Q2 2023

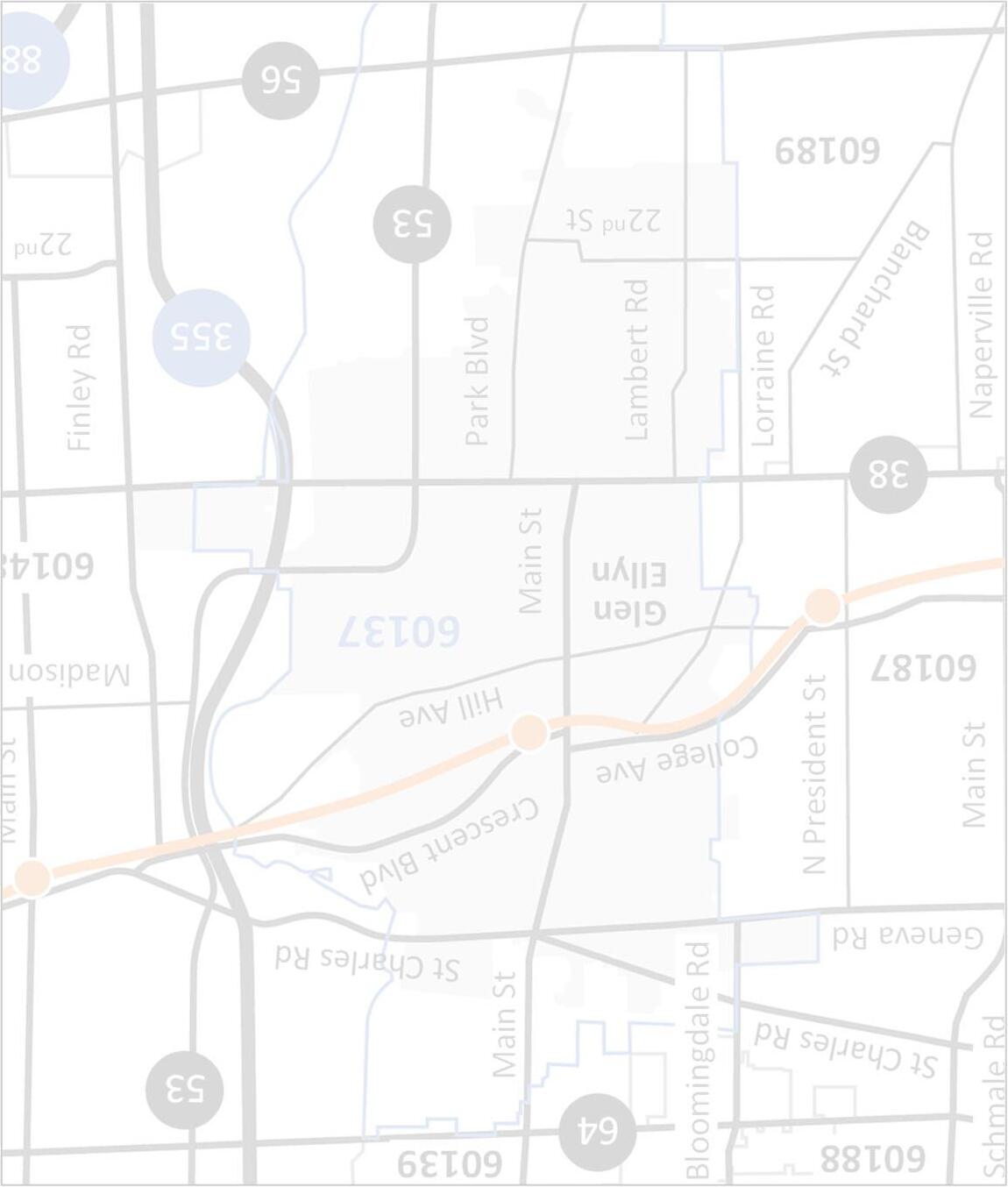

GLEN ELLYN

LOCAL REAL ESTATE GUIDE

METHODOLOGY

Overview of Terms and Glen Ellyn Submarkets

CLOSED:closed transaction reflecting the final sales price (does not include any seller credits)

CONTRACTED:contingent or pending transaction reflecting the latest asking price

CONTRACT TIME:number of days between the first list date and the contracted date (does not include time from contract to close)

HOME INVENTORY:number of homes currently available for sale

MEDIAN:middle value of a given dataset (all report values are medians, which are less impacted by outliers than averages)

PRICE DISCOUNTS:percentage difference between the initial list and recorded sale price

