Meet Patricia Mihanda, Your Multilingual Mega Agent!

Are you looking for a real estate professional who goes above and beyond to deliver exceptional service? Look no further! With Patricia Mihanda, you have found a true real estate powerhouse who speaks four languages fluently and has an unparalleled global perspective.

With extensive travels to 51 countries across four continents, Patricia Mihanda has gained a unique understanding of diverse cultures and international markets This global outlook enables them to effortlessly connect with clients from various backgrounds and cater to their specific needs, making the buying or selling process smooth and enjoyable.

Recognized as one of the top real estate agents in the industry, Patricia Mihanda has been featured in D magazine as the Best Real Estate Agent and Top Producer. Her outstanding track record of success, commitment to excellence, and dedication to her clients have earned them this well-deserved accolade

Not only does Patricia Mihanda possess the linguistic and cultural fluency to communicate effectively with clients from around the world, but she also has an in- depth knowledge of local markets. Whether you're looking to buy your dream home or sell your property for the best possible price, Patricia Mihanda has the expertise to guide you every step of the way.

Beyond her linguistic prowess and international experiences, Patricia Mihanda is also known for her unwavering work ethic, negotiation skills, and a keen eye for detail. She understands that buying or selling a home is one of life's most significant decisions, and she is committed to making the process seamless and rewarding for her clients.

When you choose Patricia Mihanda you're not just getting a real estate agent – you're gaining a trusted advisor who will listen to your needs, offer personalized solutions, and ensure your real estate journey is a resounding success.

Whether you're a seasoned investor or a first-time buyer, let Patricia Mihanda be your guide in the world of real estate. Contact Patricia Mihanda today to embark on an exceptional real estate experience like no other.

(626) 353-0670

(214) 769-0439 nunezjr186@gmail.com

(512)960- 5330 westsydney12@gmail.com

(214)286-6945 jeb3homes@gmail.com

Our goal to make you the most educated buyer, so that you can make the most informed decisions. Whether it’s the home buying process, financial goals, contracts, neighborhood. We’re here to be a resource for you.

We provide clients with insights into current market conditions, including trends in housing prices, inventory levels, and market forecasts. They educate clients about how these factors may impact their buying or selling decisions.

Throughout the process, we remain accessible to answer questions, provide guidance, and offer support as needed. We ensure that our clients feel empowered and informed every step of the way.

We know the neighborhoods they are interested in, providing information on amenities, HOAs, schools, transportation, and other local attractions. We help clients understand the fair market value of properties they are interested in buying or selling. They provide comparative market analyses (CMAs) or appraisals to justify their pricing recommendations.

Realtors educate client about effective negotiation strategies to help them achieve their goals, whether it’s getting the best price for a home or securing a favorable deal in a competitive market.

Realtors guide clients through each step of the home buying or selling process, explaining that to expect and answering any questions they may have. This includes education them about the legal, Title, and lender requirements, paperwork, and timelines involved.

This is a brief summary of the timeline for purchasing your new home. Remember, as your Real Estate Agent, I will be there to be sure you feel confident during each of step of the process.

Find the right Real Estate Agent for you

Deposit escrow and put it in your loan application within time frame of the contract

1 2 3 6 5 4 7 8 9

Schedule inspections and negotiate any repair requests of issues from inspection

Meet with a lender and get a pre-approval letter

Begin your online home search

After finding the right home, we will put in a strong offer and negotiate the terms of the contract

We will setup showings and view the homes you are interested in

Order appraisal and obtain homeowner’s insurance

LAST STEPS

Receive clear to close from lender and perform final walk through before closing

Hooray! Time to get your keys and celebrate buying a home

10

A pre - approval is needed to submit an offer. It gives the seller proof that a lender has reviewed your preliminary documents and has determined you are very likely to be approved for a loan to buy their house.

It is a good idea to speak to a couple different lenders before deciding who you’d like to work with. When interviewing loan officers, ask the following;

• What is the best type of loan for me?

• Do I qualify for any special loan programs or discounts?

• are your rates, terms, fees and closing costs negotiable? (and what are they?)

• When can you lock in my rate, and how long is it locked for?

• Will I have to pay for private mortgage insurance (PMI)? If so, how much will that cost?

• Can I buy down points for a lower interest rate?

• How much should I expect to pay in closing costs?

