19 minute read

Roundtable: The status quo and beyond for the bridging market

THE STATUS QUO AND BEYOND FOR THE BRIDGING MARKET

When it comes to bridging, nothing’s standing still

The pandemic is now gradually receding from everyday life, but it has left behind a sizeable imprint on the UK mortgage market. In association with Lendinvest, Mortgage Introducer brought together experts from Mint Property Finance, Sancus Lending, Movin Legal, Castle Trust Bank, Together, and LendInvest itself to share their verdicts on the current situation and what directions they foresee the bridging market heading in.

COVID-19 AFTERMATH

There was seemingly no sector of the economy that didn’t have to recalibrate due to the pandemic and subsequent lockdowns.

Robert Oliver, sales director at Castle Trust Bank, is clear that this has tipped the balance toward bridging, as investors are facing new challenges and are looking for different solutions post-COVID.

“Six or seven months ago we had a lot of landlords coming to us looking for out-of-town developments, looking for semi-rural properties to convert either into holiday lets or into HMOs, because they saw the migration of people out of the cities. What we’re seeing now is the holiday let market is very much segmenting, so we’re seeing the high-end holiday market, the £3,000-£5,000-plus a week market, is absolutely flying,” he said.

Oliver also explained how that has coincided with a noticeable shift toward bridging. “Property is always going to be a safe investment, but we are seeing a swing to the bridge now, as bridging is not only more affordable than it’s ever been, but also it’s more flexible, it’s more of an accepted way to finance an actual development, and it gives you the flexibility to either exit some or exit others. It’s all about the exit, we know that, but now it allows the broker to offer clients more flexibility in what they do. We’re seeing it across the board – that the market is increasing, particularly in those areas.”

That sentiment chimes with Richard White, UK sales director for Sancus Lending, who is dealing with a vast number of properties that landlords or investors want to alter, a situation forced on them by the pandemic. He said, “I think it has had a big impact on people’s needs and requirements from bridging products. Nearly 90 per cent of the enquiries we get now on what we consider to be bridging loans involve some sort of change to the property from the state [in which] it has been acquired to the state at the end of the loan term.” It’s a similar story from specialist account manager at Together Michelle Walsh. Her attention was

sharpened thanks to the stamp duty holiday, which the government introduced to help buyers as the pandemic raged on. She said, “On regulated bridging, during the pandemic we had this stamp duty tax release so there was a certain period when property transactions needed to complete at speed. The high street lenders at the time either weren’t wholly back to fully lending or they were suffering from severe delays, so regulated bridging was certainly needed.” Walsh also saw close-up an increase in bridging as people frantically moved to accommodate the new acceptance of working from home. “We saw that a lot in the regulated bridging space, too – customers looking to either downsize or potentially upsize to a property that has more space to be able to work from home and have that outdoor space as well,” she said. “The beauty of the bridging market is we can

act quickly – the intention of bridging is to move at speed, and that has been very much fundamental throughout the years, but certainly [especially] during a period when people were looking to get that home of their dreams and change their lifestyle to suit the new way of working now.”

Credit risk manager Peter Howarth explained how his colleagues at Mint Property Finance had a new way of working thrust on them by the pandemic. “We’ve gone down the route of automated valuations and sometimes internal valuations; we wouldn’t engage a professional – we would go out and use our own internal expertise to value the property. But automated valuation has certainly now been introduced and seems to be the norm.”

That concept of doing some operations differently is something Emma Hall, key relationships director at Movin Legal, can relate to. She personally has had to diversify her knowledge base to meet the demands of the new normal, as properties are turned into multiuse. “The offices are no longer there – they are being turned into residential, as everybody has gone home. They don’t need to be there anymore, so they have chosen to get rid of it. More brokers have clients where it’s mixed commercial and residential. Even I am having to go to my lawyers and say, ‘Can I have a little bit more training on the commercial aspect where it’s a mixture of a shop, offices, and residential at the same time?’”

