INTERNATIONAL GROWTH

GLOBAL ENERGY NEWS

ENERGY PROJECTS MAP

INTERNATIONAL GROWTH LEGAL RENEWABLES CONTRACT AWARDS

ANALYTICS EVENTS Vulcan Completion Products Expands in Asia with New Kuala Lumpur Office

STATS

By Qatar Airways

GLOBAL ENERGY NEWS

ENERGY PROJECTS MAP

INTERNATIONAL GROWTH LEGAL RENEWABLES CONTRACT AWARDS

ANALYTICS EVENTS Vulcan Completion Products Expands in Asia with New Kuala Lumpur Office

STATS

By Qatar Airways

Our corporate rewards programme, Beyond Business, offers Small and Medium Enterprises flexibility and exclusive savings.

Your company can benefit from: *

Privilege Club: Your employees benefit by earning Avios as members

Voluntary Carbon Offset: Travel consciously with Qatar Airways and earn Qrewards.

Enhanced travel experience: Dynamic flight redemptions on last-minute travel

Exclusive savings and enhanced flexibility: Save business money and help employees to travel smart

Earn Qrewards: Redeemable for flights and more

Account Management: With access to a live performance dashboard

Welcome to the November edition of ‘OGV Energy Magazine’ where this month we are very excited to once again be attending ADIPEC in Abu Dhabi - the world's largest energy conference and exhibition and with this in mind, this month we are rightly exploring the theme of ‘International Growth’ and championing the supply chain businesses who are increasing their footprint in new global markets.

A big thank you to our front cover partner Vulcan Completion Products and you can read all about the launch of their brand new office in Kuala Lumpur on pages 4-5 inside.

We are also delighted to welcome contributions from GDI, Petrasco Energy Logistics, TWMA, Newland Oil Tools, Rotech, Elemental Energy, KCI, Westerton Access, The Impulse Group, Drager, THREE60 Energy, J&S Subsea, Kent, Brodies and ABB.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Middle East and the US, along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

Warm regards, Dan Hyland - Director

Global oil and gas completions specialist, Vulcan Completion Products, has strengthened its presence in the Asia-Pacific (APAC) region by relocating to a significantly larger office in Kuala Lumpur.

The move, which quadruples the size of the company’s original office just a few months since its initial opening, reflects Vulcan’s growing influence in and commitment to increasing its reach in Asia and Australia.

The boosted Kuala Lumpur office now houses four full-time employees, with three additional team members based in Indonesia and Vietnam, all working to serve a growing number of customers across the APAC market.

Malaysia, which joined Vulcan’s global network earlier this year, has quickly become an important hub for fostering client relationships and deepening the company’s foothold in the region as well as becoming an essential contributor to overall company growth.

Since 2023, Vulcan has expanded its workforce by 50%, and now employs over 30 people across key international locations including the UK, US, Dubai, Baku, Saudi Arabia, Vietnam and Jakarta.

Far from resting on their laurels, the team is now seeking to expand Vulcan’s corporate horizons even further and has set its sights on onshore and offshore growth in Africa. Here, from Guinea-Bissau, Kenya to Sth. Africa are among the countries where significant inroads are being made in growing Vulcan’s presence thanks to the securing of a clutch of key contracts.

Supporting this brisk international growth across the board is Vulcan’s newly established ISO9001-accredited research and development hub at its global headquarters in Westhill, Aberdeenshire. The eight-strong R&D team based there is awash with more than 140 years combined experience and is focused on innovation, enabling Vulcan to continue leading the market with new products and technological advancements.

Recent investment in well design software ensures the perfect marriage of experience and resources to offer a bespoke service which is unparalleled, and 57 worldwide patents mark Vulcan’s products out as truly

unique, trailblazing solutions in a class of their own.

Ian Kirk of Vulcan Completion Products commented on the Kuala Lumpur expansion: “The APAC region has always been a key market for us, and its future potential is undeniable. Moving to a larger office in Kuala Lumpur positions us well for continued growth, and we’re eager to leverage this new space as a launchpad for further expansion in this exciting part of the world.”

Vulcan Completion Products (VCP) draws on more than 200 years of combined industry experience to offer bespoke, innovative, and ground-breaking solutions. From centralisation, reamer, and guide shoes to float equipment, cement plugs, collars, and cable protectors VCP has an unmatched record of success, with the emphasis firmly on being a quality service provider who consistently exceeds client expectations.

To find out more about Vulcan Completion Products, visit www.vulcan-cp.com email Sales@Vulcan-CP.com or visit stand #CN23 at ADIPEC in Abu Dhabi, UAE from November 4-7, 2024.

Editorial

+44

Advertising

+44 (0) 1224 084

Design

Editorial

Atlas Professionals is a leading international recruitment company, that connects professional staff with the energy, renewable and marine industries. With over 40 years of experience, Atlas delivers from boardroom to site, land to sea, hardware to software, in local, global and emerging markets, the knowledge required to solve complex staffing challenges, through a team of multi discipline experts.

www.atlasprofessionals.com

Formed in 2015, during a time of instability and uncertainty in the energy markets, Westerton Access realized that the industry uncertainties provided a unique opportunity to create and implement new inspection methods which were more fitting to the industry in its current climate.

www.westerton.com

Recognising the relentless challenges facing operators to maintain full production and extend the life of mature assets, KCI offers a range of unique products and services specifically designed to reduce costs and minimise downtime, whilst maintaining or increasing production across: sub sea, surface, refinery, down hole, topside pipeline and other applications.

www.kciltd.co.uk

Founded in 2011, we have over 10 years’ experience delivering large and complex subsea projects. From our headquarters in Stavanger, and offices in Oslo, Houston, Aberdeen and Dubai, we have successfully executed more than 100 projects around the globe.

WWW.oceaninstaller.com

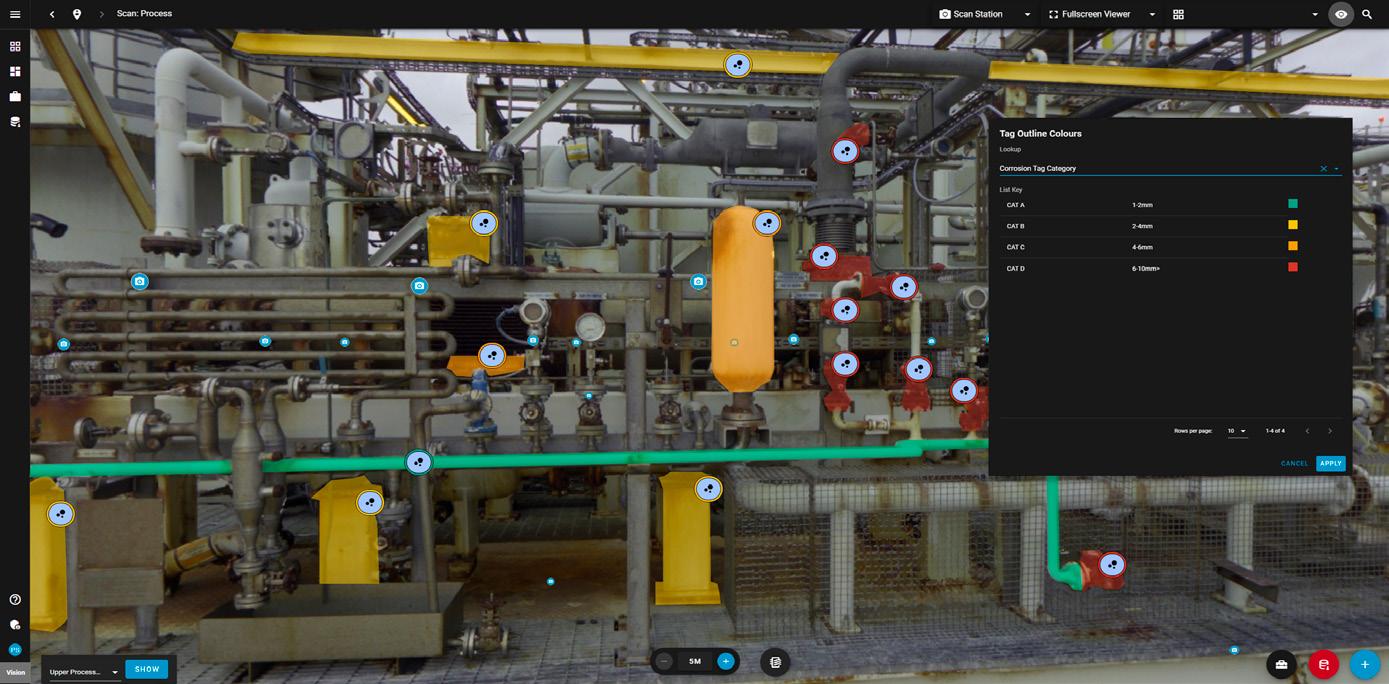

Our mission is to deliver advanced digital twin solutions and comprehensive services, integrating our core values of Innovation, Relationships, Value, and Trust. Through cutting-edge digital twin software and AI technologies, we aim to transform industries, enhance operational efficiencies, and build enduring partnerships.

