Wells expertise remains critical to the successful delivery of a Carbon Zero future Decommissioning Wells Extend Life of Assets Gas to Power Gas: A Transition Fuel Optimise Well Delivery Recycle/ Repurpose Geothermal Wells Carbon Capture Sequestration Blended Hydrogen and CCS AUGUST 2020 JAN 2023 - ISSUE 64 UK’s N o . ENERGY SECTOR PUBLICATION WELL MANAGEMENT FEATURING Exceed - QHSE Aberdeen Three60 Energy - Wellsafe Solutions RenewableUK - Viper Innovations GDi - Sword Group - Resman 1 GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS

Welcome to the first edition of ‘OGV Energy Magazine’ for 2023 and we look forward to another exciting year in the energy sector with lots of decisions to be made about the nature of the global energy mix in years to come!

The January edition kicks off with our theme on ‘Well Management’ and we are delighted to welcome Exceed Energy as our front cover partner and you can read all about how Exceed Energy are fast becoming the global leader in integrated well and reservoir management for the energy transition inside, along with further evidence of their comprehensive services package to their clients, which saw them being named ‘Great Company of the year’ by the SPE Offshore achievement awards.

We also have contributions from Fraser Well Management, Three60 Energy, Well-Safe Solutions, Kaseum Technology and QHSE Aberdeen.

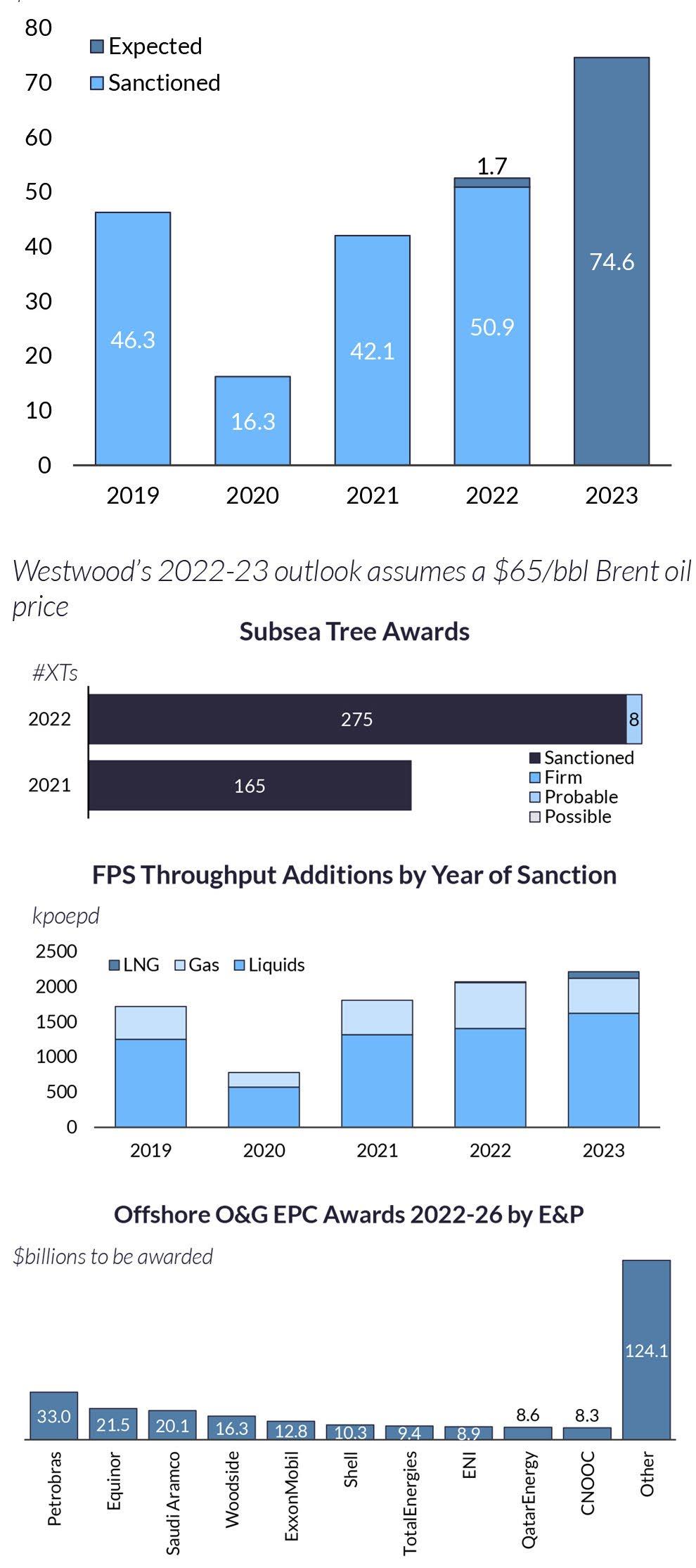

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, the Middle East, the US and Australasia along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK

Daniel Hyland, Sales and Operations Director, OGV Energy Media Group

CONTENTS FOLLOW US

26

VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY WISH TO CONTRIBUTE TO NEXT MONTH'S PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk COVER SPONSOR OGV COMMUNITY NEWS PEOPLE IN ENERGY GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS P.04 P.08 P.10 P.11 P.20 P.22 P.28 P.32 P.34 P.36 P.38 P.40 P.46 P.47 A WORD FROM OUR EDITOR 4 30 28 42 8 33 24 3

LEADING THE ENERGY TRANSFORMATION

2022 has literally been a transformative year for well management specialist, Exceed.

Growth and Recognition

The Aberdeen-headquartered company has reported a 40% growth in revenue during 2022, to £20millon. And as it continues to implement a long-term strategy to diversify and internationalise, Exceed is fast becoming the global leader in integrated well and reservoir management for the Energy Transition, attributing 60% of the year’s revenue to the work it undertakes in decarbonisation.

During 2022, the Exceed team has grown from 60 to 145, leading the company to purchase and redevelop additional premises in the heart of Aberdeen city. That growing team is at the heart of Exceed, which is committed to the development of internal capability and the support of personal and professional employee development. A six-figure investment in its Competency Management System (CMS) has ensured that all employees have appropriate knowledge, skills and behaviours to perform their roles effectively and develop competency skills, with six members of staff currently undertaking a Well Engineering Competence Programme.

2022 has also seen two members of

Exceed’s finance team achieve the ACCA accounting qualification, one of the wells team complete their MBA, another their BA in Business Management and earlier in the year, the company’s Legal Counsel completed the globally-recognised Advanced Diploma in International Taxation.

The emphasis Exceed places on its people and their continuous professional development was just one of the reasons it was named the SPE Offshore Achievement Awards “Great Company of the Year” in March 2022.

Operating at the Frontier of the North Sea’s Transition

Exceed’s commitment to the future of the energy industry is absolute. Having continuously expanded its service offering since it was established in 2005, Exceed has continued to evolve and reposition its capabilities to ensure its position as a leader within the Energy Transition. As a result, Exceed’s expertise has been applied to a number of major Energy Transition projects during 2022.

