Sustainability Report 2024

Section 99a of the Danish Financial Statements Act

This report represents the statutory consolidated statement of the Lundbeck Foundation on corporate social responsibility (CSR) in accordance with section 99a of the Danish Financial Statements Act The report includes the Management Review and Sustainability Statement of the Annual Reports for 2024 of H. Lundbeck A/S and Falck and the Management Review of ALK Abelló A/S – each of which outlines company-specific policies, activities and results for 2024

Key 2024 Figures

+19 million patients reached through the Group

~34,000 jobs sustained through the Group

+5,000DKKm spent on R&D through the Group

1,074DKKm in grants to research & activities by the Lundbeck Foundation

Commitment to society

The purpose of the Lundbeck Foundation is to create powerful ripple effects that bring discoveries to lives through investing actively in business and science at the frontiers of their fields. This report presents how sustainability is embedded in the Foundation’s purpose, strategy, business model and activities.

With the Foundation’s 2030 strategy, Bringing Discoveries to Lives’, the Foundation articulated five value flags for a clear commitment to making a positive and sustainable impact on society. The strategy is aligned with SDG 3, 8, 9 and 16 and aims to drive sustainable outcomes in health, innovation, economic growth and good governance.

Sustainability is viewed both as a responsibility and a license to operate - now and in the future - as well as an opportunity to drive long-term value creation.

Top-tier neuroscience

We create value when we fund Danish-based research that results in a better understanding of the brain and better prevention, diagnosis and treatment of brain diseases.

Close collaboration between research and business

We create value when we invest in research talents, entrepreneurs and innovation in Danish healthcare, and when we strengthen the collaboration between universities, hospitals and companies in Denmark.

Active public voice

We create value when we develop and internationalise Danish healthcare research and business culture, and when we improve society's understanding of the brain and its diseases.

Attractive financial returns

We create value when our return on investment enables us to increase our grants to society and secures our long-term financial robustness and growth.

Leading healthcare companies

We create value when we as a competent and engaged owner, develop and grow healthcare companies to become international market leaders within their categories.

The Lundbeck Foundation’s strategy is aligned with four SDGs

The Foundation’s philanthropic and commercial activities, developing top-tier neuroscience and leading healthcare companies, supports SDG 3especially sub-target 3.4 regarding treatment of noncommunicable diseases and mental health.

As part of its engaged ownership and responsible asset management, the Foundation contributes to SDG 8 through the sub-targets 8.1 - GDP growthand 8.5 - Decent work for all men and women.

Long-term ownerships, biotech investments and support for collaboration in research are key components of the Foundation’s impact on society and have a clear link to SDG 9 and sub-target 9.5 of encouraging innovation and research development.

The footprint of the Lundbeck Foundation is primarily defined by the companies it owns, the investments it makes, and the recipients of its grants. The basis for promoting sustainable development is good governance in line with SDG 16, contributing to effective, accountable and inclusive organisations.

The Lundbeck Foundation’s business model

The Lundbeck Foundation is a Danish enterprise foundation with DKK 71bn in assets under management. The Foundation has a broad scope of activities, and its societal impacts, risks and opportunities seen through all its activities.

Strategic Ownerships

The Lundbeck Foundation is a long-term owner of multiple healthcare companies headquartered in Denmark. Our ambition is to position and maintain the companies as international market leaders within their industry segment. Business ownership is a key element of the Foundation's financial and societal value creation and of building the route to market for new treatments and therapies for patients all over the world.

Financial investments ensure long-term financial stability and robustness, and allows the Foundation to invest in the future of healthcare and support new scientific research. The Foundation's biotech investments contribute to financial value creation while also developing people and businesses in the Danish life science ecosystem.

Partner to Society

The Foundation channels profits back to society through grants and partnerships, which are anchored in the Foundation’s purpose of 'Bringing discoveries to lives'. Our strategic ambition is to improve the world's understanding of the brain and create better treatments of brain disorders while also developing the Danish life science ecosystem through advancing and enhancing the conditions for science, innovation and economic growth in Denmark.

Activity: Strategic ownerships

As a business owner in the healthcare sector, the Lundbeck Foundation impacts economic growth, innovation and job creation in Denmark and in other geographies. This ownership role entails a responsibility to ensure that the companies assess and report on their sustainability impacts, risks and opportunities, and address these through policies, actions and targets.

Responsible growth and job creation

Engaged ownership is the core of the Foundation’s contribution to its healthcare companies. The goal is to position and maintain the companies as international market leaders within their industry segments, including a strong focus on sustainability.

Governance: Engaged ownership

Sustainability is an important pillar of the Foundation’s engaged ownership model, and the Foundation encourages its ownerships to assess, evaluate and report on relevant sustainability measures and initiatives. The Foundation uses its board representation to advance sustainability agendas and expects its ownerships to live up to the minimum standards that are defined in the Foundation’s Sustainability Policy.

Developments in the strategic ownerships

In 2024, the Lundbeck Foundation joined T&W Medical’s majority ownership of WS Audiology, adding the global hearing aid company to its strategic ownerships. The Foundation is now co-owner with significant minority stakes in Ferrosan Medical Devices, Ellab and WS Audiology, and holds majority ownership of its three subsidiaries H. Lundbeck A/S ALK Abelló A/S and Falck. Please refer to the Management Review and Sustainability Statement of the Annual Reports 2024 for the three subsidiaries from page 16 for detailed descriptions of their business models, governance and sustainability efforts.

In 2024, the environmental targets of the six strategic ownerships are all approved by or in alignment with the Science Based Targets initiative.

The Corporate Sustainability Reporting Directive (CSRD) requires companies to identify, assess and report on material sustainability areas. H. Lundbeck A/S and ALK Abelló A/S have reported according to CSRD for 2024, while the other companies are preparing to report under the CSRD for 2025.

The Enterprise Foundation Model Research indicates that companies with enterprise foundation ownership achieve higher environmental, social and governance (ESG) performance, maintain ESG activities even during financial crises, and commit to more significant emission reductions in the post-Paris Agreement period.

The Foundation works to advance the Danish enterprise foundation model as part of its public outreach. Enterprise foundations have a long history of value creation in Danish life science, and the Lundbeck Foundation is committed to protecting and developing this ownership model for the benefit of Denmark’s life science industry and society as a whole.

Subsidiaries by the numbers in 2024

Activity: Asset management

The Foundation’s asset management has a dual purpose. Firstly, the Foundation’s financial investment activities ensure the financial robustness to pursue the Foundation’s purpose and strategy. Secondly, the Foundation’s biotech investments advance Denmark’s life science ecosystem while also delivering a strong and competitive financial return.

Investments as a financial engine

The Foundation’s value creation relies on its financial assets, which enable the commercial and philanthropic activities. Financial returns allow the Foundation to support its business ownerships while also investing in new science and innovation, even in times of crisis.

Governance: A responsible financial investor

As a diversified financial investor, the Foundation pursues a strategy of investing in high quality companies across different sectors to generate longterm return without compromising strong near-term risk management. All financial investments must comply with the Foundation’s Sustainability Policy and Investment Policy, which are reviewed and approved by the Board of the Foundation on an annual basis.

Investment decisions and recommendations are also reviewed by the Board’s Investment Committee, which supervises the Foundation’s activities in accordance with the Investment Policy.

As defined in the Foundation’s Investment Policy, the Foundation does not invest in certain sectors, such as the tobacco industry. The investment portfolio is screened twice a year to ensure compliance with international ethical standards. Assets that are flagged as high risk in the external screening process undergo a separate due diligence process which is signed off by the Foundation’s CEO.

Biotech investments

Supporting the local life science ecosystem while also delivering a competitive financial return is at the core of the Foundation’s biotech investments through Lundbeckfonden BioCapital. Through new investments and its existing portfolio of 21 international and Danish biotech companies, the Foundation advances health innovation through commercial and sustainable businesses with the aspiration of pushing the boundaries of the current level of insights and knowledge and identifying the health solutions of tomorrow.

Governance: An active biotech investor and owner

The Foundation identifies companies and teams with a strong scientific platform and commercial potential that can solve unmet medical needs. Solving future patient needs requires excellent science, robust business models and sustainable practices.

The Foundation’s investment takes place after an indepth due diligence assessment of the science, team and business model that also involves relevant ESG considerations. Each investment is accompanied by the Foundation’s involvement in the company. This usually involves a board seat, which allows the Foundation to advance and guide strategy, operations and policies and to build up sustainable priorities and practices in the portfolio companies.

Execution on the Sustainability Programme

In 2024, Lundbeckfonden BioCapital started to execute on its Sustainability Programme. In line with the overall principle for the Foundation the programme builds on a two-pronged approach. Sustainability is both a responsibilityand license to operate – now and in the future – as well as an opportunityas a long-term value driver.

Opportunity: Building high performing teams

How can investors best help their early-stage companies to ensure that they grow strongly and sustainably into the future? In 2024, the Foundation initiated the Fit for Growth pilot, a recruitment and company building programme aimed at supporting and guiding early-stage biotech companies in developing high-performing teams. The pilot focused on how early-stage companies, operating in a cash and time constrained environment, can intentionally design a more diverse workforce and leadership team that is fit for future growth Through a short series of workshops with three of our portfolio companies, the initiative provided tangible, practical advice and concrete tools. The aim is to implement learnings from this more widely across the portfolio in the coming years.

Responsibility: Aligning material reporting requirements

The Foundation works to align sustainability reporting requirements for early-stage biotech companies through the ‘Life Sciences ESG Knowledge Project’, a collaborative effort among 23 leading life science venture investors. The initiative aims to make sustainability reporting as relevant and efficient as possible for early-stage biotech companies, enabling them to meet key responsibility expectations and regulatory requirements without undue burden.

