Upper Merion Township/King of Prussia

Upper Merion Township/King of Prussia

Located approximately 16 miles northwest of Center City Philadelphia, Upper Merion Township is the largest employment center in the Philadelphia suburban region. According to Fortune magazine, which just ranked Upper Merion as 2nd on their list, Best Place to Live for Families in the United States, “Upper Merion is a township that’s part of the city’s growing urban fringe. It has an urban-suburban feel, 65,000 jobs, and a lot to offer families.”1

In the past decade, the township experienced a surge in employment and population growth, especially since 2020 when demand for live-work-play suburban communities rose. Increased demand resulted in the construction of more than 3,562 rental and for-sale housing units since 2016, including large, multifamily developments, attached townhomes, condominiums and single-family homes.

With the dramatic change in population and employment, the residential construction that stemmed from the demand and the high level of interest from stakeholders regarding our 2020 Multifamily Housing Report, we expanded the scope in this report to include all types of housing in Upper Merion. Additionally, we explore how the pandemic has influenced the housing market through various mechanisms.

1. Net migration from other states or townships to Upper Merion increased by 76.7% over the past decade.

2. Since 2016, 3,562 new housing units were built, increasing the total number of housing units in Upper Merion by 28%. Of these, 91.6% are multifamily units with highquality amenities.

3. Upper Merion shows strong rental market performance, particularly in newer properties (built after 2016), with a 95.4% occupancy rate in Q2 2024. The average asking price in this market is $2,070 per unit.

4. The median sales price for all types of houses in Upper Merion is $505,000 in 2023, representing an increase of 68.9% over the past eight years. Single-family attached units saw the most significant increase (100.7%), followed by multifamily units (71.9%) and single-family detached units (55.4%).

5. Both renters and homeowners in Upper Merion are less financially burdened compared to those in Montgomery County and Pennsylvania overall, with a smaller percentage of households exceeding the 30% income threshold for housing costs.

6. The relatively low ratio of school-age children generated per housing unit (1 child per 22 units) suggests an insignificant impact on educational resources, with approximately 237 school-age children resulting from new housing units. Although the total number of housing units increased by 28% over eight years, only 167 new public school students were added, representing 3.7% of Upper Merion Area School District’s total enrollment of 4,502 in 2023.

Over the past decade, the total population in Upper Merion increased by 18.7%, reaching 33,664 in 2022. Figure 1 shows the age distribution by gender from the 2022 American Community Survey (ACS). The 25-34 age group represents the largest proportion, accounting for 20.9% of the total population. Additionally, 63.4% of the population holds a bachelor’s degree or higher, which is 10.1% higher than Montgomery County’s 53.3%. The average commute time to work for Upper Merion residents is 24.6 minutes, with 66.5% driving alone, 5.1% choose alternative options like carpooling or public transportation and 24.8% working from home. In comparison, in 2010, most of the residents drove alone (80.6%), 15.9% chose alternative options, and only 3.5% worked from home. This significant increase in percentage of residents working from home reflects a trend toward more flexible working arrangements after the COVID-19 pandemic.

The racial and ethnic composition of Upper Merion’s current residents is shown in Figure 2. The majority of residents are White (71.8%), followed by Asian (20.0%), Black or African American (9.1%), some other race (2.9%), American Indian and Alaska Native (0.5%) and Native Hawaiian and Other Pacific Islanders (0.4%).

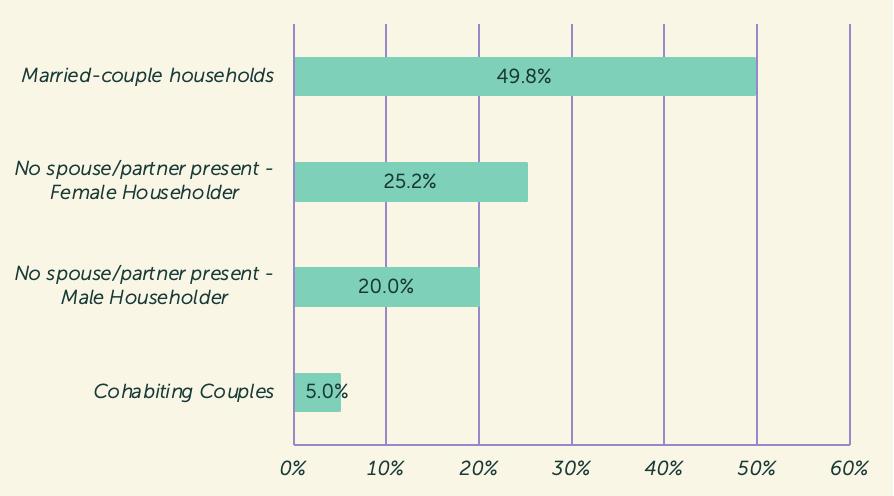

The average household size has decreased from 3.40 persons per household in 1970 to 2.28 persons in 2022. Figure 3 illustrates household types in Upper Merion, showing that half of the households are married-couple households, followed by female households (25.2%) and male households (20%).

