Lumi Gruppen

Presentation Q4 2022, 17 February 2023

CEO Erik Brandt and CFO Martin Prytz

Q4

Introduction

About Lumi Gruppen

Executive Summary

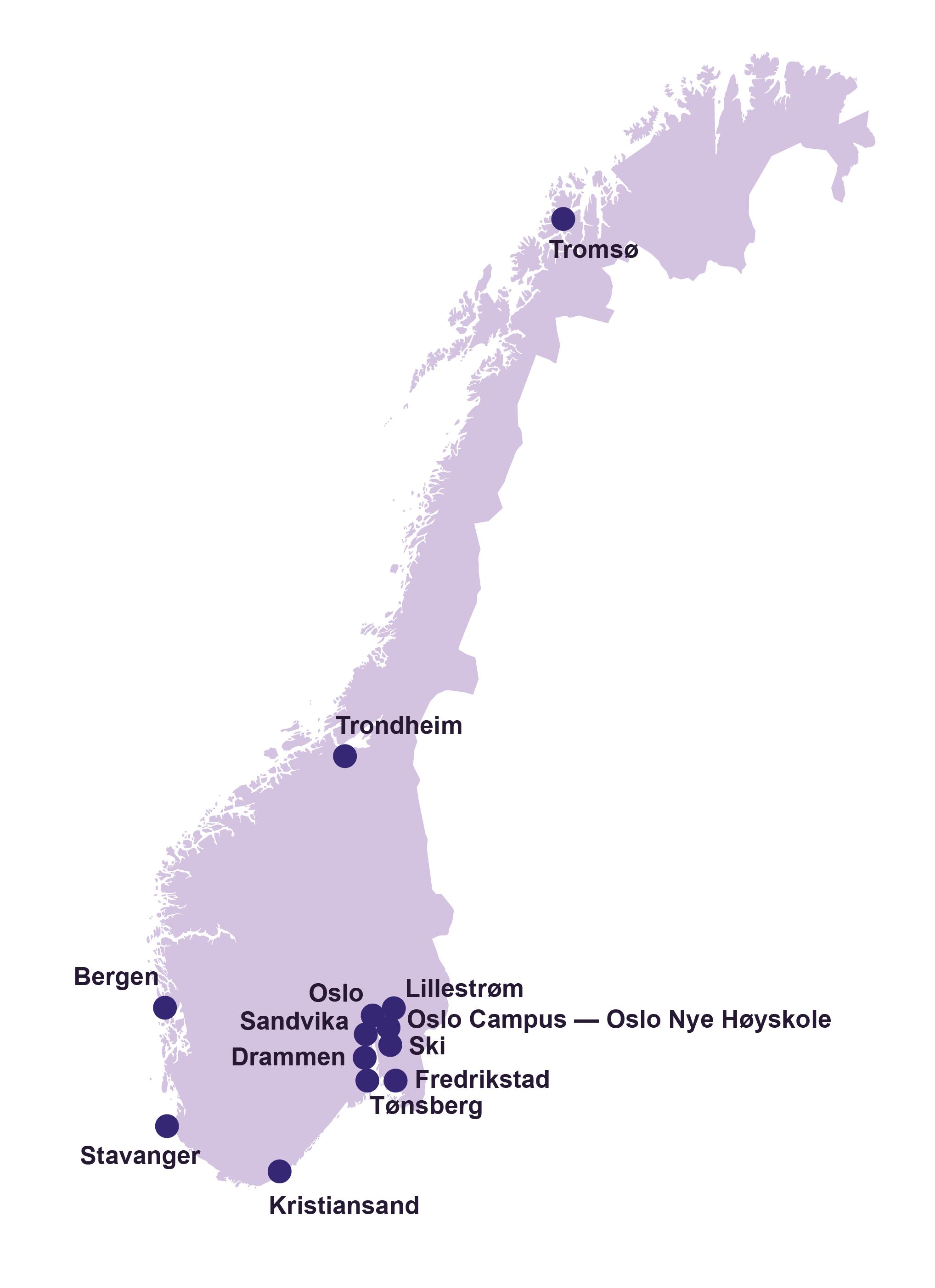

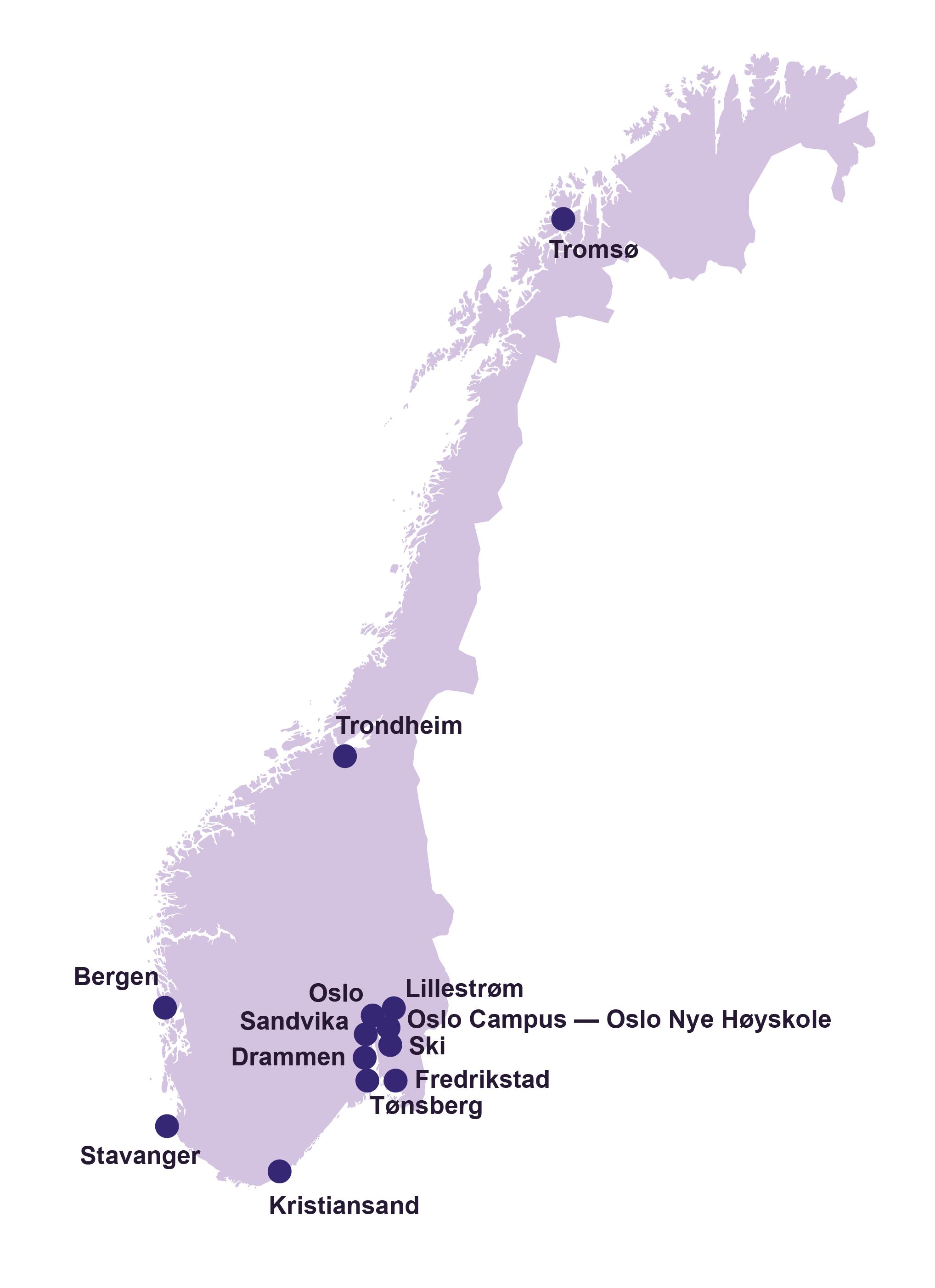

Lumi Gruppen — a leading private education provider in Norway

Financials

The group consists of two main operating segments:

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Sonans: Norway’s market leader within high school private candidate exam preparation courses.