• Recent tax returns

• W- 2 Forms

• Paystubs

• Bank Statements

• List of monthly debt

• Credit report (you will give them permission to pull your credit. It will not drastically affect your score, but you want to limit the amount of pulls if you are shopping lenders.)

Congratulations on your decision to purchase a new home. In order to make sure you have a smooth closing, here is a checklist of things you should not do as you move through this process.

Don’t buy a car

Don’t buy new furniture for your home (or any large purchase)

Don’t buy make any large cash deposits into your bank account

Don’t exaggerate your income when talking to the lender

Don’t apply for credit- avoid any hard inquiries on your credit

Don’t overextend yourself-keep your debt balances at around 30% of your credit limit or less

Don’t co- sign for anyone on a loan or rental application

Don’t get behind on any loans or utility payments

Be cautious about consolidating your debt- ask your lender first

Don’t change careers

Don’t shift your finances around

Don’t change your bank

Don’t close any existing credit cards

Don’t increase your credit limits

Don’t max out your credit cards

Don’t open any new credit card accounts

DO: Wait until you have signed the papers on your new home, and it is fully funded before making any big changes in your finances. If you make any of these mistakes before your loan closes, it could disqualify you from the loan, and you won’t be able to close on you new home

As your Real Estate Agent, my number one goal is to achieve your own. I make it my priority to understand your situation when it comes to buying your home so we can accomplish your goals.

After you speak to a lender and get pre-approved, we will begin your online home search. We can set you up with listing alerts.

We will discuss your local price range, your must-haves, your deal breakers, location preferences, school districts and all of the other factors that will help me the most with your home search.

When you decide you are interested in a home, we will schedule a showing in person. If you decide it meets your criteria, we will write an offer. When we get an accepted offer, you will officially be under contract.

• What other factors will influence your home buying decision? (School Districts, neighborhood, distance to work, etc.)

• What features are important to you in your new home?

• what are your must-haves in your new home?

• What are deal breakers in a home?

• Any other specifics not mentioned above?

Information Needed

Before we begin writing an offer, we will need to gather some documents and discuss some important details.

• Pre -approval letter

• Offer Price

• Financing Amount

• Escrow Deposit

• Closing Date

• Inspection Period

• Closing Costs

When you find the home you LOVE- it’s time to make an offer! We will go over the purchase agreement together, fill in our price and terms, and will submit it to the listing agent. The offer will include a deadline for the seller to respond to us (typically around 24 hours, sometimes shorter.)

If the seller is not satisfied with your offer in any way, or think you are too far apart in price, they may simply reject the offer.

They can choose to send a counteroffer, asking to change the price, or any other terms from the original offer.

If the seller is satisfied with the offer as it is written, they may accept the offer, and we’d all move on with the next steps!

If the seller sends us a counter - offer, that will ONLY counter the items they want CHANGED from the original Purchase Agreement. If an item is not mentioned in the counter - offer, that means they are okay with it, and it carries over legally in the agreement.

You can then either: sign and accept their counter - offer, OR send a counter offer back to them. This can go back and forth until both parties are satisfied.

TAKE NOTE: Nothing is officially “accepted” or “countered” until the signed document has been delivered from agent to agent via email. An offer or counter - offer may be rescinded at any time prior to the delivery of the signed, accepted document

Contract Details

1

The big one- the price is the main part of the offer. The purchase agreement includes the price you are offering for the home.

2

The negotiable terms include but are not limited to: type of financing, timelines for inspections & appraisal, amount for earnest money, who picks title company, closing date/possession, HOA addendum, what’s included/not included in the sale etc,

As soon as you have an accepted offer, all the deadlines outlined in the contract will begin the day AFTER acceptance was received in writing,

• Turn in earnest money and option fee: this will be given to the title company. It will be held in their account and will be applied to the purchase price at closing. Typical deadline: 3 days.

• Apply for the mortgage loan: you have your pre- approval letter, but now what you have a contract, you’ll need to sign the official loan application with your lender, Typical deadline: 7 days.

• Order inspections and respond to inspection report: you’ll want to get an inspection ordered immediately so we have time to review it and put together a repair amendment. Typical deadline: 1- 7days (during the option period).

• Pay for and have your lender order the appraisal: contract deadline says “immediately” after accepted offer. Typical deadline: 10-20 days

• Order new Survey if required. Deadline is at least 3 days before closing.

• Get a commitment letter for homeowners insurance: You’ll call your insurance provider (or I can recommend one) to get a quote and commitment letter. The lender will require this before closing. Typical deadline: 10-20 days.