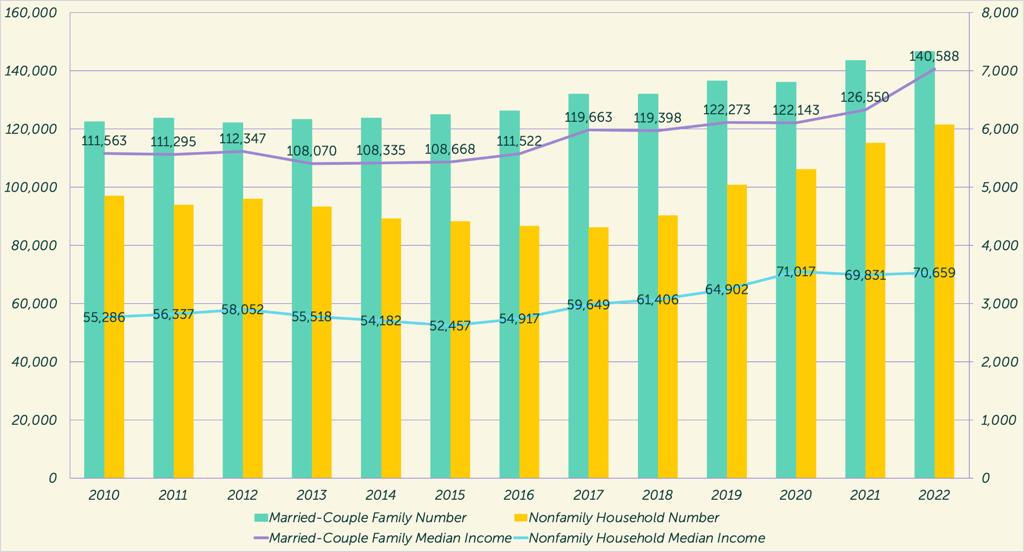

Household median income grew significantly over the past 12 years, rising from $77,955 per household in 2010 to $112,638 in 2022. Figure 4 shows that the median annual income for married-couple households increased by 26.0%, from $111,563 in 2010 to $140,588 in 2022. In comparison, nonfamily households saw a 27.8% increase, from $55,286 in 2010 to $70,659 in 2022.

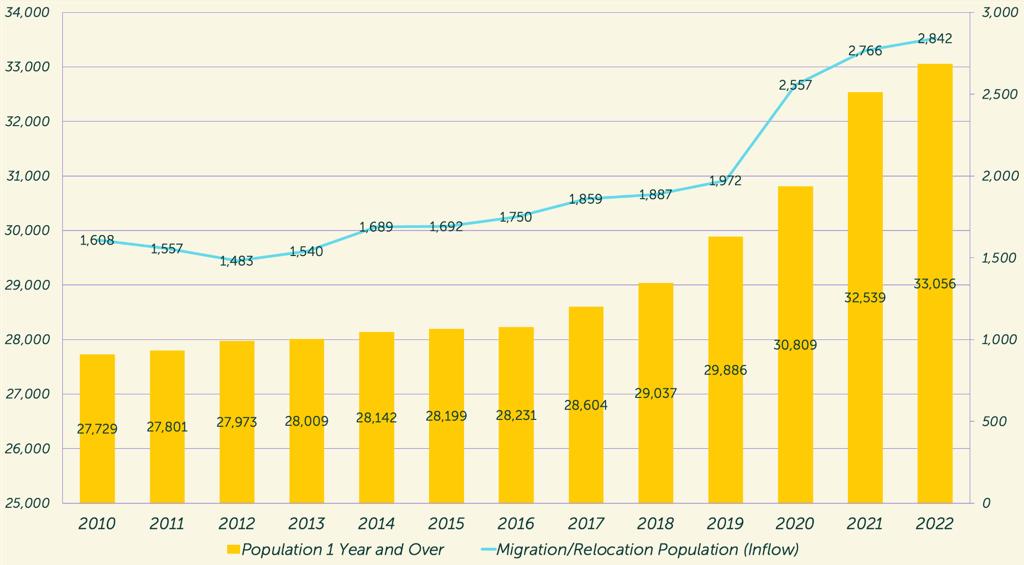

Upper Merion experienced a growing inflow of new residents over the past decade. Figure 5 shows that the migration inflow population to Upper Merion steadily increased since 2012, surged since 2019, and has gradually slowed down, closely keeping pace with population growth. From 2010 to 2022, net migration from other states or townships to Upper Merion increased by 76.7% while population aged 1 year and over grew by 19.2%.

Based on homebuyer searches, Redfin.com provides insights into migration and relocation trends at the city level, although it does not reflect actual moves. From May 2024 to July 2024, King of Prussia (located within Upper Merion Township) saw a net search inflow from 2% of homebuyers nationwide, particularly from New York (3,815 searches), Los Angeles (204 searches) and San Francisco (127 searches). Figure 6 shows the geographic net search inflow to King of Prussia in the past year. Conversely, 74% of King of Prussia homebuyers looked to stay within the area, while 26% looked to move out, with Salisbury, MD (1,732 searches) being the most popular destination.

3

King of Prussia represents the third-largest employment center in the Philadelphia region behind Center City and University City. According to On the Map, there were 62,883 jobs in King of Prussia in 2021, a 19% increase from 52,849 jobs in 2010. Of these employees, 2,775 are King of Prussia residents. Data from Placer.ai shows that the largest employee home origins are Philadelphia (15.57%) and Norristown (10.70%). Notably, 67.6% of these employees earn more than $3,333 per month. With most commuting by single-occupancy vehicles via major highways prone to traffic and congestion, like Route 76, 476, 276, 202 and 422. This substantial workforce generates potential demand for the Upper Merion housing market.

