22 minute read

MY TURN

Stop, Look, and Listen

Irecently took a golf trip with a group of friends to the “Holy Grail” of golf—St. Andrews, Scotland. One of my companions on the trip was the executive editor of this publication, Jim Lee. Jim and I became business associates when I was with Sensormatic Electronics as his account representative when he was the vice president of loss prevention at Marshalls.

Jim had brought a significant number of his LP team with him from Broadway Department Stores, where he vacated the top loss prevention spot. This was the prime example of my oft-quoted saying, “You can’t buy loyalty, but you can come pretty close!”

Throughout my career it has been my great pleasure to work with some of the best LP executives in retail America. I sit on the board of the Loss Prevention Foundation board of directors with many of the consummate professionals I grew up with in this industry.

As Jim and I stood on the first tee at St. Andrews, we marveled at the landscape. It was beautiful, intimidating, and exhilarating. Hitting off the first tee of any new golf course is filled with hope and trepidation of the many hazards that could befall you over the course of eighteen holes.

This feeling is not unlike the one you get when you take over the reins of a loss prevention department in a new company. On the golf course it’s water hazards, bunkers, tight fairways, long carries, and undulating greens that could impede your attainment of a low score. In your company it’s the personnel, policies, vendors, suppliers, and management that affect your success in lowering shrink and maximizing sales.

Eventually, Jim and I met our caddies on the first tee box. Jimmy Reid was my caddie—a diminutive man, who had caddied at St. Andrews for thirty-seven years. Jim’s caddie was named Alex—a gentleman who approached his job with the utmost seriousness.

We all possess a modicum of pride in our abilities to perform our jobs. We all have a certain amount of ego that indicates we may perform it better than others. Low scores at your home course did not ensure success at St. Andrews for misters Lynch and Lee. The analogy is “spot on” that Jim’s ability to keep shrink down at the Broadway didn’t guarantee his success at Marshalls.

However, one of the most important concepts in your quest for success is to stop, look at the landscape, and listen to your people. Your store security and district and regional managers play in the grasslands of a challenging retail field every day. They know the weaknesses and strengths of the management teams and sales associates. Listen to them. Personally absorb how they view the landscape. You may pick up data that will change your course of action as the leader of your department.

Jim and I listened to our caddies. They, in turn, viewed our abilities as golfers as we assessed their recommendations. The player and the caddie do not always agree on club selection or type of shot. Over the course of four days with the same caddie, the communication was streamlined and the capabilities assessed more accurately. Our scores were consistently lower over the latter part of the week.

Solicit advice from your team. If they tell you it’s time for new technology to play the game right, listen to them. If they have alternative ways to attack the course that is your shrinkage number, take heed.

Your people, like our caddies, are the most valuable resource in charting the course of your success. Stop, look, and listen to their views of that landscape, and you’ll be a better manager and leader in retail loss prevention.

POSTSCRIPT: For those of you who know Jim and me, you can appreciate the fact that we employed most of the tenets of this missive. Checking our egos at the first tee…well, that’s a work in progress.

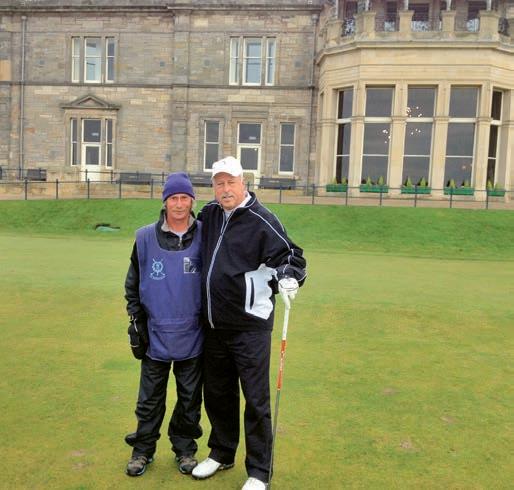

Kevin Lynch with his caddie at St. Andrews.

By Kevin E. Lynch, LPC

Lynch is executive director of business development for Tyco Integrated Security. He is well known in the industry and sits on the board of directors for the Loss Prevention Foundation and vendor advisory board for LP Magazine. Lynch can be reached at 401-846-6123 or via email at kelynch@tyco.com.

FEATURE

RFID IN RETAIL

WHAT LP LEADERS NEED TO KNOW

By Jack Trlica, Editor and Publisher

RFID has been a topic of discussion in the retail industry for a decade or more. This year the buzz has intensified as RFID implementation appears to be viable and no longer “on the horizon.”

