4 minute read

Industry News

Economic Corner: Key Economic Factors Impacting the Green Industry

By Alicia Rihn, PhD Assistant Professor, Univ. Tennessee Department of Agricultural and Resource Economics

Prospects for profitability in the Green Industry closely follow the performance of the US economy. Typically, when the economy is doing well, the Green Industry is doing well and vice versa. There are multiple metrics of the economy that can be indicative of how the Green Industry is performing at any point in time. Some metrics to pay close attention to are the Gross Domestic Product (GDP), Leading Economic Index (LEI), and Housing Starts. Each of these components gives an indication of the US economic health and should be viewed in the long-term rather than at just one point in time. Viewing the historical data allows for the perspective of what is currently happening and what may occur moving forward based on past performance.

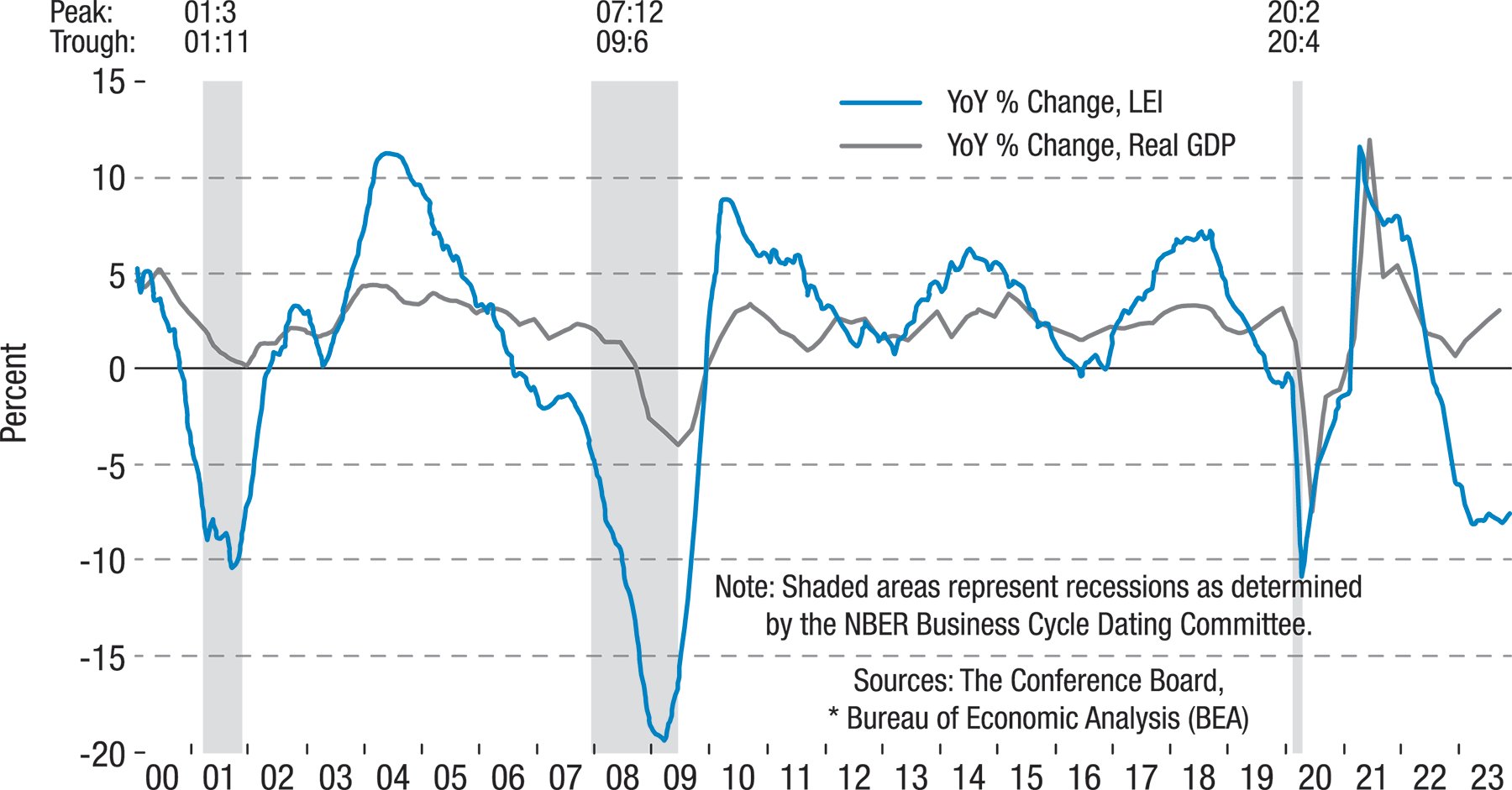

The GDP is an indicator of the overall health of the economy. During the pandemic (2020 – 2021), the GDP dropped sharply and then quickly rebounded (Fig.1; gray line). Since 2022, the GDP has somewhat normalized and remained within historically normal ranges. As of December 21, 2023, the GDP was at 4.9%. Closely related to the GDP is the Leading Economic Index (LEI; Fig.1 blue line) which is based on 10 economic indicators and reflects economic activity. An upward trend in the LEI indicates economic expansion, while a downward trend indicates a recession. Currently, the downward trend in the LEI is acting as an indicator of a recession. Partially based on the LEI and GDP, the Conference Board, an organization of about 40 business executive members, is predicting is predicting a short, shallow recession in the first half of 2024.

Another economic indicator that greatly impacts the Green Industry is the housing market, because when people build or buy houses they often install, update, or add to the landscaping. Housing starts in 2023 have been less than in 2022. Part of this decrease is attributed to rising mortgage rates (at 6.6% as of 1/8/2024) and limited supply of available inventory. However, despite this decrease, there is an unmet need for new houses. It is estimated that 1.7 million new housing starts per year are needed in the U.S. to meet housing demands through 2030 (Census Bureau, RSM US, 2023).

Demographics of US residents also favor future advances in the housing market. This is because the median age of first-time home buyers is 33 years old and Millennials (born between 1981 and 1996) are the primary drivers of first-time home purchases (National Association of Realtors [NAR], 2023). Currently, 52% of Millennials own homes (U.S. Census Bureau, 2023) and contribute to about 28% of home purchases between 2021 and 2022 (NAR, 2023). Baby Boomers (born between 1946 and 1964) comprise the largest portion of home buyers at 39% in that same timeframe, due to their accumulated wealth that afforded this group the ability to purchase during a time of higher home market prices. Although there was a decrease in housing starts in 2023, the number and buying power of Millennials set the stage in which there will likely continue to be high demand for new houses (and landscapes) projected for the upcoming five years.

When considering the potential impacts on the Green Industry, the best strategy is to stay tuned to trends in the GDP, LEI, and housing starts to better understand what is occurring in the economy, and to gauge how those trends may impact the Green Industry. If you are interested in staying up to date with these economic indicators, the www.tradingeconomics.com website provides the GDP, housing starts, and many other indicators. The LEI is available at www.conference-board.org . Regardless of the metric you are following, keep in mind the long-term trends because the economy is continually changing, and by looking at these indicators in context to their past trends in performance, we can better understand our current and future positions.