July 2023 Copyright by KW Advisors 2023

Palo Alto area

Palo Alto

Jump to Palo Alto Report

Redwood City

Jump to Redwood City Report

Portola Valley

Jump to Portola Valley Report

Menlo Park

Jump to Menlo Report

Atherton

Jump to Atherton Report

Los Altos

Jump to Los Altos Report

San Jose

Jump to San Jose Report

Mountain View

Jump to Mountain View

San Mateo County

Jump to San Mateo County

Santa Clara County

Jump to Santa Clara County

Monterey County

Jump to Monterey County Report

Santa Cruz County

Jump to Santa Cruz County Report

East Palo Alto

Jump to East Palo Alto Report

Sunnyvale

Jump to Sunnyvale Report

Santa Clara City

Jump to Santa Clara City Report

Saratoga

Jump to Saratoga Report

What’syourhome reallyworthin today’smarket?

That's the question you should be asking yourself.

Our market is incredibly diverse and rapidly changing. Values vary not just by neighborhood but by street. Your home isn't necessarily worth what your neighbors' home is. It's the current market that sets the value of your home.

So, do you know what your home is worth today's market?

Icanhelp...

Contact me for a confidential, no obligation assessment of your home's value.

TwoQuestionsToAsk YourselfifYou’re ConsideringBuyingaHome

If you’re thinking of buying a home, chances are you’re paying attention to just about everything you hear about the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, overhearing someone chatting at the local supermarket, the list goes on and on. Most likely, home prices and mortgage rates are coming up a lot.

To help cut through the noise and give you the information you need most, take a look at what the data says. Here are the top two questions you need to ask yourself about home prices and mortgage rates as you make your decision:

1. Where Do I Think Home Prices Are Heading?

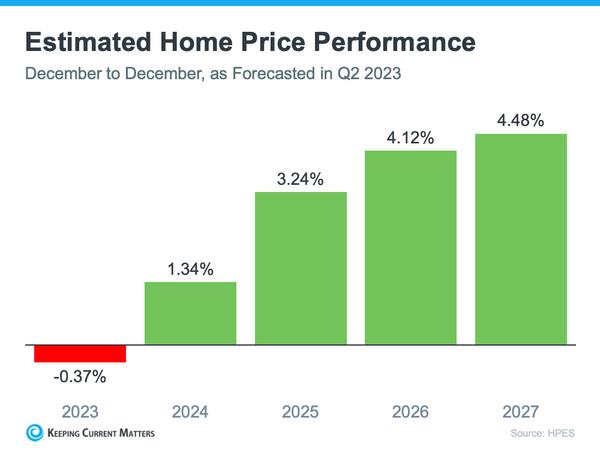

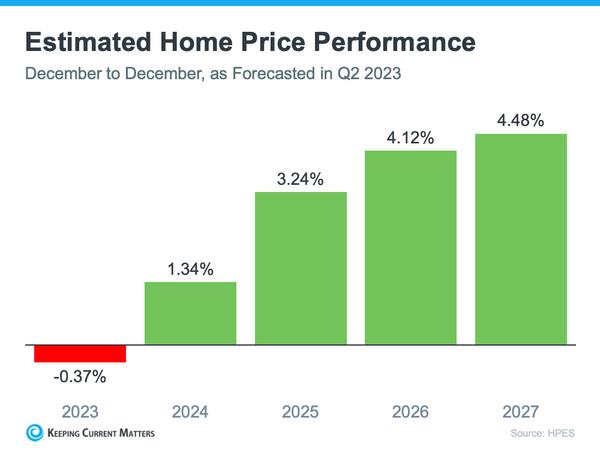

One reliable place you can turn to for that information is the Home Price Expectation Survey from Pulsenomics – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists.

According to the latest release, the experts surveyed are projecting slight depreciation this year (see the red in the graph below). But here’s the context you need most. The worst home price declines are already behind us, and prices are actually appreciating again in many markets. Not to mention, the small 0.37% depreciation HPES is showing for 2023 is far from the crash some people originally said would happen.

