Date: June 2022

CREATIVE OVERVIEW Highlights of Kelley Kronenberg Creative Marketing Projects

JOSEPH KLUCAR Creative Marketing Manager Start

BRAND GUIDELINES TABLE OF CONTENTS INTRODUCTION Introduction 4-6 PRIMARY LOGOS Logo Usage 8 Construction Lines 9 Logo Font 10 Color Usage 11 Color Variations 12 Unacceptable Usage 13 Application Examples 14 SUB-LOGOS Logo Usage 16 Logo Construction 17 Construction Lines 18 Logo Font 19 Color Usage 20 Color Variations 21 Unacceptable Usage 22 Application Examples 23 SPECIALTY LOGOS Logo Usage 25 Logo Construction 26 Tagline Font 27 Unacceptable Usage 28 MISCELLANEOUS LOGOS Logo Usage 30 Unacceptable Usage 31 PAIRED LOGOS Paired Logo Usage 33 Logo Construction 34 LATERAL ACQUISITION LOGOS Lateral Acquisition Brand Architecture Scenarios 36 JFK Logo Usage 37 JFK Logo fonts 38 Sub-Logos LOGO FONT 19 GOTHAM BLACK A B C D E F G H I J K L M N O P Q R S T U V W X Y Z 2 3 4 5 6 7 8 9 0 ! @ # $ % & ? ) Logo Font LOGO USAGE 30 Miscellanious Logos CARES Branding Book CLIENT TOUCHPOINTS CONNECT QUALIFY FOLLOW-UP PITCH CLOSE ADOPTION (1ST CASE) RETENTION (WELLNESS CHECKS, ETC) CROSS-SELL LOYALTY (TESTIMONIALS, ETC) ADVOCACY (REFERRALS) Firm Brochure -Conflict Check PASS Notification (CS)New Client info Form (CS)Master Client Contract (JMV)Contingency Fee Agreement (CS) Sample Invoice (AG) Client Pay (JMV) Litigation Letter (JMV) ---Letter to Judge (GLB)Rate Increase Letter Holiday Gift Boxes Holiday Email (To be created) Welcome Kit (To be created) Letter to Client (CAS) DE&I Brochure Firm Benefits Overview Review of Client Touchpoints LinkedIn Cover Images WWW.KKLAW.COM 800.484.4381 INFO@KKLAW.COM FORT LAUDERDALE MIAMI WEST PALM BEACH NAPLES DAYTONA ORLANDO TAMPA JACKSONVILLE TALLAHASSEE CHICAGO NEW ORLEANS ATLANTA NEW YORK NEW JERSEY INDIANA Letterhead FORT LAUDERDALE OUR OFFICES 14 OFFICES Presentation Title Banking and Financial Services Child Advocacy Construction Healthcare Hospitality Insurance Manufacturing Private and Corporate Security Professional Services Retail Transporation Logistics Technology Appellate Bankruptcy, Insolvency, and Creditors’ Rights Business Insolvency Business Bankruptcy and Creditors’ Rights Collections and Asset Recovery Receivership Assignment for Benefit of Creditors’ Business Law Business Succession Plan Business Transactions Complex Commercial Litigation Directors and Officers Liability Fiduciary Liability Errors & Omissions General Counsel General Business Litigation Construction Law Contract Drafting Negotiations Construction Litigation Construction Defect Litigation Jobsite Accidents Coverage Bad Faith Disputes Criminal Defense Data Privacy & Technology Family Law INDUSTRIES CLIENT SERVICES Florida Administrative & Regulatory Law Gig Economy Liability Immigration Law Nursing Home Defense Probate Litigation, Estate Planning and Guardianship Estate Planning Commercial and Residential Evictions Commercial Transactions (Closings) Title Curative/Quiet Title Litigation OUR PRACTICES Presentation Title Section Title Click to edit Section title Click to edit Section subtitle Powerpoint Template Zoom Backgrounds Revise Of Specialty Logos LOGO USAGE The Specialty logo is a variation of the Kelley Kronenberg logo that celebrates a specific event or campaign. 25 Specialty Logos BREAST CANCER AWARENESS CELEBRATE PRIDE MONTH DIVERSITY, EQUITY & INCLUSION 1 .58 First Letter Left Aligns with top of K and centered vertically with K Sub-Logos LOGO CONSTRUCTION Typography: Gotham Black Tracking: -25 ALL CAPS 17 Logo Architecture For Sub-Logos

