5 minute read

Streaming Wars: Technology Trends in Media & Entertainment

THE STREAMING WARS: TECHNOLOGY TRENDS IN MEDIA AND ENTERTAINMENT

By Paren Knadjian Practice Leader - M&A and Capital Markets

The U.S. media and entertainment (M&E) industry is the largest in the world. At $717 billion, it represents a third of the global M&E industry. It includes motion pictures, television programming and commercials, streaming content, music and audio recordings, broadcast, radio, book publishing, video games, and ancillary services and products. The U.S. M&E industry is expected to reach more than $825 billion by 2023.

What direction will this behemoth industry take in the 2020s and beyond? How will customers consume entertainment content? This is the question vexing every M&E company in the world plus the providers of broadband services, social networking, e-commerce, and consumer technology companies.

BUY MARKET SHARE

One way to be a major player in the industry is to buy other key businesses in the market. The most 360-degree player in this industry is now AT&T. With its $85 billion acquisition of Time Warner (which included Warner Brothers, TBS, TNT, HBO and CNN), it instantly became a key player in the M&E industry. It had previously acquired DirectTV for $67.1 billion in 2014. It is also investing heavily in 5G wireless, spending $982.5 million to buy 831 24GHz spectrum licenses from the FCC, excluding the costs of installing 5G equipment and infrastructure. Finally, it is a significant player in the wired broadband industry (fiber optics and copper) to home and business users. As for streaming, in October of 2019, it announced the launch of its principal Subscription Video on Demand (SVOD) service, called HBO Max, that will begin streaming in Q1 2020. It already has SVOD services such as HBO Go and HBO Now, but HBO Max will contain all WarnerMedia content (as opposed to just HBO).

Another industry behemoth that is focusing on content and distribution (but not broadband) is The Walt Disney Company (WDC). In 2019, the company acquired the motion picture and TV content businesses of 21st Century Fox for $71.3 billion and bought the majority stake in Over-the-Top (OTT) service, Hulu, for $7.23 billion. Previously WDC acquired key branded content providers Lucasfilm ($4 billion), A&E Television (2.5 billion, co-owned with Hearst Media), Marvel ($4.3 billion), and Pixar ($7.4 billion). It launched its SVOD service Disney+ in the fourth quarter of 2019 and offered a bundled package with Hulu and ESPN+. Early indications are that Disney+ already has 40 million subscribers, although that number is possibly exaggerated by the 10 million or so Verizon Wireless subscribers, who received a year of free service.

Another significant player is Comcast, which spent $38.8 billion acquiring Sky, Europe’s largest satellite TV provider in late 2018, and had previously acquired NBCUniversal from GE for $23.2 billion in 2013. NBCUniversal plans to launch an Ad-Supported Video on Demand (AVOD) service, called Peacock, in Q1 2020.

BORROW MONEY TO GROW

For all the attempts by the large players in the M&E vertical to be in the OTT/VOD/Streaming service business, one company dominates that space and was the first to market: Netflix. Netflix has not made significant inroads buying other businesses but has certainly invested in creating original content and subscription expansion. In terms of users, Netflix is a leader apart. The company wrapped up 2019 with an impressive 167 million worldwide subscribers—up 20% from the number of subscribers in 2018. But this impressive

growth does not come cheap. Already with $12.4 billion of long-term debt, the company announced a further $1 million and € 1.1 billion bond offering in October 2019, bringing its aggregate debt to over $14 billion.

USE YOUR TECHNOLOGY MARKET DOMINATION TO ENTER THE MARKET

Old Hollywood may only now be catching up with Netflix

and modern entertainment delivery, but the technology

heavyweights have not been standing on the sideline. In

2006, Amazon launched Prime Video its SVOD and TVOD

service. 2 Prime Video now includes a selection of Amazon

Studios original content and licensed acquisitions and is offered as part of Amazon’s Prime subscription service. It recently moved into the live sports arena with live streaming of the NFL, MLB, and, most recently, the English Premier

In 2019, Apple, which also launched its TVOD business in 2006, and has a successful music streaming subscription business, launched its own SVOD service Apple TV+.

Google, through its YouTube subsidiary, is without question, the largest provider of video content, and has moved into the vMVPD service through the launch of YouTube TV and offers TVOD service through its Google Play store.

Finally, social media giant Facebook has recently launched original content through its Facebook Watch service.

WHAT ARE THE KEY TECHNOLOGY DRIVERS?

As the M&E companies vie for market share, underlying technologies are evolving at a fast pace.

A significant part of the M&E industry is video gaming, and it is in this arena that Virtual Reality and Augmented Reality (VR/AR) has moved in leaps and bounds in the last few years. A recent report from eMarketer reported that AR technology is currently enabled on 1 billion mobile devices worldwide and is expected to grow to more than 3.4 million devices in 2020.

Don’t believe all the advertising hype, but 2020 will also be the year that 5G wireless will be available, on a limited basis, nationwide. Lack of competition in wired broadband has held back innovation in the M&E industry. But as the speed and reliability of 5G increases, more consumers will choose it over wired broadband, increasing competition in the market. But telco wireless operators will not be the only players in the emerging communication technologies. SpaceX, OneWeb, and others are developing small, low Earth orbit satellites that will be able to deliver high-performance broadband anywhere on earth, including rural or isolated communities.