Now, let’s look to the future. The green in the graph below shows prices have turned a corner and are expected to appreciate in 2024 and beyond. After this year, the HPES is forecasting home price appreciation returning to more normal levels for the next several years.

So, why does this matter to you? It means your home will likely grow in value and you should gain home equity in the years ahead, but only if you buy now. If you wait, based on these forecasts, the home will only cost you more later on.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates have risen in response to economic uncertainty, inflation, and more. We know based on the latest reports that inflation, while still high, has moderated from its peak. This is an encouraging sign for the market and for mortgage rates. Here’s why.

When inflation cools, mortgage rates generally fall in response. This may be why some experts are saying mortgage rates will pull back slightly over the next few quarters and settle somewhere around roughly 5.5 and 6% on average.

But, not even the experts can say with absolute certainty where mortgage rates will be next year, or even next month. That’s because there are so many factors that can impact what happens. So, to give you a lens into the various possible outcomes, here’s what you should consider:

If you buy now and mortgage rates don’t change: You made a good move since home prices are projected to grow with time, so at least you beat rising prices.

If you buy now and mortgage rates fall (as projected): You probably still made a good decision because you got the house before home prices appreciated more. And, you can always refinance your home later on if rates are lower.

If you buy now and mortgage rates rise: If this happens, you made a great decision because you bought before both the price of the home and the mortgage rate went up.

Source: Keeping Current Matters

PaloAlto

What's in the Palo Alto data?

In June, Palo Alto had 96 homes for sale, providing the market with 1.5 months of inventory. There were 40 new listings and a total of 41 homes sold. The median sale price was $3.4m, and the median overbid was 98.2%. The average time on the market was 27 days.

There are 28 condo and townhome units for sale, providing the market with 1 8 months of inventory There were 14 new listings for sale and 10 condos sold, with a median sale price of $1.4m and a median overbid of 100.7%. The average time on the market was 23 days.

SFH Single-Family Homes

40 New Listings

41 Sold Listings

1.5 Months of Inventory

$3.4M Median Sale Price

98.2% Median Sale vs List

27 Avg Days on Market

The data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

JUNE 2022 - JUNE 2023

S FOR SALE SOLD LISTINGS

ly Homes

nths, year-over-year.

ownhomes

nths, year-over-year

2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 g2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023

oAlto

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $3 7m last June 2022, to $3 4m as of June 2023

Condos & Townhomes

The median sales price has decreased from $1.6m last June 2022, to $1.4m as of June 2023.

Overbids

Single-Family Homes

The overbid percentage has decreased from 98 5% last June 2022, to 98 2% a year later

Condos & Townhomes

The overbid percentage has decreased from 108.1% last June 2022, to 100.7% a year later.

Single-Family Homes

The average time spent on the market went down from 28 days last June 2022, to 27 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 26 days in June 2022, to 23 days as of June 2023

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 150 100 50 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

Redwood City

What's in the Redwood City data?

In June, Redwood City had 49 single-family homes sold, with a median sale price of $2.1m. The median overbid was 100.3%, and the average time on the market was 16 days. In terms of inventory, 91 homes for sale provide the market with 1 1 months of inventory.

For condos, there were a total of 11 units sold. The median sale price increased to $1.4m, and the median overbid decreased to 99.8%. The average time on the market fell to 15 days. There are currently 21 condos for sale, providing the market with 2 months of inventory

oodCity 2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 t2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 JUNE 2022 - JUNE 2023 s r-over-year. es r-over-year

ALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has remained at $2 1m since June 2022

Condos & Townhomes

The median sales price has increased from $1.3m last June 2022, to $1.4m as of June 2023.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market went down from 19 days last June 2022, to 16 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 29 days in June 2022, to 15 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 108 2% last June 2022, to 100 3% a year later

Condos & Townhomes

The overbid percentage has decreased from 101% last June 2022, to 99.8% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 60 40 20 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

Portola Valley

What's in the Portola V data?

