Technical

Recommended Lists - RL reset With major modifications to disease ratings, it’s very much a year of change.

Fit for the

Recommended Lists - RL reset With major modifications to disease ratings, it’s very much a year of change.

Fit for the

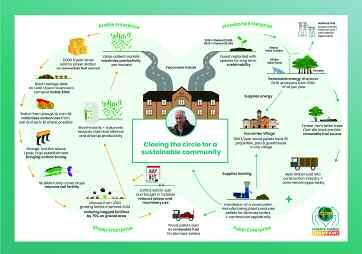

I may be about the only farmer in England who holds this view,but I think Defra’s Path to Sustainable Farming,its roadmap through transition,is a really useful,indeed impressive document.

Launched at the end of Dec, this puts a fair bit of detail into how Defra plans to manage the move from direct payments to public money for public goods. Most of the focus is on the tests, trials and pilots for the Environmental Land Management (ELM) scheme prior to its full implementation in 2024. The policy paper also looks towards 2028 and to productivity support, referred to as Improving Farm Prosperity.

It’s drawn a lot of criticism, not least from those who say it lacks the details against which you can make a credible business plan. There is also the feeling the reduction of direct payments should be delayed until their replacement is fully in place.

It’s true –– for many of us, this will be the first time in our farming career that a sizeable portion of our income we’ve relied on to be fixed will start to reduce to zero. We don’t know

how the void will be filled, and we can’t yet build an ELM scheme plan because this policy paper leaves too many questions unanswered, and figures unknown. But I’m not sure we should have expected these details to be presented to us, nor do I think we’d be happy if they were. What is clear from the paper is that there’s a lot of work that’s gone into it. It’s had to consider the views not only of every English farmer, from a shepherd in Cumbria to a Fenland wheat grower, but MPs, NGOs, auditors and of course the wider public. Weaving together a document that fulfils the hopes of that massive span of stakeholders, and moreover inspires ever y one of those farmers, is an almost impossible task. That’s why the result in my view is an impressive achievement and a credit to every civil servant who worked on it.

What’s different is the word ‘co-design’ that appears no less than 20 times within the document. This policy paper is not a set of instructions but a brief. How we take it forward is up to us –– wait for the detail and we’ll forego the opportunity to shape its outcome. So I think this plan is more likely to excite CPM readers than disappoint.

Of par ticular interest, for example, may be the pledge for “increased investment in agricultural R&D … to drive innovation which will see farmer-led R&D projects trial and demonstrate viability of

new and existing technologies”. CPM asked Defra for some clarification here, and received this response:

“The scheme will include mechanisms to bring together innovators, farmers, growers, foresters and researchers to work together, including through consortium-building workshops and networking events. Farmers and growers can get involved in projects by participating in project teams, co-designing research, outputs and plans for sharing results, and by taking part in field trials to test new techniques and technologies on-farm.

“It will fund far mer-led R&D projects to trial and demonstrate the on-farm viability of new and existing technologies to address immediate on-far m productivity challenges. It will pay to connect groups of researchers, far mers, growers and agri-food businesses to work in partnership on projects that are responsive to industry-specific challenges.”

Summer 2021 is when funding calls will be initiated, with pre-launch workshops and events planned to bring together interested farmers with scientists and researchers to for m project teams.

So what will you research? What project will you co-design? Perhaps this is an opportunity to explore how you can be par t of the solution to climate change. Just over a month ago, CPM chaired a round table meeting that brought together the arable sector’s first Climate Change

Champions with industry representatives. Hosted by the NFU, farming minister Victoria Prentis attended. There’s a full report on proceedings on p28, while ideas to take it forward may include growing miscanthus (p22) or farming carbon for a Sustainable Gain (p32).

But this is just the start. CPM’s Climate Change Champions have already made a palpable difference for UK Farming’s prospects in reaching Net Zero, and we’re now looking for farmers to step forward for 2021, to initiate and drive forward further positive change. The right individuals to do this have their eyes set on this very page, so please take the time to explore how to get involved at www.cpm-magazine.co.uk/ climatechangechampions.

It will be an uncertain transition, and Defra’s roadmap won’t really help clear up the doubts. But it is a genuine invitation to shape the future, and in the words of NFU president Minette Batters “this is our time”. So have a great Christmas, because the New Year looks as though it may be one filled with bright prospects.

Tom Allen-Stevens has a 170ha carbon store, renewable food source and wildlife haven in Oxon. tom@cpm-magazine.co.uk @tomallenstevens

The reports that the 2020 UK wheat harvest of 10M tonnes was the lowest figure since 1981 caused me to rifle through the loft in the farm office where we still keep some of dads old farming mags.

Among the titles, which included the rather pompously named Big Farm Weekly, I found some 1981 editions. Amidst the Abertay Sack adverts there were

articles that gave a glimpse into arable farming a generation ago. Farmers were growing wheat varieties called Norman, Longbow, Galahad and Avalon –– no doubt the rest of the Knights had failed to get on the NIAB list.

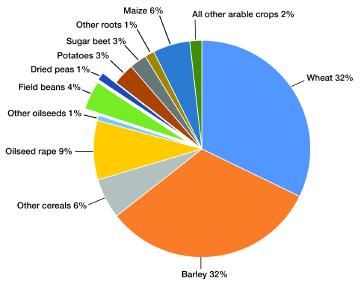

Wheat yields were averaging around the 7.5t/ha mark (or as it was then described ‘the 60 cwt to the acre’) which worryingly is more than UK farmers averaged in 2020. So the size of the national wheat crop in 1980 wasn’t so much inhibited by yield but rather by area.

It was in the 1980s that the wheat area increased from a million ha in 1980 to twice that in 1990 while barley did the reverse halving from 3 million ha to 1.5. In 1981 the wheat price was around the £100/t mark largely thanks to EU intervention buying. Judging

by the adverts for the new four door Range Rovers and Axial-Flow combines with their ‘revolutionary new threshing mechanism’, arable farmers were doing OK. Farm workers were taking home around £50/week but that didn’t include overtime.

In terms of the weather, the 1981 harvest had started very wet, no doubt inspiring farmers to install new grain driers, but by the time August was out, most the harvest was in. The sting in the 1981 weather came in the tail with December temperatures averaging below freezing. There was even a brass-monkey ball freezing -20°C in the middle of the month, complete with several inches of snow.

In other 1981 news Prince Charles married Diana, Prime Minister Thatcher was crashing down the opinion polls, unemployment was at an eye-watering 9% as was inflation and Bucks Fizz won the European Song Contest with their skirt-ripping routine.

Returning to the issue of the historically small size of the combine harvest, if you take the meagre barley and oilseed rape harvest of 2020 into consideration to calculate a total figure you will probably have to go back to the infamous drought year of 1976 to find a deeper low in terms of UK production. All sobering stuff.

In times past, meagre harvests would have sparked fear in the populace as the prospect of a winter famine stalking the land would have raised its ugly head. But today, such news of domestic paucity gets very little attention apart from when bakers announce bread price rises as they fiendishly miscalculate that somehow a 20% rise in the wheat price justifies a 20% rise in the bread price, conveniently overlooking the fact wheat only makes up 10% of a price of a loaf. But even then, a few pence increase on the price isn’t exactly

going to incite bread riots across the land. The only panic buying you see nowadays is for loo rolls and crates of cut-price Special Brew.

The only hope is the record amount of grain imports we will need to fill the gap created by the poor 2020 harvest will focus a few minds in Westminster especially as most of that imported grain will have been grown with pesticides long since banned in the UK. But maybe there’s more chance of pink snow on Christmas Day.

I note the bookies are cutting the odds on a white Christmas.Sure enough the haws and hips on the hedge outside my house are a sea of red berries.Some old wives take that as a harbinger of a cold winter.I’m not a big fan of autumn hedge cutting as I see it as a rather mean-spirited destruction of a larder that sees some bird species through the winter months.So hedges round these parts are looking as unkempt as the farmer whose trips to the barber this year have been as often as his trips to the pub for a Scotch egg.

Guy Smith grows 500ha of combinable crops on the north east Essex coast, namely St. Osyth Marsh –– officially the driest spot in the British Isles. Despite spurious claims from others that their farms are actually drier, he points out that his farm is in the Guinness Book of Records, whereas others aren’t. End of.

