26 minute read

CERTIFICATION

The Benchmark for Performance and Ethics

Why did you decide to pursue LPC certification?

I first learned about the LPC certification program from a discussion at the National Retail Federation with Gene Smith and Jim Lee talking about the need for standards and a mechanism to measure proficiency within the LP industry. This was largely viewed as a first step to initiate serious discourse in retail LP and to encourage college students in a wide variety of disciplines to consider LP as a viable career path. I really liked the idea for a few reasons: (1) it shows that LP is a legitimate career path that stands on its own and requires proficiency across many departments and functions within retail, and (2) it creates high standards for participants to understand the content and demonstrate it via their performance. I volunteered, contributed a few chapters of content to the study materials, and signed up to take the first LPC exam as it was ready.

As a solution provider, how has the LPC certification assisted in your ability to connect with your customers and develop solutions and technology to support the LP industry?

I feel that achieving and maintaining the LPC certification has done a couple of things for me in my career on the solutions side. First, it has allowed me a regular seat at the table in the companies I have joined in determining specific product offerings and formulating the right strategies for the industry. I think having this background allows me insight into areas of “unmet needs” at retail that deserve real focus and thought. Instead of chasing trendy topics or creating solutions that might miss the mark, the focus on solutions to real operational problems in retail can be much more accurate.

Second, and maybe more importantly, by demonstrating proficiency in LP, one gains a unique perspective about how to approach the retail business as a technology company. The successful approach in this industry requires honesty, integrity, and the ability to work through complex operational issues with a straightforward approach. Retail LP demands partners ready to stand side-by-side with them in the trenches to do battle. I think the LPC certification shows an understanding of this need and the willingness to roll up your sleeves and get down to the real work.

Talk about the process of going through the coursework and taking the exam.

Often in our careers, we naturally drift to one focus area or another, depending on our own motivations, interests, Interview with Dustin Ares, LPC

Ares is director of global sales for Malong Technologies, which provides unique artificial intelligence solutions for a wide variety of problems in retail. His experience in retail loss prevention includes physical security, data systems, store design, training, investigations, organized retail crime, and return-fraud prevention. Companies he has worked for include Target, Hollywood Video, Abercrombie & Fitch, and SIRAS (a Nintendo subsidiary at the time).

and curiosity. For me, that meant my role had taken me through corporate management practices and technical implementations of systems and solutions. I found, largely from the coursework, that there were significant areas in supply chain and physical security concerns surrounding distribution centers that I had not realized I was lacking. I spent the bulk of my study time in these areas, keying in on fundamentals and publications by experts in the field. I also found that while you may grow quickly in your career and demonstrate significant proficiency in something, you may not even realize the formal theory (behavioral, criminological, and so forth) that underlies your work. I found that interesting and continue to try to understand as I work through new issues.

Looking at your own background and knowledge, what information helped you the most?

After about ten years in the field, you may gain that feeling that you have “seen that, done that” and a false sense of confidence. I think the first thing I learned from the coursework is that no matter how much you have been exposed to, there is always something new over the next horizon. If you are open to the possibility that you don’t know everything, there are actually worlds of new information ready for you to discover. The depth and breadth of your understanding are entirely up to you.

From a content perspective, I still remember reading about behavioral store design as an important consideration for security in a store. While I had lived many days using carefully mapped store designs with Target stores, I had not understood all of the underlying design considerations and choices.

What benefits have you seen from taking the course?

The LPC coursework showed me how broad the industry is and how it continues to expand, even today. While one can choose to be a generalist or specialize within the LP industry, the industry continues to expand, change, and grow. As shopping experiences evolve over time, the LP industry must also adapt to meet the new challenges that are presented.

I enjoy having the LPC designation on the solution-provider side as it shows that I understand the issues facing today’s LP practitioners. I lived it firsthand. If I am engaging with retail loss prevention, they can be comfortable that I understand where they are coming from, that I have already considered the constraints and opportunities from that side of the desk, and that I won’t waste their time. This helps

to streamline conversations and spend time where the focus needs to be.

If you could offer one key takeaway to someone considering getting certified, what would it be?

Get it done! In my opinion, a comparable analogy is performing well in high school algebra or geometry. Getting good grades in math differentiates the people who can operate a calculator, for example, versus those who understand how the underlying math works. The fundamental understanding of key roles, issues, and approaches can be really important for career progression in the highly competitive and specialized LP industry. The LPC sets you apart from your peers that do not hold that certification.