In June, there were 20 single-family h sale, with 3 new listings and 8 home months of inventory was 3.8. The me price was $3.4m, with an overbid of average days on the market were 37

There is no data for condos and tow month.

There is no data for condos and tow month.

mes

8 Sold Listings

$3.4M edian Sale Price

37 g Days on Market

etrics, includes all single-family homes, above from June 2022 to June 2023. This from the time the data was gathered. All DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

PortolaValley

JUNE 2022 - JUNE 2023

Single-Family Homes

Last 12 months, year-over-year.

LISTINGS FOR SALE SOLD LISTINGS No Data For This Month.

Condos & Townhomes

Last 12 months, year-over-year

Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 40 30 20 10 0 100 75 50 25 0

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $4 5m last June 2022, to $3 4m as of June 2023

Condos & Townhomes

No Data For This Month.

Overbids

Single-Family Homes

The overbid percentage has increased from 91 8% last June 2022, to 92 3% a year later

Condos & Townhomes

No Data For This Month.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market went up from 30 days last June 2022, to 37 days as of June 2023

Condos & Townhomes

No Data For This Month

Back

of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $7,500,000 $5,000,000 $2,500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 150 100 50 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

to Table

Men

What's in

The real estate strong demand

2.3 months of and 30 homes inventory, with median overbid market was 47

The condo mar available. Ther sold, with a me median overbid the market for

omes

30 Sold Listings

$2.8M Median Sale Price

47 Avg Days on Market

Broker Metrics, includes all single-family homes, Area above from June 2022 to June 2023. This vary from the time the data was gathered. All guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

Month 100 Media

Park ov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 ov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 er-year. y er-year E SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $3 3m last June 2022, to $2 8m as of June 2023

Condos & Townhomes

The median sales price has decreased from $1.9m last June 2022, to $1.3m as of June 2023.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market went up from 11 days last June 2022, to 47 days as of June 2023

Condos & Townhomes

The average time spent on the market went up from 16 days in June 2022, to 37 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 102 7% last June 2022, to 99 3% a year later

Condos & Townhomes

The overbid percentage has decreased from 104.9% last June 2022, to 100.6% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 200 150 100 50 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

Athert

What's in the Ath

In June, Los Altos had 39 sale, providing the market inventory. There were 10 n 12 homes sold. The media family homes was $7.3m, of 90.7%. The average tim single-family homes was 1

On the other hand, the con has a much smaller inven sale. In June, 1 new listing condos were sold. The me condos was unavailable a There is no median overbi

e-Family Homes

12 months, year-over-year.

os & Townhomes

12 months, year-over-year

Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023

therton

JUNE 2022 - JUNE 2023

STINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $7 5m last June 2022, to $7 3m as of June 2023

Condos & Townhomes

The median sales price has decreased from $841k last June 2022, to $0 as of June 2023.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market went up from 11 days last June 2022, to 104 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 12 days in June 2022, to 0 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 98 8% last June 2022, to 90 7% a year later

Condos & Townhomes

The overbid percentage has decreased from 101.9% last June 2022, to 0% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125 100 75 50 25 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

LosAltos

What's in the Los Altos data?

In June, Los Altos had 49 single-family homes for sale, providing the market with only 1.5 months o inventory. There were 22 new listings added, and 25 homes sold. The median sale price for singlefamily homes was $3.8m, with a median overbid of 102.1%. The average time on the market for single-family homes was 17 days.

On the other hand, the condo market in Los Altos has a much smaller inventory, with only 15 units for sale. In June, 8 new listings were added, and 8 condos were sold. The median sale price for condos was $1.6m. The median overbid percentage for June was 99.8%. The average time on the market was 21 days.