A number of retailers both in the U.S. and Europe have successfully tested RFID applications and are moving to large-scale rollouts. With that, many loss prevention executives have questions about how this technology relates to LP operations.

In early October the magazine hosted a webinar entitled “RFID in Retail: What LP Leaders Need to Know.” The speakers included: ■ Dr. Bill Hardgrave, Dean, College of Business,

Auburn University, ■ Joe LaRocca, Vice President, Loss Prevention,

RetaiLPartners, and ■ Tom Racette, Vice President, RFID Solutions,

Checkpoint Systems.

We recently caught up with the speakers to ask a few follow-up questions. WHAT ARE RETAILERS REALLY USING RFID FOR?

Dr. Bill Hardgrave,

Dean, College of Business, Auburn University

WITH ALL THE NEW TECHNOLOGY INVESTMENTS IN RETAIL, WHY WOULD RETAILERS DEPLOY YET ANOTHER TECHNOLOGY, SUCH AS RFID?

LAROCCA: As mobile retail technologies are deployed and engage consumers differently, consumers demand items be available on shelves and get very frustrated when they’re not. Omni-channel benefits are making the accuracy at the store level even more important, because we know consumers have many choices today, and if it’s not available in a store, we don’t know where they’re going to buy it next. So, we have some great opportunities with RFID from the operations side of the business and in the loss prevention space.

Joe LaRocca,

Vice President, Loss Prevention, RetaiLPartners HARDGRAVE: There was a major shift in RFID a few years ago; moving away from pallet and case and toward item level. It happened in a few categories, but the most common category and the one that’s really dominating everything now is in apparel. We saw major retailers in the U.S. and many more in Europe that changed that emphasis from pallet and case deployment to item level. The visibility provided by RFID really opened our eyes to a lot of things, including inventory accuracy and loss prevention. We began to realize that RFID at the item level made a lot of sense. It provided a lot of visibility. As a result adoption really took off from that point. As we were going through these early pilots with retailers, including specialty retailers, department stores, apparel, and non-apparel, four big issues emerged—inventory accuracy, out of stocks, locating product, and loss prevention. There were other things like dressing-room management, price-change management, and so forth that were also important, but every retailer faced those big four.

LAROCCA: One big-box company said they were able to effectively eliminate or change the entire way that they conduct physical inventory in the company. We all know that cycle counting is every store manager’s favorite thing to do, right? Rather than taking all night long and having dozens of people marching around the store from an outsourced company, they now can take full inventory with a few people inside with a few readers in just a couple of hours. Imagine that! Once you have an accurate, up-to-the minute status of your inventory, you can use RFID handheld readers to update the inventory hourly or twice a day, and replenish fast-moving items right away.

WHILE THERE IS A GOOD DEAL OF BUZZ ABOUT RFID IN RETAIL, THERE IS NOT AS MUCH NEWS ON WHO IS ACTUALLY USING IT. WHAT ARE YOU SEEING IN THE INDUSTRY?

Tom Racette,

LAROCCA: We’ve all heard the media reports of the big-box stores, companies like Walmart, jcpenney, Bloomingdale’s, Macy’s, and Dillard’s, but many people haven’t heard stories about Disney, American Apparel, Under Armour, Brooks Brothers, and many more. So, why don’t I just rattle off a list of them so everyone knows exactly who to go talk to? Well, a number of companies have said, “We don’t want to share all of this information publicly.” In fact, RFID has been such a strong technology in their companies, they view it as a competitive advantage, so they’re keeping the results quiet. RACETTE: We’re involved with multiple retail RFID deployments in North America and Europe, from single-store pilots to chain-wide rollouts. Interestingly enough, we’re seeing a diversity of retailers: brands, specialty stores, luxury retailers, and department stores.

Vice President, RFID Solutions, Checkpoint Systems WHY WOULD A RETAILER USE RFID FOR LOSS PREVENTION? HARDGRAVE: There are a host of factors that are impacting the use of RFID for loss prevention. Let’s start with the idea of continued on page 56

continued from page 54 employee theft. As I talk to loss prevention officers in retail, one of the questions I ask them is, “How do you know the source of theft, in particular, or shrinkage, overall, in your stores?” There are annual surveys of loss prevention officers that provide the main causes where they believe shrink is occurring, whether it’s employee theft, casual shoplifting, organized crime, and so forth. For example, the survey may suggest that 38 percent of shrink is due to employee theft. And I then ask the follow-up question, “How do you know the percentage for each cause of shrink?” The answer is almost always the same, “Well, it’s a guess. We really don’t know.” Most retailers really don’t know, because they don’t have that visibility into what’s really happening there, so the best that we’re left with is a guess as to what’s actually happening.