ONH: Private university college, with a campus in central Oslo, and a strong online offering.

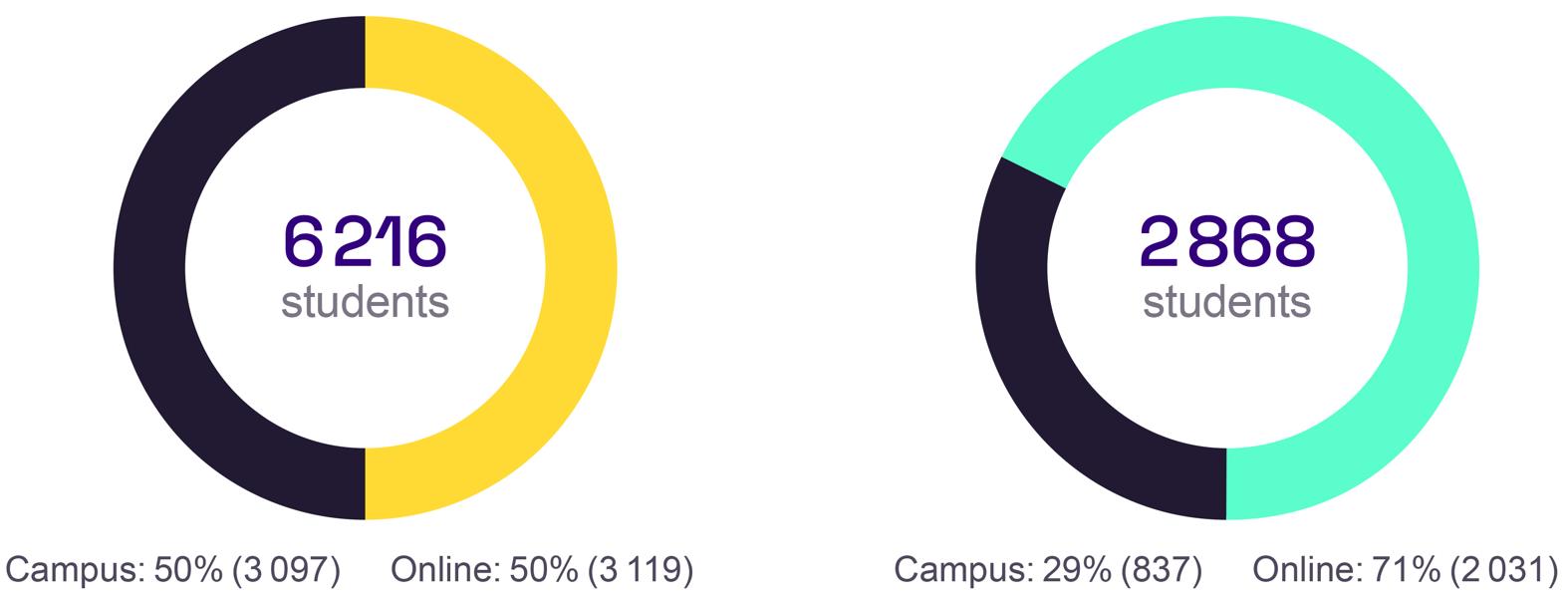

Sonans market leader for both campus and online courses

Oslo Nye Høyskole National Student Survey: overall student satisfaction (2021)

Oslo Nye Høyskole National Student Survey: Online educational offer (2021)

Top 1 Top 3 Top 1

LUMI GRUPPEN presentation Q4 22 3

Introduction

About Lumi Gruppen

Executive Summary

Lumi Gruppen Q4 — cost programmes executed as planned, prepared for a likely market recovery

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Oslo Nye Høyskole: Growing and gaining market share, cost programme implemented

Sonans: Savings from the cost programme totalling NOK 17 million in Q4

Ntech: First programme approved in December, preparing for launch in 2023

Lumi Gruppen: Prepared for likely market recovery

Revenue Q4 and Ytd (NOKm) Adjusted EBIT Q4 and Ytd (NOKm)