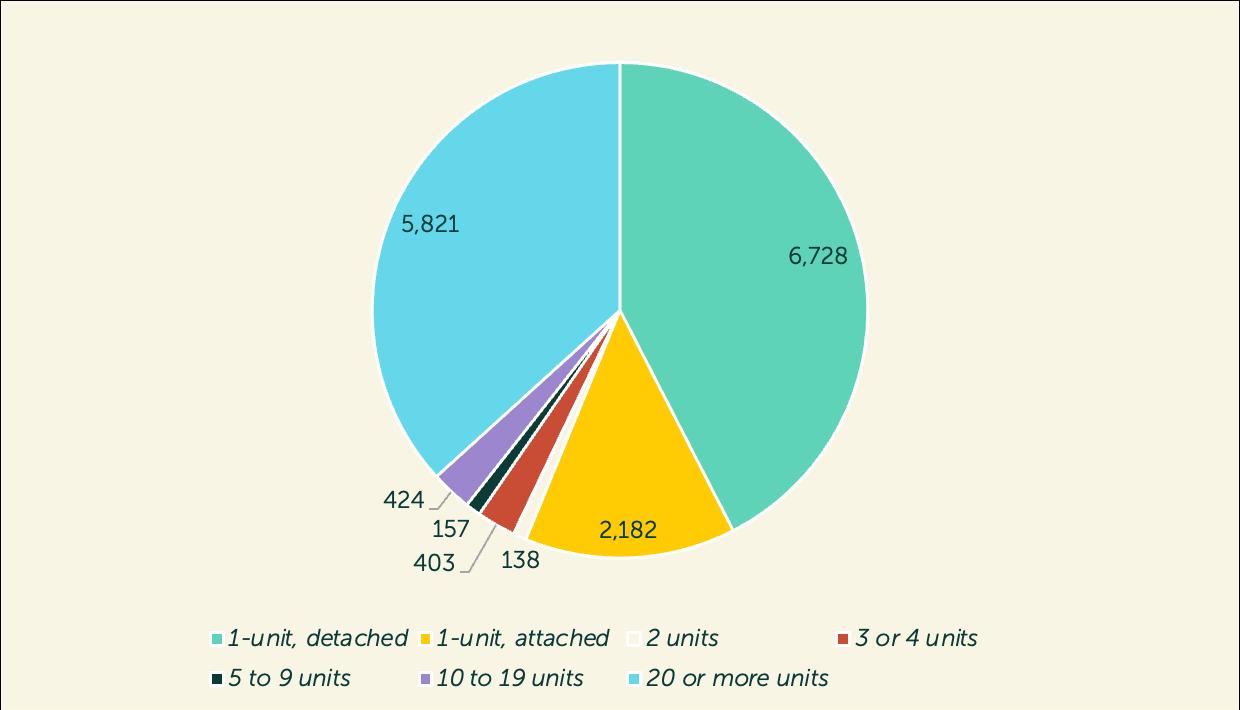

In 2022, Upper Merion had a total of 15,853 housing units with 56.2% being attached or detached single-family homes and 43.8%

being multi-unit structures. Figure 7 illustrates the distribution of housing units by type, with detached single-family homes accounting for the majority (6,728), followed by multifamily homes with 20 or more units (5,821) and finally, attached single-family homes (2,182).

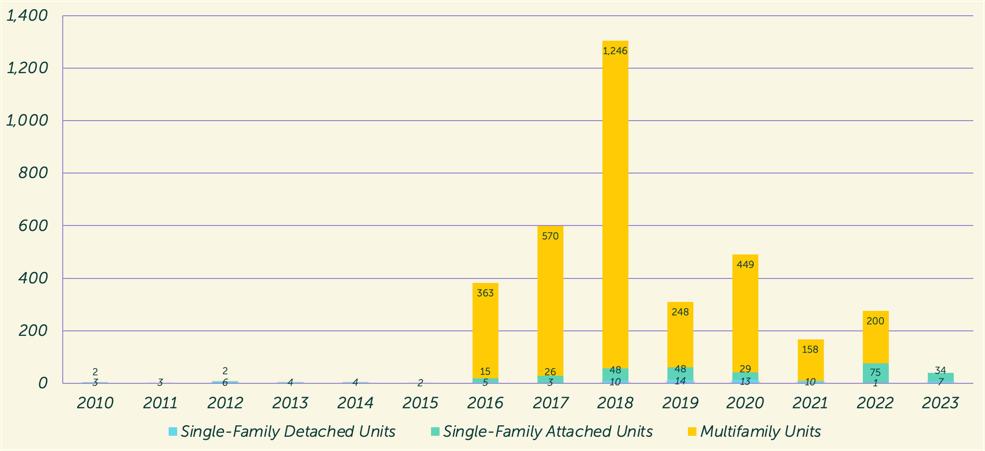

Prior to 2010, the Upper Merion housing market supply did not experience much of an increase, despite a sharp rise in employment within the township. From 2000 to 2010, only 994 new units were built. Figure 8 shows new housing units built since 2010, with a significant increase beginning in 2016, reaching a peak in 2018 when 1,246 new multifamily units were built. Between 2016 and 2022, 3,531 new housing units were constructed, with 91.6% of those being multifamily units. These new homes offer high-quality amenities such as pools and fitness centers, large gathering spaces, pet services, 24/7 concierge services and more. Ongoing housing construction projects in Upper Merion include Stonebrook at Upper Merion by Toll Brothers (65 single-family detached houses and 206 attached townhouses), River Trail at Valley Forge by JPOrleans (119 townhomes), and 2901 Renaissance Blvd. by ACRES Capital (300 approved units).

