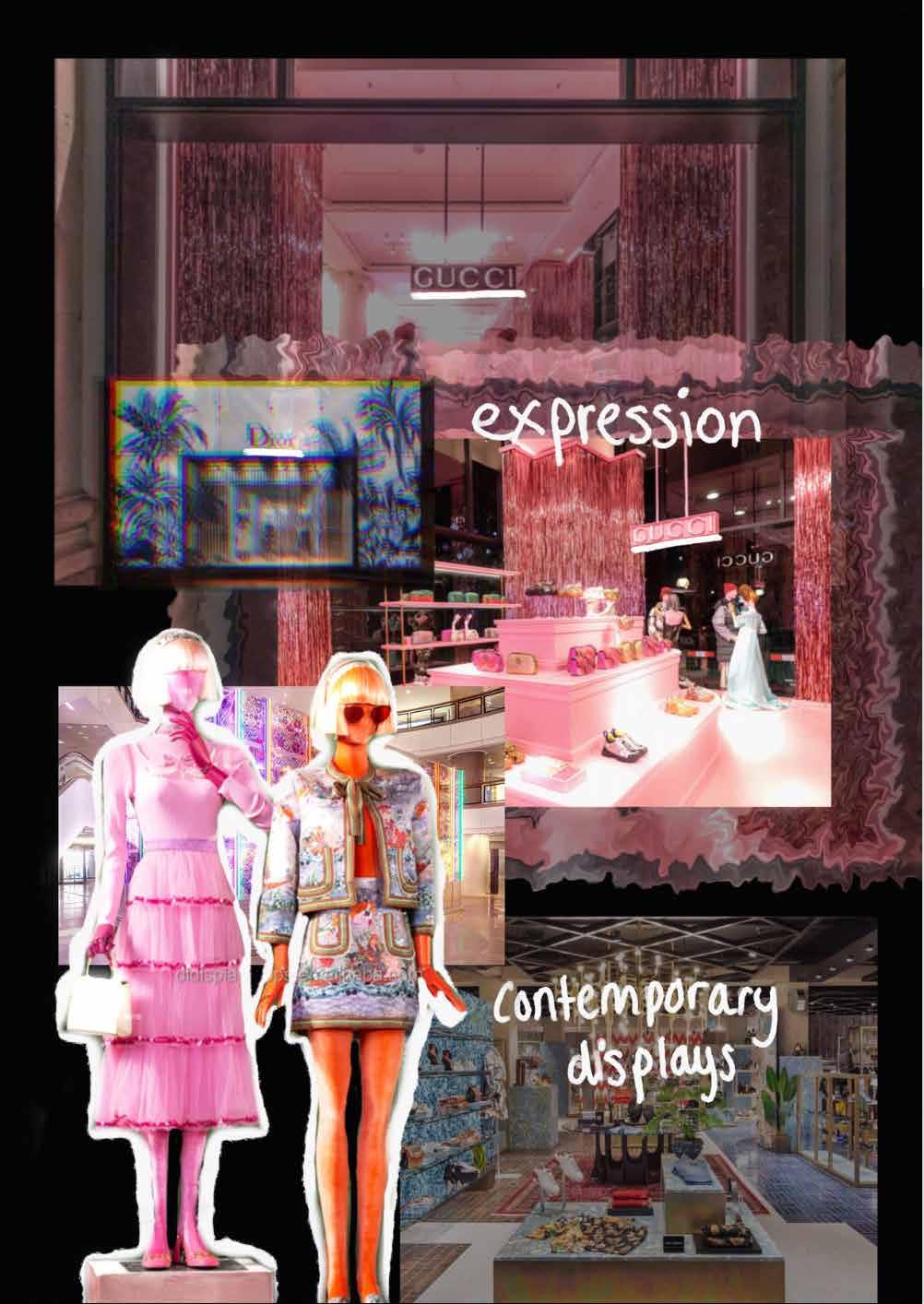

Visual merchandising can also act as such a useful tool in visually communicating a brand’s message, campaign concept, product launches and again promoting general brand visability and creating a sense of conversation and excitement for a brand. “The art of capturing attention through visual appeal has its own principles, but it all comes down to one thing: creating an amazing experience that encourages a purchase. This leads us to goal number two: to create a beautiful and positive ambience in-store that makes customers feel good by being in it. Visual merchandising doesn’t only help a store attract customers: it helps increase sales and gives customers a good reason to come back again, whilst giving your business a competitive advantage. This is why visual merchandising is so important” (Vision, C. 2023). For brands within the luxury market especially, visual merchandising installationc can have the power to be such powerful tools in capturing the attention of a variety of different audiences and consumer bases, due to it’s physical store or pop-up store nature.

I think the idea of visual merchandising can be really impactful in the way of reaching out to new audiences and those consumers which are located within previously untouched markets, and has a strong ability to extend this physical element of brand marketing communications through the opportunity of consumers then sharing in sotre concepts online also.

When researching into the luxury market level and what brands are doing in their efforts in creating a luxury market visual merchandising installation concept, I really enjoyed looking into the bold nature and eye capturing methodologies that brands use in order to attract consumer attention. Most notably, key luxury market player brands such as Gucci and Dior are quite well known for their abilities in capturing audiences attention through creative, engaging and content sharable visual merchandising installations. I really like the idea of proceeding with this concept of creating a physical marketing communications effort in the form of physical visual merchandising, and then allowing consumers to run free with the engaging element of this marketing technique which then has further opportunity to be shared and go viral across social media. Benefits of luxury visual merchandising includes “increased sales - effective visual merchandising can have a clear and positive effect on retail sales. Clear pricing, well-stocked shelves, simple displays and prominent sale signs can help drive profits while improving the shopping experience for your customers” (BusinessInfo, 2023).