Many fees are negotiable ; however, there are some fees that you and the seller must pay .

Buyer typically pays:

• Inspections

• Their share of escrow fees from the title company

• Loan fees required by your lender

• Title insurance premium

• Fire and hazard insurance premium

Seller typically pays:

• Real Estate commissions

• Any judgments or tax liens

• Any unpaid homeowner’s dues

• Transfer taxes

• Delinquent property taxes

• Their share of escrow fees from the title company

The purchase agreement says exactly how many days you have, to get all inspections done during the option period. The option period is usually around 5- 7 days.

You may either: WAIVE or RESERVE the right to have independent inspections done within an agreed upon timeline. I always recommend having a home inspection done.

Any and all inspections shall be at the buyer’s expense.

The buyer’s inspection report will outline/list out the deficiencies you want addressed. We can prepare a repair amendment requesting the repairs to be completed at the seller’s expense before closing. You can also ask for a “repair credit” or ask the seller to lower the sales price. I call this phase 2 of negotiations. This is done before the option period.

If the seller is unwilling or unable to remedy defect to your reasonable satisfaction, you can either terminate the agreement (and get your earnest money back) or waive the deficiencies and proceed towards closing.

A “Defect” means a condition that would have a significant adverse effect on the value of the property, that would significantly impair the health or safety of future occupants of the property, or that if not repaired, removed, or replaced would significantly shorten or aversely affect the expected normal life of the premises. When asking for repairs we focus on defects and not necessarily cosmetic issues with the home.

Most of these inspections all fall under a comprehensive home inspection.

• Home Inspection

• Radon Testing (basement home only)

• Wood- Destroying Organism (WDO) Inspection

• Foundation Inspection

• HVAC Inspection

Our Recommended Home Inspectors

We have great home inspectors that we use. Once our offer has been accepted our team will reach out to you to discuss your options and set up an inspection time and date.

The typical inspection period is 3 -7 days

It is critical that we begin scheduling the inspections that you choose to have done as soon as we are under contract on your potential new home. This will ensure that we don not run out of time or have any delays in the process.

An appraisal is the estimation of a home’s current market value. A licensed appraiser completes this estimation, which is calculated by comparing recent nearby sold homes to the property that is being appraised.

Appraisals are required by mortgage lenders to be sure that the money they are lending to a buyer is a fair amount for the home. The lenders want to be sure that the buyers are not overpaying for the property. This is to protect lender. If the buyer stops making payments on the home, the lender wants to make sure they would be able to sell and recoup the money that they loaned for the home.

If you are financing the sale with a mortgage, the lender will require and appraisal to be done on the home. The lender hires a 3rd party appraisal company, who will send an appraiser to the home. They will evaluate the home, look at comparable sales, then send the lender a full appraisal report, which includes the “appraised value” on your home. The buyer’s typically pay for the appraisal up front.

Appraisals can take a few minutes to a few hours to complete, depending on the details of the home and the appraiser’s methods. It usually takes a week to 10 days to complete and send the appraisal report to the lender(or whomever ordered it).

I call this phase 3 of negotiations. If the appraised value comes in and it’s BELOW the agreed upon purchase price, a few things could happen depending on the appraisal addendum:

OPTION 1 : The buyer can pay the shortage amount in addition to the down payment and closing costs .

OPTION 2 : Both parties re -negotiate the purchase price. The seller could agree to sell for the lower appraised value .

OPTION 3 : The buyer can could choose to terminate the contract (unless there is an appraisal waiver addendum) .

OPTION 4 : After reviewing appraisal report, if you believe the appraiser to be wrong (maybe you disagree with the comps they used), you could go through an appeal process . But this doesn’t guarantee that the appraiser will change the value. In this case, see if the lender will allow a second appraisal. Both parties will have to agree to this and decide who is paying for the second appraisal.

The reason these are your options, is because the lender will only loan money for (up to) the appraised value . They can’t simply add the discrepancy into the mortgage . You, as the buyer would have to have the extra cash .

1

You will typically have 3- 5 days after the contract has been executed to make your application for your loan with your lender. The appraisal will be ordered by your lender after we have made our way through the inspection period. If your contract is contingent on the appraisal, this means that if the appraisal comes back lower than the offer you made, we will have the opportunity to negotiate the price again.