4 www.ogv.energy I January 2023

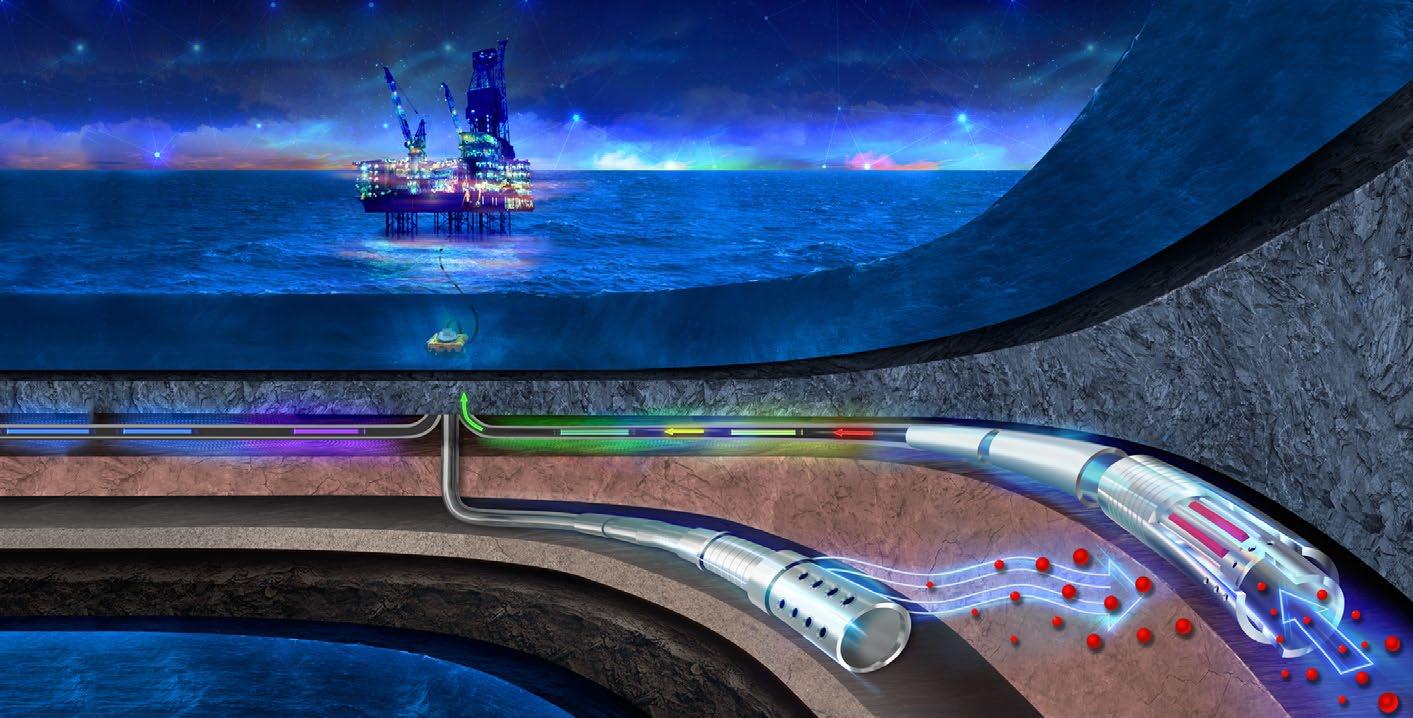

Hydrogen and Carbon Capture and Storage

Working within the Teeside Net Zero Cluster - the driving force behind the UK’s first decarbonised industrial cluster - Exceed has demonstrated its transition credentials within a truly innovative application to reuse and repurpose of the Rough field. Its team of Subsurface experts, headed up by Mark Cullen, has been instrumental in the repurpose of the Rough Bravo field to a hydrogen storage facility by providing critical conceptual work, and frontier leading geo-mechanic and reservoir modelling in conjunction with a number of universities, including the University of Edinburgh, Napier University, the University of Manchester and Heriot-Watt University.

Leading Decommissioning

Having abandoned 143 wells and 12 vesselbased wells to date, Exceed owns the most diverse decommissioning track record within the North Sea. Its well abandonment capability has been honed over the past eight years to create a market-leading decommissioning capability that is trusted by the industry’s biggest names to execute some of the North Sea’s most significant and challenging decommissioning campaigns. This was underlined in 2022 when Exceed’s inaugural appointment as Well Operator was made by Parkmead to steer its first UKCS well decommissioning operation.

During the past 18 months the volume of decommissioning work awarded to Exceed has necessitated the exponential growth of the decom team, which now comprises over 30 decom experts, led by Bart Van de Laar and located in new, dedicated premises within Aberdeen city centre.

A Shift in Status – Well Operatorship

Amongst so many significant announcements during 2022, the company’s official recognition by the UK Regulatory Competent Authority as Well Operator, builds upon its trusted reputation for outstanding results based on effective, pragmatic project management.

As outsourced Well Operator, Exceed’s capabilities include:

• Capability to be Well Operator throughout the well life cycle

• Cloud-based Well Integrity Management system: digital twin of the well

• Experience in Appendix C Well Operator submissions

• Corporate major accident prevention policy

• Safety, Environmental, Management System (SEMS) commensurate with a licence operator

• Competence Management System commensurate with a licence operator

• Emergency response provision commensurate with a licence operator

• Scheme of well examination

• Accountability and responsibility for all regulatory permitting

• Energy Transition ESG strategy

• Inspected by the relevant competent authorities

Disruptive, Collaborative – a Blueprint for Vessel-Based P&A

In 2022, Exceed’s depth of decommissioning best practice led it to create a disruptive, collaborative vessel-based decommissioning solution, leading to the award of its largest vessel-based well P&A campaign to date. With mobilisation/demobilisation accounting for a third of the total well P&A cost, the approach - which is focused upon the reduction of CO2 - has been lauded across the North Sea industry for minimising the environmental impact of multiple, separate campaigns. Initially based on a 10 well, four operator campaign, 2023’s campaign is currently set to comprise 20+ wells.

Well Managed: Leading the Energy Transformation

Maximising clients’ economic recovery factor plays a critical role in Exceed’s commitment to a sustainable energy transition, and 2022 has seen the company continue to undertake a range of UK and international projects for clients including Serica, RSUK, Serica Energy, Anasuria Hibiscus UK, Anasuria Operating Company and Ping Petroleum.

A World First – Carbon Offset Well Operations

Following a strategy to eliminate or reduce a drilling project’s direct emissions where possible, Exceed provides the option for remaining emissions to be appropriately offset. A key objective is to manage and deliver improvement in its clients’ and sub-contractors’ ESG credentials, whilst ensuring its own business operations work towards achieving net zero emissions. Leading by example, Exceed incentivises sub-contractors’ energy efficiency via the contracting strategy, the design, execution and logistics management.

As a result of this commitment, Exceed drilled the world’s first carbon offset well in late 2021, for which it was awarded the coveted Offshore Network OWI Award for “Environmental Sustainability Innovation”, in November 2022.

Growth of International Wells Market

Exceed’s global activity has continued to grow during 2022, with several international operations currently in the select planning phase for a multiwell campaign in West Africa (Namibia, Angola, Guinea Bissau), a return to the Black Sea, and operations in Kazakhstan and Mexico.

Managed Pressure Drilling

Acquired by Exceed in 2019, Exceed Managed Pressure Resources continues a trend of doubling its growth, year on year. Active across the UKCS and internationally, and having planned and executed a total of 55 wells, the team, which was awarded a global master call off contract by Repsol in 2022, has become renowned across the industry for its active development of clients’ internal competence in managed pressure drilling concepts, techniques and operational execution.

Performing at the Highest Level

With its roots in Performance Improvement, Exceed has continued to transform clients’ operations via its unique, continuous improvement process. Led by Tim Wigham, Exceed PI has maintained and built upon long-term client partnerships during 2022 with operators including RSUK, Neptune Energy UK, Serica Energy UK, TotalEnergies and Sasol Mozambique.

Not only has Exceed PI increased its international footprint during the year, adding Mexico and Kurdistan to the countries in which it is active, but has also diversified its client base, transferring operations excellence beyond energy into additional sectors, with clients including Airbus Helicopters.

Looking ahead

From continued well operations and innovative decommissioning commercial models, to the launch of a new overseas entity and supporting the UK’s hydrogen storage strategy, 2023 will see Exceed continue to lead the global wells energy transition from the front, with a 100% commitment to a sustainable lower carbon energy future.

EXCEED is the largest independent well management company and our mission is to maximise the recovery factor, managing the productive life of our clients’ wells whilst enabling the energy transition to Carbon Zero.

www.xcd.com COVER FEATURE

5

STATS GROUP Managing Pressure, Minimising Risk Mechanical Pipe Connector Piping Repair, Tie-In or Capping seal vertification port DNV TYPE APPROVAL dual graphite seals taper lock grips Permanent pipe to flange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-effective solution, with no specialist installation or testing equipment required.

CONTRIBUTORS OUR PARTNERS TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER

logistics services

freight,

customs

consultancy, packing,

services

distribution,

savings, efficiency

Editorial newsdesk@ogvenergy.co.uk +44

114 Advertising

+44

114 Design Ben Mckay Journalist Tsvetana Paraskova www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support VIEW our media pack at www.ogv.energy/advertise-with-us or scan de QR code ADVERTISE WITH OGV

Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes.

Leading provider of

to this industry, offering its customers airfreight, road

sea freight, project forwarding,

compliance, training and

crating, lashing & securing

warehousing,

freight management, rig relocation and mobilisation services and offshore logistics. Corporate Travel Management (CTM) is a global leader in business travel management services. We drive

and safety to businesses and their travellers all around the world.

(0) 1224 084

office@ogvenergy.co.uk

(0) 1224 084

Craig International has reported a 17% increase in turnover and a welcome return to profit in its accounts for the year ending April 2022.

The global procurement specialists to the energy industry reached a turnover of £116m, compared to £99m in April 2021, a financial year severely impacted by the pandemic.

The accounts lodged by Craig Group Limited, the holding company for Craig International and its subsidiaries around the world, also reveal operating profits of £1.08m.

Seismic technology company STRYDE is expanding its presence in the Middle East with a million-dollar new multi-purpose warehouse in Dubai.

The new site, located in the Jebel Ali Free Zone, in Dubai, has the capacity to stock over 1 million land seismic nodes, available to purchase or lease, and hold the company’s containerised node management systems, designed specifically for large-scale seismic surveys across the Middle East, Africa, India, Australia, and the Far East.

We are very proud to announce that our Inspection Department achieved a significant milestone by being accredited by the United Kingdom Accreditation Service (UKAS) against the requirements of ISO/IEC 17020, the international standard for bodies performing inspection.

The award by UKAS includes a world’s first accreditation of Remote Visual Inspection using point cloud data and photographic images. The method allows desktop visual inspection utilising our digital twin application, Vision.

The Vision application is used as a powerful and efficient tool which allows Inspectors to remotely undertake both routine and intrusive visual inspections. Through our own in-house procedures & processes, GDi were able to demonstrate to UKAS the effectiveness of our Remote Visual Inspection system.

We actively look forward to engaging with UKAS in the months and years to come as our integrated inspection delivery model develops further.

Prism Energy, an Aberdeen-based project & risk management consultancy to the energy sector, announces today (Friday 16th December) a one-year contract with Ithaca Energy for the use of its digital project management system.

Prism Energy will provide digital systems for risk management, action tracking, lessons learned, interface queries & management of change which will be adopted on the Marigold Cluster and Captain EOR in the UK North Sea, Ithaca’s decommissioning programmes, and the Cambo oil field, northwest of Shetland.