“According to ABI Research by 2022, over 120,000 stores will leverage augmented reality. With the number of AR-capable devices in the world expected to grow to over 4 billion, companies should take note. Augmented Reality in fashion is transforming the way companies engage customers. This technology enables customers to experience products virtually from the comfort of their homes. AR can help consumers understand what they’re buying, making it easier to meet customer expectations. The AR experience is also a great opportunity for companies to educate customers and offer more in-depth content beyond the packaging and label. It also presents the perfect opportunity to upsell companion products or accessories. Immersive experiences are also a great way to drive customers to brick-and-mortar locations. Customers may want to visit the store to ask questions, see products in person or explore additional products the company may offer. AR isn’t limited to online stores. Companies with brick-and-mortar locations can use technology in the store to enhance the shopping experience. For example, Walmart developed an AR app to drive customers to the stores in December 2018. Customers would scan codes with their phones to activate AR content sponsored by consumer brands. AR activities also included virtual sleigh rides, mini-games and face filters. Shoppers could then share these experiences on social networks. All of which helped to drive additional shoppers to the stores”

(Johnson, P. 2021).

The high street market level is probably one of the most accessible, affordable and bought into market levels within the fashion industry. This market level provides convnience, structure and often simplicity when it comes to shopping and purchasing mass market fashion products, which have been inspired and created further up at the top end of the market level pyramid. “High street stores are primarily taking inspiration from designer catwalks these days. They also take inspiration from bloggers and social media influencers, as well as what women are wearing based on the garments they buy from other high street stores. Top trends include frills, embroidered denim, sportswear luxe, and graphic prints. Nowadays, the most popular high street stores for women are ones that replicate designs from the runway at the most affordable prices. Some of these stores mass produce fast fashion according to the latest trends and fads” (Davies, K 2023). This market level is much more catered to the everyday conusmer due to the market’s affordability levels and design structures.