BRANDING

BROCHURES

KK/Nextwave Brochure

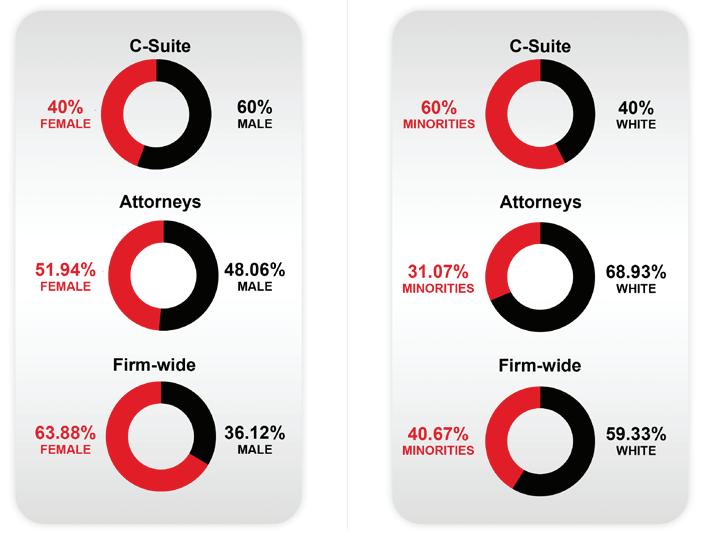

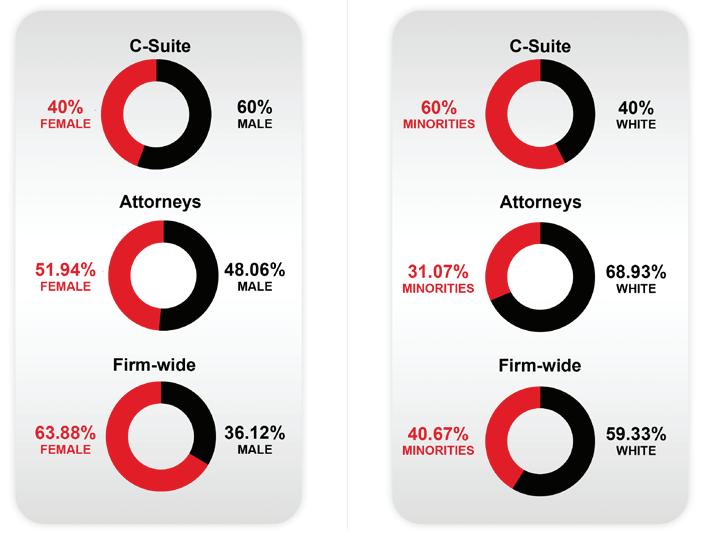

Community service has been at the core of Kelley Kronenberg’s values since the firm’s inception over forty years ago. We believe that supporting and giving back to our respective communities and helping others are fundamental obligations. Recognizing the importance of our relationship to the communities in which we do business, the firm created Kelley Kronenberg Cares. Kelley Kronenberg Cares community involvement program that provides our attorneys, staff and their families with opportunities to join forces and work together to benefit charitable organizations and organizations of all types that support and benefit our local communities. At Kelley Kronenberg, we believe that is our responsibility to interact, contribute, engage and contribute positively to make difference for others and for future generations. CARES COMMUNITY SERVICE GET TO KNOW USDIVERSITY, EQUITY, & INCLUSION SNAPSHOT Kelley Kronenberg is proud to spotlight and foster a diverse and inclusive workforce with over 400 employees. GENDER ETHNICITY WHY WE ARE DIFFERENT We value and respect the strengths and differences among our employees, clients, and communities because they reflect our future successes. Diversity characterizes our clientele, our workforce and the areas of law in which we practice. The breadth of our practice areas enables our clients to rely on Kelley Kronenberg as a comprehensive resource to address and handle their most challenging and complex legal needs. We insist on ingenuity. We are pioneers in the areas of technological advancement and client services, which allows us to provide exemplary legal representation with efficiency and skill. Our clients deserve the highest level of service and we deliver it with flawless professionalism. We are committed to providing our clients with legal representation epitomized by integrity, dedication, and perseverance. The more things change, the more some things stay the same. As our clients grow and evolve, and as new legal and service trends emerge, our focus on diversity, ingenuity and professionalism ensures that Kelley Kronenberg will remain the strong and stable law firm that our clients and employees have come to rely upon. Kelley Kronenberg incorporates many initiatives and activities that foster diversity equity and inclusion. Monthly Diversity Awareness Celebrations Seminars on Diversity, Equity and Inclusion Collaboration with Minority Bar Association Participation in all programs hosted by the Leadership Council on Legal Diversity (LCLD) Kelley Kronenberg involved in various organizations locally, regionally, and nationally connection to business, as well as diversity, equity and inclusion including: The Florida Association of Women Lawyers The Cuban American Bar Association Claims & Litigation Management Alliance Broward County Women Lawyers Association TJ Reddick Bar Association German American Business Chamber Federal Defense Lawyers Association Caribbean Bar Association Broward County Hispanic Bar Association Greater Fort Lauderdale Alliance Association for Women Attorneys New Orleans Jewish Federation Volusia Flagler Association of Women Lawyers Legal Aid Service Broward County Coast to Coast Legal Aid of South Florida Leadership Council on Legal Diversity WHAT WE DO 24/7 - MAKES THE DIFFERENCE TALLAHASSEE NEW JERSEY WEST PALM BEACH ORLANDO JACKSONVILLE 15 OFFICES JACKSONVILLE 10245 Centurion Parkway N, Suite 300 Jacksonville, 32256 Phone: (954) 370-9970 DAYTONA 128 Orange Avenue, Unit 306 Daytona Beach, FL 32114 Phone: (754) 888-5437 TALLAHASSEE 6267 Old Water Road, Suite 202 Tallahassee, 32312 Phone: (850) 577-1301 BY APPOINTMENT ONLY WEST PALM BEACH 1475 Centrepark Blvd., Suite 275 West Palm Beach, 33401 Phone: (561) 684-5956 FORT LAUDERDALE Fort Lauderdale, 33324 Phone: (954) 370-9970 MIAMI 1111 Brickell Avenue, Suite 1900 Miami, 33131 Phone: (305) 503-0850 NEW JERSEY John Kennedy Parkway First Floor West Short Hills, NJ 07078 Phone: (908) 403-8174 CHICAGO Chicago, 60602 Phone: (312) 216-8828 NEW ORLEANS 400 Poydras Street, Suite 2400 New Orleans, Louisiana 70130 Phone: (732) 547-7907 NEW YORK CITY One Liberty Plaza 165 Broadway 23rd Floor, Suite 2374 New York, NY 10006 Phone: (800) 484-4381 ATLANTA 1100 Peachtree Street NE, Suite 200 Atlanta, GA 30309 Phone: (404) 990-4972 ORLANDO North Orange Avenue, Suite 704 Orlando, FL 32801 Phone: (407) 648-9450 TAMPA Tampa, 33607 Phone: (813) 223-1697 NAPLES Naples, FL 34104 Phone: (239) 990-6490 OUR OFFICES INDIANA 5164 E. 81st Avenue, Suite 109 Merrillville, 46410 Phone: (219) 805-8065 INDIANA A Firm Built on Relationships KELLEY KRONENBERG IS A MULTI-PRACTICE BUSINESS LAW FIRM. Founded in 1980, the firm is one of the fastest-growing law firms in Florida and amongst the largest in the U.S. The firm serves all types and sizes of public and private companies, including small businesses and individuals nationwide. For more information, visit www.kklaw.com with over the convenience of more than 400 15 200 Employees Attorneys Locations Firm Brochure Redesign WWW.KKLAW.COM 800.484.4381 INFO@KKLAW.COM Construction Litigation OVERVIEW Kelley Kronenberg’s experience spans many aspects of the construction industry and our attorneys understand that the needs of our clients in this industry are unique and complex. At Kelley Kronenberg, attorneys with differing areas of legal expertise work together to address not only the contractual and litigation needs of our construction industry clients, but also the business, financial, risk management, regulatory, labor and employment, insurance, and workers’ compensation needs. From project inception to delivery (and beyond), Kelley Kronenberg represents all participants the building process, including design professionals, public and private owners, developers, general contractors, subcontractors, product manufacturers and suppliers, risk insurers, and sureties, involving a wide variety of residential, commercial, and industrial construction projects. Kelley Kronenberg’s attorneys counsel clients on all aspects of the design and construction process, assisting clients during project development, bidding, contract drafting and negotiation, construction, project close-out, and post-completion claims. Our attorneys are well versed in meeting the complex challenges that face our clients in achieving project completion on time and within budget. Our attorneys include experts in their field who routinely write and lecture on construction law topics through national organizations such as National Business Institute (NBI), Strafford, Law Practice CLE, and MyLawCLE, as well as construction industry groups such as Construction Association of South Florida (CASF). Our attorneys strive to reach negotiated solutions in construction disputes whenever possible, but we cannot achieve our clients’ goals by negotiation, we are fully prepared to proceed through all the stages of civil litigation or arbitration, including mediation, trial and appeals. We pride ourselves in thorough and detailed analysis of cases, often times with the assistance of skilled engineers and other industry experts, so that we know our cases better than our adversaries leading into mediation and trial, maximizing our clients’ recovery or mitigating their potential exposure. Our attorneys have ready access to the full range of resources necessary to assist our clients with any construction problems, both large and small, and pride themselves on knowledgeable and personalized service, always striving to achieve results efficiently and cost-effectively. CLICK HERE TO READ MORE Pre-Construction • Negotiation and drafting of construction agreements During Construction • Prosecution or mitigation of construction claims including non-payments, delays, change order disputes, and breach of contract Post-Construction • Post completion, 558 notices, and construction defect claims Gary Brown Construction Litigation Regular Hourly Rate $595 $375 $175 with $7,500 retainer Exclusive Hourly Rate $450/ $350 $150O with $7,000 retainer General Liability Coverage B Employer Liability/Workers’ Comp Immunity Spoilation of Evidence and how to preserve Chain of custody issues Dominick Tamarazzo General Liability Regular Hourly Rate Insured Employers: $225-$250 dictated by the insurance carrier Uninsured Employers: $300 $250 $150 with $7,500 retainer Exclusive Hourly Rate Insured Employers: $200-$250 dictated by the insurance carrier Uninsured Employers: $250 $200 $125 with $7,000 retainer Pre-Litigation Services Compensability decisions prior to needing an attorney (free consultation) Fraud analysis Policy Review & Development: Drug-free workplace policies Return to work policies Comprehensive WC plan Accident investigations Post-Litigation Services Depositions Mediations Trials Doctor conferences Joshua Higgins Workers’ Compensation Regular Hourly Rate Insured Employers: $150-$175 dictated by the insurance carrier Uninsured Employers: $300 $250 $150 with $7,500 retainer Exclusive Hourly Rate Insured Employers: $150-$175 dictated by the insurance carrier Uninsured Employers: $250 $200 $125 with $7,000 retainer OSHA Assist during investigations (comprehensive, accident, complaint) Review safety program for compliance Defend OSHA citations Training Labor & Employment DOL Compliance (overtime, employee classification, independent contractors, benefits, government contracts etc.) Contract issues (Non-compete, Executive/Manager/C-suite contract drafting and disputes) Non-Compete defense and enforcement Defense of Discrimination/harassment/whistle-blower claims (Government position statements/litigation) Employer Policies/Practices (risk avoidance) Rapid Response On-site assistance during OSHA visit to worksite On-site assistance during DOL audits (wage-hour, I-9s) Accident investigations Angelo Filippi OSHA, Labor & Employment, Rapid Response Regular Hourly Rate $450 $350 $150 with $7,500 retainer Exclusive Hourly Rate $400/ $300 $125 with a $7,000 retainer