I especially recommend the LPC for practitioners relatively early in their careers to gain exposure to other areas that may be of interest; for solution providers, because there are not many of us that have LPC certifications, this can be a real differentiator. Certification demonstrates that you are highly motivated, dedicated to the sport, and your words carry the weight of knowledge.

How would you compare the foundation certifications to other educational courses that you’ve taken?

The Loss Prevention Foundation’s certification content is more comprehensive than many other offerings. While others may be quite specific and can be accomplished with a day or two, the LPC certification specifically is something that requires dedicated time and focus and requires the applicant to strengthen knowledge in those areas where they are less experienced or knowledgeable.

How has certification changed your expectations of loss prevention as a career, for yourself and for others?

I value that the foundation and its certifications create a basis for students, institutions, and career practitioners to evaluate the knowledge base of the industry. By pointing to the coursework and certification process, it allows people to think about the function of loss prevention with a much more holistic view than maybe what they have seen portrayed in the media. For retail professionals, a path into loss prevention and, further, into certification can be a motivator to get people thinking about their career development.

Would you recommend certification to others?

I highly recommend certification for various reasons for various people and for different career stages. I recommend certification for the young professional in loss prevention or the high-performing retail operator to explore the industry and to obtain the LPQ as an ethical and performance benchmark. I feel the LPQ sets a good standard for basic knowledge in the LP field and sets the applicant up to build upon a strong foundation of industry knowledge.

I recommend certification for highly motivated LP professionals to obtain their LPC designation to demonstrate a well-rounded understanding of roles, issues, and approaches in retail. The certification demonstrates a high standard of loss prevention understanding and performance. It sets achievers apart from those who may simply be “going through the motions.”

Our Success Starts with Our Partners

DOCTORATE LEVEL PARTNERS

MASTER LEVEL PARTNERS

BACHELOR LEVEL PARTNERS

ASSOCIATE LEVEL PARTNERS

p r 0tecting and pr 0m 0ting retailers

inc.

Professional development is key to a fulfilling career. Visit www.LossPreventionFoundation.org to find out more. SM

Educating an industry, one leader at a time.

continued from page 37

I recommend certification for solution providers to demonstrate their knowledge and support of the industry. The LPQ and LPC certifications add credibility to your involvement as you interact with retail loss prevention teams. It also shows that you understand the concerns of retailers and know how to speak their language.

Newly Certified Following are individuals who recently earned their certifications.

Recent LPC Recipients Suzanne Clift, LPC, TJX William Decker, LPC, Harris Teeter Supermarkets Kevin Fitzgerald, LPC, Victoria’s Secret Paul Flintoff, LPC, Albertsons Scott Harbin, LPC, Skechers USA Daniel Helmick, LPC, Five Below Nicholas Hmel, LPC, Homegoods Matthew Hollingsworth, LPC, TJX Eric Koopmeiners, LPC, Five Below Benjamin Lampley, LPC, Office Depot Mike Le, LPC, Lowe’s Matthew Logan, LPC, Target Salvatore Lupo, LPC, Family Dollar Christopher Marzo, LPC, Staples Steve Mathieu, LPC, Paradies Lagardere Omer Nuhoglu, LPC, The ICONIC Jennifer Peck, LPC, TJX Bond Pratt, LPC, Office Depot Urszula Rzepien, LPC, CVS Health Jacob Sawyer, LPC, Family Dollar Joseph Shires, LPC, Family Dollar Steve Slater, LPC, Harris Teeter Bobby Templet, LPC, Whole Foods Market Daniel Viera, LPC, Lowe’s Michelle Wallace, LPC, David’s Bridal

Recent LPQ Recipients Tina Alfonso, LPQ, Walgreens Elizabeth Bell, LPQ, Army Air Force Exchange Service Scott Boyd, LPQ, Jason Burchfield, LPQ, TJX Jennifer Carl, LPQ, Nordstrom Robert Cozart, III, LPQ, Axis Communications Kelsey Demsky, LPQ, TJX Michael Downs, LPQ, AFA Protective Systems Dennis Freire, LPQ, Michaels DC Craig Hadley, LPQ, American Telecommunications Curtin Michael, LPQ, Vector Security Services Blake Owens, LPQ, Fanatics Ryan Payne, LPQ, AT&T Luke Pipkin, LPQ, Home Depot John Pocse, LPQ, Home Depot Mike Russo, LPQ, US State Department, Diplomatic

Security Service Julie Saitta, LPQ, TJX Mark Stewart, Jr, LPQ, Giant Food Stores Julie Trump, LPQ, The Beer Store Christopher Workman, LPQ, TJX

Tired of Waiting on a Promotion?