Emma Watt and Catherine Ramsay both join as Account Executives to support the delivery of strategic pr and marketing solutions for the agency’s expanding portfolio of clients.

Catherine Ramsay joins the team straight from Robert Gordon University where she studied Fashion Management for the last four years. She has a strong understanding of the digital side of marketing and has already proved to be a vital asset to the team by creating fresh and exciting TikTok content.

Just one year on from establishing a new entity in Australia, pipeline technology specialist STATS Group (STATS), is looking forward to a bright future after securing frame agreements with some of the region’s largest Tier 1 operators.

A wider market understanding of the company’s patented BISEP® double block and bleed isolation technology has laid the foundations for growth which is being realised with contract wins and formal longterm strategic relationships.

Global controls technology company Proserv has announced that it has signed an agreement with Aberdeen based sand and erosion monitoring, analytics and management experts SMS.

The deal sees SMS become the exclusive agent and representative for Proserv’s sampling activities across Malaysia. The arrangement brings Proserv’s sampling system know-how, equipment design and high-quality manufacturing, delivering safe, enclosed and portable solutions, together with SMS’s sand monitoring technologies.

OGV COMMUNITY NEWS

Aberdeenshire PR and Marketing agency, Bold St Media makes two appointments amid business growth

ALL THE FULL COMMUNITY NEWS ARTICLES ON OGV

WEBSITE

GDi have achieved a world’s first accreditation for Remote Visual Inspection using point cloud data and photographic images

FIND

ENERGY'S

Disruptive Start-Up in Running for Company of the Year

Proserv secures SMS as sampling representative in Malaysia

STRYDE opens new operation support warehouse and training facility in Dubai

Prism Energy Announces One-Year Contract Award From North Sea Operator

Craig International Reports Increase in Turnover and Profit

8 JOIN THE OGV COMMUNITY FOR JUST £30 A MONTH www.ogv.energy/register

QHSE ABERDEEN celebrates 7th anniversary with key promotions

A leading provider of professional advice and consultancy services, QHSE Aberdeen, has celebrated its 7th anniversary by announcing two key promotions to equip the business for future growth.

Established in December 2015, the company has gone from strength to strength with the size of its team more than doubling in the past 18 months and a move to larger office space in Westhill.

Increased demand has now led to two internal promotions to bolster its management team and help ease workload on the directors; allowing them to concentrate on further growing the business, develop new competencies, and strengthen relationships with existing clients.

Led by managing director, Dave Rusling, and business development director, Angela Scott, the company is committed to creating the conditions for employees to reach their full potential and offers a valuable career path to all staff. QHSE Aberdeen is also creating one new position with external recruitment expected to be completed in January.

Lee Forsyth started with the company in April 2019 as a QHSE Advisor then, after gaining suitable knowledge and experience, advanced to senior advisor which included responsibilities as a line manager.

When the opportunity of operations manager arose, Lee jumped at the chance to take on the role; putting into practice everything he has learned along his QHSE journey, shadowing Dave Rusling, and learning the ropes.

QHSE Aberdeen creates a multitude of documents for clients, as well as for internal use, and is always looking for ways to improve systems and processes. Senior QHSE adviser, Jane Pack, was the natural choice for the new position of technical manager given her meticulous approach to work and ability to complete tasks with thoroughness, accuracy and consistency.

She also possesses strong Microsoft 365 and SharePoint skills, where the company creates and stores its suite of documents, operates its bespoke client portal, and develops training materials.

Angela Scott said: “We’re extremely pleased to reward Lee and Jane for the valuable contribution they have both made to the business, particularly over the past year.

“Lee never shies away from any job and his work ethic is second-to-none. He has a

proactive attitude and is a very good team player with great patience for training. Although Jane has only been with us since February 2022, she has proved to be a strong team member with a can-do attitude, willing to take on a challenge, and was the perfect fit for the role of technical manager.

“It’s an exciting time for the whole team as we mark seven years in business, and we would like to pay tribute to our staff, clients and suppliers for all their support to date and look forward to seeing what opportunities 2023 brings.

“Thanks to these internal promotions, Dave and I are now able to focus more of our energy on growing the business and shaping the future strategy, spending time working on the business rather than in it.”

QHSE Aberdeen is a leading provider of professional consultancy and advisory services to organisations that require assistance with developing and implementing robust ISO management systems across a wide range of sectors, including oil and gas, renewables, nuclear, and construction.

The company’s focus on people – its own team as well as those working within clients’ organisations – has allowed it to stand out from the competition. This ethos was recognised by judges at the 2022 Northern Star Business Awards, where the business received the Customer First honour.

COMMUNITY NEWS

www.qhseaberdeen.com

QHSE Aberdeen provide a Consultancy and Advisory service to organisations of all sizes and sectors that require assistance in the development & implementation of robust Management Systems.

Lee Forsyth

Jane Pack

9

energyresourcing.com +44 1224 291176

PEOPLE IN ENERGY

RUTH CAMERON

Director, Energy Resourcing

Recruitment experts, placing top technical talent around the globe, with workforce solutions tailored to you

Energy Resourcing is a global technical recruitment agency. We’re passionate about matching high-quality candidates to the clients that need them. With offices in Australia, Asia, Europe and North America, we provide personalised customer experience through our dedicated support teams, day or night!

Our team of proactive recruitment professionals are experts in what they do. We specialise in providing robust workforce solutions and placing talent in typically hard to fill roles. So, whether you’re looking for your next job opportunity or need to hire technical talent to drive your next project, Energy Resourcing is here to help.

The only ambition I really have is to continue to grow a successful business, I am lucky enough to be able to reflect on my career path over the last 16 years and think, maybe its time to slow the pace down! Maybe that’s wishful thinking.

our work, but also its important to step back and take a considered view before you make the leap.

What has been the highlight of your career so far?

How did you get into the Energy sector and how long have you been working in it?

I have been working in the energy sector since I started my career after completing university in 2006. I grew up in Aberdeenshire and I am very familiar with the sector, with family members having careers in Oil & Gas as it was when I started out. A lot of the employers at the time were energy companies and so I naturally fell into the industry that’s thrived in this area for many years.

What does your job involve on an average day?

Problem solving! It’s probably the largest aspect of my role, helping my team, clients and contractors with their resource challenges and trying to find solutions for them. Our business is growing and so another large part of what I do day to day is making sure the team have everything they need to be successful.

What are main barriers to international growth for ambitious companies and what advice do you have for them?

I think understanding the market you’re trying to get into, whether that’s a geography or a sector, is really important. Each come with nuances that can trip you up if you don’t dig into the details of how things currently work and in particular when you’re dealing with people, employment law and tax. I feel like we can always do more due diligence before we jump into things, sometimes that’s just the nature of

Being able to lead the teams I have over the years is always the highlight of my career – the most challenging also! People are so dynamic and individual, but watching individuals and teams grow, develop and succeed is immensely rewarding.

What ambitions have you still got to fulfil professionally in your career?

The only ambition I really have is to continue to grow a successful business, I am lucky enough to be able to reflect on my career path over the last 16 years and think, maybe its time to slow the pace down! Maybe that’s wishful thinking.

Who has been the most influential person in your life professionally?

I have had some quite influential leaders in my career, those I worked directly for, and those from other parts of the business. All have played an important part in my professional career and when you spend as much time as you do with your work colleagues those relationships become deep and long lasting. I have seen great resilience and strength in these people, but also a real element of caring. Caring about the people we work with and the teams we support.

Over the next 10 years, what changes would you like to see in the energy sector with respect to D&I?

Its key to understand the split of Diversity and Inclusion, being the what and the how. There

has been a lot of focus on creating workforces of a more diverse nature however, we don’t always give people the tools they need to thrive in that environment when they get there.

So, a focus on inclusivity, inviting them to the party yes, but making sure that their contributions and voices are really heard. This will enable a more diverse pipeline of talent to grow within our organisations.

Within the next 10 years, seeing greater representation of female CEOs in the FTSE 100 would be one great example of D&I succeeding and provide some great role models for our future female talent. Currently there are only 9.

Given the experience you have now, what advice would you give a graduate just starting his career in the Energy sector?

Try every opportunity offered to you and give it your all, but don’t work yourself into the ground. As much as I hugely value my career, my family, friends and my own health, come first.

If you were inviting guests to a dinner party, which 3 people would you invite and why?

Dalai Llama – I would love to hear his words of wisdom and learn more about his way of living, he has a very gentle nature and kind spirit.

Whitney Houston – I love Whitney Houston and whilst she had many tragic elements to her life she was a great entertainer with an amazing voice and I am sure she would have many stories to tell.

Billy Connolly – I find him hilarious and love to watch his early and later year programmes. He is a great advocate for Scotland and knows much about its history, I find him very insightful.

Ruth has led the Energy Resourcings UK operations for around two years, since the consolidation of Primat Recruitment and Energy Resourcing in 2021. Ruth’s career started over sixteen years ago in the people function within the Aberdeen business, supporting project teams across the business’s portfolio in O&M, Engineering, Construction, holding positions in Global Mobility, People Operations, Recruitment and Contract Management.

PEOPLE IN ENERGY SPONSORED BY

PEOPLE IN ENERGY SPONSORED BY

Plans by North Sea operators to review investments in the UK after the hike in the Energy Profits Levy, meetings of the industry and government on energy security and investment, strikes on offshore platforms, and several contracts for field upgrades featured in the UK North Sea oil and gas industry over the past month.