With RFID we are really providing the visibility that has been absent for a long time. For example, in the area of employee theft, because we have RFID on a product, we now see that product as it enters the backroom of the store. We can now cycle count very quickly in the backroom, so we know what inventory we have back there. We see it as it moves from the backroom to the sales floor, so we get that visibility. We see it once it’s on the sales floor by cycle counting or zonal monitoring there with RFID, so that we understand when it’s on the sales floor. That provides us with visibility into the operations that we haven’t had before, and a big surprise about how things actually work in the stores versus how we thought things were working.

Now, if we pull that down to the loss prevention environment, it gives us that insight into the operation so that we can close those gaps that make it easy for employees to steal. One of the things it allows us to do is start looking for patterns or scenarios or anomalies. Consider a situation where we see 100 pairs of jeans come into the back room, but only 94 were eventually taken to the sales floor and there’s no inventory of those other six in the backroom. We know they made it into the back room, but they never made it to the sales floor. Another scenario we may see is 100 pairs read as they left the distribution center. But when they were unloaded at the store, only 94 were received. Therefore, those six pair went missing somewhere between the DC and the time that they were unloaded into the back room. continued on page 58

Once we become aware of these things, we can actually do something to prevent them. Without that visibility, we’re guessing as to what’s happening, and it becomes very hard to prevent something when you’re guessing. Another thing that happens, of course, in

AS MOBILE RETAIL retail stores is the idea of sweethearting, where

TECHNOLOGIES ARE somebody comes up to the register with two

DEPLOYED AND items and they’re working with the cashier to steal one of the items. The cashier rings up or ENGAGE CONSUMERS scans one item, but puts both items in the bag,

DIFFERENTLY, essentially stealing one. Well, with RFID we can CONSUMERS DEMAND become aware when a cashier is trying to do ITEMS BE AVAILABLE those things, again, leading to prevention. ON SHELVES AND GET LAROCCA: Take ORC, for example. According

VERY FRUSTRATED to the Organized Retail Crime (ORC) survey

WHEN THEY’RE NOT. released by the National Retail Federation

OMNI-CHANNEL in June of this year, 96 percent of retailers nationwide have experienced ORC activity. BENEFITS ARE MAKING Eighty-seven percent have seen a rise in ORC THE ACCURACY AT THE activity, and 52 percent have been the victim of

STORE LEVEL EVEN cargo theft. Because of this, we need to look at

MORE IMPORTANT, new solutions. We tried a number of things in the industry for decades and, over the last few years, BECAUSE WE KNOW one of the possible solutions has been RFID.

CONSUMERS HAVE Using ORC as an example, RFID can help

MANY CHOICES to uncover patterns of theft in terms of product

TODAY, AND IF IT’S category, quantity, time of day, et cetera, which is incredibly helpful. At the store level

NOT AVAILABLE IN we see a number of potential benefits with

A STORE, WE DON’T RFID. One of the big challenges, especially KNOW WHERE THEY’RE in specialty retail, is balancing merchandising GOING TO BUY IT NEXT. flexibility with traditional EAS systems, which have limited protection for open entrances

SO, WE HAVE SOME and for putting merchandise close to the GREAT OPPORTUNITIES front door. Merchants want to put product in WITH RFID FROM THE locations so that customers barrel right into it, OPERATIONS SIDE OF but if we can control that active bubble with RFID-based EAS, we now can protect open

THE BUSINESS AND entrances, put product closer to the door, and

IN THE LOSS tune the system in a way that will prevent

PREVENTION SPACE. false alarms. We also can use differentiated alarms, so that basic replenishment items that might be commonly missed in the deactivation process will sound an alarm differently than high-targeted items. Think about handbags or Levi’s jeans or other hot items that are carried in stores. We also see potential benefit from return fraud. This isn’t necessarily widely deployed today, but imagine a day when a customer comes back in the store with a return and you know exactly when and where the item was sold. If that item was not deactivated and you start to see some trends, you can use

continued from page 56 analytics to differentiate a problematic situation versus an honest customer that is returning merchandise.