@essexpeasant

With 21 new varieties and major modifications to disease resistance ratings, it’s very much a year of change for the AHDB Recommended Lists.

CPM takes an in-depth look at who’s come and who’s gone,as well as what the new ratings mean.

By Charlotte CunninghamIt’s a slightly more compact offering on the 2021/2022 Recommend Lists, with 25 varieties removed and 21 new entrants filling the space.

That said, those 21 varieties have certainly fought for their place, after the 2019/20 season being an incredibly difficult one for the trials team. “The autumn of 2019 was incredibly wet, which lasted well into the winter and led to the loss of a lot of trials,” explains Paul Gosling, who manages the RL at AHDB. “In total we lost 19 wheat, 14 OSR, eight winter barley and six winter oat trials ––either simply because they weren’t drilled, as we were unable to get onto the ground, or because we had to abandon them as they were in such poor condition.”

The spring of 2020 brought further issues due to the COVID movement restrictions meaning four spring barley trials and two spring oat plots were unable to be drilled. “COVID also impacted trial inspections, with AHDB having to turn to drone footage, in some cases, to glean the necessary information,” adds Paul.

So it’s been a year of adapting and working in new ways, but perhaps the most interesting addition this year’s RL is the change to disease-resistance ratings –– including brand new disease ratings for winter rye (brown rust) and winter triticale (yellow rust) on the Descriptive Lists.

So what’s the reason behind this? Offering a rich mixture of broad-appeal and niche varieties, the new RL acts as a foundation for integrated pest management and brings opportunities for a wide range of markets, says Paul. “The wheat brown and yellow rust ratings are now weighted, so the most recent years’ results have the largest influence on the rating. This approach makes the rating more sensitive to changes in rust populations, while still building on a valuable three-year data set.

“For wheat yellow rust and spring oat mildew, we’ve also changed the way we calculate disease ratings, relative to our susceptible and resistant variety fixed points. This ‘reset’ means, compared with the previous edition, the same amount of disease will result in a lower rating score. For rust, some varieties have dropped by as much as three rating points. We stress this

is largely due to the way we calculate the ratings, rather than an indication of a major shift in rust races in 2020.”

Turning the focus to the varieties, what’s new and what’s been dropped?

After an impressive 13 new varieties last year, it’s a much more sombre affair for OSR this year with five hybrid options added to the RL, and the majority recommended for the East/West.

New for this region is LG Antigua from Limagrain, Respect from LSPB and DK Expectation from Bayer. Also in the general-purpose category is LG Aviron, from Limagrain, however this has been awarded UK recommendation and has performed notably well in the North. “The new varieties continue to push disease resistances higher, with robust resistance ratings for both stem canker and LLS,” explains Paul.

Aviron tops the list with its stable mate,

The 2021/22 RL sees significant changes to disease ratings

Technical Recommended ListsIt’s a great example of our work to future proof varieties.

“ ”

Recommended for the whole of the UK,KWS Cranium ticks all the boxes for features of high or very high importance in modern wheat production.

Ambassador, which has held onto its high yields for the second season in a row. “Trait loading of our varieties means that LG Aviron offers the N-Flex trait unique to Limagrain’s OSR portfolio, as well as resistance to pod-shatter, TuYV and RLM 7,” says Will Charlton, Limagrain’s OSR product manager.

“N-Flex is a relatively new trait launched in our hybrids last year offering a step forward in the way that OSR varieties minimise yield losses in sub-optimal N conditions.”

While it’s technically listed as a new variety on this year’s RL, Blackpearl from LSPB, doesn’t yet have any available data as it’s not yet completed National List testing, says Paul. “LSPB are waiting for some data from Blackpearl in order for it to achieve UK National Listing status. So while Blackpearl is recommended, we won’t be sharing any data until that data has been confirmed because after 1 Jan, the variety will have to be on the UK National List to be marketed in the UK.”

The fifth new entrant is a specialist variety –– DK Imprint CL from Bayer. “This new addition is a hybrid variety with a specific recommendation for its tolerance to specific imidazolinone herbicides,” says Paul. “It has high resistance to lodging –– albeit based on limited data –– as well as resistance to pod-shatter and good tolerance to stem canker.”

More than a third of the new varieties on the RL now have TuYV resistance and for the first time this year, the winter OSR list includes pod-shatter resistance data. “We’ve been working with the John Innes Centre over the past three years to try to develop a protocol for testing varieties for pod shatter resistance,” explains Paul. “That has had its problems and we haven’t managed to develop a test that we can get to reliably work yet.

“But because so many varieties have

High GO in the North/East/West.Early flowering, early maturing and resistant to pod-shatter.

Specific recommendation for its tolerance to imidazolinone herbicides.High resistance to lodging and pod-shatter.

High GO in East/West.Resistant to lodging with good stem stiffness at maturity.

Early maturing with resistance to pod-shatter,LLS, stem canker and TuYV.High GO in East/West.

High GO in East/West,resistance to lodging with good stem stiffness at maturity.

Short,stiff-strawed and performs well in East/West. Susceptible to mildew

Short,stiff-strawed and high-yielding with uks classification.

High resistance to brown rust and septoria as well as OWBM.

High-yielding with uks classification. Relatively late maturing and high treated potential in the East.

Recommended for the East. “Medium”for distilling and uks classified.

High spec weight and rated as “medium”for distilling. Stiff-strawed and high treated yields in the East.

High treated yields in the North.Stiff strawed. Rated as “good”for distilling.

Hard-milling, high-yielding and UK recommended. Has high Hagbergs,but tends to give a low specific weight.

High-yielding with a specific recommendation for resistance to BYDV Relatively late maturing and a high treated yield in West and North regions.

High spec weight and good resistance to lodging and rhynchosporium.Very high yielding in the East.

Short-strawed with good lodging resistance.

High-yielding particularly in East/heavier soils.

UK recommended but performs exceptionally well in East/on heavier soils. Susceptible to rhynchosporium and net blotch.

High-yielding and resistant to BaYMV strain 1 and BaMMV Relatively tall but responds well to PGRs.

UK recommended with a high spec weight. Performs well on heavier soils and resistant to BaYMV strain 1 and BaMMV.

High-yielding malting variety with potential for brewing. Stiff-strawed with high resistance to brackling and mildew.

High yields in East/West.Good resistance to brackling and mildew Stiff-strawed.

been marketing pod-shatter resistance, the oilseed committee felt we had to say something about it and so we’re accepting breeders claims while we continue to test this.”

Outgoing varieties include Windozz, Architect, Elgar, Butterfly, Elevation, Nikita, Anastasia, Kielder, and Broadway.

Things look more dynamic on the wheat front with eight new winter varieties added this year and nabim Group 3 growers set to benefit the most.

New to the Group 3 category is LG Prince; LG Illuminate; LG Quasar and LG Astronomer –– all from the Limagrain stable –– as well as Merit from Elsoms.

Though Limagrain’s offerings fall into the biscuit category, they do have multiple end-use markets says the firm’s cereals and pulses product manager, Tom Barker “They shouldn’t just be considered solely as biscuit

Since the incursion of new yellow and brown rust populations in the early 2010’s, rust populations have been dynamic in space and time and RL rust ratings –– based on three years’ worth of data –– have sometimes struggled to cope.

In 2016, there was a large shift in yellow rust populations and so ratings were based on just one year’s data on the 2017/18 RL.

Reports of unexpected levels of rusts on some varieties in 2019 led to questions about new rust races emerging and the veracity of the RL ratings.As a result,yellow and brown rust RL data was subject to additional checks, which showed that varietal resistance was generally in-line with recent years.

Some varieties did have their rust ratings reduced by one point,with KWS’ Firefly falling by two points on the brown rust scale.

A special notice was added to the RL tables

wheats, as they all have the additional end market of potential for distilling and two of them (Quasar and Illuminate) also have uks export opportunities on top, for a full marketing outlet opportunity.”

As well as this, the addition of two new hard Group 4s are set to provide extra options for growers. KWS Cranium sits joint-top of the leader board of hard feed types in terms of yield at 104%, while RGT Wolverine brings a specific recommendation for resistance to BYDV to the RL for the first time.