Activity: Partner to Society

The Foundation channels profits back to society through grants, partnerships and societal activities which are anchored in the purpose of ‘Bringing discoveries to lives’. This includes investing in scientists and their pursuit of new discoveries, disseminating knowledge and discoveries to those who need them, and strengthening Denmark’s life science ecosystem through innovation and economic growth. The Foundation is also committed to using its public voice to deepen the understanding of the brain and strengthen research conditions and the Danish life science ecosystem.

The Commitment to Brain Health

Brain diseases have profound socio-economic impacts for society at large and severe personal consequences for patients and relatives across the world More than 3 billion people are estimated to be affected by brain diseases worldwide. To provide new treatments scientists, practitioners and general society require better knowledge about the brain and its diseases.

The Foundation supports scientific research with a specific commitment to the brain. The Foundation

Case: Lundbeck Foundation Parkinson's Disease Research Center (PACE)

The Foundation’s ambition is to make Denmark a frontrunner in the field of neuroscience. The Foundation funds Danish-based research that promotes an improved understanding of the brain as well as better prevention, diagnosis, and treatment of brain disorders.

In 2024, the Foundation launched its first large strategic initiative to strengthen the integration of basic and clinical research. The Foundation awarded DKK 223m to the Lundbeck Foundation Parkinson's Disease Research Center (PACE) at Aarhus University Hospital with Professor Per Borghammer as leader of the multidisciplinary NeuroHub

The NeuroHub is the first of several larger strategic initiatives to bring discoveries to lives. The initiative supports a multidisciplinary research environment to strengthen the collaboration between basic and clinical research, aiming at better prevention, diagnosis and treatment of brain diseases.

supports projects across basic, clinical applied and epidemiological research activities. In 2024, the Foundation surpassed its 2030 ambition of DKK 1bn in annual grants with a total of DKK 1,074m awarded. This is an increase of DKK 482m compared to 2023. Of this total of DKK 1,074m, 88% was committed to neuroscience research across all levels. The increase in the grant sum primarily reflects the Foundation’s execution on its strategic initiatives such as the Lundbeck Foundation Parkinson's Disease Research Center (PACE) at Aarhus University Hospital and Neuroscience Academy Denmark (see cases on page 9 and 10).

The Foundation not only supports research within brain health but also uses its public outreach to deepen the understanding of brain health and its consequences as one of the Foundation s three main agendas. See for instance the “Hjernerapporten 2.0” case to the right

Accountability, transparency, and integrity

In its grant activities, the Foundation is committed to integrity, transparency and accountability. The Foundation wants to support the best scientific research that can shape positive outcomes and push the frontiers of our knowledge. Best practices, such as the Danish Code of Conduct for Research Integrity, as well as environmental, social and governance considerations, are integrated into the Foundation’s grant processes.

The Foundation handles and evaluates applications via an application assessment process. Evaluations include

peer reviews by international third-party expert panels who operate in compliance with the Foundation’s principles of impartiality. For this purpose, the Foundation has established four permanent evaluation panels with independent experts.

The Foundation’s public voice is planned and conducted with strong attention to principles of transparency, accountability and integrity, and is shared publicly on the Foundation’s website: https://lundbeckfonden.com/about-us/socialresponsibility-and-transparency/recommendations-onfoundation-governance-corporate.

A responsible public voice

The Foundation engages in a variety of activities spanning communication, partnerships and public affairs across its entire value chain to pursue three main agendas:

- Advance the Danish enterprise foundation model

- Deepen the understanding of the brain and develop better treatments for brain disorders

- Strengthen science, research conditions and the Danish life science ecosystem

Case: Hjernerapporten 2.0 (The Brain Report 2.0)

Brain diseases have far-reaching societal and personal consequences for people around the world. Brain diseases are costly for patients, relatives and society – both socially and economically. However, brain health and brain diseases remain an under-prioritised disease area in Denmark and in many other countries. The Foundation works to improve the public understanding of the brain and brain disorders.

Raising public awareness about the importance of brain health requires accessible and relevant knowledge. To this end, the Foundation updated its “Hjernerapporten 2.0” in 2024, resulting in an expanded version of the original 2021 report. The updated report sheds light on the individual and societal impact of brain disease. For instance, the study behind the updated report shows that 1 in 3 Danish citizens are either diagnosed with or receive prescription medicine for brain disease The study estimates the indirect cost of brain diseases to be equivalent to 8% of Denmark’s gross domestic product (GDP).

The updated report provides a solid data-driven basis for the public debate around brain disease and its consequences. This contributes to both the Foundation’s and patient organisations’ efforts to drive the dialogue on the importance of brain health and to focus on brain diseases.

Case: Neuroscience Academy Denmark

The Lundbeck Foundation works to improve the academic understanding of the brain. One of the initiatives is Neuroscience Academy Denmark, a PhD programme and research network started in 2021. The aim of the Academy is to educate the neuroscientists of the future and motivate networking and collaboration between neuroscience research groups in Denmark.

The Academy’s PhD programme adds an initial year with rotations between Danish neuroresearch laboratories, enhancing the neuroscience PhD level by creating a unique learning, development and research environment in Denmark. The programme’s cross-university activities strengthen the coherence of Danish neuroscience research activities as well as motivating national collaboration between neuroscience research groups in Denmark.

Since the start of the PhD programme, a group of 48 PhD students has been recruited. In 2024, the Lundbeck Foundation awarded the Neuroscience Academy an additional grant of DKK 222m. This allows the Academy to double the size of the existing group of PhD students over the next three years.

Disseminating knowledge and discoveries

Bringing discoveries to lives requires new knowledge as well as the continuous sharing of existing knowledge to those who need it: clinicians, healthcare professionals, patients and relatives, companies, public authorities, etc. In 2024, the Foundation continued its efforts to share existing knowledge and new scientific insights about the brain to a broader audience in Denmark and globally.

Supporting collaboration between research and business

Healthcare innovation requires collaboration between the scientific research community and the commercial business world. This is seen in the world’s most innovative healthcare communities, where talents can make the leap from science to business and back again. In today’s world, companies and innovative entrepreneurs shape the route from scientific labs to patients, which requires a profound understanding of multiple sectors as well as a strong commitment to entrepreneurship and business building.

As one of the three main agendas for its public outreach, the Foundation thus focuses on research conditions and strengthening Denmark’s life science ecosystem. The Foundation engages in this agenda through its public affairs, communication and partnerships activities.

To further facilitate the scientific transition from basic research project to commercially viable products and companies that can bring the discoveries to lives, the

Foundation has set up Frontier Grants Frontier Grants aim to mature research projects to become attractive prospects for biotech investors. In 2024, four Frontier Grants totalling DKK 20m were awarded to scientists working on a new obesity drug, gene therapy, treatment of pancreatic cancer and stem cell therapy for Parkinson’s disease.

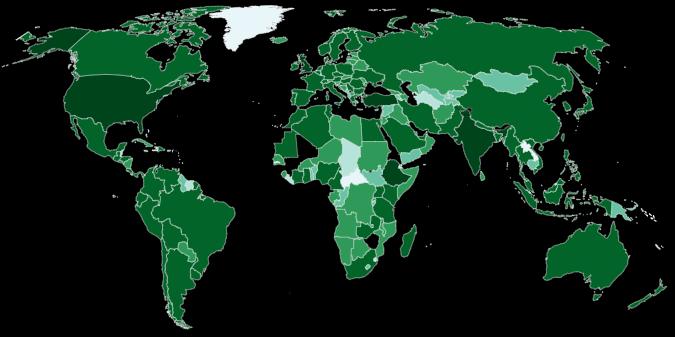

A global outreach

In 2024, the Foundation’s online platform, Neurotorium - which provides curated free educational material on neurology and mental diseases intended for clinicians and educators – attracted more than 450,000 visits from a total of 189 countries only two years after its launch in 2022 and up from 180,000 visits across 181 countries in 2023. The top 5 countries per number of users were the US Ethiopia, India, Turkey and the UK

Celebrating neuroscience

The Foundation has many activities focused on the need to bring knowledge and awareness of brain health to the wider society. This includes the world’s largest prize for brain researchers, ‘The Brain Prize’, which is awarded annually to scientists who have made groundbreaking discoveries in brain research. The award is followed by an extensive outreach programme, where the winners share their science with global audiences.

Sustainability at the Lundbeck Foundation

Governance principles

Good governance is critical for the effective integration of sustainability into the business decisions of the Foundation. The Foundation’s governance model has been developed over many years and is based on four principles:

• Compliance with Denmark’s national Recommendations on Foundation Governance and on Corporate Governance ensures clear guidelines for the Foundation’s operations.

• The principle of independence guides the composition of the Foundation’s governing bodies, including board composition, scientific evaluations, etc.

• Annual accounts, key policies and governance documents are developed to comply with the principle of transparency, and the Foundation’s eight policies are shared publicly and can be accessed on the Foundation’s website: https://lundbeckfonden.com/about-us/socialresponsibility-and-transparency/policies

• The decision-making processes in the Foundation’s organisation are defined and reflect the principle of checks and balances

Sustainability Governance

The Foundation’s Board of Directors endorses the Foundation’s sustainability policies, priorities and progress. The CEO is responsible for the Foundation’s sustainability work and ensures that ESG is integrated into strategy, management and business model. The Management Team reviews implementation and follows up on progress. The Sustainability Steering Group is responsible for advancing the sustainability agenda and programme, manages key priorities and sustainability initiatives, tracks progress and reports to the CEO. Workstream Leads lead and drive sustainability initiatives in their departments. In addition, the Foundation works to integrate and update ESG measures according to the latest developments in the core process for each of its activities.

The Lundbeck Foundation’s Sustainability Policy

The Foundation’s work on all sustainability areas follows the guiding principles defined in its Sustainability Policy. The policy articulates the expectations and guiding principles for the Foundation’s employees, its grant recipients, investments and ownerships. It also encourages partners and stakeholders, including the strategic ownerships and investments, to pursue sustainability agendas that can live up to the minimum standards set out in the policy.