PRICE PER SQ. FT:ratio of the median price to the median sq. footage of a closed transaction as a relative price measure

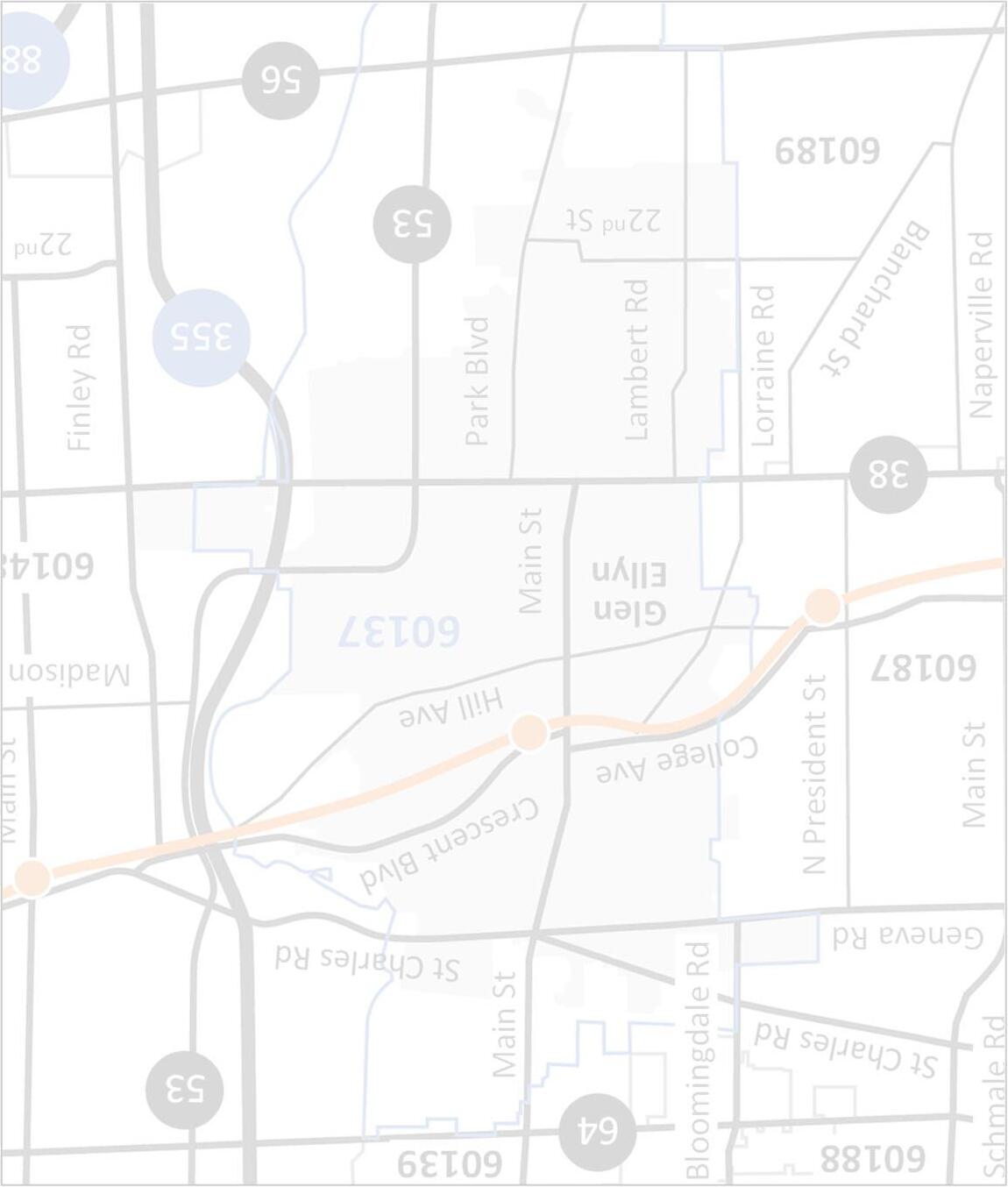

NORTHWEST (West of Main St. / North of Pennsylvania Ave. to St. Charles Rd.)

NORTHEAST

(East of Main St. / North of Crescent Blvd. to St. Charles Rd. )

CENTRAL WEST (West of Park Blvd. / South of Pennsylvania Ave. to Roosevelt Rd.)

CENTRAL EAST (East of Park Blvd. / South of Crescent Blvd. to Roosevelt Rd.

SOUTH (South of Roosevelt Rd.)