Take control of your future, get loss prevention certified and STAND OUT from your competition.

Commit to your future TODAY!

www.losspreventionfoundation.org

POWERED BY THE LOSS PREVENTION FOUNDATION LPQUALIFIED

Designed to provide benchmark loss prevention education for: n Loss prevention managers n College students n Store managers n Operations support roles n Anyone interested in a career in loss prevention

SM

POWERED BY THE LOSS PREVENTION FOUNDATION LPCERTIFIED

Designed to provide advanced loss prevention education for experienced LP professionals with three years’ experience or more:

n n Loss prevention management Loss prevention executives

FEATURE

CAUGHT ON CAMERA REVIEWING THE USE OF VIDEO TECHNOLOGIES IN RETAILING By Adrian Beck, Emeritus Professor, University of Leicester

It is hard to overestimate the extent to which video technologies are now becoming embedded in societies around the world in general and within retail in particular. Indeed, estimates suggest that global retailing could be spending as much as $2.2 billion on video technologies by 2023. In many respects, this is not surprising. Video’s use is not only longstanding but also increasingly ubiquitous. It is hard these days to find a segment of retail space that is not under the gaze of some form of video system. Indeed, retailing has been at the forefront of the use of what are often called closed-circuit television (CCTV) systems since the 1970s and 1980s. Primarily deployed as a crime prevention and detection tool, and initially based upon analogue technologies, it is now going through a period of considerable and remarkable change, driven by a rapidly changing technological and social context.

This has led to the potential role and capability of video technologies in retailing beginning to expand beyond its traditional role as merely a facilitator of safety and security to one covering a much wider range of retail activities, including managing the retail environment and playing a role in enhancing business profitability. Moreover, the recent rapid growth in the development of video systems that can potentially provide an analytic capability—in effect building some form of automation into the viewing, reviewing, and responding process—has further heightened interest in utilizing these systems more broadly across retail environments. Indeed, talk of video-based artificial intelligence (AI) and machine-learning (ML) technologies being the next big transformative change in retailing is currently dominating many trade shows and future-gazing deliberations.

However, whether their introduction and use currently makes sense, or are indeed the most appropriate interventions to address the pressing and varied concerns of retailing, is certainly open to debate and critical review. Indeed, there is a general paucity of available information on the overall role video technologies might play in supporting the endeavors of the retail industry. Given this, the ECR Retail Loss Group commissioned research to look carefully at how current and future video systems can or might contribute to the retail environment, the benefits they can bring, the lessons that can be learned from those currently using them, and the ways in which this investment can be maximized to have the greatest effect.

The study draws upon in-depth interviews with representatives from twenty-two retailers based in the US and Europe, with collective sales of nearly €1 trillion, equivalent to approximately 12 percent of their retail markets, and operating in over 57,000 retail outlets. In addition, interviews were carried out with representatives from five major video technology providers.

Given that retailers have been using various types of video technologies for the best part of forty-five years, it may seem odd to spend research time asking this deceptively simple question: to what purpose do retailers use them? Evidence of ubiquity, however, does not always translate into uniformity of purpose nor understanding of rationale. The study found that retail use of video technologies could be grouped in to eight use cases.