HARDGRAVE: Most retailers looking to adopt RFID are already familiar with EAS tagging and using portals, so the transition to RFID becomes very natural for them. The key difference, of course, is that RFID is a multiuse technology. RFID can give you visibility from source to shelf. Thus, when you consider the return on investment (ROI), you need calculate the aggregate ROI based on many use cases, not just the loss prevention piece. Also, if a retailer is already using EAS tags, they can factor that in when calculating ROI for RFID. For example, if they are already paying three cents for EAS, because RFID takes the place of the EAS tag, the three cents can be used as a subsidy for RFID tags that would be used for loss prevention, reducing out of stocks, locating product, and so forth.

RACETTE: In other words RFID provides much more useful information than EAS alone. You can store a lot of relevant data on an RFID tag, and it also allows you to uniquely identify each and every single item with an electronic product code or UPC number. Using RFID-based EAS instead of traditional EAS allows you to know exactly what and how many left your store. With traditional EAS, you just know that something left your store; it doesn’t give you any specifics. This means you can now update your perpetual inventory and preserve its accuracy.

Another great feature is the reduction of false alarms when you use RFID. I recently was at the RFID forum in Arkansas and asked members of the audience to raise their hand only if they had never falsely set off the store’s antitheft system when leaving a store. Not one single person raised his or her hand. That’s a really big problem, because eventually the integrity of the solution can start to be compromised.

False alarms exist today because of failure to deactivate security tags at the POS. When that happens, you’ll set off an alarm when leaving a store or going into another store that might have the same security system if you happen to be in a mall environment. False alarms also occur from stray tag reads, like when clothes get merchandised too close to the exit or a shopper walks by the exit door, but not out of the store carrying an EAS-tagged item. RFID helps in both of these situations. If an RFID tag doesn’t get deactivated and a shopper carries it into another store that has an RFID system, the system will read the tag, but because the tag’s ID number is not in the store’s database, it will not alarm the system. And with respect to stray tag reads, there are RFID-based EAS solutions today that can identify a tag’s location and direction of travel, and, therefore, have the smart sense to only alarm on actionable data.

SOME OF THE THINGS YOU SHOULD THINK

ABOUT AS YOU’RE

CONSIDERING RFID REVOLVE AROUND CAN YOU ELABORATE MORE ON ORC PREVENTION?

TAGS. DO YOU USE HARDGRAVE: RFID can provide insight into key

A DUAL TAG, EAS patterns to detect ORC. For example, consider WITH AN RFID TAG, OR JUST RFID? DO a scenario where fifty DVDs are stolen at one time, perhaps put into a bag and walked out the front door. Using non-RFID technology, YOU USE A SOFT TAG we may know that something was stolen—the OR A HANG TAG? DO alarm would likely sound—but we likely would YOU SOURCE TAG AND BUILD THE TAG not know that it was fifty DVDs. With RFID we would know that it was fifty DVDs. With that information, you might determine there INTO THE CLOTHING is organized retail crime in the area, and you ITSELF? DO YOU USE could then alert stores in the area to be on the

A HARD TAG, SO alert for this type of activity. THAT THERE’S VISUAL WHAT OTHER LP BENEFITS ARE DETERRENT, BECAUSE THERE IN THE RETAIL STORE BEFORE

IF YOU JUST USE MERCHANDISE REACHES THE EXIT DOOR?

A HANG TAG, THAT MAY BE TOO EASY LAROCCA: With RFID issues of vendor fraud can be easily tracked. We know exactly what the vendor shipped and, with the right controls TO REMOVE? DO YOU of tags and sequencing and serialization, we REMOVE IT AT POINT potentially can identify problems in the supply OF SALE? THOSE ARE ALL CONSIDERATIONS chain very early on, such as cargo theft from the manufacturer to the DC and the DC to the store. We know that this is charged back to the

THAT ONE HAS TO carrier, but if you really look back and try and

LOOK AT AS WE go down that black hole and find the money,

USE RFID IN LOSS PREVENTION. I’m pretty confident it’s not in the LP budget. So, if we can prevent these cargo thefts and prove the merchandise accuracy, while reducing any potential shrink issues along the way, we make some great strides there in the supply chain. Stores hate getting shipments and having absolutely no clue what’s inside. And while some retailers have made great advances here and have true merchandise visibility, many store managers today dread receiving shipments. They don’t know what size, color, product, or fashion is inside a box. Retailers often don’t know if a new shipment is going to clog the back room or can be used on the sales floor. With RFID they can potentially scan the box, scan the pallet, and continued on page 60

continued from page 58

certainly find the items in the backroom quickly and efficiently to display on the store shelf.