“The retail sector is increasingly concerned about the decline in footfall to high streets and seems fixated on the fact that millennials, that most beloved demographic, prefer to buy online. This does represent a challenge, but their younger counterparts, Generation Z – the true digital natives – may actually be the saviours of high street shopping. We recently carried out a major pan-European research project among more than 50,000 adults across 11 countries – the Retail Buying Study 2018. It revealed that while only 14% of millennials (those aged 25-34) do their research and purchasing in-store, nearly a quarter (22%) of Gen Z (those aged 18-24) do so. The high street experience needs to shift to reflect this transformation, and to acknowledge that most people will have engaged with a brand online before they walk into a store. As digital natives, Gen Z is the group most likely to be looking for an in-store experience that merges seamlessly with what they find on the internet” (Parker, G. 2018). This idea that Generation Z is still very fond of high street and physcial shopping experiences is really interesting to look into, especially due to their strong social media presence and digitally fluent online shopping abilities.

“Zara is a Spanish clothing retailer based in Galicia, Spain. Founded by Amancio Ortega in 1975, it is the flagship chain store of the Inditex group, the world’s largest apparel retailer. The fashion group also owns brands such as Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, Zara Home and Uterqüe. The company operates over 2,220 stores and is present in 88 countries. Zara has consistently acted as a pioneer in fast fashion based in a higly responsive supply chain. The customer is at the heart of a unique business model, which includes design, production, distribution and sales through our extensive retail network” (Zara, 2023). Zara is an example of a high street store which caters well towards the needs, wants and brand expectations of younger audience bases, such as Generation Z. This is due to the brand’s levels of wide accessibility, affordabiltity and online engaging presence. A Generation Z hit in terms of providing affordable fashion which is trend driven, luxury market inspired, and often a much cheaper alternative to luxury fashion trends and innovations, Zara communicates their brand image, aesthetic and trend orientated looks across a varity if different social media channels.

“The Zara target market includes women and men, mainly younger adults in the age range of 18 to 40. This places the Zara segmentation strategy as largely focusing on Millennials and Gen Z, who are both fashion conscious and tech savvy. The Zara market tends to skew more female than male – in the UK, Zara has over 4 million female customers, compared to around 2.4 million men. The Zara Kids line taps into the parents’ market, who are looking for stylish yet affordable kid’s clothing. Zara Home, the brand’s homeware and accessory stores, cater to a target market of young-adult to middle-aged homemakers. The Zara marketing strategy is built on the promise of instant fashion – giving customers the styles they want faster than competitors and still at an affordable price. Zara produces over three times the number of items each year than other fast fashion competitors, however in smaller quantities. This leads to a scarce supply of fast-rotating new styles” (Start. io 2022). The idea that Zara is a well orentiated brand which caters and responds well to the brand expectations and demands of a Generation Z and youth consumer highlights the brand’s ability to mainatain a sense of relevancy and evokes high levels of consumer engagement across both social media and a physical instore presence.

“One of my favourite things about fashion is how so many aspects of it are inspired by the world around us. From designers creating iconic pieces to consumers jumping on certain trends, we are heavily influenced by the circumstances we find ourselves in. Fashion has not stopped during lockdown and trends have continued to emerge from loungewear, to tie dye to Zara hauls. Zara hauls have also been a trend on Tik Tok. The Tik Tok algorithm means that anyone can go viral relatively easily, and Zara hauls have been a trend where many videos have gone viral. Tik Tok videos are a maximum of one minute in length so users can share quick snippets posing in their favourite Zara items. These videos are usually made by teenagers and often feature similar items. Seeing a small curation of clothes has obviously inspired many shoppers throughout quarantine. Zara have increased their Gen Z audience during lockdown as influencers and social media users alike have jumped on the trend of showing their picks from the store. Now that shops are back open in the UK, it will be interesting to see if Gen Z ditch the online fast fashion brands for an in-store option” (Elyes, P. (2020).