The most common use cases were focused on passive forms of utilization: delivering deterrence, providing reassurance, and ensuring that users were in compliance with specific legal requirements. Since its early incarnations, video systems have been employed to try and deter would-be miscreants—make them think that there is an elevated

risk that they will be caught either in the act or subsequently due What the research found is that this to their images being recorded and reviewed. What the research generalized deterrent capability is found is that this generalized thought to have a fading impact, mainly deterrent capability is thought to have a fading impact, mainly due due to familiarity and ubiquity, and has to familiarity and ubiquity, and has been superseded by attempts been superseded by attempts to make to make the deterrent effect more the deterrent effect more personalized. personalized. This was found in the increasing use of body-worn cameras, face-boxing technologies on public-display monitors, and the Overall, the research found a remains more challenging. All the use of personalized displays at fixed complex web of use cases, some of respondents to this research had self-checkout machines. which were clearly covered in the some form of experience of utilizing

There was relatively little original plans for the video system, various types of video analytic, most evidence of retailers using their while others had developed more with varying degrees of success. As systems to any great extent for organically as various retail concerns one respondent put it, “The thing real-time monitoring. The costs and problems emerged. As will with video analytics is that there have of employing staff to do this was be discussed later, the lack of an been claims, promises, suggestions not regarded as a good return on overarching and clearly articulated for years and years that it can do investment in most day-to-day plan for the use of video in retail all kinds of things, and inevitably situations. There was significant businesses can lead to significant with lots of it, it ends up being the use of systems in reactive mode, problems when it comes to ensuring emperor’s new clothes.” However, principally to undertake reviews that the system is well designed and there was also a growing sense that driven by other exception-reporting fit for purpose. the capability was beginning to systems and explicitly reported improve: “We are right at the cusp events such as slips and falls by staff Assessing the Use of Video of discovering just what can we do and customers. Using video systems Analytics in Retailing with these systems; there are a lot of to generate a response was found in As a term, “video analytics” technologies that are emerging to the some retailers where there was an has become the next big thing to point where they can begin to scale.” elevated risk of violence occurring supposedly transform the retail The most-commonly used security with video operators being alerted landscape. Promises that AI and ML and safety-based video analytics were to live events and having the will revolutionize the industry are motion-based triggers, particularly capacity to intervene in various not hard to find, although pinning alerting when intruders entered ways, such as audio warning. down how this will materialize prohibited spaces or high-risk products were moved. In addition, there was considerable use and experimentation around the use

The ECR Retail Loss Group commissioned of analytics to help manage the research to look carefully at how growing problem of self-scan related losses, such as nonscanning and current and future video systems misscanning. While some respondents to the research had tried facial/ can or might contribute to the retail feature recognition technologies and environment, the benefits they can bring, were generally excited by what they might be able to deliver, all were the lessons that can be learned from deeply concerned about the potential public relations car crash that was those currently using them, and the likely should they declare active ways in which this investment can be use. In addition, there were ongoing concerns about how it would be maximized to have the greatest effect. operationalized, particularly when many retailers were trying to

reduce the number of circumstances when store staff were brought into potential conflict situations.

There was also evidence of using video analytics to generate business intelligence, with good examples being shared of ways in which customer service could be improved, and of course as the COVID-19 pandemic has swept across the retail landscape, monitoring and counting customers.

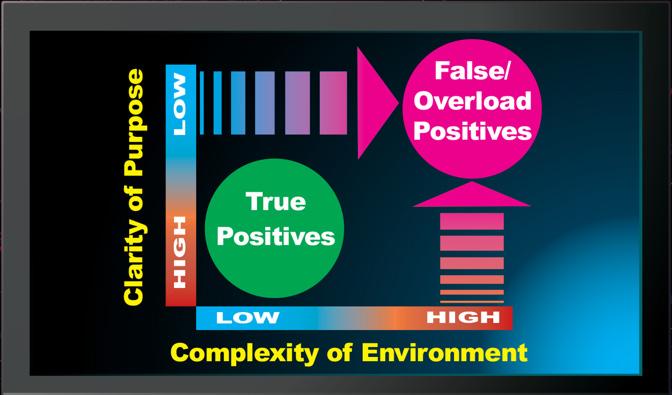

But it is also a technology that presents many challenges, and the research documents the various hurdles retailers face in trying to get video analytics to work well. Of concern is ensuring that video analytics do not generate too many false positives and what the study called “overload positives,” where a poorly designed analytic generates a flood of data, creating a real risk of alarm fatigue. Respondents also flagged issues about the challenges of scalability—the criticality of context-specific factors being considered when systems are being installed in any given location.

In addition, the research found that the efficacy of most video analytical systems is compromised by two other factors: the clarity with which the objective of the analytic can be defined and the degree of retail complexity within which it will be asked to operate. As the retail environment becomes

The most-commonly used security and safety-based video analytics were motion-based triggers, particularly alerting when intruders entered prohibited spaces or high-risk products were moved

more complex and demanding, and the link between a stated objective and an outcome trigger becomes blurrier and more ill-defined, then the likelihood of false and overload positives becomes more of a reality.