The Sustainability Policy is reviewed and approved by the Board of Directors annually. The policy is publicly accessible on the foundation’s website: https://lundbeckfonden.com/about-us/socialresponsibility-and-transparency/policies

Whistleblower system

The Foundation has a whistleblower system that provides employees, partners and stakeholders with a secure and confidential channel to flag and raise concerns, including legal and other serious risks In 2024, no reports were made via the whistleblower system.

Data ethics

In response to the Danish Financial Statements Act section 99d, the Data Ethics Policy for the Lundbeck Foundation (including Lundbeckfond Invest A/S) has been developed and approved by the Board of Directors. It is based on five principles:

• Human interests before commercial interest

Data utilised should ultimately have a human benefit. If there is a conflict between human and commercial interests, human interests should always prevail.

• Transparency.

Data uses should be clear or easily explained. When personal data is utilised, the legitimate reason for doing so should be made clear, or properly informed consent should be obtained from all involved.

• Anonymisation

Data should be anonymised or pseudonymised unless personalisation is a requirement for achieving the targeted results.

• Autonomy

The Foundation believes that individuals should have control over the use of their data. Further, the Foundation does not use automated decision-making

or artificial intelligence on data either provided or collected.

• Accountability and governance

Accountability is an integral part of responsible data use, and the Foundation goes to great lengths to reduce the risks for the individual and to mitigate undesirable social and ethical implications.

The Foundation endeavours to integrate data ethics into all its daily management and business decisions, including when acting as stakeholder in other concerns. Even with effective standards, policies and processes in place, data usage has the potential to lead to challenges, problems and errors. The Foundation seeks to prevent this by developing a positive culture among employees that promotes openness and encourages the continuous improvement of processes and systems.

Subsidiaries

For further information about the Data Ethics Policy, please see page 51 of H. Lundbeck A/S’ Annual Report 2024, page 32 of ALK Abelló A/S Annual Report 2024 and page 30 of Falck’s Annual Report 2024.

Initiatives in 2024 for the Foundation

In 2024, the Foundation conducted a double materiality assessment based on its business model as both an investor and a long-term owner. This assessment enabled the Foundation to identify key impacts, risks and opportunities from a sustainability perspective. These insights will shape the Foundation’s sustainability priorities, policies actions and targets moving forward.

The Foundation is now preparing to collect material data points throughout 2025 to ensure it can report in accordance with the Corporate Sustainability Reporting Directive (CSRD).

In 2024, emissions from unavoidable flights related to the Foundation’s international activities amounted to 332 tonnes of CO2. To offset these emissions, the Foundation purchases high-quality carbon credits. While carbon offsetting is not a comprehensive solution, it complements ongoing efforts to establish measurable and concrete emission reduction targets, which will be further developed in 2025.

ESG figures for the Lundbeck Foundation

The Foundation’s climate impact is primarily driven by scope 3 activities. The approach to handling scope 3 emissions will be further developed based on the results of the double materiality assessment carried out in 2024, which will be reflected in the 2025 reporting.

Diversity at the Lundbeck Foundation

In 2024, the Foundation’s Board of Directors comprised seven board members, who are elected based on the Foundation’s status. In 2024, six of the seven board members were considered independent. The seven board members counted one woman and six men, excluding the four employee representatives who represent the Foundation’s three subsidiaries.

The gender balance is not in accordance with the guidelines on gender equality issued by the Danish Business Authority (‘Guidelines on target figures, policies and reporting on the gender composition of management’) and adjusting the gender balance of the Board of Directors is therefore a priority going forward.

When electing new members to the Board of Directors, the Board strives to ensure diversity in competencies as well as gender. The board will continue to pursue equal representation in the coming elections.

In the short term, the Board of Directors strives towards complying with the guidelines. Currently, the board expects this target will be realised by 2027.

At 31 December 2024, the Management Team of the Lundbeck Foundation was comprised of six members, including the CEO, and counts one woman and five men. One female management member has stepped down but will be replaced by a person of the same gender in 2025, and the Management Team will then be comprised of two women and five men. The Lundbeck Foundation’s employee group counts 27 women out of a total of 56. Diversity and inclusion will remain focus areas for the Foundation in the years to come.

1 These key ESG figures are based on recommendations by the Chartered Financial Analysts’ (CFA) Society Denmark, the Association of Danish Auditors (FSR), and Nasdaq Copenhagen. They represent a first step in a process that, over the coming years, will enable the Foundation to provide stakeholders with further insights into the Foundation’s ESG profile by setting targets.

Definitions of calculations

Reporting period

All reported data cover a full-year period (1 January to 31 December 2024) for the Foundation (Lundbeckfonden and Lundbeckfond Invest A/S). The calculations have been applied consistently for all the years presented. All KPIs reported in the Sustainability Report are gathered and aligned with the timeline for the annual reporting of the financial data.

Data quality

We are committed to collecting the most accurate data. Nevertheless, it is not always possible to gain a fully aligned register of data, and estimations are sometimes necessary.

Environmental data

CO2e Scope 2

Includes all indirect emissions related to the generation of acquired and consumed electricity and district heating. All consumed energy information is provided by suppliers as specific meter readings or invoices.

Energy consumption

Consumed energy is monitored by building-specific meter readings.

Renewable energy share

Share of renewable energy generated by solar panels is monitored by building-specific meter reading.

Water

consumption

Water consumption is monitored by building-specific meter readings. Accounting period is 1st October 2023 to 31st September 2024.

Social data

Workforce

The workforce is calculated using the FTE method, which consists of the total amount of ATP reported to the Danish Tax Authorities divided by the standard ATP rate for a full-time employee (FTE) per year.

Gender diversity, percentage of women in the workforce

Includes all permanent employees hired and paid directly by the Foundation. Gender is assigned as female or male. Gender diversity reported as female share of total workforce.

Gender diversity, percentage of women in the Management Team

Includes all women in the Management Team. Gender is assigned as female or male. Gender diversity in the Management Team is reported as female share of total Management Team.

Gender pay ratio of men to women

Includes all permanent employees hired and paid directly by the Foundation. Gender is assigned as female or male. Gender pay ratio is calculated as the median of paid salary to male employees divided by the median of paid salary to female employees.

Employee turnover ratio

Includes all permanent employees hired and paid directly by the Foundation. Employee turnover ratio is calculated for both voluntarily and involuntarily departing employees.

Absence due to sickness

Includes all permanent employees hired and paid directly by the Foundation. Absence due to sickness is calculated as the number of full days of sickness for all employees divided by the total number of FTEs. Maternity leave is not included.

Governance data

Gender diversity, Board of Directors

The gender diversity of the Board of Directors is calculated as the total number of women elected divided by the total number of members of the Board of Directors for the Foundation. Gender is assigned as male or female.

Board meeting attendance rate

The board meeting attendance rate is calculated as the number of board meetings that each board member attends, divided by the total number of board meetings during the year.

A specific overview of each board member’s attendance during 2024 is presented in the Annual Report of the Foundation on page 44

CEO pay ratio

Total CEO remuneration divided by the median of the Foundation’s employee remuneration.

AnnualReport 2024

GaoLei,livingwithmigraine

H.LundbeckA/S

Advancing brainhealth. Transforminglives.

Patientperspective 20yearsonpainkillers

GaoLei,aged42,livesinBeijinginChina.Shegraduatedinmedicineand worksasabrandmanageratacompanywheresheisresponsiblefororganizingandhostingconferences.Sheisamotherandamigrainepatient formorethan20years.

“Tomycolleagues,Iamknownformyfocusand dedicationtowork.However,fewpeopleknowthat Ihavebeensufferingfrommigraineformorethan 20years.”

GaoLeirecallstheveryfirsttimeshewasattacked byaheadache.Itwasduringhersenioryearofhigh school.

“Duringtheintensepreparationforthecollegeentranceexams,Isuddenlyfeltdizzy,asiftheworld wasspinning,anditwasaccompaniedbyaparticularlysevereheadache.Atthattime,Ithoughtitwas justduetothestressandfatiguefromstudying. Afterlyinginbedforabout1or2hours,thesymptomsgraduallyeased,soIdidn'tthinkmuch ofit.”

Later,asamedicalstudent,GaoLeisstudieswere extremelydemanding,withnumerousexamstopreparefor.Theheadachescontinuedtoplagueher, causingimmensesufferingduringhergraduate studiesandlater,whenshestartedhercareerand settleddownwithafamily.

A10-year-latediagnosis

Manypeopleattributeheadachestoexcessivestress orfatigue,leadingtodelayedtreatment.

“Afterenduringnearlyadecadeoftormentandgainingaccesstoprofessionalknowledgethroughmy medicalstudies,Iwasfinallydiagnosedwithmigraineinaspecializedhospital.”

GaoLei livingwithmigraine

Afterbeingdiagnosedwithmigraine,GaoLei exploredvarioustreatmentoptionsandtrieddifferentpainkillers,buttheresultswerelessthansatisfactory.

Hercopingmechanismbecameamixofpainkillers andaquietspacetoalleviatethepain.Thisreliance onpainkillerscontinuedforanother10years.

Preventivemigrainetreatment

Twoyearsago,GaoLeilearnedaboutaclinicaltrial ofamonoclonalantibodymedicationformigraine andappliedtojoin.Itisamigrainepreventivetreatmentthatisinjected,andsheunderwentthistreatmentforaboutninemonthswithverygoodoutcomes.

Previously,shehadfrequentheadacheattacksand sheoftenneededtousepainkillersformorethan10 dayseachmonth.Afterthetreatment,shehadno significantattacksexceptforfourorfivedaysbefore andafterhermenstrualperiod.

Theunbearableheadachesweregone.

“Inthepast,painkillersweremylife-savingmedication.Now,afterpreventivetreatment,mymigraine symptomshavebeengreatlyrelieved,andIhave graduallyresumednormalworkandlife.Ihopethat thosewhosufferfrommigrainelikeme acknowledgeandfacethedisease,andbelievethat withimproveddiagnosisandtreatment,wecanbetterliveourlives.”