Note: All figures represent detached single-family homes unless otherwise specified. Price range data based on the village of Glen Ellyn. Submarket figures based on the approximate areas identified on map above and do not include every home within village limits.

2

MARKET SUMMARY

“Seller’s Market” Continues in Late Spring / Early Summer

Short Market Times List to Contract Days (Q2) Less than a week across price ranges and submarkets, except Central East (slightly longer) Limited Price Discounts Sale Price Discounts (Q2) Majority of homes across price ranges and submarkets selling at or above asking price

Sale Prices Sale Price / Price Per Sq. Ft. (Q2) Home Inventory (June) 42% “Seller’s market” with 15+ year low of available homesthis time of year Fewer Available Homes Lower Activity New Home Listings (Q2) Contracted Homes (Q2) 18% 40% Closed Homes (Q2) 12% 3

Overall flat relative prices, but some variability in price ranges and submarkets Flattening

NEW LISTINGS

By Price Range

By Price Range

New listings were down 40% in Q2 with the largest declines concentrated in the middle of the market ($400K –$800K range)

Overall listing activity now back to 2013 levels or lower; homes priced below $400K are down dramatically with rising values

What looked like a listings bottom with more activity in Q1 gave way to further declines

Rolling Last 12 Months (YoY%)

Apr. –Jun. (YoY%) 4

132 178 91 99 0 100 200 300 400 500 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (-33%) (-27%) (-19%) (-13%) Price Range'23'22% <$400K 3751-27% $400K - $599K 4288-52% $600K - $799K 2145-53% $800K+ 3541-15%

By Submarket

Q2 experienced lower new listing activity across submarkets

Large increase in Northwest for Q1 kept this submarket higher for the last 12 months even after recent declines

South submarket declined dramatically with less than 10 total new listings in Q2

Northwest 2440-40% Northeast 1014-29% Central West 3141-24% Central East 1835-49%

Apr. –Jun. (YoY%)

5

Rolling Last 12 Months (YoY%) 102 26 94 84 45 0 50 100 150 200 250 300 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 Northwest Northeast Central West Central East South (-46%) (+3%) (-18%) (-51%) (-31%) Submarket'23'22%

South 935-74%

CONTRACTED HOMES

Price

Price

Contracted homes declined nearly 20% for the quarter; homes priced under $400K increased some following major declines

Month of June experienced the largest monthly decline (almost 30%) after a soft April and flatter May

Contracts likely to decline based on fewer new listings and low inventory Apr.

–Jun. (YoY%) 6

110 138 65 58 0 50 100 150 200 250 300 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (-22%) (-22%) (-20%) (-37%)

<$400K

$400K - $599K 3549-29% $600K - $799K

$800K+

By

Range Rolling Last 12 Months (YoY%)

Price Range'23'22%

333010%

1924-21%

2433-27%

Glen Ellyn submarkets were lower for Q2; two areas had less than 10 contracts

Significant increases following the pandemic have returned to historical contract levels (below in some cases)

Northeast submarket has the lowest level of contract activity generally (also the smallest map area analyzed)

Northwest Northeast Central West

Central East South

Submarket'23'22%

Northwest 2125-16%

Northeast 710-30%

Central West 2627-4%

Central East 1317-24%

South 718-61%

7

Apr. –Jun. (YoY%) (-23%) 58 17 68 70 37 0 50 100 150 200 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

By Submarket Rolling Last 12 Months (YoY%)

(-47%) (-19%) (-24%) (-38%)

CLOSED HOMES

Closed homes declined over 10% in Q2 primarily driven by higher end homes over $800K (down nearly 50%)

April closings increased slightly following more activity in the first quarter, but fell 15%+ during May and June

Closing activity following overall declines in contracts with low home availability Apr.

–Jun. (YoY%) 8

Last 12 Months (YoY%) 115 144 62 66 0 50 100 150 200 250 300 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (-24%) (-20%) (-30%) (-32%)

<$400K

$400K - $599K

$600K - $799K

$800K+

By Price Range Rolling

Price Range'23'22%

282040%

4853-9%

22220%

2039-49%

Glen Ellyn submarkets mostly lower for Q2, except Central West (flat)

Central areas remain the most active for closings and held up better than other submarkets for the quarter

Closed activity now trending below prepandemic levels over the last 12 months

9

Rolling Last 12 Months (YoY%) Apr. –Jun. (YoY%) 59 19 70 73 41 0 50 100 150 200 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 Northwest Northeast Central West Central East South (-32%) (-18%) (-23%) (-40%) (-24%) Submarket'23'22% Northwest 1824-25% Northeast 58-38% Central West 26260% Central East 2022-9% South 717-59%

