HOMEBUYING

Prices in Chicago have continued to rise over the last In the past ten years, the annual Chicago real estate appreciation rate has amounted to 4.88%. When you buy you are investing in property that will almost always rise in value. The more it rises, the more you will profit when it is time to sell.

As a renter, you are paying a mortgage, it’s just the property owner’s mortgage. As rent prices annually increase owning your own home allows for stability, your monthly payment will stay the same.

As a homeowner you can build equity, earn a profit on your investment, and have the stability of owning your own home to build a life within!

• One-hour meeting with Lisa.

• Discuss the home buying process.

• Develop an action plan.

• Receive exclusive representation.

• Important to understand the various agent representation/relations:

Buyer’s Agent:

Represents only the home buyer’s best interest throughout the home buying process.

Seller’s / Listing Agent:

Represents only the home seller’s best interest throughout the home buying process.

Duel Agent: represents both the buyer and seller ethically and honestly, safeguarding the confidentiality of both clients.

1. Three ways to apply for a pre-approval:

Information covered during the pre-approval Process: Range of purchase price/down payment.

Income verification, credit history and asset information. Determine a monthly payment comfort level. Budgeting for closing costs.

2. Start gathering documentation:

1–2 month(s) of pay stubs

2 years of W2’s/1099’s/K1’s

2 years of 1040’s (tax returns)

2 months of broker/bank statements (checking, savings, 401K’s, etc.)

3. Shop with confidence!

DETERMINE YOUR NEEDS

Set maximum home buying price, location and criteria.

Search the database for homes that meet your needs, including new construction. Outline the “pros” and “cons” of each property to narrow your search.

• Consider making an offer.

• Ask Lisa to pull recent comparable sales information.

• Determine the fair market value of the home.

• Once an offer is determined, Lisa will present to the seller.

• If the offer isn’t accepted, discuss seller’s counter offer with Lisa.

• Repeat until an accepted offer is reached.

1. Qualifications — determine what’s included in your inspection and if it warrants specific certifications/specialties.

2. Sample Reports — request a sample to determine their style.

3. References — request contact information from past clients.

4. Memberships — not all inspectors belong to national/state associations, but memberships often mean additional education.

5. Errors & Omission Insurance — determine what the liability of the inspector or company is once the inspection is over.

• Talk with your inspector about also attending the home inspection.

• You will receive a detailed inspection report.

• This report will be forwarded to your attorney. They will notify the seller attorney of deficiencies and will request to repair or credit

• Attorney will review the accepted sales contract and handle legal notifications of inspection issues.

• Attorney will attend closing to review all documents with you.

• Apply for written mortgage application.

• Provide evidence of a written mortgage commitment letter (clear to close).

• Once you receive clear to close from lender, the attorney will schedule closing with seller attorney.

• You will receive a Closing Disclosure from lender at least 3 days prior to closing, reflecting the actual terms of your loan transaction, as well as the final amount due (closing costs).

CLOSING COSTS:

Also known as settlement fees, closing costs are fees charged by the people representing your purchase — lender and other third parties. These fees are typically between 2-5% of your purchase price.

DO

1. Do tell your mortgage loan officer or loan originator about all debts or liabilities.

2. Do continue to make all your payments on time.

3. Do contact your mortgage loan officer before changing your jobs, quitting your job, becoming self-employed or any changes to your income.

1. Don’t authorize any inquiries into your credit (that is, don’t apply for any new financing including credit cards, furniture, appliances, vehicles, boats, cell phones, cable, alarm companies, etc.)

2. Don’t incur any additional debts, including increases in credit card balances and co-signing for others.

3. Don’t close any open accounts.

4. Don’t sign-up with any credit repair or “consolidation” company.

5. Don’t spend money you have set aside for closing.

Preferably arrange walk through 72-hours in advance. However, can be arranged as soon as 24-hours.

• A valid driver’s license, proof of insurance and the monetary amount your lender told you to wire.

• When buying in Illinois, any amount greater than $50,000 must come by wire. Always confirm with your title company before wiring any amount of money!

APPRAISAL: An appraisal is a professional opinion of the property’s estimated value.

BUYER’S AGENT: Represents only the home buyer’s best interest throughout the home buying process.