Ihopethatsocietycangiveus moreunderstanding,tolerance, andsupport,andrecognizethe effortsweputintotransform ourlives.

Mirza,caregiverofAlzheimer’sdiseasepatient

Sustainabilitykeyfigures

Shareofemployeeswhocompleted theannuale-learningonourCodeof Conduct,comparedto99.9%in2023.

Keyeventsof2024

February

CEOCharlvanZylannouncedthecompositionofLundbeck’snewexecutivemanagementteam.

March

Thepotentialfirst-in-classtherapyformigrainepreventionenteredanadvanced clinicalstagewithaclinicalphaseIIb dose-findingtrial.ThePROCEEDtrialwill assesstheefficacyandsafetyofsubcutaneouslyadministeredLuAG09222inmigraineprevention.

June

Presentationofaninnovativefirst-in-humantrialdesignofthemonoclonalantibodyLuAG13909forthepotentialtreatmentofcongenitaladrenalhyperplasia (CAH)araredebilitatingdiseasewithexcessmorbidityandmortality.

ThephaseIbtrialusingLuAG13909asa potentialtreatmentforCushing’sdisease wasinitiated.LuAG13909isafirst-inclassmonoclonalantibody(mAb)that

targetstheadrenocorticotropichormone (ACTH).BybindingtoACTHwithhighaffinity,LuAG13909aimstoreduceelevatedACTHlevels,potentiallyproviding therapeuticbenefitsforindividualswith neurohormonaldysfunctions.

LundbeckandOtsukaannouncedFDAacceptanceofsNDAfilingforbrexpiprazole incombinationwithsertralineforthe treatmentofadultswithpost-traumatic stressdisorder(PTSD). FDAplanstohost aPsychopharmacologicDrugsAdvisory Committeeanticipatedduringthefirst halfof2025.Ifapproved,thebrexpiprazoleandsertralinecombinationtreatmentwillbethefirstFDA-approvedpharmacologicaltreatmentforPTSDinmore than20years.

September

LundbeckandIambicTherapeutics,a clinical-stagebiotechnologycompanydevelopingnoveltherapeuticsusingits uniqueAI-drivendiscoveryplatform,enteredastrategicresearchcollaboration

tofocusonthediscoveryofasmallmoleculetherapeuticforthetreatmentofmigraine.

October

TheclinicaltrialforLuAG22515inThyroidEyeDiseasewasinitiated,takingone furtherstepindevelopingtreatmentsfor indicationsintheneuroimmunologyand neuroinflammatoryspacewiththeinitiationofthefirstclinicaltrialofitsCD40L blocker,LuAG22515,inpatients.

TheproposedacquisitionofLongboard Pharmaceuticalswasannounced.The strategicdealwillenhanceLundbeck’s neurosciencepipelineandrepresenta significantstepforwardintheFocused InnovatorStrategy,addingahighlyinnovativeandcomplementaryproductin late-stagedevelopmentforDevelopmentalandEpilepticEncephalopathies(DEEs) -anareaofhighunmetmedicalneed.

Lundbeckannouncedpositiveresults fromthephaseIIIpivotaltrial(SUNRISE)

ofVyepti® (eptinezumab),confirmingefficacyandmeetingtheprimaryendpoint withstatisticallysignificantreductionsin meanmonthlymigrainedayscompared withplacebo.Vyepti® alsometallkeysecondaryefficacyendpointsintheSUNRISE trial,andthetreatmentwasgenerally well-tolerated.

November

LundbecklaunchedMASCOT,aphaseIII trialtoassesstheefficacyandsafetyof amlenetuginthetreatmentofMultiple SystemAtrophy(MSA).MASCOTisarandomized,double-blindtrial,andbuildson theencouragingresultsoftheAMULET phaseIItrial,showingaconsistenttrend towardsamlenetugslowingclinicalprogressioninMSApatients.

December

LundbeckcompletedthepreviouslyannouncedtransactiontoacquireLongboardPharmaceuticalsthatsubsequently becameawhollyownedsubsidiaryof Lundbeck.Theacquisitionenhancesand

complementsLundbeck’scapabilitiesand presencewithinneuro-rareconditions, andtheleadasset,bexicaserin,holds blockbusterpotential.InJanuary2025, Lundbeckannouncedpositiveresults fromthe12-monthopen-labelextension ofthePACIFICtrialevaluatingbexicaserininparticipantswithDevelopmentalandEpilepticEncephalopathies.The treatmentwithbexicaserindemonstrated favorablesafetyandtolerability,andbexicaserinachievedanoverallmedianseizurereductionincountablemotorseizuresof59.3percent.

TheRESOLUTIONtrialdemonstratedthe efficacyofVyepti®inpatientswithadual diagnosisofchronicmigraineandmedication-overuseheadache.Withtheplacebo-controlledphaseIVtrial,Lundbeck foundthatthepatientsrapidlybenefitted fromthetreatmentwithVyepti® .

LetterfromtheChairandCEO

AtransformativeyearforLundbeck

Asoneoffewpharmaceuticalcompaniessolelyfocusingonbrainhealth, theworlddependsonLundbeckmorethanever.Neurologicalconditions aretheleadingcauseofdisabilityandsecondleadingcauseofdeath,globally,affecting3.4billionpeople1 andaccountingfornearly19milliondeaths peryear2 .

Weareproudtoadvancebrainhealth,and2024has beenatransformativeyearlayingthefoundationfor apromisingfutureforLundbeckandforthepatients weserve.

Ourcontributiontothefightagainstbraindisorders isaccesstohealthforthosewhoneedourtreatments.Wearepatient-drivenineverythingwedo. Ourresearchanddevelopmenteffortspursueclear biologyanddefinedpatientpopulationstocreate maximumimpact.Wepromoteequitableaccessibility,enhanceculturalacceptabilityofmentaldisorders,andweprovideefficaciousmedicalproducts.

In2024,ourpeopleexcelledingeneratingthehighestrevenueeverrecorded,notablywhilefurther strengtheningourpipelineofinnovativeandpromisinglate-stageassets.Lundbeckcontinuestodeliver solidgrowth,drivenbythestrongperformanceof ourstrategicbrands.

Weseeagrowingneurosciencemarketandexpectit tocontinueatan8%annualgrowthrate.IntheU.S. andEurope,neuroscienceisinthetopthreefornew drugapprovals.Addingrapidlyevolvingscienceand technologiesthatwillfuelourinnovationatanew pace,andarangeofnewdrugmodalitieswhichwill expandourtreatmentopportunities,weseeavery

promisingfutureaheadofus,patients,peopleand society.

Towardssustainableprofitability

Atthebeginningof2024,welaunchedourFocused InnovatorStrategywhichwilldrivelong-termsustainablegrowthforLundbeck.

Thestrategyanswersthreefundamentalquestions: Howwegrowwithourbasebusiness,howwecontinuetostrengthenourpipeline,andhowweallocatecapitaltofundourgrowthambitions.Weare gratefultoseethatthechoiceswehavemadeare generatingverypositiveresultsanddrivingthefuturetransformationofourcompany.

Entering2025,westandonastrongfoundationof strategicbrandsthatreacheddouble-digitgrowth rates.Weexpectourstrategicbrandstocontinueto maximizegrowthinto2027,drivenprimarilybyinvestmentsinourkeymarketsandbrandsglobally, includingVyepti® andRexulti® intheU.S.Thegrowth

willbridgetheupcominglossofexclusivityonBrintellix®/Trintellix® bytheendof2026intheU.S.and 2025inCanada,andthelossofexclusivityonRexulti® bytheendofthedecade.

Treatmentsadvancingbrainhealth

Lundbeckmarketstreatmentsthattransformthe livesofpeoplelivingwithpsychiatricorneurological diseases.Globally,migraineisthethirdmostcommondiseaseandismoreprevalentthandiabetes, epilepsy,andasthmacombined.

Ourpreventivetreatmentofmigraineinadults, Vyepti®,hasalreadybeenlaunchedin31markets worldwidereducingthenumberofmigrainedays. Wecontinuetheroll-outexpandingintonewmarkets,andweexpectVyepti® totriplesalesinthe comingyears,helpingpeoplesufferingfrommigrainearoundtheglobe.

Inthefieldofdepression,280millionpeopleworldwidelivewiththislife-devastatingdisease3 .

Twoofourstrategicbrands,Brintellix® andRexulti® , areindicatedforthetreatmentofmajordepressive disorder(MDD)andhavemadeahugedifferenceto peopleovertheyears.

Rexulti® wasfirstmarketedin2015,indicatedforadjunctivetherapyforthetreatmentofMDDandschizophrenia.The2023expansionintheU.S.ofindicationsforRexulti® inAADAD,agitationassociatedwith dementiaduetoAlzheimer’sdisease–presentsa significantgrowthopportunity.WeseethatAADAD nowcontributesto19%ofdemandforRexulti® in theU.S.,andweassumethatthiswillcontinuewith expectedpeaksalesofUSD1billion.

Likewise,weexpecttheAbilifyAsimtufii® 2-monthinjectionforthetreatmentofschizophreniaandbipolarIdisorderinadultstobeanewlaunchthatwould minimizedisruptiontopatientssufferingfromthese chronicdiseasesavoidingthemonthlyadministration.

Whilebuildingonour70-yearlongexperiencein psychiatryandneurology,weareincreasingour strategicfocusonneuro-specialtyandneuro-rare diseaseareas.