RE: Align on Subject Matter Expert Curriculums & Referral Partnership Date: September 29, 2022 from 2-3p Goal: Gain an understanding of how we can mutually benefit each other and grow business. 1) Nextwave Safety to present background, client profile, business model, and overall goals of the company. 2) Discuss & develop partnership program: Nextwave’s value offer to KK: A. Expose KK attorneys to their client base for referrals B. For WC/GL, Nextwave to encourage clients to add KK on their carriers’ panels Our value offer to Nextwave: A. KK will provide content for educational curriculums with Subject Matter Experts: Angelo Filippi (OSHA, Labor Employment, and Rapid Response) b. Josh Higgins (Workers’ Comp) c. Dominick Tamarazzo (General Liability) d. Gary Brown (Board Certified in Construction Law) B. Nextwave will have a built in OSHA expert on-call (with established OSHA agent relationships) C. Nextwave can offer clients reduced “exclusive” partnership rates D. Include Nextwave in our Preferred Partner Network (Tom Choberka) 3) Pilot Program (6 month test) Align on # of curriculums, expectations, and value: Should we convert referral into client, KK will refund the retainer amount. Should we not convert, KK keeps the retainer for the time spent on the educational curriculum. ALIGN ON SUBJECT MATTER EXPERT CURRICULUMS & REFERRAL PARTNERSHIP September 29th, 2022 2 PM – 3 PM

MEETING AGENDA

CAMPAIGNS

Summer Lovin’ - Talent Recuitment

Summer Lovin’ - Posters, Flyers and Email Graphics

Summer Lovin’ - Logo

Summer Lovin’ - Video

Independent Contractor

DE&I Committee

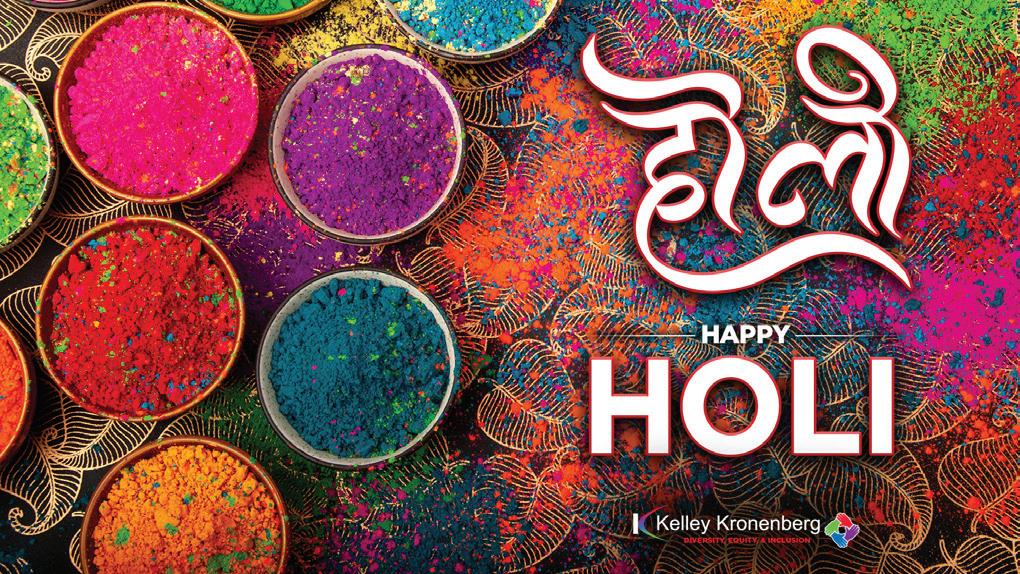

Social Graphics

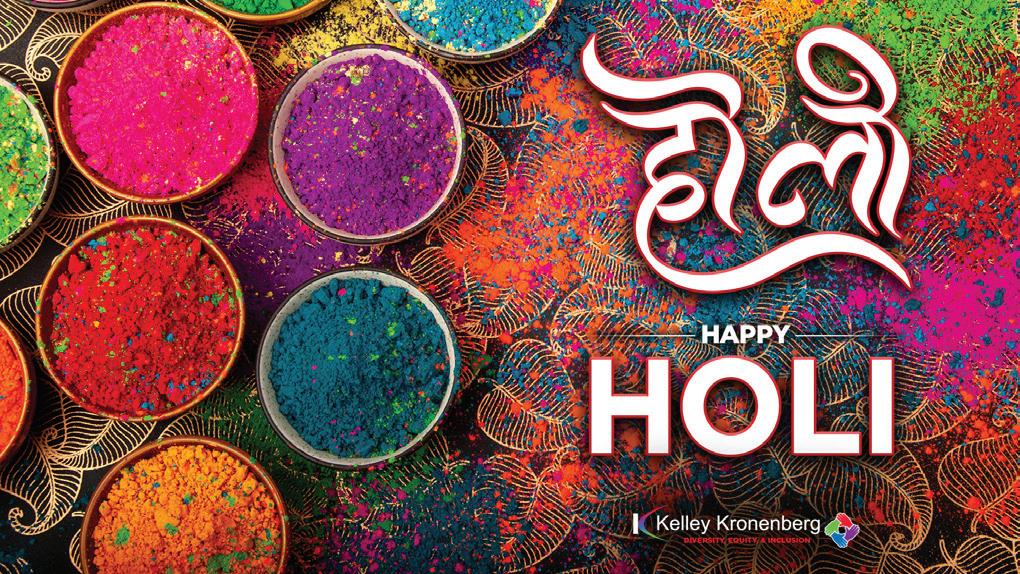

DIVERSITY, EQUITY & INCLUSION COMMITTEE

DIVERSITY EQUITY INCLUSION

E-mail Graphics

TV Graphics

First Name Last Name Title Why Diversity, Equality, and Inclusion is important to them. What does it mean to them. Cab ilit velest quatiis maxima dolorro vitatem poressu ntibus etur aped ut doluptis namus mo et laboritio. Itae poreribus acea si ommodic te doluptiis vollacimi, si de officiae sitatquat magnis esseque nusdae dolupti des eaturib erumqua erepreh enimi. Diversity, Equity Inclusion 2023 Annual Report dIVERSITY EQUITY AND INCLUSION 2023 ANNUAL REPORT WE ARE DIFFERENT TABLE OF CONTENTS Leadership Pledge Diversity, Equity Inclusion Committee Snapshot DEI Activity 10-15 Awards and Recognition 17 Kelley Kronenberg Cares 18 DEI Scholarship Program 21 Diversity Policy 22 UNIQUENESS IS YOUR SUPERPOWER! Diversity, equity, and inclusion are more than just words for us. They are the indelible principles guiding how we build our workforce, cultivate leadership, and create company that is the right fit for anyone who seeks join us. Just like our clients and our cases, each of our employees different, and we like that way! We are committed to celebrating the rich diversity of the people who enable, provide, and receive our services. We listen and engage with our diverse communities, every person taking on the role of both illuminator and illuminated. Our success comes from empowering freedom of thought and opinion an environment of safety and mutual respect. Our work, activities, and interactions are enriched by celebrating our uniqueness as well as our commonality. Diversity without equity meaningless. We ensure equal opportunity to all employees and applicants, for employment and advancement without regard to race, religion, color, age, sex, national origin, sexual orientation, gender identity, genetic disposition, neurodiversity, disability, veteran status, or any other defining characteristic. Inclusion unleashes the power of diversity. We endeavor foster belonging and empowerment. We strive create workplaces that reflect the communities we serve and where everyone feels emboldened bring their full, authentic selves work. We are driven to build and nurture culture where inclusiveness is given, not goal. As firm and as individuals, we seek to create a sense of belonging that transcends any role, business unit, or locale. Diversity, equity, and inclusion are at the core of who we are. Our commitment to these values is unwavering. They drive our mission and cultivate our impact. We know that having varied perspectives helps generate better ideas to solve the complex problems of changing and increasingly diverse world. Diversity, Equity Inclusion 2023 Annual Report