For example, the objective of identifying shop thieves in certain retail environments from their behavior is complex and difficult. Many of the ways in which they act increasingly mirror the activities of normal shoppers. In addition, the growing use of different types of self-scan systems and the encouragement of shoppers to bring their own shopping bags makes the identification of errant behavior extremely challenging. Designing a reliable video analytic that will generate a high proportion of true positives in this type of scenario seems at best optimistic. More positively, where the link between objective and

trigger can be more clearly identified and the context simplified, then the prospects are more promising. For instance, identifying when a person enters an unauthorized space that is currently not in use is a relatively easy situation for an analytic to be successfully deployed.

Unless these three factors of scalability, complexity, and clarity are carefully managed and monitored, a real danger exists that many video analytics could be accused of crying wolf, becoming subject to retail ridicule, labeled a costly distraction, and generating mountains of unusable data. It is therefore important that developers of these technologies move cautiously, responsibly, and realistically.

The study also identified a series of strategic trends in the way in which retailers are using video technologies.

Developing Organizational Leadership

For the most part, this research found a general lack of a coordinated and cross-organizational approach to the strategic use of video technologies in retail companies. While the loss prevention function was typically the titular head, this was often more a consequence of historical legacy rather than a considered corporate mandate. As such, establishing why and how video technologies should be employed across a retail business to facilitate the meeting of key company goals is

not easy. Too often, video investments are unnecessarily unidimensional, their potential poorly communicated, and insufficient attention given to maximizing the value that could be derived from a more coherent integration strategy. This inevitably leads to technological overlap, redundancy, and underperformance.

It seems clear, therefore, that retail organizations should actively anoint a “video technology czar” to positively and proactively lead on the current and future use of these systems. Their role would involve at least five interrelated activities. First, develop a clear and coordinated strategy for panorganizational use of video technologies. Secondly, ensure that the business speaks with one voice to avoid duplication of effort and investment. Thirdly, ensure that all parts of the business not only understand the potential of what video systems may offer but also actively facilitate their access to them. Fourthly, establish clear parameters and methodologies for how the value of investing in video technologies can be measured and understood. Finally, take full accountability for maximizing the ROI for any and all video technologies procured by the business.

While the loss prevention function will no doubt remain the dominant user of video systems within a retail business for the foreseeable future, it does not necessarily follow that they must take on this role. The move toward greater use of IP-based video systems and the value and importance of system integration may mean that the IT function increasingly takes a much more involved role and could therefore take on this leadership responsibility. They may well adopt a more dispassionate approach to what it could be used for and who owns it, as well as ensure greater connectivity. No doubt organizational culture, localized specialization, and historical responsibilities will all need to be considered when making this decision, but the key is that the role of video czar is established, recognized, and empowered.

Using Video Command Centers

A key development that became apparent as this research progressed was not only the growing use of centralized video-monitoring stations but also the increasing breadth of the activities being undertaken by these facilities. In and of themselves, centralized monitoring stations are not necessarily a new development. Distributed fire and burglar alarm systems in retail buildings have been brought into alarm response centres (ARCs), often provided by third-party companies, for many years. In addition, some larger retailers have operated full-time security centers where they monitor and respond to incidents occurring across their estates. However, the growing availability and use of networked video systems has encouraged more retailers to begin to establish video-based centralized command centers within their own businesses.

Broadening the Use Case of Video Technologies

While video technologies have been, and largely continue to be, focused primarily on issues relating to safety and security, and this is unlikely to change much in the foreseeable future, what is likely is that the overall use of video technologies will grow. This will be influenced by three factors. First, the retail context is likely to encourage more utilization and not less. Pressures brought about by growing competition, rising costs (particularly labor), and shrinking margins will see retailers looking to a range of technologies to meet these challenges.

Secondly, the applicability of video technologies will further grow. This can be seen in the way in which retail developments such as self-scan technologies have created a new set of risk challenges that may be ameliorated by the application of video technologies and analytics. Finally, the growing capability of video technologies will mean that they can begin to be utilized in ways that were not previously considered possible or appropriate. For instance, the growing networkification and centralization of retail video systems is enabling innovation in the way in which the problems of burglary and violence may be addressed.

