Lumi Gruppen

Lumi

Sonans

Oslo Nye Høyskole

Sonans

Sonans

Oslo

market

Oslo Nye Høyskole

(2021)

student

National Student Survey:

Oslo Nye Høyskole — National Student Survey: Online educational offer (2021)

The group consists of two main operating segments: Sonans and Oslo Nye Høyskole (ONH). Sonans is Norway’s market leader within high school private candidate exam preparation courses. ONH is a private university college, with a campus in central Oslo, and a strong online offering.

High school private candidate exam preparation courses in Norway.

Private university college with strong online offering and campus in Oslo.

Introduction

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook Disclaimer

Online shift and decline in application to higher education

significantly affects the private candidate market

Revenue ended at NOK 121.5 million for the third quarter (-7.2%)

Adjusted EBIT ended at NOK 30.9 million for the third quarter (-4.6%)

Cost reduction programme totalling NOK 61 million implemented in

Sonans to mitigate the effect of the online shift and the decline in campus sales

Introduction of “Live” successful, already a mid-sized campus with profitable operations and an integrated part of the campus course offering

Oslo Nye Høyskole with a stronger performance compared to the higher education market, cost reduction programme totalling NOK 15 million decided on and implemented in Q4 2022

Introduction About Lumi Gruppen Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Operating revenue ended at NOK 121.5 for the third quarter (-7.2%)

Sonans revenue ended at NOK 73.1 million (-15.5%) in the third quarter, online revenue grew by 54.8% while campus revenue declined by 40.7%

Changes in commercial terms for Sonans online positively affects online revenue in the quarter together with the price increases implemented

ONH revenue ended at NOK 48.4 million (+8.5%) in the third quarter, online revenue grew by 13.6% and campus revenue grew by 1.9%

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook Disclaimer

Adj. EBIT ended at NOK 30.9 million for the third quarter (-4.6%)

Adj. EBIT margin improved by 0.7% compared to same period last year

Cost reduction programme totalling NOK 61 million implemented for Sonans and reported savings in personnel cost on adjusted basis was

NOK 12.3 million in the third quarter. Other expenses were down by NOK 3.4 million

ONH OpEx increased by NOK 5.3 million in the third quarter compared to last year, while revenues grew by NOK 3.8 million. Growth in OpEx driven by the new programmes

Cost programme totalling NOK 15 million decided on for ONH, yielding impact already from fourth quarter and full effect from first quarter next year

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook Disclaimer

Operating Revenue ended at NOK 73.1 million (-15.5%) for the third quarter

Growth for online driven by higher volumes (i.e., online shift) and the effect of changes in the commercial terms for online courses from January 1, 2022

Personnel expenses were reduced by NOK 12.3 (-35.3%) million in the third quarter compared to same period last year. Number of FTEs is down by 22%

Other operating expenses were reduced by NOK 3.4 million (-15.9%), mainly related to lower campus operation expenses, overhead, and marketing expense

Adj. EBIT ended at NOK 20.9 million (+1.7%) for the third quarter

Adj. EBIT margin improved by 4.8% compared to the same period last year

Introduction

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook Disclaimer

Cost reduction programme has been successfully implemented in Q3

2022 In Q3 2022, reduction in total operating expenses was NOK 15.6 million, of which NOK 9.6 (61%) million on reported basis

Reduced personnel expenses largest contributor in the cost reduction programme, followed by reduced campus operation expenses and reduced marketing expenses

Majority of measures not short term in nature and will continue to yield impact going forward and contribute to an improved profitability for Sonans