By Submarket

HOME INVENTORY

By Price Range

Available homes declined over 40% in Q2 from levels that were already historically low

Homes priced over $800K currently represent 45%+ of all inventory with this price range increasing and others falling

Scarce inventory expected to continue driving “seller’s market” conditions

Jun. Trends (Relative%)

Jun. Quarter End (YoY%)

29% 22% 24% 23% 16% 24% 23% 28% 37% 26% 20% 21% 17% 25% 11% 27% 34% 31% 15% 47% 0% 25% 50% 75% 100% '19'20'21'22'23 <$400K $400K –$599K $600K –$799K $800K+

10

6 10 4 18 0 25 50 75 100 125 150 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (-58%) (-60%) (-75%) (+80%)

By Submarket

Home inventory is down meaningfully across submarkets, despite North areas avoiding further declines

Extremely limited home availability in all areas (10 homes or less in all submarkets)

Mix of inventory is atypical given how few homes are available across Glen Ellyn

Jun. Trends (Relative%)

Jun. Quarter End (YoY%)

Northwest Northeast Central West Central East South

Northwest

23% 21% 18% 19% 31% 14% 14% 14% 4% 10% 19% 23% 31% 32% 34% 31% 34% 23% 26% 17% 15% 8% 13% 19% 7% 0% 25% 50% 75% 100% '19'20'21'22'23

Northeast Central West Central East South

11

9 3 10 5 2 0 20 40 60 80 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

(+50%) (0%) (-33%) (-78%) (-58%)

CONTRACT TIME

By Price Range

Days between listing date and contract signing have been low (mostly less than two weeks) for a couple years

During Q2 homes mostly matched last year (only a day difference) by going under contract in under a week across price ranges

Expect contract times to remain short with very limited home availability

Apr. –Jun. (YoY%) 12

Last

Months (YoY%) 9 7 5 6 0 25 50 75 100 125 150 175 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (+17%) (0%) (-38%) (0%) Price Range'23'22% <$400K 6520% $400K - $599K 5425% $600K - $799K 5425% $800K+ 5425%

Rolling

12

By Submarket

Contract times were fast during the quarter with fewer closings

Days to contract trend is mostly flat overall with a small movement creating large percentage changes

Homes on the market for more than two weeks could be overpriced or have other factors impacting time / interest

13

Apr. –Jun. (YoY%) 7 4 9 7 11 0 25 50 75 100 125 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 Northwest Northeast Central West Central East South (-64%) (-36%) (0%) (+120%) (0%) Submarket'23'22% Northwest 6520% Northeast 48-50% Central West 5425% Central East 94125% South 34-25%

Rolling Last 12 Months (YoY%)

PRICE DISCOUNTS

Price discounts were limited in Q2 with most homes sold at asking price or a slight premium

Homes priced below $400K continued to have a very minor discount (2% or less) over the last 12 months

Price discounts expected to remain narrow given limited home inventory

Apr. –Jun. (YoY%) 14

Last

Months

98% 100% 100% 100% 80% 85% 90% 95% 100% '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (0%) (0%) (0%) (0%) Price Range'23'22% <$400K 100%99%1% $400K - $599K 101%101%0% $600K - $799K 102%102%0% $800K+ 101%101%0%

By Price Range Rolling

12

(YoY%)

By Submarket

All Glen Ellyn submarkets experienced full asking price or more for closed sales during the quarter

While only one area (Northeast) saw a higher premium versus last year, each submarket showed strong closing prices

Despite Q1 showing some negotiability, discounts mostly disappeared in the spring and early summer

Apr. –Jun. (YoY%)

Submarket'23'22%

Northwest 100%101%-1%

Northeast 101%99%2%

Central West 101%102%-1%

Central East 100%101%-1%

South 102%105%-4%

Rolling Last 12 Months (YoY%)

99% 100% 99% 99% 98% 80% 85% 90% 95% 100% '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

Northwest Northeast Central West Central East South

15

(+2%) (-1%) (0%) (-2%) (0%)

PRICE PER SQ. FT.