All of the panel were positive about the impact of COVID on bridging, and that was summed up by Justin Trowse, LendInvest’s director of bridging, who added, “I think the sector has been very lucky, with a lot of stimulus pumped into the market at an unexpected time. There was a lot of product innovation in the term markets, which drove the bridging markets, quite considerably actually, to secure something very quickly.”

BASE RATE RISES

The BoE has already taken action multiple times this year with interest rate rises – and most expect it to assess these again in the near future. But for Hall the bridging market should be in a good relative position to capitalise. She said, “Interest rate rises may put people off, but a pandemic sure as hell didn’t. I still think bricks and mortar is a long-term safe investment with the right advice and the right product. I do believe the bridging sector is in a better place to deal with interest rate rises much more quickly than perhaps some of its counterparts.” “We have had it good for a number of years now. The base rate went down, down, and down, and people ... have reaped the benefits, so perhaps normality is resuming a little bit” RICHARD WHITE

There are varying considerations for banks – something White addressed. “From a lender’s perspective, the last thing you want to do is have to continually roll bridges and issue associated fees, as they can be quite considerable.” For him and his colleagues, it’s about paying close attention to different scenarios before lending, and being comfortable about following different routes depending on the conditions. He added, “It’s making sure when you take somebody into the bridge, the plausibility is explored of Plan A and Plan B. We want to make sure the exit is there, knowing potentially the ICR coverage might not be there based on the fact that rates on terms could continue to rise. It’s about keeping one eye on that.”

White also raised the point that prior to the financial crisis of 2008, interest rates were far higher than today (the summer previous to the crisis, the rate was 5.75 per cent), and today’s rises should be seen in that context. He said, “I am not suggesting we go back to those levels, but we have had it good for a number of years now. The base rate went down, down, and down, and people have been on trackers now for several years and have reaped the benefits, so perhaps normality is resuming a little bit.”

The failure to appreciate the lie of the land pre-2008 is something Walsh is having to contend with regularly. “Obviously consumers aren’t used to the rate increases, so that’s an interesting conversation we’re having with some of our younger brokers on rate changes and how to manage those with the consumer,” she explained. “There is still going to be a continued demand for bridging finance, and I think this is where it’s key for us to continue offering those solutions at competitive pricing, in particular from the regulated perspective. We have had customers who are suffering from the cost-of-living crisis and the base rate increases affecting the rates they are on with their term lender.”