Heath S. Eskalyo, pledge to commit to the following: PERSONAL COMMITMENT will use my voice as leader in my organization and the profession advocate for diversity and inclusion the legal profession and in my community. will use my position among my firm’s leadership advocate for changes to improve the equity of processes such as work assignments, hiring, and compensation. will meet bi-annually with my organization’s LCLD Fellows, Pathfinders, and Alumni to discuss their experiences within the organization, and require each individual to come to the meeting with recommendation for how the organization could improve. will reinforce culture within my organization that encourages employees to come and leave work each day feeling that they have been authentically and visibly who they are, and by ensuring that employees feel valued, heard, and empowered as professionals. will publicly demonstrate my commitment by using my platform to advocate for greater diversity in the legal profession and for the removal systemic barriers to entry and advancement, through public engagements, by leveraging my professional network, through continued participation in and sponsorship of conferences and diverse bar events, and by advancing policies and initiatives to support this goal. ORGANIZATIONAL COMMITMENT will require human resources department and the firm’s diversity and inclusion committee to prepare and present firm leadershipan annual diversity and inclusion action plan and related metrics. will create directory of lawyers who identify as diverse, and will work with my firm to create an internal process to evaluate all client teams for diversity. will ensure that 30% of the lawyers in my firm are diverse, an are hired based on merit. Withintwoyears, willworkwithmyfirmtocreatepartnercompensationincentivessothatpartnersareevaluatedontheirpersonalcontributionstodiversity andinclusioninitiatives,includingdemographics clientmatterteams,occasionswhenthepartnerhasdesignated diverselawyer servein seniorclient relationship role, introduction of diverse lawyers into client relationships. will drive accountability for diversity & inclusion by: SAMANTHA MENDEZ Legal Assistant, FTL Diversity, Equity Inclusion 2023 Annual Report Highlighting diversity and fostering inclusion throughout the firm has been imperative to the growth of Kelley Kronenberg and its ongoing development. To further the efforts of diversity within our organizational culture, the firm introduced Diversity, Equity, and Inclusion Committee. The Kelley Kronenberg Diversity, Equity, and Inclusion Committee is tasked with seeking out and utilizing our employees’ diversity in ways that bring new and richer perspectives to the firm and its clients. Additionally, the committee oversees and supports the ongoing evaluation process and related activities and initiatives that set clear expectations and accountability around diversity, equity, and inclusion across the firm. Kelley Kronenberg realizes that investing in our people yields the highest results--better business performance, increased productivity, greater profitability, and happy workforce. Openness and support of diversity, equity, and inclusion allows our firm greater access to attract, engage, hire, and retain the best talent. Businesses with healthy gender balance are more likely to outperform their competitors. Businesses with good mix of ethnic backgrounds are more likely to outperform their competitors. Teams that are gender, age and ethnically diverse make better decisions. Kelley Kronenberg regularly and actively invests the necessary tools, resources, and training year round in order to best compete and lead amongst its competitors. ADEKEMI AKINWOLE Attorney, ORL CAROLINE CIMEI Co-Chair The DEI Committee Director Talent Acquisition, FTL AMANDA HOBSON-GARCIA Legal Assistant, TPA ANNE SKINNER Co-Chair The Committee Director Client Intake, TPA SAMUEL R. GOLDBERG Practice Group Partner, WPB FELIPE GONZALEZ Attorney, FTL IRINA DANILYAN Diversity, Equity Inclusion 2023 Annual Report DANIELLE M. SPRADLEY Attorney, FTL ELLIOTT HALSEY Partner, CHI NICOLE W. LAZAROFF VANESSA CHAVEZ Assistant, FTL MONICA OFFREDI Attorney, FTL SYDNI NIEVES Digital Marketing Coordinator, FTL ZACHARY SAWKO Attorney, WPB PATRICIA REPANOVA SUNITA SMITH Attorney, TAL RYAN A. BECKER EMMA MEYERSON Practice Group Partner, WPB CARLOS CARABALLOSANTIAGO Legal Assistant, ORL JORDAN LANDE SARA DESOUZA DEI Coordinator Legal Assistant, FTL LAYLA V. FEBRES Legal Assistant, FTL CHARLES LIGHTNER Director Digital Marketing, FTL ERICA SHOWELL Practice Group Partner, FTL SNAPSHOT Diversity, Equity Inclusion 2023 Annual Report Activity Diversity, Equity Inclusion 2023 Annual Report

Brochure

DE&I

E-mail / Flyers

$4 million final demand for bodily injury to schoolteacher when her struck by left-turning tractor-trailer prior to trial. The case settled for $400,000 after close of evidence. $2.1 million final demand for an accident involving a sugar cane truck backing across highway in rural Louisiana. The tractor trailer had mud-encrusted reflectors. Case settled for $325,000 after close of Plaintiff’s case based upon careless operation and excessive speed of driver in foggy/dark conditions. • $1.1 million final demand for premises defect case resulting in a department store customer breaking her leg requiring nail and pins to stabilize her tibia and year of rehabilitation. The case was settled for $290,000 after cross-examination of Plaintiff who bore substantial comparative fault. MSJ granted dismissing commercial landscaping company for grounds defect along casino sidewalk. MSJ also defeated casino’s claim for defense and indemnity under landscaper’s general liability policy. MSJ granted for rental center slip-and-fall claim based upon Louisiana Merchant Liability Act, and the failure of Plaintiff to demonstrate slippery conditions present long enough that store management should have been aware of Trip fall settlement with an ankle ORIF for $500 after establishing strong liability defenses and leveraging an MSJ. Aggressive approach by landlord to tenant by tendering defense and demanding tenant include landlord in settlement before landlord was sued directly and getting risk transferred with minimal expense and no indemnity. Leveraged Independent Contractor Doctrine and Florida’s Proposal for Settlement Statute to get Plaintiff to dismiss a principal for the torts of the independent contractor where there was coverage for the independent contractor. By doing this, we helped cut the cost of defense in half and limited the risk to the principal/named insured. • The Third District Court of Appeal affirmed complete dismissal involving premises liability lawsuit filed in Miami-Dade County. We represented the City of Sunny Isles Beach in the suit, which was filed when minor was injured while playing playground equipment at city-owned park. We successfully argued the child’s conduct in misusing the playground equipment was the sole proximate cause of his injuries. The judge agreed and granted summary judgment, which the appellate court upheld. • A complete defense verdict was secured following five-day jury trial held in Florida’s Nineteenth Circuit Court. At trial, the Plaintiff claimed more than $600,000.00 in economic damages and asked the jury for an award in excess of $2 million. Through the efforts of our team, our client was shielded from the damages sought and from an attorney’s fees and costs that would have been incurred had Plaintiff prevailed. David S. Henry Chair General Liability and Third-Party Insurance Defense 954-370-9970 dhenry@kklaw.com RELATIONSHIP PARTNER Heath S. Eskalyo Principal Partner Chief Financial Officer 954-370-9970 heskalyo@kklaw.com Starr Approved Panel for Florida and Louisiana