Promisingpipeline

SustainablefinancialgrowthwilldependonourcapacitytoimproveproductivityinR&D.Alongside substantialinvestments,effectivechangestoour R&Dprocesseshavecreatedenthusiasmacrossthe R&Ddepartmentasweimplementanapproachof ‘listen-to-the-biology and‘killyourdarlingsinphase I’.Now,weadvanceotherpotentialmoleculesorindicationsifonedoesnotproveitselfinphaseI,and wehaveatransformedpipelineofassetstargeting newbiology.90%ofourdevelopmentpipelineisin neuro-rareandneuro-specialty,anditdemonstrates significantpotentialinadvancingtreatmentsinareaswithhighunmetneeds.Ourlate-stageprojects arepromisingwithemergingscientificdevelopments,andweaimtohavefourphaseIIIprograms by2026.

Wewanttotakethisopportunitytothank Lundbeck’semployees.Theirhardworkand dedicationaretransformingthelivesofpeople livingwithbraindisorders.

Subsequently,weexpecttobefilinganewtherapy formigrainepreventionandthefirstdisease-modifyingtherapyinMultiSystemAtrophy(MSA).Adding ournewlyacquiredbexicaserininDevelopmental andEpilepticEncephalopathies(DEEs)andanupcomingnewmolecularentityinCushing’sdisease andCongenitalAdrenalHyperplasiawearewellunderwayestablishinganeuro-rarefranchise.

Lookingatourearlypipeline,wehavede-riskedour developmentactivitiesthroughinnovativewaysof working,e.g.,byusingnewbiomarkers.

Wewouldliketotakethisopportunitytothankour R&Dcolleaguesfortheiractivesupportintransformingandstrengtheningourdevelopmentactivities, positioningustobebestsuitedtodeliverinnovative solutionsinthefieldofneuroscience.

Asustainablefuture

AtLundbeck,sustainabilityrefersnotonlytoour growthasacompany,butalsotowardsourcommitmentstostakeholders,society,andtheenvironment.Ourmostimportantcontributiontosustainabledevelopmentiseasingtheglobalburdenfor thoselivingwithneurologicalandpsychiatricdiseases,makingaccesstohealthacoreelementofour sustainabilitystrategy.

In2024,ourtreatmentsreached7.2millionfull-year patients1,andwehavecontinuedtodonateproducts andfundpsychosocialsupporttolow-andmiddleincomecountriesandthoseaffectedbywarandcivil unrest.Thisyear,Lundbeckalsolaunchedaglobal platformtoprovidemedicaleducationtohealthcare professionals.

Lundbeckreliesonattractingandretainingaskilled anddiverseworkforce,andwevalueadiverse,equitable,andinclusiveworkplace.Tous,thisincludesa commitmenttobeaneurodiverseworkplace.In 2024,weintegratedthiscommitmentintothe LundbeckbehaviorsthataresupportingourFocused InnovatorStrategy.Company-widetrainingisin place,aimingatensuringthatallemployeesfeelfree tosharetheirperspectives.Inthecomingyears,this trainingwillexpandtoincludeinitiativesondifferent subjectssuchasbiasreduction.

WehavealsocontinuedworkingtowardsLundbeck’s environmentalgoals,actingandmakinginvestments aswesetoutinourclimatetransitionplantowards net-zero.Amajormilestonethisyearhasbeenthe startofconstructionofanewchemicalrecoveryunit atoneofoursites.

2024alsomarksthefirstyearthatLundbeckpresentsanintegratedannualreportwithextensive sustainabilitydisclosuresinaccordancewiththeEuropeanCorporateSustainabilityReportingDirective. WefullysupporttheEuropeanGreenDealandbelievethatsustainabilityfrontrunnerslikeLundbeck benefitfromthenewrequirements.Despiteitsimperfections,thenewregulationsacceleratemuch neededtransparencyandcomparabilitywithinESG reporting.

Continuousbusinessimprovement

In2024,webeganthelargestcapitalreallocation programinthecompany’shistory.Itwillallowusto optimizeourbusinessandfundourgrowthambitions.Weinvestinmaximizingourstrategicbrands inspecificmarkets,furtherboostingourpipeline, andinmodifyingouroperationalmodelsinboththe commercialfunctionandProduction&Supply.We alsoenvisagetargeteddivestmentstosourcecapital forinvestments.

Whilebuildingonour70-yearlongexperiencein psychiatryandneurology,weareincreasingour strategicfocusonneuro-specialityandneuro-rare diseaseareas.

Behindthisexcellent2024executionofourFocused InnovatorStrategyliesatrulyamazingteameffort byourdedicatedpeople,alongwithdisciplineddecision-makingintheareaswherewewillengage,as muchastheareaswherewewillnot.Settingthedirectionandleadingthewaytobecomingafocused innovatorisapriorityforthenewmanagement team.

TheExecutiveManagementteamwasinplacebyAugust2024withnewcolleaguesheadingPeople& Culture,CorporateCommunications&PublicAffairs,

CharlvanZyl PresidentandCEO

CommercialOperations,andCommercial&CorporateStrategy.EachindividualmemberoftheExecutiveManagementbringsvastinternationalexperience,andwejoinforcesasateam,unifiedinpromotingasenseofsharedownership.

Wewanttotakethisopportunitytothank Lundbeck’semployees.Theirhardworkanddedicationaretransformingthelivesofpeoplelivingwith braindisorders.Wethankeveryoneforsupporting theexcellentexecutionofourobjectivesandforcontinuingtoinnovatetoadvancebrainhealth.

LarsSørenRasmussen ChairoftheBoardofDirectors

Strategyupdate

Impactingpatients,people,andsociety

In2024,welaunchedtheFocusedInnovatorStrategyinsupportofourpurposetoadvancebrainhealthandtransformlivesbyaimingtosecuremidtermgrowth,leadwithfocusedinnovation,anddeliveronsustainableprofitability.WiththeacquisitionofLongboardPharmaceuticals,wehavesignificantlyenhancedourneurosciencepipeline.

During2024,welaunchedtheFocusedInnovator Strategy,whichwillhelpuswininneuro-rareand specialist-treateddiseaseareas.Thestrategyaddressesthreemainactionpoints:

• Securingmid-termgrowth:Westandonastrong foundationofstrategicbrandsthathavereached double-digitgrowthrates.

• Leadingwithfocusedinnovation:Wecontinued ourtransformationofR&Dbuildinganinnovative pipelinescalingourpositioninneuro-specialty andestablishinganeuro-rarefranchise.

• Deliveringsustainableprofitability:Wehaveput continualeffortsintoreallocatingfinancesandresourcestoensurefocusedinnovationandlongtermgrowth.

Investingtogrow

Throughout2024,wehadadisciplinedfocuson maximizingourexistingresourcesthroughinvestments.Thiswayweimprovedourprofitability,while investingmoreinR&Dandourkeybrands,i.e.,the launchesofRexulti® inagitationassociatedwithdementiainAlzheimer’sdisease(AADAD)andVyepti® inmigraineprevention.

Weaimtoestablishsolutionsforpatientsthatprovidedifferentiationoverthestandardofcare,and weconstantlyevaluateourstrategicchoicesasto wheretoinvestourcapitaltoachieveourlong-term goals.

Lookingatourglobalpresence,wehavehighlyspecializedemployeesinmorethan50countries.They marketourstrategicbrands,whichaccountfor75% ofourrevenue.In2024,theydeliveredverystrong results,withgrowthexceedingexpectations.

Tomaximizegrowthmovingforwardwhileensuring thatwemeetpatients’needs,wewillbefocusinginvestmentsintokeygrowthmarkets.Wedosotooffsetlossofexclusivitiesinsomepsychiatrydiseaseareasbytheendofthedecade.

IntheU.S.,wehavebeenboostinginvestmentsin Rexulti® andVyepti® andwitnessedaverysuccessful accelerationofthesetwogrowthengineswithsales ofstrategicbrandsupby23%.Inparallel,weagreed withTakedaPharmaceuticalthatby1January2025 wemovefromaco-promotion,cost-sharing,and revenue-sharingmodeltoaroyalty-basedmodelof themarketingofTrintellix®.Thishasenabledusto allocatemoreresourcesandfocusonthemarketing ofRexulti® andVyepti® .

InEuropeandInternationalOperations,wehavedecidedtomodifyourorganizationalstructuretocreatenewregionalunits,whereindividualmarketsare groupedaccordingtomarketcharacteristics,size, andgeography.

Thisway,weensurethatwehavetherightsetup andcapabilitiesforamorefocusedandspecialty-orientedapproachacrossourmarkets.Inparallel,this focusonoptimizationwillalsobeappliedtotherest ofourorganization.

Wecontinuedto advancebrainhealth, impactingpatients, people,

andsociety.

Buildingourinnovativepipeline

Neuroscienceisattheforefrontofscientificbreakthroughswithrapidtechnological,medicalandregulatoryadvancesdrivingthedevelopmentofnew treatments.

Lundbeckisastronginnovation-andscience-ledorganization.Ourcorestrengthsinneurologyandpsychiatryhavebeendevelopedoverthepast70years andareevidencedbythemorethan30treatments wehavelaunchedtodate,improvingthelivesofmillionsofpeoplelivingwithbraindisorders.Aswecontinuetoadvancebrainhealthandtransformlives, weareexpandingourfocustoincludeneuro-rare andneuro-specialtyconditionscharacterizedbyhigh unmetneeds.

InOctober2024,weannouncedtheacquisitionof LongboardPhamaceuticals,andweclosedthedeal inDecember2024.ThephaseIIIbexicaserininDevelopmentalandEpilepticEncephalopathies(DEEs)is theanchorassetandanimportantadditiontoour amlenetugprogram,whereLu82422–apotential firstdisease-modifyingtherapyinMSA–isprogressingtophaseIII.Longboardisaperfectstrategicfit tooureffortsinbuildingarobustneuro-rarefranchise,anditwillleverageourglobalexpertiseinepilepsyamongbothourR&Dscientistsandcolleagues inCommercial.

