4 minute read

Texas Land Markets

Texas Land Markets

Fourth Quarter 2023

REPORT BY CHARLES E. GILLILAND, PH.D.

Research Economist, Texas Real Estate Research Center at Texas A&M University

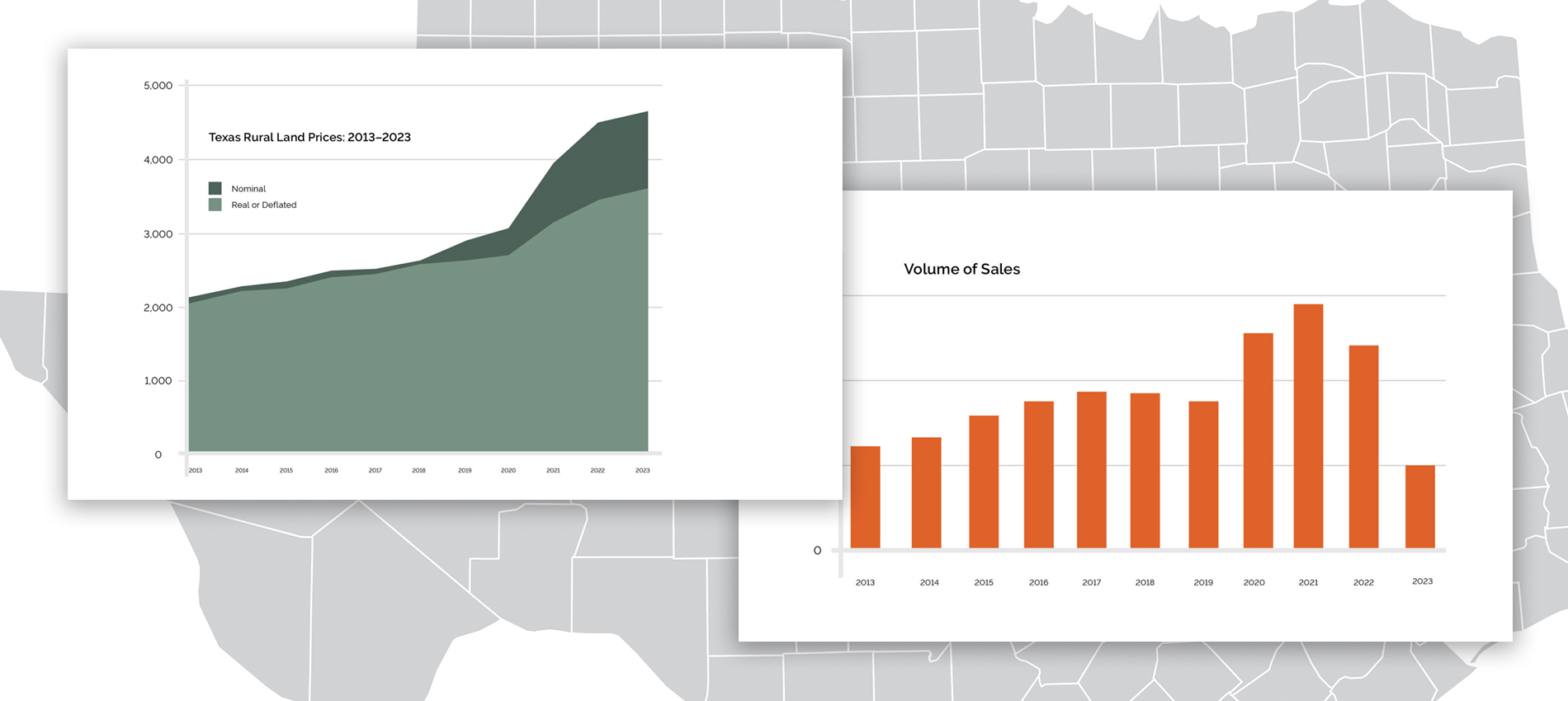

The two-year slide in the preliminary total number of sales continued as volume dropped to 3,595 a 54 percent tumble from the 2022 total. Final reports may likely soften that percentage. Nevertheless, the market continues to slide as buyers focus on price and quality. Buyers continued to concentrate on quality and have begun to insist on negotiating prices. The average price increased to $4,692 per acre, up a respectable 5.53 percent. However, the inflation adjusted, real price at $634 per acre in 1966 dollars declined 0.78 percent, the first drop since 2011. Preliminary total acreage plummeted 62 percent to 272,069 acres. Quarterly volume continues to ebb. The preliminary total dollar volume fell to $1.3 billion—a 60 percent decline. Final reports will increase the number of sales and add to the total dollar volume, but price will likely retreat a little more.

The Preliminary Total Dollar Volume Fell to $1.3 billion

Preliminary Total Number of Sales Dropped to 3,595

Prices Increased 5.53%

Preliminary Total Acreage Plummeted 62%

1. Panhandle and South Plains

Continued strong demand for cropland in this region propelled prices up 9.8 percent over 2022 levels to $1,677 per acre. Preliminary reported volume at 63,728 acres dropped 63 percent from 2022 market totals. Total sales at 380 fell 25 percent short of 2022. Total dollar volume dropped 59 percent to $107 million.

2. Far West Texas

The exodus of oil industry buyers has returned markets in Far West Texas to more normal price levels, recording a price of $586 per acre, a 24 percent rise over 2022 prices. Still, the number of sales dropped 31 percent with total acres falling 27 percent. Activity was still meager.

3. West Texas

Total acreage in the West Texas market fell 75 percent short 2022 sales to 63,127 transactions. The number of sales dipped 54 percent to 408 sales, but prices expanded 10 percent to $2,446 per acre. However, that price fell short of the second quarter price by $3 per acre. Total dollar volume plunged 73 percent to $154 million.

4. Northeast Texas

Volume in Northeast Texas declined 44 percent to 1,141 sales with prices climbing 8 percent to $8,136 per acre. Total dollar volume declined 41 percent to $293 million. The total acreage dropped 45 percent to 36,001.

5. Gulf Coast–Brazos Bottom

Prices in this region barely changed, increasing 1 percent to $9,620 per acre. Volume dropped 47 percent to 476 sales. Total dollar volume dropped 51 percent to $174 million and total acreage slid 52 percent to 18,569 acres.

6. South Texas

South of San Antonio markets strengthened, up 9 percent to $6,277 per acre. However, the number of sales fell 55 percent to 285 sales. Total dollar volume declined 58 percent to $136 million while total acreage declined 61 percent to 21,645 acres.

7. Austin-Waco-Hill Country

Activity continued to slow as the volume of sales dropped 49 percent. Buyers shifted from super active urban areas to the countryside posting a total of 889 sales. However, prices inched up a mere 1 percent to $7,085 per acre, $132 below the third quarter price. Total dollar volume declined 58 percent to $293 million. Total acres fell 68 percent to 41,393 acres.

The Future

As the year opens, many expect the Federal Reserve to reduce interest rates, easing the headwinds inspired by rising interest rates. They foresee increasing activity and rising prices once again dominating the markets. However, the Fed has repeatedly warned against anticipating an aggressive low interest rate agenda. Inflation had cooled quickly but ticked up in December. The outlook at the year open appears to be fraught with uncertainty as pundits disagree on the path of interest rates while war continues to rage in Ukraine and the Middle East.

Continued falling volume with weakened price increases suggests buyers are pushing back against high asking prices. As a consequence of those developments the current mix of sales lack a normal number of lesser quality properties. Still, sellers are balking at price cuts despite some markdowns in specific markets. All of this suggests that overall prices may level off or even soon slip. Trends in the next six months may reveal the trajectory of prices for the next few years.