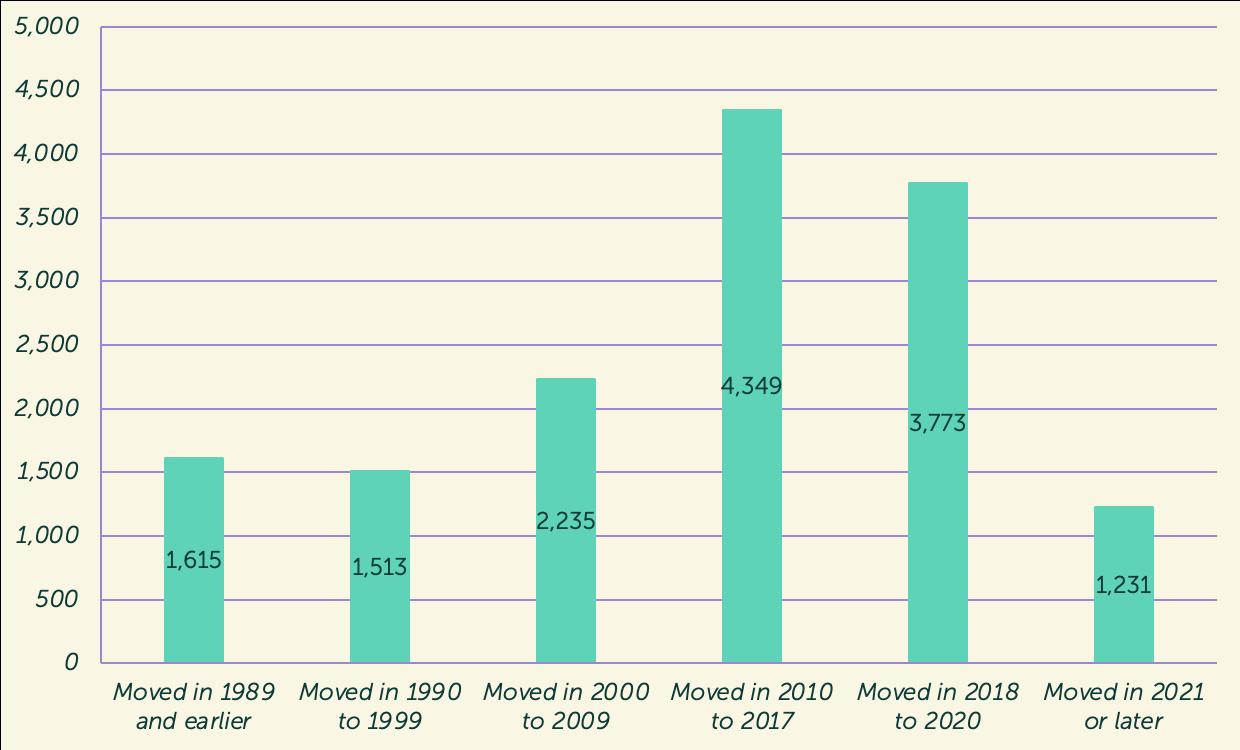

9 shows the year residents moved into their unit, aligning with the trend in newly built housing units, peaking between 2010 and 2020 with 8,122 households moving in.

Of the 15,853 total housing units in Upper Merion, 14,716 units are occupied. Of these, 8,430 units are owner-occupied with a 0.4% vacancy rate, while 6,286 units are renter-occupied with an average 10% vacancy rate.

Over the past year, Upper Merion has remained a seller’s market5, meaning that prices tend to be higher, and homes sell faster. Figure 10 shows the median sales price of housing units by type from 2016 to 2023. The median sales price for all housing types increased by 68.9% over the past eight years. Among them, single-family attached units saw the most significant increase (100.7%), followed by multifamily units (71.9%) and single detached units (55.4%).