2

3 4

You will need to obtain a Homeowner’s Insurance Policy that will begin on the day of the closing of your home. If you don’t have an insurance company that you already plan to work with, please feel free to reach out to me and I will be more than happy to give you my list of recommendations.

As excited as you may be to start shopping for furniture and all the things that make a house a home, DON’T! Be very careful during this period not to make any major purchases, open new lines of credit or change jobs. If you have any questions, please call myself or lender.

These words are music to my ears, and yours too! This means that the mortgage underwriter has you loan documents, and we can confirm your closing date with the tittle company!

Both parties will find a time they can meet at the title company (on the closing date agreed to in the contract) to sign all the closing documents together at the same time.

A Realtor representing each client is required to be there. The title company “closer” will go over all the documents with each party, will get all signatures needed and notarize, then they will get the deed recorded and transferred with the county.

All you will need to bring to closing is a valid photo ID that is not expired.

As soon as we get the clear to close from the lender, the title company will work up the “settlement statement”, breaking down all the numbers, including the final amount you need for closing. If this amount is over 10k, it MUST be wired from your bank to the title company. Other wise a cashiers check will suffice. If you are sending a wire, you will get the title company’s wiring instructions, which your bank will need to send the money. Have your bank call and verify WIRING INSTRUCTIONS with the title company to mitigate any wire fraud. Ideally this is done the day prior to closing, to make sure the money is transferred in time for closing.

The buyer will get possession as outlined in the purchase agreement, at which point you’ll give them the keys and garage openers. This may be at the closing table, or at a later date, if you have agreed to give the seller post possession.

Call for moving estimates.

Call the Chamber of Commerce and Visitors and Convention Bureau in your new town and get their new resident information packages.

Inventory all household items to be moved, and start packing NOW!.

Remove all items from basement, storage, sheds, attics, and plan a garage sale or charity donation for all items you don’t want to move.

Start using things up that you can’t move, like cleaning supplies and frozen food.

Discuss tax - related moving expenses, liabilities, and deductions with your tax advisor.

Make a list of all people/organizations to contact about change of address.

Complete U.S Portal Service change of address forms and mail them all applicable publications, stores, and organizations.

Get copies of (or arrange for transfer at both ends) all school, medical, dental, veterinary, legal, and accounting records.

Contact insurance agents to transfer or cancel coverage.

If it’s a company move, check with your employer to find out moving expenses they cover.

Get a mail subscription for the local paper in your new location to familiarize yourself with the new community its activities and uses.

Locate and obtain all automobile licensing and registration information.

Get an itemized list of all moving related costs, and review with movers including packing, loading, special chargers, insurance, vehicles, etc.

Contact all current and new location utility companies (gas, water, electric, cable, internet, trash, and phone) to set connect/disconnect dates. Remember to keep current utilities hooked up until move day.

Make arrangements for movement of pets and plants.

More valuables to safe deposit box to prevent loss during move.

If your are packing yourself, acquire packing materials/boxes and pack items you won’t need for the next month.

If a professional mover is packing your goods, schedule packing days 1 or 2 days before the move.

Prepare ay mowers, snow blowers, boats, snowmobiles, or any other vehicles you won’t be using before the move by servicing and draining gas and oil to prevent moving van fire.

Repair, send out for re - upholstery, or clean furniture, drapes, and carpeting as needed.

Make travel arrangements for family moving trip, allow for unexpected delays and cash needs that often occur in moves and house closings.

Collect all important papers (insurance, will, deeds, stocks, etc.)

Prepare auto(s) for trip to new home. Check tires and have vehicles serviced.

Terminate newspaper and other delivery services at old address.

Give away all plants you don’t intend to move.

If you’re moving out of a building with elevators, arrange with management for use of elevators on moving day.

Schedule for appliance disconnects on moving - day or the day before the move, if necessary.

Contact your moving company counselor to review and confirm all arrangements for your move.

Withdraw contents of any safe deposit boxes, return library books, pick up dry cleaning etc.

Prepare specific directions to your new home for your moving company, including travel itinerary and emergency numbers

Defrost refrigerator/freezer.

Plan simple meals for moving day to avoid using appliances.

Make plans for small children on moving day.

Separate cartons and luggage items you need for personal travel so they don’t get pakced.

Pack a box of items you will need immediately upon arrival at your new home, and have movers put this box on last. Label box PACK THIS LAST OR UNPACK THIS FIRST. Take it with you if possible.