According to KWS, Cranium sets some important new standards in the Group 4 hard wheat sector. “Recommended for the whole of the UK, KWS Cranium ticks all the boxes for features of high or very high importance in modern wheat production,” says the firm’s Will Compson.

“With the best combination of yield, yellow rust resistance and OWBM resistance on the 2021/22 RL, it’s a great example of our Sowing for Peak Performance work to future-proof varieties as much as we can.”

In the soft Group 4 market, Swallow, from Senova, is causing excitement, particularly for the Scotch Whisky Research Institute, after achieving the highest average alcohol yields in 2020 –– well clear of its competitors. “The consistency of performance for alcohol yield across different harvest years and trial sites is a very positive feature of a clearly “good” distilling variety with the potential to have a significant impact on grain distilling,” it says.

Swallow also has resistance to OWBM, which will no doubt attract growers, though

Paul warns that limited data suggests it’s very susceptible to eyespot ([3]), which is worth keeping in mind if you’re considering the variety.

Leaving the list this year are KWS Lilli; KWS Bassett; Zulu; Bennington; LG Motown; Leeds; Viscount; Revelation; KWS Crispin and Dunston.

Looking to spring wheat, WPB Escape, bred by LSPB, replaces outgoing KWS Alderon. “Escape has given high treated yields from both spring and late-autumn sowings (based on limited data) and has high resistance to both yellow rust and mildew,” says Paul.

While there are no new options for winter malting barley growers, the feed market has had quite a shake up with the addition of five new winter feed varieties now on the list, in place of departing varieties, SY Venture, KWS Glacier and KWS Astaire.

In the two-row category, KWS Tardis (from KWS), Bolton (from Elsoms) and Bordeaux (from Senova) all have joint UK yields of 106, beating closest competitors KWS Hawking and KWS Gimlet by 3%.

“KWS Tardis’ yield is just 1% point off the highest yielding six-row hybrid,” explains Will. “The variety is particularly strong in the East of the country and performs well on light soils, although it’s best on heavy ones where yields are at 110% of controls.”

Two new six-row hybrid varieties, both from Syngenta have also made recommendation. “Both SY Kingston and SY Thunderbolt offer better disease resistance

last to explain this,but doubts persisted.

So,since last year,AHDB has consulted with pathologists,breeders,agronomists,and statisticians to find a better way of calculating rust ratings,explains Paul.“The trial data is good –– varieties with high levels of rust in commercial situations were generally showing high levels of rust in RL trials. However,this wasn’t being reflected in the ratings and the system was arguably poor at dealing with constantly changing populations.”

As a result,a new system has been developed and agreed by all parties and applies to yellow and brown rust ratings.

So how does it work? In the new way of working,three years’ worth of data will continue to be used to calculate ratings,however,data from the current year will be given a weighting of three in the calculations, the previous year, two, and the year prior to that, one.

In yellow rust,the bottom “fixed”point has been adjusted in order to lower ratings for the most susceptible varieties so that disease levels reflect what farmers and agronomist expect to see at those lower levels.

A Yellow Rust Watch List system has also been developed, using RL trial data to highlight varieties that seem to have higher levels of disease than expected in some trials.

“While the watch list doesn’t form part of this year’s RL it will be available online after Christmas,”explains Paul.“This list will be useful to guide monitoring and fungicide programmes, however, it’s important to stress again that the resistance itself has not changed significantly this year.What has changed is the calculations, which we hope will better reflect what’s actually seen in the field.”

Group 3 LG Illuminate also has uks export opportunities on top,for a full marketing opportunity.

and untreated yields, combined with good quality characteristics,” explains Paul.

For those looking for spring cropping options, Skyway –– bred by Agrii –– is a new high-yielding malting option that’s currently on test for brewing. If successful, this could potentially offer huge yield increases over the current market leader, notes Paul.

Also joining the spring barley line up is Cadiz, a feed variety from Senova, with specific recommendation for the East/West region and good all-round agronomics, says Senova’s Jeremy Taylor “With a 7 for lodging and an 8 for brackling resistance, Cadiz has similar maturity to other leading spring varieties.”

Leaving the spring barley list is Concerto, after more than 10 years of recommendation.

There are no changes to either the winter or spring oat RL –– with nothing new and nothing removed –– however, where there is a difference is within spring oat mildew

ratings. “Spring and winter oat mildew ratings were not aligned –– higher levels of disease were found in spring varieties than in winter varieties with similar resistance ratings,” explains Paul. “As a result, and to bring this back into line, the bottom “fixed” point used to calculate mildew ratings in spring oats has been moved.

“The effect of this is lower ratings in the less resistant varieties, while more resistant varieties are not affected.”

Looking at the figures, some of the worst hit varieties include Madison, which moves from a score of 5 to 3, while Elison stays unaffected with a score of 8. However, Paul says it’s crucial to point out that this doesn’t mean that there’s been a significant change in mildew races this year –– “it’s simply a change in the way we calculate ratings to bring them more in line with winter oats.” ■

Swallow is causing excitement,particularly for the Scotch Whisky Research Institute,after achieving the highest average alcohol yields in 2020.

Looking for performance from a late-sown wheat, Norfolk grower NE Salmon is bringing newly recommended winter wheat KWS Cranium into its wide and diverse rotation. CPM visits to find out why.

By Tom Allen-StevensLate November is not a time of year Ed Salmon likes to get the combine out. He’s inspecting a crop of soya, hoping the current spell of dry weather will last long enough to cut the 8ha grown more as a point of principle than to test a new market opportunity

“I’m glad we’ve grown the crop, though I’m not sure we’ll be growing it again,” he says. “But I believe there’s a big opportunity for UK growers to displace imports –– it’s not right for the UK to export the environmental burden of crops we could so easily grow here, especially those destined for animal feed.”

NE Salmon, based near Dereham, Norfolk, crops around 1900ha on mainly sandy/clay loam soils that range from chalky boulder clay to pure sand. There are no fewer than 12 crops across the rotation, nine of which pass through the combine.

“We’ve had a wide and varied rotation ever since the 1950s. It’s evolved and adapted to market opportunities and new practices, but the principle is one of spreading risk and spreading the window for cultivations as well as harvest,” explains Ed, who manages the farm alongside his father Robert.

So that brings crops such as herbage seed, rye grown for grain and soya into a cropping mix dominated by winter wheat and barley, oilseed rape and spring beans. With 100ha of the wheat grown for seed, harvest is managed with just one Claas Lexion 780, apart from the herbage seed. This starts in June and usually ends in mid Sept –– although not this year.

“We’ve no set rotation –– the cropping is geared around improving soil health. So there’s a balance of spring cropping, all of which is preceded with cover crops –– we aim for no bare soil at any time of the year,” Ed explains.

“With cultivations, we cherry-pick the system that’s right for the soil, the crop and

the field conditions. We aim for appropriate cultivations using a Köckerling all-rounder at 120mm depth and a Väderstad Topdown. But we have a plough and power harrow, used where needed, with most of the drilling carried out with an 8m Väderstad Rapid.”

The farm’s emphasis on flexibility in a resilient rotation, with a system that can be efficiently managed over a wide window is reflected in its careful choice of wheats.

“The hard Group 4 feed market is where we’re focused, both with the seed wheat we grow and the varieties sown across the rest of the 500ha.”

So this year, Gleam, KWS Parkin, RGT Gravity and KWS Kinetic are the main varieties currently in the ground. “Parkin is a super variety for that early drilling slot with its

The soya,grown to explore how to displace imported livestock feed, probably won’t become a permanent feature in the farm’s diverse rotation.

“ ”

stiff straw. Gleam we’ve chosen for its high untreated yield and I’m a big fan of Kinetic –– you can’t beat it for its out-and-out

yield. That’s down to the flag leaf that must be an inch wide and soaks up the sun. I like Gravity because it tillers like mad, but its

KWS Cranium is the agronomist’s dream variety, reckons KWS product development manager John Miles.“It’s different,but this is in areas that are significant on farm,”he says.