THE OUTLOOK – 2020 AND BEYOND

The development of video streaming services is dominating the headlines and driving many of the innovations, but VR/ AR, 5G targeted advertising, cybersecurity and privacy will also be key technology developments of the M&E industry in 2020 and beyond.

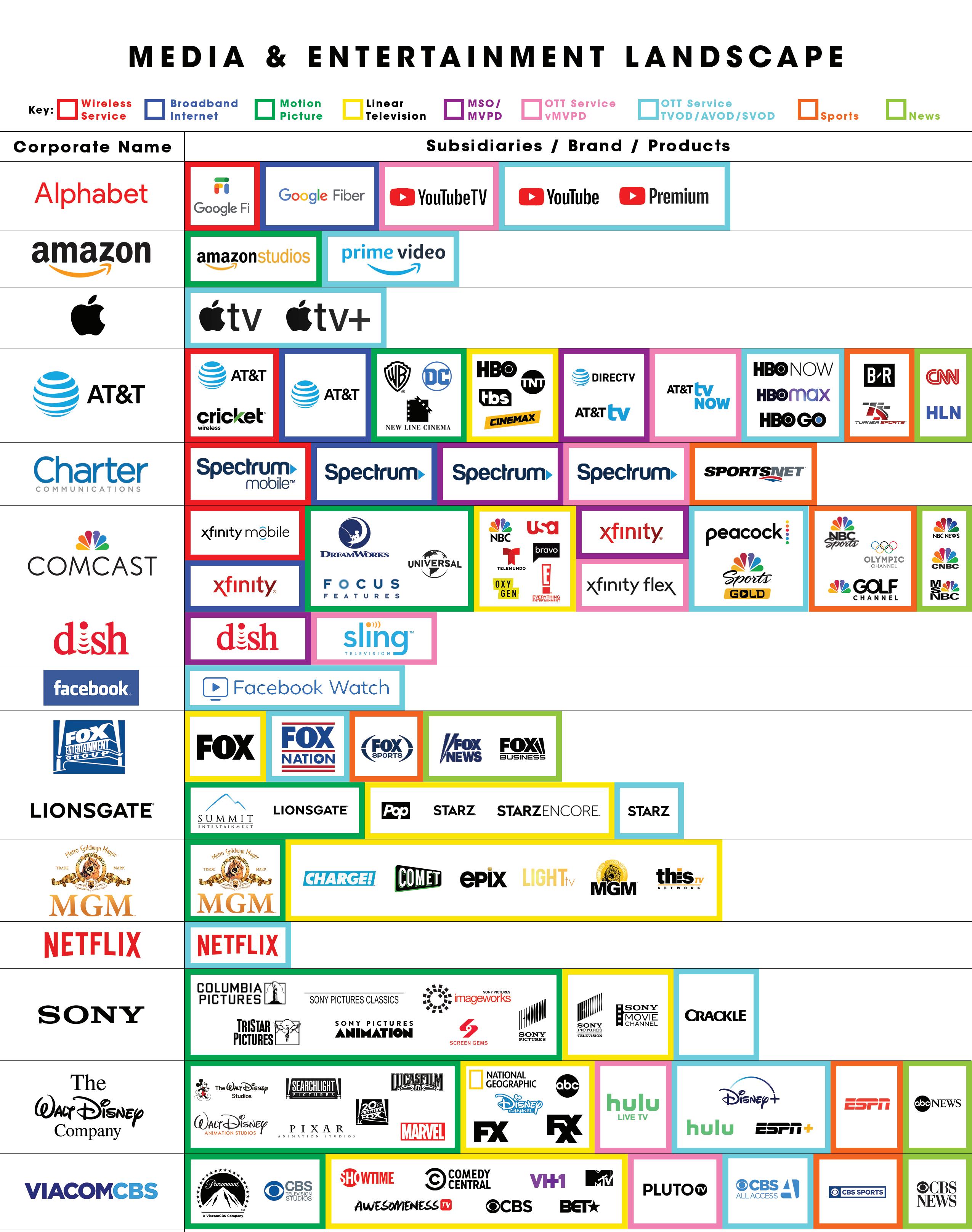

The infographic to the right shows the

current media and entertainment landscape organized by media type and major corporate players.

1 MVPD stands for multichannel video programming distributor – a service that provides

multiple television channels. Traditionally, this has meant cable or satellite television services such as Comcast, DirecTV, DISH, TImeWarner, etc. They are also known as MultiService Providers (MSOs). A virtual MVPD (vMVPD) is a service that provides multiple television channels through IP TV without supplying its own data transport infrastructure (i.e., coaxial cable, fiber, or satellite technology). These services are also sometimes called “skinny bundles” as they often contain fewer channels than a traditional cable or satellite subscription. Examples of vMVPDs include Sling TV, DirecTV Now, Fubo, Philo, YouTube TV, and Hulu Live.

2 TVOD – Transaction Video on Demand – where the consumer pays on transactional, one

off, fee per content bought or rented – as opposed to an unlimited-use SVOD service.

tanaonte - stock.adobe.com

CONTACT PAREN