UK NORTH SEA Energy Review

By Tsvetana Paraskova

By Tsvetana Paraskova

Oil and gas industry leaders and the UK government met at the end of November at the North Sea Transition Forum in London to discuss energy security, the UK’s net zero ambitions, and investment in the North Sea. Hosted and chaired by industry regulator the North Sea Transition Authority (NSTA), the forum sets the strategic direction for the UK oil and gas industry and oversees the work of seven task forces. Discussions centred on several priority areas for 2023, including regulatory, fiscal, and political areas. The industry is forecast to contribute £14.9 billion in tax receipts during the 2022-23 financial year, however industry members raised concerns around the case for continuing investment following recent changes to the Energy Profits Levy, the NSTA said.

The UK raised in November the windfall tax on the profits of oil and gas operators by 10 percentage points to 35 percent from January 1, 2023. The government also extended the so-called Energy Profits Levy to the end of March 2028, from December 31, 2025, as originally planned when the levy was 25 percent.

The offshore industry criticised the hike in the Energy Profits Levy, arguing that it drives investments away from the UK North Sea.

OEUK, the leading offshore energy body, and the UK’s leading offshore energy producers met senior Treasury ministers in early December with a stark warning that the windfall tax risks causing a rapid reduction in investment and jobs – and in the UK’s production of oil and gas.

The leading energy producers warn that the 75-percent tax rate now imposed on the industry is already deterring investment – as shown by TotalEnergies’ recent decision to cut UK investment by 25% – about £100 million, OEUK said.

“OEUK and oil and gas industry executives have repeatedly warned that imposing such a high rate on the industry could drive capital from the ageing basin at a time when the government is trying to increase the UK’s energy security,” the industry body said.

“This tax is a potential slow disaster for the UK. If investment falls now, then in a few years time our gas and oil production will plummet and we will become ever more reliant on imports. And if we produce less oil and gas then we will also be producing less jobs and, ironically, far less taxes,” OEUK’s Deirdre Michie said.

JANUARY 2023 ENERGY NEWS

Continues >

Repair, Conversion & New Build of Marine and Offshore Living Quarters & Technical Buildings Aberdeen | Blyth | Las Palmas | Dubai | Abu Dhabi | Qatar | Bahrain | KSA | Baku Proud Sponsor of the UK North Sea Review modutec.com 11

During a meeting with the Chancellor of the Exchequer, Jeremy Hunt, OEUK and industry leaders told the Chancellor “that the 75% tax rate will undermine the ability of energy producing companies to invest in the homegrown oil, gas and wind supplies we need. Without this, we will be less secure and will import more energy – while losing the benefits provided by the domestic industry in terms of taxes paid, jobs supported and investment in the wind and hydrogen projects.”

Not only TotalEnergies has reviewed investment plans for the UK North Sea following the hike in the windfall tax. Harbour Energy, the biggest oil and gas producer in the area, will not be filing applications in the ongoing licensing round in the North Sea, a spokesperson for the company told Reuters in the middle of December.

“As a result of the extension of the energy profits levy... we are reviewing investment levels and company-wide capital allocation,” Harbour Energy’s spokesperson said.

“This review is ongoing and, in the meantime, we have decided not to submit bids as part of this licensing process.”

Shell has already said it would be re-evaluating each project part of its £25-billion planned investment in the UK energy system after the hike in the Energy Profits Levy and the temporary tax on low-cost electricity generators also introduced with the Autumn Statement. Earlier this year Shell said it planned to invest £20-25 billion in the UK energy system over the next 10 years, with more than 75 percent of this intended for low and zero-carbon products and services, including offshore wind, hydrogen, carbon capture utilisation and storage (CCUS), and electric mobility.

The business of attracting, training, and retaining talent in the offshore industry is harder, Katy Heidenreich, Director Supply Chain & People Offshore Energies UK, said in the latest Workforce Insight 2022 report.

“Employment grew more than predicted last year, with 97% of companies who responded to our skills survey reporting shortages in appropriately skilled labour. These shortages will only worsen as project demand rises,” Heidenreich said.

OEUK estimates that the offshore oil and gas industry supported 200,800 UK jobs last year, which is 22,300 more than in 2020. The industry body expects to see further increases in total supported employment this year, driven by an anticipated rise in industry investment and more and more people working offshore.

Skills shortages are cited as a major challenge across industry – yet on average, companies expect the workforce to grow by 11 percent in the next two years, according to one of the key findings in the report.

In the middle of December, OEUK announced that industry veteran David Whitehouse was

appointed as its new Chief Executive, effective 1 January 2023. Whitehouse most recently led operator CNR International, where he spent two decades as managing director and vice president of development operations.

In early December, hundreds of offshore workers went on a strike to demand better terms in ongoing disputes over pay and conditions. Unite, the UK’s largest industrial union, confirmed that 146 members would begin strike action at the Petrofac Repsol installations on 8 and 9 December as a result of an ongoing, and increasingly bitter dispute over pay and working terms. “The dispute relates to the removal of a 10 percent Equal Time payment, years of below inflationary pay increases, as well as issues around payments for OEUK medicals, mileage and stand in duties,” the union said.

The Bacton Energy Hub (BEH), a Carbon Capture and Storage (CCS) hydrogen project on the coast of Norfolk, could not only help to secure the UK’s energy supply but also play a major role in significantly reducing greenhouse gas emissions, a new report by NSTA and industry players found in December. Low-carbon hydrogen could heat up to 20 million homes and businesses across London and the South East of England for decades to come, NSTA said. It is possible that by 2030 hydrogen produced at Bacton could be blended into the National Transmission System (NTS), helping the transition to net zero while ensuring energy security, according to the report.

“The reports produced by our partners clearly demonstrate that the Bacton Energy Hub is a viable, commercial project with significant expansion opportunities that can secure long-term gains in terms of energy security, the energy transition and employment,” said Alistair Macfarlane, NSTA Southern North Sea Area Manager.

NSTA said in a report on 15 December, its inaugural ESG Disclosure report, that ongoing access to finance depends on companies’ ability to demonstrate strong ESG credentials. It also reinforces the importance of robust and authoritative disclosure. The report, which looked at a sample of 31 UK licensees, found that the sector has improved its ESG reporting in recent years, with most companies now providing information on most aspects of the recommendations set out by the NSTA’s ESG Taskforce in March 2021.

“I’m encouraged by the good progress made by many businesses on ESG reporting. However, the sector must keep improving the quality of its reports to address external pressures, in particular its social licence to operate,” Joanne Edgeler, Head of Licensee Governance and ESG, said.

In company and field development news, bp, Equinor, and Ithaca Energy have signed a Memorandum of Understanding (MoU) to explore electrification options for their West of Shetland oil and gas interests.

The agreement follows the formation of the West of Shetland Electrification (WoSE) group, acting on behalf of the joint venture partners of the Clair, Rosebank, and Cambo fields.

A spokesperson for the WoSE group said: “This initiative seeks to evaluate the technical, commercial, and regulatory challenges of various low-carbon power hub solutions to recommend a technically and commercially viable option that can meet the requirements of the three field owners within the respective project timeframes.”

According to Equinor, electrification solutions could include power from shore (potentially from onshore wind) or from offshore wind. Full electrification would require in the region of 200 megawatts (MW) of power.

Energy services provider Expro announced in early December a new $50 million contract with North Sea operator Apache Corporation on its Beryl and Forties assets. The fully integrated well intervention and integrity services contract, which has a primary term of three years and two one-year extension options, involves pumping and optimisation operations across all of Apache’s North Sea assets, including Beryl Alpha and Bravo, and Forties Alpha, Bravo, Charlie, Delta, and Echo, said Expro.

Hartshead Resources has awarded to Petrofac the Platforms FEED contract for the Anning and Somerville unmanned minimum facilities jackets and topsides and the Subsea FEED contract for the interconnecting subsea pipelines connecting to Shell’s Corvette export system with onward gas transport to the Leman-A complex, associated risers and tie-in to the Anning platform. The award of the FEED contracts signals a significant milestone as the Phase I development progresses from Concept Select into Concept Define prior to entering the execution phase at Final Investment Decision (FID) which is expected to occur later in 2023, Hartshead Resources said.

“Entering into FEED for our Phase I development is another important step toward first gas and a key milestone on the field development planning process,” Hartshead’s CEO Chris Lewis said.

Hartshead also intends to participate in the UK 33rd Offshore Licensing Round which has a closing date of 12 January 2023 for the submission of applications.

ENERGY NEWS UK NORTH SEA

UK NORTH SEA REVIEW SPONSORED BY

DavidWhitehouse

12 www.ogv.energy I January 2023

ChrisLewis

THE SOCIAL STRATEGIST

commercial

Eric Doyle

By Eric Doyle

By Eric Doyle

At many points in my career, I’ve been involved in the management of risk.

From task-based to business risk. I’ve found the process of identifying, assessing, and mitigating risk, fascinating through the years.

The mere fact that good risk assessment and management saves lives, reduces waste, lowers cost and saves time is impressive enough but, the mindset and process also encourage us think about opportunity.

Opportunities for improvement, for progress and growth.

As time moved on my focus turned to business risk, often centred around cashflow, profit & clients.