SFH ingle-Family Homes

22 w Listings

25 Sold Listings

1.5 onths of Inventory

$3.8M Median Sale Price

102.1% edian Sale vs List

17 Avg Days on Market

data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

CONDO

Condo & Townhomes

8 New Listings

8 Sold Listings

1.4 Months of Inventory

$1.6M Median Sale Price

99.8% Median Sale vs List

21 Avg Days on Market

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

LosAltos Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 125 100 75 50 25 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 25 20 15 10 5 0

JUNE 2022 - JUNE 2023

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $4 2m last June 2022, to $3 8m as of June 2023

Condos & Townhomes

The median sales price has increased from $1.3m last June 2022, to $1.6m as of June 2023.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market has remained at 17 days since June 2022

Condos & Townhomes

The average time spent on the market went down from 30 days in June 2022, to 21 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 106 2% last June 2022, to 102 1% a year later

Condos & Townhomes

The overbid percentage has increased from 98% last June 2022, to 99.8% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 200 150 100 50 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

SanJos

What's in the San

In June, San Jose had 598 s sale, providing the market w inventory. There were 350 n homes were sold. The med single-family homes was $1 overbid was 104.5%. The av market for single-family hom

There are 282 condo and to providing the market with 1 There were 162 new listings

The median sale price for c the median overbid was 103 on the market for condos w

162 New Listings

138 Sold Listings

1 Months of Inventory

$865K Median Sale Price

103.5% Median Sale vs List

19 Avg Days on Market

& Townhomes

CONDO Condo

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 2000 1500 1000 500 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 750 500 250 0 JUNE 2022 - JUNE 2023

SanJose

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has increased from $1 5m last June 2022, to $1 6m as of June 2023

Condos & Townhomes

The median sales price has increased from $845k last June 2022, to $865k as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 104 6% last June 2022, to 104 5% a year later

Condos & Townhomes

The overbid percentage has decreased from 105.2% last June 2022, to 103.5% a year later.

Single-Family Homes

The average time spent on the market has remained at 20 days since last June.

Condos & Townhomes

The average time spent on the market remained at 19 days since last June

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 50 40 30 20 10 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

M Vi

Wha data In June providin

There w 25 hom $2 5m average

There a providin 24 new condos $1.3m. average

Mce single-family homes, June 2023. This was gathered. All Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated. rket

24

New

Months of Inventory

Median Sale Price

Median Sale vs List 26 Avg Days on Market

Sold

Condo & Townhomes

Listings 1.6

$1.3M

103%

22

Listings CONDO

y y

Median SalesPrice

Single-Family Homes

The median sales price has increased from $2 3m last June 2022, to $2 5m as of June 2023

Condos & Townhomes

The median sales price has increased from $1.1m last June 2022, to $1.3m as of June 2023.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market has remained at 18 days since last June

Condos & Townhomes

The average time spent on the market went up from 19 days in June 2022, to 26 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 106 5% last June 2022, to 106 2% a year later

Condos & Townhomes

The overbid percentage has decreased from 105.2% last June 2022, to 103% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $3,000,000 $2,000,000 $1,000,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 75 50 25 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

Sa Co

What' data?

In June, S for sale, p inventory of 364 ho single-fam overbid fo which is t on the m days. There we sale, prov market T total of 1 $982k. Th average t

Msingle-family homes, June 2023. This gathered. All KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

et

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 1250 1000 750 500 250 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 400 300 200 100 0 JUNE 2022 - JUNE 2023

SanMateo

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $2m last June 2022, to $1 9m as of June 2023

Condos & Townhomes

The median sales price has increased from $940k last June 2022, to $982k as of June 2023.

Overbids

Single-Family Homes

The overbid percentage has decreased from 107 7% last June 2022, to 101 3% a year later

Condos & Townhomes

The overbid percentage has decreased from 102.6% last June 2022, to 100.9% a year later.

Single-Family Homes

The average time spent on the market went up from 15 days last June 2022, to 21 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 20 days in June 2022, to 19 days as of June 2023

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 60 40 20 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

Santa Coun

What's in the S County data?

