4 minute read

Limitless Learning

IRS to Cut Estate & Gift Tax Exemption by Fifty Percent

Estate planning strategies for high-net-worth families are even more crucial given the anticipated change in the estate and gift tax exemption threshold. Unless additional congressional action is taken, the threshold for taxable estates will drop from $12.92 million to $6.8 million.

Advertisement

The IRS has ruled that, beginning in 2026, your estate tax threshold will be the greater of the estate tax threshold then in place or the total taxable gifts you made in your lifetime. For example, if in 2023, you gave your daughter $1 million and your nephew $17,000, and you die after 2026, your estate would be taxed on the amount in excess of $5.8 million. However, if you gave your daughter $10 million instead of $1 million then if you die after 2026, your entire remaining estate would be taxable. The $10 million gift would, however, be free of estate or gift taxes. In other words, you can give away $13 million or more before 2026 completely free of estate and gift tax.

Needless to say, proper planning is necessary to make sure you are taking full advantage of the current exemption and aren’t negatively affected when it decreases. There are a number of scenarios to be considered.

A Charitable Remainder Trust (CRT) pays annual income from assets donated to the trust. The remainder goes to one or more charities you designate. A CRT can help you plan for retirement, reduce your taxable estate and accomplish your philanthropic goals.

With a Spousal Lifetime Access Trust (SLAT), one spouse makes a gift into the trust to benefit the other spouse, removing the gifted asset from the spouses’ combined estates, while still retaining some access to the assets. Any post-gift appreciation in value is excluded from federal taxation for both spouses’ estates. However, federal rules permitting this trust sunset on December 31, 2025.

With a Grantor Retained Annuity Trust you may transfer appreciating assets to your heirs and minimize gift or estate taxes. A GRAT freezes the value of your estate and transfers any increased value to your loved ones.

Consider whether you may qualify for portability before the current federal estate and gift tax exclusions expire in 2026. If your spouse passed away within the past five years, you may be able to file an estate tax return and transfer their unused estate tax exclusion to yourself. So even if you do not pass away until after 2026, you may be able to add millions in tax exclusions to the benefit of your heirs.

We’re Here For You

Before, During, & After the death of a loved one

704-892-9669 16901 Old Statesville Road, Huntersville, NC 28078 Funeral arrangements are a deeply personal choice. Pre planning provides you with the time needed to make practical, detailed, decisions that reflect your standards, lifestyle, taste and budget while giving your loved ones peace of mind.

Services also include burial options, on-site cremation, out of town assistance and monuments sales.

www.kepnerfh.com Call today for a FREE preplanning guide

NOW OPEN Life Tribute Center Denver, NC

704-966-4260

388 NC 16 Business Hwy, Denver, NC 28037 Located next to Safari Miles Restaurant

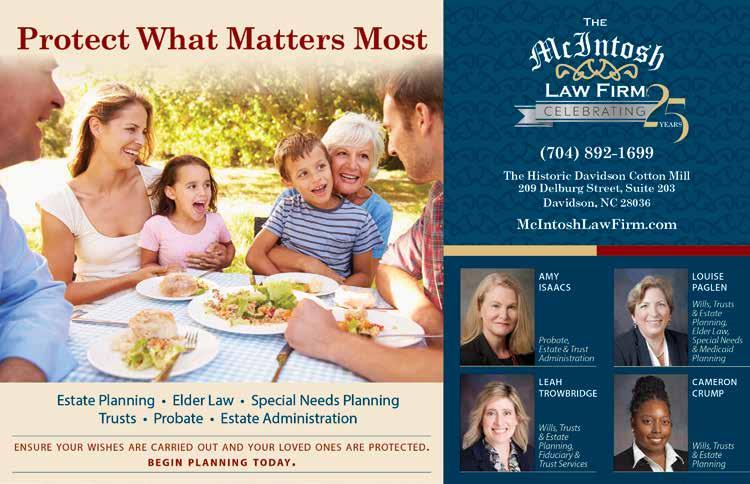

Louise Paglen, Estate Planning Attorney

The McIntosh Law Firm, P.C. www.mcintoshlawfirm.com

Where is the Opportunity for Improvement?

I often get asked “David, can you help me with THIS?” Or, “David, can you help me with THAT?” I thought that it would be helpful to identify specific opportunities that may exist for you to improve and that I’ve helped many others with over time. Here are just a few: Owning insurance policies What is the current need? that don’t fit the need An investment portfolio that is underperforming or isn’t appropriate for what you are trying to accomplish Paying needless tax on various types of income Too much cash sitting around These are just a handful of areas that can be improved. In summary, my job is to put you in a better position than what I found you. It’s that simple. Don’t wait any longer to put yourself in a better position.

David R. Hedges, CWS®, BS Finance

Re-evaluate risk, performance, cost, etc.

Review tax returns and understand where the tax “pain” is coming from Cash equivalents can still be kept safe and interest earned can increase

Go to bookmanbright.com/makeitbetter to learn more.

209 Delburg Street | Suite 205 | Davidson, NC 28036 704.256.6016 | David@bookmanbright.com

This Sonoma duck breast entree is one of many Southern-inspired entrees at Hunter House & Gardens

Dine + Wine

Eating, drinking, cooking and fun