I’ve seen some fantastic, active corporate risk registers in my time and some dreadful examples of stale, inactive box ticking exercises. I even remember a time with a board in the 2010s where the Chairman spent 30 minutes arguing that we should remove “Global Pandemic” from our risk register as it was “a ridiculous waste of time focussing any energy on this nonsense”…

Nowadays my focus is on managing modern commercial risk.

Every organisation we talk to is experiencing challenges . Many have problems recruiting good people and retaining the people that they have…but for most the challenge centres round three areas - pipeline - visibility - credibility

Pipeline = External sales Marketing = Credibility & visibility

Even those organisations that have been fortunate to have had a couple of good years of sales have invariably realised that those days are gone or drying up and, they not only have no pipeline today…but they have no reliable mechanism for regenerating it. For visibility and credibility, the stark truth is that old techniques don’t work anymore. That’s not a huge surprise as marketers only one tools, words. You can tell people that your product is amazing/class leading/world beating, and you can say you are ‘customer focused and market leading’…but so can all of your competitors.

The truth is that your prospects (the individuals within your target organisations) are going to make potentially a career-limiting mistake by choosing the wrong supplier and simply giving

them data/arguments/reviews “pricing” that you’re better than the competition doesn’t cut it because the competition are doing exactly the same.

Your commercial world has turned to Digital and knowing how to operate and be successful in your Digital sectors is now crucial.

“As leaders, we are at a crossroads – Analogue or Digital..?”

Do we hold fast and keep doing what we are doing or convert to Digital commercial practices and take what’s rightfully ours...?

The Digital Twin of your sector is already in build. Companies that have rewired their commercial processes to Digital are prospecting, networking, growing communities, building new relationships, and converting all of this to commercial interaction.

The access point to your commercial future is through Strategic Social Media.

We meet leaderships team from across sectors who tell us they have no pipeline. They tell us they have no leads and are existing on historic relationships with those 1 or 2 clients that “always come to us”.

We show them what modern Digital commerce looks like, how it works and what they should see in return….it answers their problems on revenue, ebitda, recruiting, ,market share….and more.

Then someone usually asks the question “How will we find the time to do this in our already busy days...?”

We hear this a lot.

The subtext in the introduction was “nothing we are doing is working and we are struggling to make ends meet”.

They now see a way ahead but are worried that it’s going to get in the way of all the things that they are doing that aren’t working.

This is why we talk about resetting the commercial brain of the company and the team to Digital.

Becoming the leading technical and commercial Digital influencers in your sector isn’t a ‘bolt on’, it’s the way we need to be working now.

Many of our clients realise this as we go through our programme and begin offloading things that don’t work and redefining their commercial processes for the modern age.

So, as we move into 2023., how does your Digital commercial strategy look?

Are you moving with the times or holding onto old ideas and method…more adverts, more emails, more phone calls?

Are you building Digital communities and ecosystems around your people or are you hoping everything goes back to the way it was…?

Eric is a Co-Founder of Crux Consultancy Limited who train and coach cross sector B2B teams in the art and science of Strategic Social Media through Social Selling & Influence. www.consultcrux.com

BRENT OIL PRICES OVER THE YEARS

BRENT OIL PRICE JAN 2023 - $78.14

YEAR AGO 1

- BRENT OIL PRICE 2022 - $87.82

Bumper shareholder pay-outs, soaring profits, booming asset valuations: the oil and gas industry bounced back from the downturn caused by the pandemic. Factors such as strong Chinese demand and low wind generation during summer impacted the industry. North Sea oil and gas companies expected near-record cashflows for the financial year, according to experts at Wood MacKenzie.

AGO 5

YEARS

- BRENT OIL PRICE 2018 - $69.40

BP announced two new oil and gas discoveries in the North Sea. Tests were taking place to discover just how much oil and gas was present in the Capercaillie and Achmelvich fields. With this discovery the oil giants said they hoped to double their North Sea production to 200,000 barrels by 2020.

YEARS AGO 10

- BRENT OIL PRICE 2013 - $111.32

A major pipeline system that provided up to 6% of the United Kingdom’s North Sea oil and gas was shut down due to a leak. The Brent pipeline system, which serviced up to 27 oil fields had to be shut after oil was detected in one of the legs of a platform off Shetland. It was suggested the move could result in an affect on the Brent price.

What does your 2023 Digital

strategy look like?

By Tsvetana Paraskova

Europe Energy Review

By Tsvetana Paraskova

of the daily oil demand in Europe. Recoverable volumes in the Johan Sverdrup field total 2.7 billion barrels of oil equivalent.

“Johan Sverdrup accounts for large and important energy deliveries, and in the current market situation, most of the volumes will go to Europe," says Geir Tungesvik, Equinor's executive vice president for Projects, Drilling & Procurement.

Equinor and Aker BP will also develop the Krafla gas discovery along with the Fulla and North of Alvheim discoveries in the same area, utilising extensive technological innovation and high levels of digitalisation, automation, and remote operation. Planned production start for Krafla, which has 325 million barrels of oil equivalent in place, mostly gas, is in 2027.

Equinor and partners have received the approval of Norway’s authorities to invest in upgrades to boost gas production from the Oseberg area with reduced CO2 emissions.

Aker BP said in mid-December it had submitted plans for a record number of field developments offshore Norway. Aker BP will invest in the development of Yggdrasil (formerly NOAKA), Valhall PWP-Fenris, three developments in the Skarv area – the gas and condensate discoveries in the northern part of the Norwegian Sea, Alve Nord, Idun Nord, and Ørn – and three satellite projects to utilise capacity on Edvard Grieg and Ivar Aasen on the Utsira High in the North Sea.

Wintershall Dea and partners Petoro and Sval Energi, submitted plans for the development of the Dvalin North field in the Norwegian Sea, which is expected to raise gas exports to Europe.

“Committing to a development only the year after discovery is very rare, but shows our determination to supply natural gas to Europe through a major investment in Norway,” said Wintershall Dea’s Chief Operating Officer Dawn Summers.

Neptune Energy confirmed in early December a new discovery at the Calypso exploration well (PL938) in the Norwegian Sea. Preliminary estimates point to 6-22 million barrels of oil equivalent (boe) in place.

“Initial analysis of Calypso indicates commercial potential. Together with our partners in the Calypso licence we will now study options to effectively develop the discovery using nearby infrastructure,” said Odin Estensen, Managing Director for Neptune Energy in Norway and the UK.

Oil & Gas

The EU embargo on Russian crude oil imports by sea and the price cap on Russian crude oil of $60 per barrel came into effect on December 5. Per the price cap mechanism, buyers paying $60 or less per barrel of Russia’s crude will continue to have full access to all EU and G7 insurance and financing services associated with transporting Russian crude to non-EU countries.

The markets were not immediately affected as many participants have focused on a potential slowdown in global oil demand amid slowing economies.

Equinor started oil production from the Johan Sverdrup Phase 2 field development on 15 December, which will raise the output of Western Europe’s largest oilfield to 720,000 barrels per day (bpd) at plateau, up by around 180,000 bpd. The Norwegian energy giant will look to increase production to 755,000 bpd, which would mean that Johan Sverdrup alone can meet 6-7 percent

Aker Solutions has signed a Letter of Intent (LOI) with OKEA for the Draugen Electrification project offshore Norway, which will include major modifications of the existing platform to enable it to receive power from shore via an electrical power cable. This will replace the current power generation from gas turbines at the platform and reduce CO2 emissions by about 200,000 tonnes per year.

Commodity trading giant Trafigura has signed a $3-billion four-year loan guaranteed by Germany to support a new commitment by Trafigura to deliver substantial volumes of gas into the European gas grid, and ultimately into Germany, over the next four years.

ENERGY NEWS ENERGY NEWS

The EU embargo on seaborne imports of Russian crude oil and the G7-EU price cap, numerous oil and gas field developments offshore Norway, and many deals and policy decisions in the renewable energy sector in the UK featured in the European energy sector in the past month.

14 www.ogv.energy I January 2023

Low Carbon Energy

In the renewable energy sector, the UK Government said in early December it would launch a consultation on local support on onshore wind. The government will consult on proposed changes to national planning policy on onshore wind development to explore how local communities can show support.

“Decisions on onshore wind sites will continue to be made at a local level as these are best made by local representatives who know their areas best and are democratically accountable to the local community,” the government said.

Responding to the government announcement, RenewableUK’s CEO Dan McGrail said:

“Lifting the de facto ban will mean we can generate more cheap power to help hard-pressed billpayers and cut our dependence on gas. Creating a level playingfield for onshore wind will boost our energy security while ensuring there is local support for new projects, and we look forward to working with Government and communities on the detail of a new approach.”

“Backing onshore wind is one of the best solutions to the energy crisis, as projects can be up and running within a year of getting planning permission. Growing the UK’s onshore wind capacity could add £45bn to our economy, grow our domestic renewable supply chain and support the competitiveness of British business,” McGrail added.

Crown Estate Scotland confirmed on 13 December that a total of 19 applications have been made for its Innovation and Targeted Oil and Gas (INTOG) offshore wind leasing process. INTOG is expected to help to decarbonise the North Sea oil and gas sector by supporting the building of wind farm projects connected to oil and gas infrastructure (TOG) providing electricity and will reduce the carbon emissions associated with oil and gas production. It will also allow for the development of small-scale (IN) innovative offshore wind projects of 100 MW or less, Crown Estate Scotland said.