www.envizion.digital

WSG Energy Services is a global specialist service provider to traditional and burgeoning clean energy infrastructure. From new build construction, shutdown, turnaround events and maintenance to decommissioning, WSG provides an integrated range of integrity and commissioning services.

www.wsgenergyservices.com

OCI partners with large corporates and governments globally. We link directly into their supply chain; leveraging our global network and specialist expertise, engineering solutions across sourcing, logistics and finance to unlock their true potential.

a clear mission: to deliver world-class training, management, and consultancy services across the global industrial sector. Our journey began with a strong focus on excellence, safety, and innovation.

Over the years, we've grown into a leading provider of specialized solutions in fabric maintenance, coatings, painting, and blasting.

www.romeoalphainternational.com

We are Marsh Commercial; a business with global backing and a local focus, that comes from a reassuring heritage with decades of experience. We’re proven and trusted experts.

www.marshcommercial.co.uk

By Tsvetana Paraskova

The future of Great British Energy and prospects of the offshore industry in the UK’s changing fiscal environment were key themes in the UK North Sea industry in the past month.

Great British Energy (GB Energy) will be based in Aberdeen, the UK government announced at the end of September.

Aberdeen City Council Co-Leaders, Councillors Ian Yuill and Christian Allard, commented,

“As the energy capital of Europe, Aberdeen is best placed in Scotland to be home to the UK Government’s GB Energy headquarters. Aberdeen has been a magnet for energy investments for decades and the city has already established itself as a renewables hub with businesses investing in offshore wind and green hydrogen.”

GB Energy’s base in Aberdeen will help secure future investments in the sector and will help confirm Aberdeen as the Net Zero Capital of Europe.

“Aberdeen's entrepreneurial and innovative energy businesses have the people, the experience, the skills, and the business knowhow in leading the energy transition worldwide,” Yuill and Allard said.

Offshore Energies UK, the leading trade body, also welcomed the announcement that GB Energy will be located in Aberdeen.

“The city has been Europe’s energy capital for the last fifty years and with the right energy policies in place to back firms and their workers, it can continue to spearhead the UK’s homegrown energy transition,” OEUK said.

David Whitehouse, CEO Offshore Energies UK commented:

“Aberdeen is an energy powerhouse and home to brilliant British engineering. It must and should be part of the UK’s energy future. The people of this city are rightly proud of their energy heritage and it’s imperative GB Energy helps to safeguard their jobs and build on their world class expertise to benefit the whole UK.”

At OEUK’s Annual Conference in September, CEO Whitehouse said that the offshore industry needs long term planning and stability.

“The North Sea, its people, skills, and companies, are a strength and remain a vital part of our energy ecosystem. Our world class supply chain companies use the revenue from oil and gas activity to invest in our energy future. A homegrown energy future,” Whitehouse noted.

The UK oil and gas industry has more than halved methane emissions since 2018 and reduced overall emissions associated with the production of oil and gas by 28 percent in the same time frame, new figures in OEUK’s 2024 Emissions Reduction Report showed.

This reduction means the UK will achieve targets agreed with the government for methane reduction seven years ahead of the 2030 deadline and exceed the 25-percent reduction target for production emissions four years ahead of schedule.

OEUK analysis shows that almost 70 percent of the reductions have been achieved through

operator improvements such as modifying power systems used to extract oil and gas from reservoirs deep under the seabed, or introducing new systems to capture unused gas under pressure that was previously burned off for safety reasons.

Emissions from these so-called flaring and venting processes have also fallen by more than half in the past five years.

Assessments by OEUK also showed the North Sea still has the potential to unlock the equivalent of 13.5 billion barrels of domestic oil and gas.

“Oil and gas will remain essential for decades to come. It is better from all points of view –financial, environmental and social that energy comes from our own homegrown North Sea supplies,” said Mark Wilson, HSE & Operations Director at OEUK.

At OEUK’s Wells Conference in early October, Wilson warned of the widening gap between UK energy production and consumption. The UK is producing less energy than ever before – the equivalent to only 60 percent of demand, Wilson said.

Well drilling activity has also significantly reduced, dipping by nearly 60 percent in the last ten years as oil and gas reserves have declined, but also as a consequence of lack of investment, according to OEUK.

“As the UK’s oil and gas production declines, the chasm between the energy we create and the energy we consume grows,” Wilson said.

“The government acknowledges that we need oil and gas for decades to come. We must mind the gap between the UK’s energy consumption and falling levels of production, or risk becoming more reliant on imports than ever before.”

Added Wilson, “The UK, its politicians, people, and businesses must be conscious of this energy gap and the implications it has for our energy security, economy, supply chain and skills.”

Stuart Payne, chief executive of the North Sea Transition Authority (NSTA), told OEUK’s annual conference in Aberdeen the oil and

gas industry can rise to the challenges posed by the energy transition and make the North Sea’s next chapter its best chapter. Payne also urged industry to maintain a sharp focus on the basics: safety, emissions cuts, timely well decommissioning, and greater diversity. This could help the industry to get the energy transition right and “the UK can be a shining example of how to transition an oil and gas province into a clean energy super basin,” Payne added.

The NSTA has published new guidance to help multi-million-pound transactions complete more smoothly. The regulator has finalised a set of recommended principles and practices which will encourage buyers, sellers, and interested third parties to work together to ensure that transactions go through quickly and the full potential of the North Sea is met.

The guidance has been created to help industry minimise transaction delays which increase costs, prolong uncertainty, hold up operational and strategic decisions, damage trust and working relationships among companies working in the Basin, and erect real barriers to investment, the regulator said.

The NSTA and The Crown Estate have published a new Statement of Intent to confirm joint aspirations in ensuring a more sustainable and closely co-ordinated management of the seabed. The statement of intent is aimed at building on close collaboration to date and now proactively share data between the two organisations, where possible. While not legally binding, this agreement represents a shared commitment to fostering sustainable marine development and supporting the UK's energy transition, the NSTA said.

“This will enable marine development and support a co-ordinated approach to the leasing and licensing of carbon storage, helping to make the UK a worldleading destination for CCUS project investment and the supply chain,” the regulator noted.

The UK North Sea’s oil and gas future hangs in the balance amid the recent ad hoc changes in fiscal policy, energy consultancy Wood Mackenzie said in an analysis in October.

The UK government must implement, as soon as possible, a more predictable tax regime that provides greater long-term stability to the North Sea oil and gas sector, the analysis found.

Despite recognizing that oil and gas will be needed for decades to come, the UK government’s recent and proposed modifications to the Energy Profits Levy (EPL) – currently set to end in 2030 – have created “unparalleled sector uncertainty and consternation”, the report states.

“North Sea oil and gas operators are trying to make long-term financial decisions beyond 2030, but the current fiscal regime does not allow for such clarity,” said Graham Kellas, Senior Vice President, Global Fiscal Research at Wood Mackenzie.

“Price responsiveness, predictability, fairness, simplicity and transparency must all be considered to ensure the correct outcome is reached at what is a crucial juncture for the sector.” In company news, Eni completed in early October

the combination of substantially all of its upstream assets in the UK, excluding East Irish Sea assets and CCUS activities, with Ithaca Energy plc.

The merger reaffirms the commitment of Eni in the UK, where it is engaged across the entire energy value chain, including upstream oil and gas, renewables, CCS projects, and potential future development of magnetic fusion projects.