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook Disclaimer

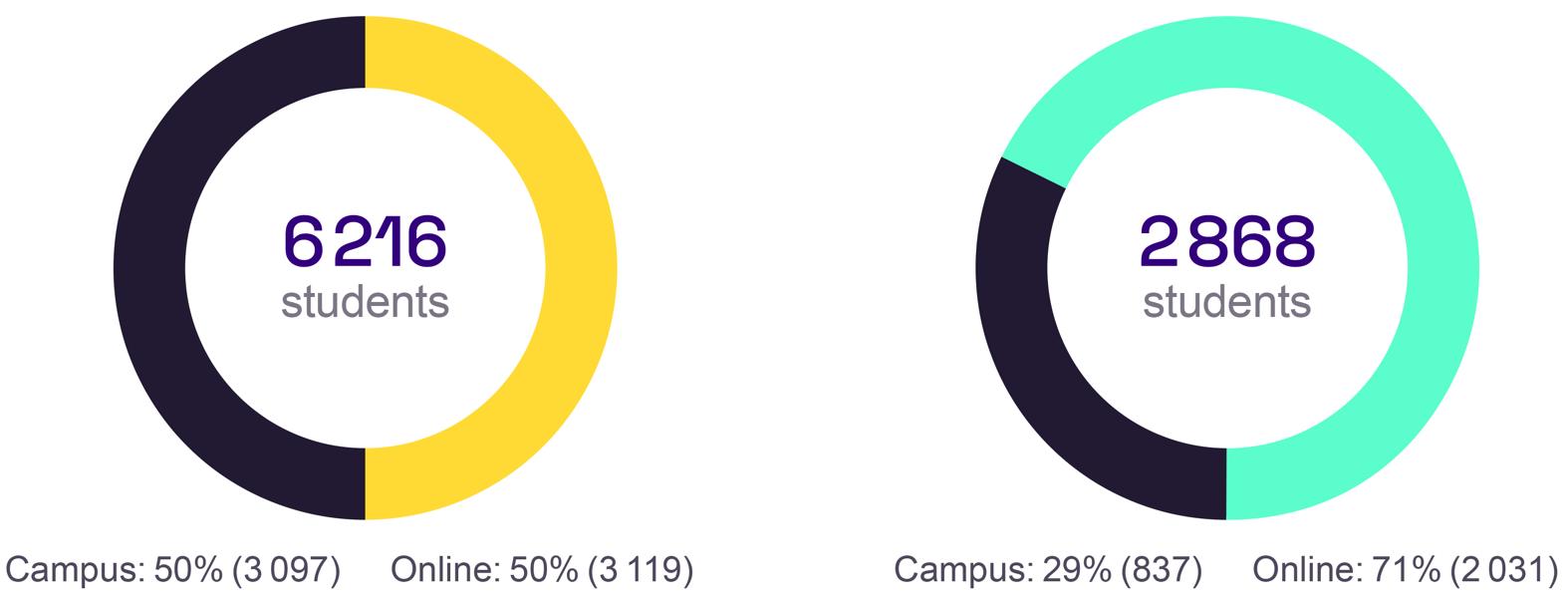

Operating Revenue ended at NOK 48.4 million (+8.5%) in the third quarter, online revenue growing by 13.6% and campus revenue growing by 1.9%

Growth driven by new programmes in combination with a higher share of recurring revenues from the multi-year programmes (bachelor and master’s programmes)

Operating expenses at ONH increased by NOK 5.4 million in the third quarter. This is mainly related to personnel expenses for the new programmes. Other expenses decreased by NOK 0.9 million

Cost reduction programme totalling NOK 15 million decided on and implemented in the fourth quarter. Expect full effect from January 2023

Adj. EBIT ended at NOK 11.0 (-12.3%) with a corresponding margin of 22.7% (-5.5%)

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Agreement with Nordea on new terms for the school year 2022/2023. The new agreement allows for a sufficient headroom

Covenant waiver for Q3 and Q4, leverage covenant @4.0 in Q1 2023 and @5.0 in Q2 2023

Slightly higher interest rate next 9 months (+0.25%) and penalty fee of NOK 1.25 million

Measures taken to improve net working capital and liquidity. Negotiation on payment terms with suppliers and monthly payment for leases vs. pre-quarterly payments

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Execute on the cost reduction programme totalling NOK 61 million to mitigate the effect of the decline in revenue for the school year 2022/2023

Additional measures in pipeline, including a review and assessment of the campus network and online offering (channel strategy)

Execute on the cost reduction programme totalling NOK 15 million to mitigate the effect of flat volumes year on year and ramp -up in OpEx from new programmes Group Functions

Contribute to optimization of processes cross business units and continue the process to reduce overhead expenses for Sonans and ONH

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole Strategy & Operations

Sonans Oslo Nye Høyskole Outlook Disclaimer

Introduction About Lumi Gruppen Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

• Strong market position maintained in a challenging market

• Underlying market demand for education still strong

• Significant cost programme implemented according to plan, a more scalable and flexible operational model established

• Strong intake for Bachelor and Master’s programmes

• Outperformed the market development for higher education in Norway

• Growth strategy from 2019 implemented, updated growth strategy in process

Introduction About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Total sales for the student intake this autumn down by 28% vs. last year