Yield-wise the variety sits in the top of the pack of Group 4 hard wheats,a new entrant on the 2021/22 AHDB Recommended List.“But it retains this yield performance as a second wheat,while it outstrips any other variety where it’s late sown

septoria susceptibility, coupled with the loss of chlorothalonil, makes it a risky choice and I think this year will be our last with the variety.”

Still in the shed and yet to be drilled is KWS Cranium. This is a variety that was grown for the first time as a seed crop for the 2020 harvest. The plan has been to bring it into the main wheat portfolio and take advantage of its suitability for the late slot, eventually taking the place of Gravity. But the wettest October Ed can remember has kept the drill out of the field.

“We have Cranium lined up for our late-sown and second wheat slot. Many growers may choose to put it after roots, but our potatoes and sugar beet go on our lighter land, while Cranium’s suited to heavier soil.

“With Kielder in its parentage the variety knows how to yield and spreads the combining window –– at harvest this year, the Kinetic had gone golden while the Cranium was still bright green. But it produces a huge ear –– I’ve never seen anything

The cropping is geared around improving soil health with cultivations cherry-picked for the soil,the crop and the field conditions.

like it, each carrying around 80 grains,” he remarks.

Last year, the crop was drilled on 24 Oct –– relatively late for a business that prefers to have drilled up its main wheat crop by the second week of Oct. “It was a difficult autumn, but at least we could actually get the crop drilled. As with all our seed crops, it followed the double break of a herbage ley.

“The Cranium emerged well, but didn’t tiller as much as Gravity and was slow to start in the spring. But then it really put on some pace and raced through the growth stages. It was a shame the season was

–– in trials in Framlingham, Suffolk,sown in late Dec/Jan,Cranium delivered 113% of controls,” he notes.

John puts this down to the recovery of the variety –– its ability to catch up when sown late. KWS trials have identified Cranium as a fast developer in later sowings.“It has vigour,but it also has stiffness –– that’s where a lot of fast-growing varieties fall down.And this recovery goes right the way through to its late harvest –– Cranium is a variety that wants to maximise its yield.”

A strong score on yellow rust comes from Timaru that’s in the variety’s parentage and also gives the variety seedling resistance.This is coupled with a respectable 6.0 for septoria and there’s also orange wheat-blossom midge resistance,he adds.“We’re calling it the wheat for the thinking grower because it ticks a lot of boxes.”

KWS wheat breeder Mark Dodds notes that Cranium has KWS Crispin and Kielder as its parents. “Crispin doesn’t grab headlines for yield,but always performs in later sowings, particularly after roots.The problem with the variety is its straw.”

That’s where the Kielder comes in with good straw stiffness and high yield. “The result is a really useful package of four agronomic traits:OWBM resistance,stiff straw,yellow rust resistance and a high yield –– that’s an attractive combination, particularly for growers in the East,”notes Mark.

Cranium puts on strong growth in the autumn, competing well with blackgrass, he adds. “It’s more upright than most, tillers well and grows steadily through the winter.The real added bonus is its performance in later sowings,”he concludes.

so dry as the crop did suffer some water stress. But it was pretty clear of disease throughout.

“We applied CTL until the T2 timing and dropped back the rate of Ascra at T1. In hindsight, given the season, we could have gone with a cheaper T2 than Verydor. All we saw was a bit of mildew to start with then a little septoria and a spattering of rust, but nothing that would have troubled yield,” recalls Ed.

held onto its green leaf area until late in the season, and was one of the latest wheats to be harvested on 11 Aug. “One thing we noticed was a low specific weight, which I think was down to those large ears and the lack of sunlight in June. It may be that you can manage the crop to feed the ears a little more at the end of the season, which would add a little to the yield, too.”

That said, Ed was pleasantly surprised with a crop that came over the weighbridge at 10.77t/ha, against a farm average of 10.87t/ha. “That’s impressive for a late-drilled wheat, and lines it up for our second wheats, especially on stronger soils. We usually give these some farmyard manure, so I reckon it won’t be difficult to bring the performance of a late drilled Cranium up close to our first wheats.”

He’s expecting this will bolster the heap of Group 4 hard feed wheats they’ll have to sell. Here again, Ed has a close eye on the market and is looking for post-Brexit opportunities. “I’m not a fan of Group 1 milling wheats as all too often you fall foul of spurious rejections. But we have found some local mills that are now taking around 40% of our feed wheat into their grists and paying a small premium.”

While the wide rotation,with a focus on the soils have always been strengths for the business, Ed Salmon plans to use digital technology to adapt the system for the future.

risk and window, but we don’t want to over-complicate things. That’s why Cranium fits in well –– it serves a purpose putting a dependable variety in the late, second wheat slot,” Ed concludes. ■

KWS Cranium performed well as a seed crop for 2020 harvest,but the area planned for this autumn has not yet been drilled.

As for the rest of the rotation, while it’s unlikely soya will become a permanent feature, Ed’s bringing in the latest digital technology in his quest to help determine how the farm’s rotation will adapt through the transition after Brexit. The business is collaborating with a number of other farmers in the area on around 8000ha in total, employing a data analyst to sift through the wealth of digital information they’ve amassed to identify and pinpoint opportunities for their systems to evolve and adapt.

“It’s the wide rotation, with our focus on the soils that have always been strengths for the business. There’s potential for digital farming to help refine how this goes forward, further improving its sustainability. With the wheats, we want to keep the spread of

The Brexit-ready marketing strategy involves identifying opportunities to displace imports and premium markets found for the Group 4 hard feed wheats.

In this series of articles, CPM has teamed up for the third year with KWS to explore how the wheat market may evolve,and profile growers set to deliver ongoing profitability.

The aim is to focus on the unique factors affecting variety performance,to optimise this and maximise return on investment.It highlights the value plant genetics can now play in variety selection as many factors are heavily influenced and even fixed by variety choice.

Compost is among soil additions used to bring a steady rise to organic matter levels.

KWS is a leading breeder of cereals, oilseeds,sugar beet and maize.As a family-owned business,it is truly independent and entirely focussed on promoting success through the continual improvement of varieties with higher yields,strong disease and pest resistance, and excellent grain quality. We’re committed to your future just as much as you are.

included commitments to sustainable food and farming practices, although there was no mention specifically of any incentives for pulses. “The obvious place for this is the Sustainable Farming Incentive,” he suggests.

“The door’s wide open for pulses. I can’t think of another crop group that could offer a better pathway to a more sustainable way of farming and source of food.”

well-managed pulse crop into the rotation, that would bring the current crop area from the current 5% of arable cropping to 15-20%. This would have a substantial impact on the 3.8M tonnes of soya we currently import and result in a massive reduction in our overall carbon footprint, not to mention the soil health and other environmental benefits that would bring.”

The renewed call for action builds on PGRO’s Blueprint for UK Pulses in a post-Brexit world, a strategy document produced two years ago. This laid out specific steps to exploit the potential of pulses to address the changes and challenges facing growers, researchers and traders following Brexit:

● Encourage cropping for environmental good. Specifically targeting pulses and vegetable legumes to aid the sustainability of UK food production systems in agriculture.

● Take an approach to crop protection and nutrition to assist the production of pulse crops, ensuring more economic productivity and reliability.

● Incentivise the feeding of UK-produced plant proteins to drive local demand and fuel production.

By Tom Allen-StevensUK growers have the opportunity to displace a considerable proportion of imported soya and make a step change on their journey to Net Zero. But it will take a firm commitment to bring a pulse into the rotation, and solid support for home-grown protein crops from Government.

The call comes from PGRO CEO Roger Vickers following the release of Defra’s Path to Sustainable Farming. The policy paper, released at the end of Nov, sets out the Government’s Agricultural Transition Plan, shifting payments from direct subsidy to public money paid for public goods.

“The need for home-grown pulses has received plenty of support from the wider public, but not a lot has happened on farm or in terms of policy that would effect any change,” he told CPM

He points out the Defra policy paper

Roger’s not in favour of a direct crop subsidy nor area payment for pulses, but suggests there could be an option to meet a particular target under a wider incentive for more flowering crops, for example. He’s also keen to see the crop receive more R&D and on-farm agronomy support to boost returns from pulses under the elements of the Defra plan to improve farm prosperity.