Wehaveatransformedpipelineofassetstargeting newbiologies.Wehavede-riskedourearlydevelopmentefforts,andduringthelastcoupleofyears,we haveprogressedtwoprogramstophaseII,amlenetugandAnti-PACAPinmigraineprevention.We areaimingforfourphaseIIIprogramsby2026,addingamlenetug,Anti-PACAPandAnti-ACTHinCushing’sdiseaseandCongenitalAdrenalHyperplasiato ournewlyacquiredassetinDEEs,bexicaserin.

Advancingbrainhealthand sustainability

In2024,wecontinuedtomakestridesinadvancing brainhealth,impactingpatients,people,andsociety. Oureffortsarecloselylinkedtooursustainability strategy,whereaccesstohealthiscore,including takingactionthroughawarenessbuilding,advocacy, andfightingstigma.

In2024,Lundbeckcontinuedits‘Letthepatient speak’eventstointegratepatients’perspectivesinto ourdevelopmentprograms.Weinvitepatientsand caregiverstosharetheirinsights,aidingLundbeckin innovationandevidencegeneration.Wealsocollaboratewithpartnerstogaindeeperinsightintounmetpatientneeds,andworktofurtherenhancethe diversityofourclinicaltrials.

Tomaximizegrowthmoving forwardwhileensuringthatwe meetpatients’needs,wewillbe focusinginvestmentsinto keygrowthmarkets.

Thisyear,ourtreatmentsreachedmorethanseven millionpeopleworldwide1 .Improvingaccessto healthholdstheopportunityofmakingLundbeck’s medicalinnovationsaccessibletomorepatientswho needthem.Wehavedefinedlong-termaspirations tomakeinnovativetreatmentavailablethrough R&D,promoteequitableaccessibility,enhanceculturalacceptability,andprovideefficaciousmedical products.

Webelievethatthiswillenhancehealthoutcomes andimprovethequalityoflifeforpatients.Itwill alsoimprovetheproductivityofpeoplesuffering fromneurologicalandpsychiatricconditions,addressingtheUNSustainableDevelopmentGoals (SDG)of“GoodHealthandWellbeingforall”.

Inadditiontoaccesstohealth,Lundbeckalsorecognizestheimportanceofdoingrightbyourpeople, minimizingimpactsontheenvironment,andconductingourbusinessethically.Wecontinuouslywork tomaintainacultureofrespectandsafeworking conditionsforbothemployees,valuechainpartners andpatients.The100%completionrateofourannuale-learningonourCodeofConductisatestamenttothis.

In2024,Lundbeckcontinuedtoworktowardsour climateandcircularityaspirations,includingcontinuouslyexpandingthecollaborationwithsupplierson thechallengingtaskofloweringourcollectiveclimatefootprint.Thisyear,wehavestartedtheconstructionofanewchemicalrecoveryunitatoneof

oursites.Thiswillbothincreaserecyclingratesand reduceourgreenhousegasemissionswhenitbecomesoperationalfollowingtheexpectedcompletionofitsconstructioninlate2025.

Wearecommittedtointegratingsustainablepracticesthroughoutouroperations,drivingbothshorttermactionsandlong-termaspirationstowardsa sustainablefuture.

Cultureasanenablerof transformation

AtLundbeck,ourcultureisrootedinalegacyof commitmenttopositivelyimpactingpeople,patients,andsociety.Globally,ouremployeesfeela strongconnectiontoourpurpose,whichenhances collaborationacrossourorganization.Ourpeople areourgreatestasset,drivingourpurposeforward.

In2024,culture,whichispartofthefoundationof ourFocusedInnovatorStrategy,wasidentifiedasan importantenablerofthetransformationtoensure success.Withthat,anewpeoplestrategywasintroducedaimedatcultivatingaculturethatattractsand retainstalentwhileexpandingourcapabilities,e.g., withinAIandsustainability.

Ourstrategyisbuiltonthreeessentialbehaviors:

• Curiosity:Encouragingexplorationandchallengingthestatusquotofostercreativityandinnovation.

• Adaptability:Nurturingcross-functionalcollaborationtoembracechangeandenhanceproblemsolving.

• Accountability:Prioritizingourpatientsandensuringouractionsalignwithourmissiontomakea positivesocietalimpact.

Asweembracethesebehaviors,westrengthenour cultureandcommitmenttoadvancingbrainhealth andtransforminglives.Together,weleadtheway forabrighterfutureasaFocusedInnovator.

Patients

Oursingularpurposeistofulfilthelarge unmetmedicalneedandbringhopetoindividualslivingwithbraindisordersenabling themtolivetheirbestlives.

People

Withbetterpatienttreatmentweeasethe burdenonfamiliesandrelativeswhoareoftenaffected,notonlyemotionally,butalso financiallyrelatedtomedicalcare,caregivingresponsibilitiesetc.

Society

Bybringingforwardtransformativetreatmentstopatients,wepositivelyimpactthe personal,medicalandeconomicburdenon societycausedbybraindisorders.

ForfurtherinformationonourSustainabilityStrategy,pleaseseepage62.

Businessmodelandvaluechain

AtLundbeck,wediscover,develop,andcommercializetreatmentsthatmakeadifference topeopleaffectedbypsychiatricandneurologicaldisorders.

Wecoverthefullvaluechain

Wehavemorethan70yearsofexperiencein neuroscienceandinimprovingthelivesofpeople withbraindisorders.

• Weresearchtobuildastrongpipelineconsistingofpromisingmoleculesandantibodies.

• Wedevelopourdrugcandidatesintonewmedicines.

• Wemanufacturemedicinesathighlyadvancedproductionsitesand continuetosupplyourdrugstopatientsinneed.

• Wemakeourmedicinesavailablethroughhealthcaresystemsin morethan100countries.

Wefocusourinnovationwithin psychiatryandneurology

Weareoneofthefewbiopharmaceutical companiesintheworldworkingexclusivelywithin neuroscience.

• Psychiatrycoverspsychoticdisorderslikeschizophrenia,moodand anxietydisorderslikedepression,bipolardisorder,and post-traumaticstressdisorder.

• Neurologycoversdisorderslikemigraine,dementia,andmovement disorderslikeParkinson’sdisease,epilepsy,andmultiplesystematrophy(MSA).

• Neuroscienceisanexcitinggrowingareawithlargeunmetmedical needs.Weseegrowthandrapidlyevolvingtechnologiesandmethodologies.

Weensurepositiveoutcomestopeople andsocieties

Everywhereweoperate,westrivetocreatelongtermvalueandmakeapositivecontributionto peopleandsocieties.

• +7millionpatientsaroundtheworldarehelpedbyourmedicines daily2

• Wereinvestaround20%ofourrevenueinR&Dtocontinueourdevelopmentofnew,innovativedrugs.

• Throughoutourvaluechain,weincorporatepatientinsightsbytalkingtoandlearningfromthosewithlivedexperiences.

• Wecreateshareholdervalueensuringsustainableandprofitable growth.

Wearearound5,600highlyspecializedemployees across+50countries1 . *

Weworkinpartnershipstofightstigmaand addressthelargeunmetmedicalneeds.

Weacttoimprovehealthequityforthepatientswe serveandthecommunitieswearepartof.

Input1

Lundbeckworkswitharangeofdifferentstakeholderssourcingsuppliesandservices:

• Energyandrawmaterialstoproducemedicines.

• Researchorganizationstoconductclinicalstudies andestablishevidencefornewdrugcandidates.

• Medicinesproducedbycontractmanufacturersand partners.

• Keyopinionleaderse.g.,healthcareprofessionals.*

Transformation1

LundbeckisheadquarteredinDenmarkand operatesinover50countries,covering:

• Research&Development.

• Production&Supply.

• Marketing&Sales.

• Businessenablingfunctions,suchasCorporate Functions,People&Culture,CorporateCommunications&PublicAffairs.*

Outputandoutcome2

Lundbeck’smainoutcomeisourimpacton patients,people,andsociety,covering:

• Valuebasedtreatmentoptionsforhealthcaresystems.

• Improvementofhealthoutcomesforpatients.

• Profitabilitytoshareholders.

• ReinvestmentintoR&D.

• Jobsandskillsdevelopmentforemployees.

• Taxcontributionstosocietieswearepartof.*

Ourkeystakeholders3

PatientsareanintegralpartofLundbeck’sfullvaluechain ecosystemandfundamentaltoourpatient-centricgo-to-marketapproach.Theirlivedexperiencesandabilitytopointto unmetmedicalneedsenableustodrivefocusedinnovation acrossallaspectsofourbusiness.*

Whilepatientsaretheend-usersofourpharmaceuticalproducts,Lundbeck’scustomersarehealthcareprofessionals (HCPs),includingphysiciansandspecialists,aswellasauthorities,suchasregulatorybodies,andpublicandprivate healthcareproviders.Ourcustomersplayanimportantrole acrossourvaluechain,whereHCPsarethepointofcontact withpatientsinthedownstreamvaluechain,andtheauthoritiesareregulatingouraccesstothemarket.*

Operatinginahighlyregulatedindustry,Lundbeckhas strongproceduresandinternalprocessesinplacetoensure compliancewithpharmaceuticalregulations,achieveoperationalexcellenceandinstilltrustacrossourvaluechain.*

Leveragingourkeypartnershipsacrossthevaluechain,includingR&D,commercialandothertypesofpartnerships, e.g.,civilsocietyandNGOsenablesLundbecktodriveour business,increaseawarenessandensuresocietalimpact.*

Asalistedcompanywithmanyinvestorsandshareholders, Lundbeckiscommittedtocommunicatingaconsistentmessageanddeliveringsustainablegrowth.*

Topursueallthesegoalsandservepeopleaffectedbybrain disordersandsocietyatlarge,Lundbeckreliesonhighlyqualifiedandspecializedemployees.Furthermore,suppliersand theworkersinthevaluechainarekeytoprovidingthefundamentalinputstoproduceLundbeck’shigh-qualityproducts.*

Formoreinformationonourstakeholderengagement, pleaserefertoourSustainabilityStatement(seepage72).