Scotland also launched a Hydrogen Action Plan, outlining actions that will be taken over the next five years to support the development of a hydrogen economy to further Scotland’s efforts to reduce greenhouse gas emissions from the energy system while ensuring a just transition. The ambition is for Scotland to be a leading producer and exporter of hydrogen and hydrogen derivatives for use in the UK and in Europe, with the first hydrogen delivered from Scotland to mainland Europe in the mid-2020s.

On December 14, the Net Zero Technology Centre and ERM announced the launch of the Liquid Organic Hydrogen Carrier (LOHC) for Hydrogen Transport from Scotland (LHyTS) project, which will play a key role in the export of hydrogen from Scotland to Rotterdam.

The project, which will be delivered by a diverse international consortium, aligns with Scottish Government’s Hydrogen Policy Statement, which aims to deliver 5 GW of renewable and low-carbon hydrogen production by 2030 and 25 GW by 2045.

Hydropower can realistically provide an additional deployment of 1 GW in the UK, a 50 percent increase

from its existing installed base of 2 GW, the Energy Informatics Group at the University of Birmingham said in a report commissioned by the British Hydropower Association (BHA) to assess the future potential of hydropower in the UK.

“This report provides evidence and data that makes it clear hydropower has long-standing benefits to help decarbonise the UK's electrical system,” said Dr Grant Wilson, School of Chemical Engineering.

RWE has announced plans for a new UK project combining solar, batteries, onshore wind, and sustainable farming in south Yorkshire and north Lincolnshire. The project, named Tween Bridge Solar Farm, would mark a UK-first for RWE with development of solar and battery storage in combination with existing onshore wind farm whilst supporting one of the largest lowland sheep farms. Located on land to the east of Thorne, Tween Bridge Solar Farm has an agreement for a possible generation capacity of up to 600 MW which could be operational by 2029.

Octopus Energy has acquired UK solar developer and asset manager Zestec Renewable Energy to build cheap solar power on British businesses’ roofs, helping to drive down energy bills.

EDF Renewables UK has signed a contract with Wärtsilä for a new transmission-connected battery storage facility in Sundon, Bedfordshire, which will form part of a new Energy Superhub in the region, helping to support the transition to a decarbonised electricity system and accelerate the UK’s net zero future.

SSE Thermal and Equinor’s Keadby 3 Carbon Capture Power Station in the Humber has become the first power CCS project in the UK to receive planning permission. Keadby 3 would have a generating capacity of up to 910 MW and capture up to one and a half million tonnes of CO2 a year, which represents at least five per cent of the UK Government’s 2030 target, Equinor said. The lowcarbon flexible power station could be operational as early as 2027, assuming success in the UK Government’s Cluster Sequencing Process leading to a Final Investment Decision.

Marks & Spencer (M&S) and bp pulse have signed an exclusive agreement to bring high-speed electric vehicle (EV) charge points to the M&S store estate across the UK. M&S and bp pulse will work together to install an initial 900 EV charge points in around 70 of M&S’ national stores in the next two years.

Centrica and Ryze Hydrogen agreed to jointly develop, build, and operate hydrogen production projects on existing Centrica sites and work with third-parties to build production on their sites too, aiming to provide a reliable supply of hydrogen for industry and transportation.

RWE has acquired 100 percent of Irish company Western Power Offshore Developments Ltd, which is in the early stages of developing the East Celtic Wind Farm project off the coast of Ireland. The East Celtic project is in the very early stages of development, and important decisions have yet to be made, from the overall size of the wind farm to turbine locations, cable routes and land-based developments. Depending on the final agreed installed capacity, and once fully developed and constructed, it could have the potential to generate up to 900 MW of clean wind energy.

EUROPE

"Lifting the de facto ban will mean we can generate more cheap power to help hardpressed billpayers and cut our dependence on gas. Creating a level playing-field for onshore wind will boost our energy security while ensuring there is local support for new projects, and we look forward to working with Government and communities on the detail of a new approach."

15

RenewableUK's CEO Dan McGrail said

SPONSORED BY

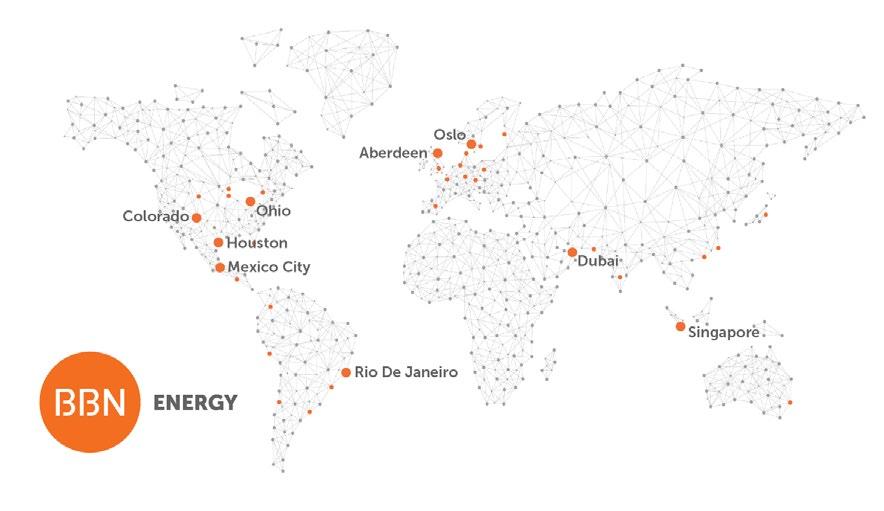

Local expertise empowering the world

At BBN Energy, the presence of our industry experts across every major energy basin around the globe helps us to provide local marketing expertise to global energy operators and service providers. If you are a growing energy company, looking for an active marketing communication partnership ensuring accelerated growth, revenue and reputation, get in touch today.

ENERGY REVIEW US

By Tsvetana Paraskova

US petrol prices dropped in early December to below the levels seen a year ago with the slide in international crude oil prices to below $80 per barrel—the lowest level in a year. Higher refinery utilisation levels and slowing demand have also contributed to the lower prices at the pump for American consumers.

Next year US retail petrol prices would average about $3.50 per gallon, the US Energy Information Administration said in its ShortTerm Energy Outlook (STEO) for December.

US crude oil production is set to increase in 2023 compared to the average 2022 output, the EIA forecasts, although the growth will be lower than anticipated at the start of this year due to supply-chain constraints, capital discipline from E&P operators, labour shortages, and cost inflation for services. US natural gas exports are set for another rise in 2023 led by high LNG demand in Europe and Asia, according to the EIA.

Job growth in the US oilfield services sector hit the highest level since March 2020, when oil demand plunged at the start of the pandemic, while upstream job growth in the key oilproducing state, Texas, is also on the rise.

The clash between the Democrats and the oil and gas industry continued with a new report signed off by House Democrats which accused Big Oil of greenwashing and only accelerating the climate catastrophe.

bbn-international.com/energy

US Petrol Prices Drop Below Year-Ago Levels

Lower international crude oil prices, high refinery utilisation, and lower demand have led to declines in US retail petrol prices over the past weeks. As of the middle of December, the average price of retail petrol was lower than year-ago levels in more than 30 US states.

The national average pump price plunged by 14 cents in one week to $3.26 per gallon as of December 12, six cents less than a year ago and 52 cents less than a month ago. There were 34 states with averages lower than last year, AAA said in a weekly overview.

“The seasonal pattern of less driving due to shorter days and crummy weather, combined with a lower oil cost, is driving gas prices lower,” AAA spokesperson Andrew Gross said.

“If this trend continues, many states could see their average prices fall below $3 a gallon by early next year.”

ENERGY NEWS

16 www.ogv.energy I January 2023

Higher US Natural Gas Production in 2023

The EIA raised in its STEO for December the forecast for US natural gas production by almost 1% in 2023 compared with the November forecast. Although the EIA continues to expect natural gas production in the Permian Basin to be limited early in 2023 by the lack of pipeline capacity to bring associated natural gas production to market, the administration expects that these constraints will be resolved earlier than it had previously assumed.

In the December STEO, the EIA also includes a contraction in US economic activity in the fourth quarter of 2022 and in the first quarter of 2023, which represents a slightly shorter and milder period of economic contraction than in the previous month’s STEO.

“Uncertainty in macroeconomic conditions could significantly affect energy markets in the forecast period. Based on the S&P Global macroeconomic model, we assume U.S. GDP will remain flat in 2023,” the EIA said.

In a report from early December, Enverus Intelligence Research (EIR) expects near-term recession concerns and oil price weakness to not obscure a tight supply outlook for 2023, when the research firm expects Brent pinned above $100 per barrel on the back of OPEC supply management and EU sanctions on Russian exports.

“U.S. oil supply has disappointed this year, forcing us to downgrade our growth expectations significantly. We now forecast U.S. supply growth of 560 Mbbl/d E/E in 2023,” said Bill Farren-Price, report author and a director at EIR.

For US natural gas prices, EIR forecasts NYMEX gas prices of $5.10/MMBtu this winter, falling to $3.50/ MMBtu in the summer of 2023.

The Permian is accelerating gas production where takeaway constraints could slow the growth, but the Haynesville and the Marcellus shale gas plays are showing signs of slowing, EIR said in a separate report in December.

“Permitting activity across the Delaware has shifted from the liquids-rich regions of the basin to the gasweighted areas,” said Stephen Pratt, report author and senior associate at EIR.