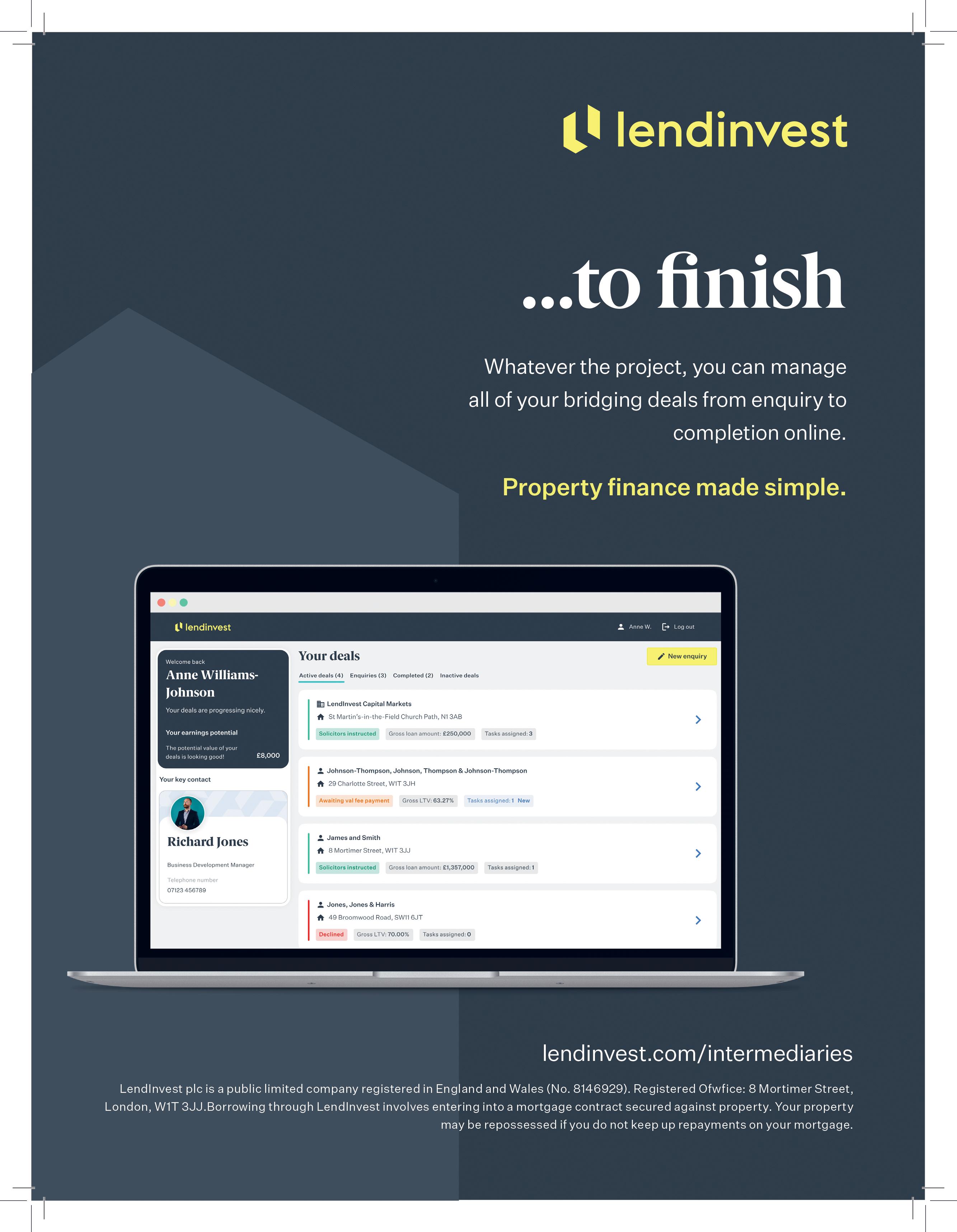

Enquire, apply and manage your deals online

The general optimism for bridging was echoed by Trowse. In fact, he feels that some people would be quite surprised to find how bridging is actually far cheaper than they assume. He said, “The connotation of bridging being expensive – that argument is almost subsiding. If you’re looking at something like 50 basis points, over 100 basis points, you’re really looking at the mid-fours, which is comparable to some term finance for buy-to-let at the moment.”

More rate increases are coming, explained Howarth. The problem he foresees is that there will come an inevitable tipping point, where rate rises spell unavoidable pain for the ordinary person.

“I’d like to think the recent increases are manageable for a lender without passing on the costs at this time, [but] I think there will be a point at which, depending on your funding lines, which is a really important point, it will have to be passed on to the customer,” he said. He also has a feeling that rate increases may even drain investment out of the property market as the savings rate is increased; he added, “It might become a bit more attractive to put your money in the oldfashioned savings product compared to, say, investing in the property sector.”

DEADLINE LOOMING FOR EPC RATINGS

At the time of going to print, the government was sticking with its requirement that all rental properties would have an EPC rating of at least C by 2025. There has been talk of potential delays to the cutoff, but nothing has been confirmed, and all the messaging points to the originally planned mandate going ahead.

Walsh has concerns about the need to meet these ratings, which she feels are akin to an iceberg on the horizon.

“These three years can go very, very quickly, and what we have seen is that a good, significant volume

“The beauty of the bridging market is we can act quickly – the intention of bridging is to move at speed and that has been very much fundamental” MICHELLE WALSH

of private rental properties are lower than a level C,” she said. The problem, she feels, is made worse by the fact that improvements are so costly, and there is also the issue of shortages in terms of carrying out the upgrading work.

She added, “There is still a challenge with material shortages, and labour availability is also still quite limited, so if you’ve got a large portfolio that needs work to get up to the necessary category C or above, it can take some time. Even from existing portfolio landlords and existing customers with their own properties, we’re starting to see these transactions happening now and, even on purchase transactions, they are being factored in.”