Building Greater Capacity through Data Integration

Video systems are increasingly being viewed as one of several data sources that retailers can access and analyze to improve their operations and business profitability. As such, the value of integrating video data with other data feeds to improve value was a readily apparent trend in those taking part in this research. For some, this was part of the growth of the Internet of Things (IoT) and the value that can be had from enabling various objects to communicate, including video technologies. For others, it was the way in which better decisions could be made when multiple data sources could be accessed, combined, and analyzed. Certainly, when it comes to the growing utilization of video analytics, especially in complex environments where the likelihood of overload positives is high or the risk of a false positive is unacceptable, then combining video data with other data sources would seem a useful strategy. A key trend, therefore, will be technology providers working with their retail partners to ensure that, wherever possible, video data is fully integrated into the broader organizational information web to maximize impact and value.

Prioritizing Value Measurement

While the presence of video systems in retailing is now almost ubiquitous, it is a technology that can be difficult to justify purely in terms of a definitively identifiable ROI. Part of the challenge is the intangibility of some of the desired outcomes of using

these systems, such as customer and staff reassurance and the deterrence of crime. It can be hard to put a concrete monetary value on what these are worth, and in some respects, it may not be desirable to try. However, this research has singularly struggled to identify many retail companies that have developed a systematic approach to capturing the various ways in which their investments in video systems have secured value. Too often, the approach is piecemeal, partial, and incomplete, driven in part by a lack of strategic oversight as detailed earlier, but also by the disparate ownership of various systems within a retail business.

In addition, it is driven by a lack of a coherent understanding of the overall purpose of any given investment in video technologies. When the use case is wrapped in blurry and imprecise expectations, such as reducing crime and detecting persistent offenders, then it should come as no surprise that the key performance indicators (KPIs) are equally fuzzy and unclear. More encouragingly, it is possible to identify a range of KPIs that can be measured to begin to assess the overall contribution of various video systems. But without a clear cross-functional plan to consolidate the various ways in which video generates value to an organization, the route to making a persuasive business case for future investment will continue to be challenging, undermining opportunities for further utilization, innovation, and integration.

Business Requirements Driving System Design

A final key trend that emerged from this research was a growing realization that unless the retail business fully understands how it wants to benefit from an investment in video technologies, then system designs will continue to be ad hoc and poorly configured.

In many respects, this is linked to

the need for somebody to take overall cross-organizational ownership of the video strategy—to be a video czar—to ensure that desired outcomes are matched against system requirements. This was evident from some of the responses to this research: “If you don’t know what you want the system to deliver, how can you design a system in the first place?” Others lamented the outcome of not adopting a systematic approach to the procurement and use of video systems: “Our store ceilings look like a showroom for video cameras—so

Download your FREE copy To receive a free copy of the report, go to: ecr-shrink-group.com/page/the-use-of-video-cctv-in-retail many different unconnected systems, just looks a mess.”

Part of this process is not only understanding what the technology can deliver now and to a degree in the future, but also engaging in an educational/listening/training exercise with the rest of the business. Does the rest of the organization understand the potential of what video technologies might deliver, and what are the future priorities of various retail functions? While future-proofing is never an easy task, developing a clear and considered organizational strategy for how video technologies may be used to benefit the profitability and productivity of a business will be a key first step in ensuring that any proposed video system design is fit for purpose.

Next Steps

Retailing is a constantly evolving and dynamic industry, hard wired into the economies of most countries. It is also an increasingly competitive and complex environment, demanding businesses not only to be agile and responsive to the needs of their customers, but also to make use of a growing array of technologies. While video systems have been used by retailers for many years, primarily to deliver security and safety, this new ECR research provides a stimulus to think more creatively now, and in the future, about how its role can be further developed to enable retailers to meet their core goals of satisfying customers and returning a profit.

Emeritus Professor ADRIAN BECK spent his academic career in the criminology department at the University of Leicester in the UK where he focused on retail crime and shrinkage issues. He currently is an academic advisor and researcher for organization’s like the ECR Community’s Shrinkage and On-shelf Availability Group and the Retail Industry Leaders Association. Beck is a frequent speaker at conferences worldwide and a contributor to both LP Magazine’s US and Europe publications. He can be reached at bna@le.ac.uk.