“The relative well-level economics in the gas-weighted areas generate comparable returns and value when compared to the core of the basin and should compete for capital for operators with regional optionality.”

Jimmy McNamara, vice president at Enverus Intelligence Research and report author, noted, “Average well productivity has increased this year in the Haynesville, deteriorated in the northeast Marcellus and remained flat in the southwest Marcellus.”

Democrats Say Big Oil Greenwashing While Not Cutting Emissions

The Committee on Oversight and Reform at the US House of Representatives released in December a new memo and documents which, the Democrats on the committee say, shows “how the fossil fuel

industry engages in “greenwashing” to obscure its massive long-term investments in fossil fuels and failure to meaningfully reduce emissions.”

“Despite public promises that fossil fuels are merely a “bridge fuel” to cleaner sources of energy, Big Oil has doubled down on long-term reliance on fossil fuels with no intention of taking concrete actions to transition to clean energy,” according to the findings of the committee in the memo which was not signed off by any Republican Party representative.

“The industry’s inadequate climate pledges and commitment to emissions reductions are intended to provide cover for Big Oil to continue raking in billions of dollars by selling fossil fuels for decades to come,” the committee’s memo says.

Carolyn B. Maloney, Chairwoman of the Committee on Oversight and Reform, said, “Even though Big Oil CEOs admitted to my Committee that their products are causing a climate emergency, today’s documents reveal that the industry has no real plans to clean up its act and is barreling ahead with plans to pump more dirty fuels for decades to come.”

In an op-ed in World Oil, Frank Macchiarola, senior vice president of Policy, Economics and Regulatory Affairs at the American Petroleum Institute (API), wrote that the energy industry already leads on reducing methane emissions.

Over the past decade, average methane emissions intensity declined by nearly 60% across all major oil and natural gas-producing regions in the US and flare intensity declined nearly 50% in 2021. As one major participant in The Environmental Partnership (TEP) the API launched five years ago, has recently noted, “Addressing methane emissions is a key part of being a responsible producer of oil, products and natural gas… Our goal is simple – keep methane in the pipe,” Macchiarola wrote.

Employment in US Oil & Gas Sector On The Rise

Employment in the US oilfield services and equipment sector rose by an estimated 2,346 jobs to 645,486 in November, according to preliminary data from the Bureau of Labor Statistics (BLS) and analysis by the Energy Workforce & Technology Council.

The November increases make OFS employment the highest since numbers started to drop in March 2020, and roughly 60,000 off from the pre-pandemic mark in February 2020 of 706,528, the energy council said.

“The latest increase in our sector is very encouraging. We now have almost gained back all the jobs lost since March of 2020 when the pandemic began to significantly hit the labor market,” said Energy Workforce & Technology Council CEO Leslie Beyer.

Upstream oil and natural gas employment in Texas grew in October, the Texas Oil & Gas Association (TXOGA) said, quoting state data.

Per TXOGA estimates, months of increase in upstream oil and gas employment in Texas have outnumbered months of decrease by 22 to 3 since the low point in September 2020, when the pandemic decimated oil and gas employment nationwide. Since the COVID-low point, industry has added 50,000 Texas upstream jobs, averaging growth of 2,000 jobs a month.

US

“The latest increase in our sector is very encouraging. We now have almost gained back all the jobs lost since March of 2020 when the pandemic began to significantly hit the labor market,”

said Energy Workforce & Technology Council CEO Leslie Beyer

“The seasonal pattern of less driving due to shorter days and crummy weather, combined with a lower oil cost, is driving gas prices lower,”

US NEWS SPONSORED BY 17

AAA spokesperson Andrew Gross said

www.craig-international.com

MIDDLE EAST Energy Review

By Tsvetana Paraskova

The OPEC+ group left their target production level unchanged amid many uncertainties in the oil market, OPEC didn’t make material changes in its estimates of global oil demand growth, while the biggest oil and gas firms in the Middle East made major announcements and signed landmark deals in December.

OPEC+ Sticks To Cautious Production Policy

During the last meeting of the OPEC+ alliance for the year, the group decided to leave the production quotas unchanged from November, when the members of the pact had to cut 2 million barrels per day (bpd) from their collective production quota. In fact, the actual production cut is lower, estimated at around 1 million bpd, because many OPEC+ members outside the Middle East have had troubles producing to quotas even before the decision for the 2-millionbpd cut.

OPEC+ also decided to adjust the frequency of the monthly meetings to become every two months for the Joint Ministerial Monitoring Committee (JMMC) and the authority of the JMMC to hold additional

Smart Procurement

At Craig International, procurement isn’t just about processes, products and numbers. We promote a culture of ownership among our people, who are trusted to get on with the job on your behalf. We’re proud of how we serve clients.

We’re always looking for new ways to add value and routinely introduce new technological solutions to make service delivery even simpler, smoother, faster.

meetings, or to request an OPEC and nonOPEC Ministerial Meeting at any time to address market developments if necessary. Currently, the next full OPEC and non-OPEC Ministerial Meeting on is set to be held on 4 June 2023.

Analysts largely interpreted the OPEC+ decision not to change quotas as a ‘waitand-see’ approach from the group just ahead of the EU embargo on seaborne imports of Russian crude oil and the G7-EU price cap of $60 a barrel for Russian crude if EU/G7 maritime transportation services be used.

OPEC+ prepares for market uncertainty with the continued 2 million bpd production cut, Wood Mackenzie said in a commentary after the December 4 meeting of OPEC+.

“The decision by OPEC+ to continue with its recently agreed 2 million barrels per day (b/d) production cut through the end of 2023 is not a surprise, given the uncertainty in the market over the impact of the 5 December EU Russia crude oil import ban and the G7 price cap,” said Ann-Louise Hittle, vice president, Macro Oils, at Wood Mackenzie.

“EU nations that import Russian crude oil either by ship or from the Druzhba North pipeline will need to replace those volumes with waterborne imports, increasingly pulling

on crude oil exports from the Middle East, West Africa, and US,” Hittle added.

OPEC Leaves Oil Demand Growth Forecast Unchanged

In its Monthly Oil Market Report (MOMR) published in the middle of December, OPEC did not make any material revisions to its oil demand growth estimates, after cutting forecasts several times already since the spring of this year.

World oil demand is set to rise by 2.5 million barrels per day (bpd) in 2022 and 2.2 million bpd in 2023, OPEC said, keeping its forecasts from November essentially unchanged.

There is upside potential for demand growth next year in case of a resolution to the war in Ukraine and easing of the COVID curbs in China, OPEC said, but warned that uncertainty in the oil and energy markets remains high.

“As the year 2022 draws to a close, the recent global economic growth slowdown with all its far-reaching implications is becoming quite evident. The year 2023 is expected to remain surrounded by many uncertainties, mandating vigilance and caution,” the cartel warned.

ENERGY NEWS

SPONSORED BY

18 www.ogv.energy I January 2023

Discoveries & Deals

Saudi Aramco announced at the end of November the discovery of two unconventional natural gas fields in the eastern part of the country.

The Awtad unconventional gas field has been discovered southwest of the giant Ghawar field, and the AlDahna unconventional gas field has been discovered 230 kilometers (143 miles) southwest of Dhahran, the Saudi Press Agency reported, quoting Energy Minister Prince Abdulaziz bin Salman as saying.

“Prince Abdulaziz said that the importance of these discoveries lies in increasing the Kingdom’s natural gas reserves, which would, in turn, support the Kingdom’s strategies and help realize the objectives of the Liquid Fuel Displacement Program,” the press agency reported.

Saudi Aramco and TotalEnergies announced in mid-December the final investment decision for the construction of a large petrochemical facility in Saudi Arabia with an investment of $11 billion. The “Amiral” complex will be owned, operated, and integrated with the existing SATORP refinery in Jubail on Saudi Arabia’s eastern coast. The petrochemical facility will enable SATORP to convert internally produced refinery off-gases and naphtha, as well as ethane and natural gasoline supplied by Aramco, into higher value chemicals, helping to advance Aramco’s liquids to chemicals strategy.

In the United Arab Emirates, the board of the Abu Dhabi National Oil Company (ADNOC) endorsed plans at the end of November to bring forward ADNOC’s 5 million barrels per day (bpd) oil production capacity expansion to 2027, from the previous target of 2030, as part of the accelerated growth strategy.

“The accelerated production capacity target is underpinned by the UAE’s robust hydrocarbon reserves, which have increased by 2 billion stock tank barrels (STB) of oil and 1 trillion standard cubic feet (TSCF) of natural gas this year. These additional reserves increase the UAE’s reserves base to 113 billion STB of oil and 290 TSCF of natural gas, reinforcing the country’s position in global rankings as the custodian of the sixth-largest oil reserves and the seventh-largest gas reserves,” ADNOC said.

ADNOC and Malaysia’s PETRONAS signed a concession agreement for Abu Dhabi’s Unconventional Onshore Block 1, which is the Middle East’s first unconventional oil concession. Under

Aramco and TotalEnergies announced the final investment decision for the construction of a large petrochemical facility in Saudi Arabia with an investment of $11 billion

the six-year concession agreement, PETRONAS will hold a 100% stake and operatorship to explore for and appraise unconventional oil in Unconventional Onshore Block 1. The block covers an area of more than 2,000 square kilometres in Al Dhafra region in the Emirate of Abu Dhabi.