CLOSING COSTS: Also known as settlement fees, closing costs are fees charged by the people representing your purchase — lender and other third parties. These fees are typically between 2-5% of your purchase price.

CONTINGENCY: A contingency is a condition that must be met for a contract to be valid and binding.

DUAL AGENCY: Dual agency occurs when a real estate agent represents both the home buyer and the home seller.

HOMEOWNER’S INSURANCE: Homeowner’s insurance is a type of insurance that protects homeowners from financial loss due to damage, theft, or accidental loss of their property.

HOMEOWNER’S ASSOCIATION (HOA): A homeowner’s association is a group that manages rules and regulations and shared spaces for tenants in a community.

HOME WARRANTY: A home warranty protects the buyer and seller if the home has defects or items that may need to be serviced or replaced.

LISTING AGENT: A listing agent is a licensed real estate professional who is hired to market the seller’s property and to represent the seller during the purchase process.

MORTGAGE INSURANCE: Mortgage insurance is an insurance cost that protects the lender in the event that the borrower defaults on their loan.

MULTIPLE LISTING SERVICE (MLS): The Multiple Listing Service is a database that contains all real estate listings in a given area and allows agents and buyers to access information for all properties currently available on the market.

OFFER: The offer is a proposal by a buyer to purchase a property at a specific price and outlined terms.

TITLE INSURANCE: Title insurance is an insurance option that protects the buyer and the lender from financial loss due to defects in the title, such as hidden liens, filing errors, forgeries, etc.

WALK-THROUGH: The walk-through, or final walk-through, is an inspection of the property by the buyer before closing to ensure that all of the agreed-upon repairs or property changes have been made before ownership is transferred.