LUMI GRUPPEN presentation Q4 22 5

Q4-22 133.7 Q4-21 Ytd-21 Ytd-22 514.6 126.1 532.0 -5.7% -3.3% Q4-22 113.2 Q4-21 Ytd-21 Ytd-22 23.1 24.0 133.5 -3.8% -15.2%

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Financials

LUMI GRUPPEN presentation Q4 22 7

Introduction

About Lumi Gruppen

Executive Summary

Revenue in Q4 as expected, online revenue share above 50% in the fourth quarter

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

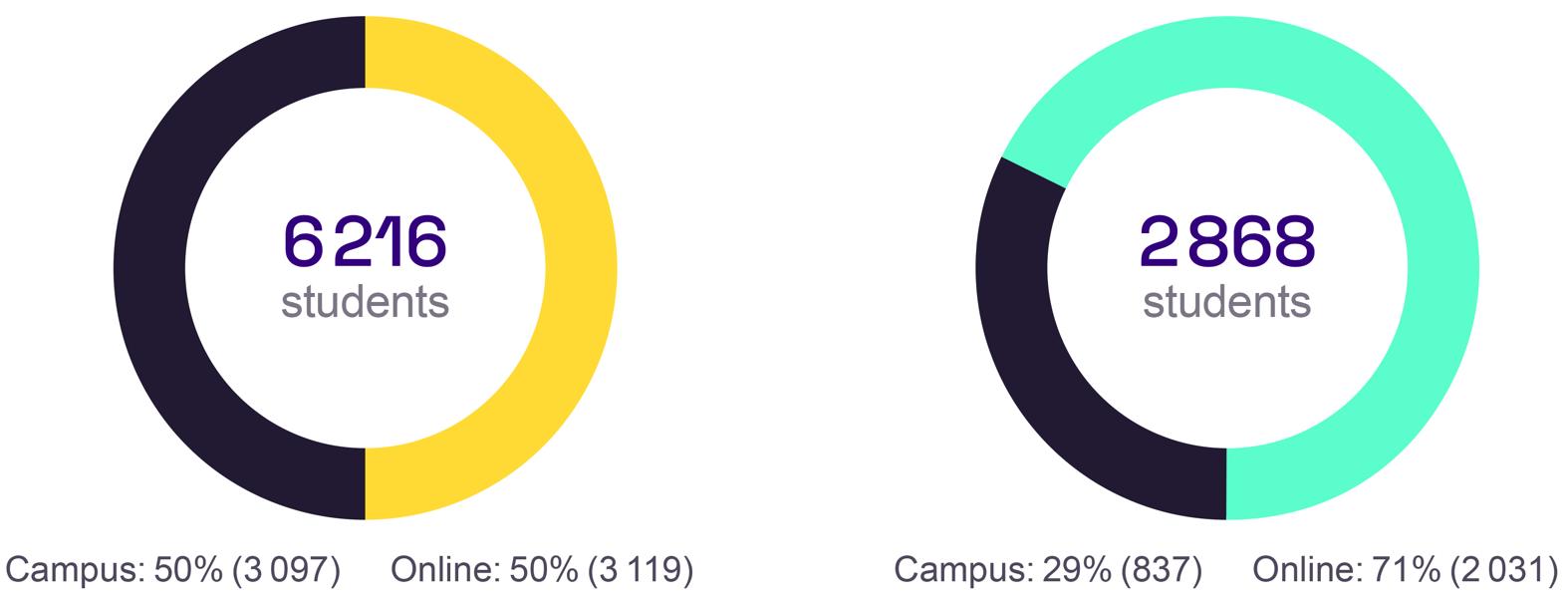

Operating revenue NOK 126 million (-5.7%)

Sonans revenue NOK 71.6 million (-17.3%) due to post-Covid market setback

― NOK 61.6 million (-28.8%) excluding effect of new commercial terms for online (like for like)