― Campus declined by 42%

― Online including “Live” up 12%

― Total sales declined by 28% as of week 37

Key market drivers affecting the education market in 2022

Strong decline in applicants to higher education (-13%)

— Strong decline in students without an admission place (-43%)

— Third consecutive year with cancelled exams in high schools, improved grades and less students failing (low drop out rate and “grade inflation”)

— Low unemployment rate

— Young people can travel and do something else for the first time since 2019

Lumi

Gruppen

Nye Høyskole

& Operations

Nye Høyskole

aligned with the challenging market conditions

time employees reduced by 22% per Q3

campuses closed

efficiency optimized

Administration re-organized

more scalable and flexible business model established

of «Live» successful

already a mid-size campus and profitable

Significant increase in online students possible without additional costs

capacity not fully utilized

increased geographical reach

financial metrics for digital platforms with limited

cost and a more flexible cost base

Lumi Gruppen

Summary

Gruppen

Nye Høyskole

& Operations

Nye Høyskole

for skilled workers

Technological advances

in society increasing

Increased job opportunities

wages Report from SSB*

the importance of

diploma before

schools

for

private candidate schools

people wanting to

education

their

labour market

candidates are

growth in the market for

from

when including

years

older

education

Introduction

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Stable market share of around 60% maintained since 2014

— Four times higher than #2 private candidate school

Highest student satisfaction among private candidate schools

— Considerable resources devoted to create optimal learning environment

— Never compromised on student satisfaction when implementing efficiency measures

— Student satisfaction on same high level Autumn 2022 despite significant cost reduction

— Student critical functions remained at local campuses

Introduction About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

ONH with stable student intake vs last year, excluding single subjects

— Overall market for higher education fell 12.6% in 2022

Bachelor programmes up 9% secures increased earnings visibility

Limits operational risk

— Master programme up 65%

— Annual programmes fell by 11%

Robust growth for new programmes

— Existing programmes affected by challenging markets due to post-covid effects

— Plan to launch new annual programmes derived from multi year programmes

Introduction

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Key priority to increase number of students in existing programmes

— Increase economies of scale

Cost reduction programme totalling NOK 15 million in annual cost savings

Full effect from January 2023

— Positive P&L impact expected already in Q4 2022

Cost reduction mainly related to personnel reductions

Introduction About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans

Oslo Nye Høyskole Outlook Disclaimer

Growth strategy implemented in 2019 completed

— Continue to develop new programmes with a solid market potential

Business model increasingly more effective and scalable

— Simplify reporting routines

— Quality audit by NOKUT in Q1 2023

Improve coordination of operations

— Identify synergies and better coordinate operations at ONH and Norwegian School of Technology when operational

— More Bachelor students attending online programmes

— ONH: a unique position within online courses

— public sector does not prioritize

Introduction About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen

Sonans

Oslo Nye Høyskole

Strategy & Operations

Sonans Oslo Nye Høyskole Outlook Disclaimer

Operations aligned with challenging market conditions

— Sonans: cost programme implemented, additional measures in pipeline

— ONH: cost reduction programme of NOK 15 million decided on

Financial flexibility restored

— Financial covenants in 2022 waived, adjusted for the first half of 2023

Financial forecast for 2022

— Expect revenues in the area of NOK 505 million (532) and Adj. EBIT in the area of NOK 105 million (134)

Well prepared for a likely market recovery next year

— Still a strong need for higher education in Norway

— A new more scalable business model established

— Competitive position for Lumi Gruppen strengthened during the pandemic

Challenging macro environment with increasing interest rates and inflation

This presentation includes forward-looking statements which are based on our current expectations and projections about future events. Statements herein, other than statements of historical facts, regarding future events or prospects, are forward-looking statements. All such statements are subject to inherent risks and uncertainties, and many factors can lead to actual profits and developments deviating substantially from what has been expressed or implied in such statements. As a result, you should not place undue reliance on these forward-looking statements.

The Group reports its financial results in accordance with accounting principles IFRS. However, management believes that certain alternative performance measures (APMs) provide management and other users with additional meaningful financial information that should be considered when assessing the Group’s ongoing performance. These APMs are non-IFRS financial measures, and should not be viewed as a substitute for any IFRS financial measure. Management, the board of directors and the long term lenders regularly uses supplemental APMs to understand, manage and evaluate the business and its operations. These APMs are among the factors used in planning for and forecasting future periods, including assessment of financial covenants compliance.