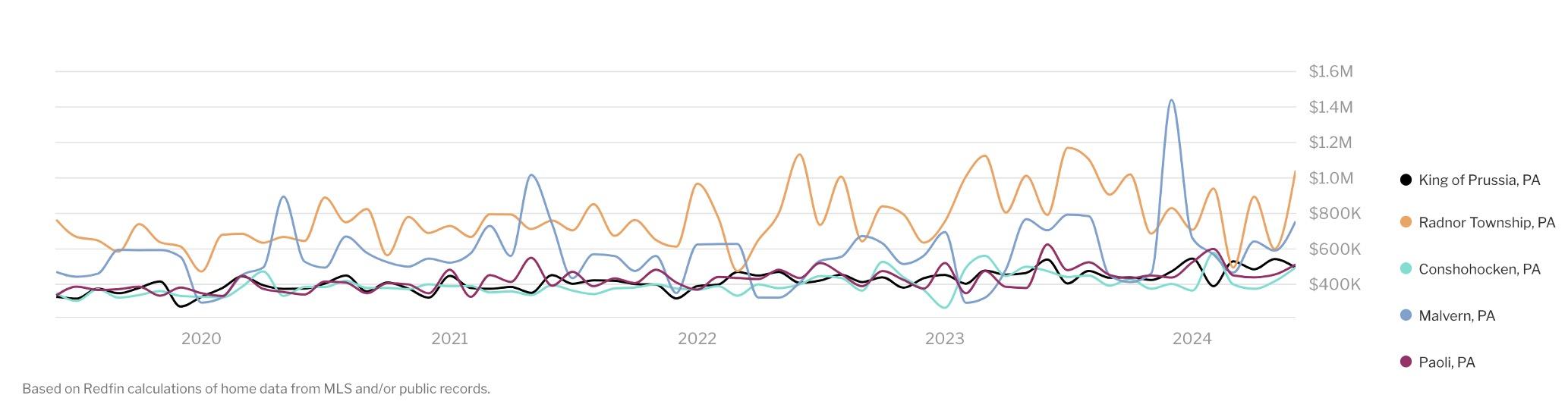

Compared to nearby townships, Redfin’s Compete Score™ rates King of Prussia at 56 of 100, indicating a somewhat competitive market. The average home sells for around list price and goes pending in approximately 32 days. Figure 11 shows the median sales price in nearby competitive townships from 2019 to 2024. In June 2024, the median sales price for King of Prussia was $493,750, with an 8.5% decrease in year-over-year growth. Radnor Township had the highest sale price at $1,042,500, with a significant 31.7% increase from last year, followed by Malvern at $755,671 with a 7.2% increase. Paoli had a median sales price of $512,500, making an 18.0% decrease, while Conshohocken’s median sales price was $495,700, with a 4.4% year-over-year increase.

In the second quarter of 2024, we requested the most up-to-date vacancy rates for Upper Merion multifamily rental properties containing 100 units or more. Our dataset includes 6,370 total units, categorized based on the year built:

• Pre-2016 Properties: 8 existing properties with 2,725 units, showing a 96% occupancy rate.

• Substantially Rehabilitated Properties: 1 property with 628 units, showing a 90.6% occupancy rate.

• New Properties (2016-now): 10 properties with a total of 3,017 units, showing a 95.4% occupancy rate.

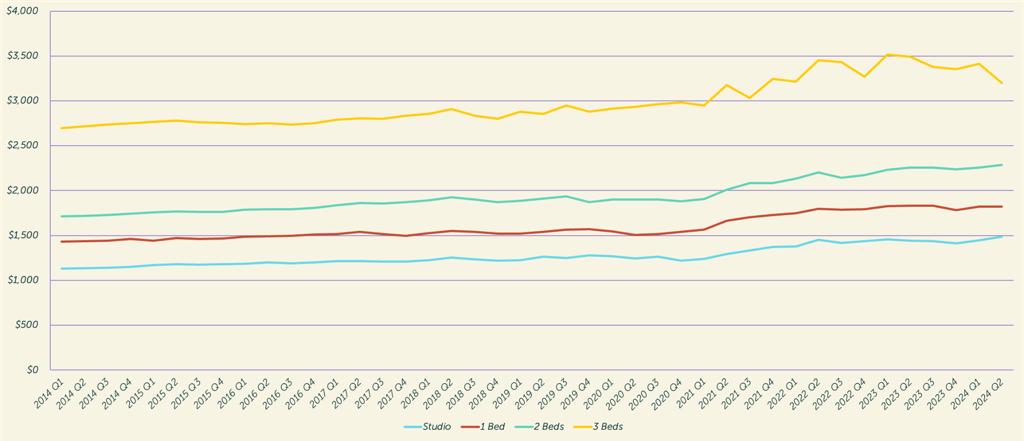

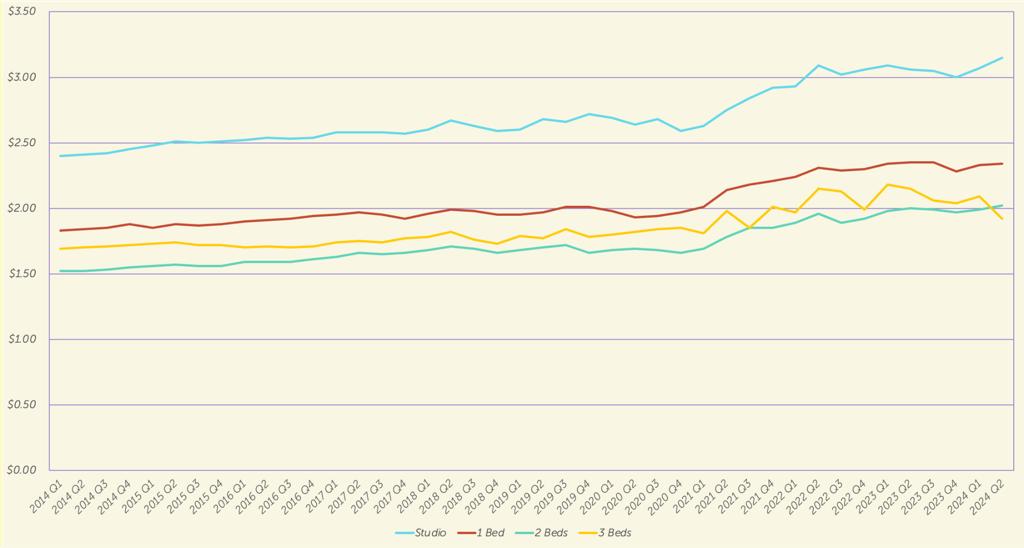

The average asking rent is $2,070 per unit in Q2 2024, based on a total 7,413 multifamily units in Upper Merion. Figure 12 shows the market asking rent per unit by bedroom from 2014 to 2024. In Q2 2024, the average asking price for studio was $1,485 (31.1% increase since 2014); $1,821 for one-bedroom (27.3% increase); $2,287 for a two-bedroom (33.7% increase); and $3,202 for a three-bedroom, an increase of 18.8%.

Figure 13 shows the market asking rent per square foot by bedroom from 2014 to 2024. Studios had the highest rent per square foot and the most significant increase over the period. In Q2 2024, the average asking rent per square foot is $3.15 for a studio, $2.34 for a one-bedroom, $2.02 for a two-bedroom and $1.92 for three-bedroom units.