HARDGRAVE: In numerous RFID pilots, we put readers near the employee entrance and exits. We have observed employee theft by employees taking products out those doors. We have also seen where employees throw things into the trash compactor or the garbage, for example, so they can retrieve them later, either on their way home or after the store has closed. If you put RFID readers on entrance to the trash compactor, you can see if they are throwing things in there that do not belong.

For customer theft, we can also look for patterns of theft as a means of detection. For example, a customer takes two identical items into a dressing room. More than likely, if someone takes two identical items in a dressing room, it’s because they’re going to steal one of them and then bring one of them back out of the dressing room. With readers in the dressing rooms, we would be able to detect that type of thing. It’s all about looking for patterns of theft. WHAT IS LP’S ROLE IN RFID INVENTORY MANAGEMENT PROJECTS?

HARDGRAVE: Everything centers around inventory accuracy. It affects replenishment, out of stocks, forecasts, and, ultimately, customer satisfaction and sales. We can correct our inventory accuracy with RFID by taking frequent cycle counts or by continually monitoring the inventory. We can keep our inventory updated much more accurately than we can with traditional methods. But, shrink is one of the main causes of inventory inaccuracy. Ultimately, we want to eliminate the causes of inventory accuracy, rather than just correcting the counts. With RFID we can start attacking the root cause and solve the problem. Thus, the impact of shrinkage on inventory accuracy affects everything else.

YOU CAN STORE A LOT OF RELEVANT DATA ON AN RFID TAG, AND IT ALSO ALLOWS YOU TO UNIQUELY IDENTIFY EACH AND EVERY SINGLE ITEM WITH AN ELECTRONIC PRODUCT CODE OR UPC NUMBER. USING RFID-BASED EAS INSTEAD OF TRADITIONAL EAS ALLOWS YOU TO KNOW EXACTLY WHAT AND HOW MANY LEFT YOUR STORE. WITH TRADITIONAL EAS, YOU JUST KNOW THAT SOMETHING LEFT YOUR STORE; IT DOESN’T GIVE YOU ANY SPECIFICS. THIS MEANS YOU CAN NOW UPDATE YOUR PERPETUAL INVENTORY AND PRESERVE ITS ACCURACY. ARE THERE CONSIDERATIONS LOSS PREVENTION SHOULD HAVE WHEN IMPLEMENTING RFID?

HARDGRAVE: Some of the things you should think about as you’re considering RFID revolve around tags. Do you use a dual tag, EAS with an RFID tag, or just RFID? Do you use a soft tag or a hang tag? Do you source tag and build the tag into the clothing itself? Do you use a hard tag, so that there’s visual deterrent, because if you just use a hang tag, that may be too easy to remove? Do you remove it at point of sale? Those are all considerations that one has to look at as we use RFID in loss prevention.

You also have to look at it from a data perspective. Where does that data reside? Does it reside on the tag or in a database? It can do both, and we’ve run tests to determine whether when somebody’s walking out a door through a portal, you have enough time to look something up in the database and know if it was stolen. It depends upon one’s system architecture, but, yes, we’ve seen you can do that. Or it could just be one little bit on a tag that is changed. Say, for example, that bit 9 is on. That may mean that item hasn’t been sold. That is something still being worked on. In fact, GS1 is working on some standards around that right now.

From an infrastructure perspective, LP has to decide if they use dual portals that do traditional EAS and RFID, or if they use RFID-only portals. They also need to decide if they put RFID just at the exit door or at various points in the store, including the dressing room and backroom. The key really is the use of data to help prevent loss rather than just knowing about loss. Some of the things we do now are theft deterrents, but we really want to move to theft prevention and true loss prevention. Because by the time the item goes through the exit door, in many cases, it’s too late.

Listen to the Archived Webinar

To hear these speakers further discuss “RFID in Retail: What LP Leaders Need to Know” and see their PowerPoint slides, visit the magazine website at LPportal.com. Individuals who register for the webinar will also receive a booklet entitled “RFID for Loss Prevention Planning Guide.” The webinar and planning guide are sponsored by Checkpoint.