Santa Clara had 612 s in June, providing the inventory. In June, the a total of 787 homes s price of $1 8m The m and the average time

There are currently a t providing the market w There were 272 new li 304 condos sold with The median overbid w time on the market wa

mily Homes

9% st

787 Sold Listings

$1.8M Median Sale Price

17 Avg Days on Market

InfoSparks and Broker Metrics, includes all single-family homes, the California Area above from June 2022 to June 2023. This data, and may vary from the time the data was gathered. All not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

ory

New Listings

Months of Inventory $1M Median Sale Price 102.3% Median Sale vs List 18 Avg Days on Market 304 Sold Listings

Condo & Townhomes

272

1.1

CONDO

, y y

Median SalesPrice

Single-Family Homes

The median sales price has remained at $1 8m since last June

Condos & Townhomes

The median sales price has increased from $965k last June 2022, to $1m as of June 2023.

Overbids

Single-Family Homes

The overbid percentage has decreased from 104 9% last June 2022, to 103 9% a year later

Condos & Townhomes

The overbid percentage has decreased from 104% last June 2022, to 102.3% a year later.

Single-Family Homes

The average time spent on the market went up from 14 days last June 2022, to 17 days as of June 2023

Condos & Townhomes

The average time spent on the market went up from 14 days in June 2022, to 18 days as of June 2023

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 40 30 20 10 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

Monterey County

What's in the Monterey County data?

In June, Monterey had a total of 495 single-family homes on the market, providing 2 months of inventory. There were 212 new listings and a total of 156 homes sold, with a median sale price of $800k and a median overbid of 97 7% The average time on the market decreased to 32 days.

52 condo and townhome units were available for sale, providing the market with 2.2 months of inventory. There were 23 new listings and a total of 28 condos sold, with a median sale price of $767k and a median overbid of 96.7%. The average time on the market remained relatively stable at 32 days.

SFH ingle-Family Homes

212 w Listings

156 Sold Listings

2 onths of Inventory

$800K Median Sale Price

97.7% edian Sale vs List

32 Avg Days on Market

data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

2.2

23 New Listings

Months of Inventory

Median Sale Price

Median Sale vs List

Days on Market

Condo & Townhomes

$767K

96.7%

32 Avg

28 Sold Listings CONDO

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

MontereyCounty Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 1000 750 500 250 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 100 75 50 25 0

JUNE 2023

JUNE 2022 -

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $852k last June 2022, to $800k as of June 2023

Condos & Townhomes

The median sales price has increased from $550k last June 2022, to $767k as of June 2023.

Overbids

Single-Family Homes

The overbid percentage has increased from 97 2% last June 2022, to 97 7% a year later

Condos & Townhomes

The overbid percentage has decreased from 101.4% last June 2022, to 96.7% a year later.

Single-Family Homes

The average time spent on the market went up from 31 days last June 2022, to 32 days as of June 2023

Condos & Townhomes

The average time spent on the market went up from 18 days in June 2022, to 32 days as of June 2023

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $1,000,000 $750,000 $500,000 $250,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 75 50 25 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

SantaCruz County

What's in the Santa Cruz County data?

In June, Santa Cruz had 422 single-family homes for sale, providing the market with 2 months of inventory. There were 188 new listings added, and a total of 149 homes sold. The median sale price for single-family homes was $1 2m, and the median overbid was 99.8%. The average time on the market was 30 days.

There were 68 condo and townhome units for sale, providing 1.8 months of inventory for the market. There were 28 new listings for sale, and a total of 26 condos were sold. The median sale price for condos was $791k, with a median overbid of 101%. The average time on the market was 21 days.

SFH Single-Family Homes

188 New Listings

149 Sold Listings

2 Months of Inventory

$1.2M Median Sale Price

99.8% Median Sale vs List

30 Avg Days on Market

The data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

28 New Listings

26 Sold Listings

1.8 Months of Inventory

$791K Median Sale Price

101% Median Sale vs List

21 Avg Days on Market

CONDO Condo & Townhomes

Last 12 months,

Last 12 months, year-over-year

SantaCruzCounty Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 600 400 200 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 150 100 50 0 JUNE 2022 - JUNE 2023

Homes

Single-Family

year-over-year.