Lundbeck’sproductsareregisteredinmorethan80countries,and wehaveemployeesinmorethan50countries.Ourlargestmarkets aretheU.S.,China,Canada,Spain,Italy,France,Brazil,Australia, SouthKoreaandSwitzerland.*

Products

Strategicbrands

AbilifyLAIfranchise1,2*

AbilifyMaintena® (aripiprazoleoncemonthly)hasbeenmarketedsince2013asamonthlyintramuscularinjectionindicatedforthetreatmentofschizophreniaandbipolarIdisorderinadults.

AbilifyAsimtufii® (aripiprazoleeverytwomonths)was launchedasanintramuscularinjectionevery twomonthsin theU.Sin2023.InMarch2024,theEuropeanCommission approvedAbilifyMaintena® 960mg.Theproductislaunched eitheraloneorincollaborationwithOtsukaPharmaceutical.

Brintellix®/Trintellix®1* (vortioxetine)

Indicatedforthetreatmentofmajordepressivedisorder (MDD)LundbeckmarketsBrintellix®/Trintellix® inEuropeand InternationalOperations.Takedaisourco-promotionpartnerintheU.S.andJapan.Launchedinthefirstmarketsin 2014,itisnowavailableinapproximately60countries.

Rexulti®/Rxulti®1* (brexpiprazole)

Indicatedforadjunctivetherapyforthetreatmentofadults withMDDandasatreatmentforadultswithschizophrenia. In2023,itwasfurtherapprovedforthetreatmentofagitationassociatedwithdementiaduetoAlzheimer'sdisease. LaunchedintheU.S.in2015incollaborationwithOtsuka Pharmaceutical,andsubsequentlyinseveralothercountries.

Vyepti®1* (eptinezumab)

Indicatedforthepreventivetreatmentofmigraineinadults. LundbeckmarketsVyepti® acrossall3regionsintheU.S.,EU andInternationalOperations.LaunchedintheU.S.atthe beginningof2020,itisnowavailablein24countriesacross theworld.

3,504

Maturebrands

Cipralex®/Lexapro®1* (escitalopram)

Indicatedforthetreatmentofdepression.Firstlaunchedin 2002,andisnowavailableincloseto100countriesaround theworld.

Revenue(DKKm)

2,048 Otherpharmaceuticals1*

Northera® (symptomaticneurogenicorthostatichypotension(nOH)),Onfi®(epilepsy),Sabril® (refractorycomplexpartialseizures(rCPS)andinfantilespasms(IS)),Ebixa® (dementia),Azilect® (Parkinson’sdisease),Xenazine® (chorea), Deanxit® (depression),Cipramil® (depressionandanxiety), andCisordinol® (psychosis)areamongthebiggestofour othermaturebrands.

Revenue(DKKm)

3,180

Scienceandinnovation

Drivinginnovationofnewtreatments

In2024,wecontinuedtobuildourpipelineonrigorousdevelopmentprocesses,combiningourstrongcompetenciesandnewtechnologieswithdisciplinedselectionandprogressioninourinnovativeprogramsthatcombine internalinnovationandexternalpartners’research.

ExecutingtheR&Dstrategy

Lundbeckisdedicatedtoneuroscience.Wehavethe heritage,expertise,andpassiontotranslateleading scienceintotransformativetreatments.Opportunitiestomakeadifferencearehuge:Theunmetneeds ofpatientsareenormous,andthenumberofaffectedpeopleisrising.Atthesametime,neuroscienceisattheforefrontofscientificbreakthroughs, withrapidtechnological,medical,andregulatoryadvanceswhichdriveinnovationofnewtreatments.

WiththeFocusedInnovatorStrategy,wehavefurthernarrowedourfocus.Lundbeckhasafoundationalstrengthinpsychiatryandneurology,andwe builduponthiscore.Wereinforceourneuro-specialtyposition,andweestablishaneuro-rarefranchise.

Wearesuccessfullyprogressingourpipeline througharigorousdevelopmentprocessdefining howweoperatebylettingthebiology,themolecule, andthepatientspeak.

OurR&Dorganizationfocussesonpromisingbiology,andweworkwithinnovativediscoveryresearch usinge.g.,CLiPrandBloodBrainBarriershuttle.All inall,thisapproachallowsustode-riskourearlydevelopmentefforts.Inaddition,wearede-riskingthe earlypipelinebyhavinganadequatenumberof phaseIprograms.Likethis,wecanbringpromising projectsquicklyforwardtoearlyclinicalproofofconcept,andweinvitepatientstoguideusinthelate developmentphaseonourwayfromunmetneeds totransformativetreatments.

Withtechnologyexpandingthetargetlandscapeand newdrugmodalitiesincreasingtreatmentopportunities,theuseofnewbiomarkers,andaregulatory evolutionthatacceleratestheapprovalsinneuroscience,weleadwithfocusedinnovation.Overthepast year,wecontinuedtobuildourpipelineastheengineforsustainablegrowth.

InJanuary2024,Lundbeck’sAMULETphaseIItrial withamlenetug(LuAF82422)showedconvincing trendsofslowingMultipleSystemAtroph(MSA). Lundbeckiscommittedtoaddressingtheunmet needsofMSApatientswithamlenetugandhasprogressedtheprogramindialoguewithhealthauthorities.

InMarch2024,Lundbeck’spotentialfirst-in-class therapyformigraineprevention,theLuAG09222 (anti-PACAPmAb)program,enteredanadvanced clinicalstagewithaclinicalphaseIIbdose-finding trial.Thistrialwillassesstheefficacyandsafetyof subcutaneouslyadministeredLuAG09222in

Fourbiologicalclusters

Throughpursuitofnoveltargetswithin4biological clusters,Lundbeckadvancesinnovativesolutions toareasofsignificantunmetmedicalneedswithin neuroscience.

Thefourbiologyclustersare:

Hormonal/neuropeptidesignaling:

Targetingselectedpathwaysofpainsignaling, stressandotherneurohormonalresponses.

Circuitry/neuronalbiology:

Targetingneurotransmission/synaptic dysfunctiontorestorebraincircuitsandreduceneurological,psychiatric,andpainsymptoms.

Neuroinflammation/neuroimmunology:

Targetingneuronallossduetoanoveractiveimmunesystem,relevantacrossmany nicheandrare neurologicaldisorders.

Proteinaggregation,foldingandclearance:

Targetingneurodegenerativeproteinopathiesinvolvedinarangeofneurodegenerativeconditions, e.g.,Alzheimer’sdementiaandParkinson’sdisease, aswellasrarediseasescharacterizedbyproteinopathy,suchasmultiplesystematrophy(MSA).

Readmoreonthefollowingpages.

migrainepreventionaimingtoestablishtheoptimal doseforfutureglobalpivotaltrials.

InJune2024,LundbeckinitiatedafirsttrialwithLu AG13909inpatientswithCushing’sdisease(CD).

InJune2024,theU.S.FoodandDrugAdministration, FDA,acceptedasupplementalnewdrugapplication, sNDA,filingforbrexpiprazoleincombinationwith sertralineforthetreatmentofadultswithpost-traumaticstressdisorder(PTSD).TheFDAplanstohosta PsychopharmacologicDrugsAdvisoryCommittee meetingtoseekinputonissuesrelatedtothesNDA. Themeetingisanticipatedtooccurduringthefirst halfof2025.Iftheapplication,isapproved,thebrexpiprazoleandsertralinecombinationtreatment wouldbethefirstFDA-approvedpharmacological treatmentforPTSDinmorethan20years.

InOctober2024,Lundbeckinitiatedthefirstclinical trialofitsCD40Lblocker,LuAG22515,inpatients. Theproof-of-concept(PoC)trialwillevaluatetheefficacy,safety,andtolerabilityofLuAG22515asapotentialtreatmentforThyroidEyeDisease,anautoimmunediseasecausingadebilitating,disfiguring,and potentiallyblindingperiocularcondition.Blocking CD40LinhibitsbothBandTcellactivationswithout directclearanceofBcellpopulationsandholds strongpromiseintreatingawiderangeofautoimmune-relatedCNSdisorders.

InOctober,Lundbeckannouncedpositiveresults fromtheSUNRISEphaseIIIpivotaltrialofVyepti® (eptinezumab)inmigraineprevention.Vyepti® confirmedefficacy,meetingtheprimaryandallkeysecondaryendpoints.SUNRISEwaspredominantlyconductedinAsia,evaluatingtheefficacyandsafetyin patientswithchronicmigraine.Basedonthetrialresults,Lundbeckplanstoinitiatediscussionswithrelevantregulatoryauthoritieswiththeaimofmaking Vyepti® availableforpeoplesufferingfrommigraine acrossAsia.

Epilepsybackinthepipeline

In2024,LundbeckacquiredLongboardPharmaceuticalswiththeleadassetbexicaserinwhichholds blockbusterpotential.InSeptember2024,aglobal phaseIIItrialwasinitiatedbyLongboardPharmaceuticals,evaluatingbexicaserinforthetreatmentof seizuresassociatedwithDravetSyndrome,oneof therareepilepsies.InNovember,LongboardPharmaceuticalsinitiatedasecondphaseIIItoevaluate theefficacyofbexicaserininDevelopmentalandEpilepticEncephalopathies(DEEs).

Bexicaserinhasshownencouraginganti-seizureeffectstodateinpreclinicalandclinicalstudies,with itsnext-generationsuperagonistmechanismspecificallytargeting5-HT2C receptors,supportingbexicaserin’spotentialtoofferahighlydifferentiated andbest-in-classprofile.Itcomplementsperfectly

ourlate-stageinternalpipelineandourFocusedInnovatorambitiontobuildaneuro-rarefranchiseand reestablishLundbeck’sstrongpresenceintheepilepsyspace.