Have appliances disconnected and prepped for move.

Set aside one room for movers and packers to work in freely.

Arrange utilities to be turned on at new home.

Notify friends, family and neighbors of the new address.

Fill in any necessary prescriptions for the next two weeks.

Set aside manuals and instructions for your current home for the new owner.

Plan on sending an entire day at the house with movers. Do not leave until they have one.

Record all utility meter readings (gas, oil, electric, water).

Stay with moving van driver to oversee inventory of goods.

Ensure driver has correct route to new home.

Review carefully and sign bill of lading and inventory, and keep your copy in a safe place until all charges have been paid and any claims have been settled.

Make final walk - through of house to make sure its empty. Don’t forget attic and basement.

Lock all windows and doors. Ask your realtor if you should drop off the key or leave it in a lockbox.

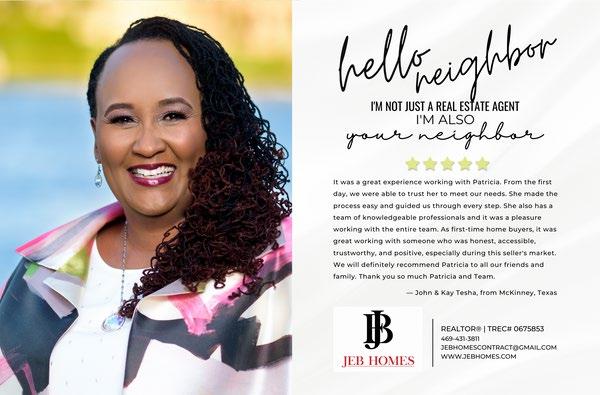

“Patricia is an angel from heaven living here on earth. She's more than just a realtor, she goes the extra mile to help buyers understand the benefits of a particular community, she teaches and preaches and answers every question asked professionally. She's a listener; she's knowledgeable in this market. She's always smiling and doesn't get tired of many phone calls. She knows almost all cultures and how to handle them to their satisfaction.

For us and other friends and family members we referred to her, everyone is 200% satisfied. We got the best home of our dreams, in the best school district for our kids, we didn't know much (we thought we did) about what she taught us and we decided to go with her advice. Anyone who needs a home, please she's your best option in the market. May God bless her forever.”

Emmanuel S from Aubrey, Texas

“ I'm not looking for a house, I've got a great house with the help of Patricia M. She's a gift from heaven to us as a community. I recommend anyone who is in the market to buy a home to contact her ASAP, she got tons of information most of us don't know”

Buyer B from Dallas, Texas

“ It has been an absolute delight to work with Patricia, first with her help finding us a rent house and currently with our new build. My wife and I could not imagine going through this process without Patricia's guidance and knowledge. I have always said that she is out of our league, but we are so happy to have her experience and professionalism during this long process.”

Jared N from McKinney, Texas

“ Patricia is a Godsend! We absolutely love her and she is more than a realtor. We are so appreciative to have her helping us along this home build journey. My wife and I could not imagine finding and building a home without her experience and knowledge. Patricia is a rock star!!“

Jared N from McKinney, Texas

“ Patricia worked with my family since 2018. She is courageous and professional. I highly recommend her to anyone.”

Yassin M from Aubrey, Texas

“ Excellent job from Patricia Mihanda, I appreciate what you're doing for us to help our community to become house owners. Keep it up. Thank you.”

Patou K from Northlake, Texas

“ I really appreciated her for how she helped me and my family to get a new home that we all LOVE. One more time, Thank you Patricia for your Service and I will ask you to continue with this attitude to serving others. Thank you.”

Norbert B from Fort Worth, Texas

“ Patricia is the best realtor in the DFW area. If you want someone you can rely on with great advice and knowledge, definitely go with Patricia!”

M. Elise U from Fort Worth, Texas

“ Patricia is very friendly and helpful person. As first time homeowners, we had a lot of questions and concerns, Patricia has been very patient with us and addressed all our worries. She is very knowledgeable and professional.”

Let’s get started

Again, thank you for the opportunity to present my proven winning - buying strategy to help you find and purchase your property. I am excited and honored to be helping you on your journey to home ownership.

Keller Williams Legacy

TREC #0675853

M: (469) 431- 3811

E: Jeb1homes@gmail.com

W:Jebhomes.com

3600 Preston Rd, Plano, TX 75093

Each office is independently owned and operated. TREC #0492040.