ONH revenue NOK 54.4 million (+18.0%) driven by new study programmes

― Online grew 31.8 %, campus grew 2.5%

Quarterly Revenue (NOKm) Development in Revenue (NOKm)

LUMI GRUPPEN presentation Q4 22 9

-24.8 Q4-21 Group Sonans Campus 9.9 Sonans Online 0.5 ONH Campus 7.8 -1.0 ONH Online Q4-22 133.7 126.1 Q4-21 Q4-22 126.1 133.7 -5.7%

Introduction

About Lumi Gruppen

Executive Summary

Adjusted EBIT Margin on par with last year, cost programmes on track

Financials

Adj. EBIT NOK 23.1 million (-4.0%)

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Adj. EBIT margin 18.3%, slightly above last year

Gross savings in operating expenses of NOK 14 million for the Group in Q4

Additional provision for bad debt of NOK 6 million in Q4

Credit control measures implemented in Q4 already yielding positive impact

Adjusted EBIT margin (%) Development in Adjusted EBIT (NOKm)

LUMI GRUPPEN presentation Q4 22 11

Q4-21 Q4-22 18.0% 18.3% +1.7% 24,0 23,1 11,5 8,3 ONH Revenue Sonans Revenue -1,0 Adj. EBIT Q4-21 -5,4 -14,9 Sonans OpEx ONH OpEx Group/ NTECH 0,6 Depr. & Amortisation Adj. EBIT Q4-22

Introduction

About Lumi Gruppen

Executive Summary

Significant reduction in costs for Sonans, ONH invested for further growth and costs stabilised

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Gross savings of NOK 17.4 million for Sonans in Q4

Net savings of NOK 11.4 million when including additional provision for bad debt (NOK 4 million) and inflation in campus operations expenses (NOK 2 million)

Further reduction in the operating expenses from 2H 2023 when consolidating the Greater Oslo region by closing an additional 3 campuses

Cost level at ONH stabilizing, leading to expected margin expansion as volume grows

* NOK 5.8 million represent the additional (nominal) bad debt provision in Q4-22 in nominal value

** CoE represents Campus Operation Expenses and the inflation in expenses from higher electricity prices and utility

LUMI GRUPPEN presentation Q4 22 13 2H 2021 2H 2022 Proforma 2H 2022 Reported 116.5 89.4 81.7 -23.3% -29.9% Total OpEx Proforma 2H 2022 Other OpEx Payroll Expenses Total OpEx 2H 2021 24.5 10.3 Bad Debt* 5.8 1.9 81.7 CoE** Total OpEx Reported 2H 2022 116.5 89.4

(excl. D&A) Sonans OpEx 2H 2022 vs. 2H 2021 (excl. D&A)

Sonans OpEx Development

Introduction

About Lumi Gruppen

Executive Summary

Cash flow from operations starting to improve with less restructuring cost with cash effect

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Net cash flow from operations NOK -22 million (NOK -19 million)

Cash position of NOK 29 million at end Q4-22, strong cash flow in Q1-23 with the tuition fees being paid in January for the upcoming semester

New leverage covenants agreed for Q1-23 and Q2-23, still sufficient headroom

― Q1-23: 4.0 NIBD/Adj. EBITDA LTM / Q2-23: 5.0 NIBD/Adj. EBITDA LTM

― Q4 22: 3.4

Dialogue ongoing with Nordea to secure a renewed long-term financing solution

― Current loan facilities mature in February 2024

LUMI GRUPPEN presentation Q4 22 15 NIBD, ex. lease (NOKm) 70 70 64 29 134 Q4-21 Q4-22 99 377 401 Q4-22 Q4-21 Cash Revolving credit facility -19 -22 Q4-21 Q4-22

Liquidity reserve (NOKm) CF from Operations (NOKm)

Introduction

About Lumi Gruppen

Executive Summary

Financial Focus

Financials

Improve financial performance through cost control, unified pricing and leverage effect from renewed growth

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Improve credit quality and cash conversion from student contracts

Secure long term financing for the group, allowing for new investments following the completion of the restructuring in Sonans

Earnings quality, adjusted and reported figures will increasingly converge in 2023