Thereisastrongunmetneedacrossabroadrange ofepilepsyindications,includingDevelopmentaland EpilepticEncephalopathies(DEEs).Amongthemore than20knownDEEs,only4haveapprovedtreatmentssofar.Theinnovativepotentialofbexicaserin, withitsunique5-HT2C super-agonistmechanismof action,positionsustoaddresssignificantunmet needsinsevereepilepsiesacrossDEEsincluding DravetandLennox-Gastautsyndromes.

BexicaserinhasthepotentialtoaddressallDEEs, andcomparedtothetreatmentscurrentlyavailable, e.g.,fenfluramine,bexicaserinhasgreaterselectivity andspecificity,designedtoonlybind5-HT2Creceptors.On30January2025,Lundbeckannouncedthe headlineresultsofthebexicaserinPACIFICphase 1b/2a12monthsOpen-Label-ExtensionstudyevaluatingbexicaserininpatientswithDevelopmental andEpilepticEncephalopathies(DEEs)demonstratingasustained,durableresponseinseizurereductionandafavorablesafetyandtolerabilityprofile acrossabroadrangeofDEEpatients.Thesedata providefurthersupporttobexicaserin’spotentialto offerahighlydifferentiatedandbest-in-classprofile.

Hormonal/neuropeptidesignaling

LuAG09222–phaseII

LuAG09222representsapotentialnewtherapeutic optionforthetreatmentofmigraine,which,unlike thecalcitoningene-relatedpeptide(CGRP)migraine treatmentdrugclass,isamonoclonalantibodytargetingpituitaryadenylatecyclase-activatingpolypeptide(PACAP).PACAPanditsreceptorsare broadlyexpressedinthenervoussystemsandinflammatorycells.ByinterferingwiththePACAPsignaling,thereisapotentialtoaffectmultiplesymptomsofheadachedisorders.

LundbeckhasinitiatedthePROCEEDtrial,aphaseIIb trialwithsubcutaneouslyadministeredLuAG09222 thatbuildsonthepositiveresultsoftheHOPEtrial.

PROCEEDisaninterventional,randomized,doubleblind,parallel-group,placebo-controlled,dose-findingphaseIIbtrialthatwillbeconductedinEurope, JapanandtheU.S.Itassesses4differentdosesofLu AG09222versusplacebo,administeredsubcutaneouslyoncemonthlyforthreemonths.Thetrialisintendedtoestablishtheoptimaldoseforfuture globalpivotaltrialsdesignedtoconfirmtheefficacy andsafetyofLuAG09222asamigrainepreventive treatment.PROCEEDisplannedtoenrollapproximately498patientsandwillassesstheefficacy, safetyandtolerabilityofLuAG09222.

ThetargetpopulationforthistrialisdefinedaspatientsdiagnosedwithmigraineasoutlinedintheInternationalClassificationofHeadacheDisorders ThirdEdition(ICHD-3),andwhofailedtotake2-4differentpreventivemigrainemedicationsinthepast 10years.Studycompletionisexpectedinthesecond halfof2025.

LuAG13909–PhaseI/II

LuAG13909isafirst-in-classmonoclonalantibody, whichhasthepotentialtoofferatreatmentalternativetopatientssufferingfromconditionsrelatedto thehypothalmic-pituitary-adrenal(HPA)axis,leading toincreasedlevelsofadrenocortotropichormone (ACTH).BybindingtoACTHwithhighaffinity,Lu AG13909BaimstoreduceelevatedACTHlevels,potentiallyprovidingtherapeuticbenefitsforindividualswithneurohormonaldysfunctions.

Lundbeckhasinitiatedafirst-in-humantrialinpatientswithCongenitalAdrenalHyperplasia(CAH)in December2022,andatrialinCushing’sdisease(CD) inJune2024.

Circuitry/neuronalbiology

BrexpiprazoleinPost-TraumaticStressDisorder (PTSD)

On25June2024,Lundbeckannouncedthatasupplementalnewdrugapplication(sNDA)forbrexpiprazoleincombinationwithsertralineforthe treatmentofadultswithpost-traumaticstressdisorder(PTSD)wasacceptedandfiledbytheFDA.

ThesNDAisbasedondatafromthreerandomized clinicaltrialsevaluatingthesafetyandefficacyof brexpiprazoleincombinationwithsertralineinadult patientswithPTSD,namelythephaseIItrial061and thetwophaseIIItrials071and072.

Theprimaryendpointforallthreetrialswasthe changefromweek1toweek10intheClinician-AdministeredPTSDScale(CAPS-5)totalscoreforbrexpiprazoleandsertralinecombinationtherapyversus sertralineplusplaceboinpatientsdiagnosedwith PTSDaccordingtotheDiagnosticandStatistical ManualofMentalDisorders,FifthEdition(DSM-5).

Thetrialswererandomized,doubleblind,andactivecontrolled,andTrial061and071wereflexible-dose trials,whileTrial072wasafixed-dosetrial.InTrial 061and071,brexpiprazoleincombinationwithsertralinewasassociatedwithastatisticallysignificant reduction(p<0.05)inPTSDsymptomscomparedto sertralineplusplacebo,asmeasuredbythechange intheCAPS-5totalscorefromweekonetoweek10 (primaryendpoint).InTrial072,whiletheprimary endpointwasnotmet,reductionsinPTSDsymptom severitywithbrexpiprazoleincombinationwithsertralinewereconsistentwithTrials061and071.

Acrossthethreerandomizedtrials,thecombination ofbrexpiprazoleandsertralineinadultpatientswith PTSDwasgenerallywell-tolerated,andnonew safetyobservationswereidentified.

FDAplanstohostaPsychopharmacologicDrugsAdvisoryCommitteemeetinganticipatedduringthe firsthalfof2025.Ifapproved,thebrexpiprazoleand sertralinecombinationtreatmentwillbethefirst FDA-approvedpharmacologicaltreatmentforPTSD inmorethan20years.

Brexpiprazole–phaseIIIinadolescentpatients (13-17yearsold)withschizophrenia

ATypeIIvariationtoapplyforapediatricschizophreniaindication(foradolescentsaged13to17 years)wassuccessfullysubmittedtotheEuropean MedicinesAgency(EMA)on26June2024.Theexpectedactiondateisinthesecondquarterof2025.

ThesubmissionisbasedonthephaseIIItrial33110-234inadolescentpatientswithschizophrenia (NCT03198078),whichdemonstratedasignificant improvementforbrexpiprazolecomparedtoplacebo. Inthetrial,brexpiprazolewasgenerallywell tolerated,andthesafetyprofilewassimilartothat observedinadultpatientswithschizophrenia.The trialformspartofthebrexpiprazoleEMAPaediatric InvestigationPlan(PIP).

Aripiprazole–2-monthlong-actinginjectable (LAI)formulation

Thenew2-monthformulationisaninnovativeadditiontothelong-actinginjectable(LAI)franchiseand haspatentprotectionuntiltheearlypartofthenext decade.

AsupplementalNewDrugSubmission(sNDS)forthe 2-monthformulationhasrecentlybeenapprovedby HealthCanada(January2025).

Basedonpharmacokineticmodelling,twosupplementalNewDrugApplications(sNDAs)toupdatethe AbilifyAsimtufii® andAbilifyMaintena® USPIs,witha 1-dayinitiationregimen(1-IR)inadditiontothecurrentlyapprovedinitiationregimens,wereaccepted andfiledbytheFDAinAugust2024,withatarget dateforcompletionofthereviewof30March2025 forbothproducts.Ifapproved,patientsstabilizedon oralAbilifywillbeabletoinitiatetheevery-2-months AbilifyAsimtufii® treatmentregimeninasingleday byadministeringoneinjectionofAbilifyAsimtufii® 960mg,oneinjectionofAbilifyMaintena® 400mg, andasingleoraldoseofAbilify20mg.ForAbilify Maintena®,the1-IRconsistsoftwoseparateinjectionsofAbilifyMaintena® 400mgandasingleoral doseofAbilify20mg.

MAGLiprogram–phaseI

Followingtherecentcompletionofamechanismof actionphaseItrialwithLuAG06474,emanating fromtheacquisitionofAbide,ithasbeendecidedto writedownpartofthecarryingamountofthisasset intheFinancialStatementsfor2024.Thereisstillsignificantpotentialvalueremainingfromthisacquisition,includinganadditionalongoingclinicalprogramandauniquediscoveryplatform.

Vortioxetine–Pediatricdevelopmentprogramin MajorDepressiveDisorder(MDD)inJapan

Givenalargeunmetmedicalneedandnomedicines approvedinJapanfortreatmentofMDDinchildren, LundbeckhasdecidedtoinitiateapediatricdevelopmentprogramincollaborationwithitsalliancepartnerTakeda.

ThephaseIIItrialisarandomized,double-blind,placebo-controlled10-weeksstudyevaluatingtheefficacyandsafetyofflexibledosevortioxetine(1020mg)inMDDinadolescentsaged12-17years,with First-Patient-First-VisitplannedforQ42025.

InAugust2024,basedonthedevelopmentprogram, LundbeckandTakedareceivedapositiveopinion fromtheJapanesePharmaceuticalAffairsCouncil CommitteeonDrugIoftheMinistryofHealth,LabourandWelfare,grantingvortioxetinewasgranted a2-yearextensionuntil2029ofthere-examination periodfortheadultindicationinMDD.Thismeans thatvortioxetine’slossofexclusivityinJapanwillbe extendedbytwoyears.Thisextensionisunrelated tothephaseIIItrialoutcome.

Proteinaggregation,folding, andclearance

LuAF82422(amlenetug)–phaseII

LuAF82422isamonoclonalantibody(mAb)targetingthepathologicalformoftheproteinalpha-synucleinthatisbelievedtoplayapivotalroleinthe

developmentandprogressionofneurodegenerative diseasessuchasmultiplesystematrophy(MSA),Parkinson’sdisease(PD),andothersynucleinopathies.