“Following the Combination, Eni is a fully committed, long-term and supportive shareholder of Ithaca, that is now positioned as the largest resource holder in the UK North Sea with a diversified portfolio of production and development opportunities, that has the ability to underpin material long-term organic growth, delivering the oil and gas essential for energy security while supporting the UK’s decarbonisation targets,” the Italian company said.

Deltic Energy recognised an impairment of £18.0 million for the first half of 2024, resulting from the decision to notify the partners of Licence P2252 of the company’s intention to withdraw from the Pensacola licence.

In the outlook for the near term, Deltic said that it continues to engage in and support industry lobbying efforts, and “it is hoped that the new Government's first budget will provide an element of clarity and much needed stability if the UK oil and gas industry is to avoid an accelerated decline.”

The fact that we are in the second half of the year and Selene is the first exploration well to be drilled in the UKCS clearly demonstrates the impact that political and fiscal instability has had on levels of activity and investment, Deltic said.

“Therefore, until further clarity exists Deltic intends to limit further investment in its UK portfolio (other than Selene) and will look to pursue opportunities overseas in jurisdictions that are more favourable and supportive of the oil and gas industry,” the company added.

At the beginning of October, Serica Energy plc confirmed that the B6 well on the Bittern field, which commenced initial flowback to the Triton FPSO on 11 September, is now producing at a stable rate. The well is producing oil and gas at a combined gross rate of around 8,000 boepd, a total of around 5,200 boepd net to Serica.

Meanwhile, drilling and completion activities on Serica’s 100-percent held Gannet GE-05 well have now concluded. Data collected during drilling have shown encouraging results, and production is expected to commence around the start of November, the company said. The COSL Innovator rig is now moving to drill the next well in the campaign, on the Guillemot NW field, in which Serica has a 10-percent interest.

By Tsvetana Paraskova

The directorate has found that the discoveries are valued at three times the costs expended.

Exploration activity, discoveries, and project advancement offshore Norway, the UK’s clean energy strategy and policy, and milestones in renewable projects featured in Europe’s energy market over the past month.

In Norway, the Norwegian Offshore Directorate said that it believes new innovations within hydraulic fracturing should lead to the development of more discoveries in tight reservoirs. The Directorate is now challenging the industry to have a go at one of the largest puzzles of all – the Victoria discovery in the Norwegian Sea. At the time when it was discovered and explored in the 2000s, existing technology indicated it would be challenging to develop.

With the advances in fracking in recent years, the Norwegian regulator is now challenging operators to take a new look at the Victoria discovery.

“This is one of the largest remaining gas discoveries on the Norwegian continental shelf (NCS) that is still not covered under a production licence,” said Arne Jacobsen, Assistant director of Technology, analyses and coexistence at the Norwegian Offshore Directorate.

“This is acreage that the companies can apply for in the next APA (Awards in Predefined Areas). Previous work on the discovery has shown around 140 billion standard cubic metres of gas in place, and the study reveals that four wells could yield production of 29 billion cubic metres.”

Exploration activity offshore Norway has been profitable in all areas in the shelf over the past two decades, an analysis by the Norwegian Offshore Directorate showed.

Moreover, all exploration investments between 2004 and 2023 have already been repaid by the discoveries that have come on stream. About 50 of 190 discoveries have been developed and are producing oil and gas.

“This means that around three-quarters of the resources discovered during these years have yet to be produced. These investments will remain profitable as more fields come on stream,” the directorate said.

Continued exploration offshore Norway is necessary for a sustained production in the long term, the regulator noted. Large discoveries contribute the most to value creation, but are also crucial for establishing new infrastructure in new areas that makes it possible to develop smaller discoveries, according to the directorate.

Norwegian oil and gas operator DNO ASA has confirmed the size of the pay-opening Heisenberg oil and gas discovery in the Norwegian North Sea made in 2023.

After completing in late September 2024 the second well delineating the discovery, DNO said that the well encountered a six-meter oil-filled Eocene sandstone reservoir. The well confirmed the Heisenberg volume estimate of 24 to 56 million barrels of oil equivalent (MMboe) with mean of 37 MMboe.

The license partnership, which in addition to DNO Norge AS (49 percent) includes operator Equinor Energy AS, is studying a tieback of Heisenberg to nearby infrastructure, potentially jointly coordinated with the development of other recent discoveries in this highly prolific area surrounding the Troll and Gjøa production hubs.

Equinor has announced that the floating production, storage and offloading vessel (FPSO) is now securely anchored on the Johan Castberg field in the Barents Sea.

The FPSO is now being hooked-up to the subsea facilities, preparing it for production start-up towards the end of the year.

Johan Castberg, with estimated recoverable volumes of between 450 and 650 million barrels, is expected to produce for 30 years, and at its peak, the field may produce 220,000 barrels per day.

Aker Solutions has been awarded a sizeable EPCIC contract by Equinor to prepare the topside of Troll A for accelerating production from the Troll West gas reservoir in the Troll Phase 3 stage.

Eni, which secured UK government funding for Liverpool Bay CO₂ Transport and Storage Project, a significant milestone in the development of the HyNet CCS project, said that the allocation of funding marks the launch of the UK’s CCS industry.

The funding includes investment for Track 1 industrial emitters and is a key milestone towards the execution phase of HyNet, which will unlock significant investment in the area.

“HyNet will become one of the first lowcarbon clusters in the world and the project will decarbonise one of the key energyintensive industrial districts as well as unlock significant economic growth in this region of the UK,” Eni CEO Claudio Descalzi said.

“This commitment is clear evidence of how governments and industry can work together to implement pragmatic and effective industrial policies, in order to accelerate decarbonisation.”

"HyNet will become one of the first lowcarbon clusters in the world and the project will decarbonise one of the key energy-intensive industrial districts as well as unlock significant economic growth in this region of the UK,”

The UK is sitting on a £12 billion a year investment opportunity to develop offshore wind, with a highly skilled domestic workforce and world-class engineering capability to win wind energy development work abroad, offshore industry body OEUK says.

move to help turbocharge the UK’s green energy revolution.

Octopus seals the deal on four new solar farms being developed by BayWa r.e. in Bristol, Essex, East Riding of Yorkshire, and Wiltshire. The solar projects will have a combined capacity of 222 MW, in addition to a 30 MW battery located on one of the sites.

With the latest additions, Octopus now backs 16 onshore wind farms, 3 offshore wind farms, 3 battery projects, 138 solar farms, and thousands of rooftop solar projects in Britain, the company said.

Germany-based RWE, which is the UK’s leading power generator, has announced the start of construction of a further four of its solar projects in the UK. It brings the total number to 11, and marks another step in the growth of the company’s renewable energy footprint in the UK.

The Troll field in the North Sea is Norway’s largest gas producer, supplying 10 percent of Europe’s total gas needs. Troll Phase 3 involves producing the gas cap overlying the oil column in Troll West, while also continuing the production of oil.

The UK government confirmed in early October up to £21.7 billion of funding available, over 25 years, to make the UK an early leader in two growing global sectors, CCUS and hydrogen, to be allocated between these two clusters.

The government confirmed the funding to launch the UK’s first carbon capture sites. The UK will be among the first to deploy CCUS technology at scale in Teesside and Merseyside – capturing CO2 emissions before they reach the atmosphere and storing them away safely.

The projects are expected to create thousands of jobs, attract £8 billion of private investment, and accelerate the UK towards net zero in 2050, the government said.

Eni, Equinor, and bp will be among the first beneficiaries of funding for these projects as they are developing the CCUS hubs.

“This announcement represents another step forward for the Northern Endurance Partnership and East Coast Cluster,” said Louise Kingham, SVP Europe and head of country, UK for bp.

Currently, OEUK members are building 13 GW of the government’s production target of 55 GW of wind energy by 2030, Offshore Energies UK director Katy Heidenreich said at the 2024 Celtic Sea FLOW (Floating Offshore Wind) summit. The UK offshore wind sector needs to pull together investors and businesses with the capacity to make this ambitious energy production target a reality, Heidenreich added.

RenewableUK Cymru is calling on the Welsh Government to take urgent action to expedite decision-making, following news that three onshore wind farms with a combined capacity of over 200 MW have been delayed yet again.