“If every UK grower brought a

● Stimulate investment of private equity in industrial processing and ingredient manufacture to kick-start demand and to drive increased, more efficient production and to add value.

● Increase education of growers and the supply chain about the environmental and economic benefits of pulse production.

● Set out a clear strategy of education in schools via the national curriculum to stress the health benefits of pulses, food origins and to encourage healthy eating choices.

● Require public procurement and service providers to take a lead in the provision of healthy pulse-based diets and education initiatives.

● Require Government departments to col late and distribute timely, accurate public supply statistics.

● Set up a market and research development platform with trade and research organisations to identify research priorities for funding initiatives with a unified approach.

The door of opportunity is wide open for pulses, reckons Roger Vickers.

● Use public funds for public good research directed at agronomic risk reduction, developing UK traits for genetic improvements, pulse crop diversification and added-value processing.

Roger believes the ability for growers to

With the right incentives and a commitment from growers, there’s a very promising future for protein crops. CPM assesses the policy pathways,market opportunities and varieties that could make that happen.

There are growers producing excellent pea and bean crops and following really innovative practices that would be fascinating to explore.

“ ”

apply good agronomy and crop protection is mission critical in building a greater area of profitable protein crops. “The direction of travel is towards regenerative agriculture. But these systems still include an element of crop protection to optimise productivity and result in the most sustainable outcome,” he points out.

“The amount of agrochemicals applied to pulses is miniscule, but growers and agronomists cannot be hemmed in by regulation that prohibits its use. The loss of products such as diquat with no viable alternative results in a vicious circle for protein crops. It’s a sector too small to warrant the large investment neededby agrochemical companies to support products, but too large to qualify for a derogation or EAMU.”

Managing director of LS Plant Breeding Chris Guest believes the reduction in oilseed rape area and move away from sugar

Policy

crops.

beet do create opportunities for pulses. “Current market demand could utilise a doubling in the pulse area –– there’s currently lots of interest in pea protein,” he says.

“The UK would require investment in a fractionation plant to properly benefit from this new and exciting market opportunity. New technological advances, for example the work being done by the Cambridge start-up Xampla looking at a plastic alternative from pea protein, is very exciting for the future.”

In beans, he believes there’s a “huge opportunity” in the animal

feed sector, particularly in monagastrics, such as pigs, and poultry. LSPB is responsible for breeding or marketing over 85% ofthe bean varieties grown in the UK and Chris sees great potential for those low in vicine and convicine (LVC). These are pyrimidine glycosides that can decrease feeding efficiency in monogastric animals.

“I don’t see a rise as significant as a quadrupling of the pulse crop area, but policy support is justified –– work by the Game and Wildlife Conservation Trust has shown the benefit of beans and peas within the rotation to farmland wildlife, with an extension to the flowering period benefiting insect life and onwards to bird species including the grey partridge.

“It will be interesting to see how Defra’s innovation and R&D element rolls out as there are many potential opportunities here, including further potential work on LVC beans. We’ll assist wherever possible with industry lobbying to ensure that additional R&D can be targeted to the pulse crop,” adds Chris.

Roger’s also keen for support for farmer-led R&D. “There are growers producing excellent pea and bean crops and following really innovative practices that would be fascinating to explore. Let’s find the IPM approaches progressive growers are already utilising and make a step change in prospects for the crop,” he says.

The PGRO has launched its 2021 Descriptive Lists (DL) for combining peas, winter and spring beans. The list represents a significant change for the levy-funded lists as the data moves from its long-established Recommended List format.

“The result will be a more open system that gives breeders the freedom to innovate,” says PGRO principal technical officer Stephen Belcher. “They’ll know their products will be independently trialled and presented without judgement giving them the opportunity to react more quickly to market interest.”

Challenging weather was a theme across all crops during the 2020 trials, he reports, but several new varieties have delivered encouraging results and the conditions provided a greater level of disease information for pulse growers.

“Lack of rainfall post drilling in the spring gave rise to patchy and uneven emergence for many trials and crops with double emergence a common occurrence.”

Yields are therefore well down on 2019, with winter beans suffering the worst. The control yields for 2020 were 2.72t/ha for

peas, 3.68t/ha for spring beans and 2.67t/ha for winter beans.

“Powdery mildew in peas became a significant problem late in the season, while late rust in spring beans was a problem in some trials,” notes Stephen.

Stella, one of three new varieties from Saaten Union now tops the list with a yield of 108%, just ahead of LSPB’s Lynx, added to the list five years ago. Capri and Daisy, also from Saaten Union, have also joined the 2021 list.

“Both Lynx and Yukon continue to show very good tolerance to downy mildew,” comments Stephen. Bolivia, from LSPB has been added to the electronic version of the DL, available on the PGRO website, while LG Viper and LG Sphinx from Limagrain and Allison from LSPB will be added, subject to

A pulse crop in every rotation could have a substantial impact on the 3.8M tonnes of soya imports and result in a massive reduction in the UK’s carbon footprint.

confirmed National List status.

Although all eight trials were taken through to harvest, yields varied from 6.29t/ha in North Yorks to 1.88 t/ha in Lincs, Stephen notes. Vespa is still the top-yielding winter bean variety at 109%. Vincent and Norton, both from Senova, are

Chris Guest believes there’s a huge opportunity in the animal feed sector for beans,particularly in monagastrics,such as pigs and poultry.

new high-yielding additions to the list, subject to confirmed NL status.

“Spring bean Lynx has proven itself as a very consistent performer,” comments LSPB’s Chris Guest. “A great combination of yield and agronomics still make this the market leader. Macho has a very large seed size, making it suitable not only for human consumption export markets but also the fish food market where the skins are removed.”

Chris points growers to the availability of LVC varieties. “We’re working hard to build awareness of this valuable trait, present in Victus, Tiffany and now Bolivia. LVC represents an added benefit to other market opportunities.

“Yukon, new to the market last year, combines very early maturity with excellent downy mildew resistance and brings a new opportunity to growers from York to the Scottish Borders where late harvest can lead to issues.” There’s limited seed availability of this variety for next year, however, he adds.

Nudging just behind Lynx in yield terms is LG Raptor, scoring 105% over control on the new DL, notes Limagrain pulse breeder Will Pillinger. “Yield is the most important factor for spring beans, and a major focus in our breeding programme. LG Raptor offers extremely high yield potential that could see it out-yielding the market leader by next season.”

This season has seen the variety produce a uniform sample, while it also has solid agronomics and traits, he adds. “It is fairly early to mature, stands well and offers a good disease package including rust. This combination of traits makes it a good variety for the north.”

LG Raptor is suitable for human consumption, fish feed and animal protein markets.

At 120% of controls, last year’s newcomer Kameleon from Senova tops the yield rankings in the yellow/white pea category, closely followed by Orchestra at 115%, notes Stephen. “New to the list for 2021 are Kaiman from Senova and IAR Agri’s Raider.”

New additions in green/blue peas for 2021 are LSPB’s Stroma, Kiravi from Senova Greenway and Mikka (IAR Agri). “Kactus emerged top of the yield rankings at 112%, closely followed by Bluetime and Stroma at 111%. Blueman came top for tolerance to downy mildew with a rating of 8. Kactus, Karioka, Mikka, Croft and LG Aviator followed with 7,” he adds.

In the marrowfats, Akooma from LSPB is new to the 2021 list with a yield of 97% ––11% higher than Sakura –– and with a very large seed size, notes Stephen.

“Our new marrowfat pea is really exciting,” comments Chris. “The market has been

With AHDB’s Early Bird Survey figures suggesting a further slight rise of 7% in the area grown to pulses, the trade is reporting increased interest in pea cropping for 2021 and requests for contracts are being welcomed, notes president of Pulses UK Lewis Cottey

“As for beans,the large Australian crop has begun to find its way into the market. With better visual quality, they’re undercutting UK feed bean prices and demand for UK beans for human consumption has dried up.”

The variability of the cropping season remains a conundrum,he says,but there’s confidence demand will return later in the winter “For now, feed bean prices appear to be supported by recent increases in wheat,soya and rapemeal prices.”