& Townhomes

Condos

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $1 3m last June 2022, to $1 2m as of June 2023

Condos & Townhomes

The median sales price has decreased from $800k last June 2022, to $791k as of June 2023.

Overbids

Single-Family Homes

The overbid percentage has decreased from 101 7% last June 2022, to 99 8% a year later

Condos & Townhomes

The overbid percentage has decreased from 102.2% last June 2022, to 101% a year later.

Single-Family Homes

The average time spent on the market went up from 21 days last June 2022, to 30 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 30 days in June 2022, to 21 days as of June 2023

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 80 60 40 20 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

East PaloAlto

What's in the East Palo Alto data?

In June, East Palo Alto had 15 single-family homes for sale, providing the market with 1.2 months of inventory. 6 new listings were added, and 6 homes were sold at a median of $1m. The average time on the market was 17 days, with a median overbid of 101.6%.

There were only 4 condo and townhouse units for sale, providing the market with no inventory, and 2 new listings were added in June. No condos were sold in either January or June. The average time on the market for condos was 22 days.

SFH Single-Family Homes

6 New Listings

6 Sold Listings

1.2 Months of Inventory

$1M Median Sale Price

101.6% Median Sale vs List

17 Avg Days on Market

The data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

2 New Listings 0 Months of Inventory $0 Median Sale Price 0% Median Sale vs List 0 Avg Days on Market 0 Sold Listings CONDO Condo & Townhomes

EastPaloAlto

JUNE 2022 - JUNE 2023

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 40 30 20 10 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 8 6 4 2 0

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $1 3m last June 2022, to $1m as of June 2023

Condos & Townhomes

The median sales price has remained at $0 since last June.

Overbids

Single-Family Homes

The overbid percentage has decreased from 106 3% last June 2022, to 101 6% a year later

Condos & Townhomes

The overbid percentage has remained at 0% last June.

Single-Family Homes

The average time spent on the market went down from 31 days last June 2022, to 17 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 8 days in June 2022, to 0 days as of June 2023

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 100 75 50 25 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

AVGDays OntheMarket

Sunnyvale

What's in the Sunnyvale data?

Sunnyvale had 75 single-family homes for sale in June, with 39 new listings, resulting in 0.6 months of inventory. The median sale price for singlefamily homes was $2.3m, and 54 homes were sold with a median overbid of 107.7% and an average time on the market of 15 days.

There were 35 condo and townhouse units for sale, with 21 new listings, providing the market with 0.4 months of inventory. The median sale price for condos was $1.2m, and 21 condos were sold with a median sale over ask percentage of 104.8%. The average time spent on the market was 14 days.

SFH Single-Family Homes

39 New Listings

54 Sold Listings

0.6 Months of Inventory

$2.3M Median Sale Price

107.7% Median Sale vs List

15 Avg Days on Market

The data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

21 New Listings 0.4 Months of Inventory $1.2 Median S 104.8% Median Sale vs List Avg Days o Sold COND Condo & Townh

nnyvale

JUNE 2022 - JUNE 2023

GS FOR SALE SOLD LISTINGS

mily Homes onths, year-over-year.

Townhomes onths, year-over-year

Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $2 4m last June 2022, to $2 3m as of June 2023

Condos & Townhomes

The median sales price has remained at $1.2m since last June.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market has remained at 15 days since last June

Condos & Townhomes

The average time spent on the market went down from 18 days in June 2022, to 14 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 110 1% last June 2022, to 107 7% a year later

Condos & Townhomes

The overbid percentage has decreased from 107.4% last June 2022, to 104.8% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 40 30 20 10 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

SantaClara City

What's in the Santa Clara City data?