Norway’s energy major Equinor has bought 9.8% of Denmark-based Ørsted, the world’s biggest offshore wind farm developer. Equinor thus becomes Ørsted’s second largest shareholder after the Danish State, which holds a controlling stake in the company.

SSE now expects the completion of Dogger Bank A offshore wind farm in the second half of calendar year 2025, later than the previously guided first half 2025, the company said in a trading update in early October.

“Whilst completion of Dogger Bank A offshore wind farm is now expected in the second half of calendar year 2025, project returns are not expected to be materially impacted,” SSE noted.

Octopus Energy’s generation arm has announced plans to invest £2 billion into UK clean energy projects by 2030 in a

The Menter Môn-led Marine Characterisation Research Project (MCRP) has said that Natural Resources Wales successfully completed the environmental plan for the Anglesey tidal energy project. Menter Môn Morlais Ltd owns and manages Morlais, including the recently completed landfall substation on the outskirts of Holyhead. It also holds the Marine Licence, which means they are legally responsible for the project. The first tidal energy devices will be deployed in the sea in 2026. The project is funded through the Crown Estate and Nuclear Decommissioning Authority.

Statera Energy has submitted plans for the UK’s first utility-scale green hydrogen project to be built in Aberdeenshire. Kintore Hydrogen will help balance a renewables-led power system by using surplus renewable energy to produce green hydrogen. Once constructed, Kintore Hydrogen will be the largest project of its kind in Europe. The first 500 MW of operational capacity is expected to be online by 2028, and when operating at its full, 3 GW capacity Kintore Hydrogen could save up to 1.4 million tonnes of CO2 per year.

Equinor has announced that the world’s first cross-border CO2 transport and storage facility has been completed and is ready to receive and store CO2. In late September, the Northern Lights CO2 transport and storage facility was officially opened in Øygarden, near Bergen. The Northern Lights facility is a joint venture between Equinor, Shell, and TotalEnergies.

The full-scale project includes capture of CO2 from industrial sources and shipping of liquid CO2 to the terminal in Øygarden. From there, the liquefied CO2 will be transported by pipeline to the offshore storage location below the seabed in the North Sea, for safe and permanent storage.

By Tsvetana Paraskova

US oil and gas activity has slowed in recent months as the outlook on international oil and gas prices becomes increasingly uncertain while the upcoming US presidential election is also raising uncertainty among American energy producers. .

Oil and gas sector activity in Texas, northern Louisiana, and southern New Mexico fell slightly in the third quarter of 2024, according to the latest quarterly Dallas Fed Energy Survey of company executives.

The business activity index, the survey’s broadest measure of the conditions energy firms face in the area, slumped from 12.5 in the second quarter to -5.9 in the third quarter. The business activity index was 0 for exploration and production (E&P) firms compared with -18.1 for services firms, suggesting activity was unchanged for E&P firms but declined for service firms, the survey found.

In terms of production, the oil production index increased from 1.1 in the second quarter to 7.9 in the third quarter, suggesting oil production slightly rose during the quarter. But the natural gas production index fell from 2.3 to -13.3, suggesting natural gas production decreased in the quarter.

Costs for companies continued to increase, but at a slower pace compared to the previous quarter, according to the survey.

The company outlook index turned negative in Q3, plunging by 22 points to -12.1, suggesting that firms are now modestly pessimistic about their future business. Uncertainty soared, with the overall outlook uncertainty index jumping by 25 points to 48.6.

On average, company executives polled in the survey expect a West Texas Intermediate (WTI) oil price of $73 per barrel at year-end 2024, with responses ranging from $55 to $100 a barrel. Longer-term expectations point to average forecasts of a WTI oil price of $81 per barrel two years from now and $87 per barrel five years from now.

Survey participants expect the US benchmark natural gas price Henry Hub to rise from current levels, expecting $2.62 per million British thermal units (MMBtu) at year-end, $3.24 per MMBtu two years from now, and $3.89 per MMBtu five years from now. For reference, WTI spot prices averaged $70.82 per barrel and Henry Hub spot prices averaged $2.23 per MMBtu during the survey collection period, 11-19 September.

The low prices for natural gas in the Permian, at the Waha hub, are weighing on gas production and plans for future drilling, according to respondents in the survey. Most companies, or a total of 80 percent of executives, said they are not planning to ramp up well completion activities in the Permian Basin once the natural gas pipeline bottleneck clears. The remaining 20 percent said their firm plans to do so.

There are no bottlenecks in crude pipelines, executives said. A total of 92 percent of executives do not expect their firm’s crude oil production to be limited between now and the end of 2026 due to crude oil pipeline capacity constraints in the Permian. Only 8 percent said that they expect constrained production.

Electrification of oilfield operations has gathered momentum as companies look to cut emissions from operations and diesel use. Eighteen percent of executives said their firm’s oilfield operations are already fully electrified. Another 6 percent of executives said they aim to completely electrify oilfield operations for their firm, and an additional 31 percent said they expect to partially electrify operations. The remaining 45 percent said they do not plan to do so.

However, companies face challenges in electrifying their oilfield operations.

Among firms focused on the Permian and aiming to electrify oilfield operations, or that have already done so, the top selected challenge was “uncertainty about future access to the grid” (29 percent). Among firms primarily focused outside the Permian, the top selected challenge was “too expensive” (30 percent), followed by “lead times for equipment” (26 percent).

Among respondents not looking to electrify, the most-cited response was “too expensive” (48 percent), followed by both “uncertainty about future grid stability” and “other,” which were each selected by 17 percent of respondents.

“Most of our rigs are capable of running off grid power, but the logistical (regulatory and permitting) hurdles that our customers have to go through to bring power to the rig is formidable and expensive,” an executive at an oil and gas service firm said in comments to the survey’s special question on electrification.

Another executive at an oilfield services firm said, “To add the additional costs to electrify equipment, the returns have to be there through higher prices or reduced costs. That is not the case in our segment.”

the election uncertainty and the anticipated impact on the overall market.”

An oilfield services firm executive said that “The consolidation and shutting down of oilfield service firms will hurt the ability of the U.S. to ramp up in the face of international supply disruptions.”

Lower natural gas prices in the US in early 2024 weighed on the cash flows from operations of the oil-focused public companies, according to an analysis of the financial results for 36 publicly traded US oil exploration and production (E&P) companies by the US Energy Information Administration (EIA).

In the first quarter of 2024, lower crude oil and natural gas prices reduced cash from operations for these companies by 12 percent compared with the first quarter of 2023, to $23.3 billion. Although West Texas Intermediate crude oil prices fell by 2 percent over this period, US crude oil production by these companies rose by 5 percent to nearly 4.2 million barrels per day (bpd), the EIA said.

Natural gas prices slumped by 26 percent from the first quarter of 2023 to the first quarter of 2024 and reached their lowest average monthly inflation-adjusted price since at least 1997.

Although the companies in the analysis focus on crude oil production, natural gas still typically makes up around 30 percent of what they

"Mergers and acquisitions in the US oil and gas industry continued their momentum in the second quarter as pressure grew on some producers to boost scale and production to compete with peers."

Additional comments also signalled that suppliers are not manufacturing electrical options for many types of machinery being used in drilling and well services.

The general comments of the survey respondents continue to reflect frustration with the current US policies in the sector and increased uncertainty about domestic politics and geopolitical developments.

“Recent volatility has started to impact planning discussions for 2025. We have not adjusted our plan yet, but we are starting to work on potential drilling plans for a lower commodity environment,” one E&P company executive said.

Another one noted, “There is greater uncertainty surrounding the economy and the oil market. Much of this has to do with

produce because of associated natural gas present in crude oil deposits and more diversified operations by some of the E&P companies in the group, according to the administration.

In early October, a month ahead of the presidential election, the American Petroleum Institute (API) released new polling showing nearly 9 in 10 voters in key battleground states are looking for details from presidential candidates on energy issues.

The poll conducted by Morning Consult for API also found that 9 in 10 battleground state voters are concerned about inflation and more than 4 in 5 voters agree producing more oil and natural gas in the US could help lower energy costs for American consumers.

Battleground state voters see the domestic production of natural gas and oil in the United States as a positive influence on American energy independence and national security.