These are seeing beans leave the farm at £210/t.Prices for new crop (2021) are around a £30/t premium on Nov wheat.Good sample marrowfat peas are currently getting up to £305/t on the open market while contracts for new crop are getting up to £335/t ex farm.Pale/bleached green/blue peas might get £220/t with the best quality trading at £270/t.New crop contracts are in the range £215-260/t ex-farm.

“More recently yellow/white peas have started to attract a little more interest from both domestic processors and European buyers,although from a very low level within the UK.This probably reflects the growing profile peas are getting in health messages,flour production and snack processing,”adds Lewis.

crying out for a new marrowfat for many years, one that also improves yield and agronomics at the farm level. Akooma really looks to be a step in the right direction in this segment.” End user testing has just started and early indications have been very positive, he reports.

LSPB’s Bluetime brings a high-yielding green/blue pea to growers in the South at 111% of controls, he notes, while Blueman offers high resistance to powdery mildew, along with its score of 8 to downy mildew.

LG Aviator has the same high resistance to powdery mildew, offering a 7 against downy mildew, points out Will. New to the list last year and with a yield rating of 103% over control, LG Aviator is a multi-podded variety type, he explains.

“For each node it produces, there are three pods. This means there are more pods at the top of the plant, making for a more even maturity with less competition for light. This is a significant characteristic in building yield. It’s early, and has good ratings for standing ability and straw length (rated 6),” he adds.

More analysis and the full 2021 PGRO Descriptive List can be found in the current copy of the Pulse magazine, included with this issue of CPM ■

Yellow/white pea interest reflects the growing profile they’re getting in health messages,flour production and snack processing.

Current values are in the region of £215/t ex farm.He tips yellow peas as having a significant role to play in the future of UK pulse production, and notes 2021 contracts are available.

Spring oats combine a food with recognised health benefits and a crop that leaves the soil in good heart.

CPM explores the agronomic value and market prospects of the crop and leading varieties available for 2021.

By Tom Allen-StevensA crop that roots voraciously, bringing soil health benefits,that competes well against blackgrass and produces a food with recognised human health benefits –– what’s not to like about oats?

“With the trend for more spring cropping, widening of rotations and less reliance on oilseed rape as a break, and with prospects for spring barley perhaps not as good as they were, spring oats are gaining favour,” notes Saaten Union UK cereals product manager Andrew Creasy.

“There’s strong demand, especially for milling oats, and unlike some other spring breaks, it’s a crop growers are familiar with. What’s more, the varieties now available do present growers with a nice range of options to fulfil some of the market opportunities.”

Saaten Union UK represents leading German plant breeder Nordsaat, with whom Elsoms have an exclusive arrangement in the UK. Andrew’s also been working with UK oat processors to help bring to the UK germplasm specifically adapted for the

northern European climate that has real domestic promise. The collaboration has resulted in Lion, a milling-quality variety that joins a strong offering of high-yielding feed types (see panel on p21).

So what qualities make a spring oat resilient within the arable rotation? “Agronomically, growers look primarily for a dependable yield. But one of the biggest benefits of oats is their competitive nature –– they cover the ground so quickly, which is a key feature, especially in a spring-sown situation and where blackgrass is an issue,” Andrew points out.

“Spring oats are also strong-rooting, which makes them good soil conditioners, especially on heavy-land sites. They have a reputation for leaving the land hungry, but I’d say they leave a good tilth and they’re a take-all break so a good entry for a first wheat.”

Other qualities to look for are straw strength and height – oats grow tall so benefit from use of growth regulators. “PGRs should be matched to season –– if it’s cool and dry during stem extension, their use can check growth harshly. But oats are vulnerable to brackling and lodging later on if the canopy isn’t well managed,” he advises.

Compared with other cereals, disease is less of a consideration. “Mildew can be an issue for some sites, while late in the season crown rust can be a problem –– a bit like brown rust in wheat. But both are very easily managed in susceptible varieties with a one or two-spray fungicide programme.”

When it comes to the market, oats score

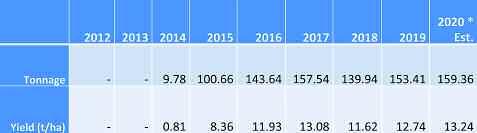

favourably, with domestic demand enjoying a steady rise of around 10% per year. “But it is important to have a market lined up for your crop –– the spot feed market has relatively poor returns,” Andrew notes (see table on p20).

“Processors look for high kernel content –– the proportion of the grain that can be utilised – and hullability, which is the ease with which the hull is separated through the mill. Oats have either a white or more yellow hull, which affects flour colour, and some markets prefer a whiter hull, especially in Northern Ireland and certain export destinations.”

Most spring oat varieties are husked, which means they retain their hull through the combine, he explains. “The hull makes up about 30% of husked varieties, which explains the lower apparent yield of naked types. But most processors prefer the quality of husked varieties, despite the need to de-hull them.”

▲

Oats cover the ground quickly, competing against blackgrass, says Andrew Creasy, and they leave a good tilth.

We have extraordinarily good feedback from commercial mills – they’ve been euphoric.

“ ”

Newcomer to the RL Lion has very strong scores for kernel content and specific weight,with the resulting high extraction rate drawing favour from millers across Europe.

OatsBarley

Seed7167

Fertiliser7885 Sprays96151

Total Variable costs245303

Yield (t/ha)6.256.50

Cost per tonne (£)39.2046.61

PremiumReturn862.50942.50 market G margin617.50639.50

Feed Return737.50877.50 market G margin492.50574.50

Source:John Nix (costs + yield); AHDB (spot prices at 08/10/2020):malting barley £145/t,feed barley £135/t, milling oats £138/t,feed oats £118/t; all figures in £/ha, unless otherwise stated.

Richardson Milling, with a base at Bedford, and Quaker with mills in Scotland are two key UK buyers for human

Initial results from milling spring oat newcomer Lion suggest good prospects for the variety in domestic markets,as well as for export destinations.

Richardson Milling (UK) is the biggest business-to-business buyer of oats in Europe, notes the firm’s agronomy manager Brin Hughes. It’s owned by Richardson International,Canada’s largest agribusiness,that purchased European Oat Millers from the Jordan family in 2017. Along with Jordans,Dorset Cereals and Oatibix (the oat-based version of Weetabix) are among the popular brands supplied by the Bedford mill, from oats and other cereals sourced mainly within an 80-mile radius.

“We’ve seen a steady growth in demand that’s doubled over 20 years,” says Brin. “The entire UK oat market is about 1M tonnes,with human consumption taking about half.The strength in demand is largely down to the health benefits.”

Oats are proven to be high in beta glucans,a soluble dietary fibre strongly linked to improving cholesterol levels and boosting heart health.“In processing terms,the key for us is an oat with good hullability and low hulling losses.These are related to kernel content,but also with how the oats travel through the mills and how easily the hull shatters –– some varieties dehull more easily than others.Every mill has its own set-up so you’ll find millers differ with their favoured varieties,” he explains.

The colour of the oats –– the whiteness of the finished product –– is less of a concern for the Bedford mill.A typical contract will specify more than 50kg/hl specific weight with less than 6% screenings.“While we’re considering adding hulling losses,we don’t currently have a contract spec but look for varieties with less than 30%.

Winter varieties tend to have lower screenings and are the only ones we buy on contract,comprising around 80% of throughput,although we process a considerable spring-sown crop.”

Brin works closely with breeders to identify and encourage varieties that perform well through the mill.“Elyann has historically been our preferred spring oat,but what we’ve seen of Lion this year is looking very promising.Bearing in mind harvest quality was generally very good,Lion achieved hulling losses from the limited samples we tried as low as 20%,which is fantastic.This is a variety we are interested in.”

Harvest 2020 contrasts starkly with the previous two seasons,however.“We’ve had two horrendous years for the spring crop,with drought and poor weather hitting specific weight,and screenings over 10%.We don’t yet know how Lion will perform in a more challenging year,but

consumption, he adds (see panel below). “Mills have their preferred varieties, with Quaker favouring Canyon from Scottish growers and Richardson looking very favourably on Lion. There’s a strong demand from some outlets for feed varieties, especially in the South West.”

The Saaten Union lines, marketed through Elsoms, have come from Nordsaat’s North European breeding programme, based on the Rügen peninsular in N Germany. The company has the largest multiplication area of spring oats across Europe.