Higher value per student

Cost control and cost optimization

Leverage from structural cost reductions

New long term financing

Credit quality and strong cash conversion

Earnings quality

LUMI GRUPPEN presentation Q4 22 17

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Strategy & Operations

LUMI GRUPPEN presentation Q4 22 19

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

― Turnaround strategy completed, cost base aligned with current market volumes

― Underlying demand for education still strong, likely improvement for the private candidate market

― Has taken a leading role in the consultation process following the proposal from the Admission committee

― Solid education platform ready for the autumn intake, new programme in pipeline and awaiting approval from NOKUT

― First two-year higher vocational education programme approved

― Launch in Q1 to recruit first cohort autumn 2023

― Another strong intake with 17% growth

― Demonstrates position as leading online player in higher education market

New programmes will be developed, both shorter and longer

― Plans to offer both digital courses and campus

21 LUMI GRUPPEN presentation Q4 22

Introduction

About Lumi Gruppen

Executive Summary

Sonans — spring intake in line with the autumn intake, as expected

Financials

Total sales from spring student intake ended down by 31% vs. last year

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Most drivers affecting the education market for the school year 2022/2023 are Covid-19 related or a direct consequence of Covid-19

A market recovery is likely, driven by re-introduction of exams and a softer labour market

Market fundamentals and need for higher education still strong

LUMI GRUPPEN presentation Q4 22 27 11 Campus -58% 26 25 Online -5% Accumulated student sales spring intake 2022 to 2023 (NOKm) 53,0 36,4 0 5 10 15 20 25 30 35 40 45 50 55 W45 W41 W46 W38 W43 W42 W39 W49 W40 W44 W47 W52 W48 W50 W51 W1 W2 W3 W4 -31% Sales 22 Final student sales spring intake 2023 (NOKm) 53 36 Total -31% Total sale LY Total sale 23 Sales 23

Introduction

About Lumi Gruppen

Executive Summary

Sonans — turnaround strategy completed and costs are now aligned with current market volumes

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Additional three campuses to be closed from 2H of 2023, campus operations will be concentrated in the largest cities of Norway

Will continue to develop the digital platforms Live and Online to secure geographical reach with fewer campuses

Will adjust prices to compensate for inflation, targeting unified pricing across platforms

LUMI GRUPPEN presentation Q4 22 25

Introduction

About Lumi Gruppen

Executive Summary

Sonans — the Admission committee have proposed the following changes to the admission system

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Grades should still be the most important method of ranking students

The introduction of an entrance test (based on the Swedish system)

Remove all additional points (age, military service etc)

Not possible to improve grades after high schools

Remove special grade requirements for teacher and nursing programmes Remove additional points for science subjects

Existing model New model

Søkere med vitnemål fra VGO (uten forbedrede karakterer)

• realfagspoeng • kjønnspoeng

• språkpoeng

Søkere med forbedrede karakterer 23/5-søkere

• realfagspoeng • tilleggspoeng

• språkpoeng • alderspoeng

• kjønnspoeng

Søkere som ikke kan poengberegnes

Søkere med vitnemål fra videregående opplæring 23/6søkere

Søkere som ikke kan poengberegnes

Karakterkvote (80%) Opptaksprøvekvote (20%)

Førstegangsvitnemålskvote (50 %)

Ordinær kvote (50 %)

Spesielle kvoter Spesielle kvoter

Spesielle kvoter for kjønn, regional tilknytning og samisk språkkompetanse Spesielle kvoter

Source: https://www.regjeringen.no/no/dokumenter/nou-2022-17/id2948927

LUMI GRUPPEN presentation Q4 22

27

Introduction

About Lumi Gruppen

Executive Summary

Sonans — new admission regulation still pending, any outcome will leave room for new business

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

As long as access to attractive university programs is limited, there will be a market for services that help students qualify

Consultation process to be finalized 9 March, likely that outcome will be different from the committee’s proposal

Any changes will likely take several years to be implemented, earliest in 2027/2028

Lumi Gruppen is actively planning to adapt, based on various scenarios

Example of potential business opportunity:

Additional services for high school students if the opportunity to improve grades after high school is limited or removed

Source: Kantar (survey commissioned by Sonans), N=1074

Source: https://www.oecd.org/education/education-at-a-glance/

LUMI GRUPPEN presentation Q4 22

give young people a second chance 8 25 68 13 25 63 11 25 63

Neutral Familiy backround, higher education Familiy backround, limited education Total

are

for initiation of

25 25 24 24 24 24 23 23 23 23 23 22 22 22 22 22 22 22 22 22 22 22 22 22 21 21 20 20 20 20 20 20 19 18 Danmark Colombia Mexico Spania Austria Sveits Tsjekkia Island Israel Sverige Nederland Finland Japan EU22 Tyrkia Litauen Tyskland New Zealand Portugal UK Kanada Belgia Chile Estland USA Luxembourg Norge OECD snitt Polen Slovakia Ungarn Hellas Italia Slovenia

Strong public support of the current private candidate model and the opportunity to

Positive Negative

Norwegian students

in line with the OECD age average

studies

29

Introduction

About Lumi Gruppen

Executive Summary

ONH — Continues to outperform the market for higher education, 17% growth in the spring intake

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

ONH continues to strengthen its position with a 17% growth in the spring intake 2023

The college is well prepared for the autumn intake with the application deadline for public universities 15 April as first milestone

Strong programme portfolio both on campus and online securing flexibility in the delivery model and efficient operations

Additional growth opportunities are being explored, including:

― —

New Bachelor programmes — More courses and B2B opportunities

More twinning programmes

Spring intake: Solid performance with 17% growth in signed contracts in a challenging market (#signed contracts)

LUMI GRUPPEN presentation Q4 22 164 82 160 26 432 176 93 182 53 504 Total Bachelor Single subjects Annual units Other +7% +13% +14% +104% +17% 2022 2023 31

Introduction

About Lumi Gruppen

Executive Summary

NTECH — approval received from NOKUT, preparing for launch and first intake

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Launch planned in Q1-23 with a new website and marketing campaign

Offer the full two-year programme WebApp development and design on Sonans premises at Bislet

Close collaboration with the industry, including Rebel, a leading tech hub in Oslo

The offer will consist of campus programmes for full time students and online programmes and courses

Will rapidly expand the portfolio to increase student volume

LUMI GRUPPEN presentation Q4 22 33

Introduction

About Lumi Gruppen

Executive Summary

Outlook

Financials

Lumi Gruppen is of the opinion that a market recovery is possible as early as the next school year 23/24

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

A more favourable market situation for Sonans will quickly improve the financial performance given the completed restructuring process and significant leverage of the business model

Continued growth for ONH, ready for a further volume expansion for current programme portfolio

Preparing launch of NTECH, a new growth opportunity for the Group

Lumi Gruppen is closely following and taking part in the process following the recommendations published by the Admission Committee in December

Including the additional sales from the spring sales cycle, revenue for H1 2023 estimated to end at NOK 205-210 million

LUMI GRUPPEN presentation Q4 22 35

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Disclaimer

This presentation includes forward-looking statements which are based on our current expectations and projections about future events. Statements herein, other than statements of historical facts, regarding future events or prospects, are forward-looking statements. All such statements are subject to inherent risks and uncertainties, and many factors can lead to actual profits and developments deviating substantially from what has been expressed or implied in such statements. As a result, you should not place undue reliance on these forward-looking statements.

The Group reports its financial results in accordance with accounting principles IFRS. However, management believes that certain alternative performance measures (APMs) provide management and other users with additional meaningful financial information that should be considered when assessing the Group’s ongoing performance. These APMs are non-IFRS financial measures, and should not be viewed as a substitute for any IFRS financial measure. Management, the board of directors and the long term lenders regularly uses supplemental APMs to understand, manage and evaluate the business and its operations. These APMs are among the factors used in planning for and forecasting future periods, including assessment of financial covenants compliance.

LUMI GRUPPEN presentation Q4 22 37

LUMI GRUPPEN presentation Q4 22 38