In June, Santa Clara had a total number of 60 single-family homes for sale, providing only 0.4 months of inventory. There were 35 new listings and 41 homes sold, with the median sale price at $1 7m and the median overbid at 107 1% There was an average of 14 days on the market.

There were 39 units for sale, providing 0.8 months of inventory. There were 21 new listings and 16 condo units sold, with the median sale price at $948k and the median overbid at 104.6%. The average time on the market also decreased to 18 days

SFH Single-Family Homes

35 New Listings

41 Sold Listings

0.4 Months of Inventory

$1.7M Median Sale Price

107.1% Median Sale vs List

14 Avg Days on Market

The data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

21 New Listings

0.8 Months of Inventory

$948K Median Sale Price

vs

104.6% Median Sale

List 18 Avg Days on Market

Condo & Townhomes

16 Sold Listings CONDO

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 50 00 50 0 Jun2022 Jul2022 Aug2022 Sep2022 Oct2022 Nov2022 Dec2022 Jan2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 50 00 50 0

SantaClaraCity

JUNE 2022 - JUNE 2023

LISTINGS FOR SALE SOLD LISTINGS

Median SalesPrice

Single-Family Homes

The median sales price has decreased from $1 8m last June 2022, to $1 7m as of June 2023

Condos & Townhomes

The median sales price has increased from $940k last June 2022, to $948k as of June 2023.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market went down from 18 days last June 2022, to 14 days as of June 2023

Condos & Townhomes

The average time spent on the market went down from 20 days in June 2022, to 18 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has decreased from 107 7% last June 2022, to 107 1% a year later

Condos & Townhomes

The overbid percentage has decreased from 105% last June 2022, to 104.6% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 60 40 20 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

Saratoga

What's in the Saratoga data?

In June, Saratoga had 42 single-family homes for sale, providing the market 1.7 months of inventory. There were 16 new listings and a total of 17 homes sold, with a median sale price of $4.1m. The median overbid was 102.1%, and the average time on the market was 18 days.

There were 7 condo and townhome units for sale, providing 0 4 months of inventory to the market There were 4 new listings for sale, and a total of 5 condos sold, with a median sale price of $1.3m. The median overbid was 103.2%, and the average time on the market was 15 days.

SFH Single-Family Homes

16 New Listings

17 Sold Listings

1.7 Months of Inventory

$4.1M Median Sale Price

102.1% Median Sale vs List

18 Avg Days on Market

The data, sourced from InfoSparks and Broker Metrics, includes all single-family homes, condos and townhomes in the California Area above from June 2022 to June 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01511642. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

0. Months of Inven

103.2% Median Sale vs

New

List

C

OLD LISTINGS

2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 2023 Feb2023 Mar2023 Apr2023 May2023 Jun2023 y y

Median SalesPrice

Single-Family Homes

The median sales price has increased from $3 7m last June 2022, to $4 1m as of June 2023

Condos & Townhomes

The median sales price has remained at $1.3m since last June.

AVGDays OntheMarket

Single-Family Homes

The average time spent on the market went down from 29 days last June 2022, to 18 days as of June 2023

Condos & Townhomes

The average time spent on the market went up from 14 days in June 2022, to 15 days as of June 2023

Overbids

Single-Family Homes

The overbid percentage has remained at 102 1% since last June

Condos & Townhomes

The overbid percentage has decreased from 107.8% last June 2022, to 103.2% a year later.

Back to Table of Contents Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023Jun2023 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125 100 75 50 25 0 Jun2022 Jul2022Aug2022Sep2022Oct2022Nov2022Dec2022 Jan2023Feb2023Mar2023Apr2023May2023 Jun2023 125% 100% 75% 50% 25% 0%

: 505 Hamilton Ave Suite #100, Palo Alto, CA 94301 PaloAlto DRE #02204560 raulnogueira@kw.com raulnogueira.kw.com RaulNogueira

There is no data for condos and tow month.

There is no data for condos and tow month.