“One trait in particular we’ve focused on for the N European market is straw strength,” notes oat breeder Dr Steffen Beuch, who heads up the breeding station and has developed the company’s oat breeding lines over 20 years into the market-leading position.

“PGRs aren’t allowed in some of the

Brin Hughes believes there’s potential to improve the on-farm performance of spring oats.

currently we’re happy with it for 2021 plantings.”

He’s keen for growers with attention to detail to get involved with oats.“It’s a fascinating crop,with very elastic potential to adapt to its situation, but we don’t don’t know enough about it –– oats don’t attract as much R&D investment as wheat or barley.”

He advises sowing at a relatively low seed rate of 300 seeds/m2 early,ideally Feb or early March to encourage roots to explore. Around 130kgN/ha gives the crop what it needs, split 30% in the seedbed and 70% soon after emergence. “Although the crop’s seen as low input, in my experience a decent two-spray triazole/strobilurin fungicide programme usually pays dividends.

“But we’re way off understanding some of the details about this crop, such as the optimum grains per panicle and how to balance N and PGR use to coax the best performance. There’s real scope for the professional grower to get a really healthy return from some careful crop management,” notes Brin.

markets of this region. There’s a general preference for white-hulled varieties, while yield stability and foliar disease resistance are key requirements for UK and Ireland.”

Lion has been a particular success for Nordsaat, he notes. “It’s short, early, very stiff with a very stable yield. It’s not the highest yielder but adapts well over many different sites which is a mark of consistency.

“Lion’s stand-out feature is its quality ––it has the best kernel content of all spring varieties, coming out consistently high in all trials and all years, with a high extraction rate and good hullability. We have extraordinarily good feedback from commercial mills across Germany ––they’ve been euphoric.”

Steffen expects Lion to get a similar reception from UK millers. “It’s almost ten years since we introduced our first spring oat, Canyon, to the UK, which now has some well established market outlets. Lion represents a step-up on quality.”

Yukon he calls a “classical” oat, performing well in low input situations. “It has very good standing ability and is short. Delfin is similar although has slightly better quality, but the remarkable aspect

of this variety is its yield –– it’s the highest yielding spring oat across Europe. It delivered a staggering 13t/ha in a trial in Sweden, which is the highest I’ve seen for a spring oat,” he notes.

He now has his eyes set on Scotty and Tasman, both candidates for the UK and both with Yukon in their parentage. “Scotty has been yielding top consistently across N Europe. It combines this with early maturity, good straw stiffness, disease resistance and quality. This isn’t as high as Lion’s, although it’s a white-hulled variety. Tasman is even higher-yielding, especially in untreated trials, so we’re expecting a strong uptake among organic growers. It has good specific weight and hullability.”

Growers who suffer mildew will benefit from very high ratings for the disease in the future –– two genes have been identified and crossed into lines that are making their way through the N European programme, reports Steffen. But an issue identified by breeders is a widening yield gap between the best of new material in trials and on-farm spring oat performance –– higher

Over 20 years,Nordstat breeder Steffen Beuch has developed some of Europe’s leading spring oat lines ,but notes a yield gap with on-farm performance.Photo Saaten Union.

than in wheat or barley

“The potential is there for UK growers to significantly raise the returns from spring oats with good management. Meanwhile we’re using the latest breeding techniques, such as genomic selection, to advance the spring oat lines, and the result is really good diversity and robustness in the traits we’re now bringing forward. That will ensure resilience for rotations across Europe in years to come,” he concludes. ■

(days

0 0 0 -1 Resistance to lodging887[9] Straw length (cm) 111106110[104]

resistance

8783

rust454Source:AHDB

data.*NOTE:Lion

a candidate variety so figures are not

Less oilseed rape, spring cropping, a focus on improving soil health and building carbon all rely on a cropping rotation that is resilient. Each crop must deliver a profit on the year while the rotation as a whole should ensure the farming business remains sustainable for years to come.

comparable

that

Saaten Union. Delfin has not only the highest treated yield but also tops the spring oat RL with its untreated performance.This is coupled with one of the strongest scores on the RL for mildew and good stem stiffness, making the variety suitable for organic and low input situations.Performing particularly well in the East,its main market is for feed,although there are milling outlets that take the variety. Yukon has a very similar profile to Delfin,with the second highest untreated yield on the RL.It has a slightly lower mildew score, but performs better on crown rust,is slightly shorter and stiffer. Canyon has the edge on quality,with similar disease scores and straw stiffness to its stable mates. The first Nordsaat variety to make it onto the UK RL,it retains a mid-range yield performance that’s dependable and is one of the widest grown across Europe.It’s a yellow-hulled variety used by Quaker, making Canyon a popular choice for growers in the north of England and Scotland.

Lion is the newcomer,still a candidate on the RL,but with very strong scores for kernel content and specific weight in a yellow-hulled variety.The resulting high extraction rate is drawing favour from millers across Europe.Stiff-strawed,it’s also significantly earlier maturing,although mildew is one disease to watch for.

In this series, CPM partners with Elsoms to look at the opportunities offered by cereals other than wheat and delves into the genetics behind them. Through privileged access to the company’s staff and resources,these articles explore rotations that secure a reliable return today and offer bright prospects for the future.

Elsoms Seeds is the UK’s leading independent seed specialist and plant breeder.The company’s experienced, specialist staff combine a passion for high quality vegetable and agricultural seed with the latest in plant-breeding research and seed technology.This ensures a focus on high performance and low-risk varieties,building resilience into rotations for years to come.

There’s less than a 20-year timescale for UK agriculture to meet the NFU’s Net Zero target– that’s also less than the lifecycle of the biomass crop,miscanthus. CPM explores the potential of a crop with a market that’s beginning to expand rapidly.

By Lucy de la PastureFarming with carbon in mind is something many growers are getting to grips with –– partly because increasing carbon in the soil goes hand in hand with soil health,but also by necessity as the industry sets its sights on achieving Net Zero by 2040.

Sarah Wynn, principle sustainable food and farming consultant atADAS, says many growers are choosing to look at carbon accounting on their farms –– a process which was driven primarily by the supply chain until very recently.

Although there’s a lot of discussion about the discrepancies between the carbon accounting tools available, Sarah says the absolute numbers they provide don’t really matter. “The important thing is to choose a tool and then stick with it so you can see the direction of travel and then the results will help drive the adoption of the right carbon practices.

“Generally the tools are very good at calculating emissions but less so when it comes to carbon capture. The interaction of soil type, environment and carbon is very complex and the science is only just catching up with demand.The risk is that the tools oversimplify things and, in some cases, over-estimate how quickly soil carbon can be accumulated.”

Carbon capture and sequestration is much more nuanced than is widely believed, explains Sarah. “In a normal annual cropping cycle, we don’t look at carbon capture in carbon accounting because it is so transient. It’s true to say a winter wheat crop will capture carbon dioxide by photosynthesising and build the assimilates into plant-based material, However the grain is then consumed and

the straw either incorporated, used for livestock or combusted, releasing the carbon stored in it.”

Building soil organic matter is acknowledged to be a very slow process and exactly the same applies to soil carbon, which is why coppice and timber are more effective ways of sequestering carbon –– particularly if the above-ground biomass is used in construction, which

Sarah Wynn explains that carbon capture and sequestration is much more nuanced than is widely believed.

Over time a carbon equilibrium will be reached

“ ”

Underground the miscanthus adds carbon to the soil over its lifetime, whereas above ground the harvested biomass only offers a transient capture of carbon.

only a change in management practice will enable the crop to accumulate more carbon. For, example changing from an intensive grazing regime to a rotational one, where the grass is rested so it has more chance of capturing carbon, will allow the crop to continue to add carbon to the soil.”

of carbon. But over time a carbon equilibrium will be reached so then you have to look to do something else, such as introducing cover crops into the rotation or adding organic amendments, to continue to enhance the carbon in the soil,” explains Sarah.

But carbon doesn’t travel in just one direction so the problem remains that growing practices also have the potential to release carbon as well as store it, highlights Sarah.

▲

maintains the carbon ‘under lock and key’.