Moreover, a bipartisan majority of voters oppose government mandates that would ban gas stoves, gas furnaces, or new gasoline, diesel and hybrid vehicles, the poll showed.

Finally, 9 in 10 voters agree producing oil and natural gas in the US makes the country more secure against actions by countries such as China and Russia.

By Tsvetana Paraskova

lot of spare capacity right now. This capacity could offset the potential loss of oil supply from Iran.

After months of simmering tensions, the Middle East was inflamed again at the end of September with an escalation of the standoff between Israel and Iran. Israel killed leaders of Hezbollah and Hamas in Lebanon as the war expanded, while Iran sent a barrage of missiles on Israel in retaliation.

The worst-case scenario would be Iran attempting to block the Strait of Hormuz, which handles 21 percent of the daily global petroleum consumption. This scenario is however seen as a low-probability event. If the worst comes to the worst, disruption to traffic in the most vital oil shipping lane could send oil prices well above $100 per barrel and to new record highs, analysts say.

The threat to oil supply could be potentially large if energy infrastructure is targeted in an escalation, analysts at Wood Mackenzie said in early October.

If a supply outage were to occur, WoodMac estimates that OPEC has roughly 6 million barrels per day (bpd) of spare productive capacity readily available to come to market should it be required.

However, a further risk for the oil market would be if the Strait of Hormuz were to become inaccessible. Around 20 percent of global crude trade passes through the Strait, as would much of the spare capacity, the analysts noted.

Oil prices haven’t jumped too much due to concerns about global oil demand, especially in China, and to the relative complacency that OPEC’s spare capacity could offset potential losses to supply, unless the mother of all oil shocks – a closure of the Strait of Hormuz –were to occur.

The oil market started to price in a higher war premium, awaiting a response from Israel to the Iranian missile attack. Oil price volatility soared again, as prices moved higher, rising by 13 percent in one week and Brent crude prices reaching $80 per barrel, the highest level since August.

One of the reasons why prices did not shoot up much higher was that the major Middle Eastern oil producers Saudi Arabia and the United Arab Emirates (UAE) are sitting on a

“It looks as if oil and gas traders are betting that supply disruptions can be avoided, in spite of the escalation of the conflict. But if military activity between Israel and Iran intensifies, the upside could be substantial,” according to Wood Mackenzie’s Ann-Louise Hittle, Head of Macro Oils, and Massimo Di Odoardo, Head of Global Gas and LNG Research.

Amid escalating tensions in the Middle East, the OPEC+ group led by the major OPEC producers in the region affirmed its intention to begin unwinding the production cuts from December 2024.

The Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ alliance reviewed the crude oil production data for the months of July and August 2024 and current market conditions at a meeting in early October.

OPEC+ had already announced in early September that they would extend their additional voluntary production cuts of 2.2 million bpd for two months until the end of November 2024, after which these cuts would be gradually phased out on a monthly basis starting 1 December 2024.

OPEC+ initially planned to add a combined 180,000 bpd to their production in October. Now this supply addition has slipped to December and the group confirmed the latest plan during the October meeting.

At the meeting, Iraq, Kazakhstan, and Russia confirmed that they had achieved full conformity and compensation according to the schedules submitted for September, OPEC said.

“The three countries reiterated their strong commitment to maintaining full conformity and compensation throughout the remaining period of the agreement,” the organization noted.

The final assessments of September crude oil production levels will be based on the secondary sources approved by OPEC which provide data on production of countries participating in the Declaration of Cooperation (DoC), the official label of the OPEC+ alliance.

The JMMC panel also “emphasized the critical importance of achieving full conformity and compensation,” adding that it would continue to monitor adherence to the production adjustments.

Several significant deals involving the region’s national oil companies (NOCs) have been signed in recent weeks.

ADNOC, Abu Dhabi’s national oil company, signed in October an investment agreement to buy German chemicals giant Covestro.

The agreement stipulates, among other items, that the bidder, ADNOC, will make a public takeover offer for all outstanding shares of Covestro at a price of 62.00 euros per share. The entire deal is worth 14.7 billion euros ($16.3 billion) including debt.

“The offer will be subject to a minimum acceptance level of 50 percent plus one share and customary closing conditions, including merger control, foreign investment control, EU foreign subsidies clearances,” Covestro said.

The deal would be one of the largest cash transactions in the chemicals industry ever, as well as the first time a company part of the DAX 40 blue-chip index in Germany would be acquired by a state company from the Gulf.

“This strategic partnership is a natural fit and aligns seamlessly with ADNOC’s ongoing smart growth and future proofing strategy and our vision to become a top 5 global chemicals company,” said Sultan Ahmed Al Jaber, ADNOC Managing Director and Group CEO.

Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Chairman of the Abu Dhabi Executive Council, has chaired a meeting of the Executive Committee of the ADNOC Board of Directors, at which His Highness endorsed ADNOC’s innovative Artificial Intelligence and Digital Technology (AIDT) strategy, ENERGYai. The strategy aims to harness the power of AI to drive efficiency, sustainability, and growth across the group’s operations. The crown prince commended ADNOC for its ambition to become the world’s most AI-enabled energy company and for emerging as a global leader in AI, setting new benchmarks for use of the technology in the energy sector.

In Saudi Arabia, state oil giant Aramco completed in early October a $3 billion international sukuk issuance, comprised of two US dollar-denominated tranches. The first tranche of $1.5 billion is maturing in 2029, carrying a profit rate of 4.25% per annum, and the second tranche of $1.5 billion matures in 2034, carrying a profit rate of 4.75% per annum. The offering received strong demand and was six times oversubscribed.

“Building on the strong investor reception from our July 2024 bond issuance, this sukuk offering represented an opportunity to engage with a broader investor base,” Ziad T. AlMurshed, Aramco Executive Vice President and CFO, said.

Saudi Aramco also announced new agreements with key Chinese partners during a visit to the Kingdom of Saudi Arabia by a senior delegation led by Chinese Premier Li Qiang.

The agreements include preliminary documentation relating to a Development Framework Agreement with Rongsheng Petrochemical Co. Ltd. and a Strategic Cooperation Agreement with Hengli Group Co., Ltd.

With Rongsheng, Aramco plans the potential joint development of an expansion of Saudi Aramco Jubail Refinery Company (SASREF) facilities. This includes Rongsheng’s potential acquisition of a 50-percent stake in SASREF, the development of a liquids-to-chemicals expansion project at SASREF, Aramco’s potential acquisition of a 50-percent stake in Rongsheng affiliate Ningbo Zhongjin Petrochemical Co. Ltd. (ZJPC), and participation in ZJPC’s expansion project.

The agreement with Hengli Group advances talks relating to Aramco’s potential acquisition of a 10-percent stake in Hengli Petrochemical Co., Ltd., subject to due diligence and required regulatory clearances. It follows the signing of a Memorandum of Understanding in April 2024 regarding the proposed transaction.

QatarEnergy, the state firm of Qatar, has signed an agreement with China State Shipbuilding Corporation (CSSC) for the construction of six additional state-of-the-art QC-Max vessels, bringing the total number of LNG vessels on order under its fleet expansion program to 128, including 24 QC-Max mega vessels.

The QC-Max vessels which will be built at CSSC’s wholly owned subsidiary, HudongZhonghua Shipyard, are the largest LNG vessels ever built with a capacity of 271,000 cubic metres each. The new carriers are scheduled to be delivered between 2028 and 2031.

“The signing of today’s agreement is underscored by the strategic importance of QatarEnergy’s historic LNG fleet expansion program and its commitment to maintaining a leadership position in the global LNG market,” said Saad Sherida Al-Kaabi, Qatar’s Minister of State for Energy Affairs, who is also president and CEO of QatarEnergy.

Wellpro Group & Omega Well Intervention provide a complete Thru Tubing, Inflatable Packer & Well Intervention portfolio including operational design, project management, service, rental & sales.

By Tsvetana Paraskova

Australia, one of the world’s top LNG exporters and a major lithium and nickel producer, is looking to become a clean energy powerhouse while maintaining security of energy supply.

Australia’s Labour government is backing exploration and higher production of natural gas to provide domestic energy supply and export LNG to allies. At the same time, the country is investing billions of US dollars in incentivising renewable energy generation and critical minerals production and processing.