TV Graphics

FIRM BENEFITS OVERVIEW WWW.KKLAW.COM 800.484.4381 INFO@KKLAW.COM Our people represent the best part of Kelley Kronenberg. We believe that if we know their passions, goals, and aspirations, then we can chase those dreams together. We understand that everybody has different priorities, medical needs, and lifestyles. Kelley Kronenberg’s wellness package offers variety of cost-effective plans to support your health and financial goals. ADDITIONAL MEDICAL BENEFITS Challenges Lifestyle Action Plans Health Survey Rewards for Participation Tele-medicine Services Mental Health Appointments Doctor Consultation Anytime Obtain Prescriptions for Acute Condition WELLNESS VIRTUAL VISITS HEALTH DISCOUNT PROGRAM Helps save on many health and wellness purchases not included in your standard health benefit plan MEDICAL BENEFITS Florida Blue offers the largest and strongest provider network the country, which means you can choose any doctor, clinic, hospital, or healthcare facility in their national network. We offer a variety of medical plans tailored to meet your needs. Our medical provider See below list of our medical plans and their cost: BLUE OPTIONS 05301 PPO $0.00 Per Pay Period Employee Cost Only BLUE OPTIONS 05901 PPO BLUE OPTIONS 05180 05181 HSA BLUE OPTIONS 03768 PPO We offer three dental plans, including low-cost DHMO plan with major carrier, and PPO plans with up to $5,000 in coverage. We offer comprehensive plan covering eye exams, prescriptions, and lenses or contact lenses, when receiving in network services. DENTAL VISION Our dental and vision benefits are offered through DENTAL AND VISION PPO HIGH PLAN ($5,000/yr. coverage) PPO LOW PLAN ($1,000/yr coverage) DHMO DENTAL PLAN LIFE & SUPPLEMENTAL COVERAGE LIFE INSURANCE Life insurance benefits will be offered to all eligible employees. Kelley Kronenberg will pay benefits in full. VOLUNTARY LIFE INSURANCE Voluntary life insurance will be offered to increase your life insurance coverage amount. SUPPLEMENTAL INSURANCE COVERAGE Supplemental insurance coverage will be offered to cover unexpected events (i.e., Accident, Hospital Indemnity, and Critical Illness). Our basic life benefits are offered through DISABILITY COVERAGE Our supplemental benefits are offered through SHORT-TERM DISABILITY Short-term disability is available at low-cost premiums. you become disabled because of non-occupational illness or injury and cannot work, you can be covered by the short-term disability insurance policy. Elimination Period: Benefits can begin on the 8th day following an accident and the 8th day sickness. Duration of Benefit: You can receive short-term disability benefits for up to 12 weeks. LONG-TERM DISABILITY Long-term disability insurance paid in full by the firm. If you become unable to perform your regular job duties for an extended period of time due to sickness, or accidental injury, you can be covered by the long-term disability (LTD) policy. Elimination Period: Benefits begin on the 91st day after you are unable to work due to covered sickness or accident. Duration of Benefit: To Social Security Normal Retirement Age. GAP INSURANCE Gap insurance is offered as a supplemental plan, which acts as cushion for employees with high deductibles. FSA DEPENDENT CARE FSA dependent care allows working parents and/or caregivers to reduce their annual taxes up to $700 for eligible dependent-care expenses. (daycare, after care etc. PET INSURANCE Pet insurance helps lessen the overall costs of veterinary care. ID THEFT PROTECTION Norton LifeLock offers plans that include comprehensive identity theft protection and credit monitoring for you and your family. EMPLOYEE ASSISTANCE PROGRAMS (EAP) KK’s EAP offers confidential counseling services to support employees’ wellbeing in the workplace and personal lives. assists employees with issues including but not limited to family issues, financial concerns, relationship problems, mental illness or substance abuse issues. TRAVEL ASSISTANCE Travel assistance is included with your Life Insurance Policy. HEALTH ADVOCATE SERVICES Health Advocate Services offered for Short-term Disability claimants. This concierge service assists employees with seamlessly processing their Short-term Disability claims. LIFE SERVICES TOOLKIT Life Services Toolkit is included with our Life Insurance Policy, including online will preparation, grief counselling services, and other benefits. ADDITIONAL LINES OF COVERAGE HR Benefits Brochure

Do not bill more than 10 hours day on State Farm files. When reviewing documents/reports, you must include the number of pages reviewed. Only 1 Partner and 1 Associate on each file –no multiple attorneys on file events. Upload/Attach all documents you refer to in the time entry. No Excessive Billing –you must provide sufficient detail/description to support the time entry. Do NOT bill the same task twice –No duplicate entries. Attorneys – Do not bill for Paralegal tasks (see Guidelines) Time spent on analysis of historical aerial imagery will be cut from 1.0 to 0.5. State Farm will not pay for preparing budgets Review of incoming discovery should be billed at 0.1. Get Adjuster Approval when needed (see Guidelines) –include Adjuster’s name LA’s may not bill for scheduling. No one can bill for Admin./Clerical/Overhead tasks –such as scheduling, reviewing transmittal letters, etc. Mandatory Billing Entry Compliance **The following information is based on notable trends discovered upon reviewing the Client’s Audits of our invoices for fees and costs. Thus, is imperative that you follow the strategies set forth below to ensure prompt payment, rather than audits, of our submitted invoices. Your compliance is appreciated. NOT COMPLETED YET E-mail Graphics