That’s not to say shorter term crops don’t have a role to play in increasing soil carbon, explains Sarah. “When a grass ley is planted, it starts to accumulate carbon by putting on biomass –– with its roots, root exudates and leaf matter

all adding carbon to the soil. So over time the grass ley sequesters carbon until it reaches a state of equilibrium and then it becomes carbon neutral, if it’s continuously managed in the same way, where the carbon it uses equals the carbon it stores.

“Once this point is reached,

Even so, there is a ‘but’ when it comes to the influence of a management change, she highlights, because different soils or vegetation types behave in different ways and climatic conditions can either promote emissions or carbon sequestration.

Min-till and no-till cultivations minimise the release of carbon from the soil but exactly the same principle applies as it does when a new crop of grass is planted. “When a change is made from ploughing to min-till, or from min-till to no-till, there will be a gradual accumulation

“All the benefit from moving to a system of minimal cultivations can be undone if the ground has to be ploughed for agronomic reasons. The carbon turned up in the soil will become oxidised when it’s exposed to the air and released as carbon dioxide.”

Because carbon is so easily released from soil and this happens much more quickly than it can be accumulated, Sarah believes it’s important to

have a good understanding of the processes involved in the carbon cycle and the practices that influence them.

Crops which occupy a longer term in the rotation, such as miscanthus, can add a pool of carbon to the soil over its lifetime. “Miscanthus is planted as a small rhizome which accumulates biomass each year until it becomes a large root body –– allowing the soil to accumulate carbon. The leaf litter falls which also replenishes carbon in the soil.

“The above ground harvested biomass only offers a transient capture of carbon, although there is some carbon offset to put against otherwise burning a fossil fuel. If the miscanthus is used as a biofabric then this will lock the carbon up over a longer period of time.”

Miscanthus is currently grown on over 7,000ha of marginal land in the UK and its mainly supplied to whole-bale

biomass renewable energy plants, which power over 200,000 homes. The crop could have a key role to play in reaching Net Zero emissions in agriculture and not only is it scalable –– it’s making waves in the industry as new technologies and markets emerge.

Earlier this year, the UK Committee on Climate Change (CCC) released its “Land use: Policies for a net zero UK” report, stating that expanding biomass crops, including miscanthus, by around 23,000ha/annum would deliver a 2Mt CO2e emissions saving in the land sector. Additionally, it highlighted that an extra 11Mt CO2e reduction in emissions is possible by using harvested biomass for construction or bioenergy with carbon capture and storage (BECCS).

Jonathan Scurlock, NFU chief adviser for renewable energy and climate change, believes miscanthus can contribute significantly to UK

net zero targets. “The NFU expects growth in land use for perennial energy crops like miscanthus to result in feedstock supply for bioener gy, displacing fossil fuels, supply of bio-based materials and also bioenergy coupled to carbon capture (BECCS), all of which are essential components of our

ambition for Net Zero agriculture and will contribute to the overall national goal,” he says.

Over a period of time a crop or management practice becomes carbon neutral and a change in management is then needed to capture more carbon. ▲

“Probably the largest bulk end-market will remain as a feedstock for power generation, which is likely to include carbon-negative technology in the future, but miscanthus also has potential as a fuel for

Miscanthus acts as a net carbon absorber which helps mitigate against greenhouse gas emitted by the land-use sector,says Alex Robinson.

district heating, as a supplement to wheat straw for anaerobic digestion, and as a source of fibre products for a growing bioeconomy.”

Expanding the sustainable future of the crop is miscanthus specialist Terravesta, a company which works with over 300 growers throughout the UK, facilitating planting, providing agronomic support, securing markets and offering long term contracts.

“Agriculture is seen as a significant carbon net emitter. With miscanthus, what you have is a proportion of land that’s a net carbon absorber which helps to mitigate against greenhouse gas emitted by the land-use sector,” says Alex Robinson, the company’s operations director.

Rob Meadley,agricultural business consultant for Brown and Co and an East Yorkshire arable farmer,grows 12ha of miscanthus on outlying land of varying quality which wasn’t delivering a viable return with arable crops.

His crop is coming up to eight years old and had a slightly difficult start.Rob planted miscanthus in March 2012 in good conditions, but this was followed by the wettest April on record,meaning the freshly planted crop was in standing water and then the bad weather hit again in June.

“We therefore couldn’t control weeds on a poor-quality field with a heavy weed burden,”he says.“We applied a selective herbicide in August that year,then the following year we topped it and controlled the weeds.Apart from a little patch spraying in 2014,no herbicide has been used on the crop,which out-competes the weeds each year.

“The only issue to note was on one of the headlands –– where the forager and baler turns,we noticed compaction.We used a low disturbance subsoiler and this affected the height of the crop across a couple of passes, but the following year it was back to normal.”

Rob explains that the 2014 harvest was affected by the legacy from flooding and lack of weed control,but arable crops would never have survived the conditions that the miscanthus was exposed to and he didn’t lose any money on inputs.“The annual yield quickly recovered,and in 2017 we had a bumper harvest of 13t/ha.”

Rob believes it’s the right crop for this land and has not only met the budgeted return but has introduced additional ecological benefits to the farm.

“We’ve had a number of RSPB surveys done

on the farm and the feedback was that they were genuinely surprised by the abundance and diversity of birds in and around the miscanthus, including curlews,rarely found in East Yorkshire,”explains Rob.“We also saw breeding deer,brown hares and an abundance of invertebrates.”

The miscanthus-planted area has allowed Rob to square off an arable crop next to it and has also helped to naturally control blackgrass. The field is two miles away from the farm, meaning the minimal maintenance required is noticeable,he notes.

Ultimately,Rob says that there wouldn’t have been another option for a crop on that land which would have been as profitable.“In 2012 when we decided to plant miscanthus,the principle was looking at the whole farm net margin and identifying the risk in this area.

“It wasn’t performing as well as other parts of the farm and miscanthus was 100% the right decision for it.The only other option for that land would have been environmental grass,but miscanthus beats this hands-down from a net margin point of view

“Miscanthus is a vitally important crop due to

Terravesta is working with scientists to introduce new ‘performance hybrids’ to the market which can be cultivated from seed rather than having to plant a rhizome.

“Not only is there a case for planting miscanthus for environmental reasons, it helps boost food production on-farm and it makes good business sense because it’s grown on unviable farmland, which struggles to yield annual crops, and improves the quality of the land.”

The perennial energy crop can grow to heights of up to 3.7m and has the potential to yield 15t/ha, which can give a return of £900/ha after establishment costs have been paid back. The new performance hybrids provide an average net profit of £558/ha/annum over 15 years.

So what about agronomy? Miscanthus

Since planting miscanthus,the abundance and diversity of birds in and around the crop has increased in RSPB surveys,says Rob Meadley.

its soil carbon capabilities and positive ecological impact, and with the uncertainty around farm subsidies under the Environmental Land Management (ELM) model,it provides a long-term fixed price, reliable income,”he adds.

The miscanthus crop grows up to about 3.7m tall and produces a stem, which is primarily used as a biofuel but its use is expanding rapidly into new markets.

requires minimal inputs once established, because the root stock or rhizome, recycles nutrients back into the soil, so no fertiliser application is required.

“Planting takes place in the spring and there’s a minimal herbicide input once established as the crop suppresses annual weeds, such as blackgrass, because its high canopy out-competes it,” says Alex.

As miscanthus is harvested annually between March and April, and has a productive life of 20+ years, growers consider it a long-term, low maintenance investment that provides an assured income well into the future.

Terravesta offers long-term, index-linked, fixed price contracts for miscanthus. “The upfront cost is £1,500/ha, which is significant but with yield improvements, a return on investment is quicker and its zero inputs means the crop delivers a reliable annual income,” says Alex.

The market for miscanthus is seeing sustainable growth and is currently expanding, with several different end-markets including whole bale power stations –– Terrvesta currently supply Brigg in Lincolnshire and Snetter ton in Nor folk on long ter m contracts.

Other markets include horse

and poultry bedding, consumer briquettes, miscanthus logs and firelighter ranges, and current development into future markets include construction, biofuels, composite materials, medical/cosmetic applications, land remediation, and as a bioherbicide replacement for glyphosate.