It does, though, appear that this legislation could turn out to be another positive opportunity for the bridging market to thrive. Trowse is confident the benefits will boost bridging, and is also of the opinion that the overall concept behind the legislation should be encouraged. “Obviously regulation is pushing this – I think, also, investors on the ESG side of things will see some push toward this, and I think we should all have some CSR to push these properties toward being green. Any business that is offering the bridge-to-let product – i.e., something short-term to term – is going to do very well out of this,” he said.

Chiming in with a similar view was Oliver, who is witnessing increased enquiries for bridge-to-let, but feels it’s key to see the schedule of works factoring into the EPC rating. He explained, “From the underwriter’s perspective it’s imperative they understand what that schedule looks like with a view to pushing people toward that C rating in 2025. You are seeing typical landlords will raise capital to leverage the most they can to purchase other assets, but that conversation of capital raising now and exiting bridges or refinancing unencumbered assets, that conversation now does turn to the EPC rating being an effective part of that asset capital raise.”

Oliver does have a concern about the UK’s treasured collection of historic and much-loved buildings. Can these old cultural icons sync with modern EPC regulations? “We are seeing some quite wonderful assets, maybe some listed buildings or some conversions that have been done in older property, and I’m not sure whether they will ever get to C or above, and you don’t want a huge number of those left on your books.” He also referred to a loan he was involved in recently for an iconic property that is the

Get expert support at every step

proud bearer of a blue plaque. “Would you go there on holiday? Yes, you would. Was it a very successful holiday let business? Yes, it was. Will it be up to the C rating because it’s an old, listed building? That would be a really tough ask for the landlord to do that – so it’s about applying some common sense to some of those assets you are actually taking on board.”

Trepidation is also something White feels regarding the impending EPC deadline. “Three years is no time at all – factoring in labour shortages, timing your renovations to come online when you get to the end of fixed terms or fixed rates that you are on with existing debt on properties means you’ve really got to be planning to do this stuff now. The stats are horrifying – 70 per cent-plus of private rental properties are EPC D or below, and in the rental space you are talking about £15,000 and more to renovate properties,” he cautioned. “I think what will probably be a bit more interesting in terms of the fallout is how many of those investors and landlords want to see the course. They might just find it’s not economically viable to do the upgrades and decide to dispose of the properties or do something else with them by cashing in.”

According to figures that Howarth has seen, there are around three million privately rented properties that need to be brought up to a C rating. He emphasised how challenging a task that will be across the board, and said, “That’s a hell of a number. People are still going to have to live somewhere, so again, without being too cynical, will the government just take a backward step at some point, or delay the date for that happening? Who knows. Bridging has a part to play, there is an opportunity for funds to be made available, the sector is flexible and can find ways of helping the customer. It’s a great opportunity for the bridging sector to help out.”

Even with a measured overview, Howarth doesn’t see the problem disappearing, and is cautious about a works blockage as landlords and investors realise the task they are facing, then scramble to meet the deadline. “They are going to have to bite the bullet at some point – maybe you look to future-proof your properties now rather than wait till 2024 when there might be a rush on for materials and all of a sudden you can’t quite get your boiler or your windows through lack of materials.”

Hall is in agreement that there may be delays, but she points out that nevertheless, the legislation will be introduced formally at some point. She does have concerns, like the others, about last-minute panicking, “I’d like to think the recent increases are manageable for a lender without passing on the costs ... [but] there will be a point at which ... it will have to be passed on to the customer” PETER HOWARTH

but her thoughts are also on the bigger picture. “Many people won’t know this is happening and they’ll trundle along in 2024 thinking they can refinance their property, to be told, ‘By the way you need EPC C.’ My interest in this is, who is going to be the one who actually regulates it to make sure they are up to an EPC C? I can see what is going to happen, I can see it’s going to be conditioned in offers – the lawyer is probably going to be the one to tick to say they’ve got it from the landlord that the EPC is at a C and if any landlords have left it to the last minute, like people did with the stamp duty, then we are going to end up with potentially a backlog in the legal sector again,” she warned.