The government unveiled in May this year its Future Gas Strategy in which the country would continue to support exploration and increased production of natural gas. The fuel is set to play a key role in Australia’s transition to a net-zero economy by 2050 and help provide a reliable source of energy to Australia’s allies, the government said.

The government has also found that new sources of gas supply are needed to meet demand during the economy-wide transition.

The gas strategy identified that Australia needs to prevent gas shortfalls by working with industry and state and territory governments to encourage more timely development of existing gas discoveries in gas-producing regions.

“The Strategy makes it clear that gas will remain an important source of energy through to 2050 and beyond, and its uses will change as we improve industrial energy efficiency, firm renewables, and reduce emissions,” said Madeleine King, Minister for Resources and Northern Australia.

“But it is clear we will need continued exploration, investment and development in the sector to support the path to net zero for Australia and for our export partners, and to avoid a shortfall in gas supplies,” the minister added.

Currently, natural gas supplies 27 percent of Australia’s energy needs and accounts for 14 percent of Australia’s export income, the government said.

Gas will also have an important role to play in firming renewable power generation and is needed in hard-to-abate sectors such as manufacturing and minerals processing until viable efficient and cost-effective alternatives are available, it noted.

“Gas is crucial for A Future Made in Australia as it supports manufacturing, food processing and refining of critical minerals which will help Australia and the world to lower emissions,” the government said.

Australia will have sufficient supply to meet demand for gas in the east coast in 2024 to 2026, the Australian Competition and Consumer Commission (ACCC) said in its latest interim update on the east coast gas market from June 2024.

The recently-announced extension to the life of Eraring Power Station has improved the outlook in the east coast market in 2026 and

2027, but the fundamental trajectory of supply has not altered and is projected to decline and lead to growing annual shortfalls from 2027 unless new gas supply is not available, ACCC warned.

Gas shortfalls are expected to emerge from 2027 unless new sources of supply are made available. This is earlier than the previous ACCC forecast from December 2023 of a possible shortfall from 2028, and reflects lower forecast supply due to delays in anticipated regulatory approvals for new projects and problems with legacy gas fields.

“Long term solutions to gas market shortfalls will require a range of policy and market responses. Amongst these, there is an urgent need to develop new sources of gas production and supply,” ACCC said.

“Ensuring efficient supply to the east coast market would also be supported by increased competition in upstream production.”

Some companies are already boosting investments in Australia’s energy supply.

In August, Arrow Energy, a 50/50 joint venture between Shell and PetroChina, announced plans to develop Phase 2 of Arrow Energy’s Surat Gas Project in Queensland, Australia. The expansion of the coal seam gas project in northeast Australia will boost supply to domestic customers and long-term LNG shipments, Shell said.

The gas from the project will flow to the Shelloperated QCLNG liquefied natural gas facility on Curtis Island, near Gladstone, to meet long-term contracts and supply domestic customers. This is part of an existing 27-year gas sales agreement between Arrow Energy and QGC. Phase 2 is expected to contribute around 22,400 barrels of oil equivalent per day (or 130 million standard cubic feet per day) at peak production.

Alongside bolstering near- and medium-term energy security, Australia looks to boost investment in and deployment of renewable energy and critical minerals production.

Investment in renewable energy projects in Australia bounced back in the first quarter of 2024 from the lows in 2023. Yet, the country needs to further increase its annual investments to meet the government’s 2030 clean energy target, industry body Clean Energy Council said in a report in June.

Q1 2024 was the best quarter for electricity generation projects reaching financial commitment since the end of 2022, with five projects totalling 895 MW being financially committed, the report noted.

However, investment levels in generation projects will need to significantly improve with financial commitments of at least 6-7 GW of new large-scale generation projects needed this year (and in successive years) for investment to get back on track to meet the Federal Government’s target of 82 percent renewables by the end of 2030, the industry body said.

Australia plans to invest as much as US$15.6 billion (AUS$22.7 billion) over the next decade to help the country succeed and remain an indispensable part of the global economy as the world undergoes the biggest transformation since the industrial revolution, the government said in May.

This plan will help Australia build a stronger, more diversified and more resilient economy powered by clean energy, the government said unveiling the Future Made in Australia plan.

Apart from a clean energy boost, Australia will look to increase production and processing of minerals vital for the energy transition. The country is a major producer of lithium, the key mineral in the current leading global battery technology, and of nickel, which is also crucial for battery manufacturing.

The government is helping secure Australia and the world’s renewable energy supply chains by backing the Kathleen Valley Lithium Project in Western Australia. Early this year, the government extended funds from the Clean Energy Finance Corporation (CEFC) and from Export Finance Australia

(EFA) to help battery minerals producer Liontown Resources secure the final stages of construction of the company’s Kathleen Valley Lithium Project. Liontown Resources in July announced that first spodumene concentrate had been produced at Kathleen Valley.

Australia’s government has also recently unveiled a new national hydrogen strategy as it aims to become a “renewable superpower.”

With the new strategy published in September, Australia will aim to develop new domestic clean energy manufacturing capabilities and capitalise on massive export opportunities for clean, secure energy supply chains through becoming a hydrogen world leader.

The National Hydrogen Strategy, finalised by joint work by state, territory, and federal governments, looks to create an Australian hydrogen industry at scale.

Key to these efforts is the green Hydrogen Production Tax Incentive programme and the expanded green Hydrogen Headstart programme, which the government is funding through an estimated US$5.5 billion (AUS$8 billion) allocation made in this

year’s Federal Budget as part of a Future Made in Australia.

Both programmes have been designed with industry to most effectively drive economies of scale, accelerate investment, reduce the cost gap, and help major projects reach financial close faster, thegovernment said.

It also estimates that these hydrogensupporting programmes could unlock US$34.2 billion (AUS$50 billion) in private sector investment and see Australia’s annual domestic production capacity exceed 1 million tonnes of green hydrogen by 2030.

The strategy “sends a clear signal to trading partners about the future marketplace in Australia for hydrogen and hydrogen-based fuels,” Minister for Climate Change and Energy Chris Bowen said.

“Having this blueprint also informs future infrastructure planning and investments across all Australia’s governments, and outlines how Australia can take advantage of the global transition to net zero, by underpinning new domestic manufacturing such as green metals and chemicals, as well as energy exports to our international partners.”

A user-focused, cloud-based environment for your applications, data and people.

Cetegra gives energy companies access to all applications and data in a unique, collaborative and flexible yet fully integrated solution.

Seamless and cloud based, Cetegra offers an optimal work environment, for everyone, everyday, regardless of their location or device.

Based on a pay-as-you-go model, Cetegra keeps operational costs under control yet scalable whenever needed.

The Cetegra Ecosystem at a glance

Cetegra Workspace

Access to data, applications and services through one centralized web-based portal.

Cetegra Customer Care

Global round-the-clock support to help you maximize the business value of your technology.

Cetegra High Performance Desktop

Powerful and scalable virtual desktop supporting resource-demanding applications.

Cetegra High Performance Computing

Scalable, on-demand computing capacity for energy-specific workflows such as seismic processing, geomodeling or complex simulations.

Cetegra Data Room

Smart and secure virtual data rooms to support transactions, from due diligence to farm-out deals.

Cetegra Security

Protecting your most valuable assets in secure data centres.

Scan the QR code to learn more about Cetegra.

Brent Oil Column November 2024

1 YEAR AGO

1 Year Ago - $81.74

The Brent crude oil benchmark reached above $80 a barrel after demand concerns and a fading war-risk premium triggered a sell-off. The onset of the Israel-Hamas war did fuel volatility and bring additional risks but it did not affect underlying oil market fundamentals. Oil prices remained below the first Hamas attack in September.

5 YEARS AGO

5 Years Ago - $62.46

Oil prices fell amidst rumours that OPEC’s leading members weren’t willing to deepen output cuts. Oil prices held firm in recent weeks on the understanding that Saudi Arabia was willing to extend the production quota through to next year. Saudi Arabia’s priority was to keep the price around the $60 mark but was facing some resistance from other members.