Human Resources

In the Know - Newsletters

MARCH 2023 IN THE NOW FIRST- PARTY PROPERTY APPELLATE EDITION IN THIS ISSUE: • Application of Section 627.7152, Florida Statutes Recovery of Expert Fees Recovery of Pre-litigation Attorney’s Fee Reasonableness of Fees • Appraisal • Post-Loss Duties – SPOL (Waiver and Prejudice Analysis) IN THE NOW IN THE NOW “In order to find that a survivor spouse has waived [or] relinquished homestead protection, evidence must demonstrate the survivor’s intent to waive the constitutional and statutory claim to homestead property.” Rutherford, 679 So. 2d at 331. Because the surviving husband was unaware of his deceased wife’s will to sell the property after her death, the boilerplate provisions should not warrant true waiver of the homestead exemptions and rights. The court held, “Under these circumstances, we conclude, as did the trial court, that the mortgage waivers are procedurally deficient and insufficient to “evince an intent by [Schocket] to waive [his] homestead rights.” Rutherford, 679 So. 2d at 330. Ultimately, the husband was able to keep the house despite the waiver of homestead in the mortgage itself. This should be a good lesson for both owners in “rush” to execute papers in closing, as well as to lenders who rely on boilerplate provisions in their mortgages. Title Insurance and Alternative Title Products By: Jacqueline Costoya Guberman, Partner A crucial component to any real estate transaction is the issuance of title insurance policy. Universally required by lenders, title insurance protects the insured from prior rights or claims that other parties may have to the property, and financial loss due to any defects in title all for a one-time fee at closing. Title insurance is also overwhelmingly elected BACKGROUND: After the Civil War, Florida created the homestead exemptions to prevent the wholesale loss of farms and homes. Notwithstanding, the homestead exemption laws have turned into complex system of rulings, interpretations and applications. In fact, many characterize these laws as Florida’s “legal chameleon”. See generally Harold B. Crosby & George John Miller, Our Legal Chameleon, the Florida Homestead Exemption I-III, 2 U. Fla. L. Rev. 12 (1949). This is mainly because the homestead protection has different definitions based on the context it is utilized. For example, the under the Florida Constitution, the most notable application is for tax exemptions that many property owners seize annually. Secondly, the homestead provisions protect owners from force sales by creditors. Thirdly, the homestead provisions apply restrictions on how an owner can place lien on their property or even devise the property (through will) upon death. See art. X, 4, Fla. Const. Recently, Florida’s Third District Court of Appeal, in Feldman v. Schocket, took up the issue regarding the third application of the homestead exemption—the restrictions on how an owner can devise a property when surviving spouse remains in the homesteaded property. As the case with many residential mortgages, spousal joinder (i.e., your spouse’s signature) must accompany your signature on a mortgage to ensure the lien’s validity. However, there is often times homestead waiver built within the mortgage boilerplate language to ensure the surviving spouse cannot claim the exemption in event there is default and a need to foreclose a homesteaded property. That being said, often times these waivers are utilized by an estate to sell property after one of the spouses dies testate. As in the case of in Feldman Schocket, the personal representative of the wife’s estate attempted to sell the homesteaded property of the surviving husband after hurricane made the house inhabitable. The personal representative tried to use the homestead waiver provisions in the mortgage as basis for the forced sale. The court citing Rutherford v. Gascon, stated, Homestead Waivers in Mortgages— Valid? By: Jason Vanslette, Editor and Business Unit Leader/Partner KK TAKEAWAY: Mortgage provisions regarding homestead exemption waivers may not always be enforced by the courts depending on the homestead contextual applications and “intent” of the borrower when executing the mortgage itself. DECEMBER 2022 IN THE NOW FIRST PARTY PROPERTY APPELLATE EDITION IN THIS ISSUE: Attorney Fees Challenges to Standing Assignment of Benefits Appraisal FEBRUARY 2023 IN THE NOW FIRST- PARTY PROPERTY APPELLATE EDITION IN THIS ISSUE: Appraisal (Attorney fees) Post-Loss Duties (Notice Analysis) Post-Loss Duties (Prejudice Analysis) Bad Faith (Punitive Damages Claim) IN THE NOW IN THE NOW for protection. First, the opinion letter must be approved by Fannie Mae, be commonly accepted in the area where the subject property is located and provide gap coverage for the duration between the loan closing and recordation of the mortgage. Importantly, the attorney issuing the title opinion letter must be licensed to practice law in the jurisdiction where the subject property is located and must be insured against malpractice for rendering opinions of title. Overall, this is an important development to watch for all parties actively engaged in loan origination. “The Devil Is In The Details” Ensuring Proper Service Of Process By: Marc Marra, Partner KK TAKEAWAY: Pursuant to section Fla. Stat. §48.031(5), person serving process shall place, on the first page only of at least one of the processes served, the date and time of service, his or her initials or signature, and, applicable, his or her identification number. (Emphasis added). BACKGROUND: The defendant titleholder (the “Titleholder”) in an underlying foreclosure case, filed an appeal of a non-final order in the foreclosure case denying their motion to quash service of process. The Titleholder moved in the trial court to quash service of process on the basis that the foreclosure plaintiff bank’s (the “Plaintiff”) process server failed to identify the date and time of service on the summons issued to Title holder and did not initial or sign the summons, as required by section 48.031(5), Florida Statutes. Florida Statutes §48.031(5) specifically states: (5) person serving process shall place, on the first page only of at least one of the processes served, the date and time of service, his or her initials or signature, and, if applicable, his or her identification number. The person requesting service or the person authorized to serve the process shall file the return-ofservice form with the court. (Emphasis added) In light of the clear language set forth in Fla. Stat. §48.031(5), the Bank confessed to the error in the summons issued to the Titleholder, and the Florida Third District Court of Appeal reversed the foreclosure court’s denial of the Titleholder’s motion to quash service and remanded for further proceedings. The ruling in Ottawa Properties LLC is an important reminder that in Florida “strict compliance with the statutory provisions governing service of process is required in order to obtain jurisdiction over a party […] to assure that a defendant receives notice of the proceedings filed. Vidal v. SunTrust Bank, 41 So. 3d 401-403 (Fla. 4th DCA 2010)(Internal quotations omitted). by home purchasers for the same peace of mind. An enforceable title insurance policy is also an invaluable safeguard to lender’s lien priority. In the event of default, lien priority can make or break the amount of foreclosure sale proceeds can claim. Although title insurance remains the standard for protection against loss due against title defects, omitted outstanding liens, fraud and bevy of other potential issues post-closing, there is currently measured movement towards alternative title products. Due to the Equitable Housing Finance Plans announced earlier this year by FHA, GSEs have begun to look at accepting alternative products, such as attorney title opinion letters, in lieu of title insurance. Specifically, in April 2022, Fannie Mae announced that would begin allowing lenders to accept written opinion letters in lieu of lender’s title insurance policy in limited circumstances. See https://singlefamily. fanniemae.com/media/31151/display. Yet, industry associations, such as the American Land Title Association (“ALTA”) have warned that alternatives to title insurance can increase lender and consumer risk, as alternatives products may increase risk of the lender. For example, title insurance provides coverage for forged or fraud in the conveyance deed, while an attorney opinion letter does not. Similarly, an attorney opinion letter can only opine as to items shown in public records search and thus cannot provide coverage for items not discoverable or misindexed in the public records. However, GSEs such as Fannie Mae has provided several limitations and safeguards 9 IN THE NOW IN THE NOW “Mini-Miranda” Warning In Mortgage Statement Can Be An “Attempt To Collect A Debt” Under The FDCPA By: R. Elliott Halsey (IL), Partner KK TAKEAWAY: A mortgage servicer should be aware that the standard monthly mortgage statements required by the TILA may plausibly constitute communications in connection with the collection of debt under the FDCPA (a) they contain (1) “this is an attempt to collect debt” language and (2) consequences of late payments. BACKGROUND: Reversing district court ruling that mortgage statements sent in compliance with Truth In Lending Act (“TILA”) are not communications in connection with the collection of a debt under the Fair Debt Collection Practices Act (“FDCPA”), the Eleventh Circuit in Daniels Select Portfolio Servicing, Inc., 34 F.4th 1260 (11th Cir. May 24, 2022) ruled that the inclusion of the FDCPA’s “mini-Miranda” warning in the servicer’s monthly statements was an attempt to collect a debt. The Court concluded they “attempt to collect debt” under the FDCPA, noting that the statements expressly said they were “an attempt to collect debt”, “all information obtained will be used for that purpose” with entries for loan due date, payment due date, amount due, total amount due, interest-bearing principal, deferred principal, outstanding principal, and interest rate. The standard monthly statements attached monthly payment coupon with late fee information and instructions to the borrower to return the coupon with the payment by date certain. The key issue was whether the TILA’s requirement that the statements containing most of this information be sent to the borrower put them outside of “communications in connection with the collection of a debt”. The servicer argued that the statements cannot be actionable under the FDCPA because they largely conform to the requirements of the TILA and its regulations, relying on an unpublished opinion from the Eleventh Circuit, Green v. Specialized Loan Servicing LLC, 766 F. 777 (11th Cir. 2019) which held that the servicer’s monthly mortgage statement contained no language “beyond what is required by [the] TILA” and therefore did “not rise to the level of being unlawful debt collection language.” The Court noted that a communication can have “dual purposes” such as providing consumer with information and demanding payment on a debt. The Court acknowledged that TILA requires servicers to send borrowers monthly statements detailing important information about the loan, but without the “this is an attempt to collect debt” language, as distinguished in Green. The TILA regulations include three sample standard forms for the required monthly mortgage statements which the servicer’s statements largely followed, but none of the sample forms contain the words “this is an attempt to collect a debt.” What Qualifies A Fee Expert? By: Jason D. Silver, Attorney KK TAKEAWAY: The attorney’s fee expert can indeed make or break the case for the party fighting for or against the fees. Parties often try to seek well-known name in the legal community, former judge, or career expert witness. What, exactly, however, satisfies the threshold? What is the threshold? Judges can strike witness and the testimony entirely if they do not find the witness to be an “expert.” This happened recently in trial court in Broward County, Florida in case between homeowner’s association which was sued by an individual. The sitting judge struck a witness and its testimony entirely simply because the witness had never testified before. The witness was a practicing attorney who had experience in litigation and billing practices and even knowledge and experience on billing practices in the field of law of the case being heard. Fourth District Court of Appeal based out of West Palm Beach very recently reversed the decision in an opinion dated October 26, 2022 and provided helpful guidance on the analysis of expert witness criteria.