MAINSTREAM ACCEPTANCE AND THE REST OF 2022

In some quarters, bridging is a term that conjures up negative connotations. That stereotype appears to be waning, though, as a greater understanding pervades. Oliver said, “It’s more of an acceptable term of finance – I think, go back three or four years and bridging was a lender of last resort, a finance option of last resort, it was ‘I can’t do anything else, so I’ll take bridging.’ Now it’s changed completely – people see it as an acceptable way to purchase an asset.” He feels that → level of comfort and acceptance will only increase as the year progresses. He added, “We are seeing people coming to us with general enquiries that they are not allowed to write for their network, and that’s because they perhaps don’t understand the complexity. So aggregators and packagers have a massive part to play in this, through education, as lenders do.”

Trowse is particularly buoyant about the next six months, as the economy moves farther away from the tribulations it has endured over the past few years. “In terms of bridging finance, the uncertainty of the pandemic has pretty much subsided now. I think this →

Instant quotes and Heads of Terms in minutes

year is going to be a good year – we’re actually seeing larger developers now commit to larger transactions; for instance, pre-construction, pre-planning deals, we are seeing a lot of big tickets in commitment now, whereas maybe a quarter or two quarters ago, people were deliberating.”

He still feels there is work to be done on promoting the acceptance of bridging, feeling the market it occupies is split into two cohorts between developers/ investors and homeowners.

“If you ask me, for the homeowner I would say it wasn’t mainstream. I think it still is a last resort, but it’s more palatable now with the lower rates, it’s more acceptable and [has] more reputable businesses,” he said.

“In terms of the other side of the picture, the investors and developers, I think it is becoming more mainstream. We’ve certainly seen a lot more clients from, say, the Lloyds and Barclays – big clearing banks – come into the bridging sector, and also those who typically borrowed or had equity investors come in to the bridging space now ... again, as the rate is more palatable and the products are a lot wider [in scope].”

Walsh is experiencing something of a boom, and she doesn’t expect a slowdown any time soon.

“We’re expecting to be at the same level of demand as what we’ve already experienced,” she said. “Last month was our record-breaking month for bridging, and we’re expecting that to keep going.” One particular area for this growth is customers buying properties that need work before they can term out with another lender. She added, “We’re planning for continued growth. It’s going to be busy, we’re continuing to recruit to support with the demand in the bridging space.

And Walsh even vowed to continue “to beat the drum” for bridging, as she does feel mainstream acceptance is becoming more and more of a reality, even if it’s not fully there yet.

“From the perspective of three years ago, there were still a lot of attitudes out there in the market that bridging was not the right product for consumers or investors, that it was an extremely expensive product, that it would be the last choice. But we’ve seen, actually, [that] bridging lenders and the solution of a bridge has certainly proved their benefits over the past couple of years – the reputation has improved and it’s becoming a more accepted product.”

Offering a slightly different take on the perception of bridging, Hall doesn’t feel there is a need to worry too much if the ordinary person on the street still views it with some suspicion.

She said, “I suppose, in essence, we’re looking at is as a mortgage broker rather than a consumer – my friends just look at me a bit blankly and don’t really understand it. Do I talk to brokers more about it than I did in the last two to three years? Yes, I do. More brokers looking at the circumstances for their clients are looking at different options than they did before.” There is one concentrated hotspot, too, that Hall has noticed this year and anticipates will continue: “The multi-use of the building, they are no longer always just looking at it as a residential buy-to-let, they are

looking at the commercial element as well.”

The need to no longer spend time espousing the value of bridging is a welcome sign for all. White is particularly open about the changes he has noticed; he said, “I very rarely have conversations now, either with introducers from a very broad spectrum or the borrowers themselves, where they are querying why they would use the products or why they would want to sully themselves, as it were, by taking bridging loans. I think they see it as a very natural thing to do. In that regard, I think it is part of the mainstream now.”

Broad products, reliably funded