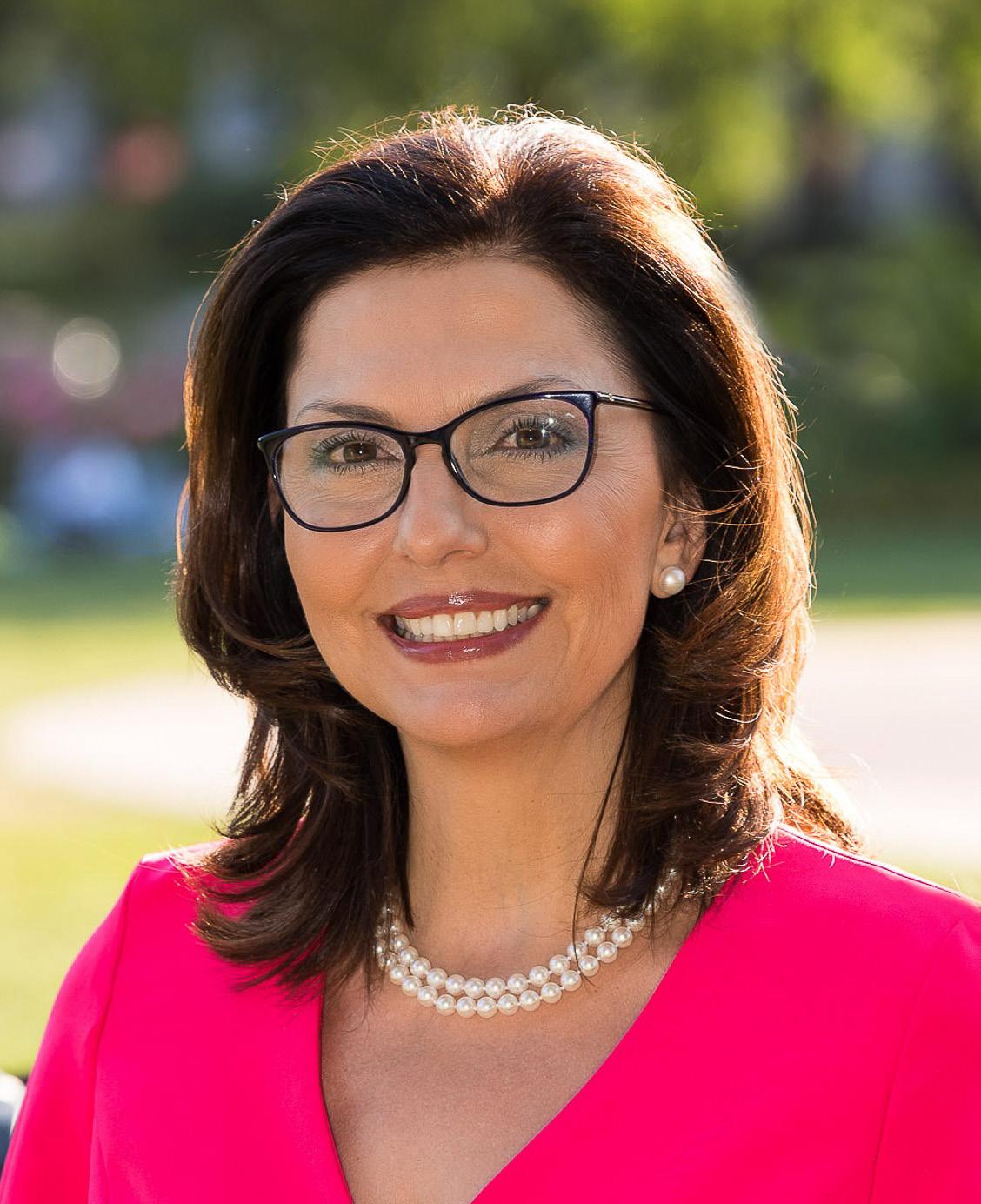

My passion is residential real estate. My idea of fun is following the market’s trends and the latest in design to bring the most up to date information to my clients. Whether I am representing the buyer or seller I am deeply committed to my clients. I learn their lifestyle, short and long-term goals, budget and timeline. My methods of bringing a seller’s property to market are a proven success. By getting to know my buyers, I can make the best use of their time and hand select properties that are aligned with their preferences. Using my knowledge of comparable properties, neighborhood attributes and the most current state of the market, I can present options to both my buyers and sellers that wouldn’t have been discovered otherwise.

“Her clients receive all the unique benefits of Huber’s expertise as a Chicago broker, as well as her learnings as a buyer, seller and investor. She also brings prior experience as a business owner in retail services, product distribution and development. Combined with the national and local resources of BHHS, one of the nation’s largest real estate companies, Huber and her team give clients a powerful edge in reaching their real estate goals.”

“Lisa is a consummate professional for whom no detail is trivial and yet who can develop a sophisticated practical plan within minutes. Enjoys learning what her clients want and need, pays full attention, and yet does not hesitate to give her opinion should she have an alternate view - for which she quickly produces relevant data - and always proves to be right.”

“Lisa is the best real estate agent you will find in Chicago. She takes her job seriously and does everything to make sure that clients are happy with their choices of houses or apartments, which I can attest from my own experience as well! Her team has been wonderful throughout this process too-they’re always available when we need them most but still give us plenty space independence by providing detailed information on each property before showing it off so there really isn’t any stress involved at all.”

“Extremely happy with our buying agent Lisa. She worked with us for a long time trying to find us the perfect house and just when we thought we would have to settle on something, she was able to find us our dream home.”

DESIRED NEIGHBORHOOD(S):

WHAT ATTRACTS YOU TO THESE AREAS?

NUMBER OF BED(S)/BATH(S):

TYPE OF BUILDING: Condo Townhome Single-Family Home

APPROXIMATELY HOW MANY SQUARE FEET:

DO YOU HAVE CHILDREN, HOW MANY?

SCHOOL REQUIREMENTS:

DO YOU HAVE ANY PETS, WHAT KIND?

MOVING TIME FRAME:

WHAT IS YOUR PLAN IF YOU DON’T FIND A HOME IN THIS TIME FRAME?

DO YOU NEED TO SELL ANOTHER HOME? Yes No

DESCRIBE THE IDEAL HOME FOR YOU:

LIFESTYLE: WHAT DO YOU SEE YOUR SELF DOING IN YOUR NEW HOME?

WHAT DO YOU FEEL WILL BE THE KEY FACTORS IN YOUR DECISION:

IS THERE ANYTHING ELSE YOU WOULD LIKE TO TELL ME THAT WOULD BE HELPFUL IN OUR WORKING TOGETHER?

PLEASE RATE THE IMPORTANCE OF EACH FEATURE THAT YOU WOULD LIKE IN A HOME. Choose the number that best fits your desires

1 being not important. 5 being very important.