Presentations • Opportunity to partner together o Key efforts are focused on expansion and finding laterals with books of business • Learn more about Kelley Kronenberg 1980 –1987 –1989 –1995 –2000 –2019 –2020 –2022 –KK started as a Workers’ Compensation only Firm Michael Fichtel, current CEO, joins the firm Howard Wander, current COO, joins the firm Heath Eskalyo, current CFO, joins the firm KK begins to diversify its practice areas – total numbe of employees 25 –new locations continue to open KK completes construction and opens state-of-the-art corporate headquarters in Fort Lauderdale Daytona Naples, and New Orleans offices open KK breaks ground on 2nd FTL building – 450 employees We Are Different Recruiter Partnership Program We are proud of our history and celebrate our continued growth as one of the fastest-growing law firms in Florida. We Are Different NURY PEREIRO Partner SAM ITAYIM Partner CATHERINE ARPEN Attorney 1. Plaintiff’s “Billed Amount” Argument Billed Amount Case Law Update a. Fla. Stat. 627.736(5)(a)(5): “An insurer may limit payment as authorized by this paragraph only the insurance policy includes notice at the time of issuance or renewal that the insurer may limit payment pursuant to the schedule of charges specified in this paragraph. A policy form approved by the office satisfies this requirement. If a provider submits a charge for an amount less than the amount allowed under subparagraph 1., the insurer may pay the amount of the charge submitted.” ii. Plaintiff interprets this provision to require Defendants to pay bills at the amount billed (if they are less than Fee Schedule amounts) at 100% (not 80%) GARY BROWN Partner, Construction Litigation, Board Certified in Construction Law PROTECT YOUR BOTTOM LINE Important Tips for Mitigating Risk PROTECT YOUR BOTTOM LINE Risk Transfer Opportunities Contractual Provisions Indemnity Provisions Broad Form Intermediate Form Limited Form AIA A201 General Conditions 3.18 Common Law Indemnity Anti-Indemnity Statutes Fla. Stat. § 725.01 Fla. Stat. § 725.06 Fla. Stat. § 725.08 PROTECT YOUR BOTTOM LINE Risk Transfer Opportunities Insurance Requirements Commercial General Liability “Business Risk” Exclusions (J5, J6, 2l (“Your Work”)) Additional Insured Status Broad vs. Specific Form Endorsements Primary Non Contributory “Other Insurance” Clauses “Pro-rata” Clauses Be aware of endorsements! Professional Liability Subcontractor Default Insurance (SDI) Bond Requirements Payment and Performance Bonds Different than CGL and SDI coverage PROTECT YOUR BOTTOM LINE Construction Defects/Claims Alternate Dispute Resolution Fla. Stat. 558 Notices Pre-suit Mediation Arbitration Dispute Resolution Board (DBR) Creation of foundational estate planning to work in concert with your beneficiary planning in investments. Benefits of having cohesion between your financial plan and estate plan to avoid litigation and create efficient financial management. Balancing your tax and investments needs with an appropriate estate plan PIP Case Law Update Protect Your Bottom Line KK/Tobias: Estate Planning

Print

Retractable Banners

First Party Property Appellate Team

Placemats

Print Ads

40+ Years Meeting the Needs & Exceeding the Expectations of our Corporate and Individual Clients An Award-Winning Law Firm, Amongst the Fastest Growing in Florida & Largest in the U.S. Business Law • Complex Commercial Litigation Employment Law Probate & Estate Planning • Real Estate Bankruptcy & Creditors’ Rights Construction Law Family Law • Workers’ Compensation • Insurance Defense Litigation Data Privacy & Technology Social Media Representation • And More Standing by You Through it All Contact Us Today ASK_ME@KKLAW.COM 800.484.4381 WWW.KKLAW.COM WPB JOHN RIORDAN Partner jriordan@kklaw.com FIRST PARTY INSURANCE DEFENSE MELANIE WESEMAN Partner SAMUEL GOLDBERG TEAM JOSHUA ROSENBERG Partner jrosenberg@kklaw.com PROBATE LITIGATION, ESTATE PLANNING, & GUARDIANSHIP MIA FTL GARY BROWN Partner gbrown@kklaw.com CONSTRUCTION LAW FTL TRACY NEWMARK Partner tnewmark@kklaw.com FAMILY LAW Meet n’ Greets for Referral Business: Roadshow to West Palm Beach FTL JIM SILVER Partner jsilver@kklaw.com BUSINESS BANKRUPTCY, CREDITORS’ RIGHTS, INSOLVENCY WPB JAKE HUXTABLE Partner jhuxtable@kklaw.com FIRST PARTY INSURANCE DEFENSE MELISSA USHER Practice Group Partner ROBERT DIMARCO Associate ZACHARY SAWKO Associate TEAM WPB TEAM JORDAN GREENBERG Partner GL (DAVID HENRY UNIT) JOHN DEJAGER Associate Construction (BROWN-HARLEY UNIT) GOAL To gain an understanding of each practice area and the types of referrals needed to grow your business. 1) Introductions around the room: Name, practice, years practicing, how long you’ve been with Kelley Kronenberg. 2) Icebreaker Questions: a. What would we be surprised to learn about you? b. What do you like to do on the weekends? c. Share your most unusual client meeting. d. Why did you decide to become an attorney? 3) Who is your ideal client? What is their role? 4) Deeper Dive into specific practice areas. How do you grow your business? 5) What is the process of referring clients to other units? AGENDA December 8, 2022 11:30 am WPB CASEY MULLIN Partner cmullin@kklaw.com FIRST PARTY INSURANCE DEFENSE VARISA LALL DASS Associate TEAM

FLORIDA AND ILLINOIS PARTNERSHIP WORKERS’ COMPENSATION WWW.KKLAW.COM 800.484.4381 INFO@KKLAW.COM FORT LAUDERDALE MIAMI WEST PALM BEACH NAPLES DAYTONA ORLANDO TAMPA JACKSONVILLE TALLAHASSEE CHICAGO NEW ORLEANS ATLANTA NEW YORK NEW JERSEY RELATIONSHIP PARTNERS Howard Wander Principal Partner Chief Operating Officer Fort Lauderdale Phone (954) 370-9970 Mobile (954) 661-8058 Fax 954) 382-1988 Emai hwander@kklaw.com Scott McCloskey Attorney Jacksonville Phone (954) 370-9970 Email smccloskey@kklaw.com FIRM OVERVIEW TEAM LEADERS Sam Itayim Partner Team Leader, PIP Miami-Dade, Broward, Lee & Collier Counties Phone 954) 370-9970 Mobile (954) 258-4447 Emai sitayim@kklaw.com Phone 561) 684-95956 Mobile (727) 480-1327 Emai cprior@kklaw.com Charles Prior Partner Team Leader, PIP Palm Beach County Kim Fernandes Partner, Workers’ Compensation Tallahassee Phone 850) 577-1301 Mobile 850) 491-3296 Fax 954) 382-1988 Emai kfernandes@kklaw.com Jordan Greenberg Partner, General Liability & Third-Party Insurance Defense West Palm Beach Phone (561) 684-5956 Mobile (561) 702-7654 Emai jgreenberg@kklaw.com