“Zara has historically been light on collaborations, as far as fashion brands go. While the rest of the industry has been trigger-happy with collabs, Zara had only one collaboration with a major brand in 2020, releasing a pair of sneakers with Playstation in July. But in 2021, Zara has partnered with names including Everlast in January, Kassl Additions in September and Charlotte Gainsburg in October. And in the last three weeks, it’s rolled out collaborations with Korean streetwear label Ader Error, biotech company LanzaTech and TRX, a company that makes at-home fitness equipment and publishes digital workout videos. It seems Zara’s strategy is to tap partners that specialize in emerging spaces to gain a foothold in those categories”(Parisi, D. 2021). Zara has also collaborated with many top influencial figures within the fashion industry, such as high fashion supermodels and trendsetters, Kaia Geber and Irina Shayk. The Zara brand is definetly not afraid of brand collaborations, which I think comes at a benefit for the brand due to their high street and mass market level status. Mostly in fashion, we tend to see large luxury market brands collaborating with big names and other big brands within the industry. Therefore, I find it really interesting how Zara is able to collaborate with other players in the industry who also have a big influence in fashion, making luxury fashion more accessible and affordable for the everyday consumer.

I think one of the most interesting aspects about the Zara brand is their ability to act as a brand that is providing affordable and accessible luxury for mass market and consumer bases with lower levels of disposable income to spend on fashion. Even though Zara is positioned between the fast fashion and high street mass market levels, Zara is one of the brands who has more of a premuim and higher pricing strategy as opposed to high street competitors such as H&M and New Look. This idea is intriguing to consider when thinking about how younger consumers and Generation Z audiences can consume fashion that feels more premuim and creates a feeling that these consumers can in fact buy into luxury, through the affordable luxury route of fashion. I think this idea really gives Zara a unique selling point and brand advantage in the way of catering and providing a luxury sense of fashion, which fulfills the desires, brand expecations and demands from younger audiences such as Generation Z. I want to explore further this idea of delivering affordable luxury into the Generation z consumer’s shopping abilities.

In conclusion, this research and concept development book aimed to visually and verbally communicate my journey of research into the key inspirations and ideas behind my moving forwards in creating my final campaign concept. The next stage of my campaign development is a process of brand interrogation.

Fabricant, T. (2023) Retrieved from https://www.thefabricant. com/about

Onufrocwiz, M. (2021) Retrieved from https://www.dazeddigital. com/fashion/article/51913/1/auroboros-celestial-couture-alexander-mcqueen-vr-technology-digital-fashion

Blance, D. (2020) Retrieved from https://daisyblance19.wixsite. com/mysite-2/post/chanel-s-target-consumer-tribe-and-theirvisual-identity

Regaudie, T. (2022) Retrieved from https://hashtagpaid.com/banknotes/chanel-marketing-then-and-now

McCall, T. (2023) Retrieved from https://www.wmagazine.com/fashion/chanel-couture-spring-2023-review-photos

Vision, C. (2023) Retrieved from https://www.contravision.com/ visual-merchandising-importance/

BusinessInfo (2023) Retrieved from https://www.nibusinessinfo. co.uk/content/advantages-and-disadvantages-visual-merchandising

Johnson, P. (2021) Retrieved from https://rockpaperreality.com/ insights/ar-use-cases/augmented-reality-in-fashion/

Davies, K. (2023) Retrieved from https://www.lovetoknow.com/life/ style/what-is-high-street-fashion

Zara.(2023) Retrieved from https://www.businessoffashion.com/organisations/zara

Start.io (2023) Retrieved from https://www.start.io/blog/ who-is-zaras-target-market-zara-brand-analysis-customer-segmentation-marketing-strategy-competitors/#:~:text=Zara%27s%20 Psychographic%20Segmentation,enjoy%20a%20personalized%20shopping%20experience.

Elyes, P. (2020) Retrieved from https://www.thecourieronline. co.uk/have-online-zara-hauls-boosted-sales/

Parisi, D. (2021) Retrieved from https://www.glossy.co/fashion/ zara-is-changing-its-tune-on-collaborations/