13 | Market Asking Rent Per SF by Bedroom, 2014 – 2024 6

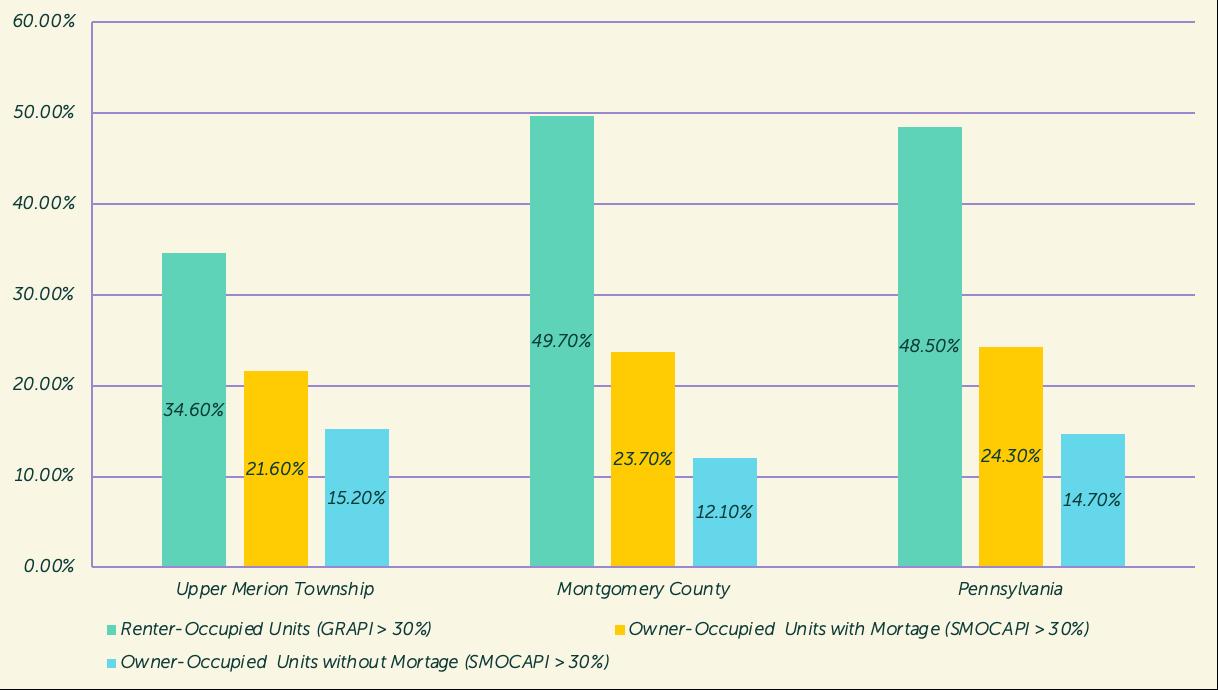

Housing affordability is an important factor in evaluating social equality and is measured by the percentage of household income spent on housing. Households spending more than 30% of their income on these costs are often considered financially burdened. According to the US Census Bureau, Gross Rent as a Percent of Household Income (GRAPHI) measures the percentage of household income spent on rent, while Selected Monthly Owner Costs as a Percent of Household Income (SMOCAPHI) includes costs such as mortgages, taxes and utilities.

Figure 14 shows the percentage of households with GRAPHI or SMOCAPHI greater than 30% in Upper Merion Township in 2022:

• Renters: 34.6% of households in Upper Merion spend more than 30% of their income on rent, 15.1% lower than Montgomery County and 13.9% lower than the Pennsylvania average.

• Homeowners with Mortgages: 21.6% of homeowners in Upper Merion are costburdened; 2.1 points lower than Montgomery County and 2.7 points lower than Pennsylvania.

• Homeowners without Mortgages: 15.2% in Upper Merion are cost-burdened; 3.1 points higher than Montgomery County but 0.5 points lower than Pennsylvania.

Figure 14 | Percentage of Household with GRAPHI or SMOCAPHI Greater Than 30%, 2022 2

The COVID-19 pandemic significantly changed people’s work patterns, further influencing their relocation and home-buying decisions. People tend to seek housing in areas with a low tax burden and spacious living options, as homes also function as workplaces due to the increase in remote work.7 The “Great Migration” began at the start of the pandemic, largely due to the combination of remote work and historically low mortgage rates.8

However, as interest rates rise, the housing market is expected to slow down. Some reports suggest that the Great Migration is largely over, as opportunities for remote work diminish and corporate policies become less flexible. Figure 15 shows the 30-Year Fixed Rate Mortgage Average in the United States (MORTGAGE30US). Currently, the average rate is above 7%, the highest since December 2000, which has reduced homebuyers’ purchasing power.