10 YEARS AGO

10 Years Ago - $77.39

The price of oil slumped after the OPEC oil producers cartel decided not to cut output at its meeting in Vienna. Crude oil prices had fallen 30% since June on sluggish global demand and rising production from the US. This fall in price had been causing concern for several members but OPEC’s secretary general claimed that there was no need to panic and cut output.

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

BLOCK

A final investment decision has been made for the GranMorgu FPSO. The 220,000 b/d GranMorgu FPSO is to be connected to a system of subsea wells about 150km off the coast of Suriname. The project will include a drilling campaign entailing 32 development wells (including oil production, water reinjection and gas reinjection). The FPSO will be all-electric and designed for zero flaring, with associated gas either being use as fuel onboard the platform or being reinjected into the reservoirs.

Shell has announced a positive Final Investment Decision (FID) for the project. The 161km pipeline will follow the path of existing corridor pipelines, starting from Shell’s GC-19 hub and linking to major crude oil markets in Texas and Louisiana. Subject to required permits and regulatory approvals, the pipeline is expected to begin operations in 2028. Shell and bp have formalised an agreement for the Rome pipeline to transport 100% of the oil output from bp’s newly approved Kaskida project.

McDermott has been awarded an EPCI contract to deliver approximately 250 km of offshore and onshore gas pipelines, linking five new offshore wellhead platforms to two new onshore LNG trains. The scope of work also includes subsea composite power and control cables. The project will be overseen from McDermott's office in Doha, with fabrication support provided locally by the QFAB fabrication yard and will utilise McDermott's in-house marine assets for installation.

Saipem has awarded a new offshore contract worth around $2 billion. Saipem's scope of work includes the engineering, procurement, construction, and installation of topsides for wellhead platforms, jackets for wellhead platforms, a tie-in platform jacket and topside, rigid flowlines, submarine composite cables, and fibre optic cables. Fabrication will take place at the Saudi-based Saipem Taqa Al-Rushaid Fabricators Co. Ltd. (STAR) yard in Dammam.

BW Energy will submit the final development plan in February 2025. Following the results of new 3D seismic data, the company is also looking to drill a $100 million exploration well as part of the plan.

The engineering design by KBR for the Artawi field is now 99% complete. Once the designs are finalised, the project will proceed to the detailed engineering phase, which involves multiple contracts. These include a contract for pipeline equipment and a contract for gas compressors, among others. These contracts are integral to the overall engineering design of the project.

Aker Solutions has been awarded a contract by Equinor worth $140.2m for modification work on the A platform. The company will be responsible for the EPCIC process of topside modifications. The construction and prefabrication process will be executed at the company’s yard in Egersund. Aker Solutions' Stavanger office handles project management, detailed engineering, procurement, and shop engineering, with support from the teams in Bergen and Mumbai. Work will commence immediately, and completion is expected in 2027.

KOC has awarded a $140 million EPC contract for flowline and associated works for exploratory and Jurassic wells in North Kuwait to Mechanical Engineering and Contracting Company. Construction is set to commence in November 2024, with an expected completion date in Q4 2026. It is understood that the third phase of the programme is aimed at producing condensate, 400 MMcf/d of gas, and 100,000 b/d of crude oil.

TechnipFMC has signed a new contract with Petrobras entailing the supply of subsea equipment to the Atapu, Sépia and Roncador fields. The latest contract covers the design, engineering and manufacturing of subsea production systems, as well as installation support, life-of-field services and the option for additional equipment and services. SLB has been awarded a contract that entails well construction services at Atapu, Sépia and Búzios.

$1 billion

Navitas Petroleum AUSTRALIA

$500

MinRes reported that the project has now been proven through successful drilling and record flow tests across a 6 well program. Gas resources indicate it is one of the largest onshore gas discoveries in Western Australia with resources estimated of total more than 1.4 Tcf of gas. Planning for the development of the project has progressed with approvals submitted for a Central Processing Facility.

Navitas and Rockhopper have revealed the second phase of the Sea Lion field will entail the drilling of 12 additional development wells to increase capacity by 10,000 b/d to achieve a production of 55,000 b/d. Completion of Phase 2 is expected up to two years after first oil of Phase 1.

According to SKK Migas, first oil is anticipated in 2026. FID could be seen in H2 2025. The development plan involves constructing an offshore platform at the well location and a 3-kilometre, 14 -inch diameter pipeline to connect to the existing MD-1 platform.

Major oil and gas companies are looking to expand their operations to the world’s most promising basins as energy investments are rising and demand for hydrocarbons and electricity is growing with the advance of AI and data centres.

By Tsvetana Paraskova

International oil and gas majors are moving to explore prospects offshore Namibia, Guyana, and Suriname, while the national oil companies in the Middle East are looking to establish a presence in the growing global LNG market and low-carbon projects.

This year, global energy investment is expected to top $3 trillion for the first time, with $2 trillion of this going to clean energy technologies and infrastructure, the International Energy Agency (IEA) said in its World Energy Investment 2024 report in June.

Global upstream oil and gas investment is set to increase by 7 percent in 2024 to reach $570 billion, following a similar rise in 2023. This year’s investments are expected to return to the 2017 levels. The growth in upstream spending in 2023 and 2024 is led by the national oil companies in the Middle East and Asia, the IEA noted.

Lower cost inflation suggests that the headline rise in spending results in an

even larger rise in activity, up by around 25 percent compared with 2022. Existing fields account for around 40 percent total oil and gas upstream investment, while another 33 percent goes to new fields and exploration. The remainder goes to tight oil and shale gas, the IEA said in its report.

Moreover, a significant wave of new investment is expected in LNG in the coming years as new liquefaction plants are built, primarily in the United States and Qatar. The concentration of projects looking to start operation in the second half of this decade could increase competition and raise costs for the limited number of specialised contractors in this area, according to the agency.

Within the oil and gas industry, the dynamics of investments is shifting from US shale to international offshore, Rystad Energy said in a report in August.

“Our sixth multi-billiondollar project in Guyana will bring the country’s production capacity to approximately 1.3 million barrels per day,”

Meanwhile, while investment in clean energy technologies is now nearly double the spending on fossil fuels, the world needs to double investments in renewables in order to reach the target of tripling renewables capacity by 2030, the IEA said.

US tight oil investments are set to decline by about 10 percent in 2024 compared to last year, and thus US production is forecast to grow by only around 400,000 barrels per day (bpd) this year and next – the lowest level of growth for the sector since the Covid-19 pandemic-affected years of 2020 and 2021, Espen Erlingsen, Head of Upstream Research at Rystad Energy, wrote. At the same time, investments in the offshore sector are rising and expected to grow by about 5 percent both this year and next.

Offshore – and the deepwater sector in particular – was heavily affected by the growth of tight oil in the last decade. Total upstream offshore investments fell from $340 billion in 2014 to $140 billion in 2021.

But offshore investments began to increase in 2022, thanks to high oil prices, improved economics for offshore projects, and lower tight oil growth.

Rystad Energy estimates total offshore investments will reach nearly $250 billion next year, suggesting that the offshore sector will most likely be the source that will drive the growth in oil production for the rest of this decade, Erlingsen says.

With more investments offshore and renewed risk appetite from supermajors to explore for advantageous resources, the South Atlantic margins in South America and West of southern Africa have gained prominence.

Guyana and Suriname in South America and Namibia off Africa’s southwest coast have emerged as the newest exploration hotspots in which major international oil companies, including ExxonMobil, Shell, and TotalEnergies, have been investing in drilling and production in recent years.

Exxon earlier this year made a final investment decision for the Whiptail development offshore Guyana, its sixth offshore project there, after receiving the required government and regulatory approvals.

The $12.7 billion Whiptail project, the sixth project on the Stabroek block, is expected to add approximately 250,000 barrels of daily capacity by the end of 2027.

“Our sixth multi-billion-dollar project in Guyana will bring the country’s production capacity to approximately 1.3 million barrels per day,” Liam Mallon, president of ExxonMobil Upstream Company, said in April.

European majors Shell and TotalEnergies are looking to explore and potentially develop the large oil discoveries they have recently made offshore Namibia in West Africa.

Shell has drilled with its joint venture partners exploration and appraisal wells across its license in deep water more than 250 km from Namibia’s shore. Shell has made five discoveries in the Orange basin, including the large Graff discovery.