By Price Range

By Price Range

Price per sq. ft. was roughly flat in Q2 with the middle of the market ($400K –$800K) increasing and the ends slightly softening

Relative prices set new records from $400K –$800K for the last 12 months after the strong quarter

While price growth is mixed, above $400K continues to remain strong

16

Rolling Last 12 Months (YoY%) Apr. –Jun. (YoY%) $204 $252 $276 $313 $75 $125 $175 $225 $275 $325 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 <$400K $400K –$599K $600K –$799K $800K+ (+6%) (-5%) (+13%) (+11%) Price Range'23'22% <$400K $217$224-3% $400K

$599K $255$2464% $600K

$799K $279$24813% $800K+ $311$315-1%

-

-

Most submarkets were up for the quarter, except the Western areas

Strong increase for Northeast again in Q2 despite lower overall closed sale prices (driven by home size mix); also represents only 5 transactions

Central West declined in Q2 and had the largest drop in overall closed sale prices

17

Apr. –Jun. (YoY%) $266 $319 $282 $301 $223 $100 $125 $150 $175 $200 $225 $250 $275 $300 $325 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

(+22%) (0%) (+8%) (+2%) (+12%)

Northeast

Central

Central East

South $228$2223%

By Submarket Rolling Last 12 Months (YoY%)

Northwest Northeast Central West Central East South

Submarket'23'22% Northwest $265$295-10%

$347$29418%

West $275$298-8%

$318$3016%

CLOSED SALE PRICES

By Submarket

Overall sale prices were mostly lower for Q2, except Central East and South

Central East and South are also the only submarkets higher over the last 12 months

South remains on the lower end of prices

Low closed volume and home mix resulting in declines (price per sq. ft. a better metric)

Apr. –Jun. (YoY%)

Submarket'23'22%

Northwest $588K$763K-23%

Northeast $762K$908K-16%

Central West $465K$658K-29%

Central East $825K$772K7%

South $450K$430K5%

Rolling Last 12 Months (YoY%)

$525 $785 $526 $690 $451 $250 $350 $450 $550 $650 $750 $850 $950 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 Northwest Northeast Central West Central East South K (-4%) K (-5%) K (-8%) K (+5%)

K K K K 18

K K K (+16%) K K

CLOSED SALE VOLUME

By Submarket

Overall closed sale volume for Glen Ellyn was down 20%+ for the quarter and now 25%+ lower over the last 12 months

Central East (largest map area) was the only submarket that increased overall sales volume in Q2

Central submarkets remain the largest sale volume areas in Glen Ellyn

Apr. –Jun. (YoY%)

Submarket'23'22%

Northwest $11M$18M-37%

Northeast $5M$9M-50%

Central West $13M$19M-33%

Central East $18M$17M7%

South $3M$8M-56%

Rolling Last 12 Months (YoY%)

$34 $18 $42 $54 $20 $0 $25 $50 $75 $100 $125 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

West Central East South M (-29%) M (-23%) M (-28%)

Northwest Northeast Central

M (-16%)

M M M M M 19

M

M

(-42%)

COMPARING HOME

Analyzing Glen Ellyn Home Types for Q2 2023 New Listings135740 Contracted Homes111932 Home Inventory3818 Contract Time5 days5 days5 days Price Discounts101%102%102% Price per Sq. Ft. $261$225$176 Closed Sale Price$510K$424K$198K Home TypeSingle FamilyTown HousesCondos 20 Closed Homes1181128 11% 0% 0% 25% 42% 12% 18% 40% 14% 17% 2% 17% 75% 15% 31% 53% 1% 7% 2% 0% 27% 4% 23% 11%

TYPES

COMPARING SUBURBS

Analyzing Western Suburb Markets

SuburbMedian PriceQ2 YoY%Price / Sq. Ft.Q2 YoY%Contract DaysQ2 YoY% Clarendon Hills$959K29%$282-7%860% Downers Grove$503K9%$2493%620% Elmhurst$545K-13%$2983%950% Glen Ellyn$510K-11%$2610%525% Hinsdale$1.2M2%$3170%1043% Lisle$456K1%$2112%50% Lombard$360K-2%$2303%4-20% Western Springs$663K-12%$295-12%40% Westmont$394K-3%$212-4%980% Wheaton$486K-4%$2423%4-20%

21

Compass is a licensed real estate broker and abides by federa l, state and local equal housing opportunity laws. All materialpr esented herein is intended for informational purposes only, is compiled from sources deemed reliable but is subject to errors, omissions, and changes with out notice. Sources include Midwest Real Estate Data LLC. This is not intended to solicit property already listed. Glen Ellyn Office 479 N Main St, Suite 230 Glen Ellyn, IL 60137 www.kellystetlerrealestate.com Kelly Stetler 630.750.9551 kelly.stetler@compass.com Teresa Parry 810.569.0078 teresa.parry@compass.com Christina Corso 815.922.0459 christinacorso@compass.com

By Price Range

By Price Range

Price

Price

By Price Range

By Price Range