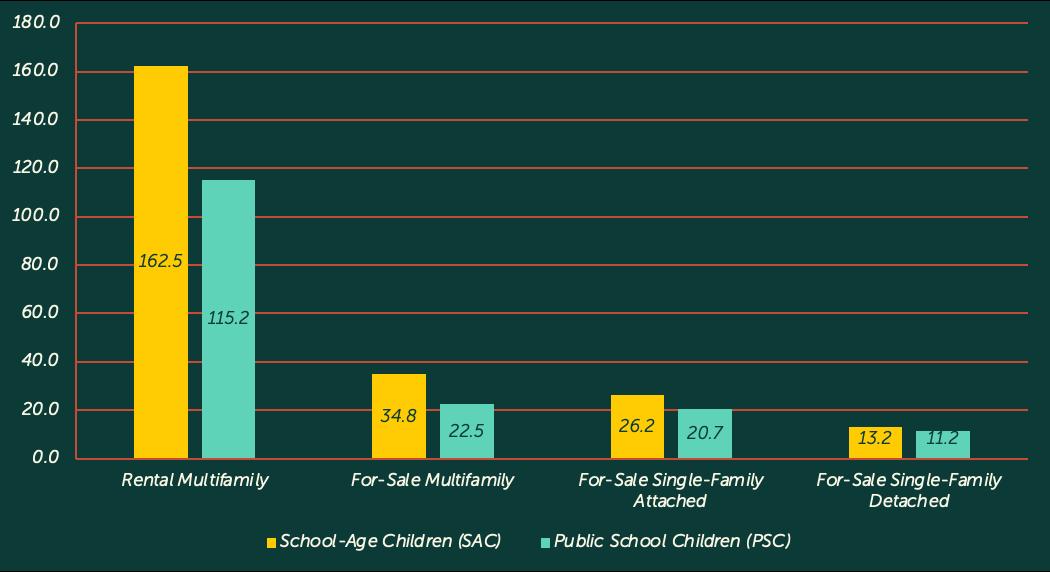

Oftentimes, during periods of new residential construction, concerns are raised about the potential burden of new school-age children on local education resources. Using estimates from Alexandru and David (2018),10 who conducted studies of school-age children generated from new housing construction in New Jersey from 2010 to 2016, we assessed the impact of new housing on the local school system. Generally, larger single-family homes generate more school-age children per unit, while smaller rentals and luxury condos contribute fewer children.

We estimate that since 2016, 237 school-age children (167 in public schools and 70 in private schools) were generated from new residential construction.

This includes 3,017 rental multifamily units, 274 for-sale multifamily units, 65 attached single-family houses and 206 detached single-family houses. Figure 16 shows that rental multifamily units contribute the most as they represent the largest proportion of total units, generating 162 school-age children (115 in public schools and 47 in private schools). These estimates indicate that the new housing construction has a low impact on the school district, with an average of one school-age child generated for every 22 units. Upper Merion Area School District, which includes five elementary schools, one middle school, and one high school, saw an increase in school enrollment from 3,985 in 2016 to 4,502 in 2023, not all of which generated from new housing construction.

Questions remain about how future mortgage rates and home price trends will impact homebuying decisions. Will rising rates influence whether people choose to buy or rent? How might this affect first-time home buyers and young families? Furthermore, will migration trends continue, and will more potential employees convert to residents in the coming years?

WITHIN KING OF PRUSSIA DISTRICT BOUNDARY

• New multifamily rental properties: Ten (10) from 2016-present

• Existing multifamily rental properties: Eight (8) from 1964-2015

• Major rehabilitated rental properties: One (1)

• Owner-occupied condominium properties: Five (5)

OUTSIDE KING OF PRUSSIA DISTRICT BOUNDARY

• Existing multifamily

•

properties: 22 from 1958

In 2016, Candlebrook Properties transformed the Marquis Apartments into 650 studio, one, two and three-bedroom units ranging from 250 to 2,350 SF situated in a 26-acre gated community. The $50M renovation project includes amenities like an outdoor pool, fitness center and rotating art exhibit. 251dekalb.com

Morgan Properties’ Abrams Run features 192 one and two-bedroom units with private entrances ranging from 815 to 1,140 SF. Amenities include an outdoor media lounge and table games, a fireside lounge with fire pit, tennis and pickleball courts and access to a community swim club at sister property, Kingswood Apartments & Townhomes. morgan-properties.com

Not far from its townhome project, The Brownstones, Toll Brothers offers the only for-sale condominiums in The Village at Valley Forge. The building includes 60 one, two and three-bedroom condos, ranging from 884 to 1,751 SF. Amenities include a rooftop lounge, fitness center, theatre room and a golf simulator. tollbrothers.com

This 274-unit flexible stay rental property by Korman Communities features studio, one, two and three-bedroom fully-furnished and unfurnished and a two-level parking garage. The property includes fitness facilities, an outdoor pool with TVs, a media theater, a business center and multiple meeting spaces. aveliving.com

5. The Brownstones

Now entirely sold out, the Toll Brothers community features 132 three-bedroom stacked townhomes, ranging in size from 1,561 to 2,401 SF in 11 buildings. tollbrothers.com

Located within minutes of KOP Mall and Valley Forge National Historical Park, 339-units make up Cirro King of Prussia, which offers a balance of urban convenience and natural tranquility. Amenities include a resort-style pool, 24-hour fitness center, dog spa and clubhouse. cirrokingofprussia.com

Canvas is the first active adult (55+) apartment complex in KOP. The 5-story property built by The Bozzuto Group features 231 one and two-bedroom units with enclosed first floor parking, an infinity pool and outdoor dining areas, a spa, a dog park, workshop space and a community garden. canvasvalleyforge.com

Situated in a mid-rise, 5-story building, Willner Property’s Courtside Square features 74 recently renovated studio, one and two-bedroom units ranging from 470 to 895 SF, each with a private balcony. willnerproperties.com

90 Monroe Blvd.

9. The George Apartments

Located in the heart of KOP Town Center, these apartment homes offer tasteful design in a highly sought-after location. Take advantage of the abundant amenities throughout the community. Units feature smart home technology, shaker-style cabinetry and thoughtful finishes throughout. udr.com

Moore Park | 550 American Ave.