ADNOC set up in early December its new Low Carbon Solutions and International Growth vertical that will focus on renewable energy, clean hydrogen and carbon capture and storage, as well as international expansion in gas, LNG, and chemicals.

QatarEnergy and ConocoPhillips affiliates for the delivery of up to two million tons per annum (MTPA) of LNG from Qatar to Germany

QatarEnergy announced at the end of November the signing of two long-term LNG sale and purchase agreements between QatarEnergy and ConocoPhillips affiliates for the delivery of up to two million tons per annum (MTPA) of LNG from Qatar to Germany. Pursuant to the agreements, a wholly owned subsidiary of ConocoPhillips will purchase the agreed quantities to be delivered ex-ship to the “German LNG” receiving terminal, which is currently under development in Brunsbüttel in northern Germany, with deliveries expected to start in 2026. The LNG volumes will be sourced from the two joint ventures between QatarEnergy and ConocoPhillips that hold interests in Qatar’s North Field East (NFE) and North Field South (NFS) projects.

Energy services provider Petrofac said it had been selected by Shell to undertake three new Engineering and Procurement Services (EPS) contracts in three separate block developments in Oman.

Petrofac has also secured a lumpsum engineering, procurement and construction (EPC) contract with ADNOC in the UAE. Under the agreement, Petrofac’s Asset Solutions business will design and install facilities to optimise operations and reduce methane and greenhouse gas emissions at the Habshan Complex, located 150 kilometres southwest of Abu Dhabi.

ADNOC and Malaysia’s PETRONAS signed a concession agreement for Abu Dhabi’s Unconventional Onshore Block 1

French supermajor TotalEnergies has mobilised the teams in charge of drilling operations on Block 9 offshore Lebanon. TotalEnergies plans to start drilling on the block in 2023, CEO Patrick Pouyanné told Lebanon’s Minister of Energy and Water, Walid Fayad, at a meeting in December after Israel and Lebanon reached an agreement to settle their maritime border dispute in the eastern Mediterranean.

The call for tenders to secure the drilling rig has been launched and should lead to a selection of the rig in the first quarter of 2023. Pre-orders have also been placed with suppliers for equipment required for the well, TotalEnergies said.

MIDDLE EAST

MIDDLE EAST NEWS SPONSORED BY

19

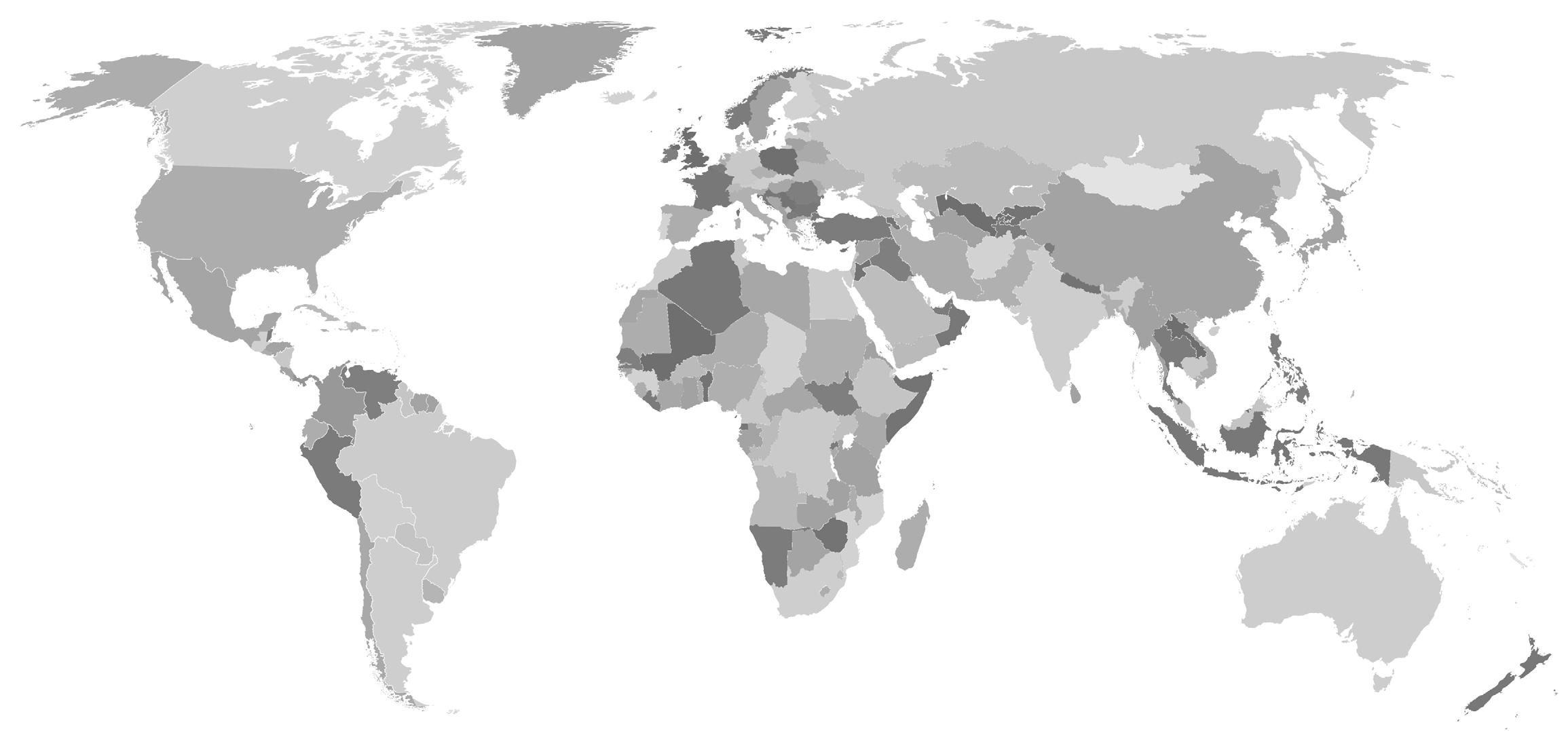

ENERGY PROJECTS MAP

DENMARK

Project Greensand Ineos

$400 million

Kent has been contracted to conduct screening studies covering the CCS value chain from the onshore capture sites, liquefaction, onshore storage, transportation, and offshore sequestration for Project Greensand. The scope includes studies to investigate the transportation of CO2 and its storage potential in the depleted Nini Field in the Danish North Sea. The project will look at further expansion and use of other depleted fields and adjacent aquifers in the Siri Area (e.g. Cecilie, Nini East, Stine, and Siri).

SPONSORED BY

NORWAY

Dvalin Nord Gas, Condensate & Oil Discovery Wintershall Dea $823 million

Wintershall Dea and its partners have submitted the PDO for the field. The discovery will be developed as a tie-back to the Heidrun platform. The plan calls for three production wells to be drilled from a single subsea template located 10 kilometres north of the Dvalin field. The partners intend to invest more than US$822.6 million (NOK 8 billion) in the project. Startup is planned for 2026.

NORWAY

Irpa Gas Field – Subsea Tie-back Equinor $1.4 billion

Joint venture partners BP, Kosmos, Petrosen, SMH and the governments of Senegal and Mauritania are in advanced discussions on the development concept for Phase 2 development of the field. The partnership will select a solution which leverages the infrastructure from Phase 1 and allows the partnership to access attractive gas marketing opportunities.

NETHERLANDS

N05-A (Ruby) Platform Development One-Dyas $482 million

HSM Offshore has been awarded a contract to construct the electrified ONE-Dyas N05-A gas production platform that will be powered exclusively by offshore wind energy. The NO5-A platform's energy supply will come from the nearby Riffgat offshore wind farm. Construction of the platform has commenced at HSM’s Schiedam facility.

Energy projects and business intelligence in the energy sector

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today. www.eicdatastream.the-eic.com

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

WORLD PROJECTS

1 3 9 6 10 7

8 1 1 3 2 4 5 12 2 8 11 4 20 www.ogv.energy I January 2023

TRINIDAD & TOBAGO

Cypre Gas Discovery

BP

$500 million

Subsea 7 S.A. has announced a contract with BP to supply and install dual flexible flowlines, a manifold gathering system and topside upgrades. The workscope will include project's concept and design, engineering, procurement, construction and installation of a two-phase LNG tieback. Project management, design and engineering will start immediately at Subsea 7’s offices in the USA, to be followed by offshore installation scheduled in 2024. Subsea 7 will perform the work under its Subsea Integration Alliance with OneSubsea that will deliver the subsea production system for the project.

BRAZIL

Bijupirá-Salema Field Decommissioning Shell

$100 million

Shell has launched a tender for the decommissioning of anchoring equipment, flowlines, umbilicals and production lines. Bids will be submitted in December and the contract will be executed over 180 days. Helix was Helix recently awarded a contract for the well plugging and abandonment campaign at the oil fields. Helix will employ the Q7000 DP3 well intervention vessel for the work. The contract will start in 2024 and take 12 months.

OMAN

Block 61 - Khazzan Gas Field BP

$100 million

A consortium made up of Worley and Special Technical Services (STS), has been awarded a contract extension by BP Oman to provide engineering, procurement and construction services for the Khazzan facility. This 5-year [20222027] agreement for services will be led by Worley's Oman office.

OMAN

Block 10 and 11 - Greater Barik Intergated Gas Development Shell

$4 billion