TotalEnergies, for its part, has raised its interests in offshore blocks 2913B and 2912 offshore Namibia, both of which it operates.

“This transaction not only increases our share in the Venus discovery and remaining prospectivity on these blocks, but also represents a key step toward the development of Venus by consolidating the partnership and securing financing of all partners which will add value to all stakeholders”, said Patrick Pouyanné, Chairman and Chief Executive Officer at TotalEnergies.

On the other side of the Atlantic, TotalEnergies announced in early October the Final Investment Decision (FID) for the “GranMorgu” development located on Block 58 offshore Suriname. TotalEnergies is the operator of Block 58 with a 50-percent interest, alongside APA Corporation with the other 50 percent.

The GranMorgu project will develop the Sapakara and Krabdagu oil discoveries, on which a successful exploration and appraisal campaign was completed in 2023. The fields, located 150 km off the coast of Suriname, hold recoverable reserves estimated at over 750 million barrels.

The project includes a 220,000 barrels of oil per day Floating Production Storage and Offloading (FPSO) unit, which replicates a proven and efficient design. Total investment is estimated at around $10.5 billion and first oil is expected in 2028. The GranMorgu FPSO is designed to accommodate future tie-back opportunities that would extend its production plateau, TotalEnergies said.

The French supermajor has also acquired shale gas assets in the Eagle Ford Basin in Texas, US, to boost its gas value chain integration and supply for LNG exports.

With over 10 million tons (Mt) exported in 2023, TotalEnergies is the largest exporter of US LNG, thanks to its 16.6-percent stake in the Cameron LNG plant in Louisiana and several long-term purchasing agreements.

“This acquisition further strengthens our upstream gas position in the United States and contributes to our integrated LNG position with a low cost upstream gas supply”, Nicolas Terraz, President, Exploration & Production at TotalEnergies, said in September.

The national companies of the biggest oil and gas producers in the Middle East are expanding their export capabilities and looking to secure LNG and downstream deals abroad.

QatarEnergy is working on the world’s largest LNG expansion project to tap additional gas resources from the North Field and build liquefaction and export plants. The Qatari state company has already signed a number of agreements with big international oil and gas firms to have them as minority partners in each of the new trains under construction.

QatarEnergy has also recently signed an agreement with Chevron to acquire a 20-percent working interest in a production sharing contract for block 5 offshore Suriname.

“This agreement highlights our continued commitment to exploring the promising basins of Suriname and marks an exciting new

partnership with Chevron in the international upstream sector,” Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy, said in July.

Also in international upstream, QatarEnergy has signed a farm-in agreement with ExxonMobil to acquire a 40-percent participating interest in two exploration blocks offshore Egypt.

In May, QatarEnergy announced that the consortium partners in the Sepia joint venture have taken the final investment decision (FID) for the second development phase of the Sepia field, located in the prolific pre-salt Santos Basin offshore Brazil. The Sepia joint venture is a partnership between QatarEnergy, TotalEnergies, Petronas, Petrogal Brazil, and Petrobras, which is the operator.

The world’s largest crude oil exporter, Saudi state oil firm Aramco, continues to seek acquisition opportunities in the downstream and LNG, Aramco’s Executive Vice President for Products and Customers, Yasser Mufti, told Reuters in an interview in September.

At the end of 2023, Saudi Aramco entered Pakistan’s downstream market by acquiring a 40% stake in Gas & Oil Pakistan Ltd, one of the country’s largest retail and storage companies, as the oil giant seeks international downstream expansion.

Aramco has also signed a non-binding Heads of Agreement (HoA) for a 20-year sale and purchase agreement for LNG offtake of 5.0 million tonnes per annum (Mtpa) from the Port Arthur LNG Phase 2 expansion project in the United States. The agreement includes the option for Aramco to buy 25 percent in the project-level equity of Phase 2.

Abu Dhabi’s national oil and gas company ADNOC is also expanding with deals in the United States.

In September, ADNOC signed an agreement with ExxonMobil to buy a 35-percent equity stake in Exxon’s planned low-carbon hydrogen and ammonia production facility in Baytown, Texas.

Contingent on supportive government policy and necessary regulatory permits, the facility is expected to be the world’s largest of its kind upon start-up. It will be capable of producing up to 1 billion cubic feet (bcf) daily of lowcarbon hydrogen, which is virtually carbonfree with approximately 98 percent of carbon dioxide (CO2) removed and more than 1 million tons of low-carbon ammonia per year. A final investment decision is expected in 2025 with anticipated start-up in 2029, ADNOC and Exxon said.

Newland Oiltools is honored to be featured in the November edition of OGV Energy Magazine, a publication that highlights innovation and excellence within the energy sector. This issue spotlights our advanced manufacturing techniques, the exceptional technical expertise of our team, our commitment to developing next-generation talent, and our steadfast dedication to serving the Eastern Hemisphere market.

To support this growth trajectory, we have expanded our team of design engineers at our primary facility in China, which is recognized for its technological innovation and research and development (R&D) in well completions and manufacturing processes. This bolstered engineering team is crucial as we continuously refine our product offerings to meet evolving industry needs.

At the heart of Newland Oiltools' success is our distinguished team, whose collective experience forms the backbone of our operations. Led by Wang Beixing, President and Owner, our leadership team also includes David Li, VP of Sales; Li Yang, Director of Sales; Jason Kent, EVP of the Americas; and Martin Pirie, EHO Vice President. Each member brings extensive industry knowledge, with many having over 25 years of experience in the oil and gas sector, particularly in the Middle East. This wealth of expertise not only fosters our company's development but also enables us to attract and retain top talent in the completions sector.

Our team’s background spans various specialties, including drilling operations, engineering, and project management, ensuring that we have the right skills and insights to address the diverse challenges faced by our clients.

We take immense pride in our seasoned professionals and partners who uphold Newland’s reputation for excellence. Recent expansions— including key hires in the USA—demonstrate our commitment to growth. Under the visionary leadership of Wang Beixing, Newland Oiltools is making significant strides on a global scale. He emphasizes, “Our recent global successes have firmly established Newland Oiltools as a leading manufacturer and supplier of high-quality equipment. We are designing and producing innovative tools that facilitate quicker market entry and tackle bespoke operational challenges for clients worldwide.”

Newland Oiltools has demonstrated a strong commitment to the Eastern Hemisphere, particularly in the Middle East and the Caspian region. With a substantial inventory of equipment readily available, we are well-positioned to support existing contracts and seize emerging opportunities. Our recent contractual achievements in Southeast Asia—including multimillion-dollar contracts with leading operators— have solidified our status as a premier provider of casing accessories in this region.

These long-term contracts have not only expanded our operational footprint but have also allowed us to offer our “world-class” testing facilities to new clients, further enhancing our ability to provide tailored solutions for their operational requirements. Our strategically located facilities in the United Arab Emirates, China, the USA, and Malaysia enable us to deliver agile and responsive service to our clients.

As part of our ongoing success, we are actively exploring the establishment of a new manufacturing facility within the MENA region. This facility will serve local clients and enhance our global production supply chain, ensuring we remain competitive and responsive to market demands.

A standout achievement in our product development is the significant evolution of the ASLO PRO, originally requested by a global operator in Azerbaijan. This innovative solution for “under-reamed” applications exemplifies our commitment to delivering exceptional performance and quality solutions. By working closely with our clients, we ensure that our products not only meet but exceed their expectations.

Wang Beixing underscores Newland’s leadership in manufacturing and technological innovation: “Our expertise in technology and production is widely recognized. We are committed to exploring new technologies and opportunities within the industry. Our research and development team is focused on delivering rapid and efficient product solutions tailored to our clients' needs.” Our commitment to advancing manufacturing techniques is crucial for adapting to evolving operational demands. We prioritize modernizing our production processes, enhancing efficiency, stabilizing quality, and promoting environmental sustainability.

Aligned with our strategic approach, lean manufacturing plays a pivotal role in enhancing operational efficiency and minimizing waste across our production processes. This methodology focuses on systematic improvements to workflows, reduction of cycle times, and the elimination adding activities. By implementing key lean practices such as value stream mapping, just-intime production, and standardized work procedures, we achieve notable cost savings, improved product quality, and a more responsive approach to customer needs.