10. Gulph Mills Village

Westover’s Gulph Mills Village offers 328 one and twobedroom units with private balconies and patios. The property also includes access to a pool and fitness center, among other amenities.

rentgulphmillsvillage.com

11. Henderson Square Apartments

In total, Henderson Square I and II offer 160 one and twobedroom fully furnished or unfurnished units. The property also includes a 24-hour fitness center, covered carport and a tennis court.

gambone.com

The first multifamily residential development to open in The Village at Valley Forge in 2016, Indigo 301 features 363 one, two and three-bedroom apartments ranging from 687 to 1,391 SF. Amenities include a fitness center, bocce court, a sports simulator and an outdoor pool and kitchen with grilling stations.

indigo301.com

Morgan Property’s Kingswood features 771 units, ranging from studio, one and two-bedroom apartments with private patios or balconies, to three-bedroom townhomes. Units range from 190 to 1,675 SF. The property features various sport courts, a fitness center, two dog parks and an outdoor pool. morgan-properties.com

The Lafayette offers 604 studio, one, two and three-bedroom units, ranging from 447 to 1,256 SF, featuring individual balconies. A property from the Westover Company, the complex features an outdoor pool, fitness center and on-site laundry facility.

rentlafayetteatvalleyforge.com

Omnia features 339 studio, one and two-bedroom apartments ranging from 552 to 1,390 SF, in addition to an outdoor courtyard with pool and fire pit, a fitness center, a cinema, a demonstration kitchen and a gaming area. omniakop.com

Toll Brothers is developing their third project in The Village at Valley Forge, a 142-unit townhome development in thirteen buildings located on seven acres. The for-sale homes are priced from the low $600,00s and feature modern open floor plans with optional basements and rooftop terraces. tollbrothers.com

Moore Park | 751 Vanderburg Rd.

Built by Bentley Homes and CornerstoneTracy Development and later acquired by UDR, Park Square features 313 one to three-bedroom apartments in four buildings surrounding a central park featuring a pool, grilling and dining stations and fire pits. The property also includes a mile of paved trails and a dog park. liveparksquare.com

The Village at Valley Forge | 350 Village Dr.

18. The Point at King of Prussia

First-class amenities, one-of-a-kind luxury finishes and a dedicated staff that’s committed to making life easy all contributes to a higher standard of living at The Point at King of Prussia. thepointatkop.com

Moore Park | 850 Mancill Mill Rd.

A vibrant upcoming community of 2 and 3-story modern townhomes, nestled in the heart of King of Prussia, where luxury meets convenience. River Trail at Valley Forge seamlessly blends contemporary living with nature, tucked neatly between the Schuylkill River Trail and the scenic Schuylkill River. jporleans.com

Moore Park | 750 Moore Rd.

SKYE 750 is a five-story apartment complex featuring 248 one and two-bedroom units, ranging from 681 to 1,246 SF. The complex boasts an elevated interior courtyard with a pool, fitness center, private movie theater and a resident lounge. skye750apartments.com

The Village at Valley Forge | 580 S. Goddard Blvd.

Featuring 320 one to three-bedroom apartments ranging from 601 to 1,399 SF, The Smith’s amenities include a rooftop sky lounge and dining area, an outdoor pool, fitness center with yoga and spin studios and a club room with games. thesmithvalleyforge.com

Blvd. & Dekalb Pk.

Toll Brothers is under construction on its fourth community in King of Prussia. Stonebrook features 65 single-family, detached houses priced from $1,299,995, and 206 attached townhouses, priced from $614,995. The luxury homes feature openconcept. floor plans, well-appointed kitchens and designer features.

tollbrothers.com

Moore Park | 500 American Ave.

A Westover property, Valley Forge Suites offers 356 one and two-bedroom units, ranging from 705 to 1,075 SF, each with a balcony or patio. Amenities include a swimming pool and a fitness center rentvalleyforgesuites.com

3000 Valley Forge Cir.

Valley Forge Towers North features 242 units one, two and three-bedroom units, ranging from 1,079 to 1,608 SF, each with a private balcony. Amenities include indoor and outdoor pools, a private movie theatre and a concierge service. galmangroup.com

Properties outside of King of Prussia District boundary: 25. Beidler Knoll 26. Carmella Court 27. Cooper Mills Station 28. The Court at Henderson I 29. The Court at Henderson II 30. Crooked Lane Crossing 31. Deer Creek 32. Enclave 33. Glen Arbor 34. Glenn Rose 35. Hamlet Drive 36. Heather Hill 37. Heritage Manor 38. King of Prussia Arms 39. King Manor 40. Pinecrest 41. Prussian Woods 42. Rebel Hill 43. Schoolhouse Commons 44. Valley Forge Towers (South and West) 45. Williamsburg Commons 46. Willow Manor 47. The Woods at Wayne

1. Fortune Well (2024), 2024 Best Places to Live for Families

2. Census Bureau, American Community Survey, 5-Year Estimates

3. Redfin Corporation

4. Montgomery County Planning Commission, Montgomery County Board of Assessment Appeals, Montco Planning Data Portal

5. Rocket Homes Real Estate LLC

6. CoStar Group

7. Bankrate (2023), How did COVID affect the housing market?

8. Philadelphia Business Journal (2024), The Great Migration is largely over, done in by two economic developments

9. Federal Reserve Bank of St. Louis

10. Alexandru and David (2018), The Profile of Occupants of Residential Development in New Jersey

Qi Guo, Manager of Research & Data Analytics qi@kopbid.com King of Prussia District

234 Mall Boulevard, Suite 150

King of Prussia, PA 19406