As the first-party property insurance industry has remained significantly litigious, Kelley Kronenberg has maximized its efforts to bring positive changes to the law for the benefit of all of its clients by establishing an expertise in appellate law. Our appellate team has a combined portfolio of more than 100 written court opinions impacting case law precedence across the state. At every stage of the process – deciding whether to appeal, determining the chance of success on appeal, preparing legal briefs, presenting oral arguments, and advising on the impact of appellate decisions – Kelley Kronenberg’s First Party Property Appellate Team provides clients with expert guidance and representation in all appellate jurisdictions. Kimberly J. Fernandes Partner Tallahassee Atlanta T: (850) 577-1301 kfernandes@kklaw.com Daniel Montgomery Partner Jacksonville T: (904) 549-7700 dmontgomery@kklaw.com Louis Reinstein Partner Fort Lauderdale T: (954) 370-9970 lreinstein@kklaw.com ADMISSIONS Florida U.S. District Court, Northern District of Florida U.S. District Court, Middle District of Florida SELECTED OPINIONS w Progressive American Insurance Company Glassmetics, LLC, No. 2D21-488, 2022 WL 1592154 (Fla. 2d DCA 2022) (“we reverse the trial court’s order and its conclusions (1) that the appraisal provision was against the public policy underlying section 627.428; (2) that the appraisal provision failed to provide sufficient procedures and methodologies; (3) that Progressive waived its appraisal right; (4) that the appraisal provision was unenforceable because Progressive failed to prove that the insured knowingly, voluntarily, and intelligently waived his rights of access to courts, to jury trial, and to due process; and (5) that the appraisal provision contains an ambiguity.”). w All Auto Glass v. Progressive American Ins. Co., Case No. 2018-SC-3126, 2019-33-AP (Fla. Seminole Cnty. Appellate Division.) (“reversing trial court, holding ruling of district court of appeal in jurisdiction other than where trial court is located is binding upon trial court absent conflict with another district court of appeal. w Progressive Am. Ins. Co. Broward Ins. Recovery Ctr., LLC, 322 So. 3d 103 (Fla. 4th DCA 2021) (“reversing trial court, holding prohibitive cost doctrine inapplicable to appraisal”). ADMISSIONS Florida Georgia United States Court of Appeal, Eleventh Circuit SELECTED OPINIONS w Expert Inspections, LLC d/b/a ITest d/b/a Moldexpert.com a/a/o Pat Beckford United Property Casualty Insurance Company, 333 So.3d 200 (Fla. 4th DCA 2022) (holding that an insurer cannot be required o follow the terms of an AOB contract where the insurer is not a party to that contract). w The Kidwell Group, LLC d/b/a Air Quality Assessors of Florida a/a/o Maria Amadio v. Olympus Insurance Company, Case No. 5D21-2955 (Fla. 5th DCA July 22, 2022) (interpreting sectio 627.7152, F.S., as applying to AOB contracts executed after the enactment of the statute, finding the policy inception date irrelevant to the analysis). w Saunders v. Florida Peninsula Insurance Company, 314 So.3d 592 (Fla. 3d DCA 2020) (interpreting the “faulty workmanship” policy exclusion to include the workmanship process as well as the finished product in affirming the insurer’s denial of property damage claim). w The Kidwell Group, LLC d/b/a Air Quality Assessors of Florida a/a/o Benjamin Kivovitz, Case No. 4D21-2843 (Fla. 4th DCA June 15, 2022) (enforcing the new section 627.7152, F.S., requirement of including line-item estimate with an AOB contract at the time of execution) ADMISSIONS Florida District of Columbia United States District Court, Southern District of Florida United States District Court, Middle District of Florida United States District Court, Northern District of Florida United States Court of Appeals, Eleventh Circuit Supreme Court of the United States SELECTED OPINIONS w Taffe v. Wengert, 775 F. App’x 459 (11th Cir. 2019) (reversing the denial of summary judgment in the district court for the sheriff and finding the sheriff was not negligent in the hiring, supervision, or retention of deputy sheriff) w Taffe v. Wengert, 140 S. Ct. 1106, 206 L. Ed. 2d 179 (2020) (Petition for writ o certiorari to the United States Court of Appeals for the Eleventh Circuit denied). w Williams Tony, 319 So. 3d 653 (Fla. 4th DCA 2021) (holding the plaintiff inmate was not an intended third-party beneficiary of the contract between county sheriff and inmate medical services provider, and, thus, could not pursue a negligence claim against provider based on the contract). w People’s Tr. Ins. Co. v. Progressive Express Ins. Co., 336 So. 3d 1207 (Fla. 3d DCA 2021) (holding the commercial automobile liability policy excluded coverage for property damage caused by improper operation of mobile crane mounted on a truck). w Watkins v. Pinnock, 802 F. App’x 450, 454 (11th Cir. 2020) (holding that the plaintiff’s proposed amendments could not cure the deficiencies in the fifth amended complaint as the factual allegations did not support deliberate indifference by the nursing staff).

Holiday Gift Boxes

Dossiers Flyers

Social Media

TV Graphics

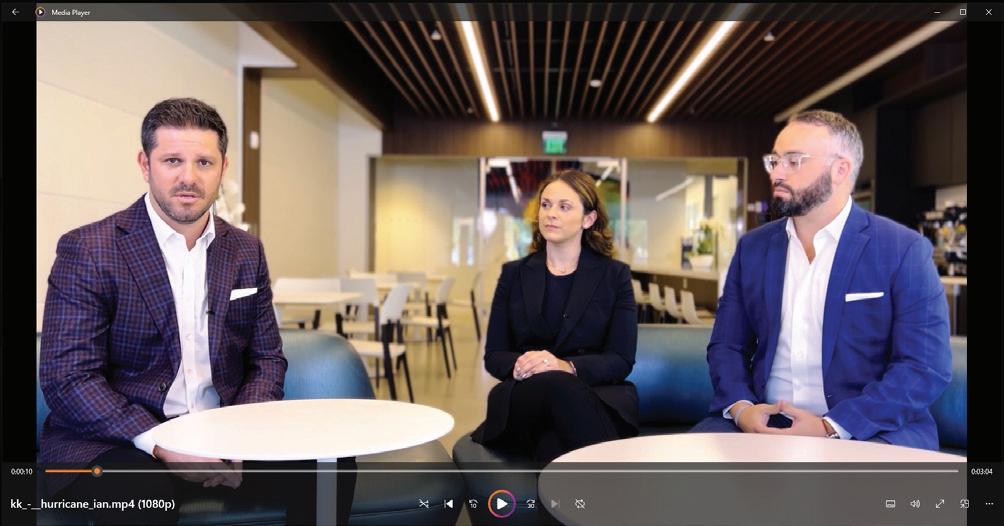

Developed “Side Bar with Kelley Kronenberg” name and brand for video series

Video

Elevator Pitch Videos

• Managed video production with outside vendor

• Directed on-set

• Scouted locations

Elevator Pitch - Amy Siegel Oran

Title Cards

Elevator Pitch - Angelo Fillipi Elevator Pitch - Natalie Kay

Side Bar - JMV Unit

How to Avoid Litigation and Mitigate Risk

Side Bar - JMW Unit

How To Get Ahead of Your Hurricane Ian Claims

Elevator Pitch - James Silver Elevator Pitch - Robert Friedman

Side Bar - JMV Unit

Expected Impact of the 2023 Housing Market Forcasts

Side Bar - JMW Unit

How to Conduct a Successful Initial Investigation

Elevator Pitch - Joshua Higgins Elevator Pitch - Tracy Newmark

Side Bar - JMV Unit

How a Broad-Range Foreclosure Team CAn Improve Litogation Outcomes

Video for ICIMS Portal

Web Graphics

510 x 202 1157 x 459

Projects By The Numbers

BRANDING 1 Diversity Chart 1 Cross-Sell Flow Chart 1 Review of Client Touchpoints 1 Letterhead 4 LinkedIn Cover Images 1 PowerPoint Template 2 Screen Backgrounds 1 Branding Book 35 Zoom Backgrounds 5 BROCHURES 6 CAMPAIGNS 35 EMAIL/FLYERS 12 IN THE KNOW - NEWSLETTERS 8 PRESENTATIONS 10 PRINT 310 SOCIAL MEDIA 111 TV GRAPHICS 20 VIDEOS 12 Title Cards 10 WEB GRAPHICS

600 Projects/Graphics Since June 2022 UPCOMING PROJECTS Black Books Full brand repositioning Brand training New HQ building unveiling Konnect (KK’s intranet) restructure

OVER